Overview

Navigating the complexities of back taxes can feel overwhelming, but there are seven compassionate methods available to help ease your financial burdens. Options such as the Offer in Compromise, Currently Not Collectible status, and First-Time Penalty Abatement can provide relief. We understand that seeking assistance can be daunting, which is why utilizing AI technology and expert guidance is crucial in effectively navigating these processes.

Imagine having structured pathways to achieve tax relief and regain your financial stability. It's common to feel lost in this journey, but you are not alone. By exploring these options, you can take meaningful steps toward a brighter financial future. Remember, we're here to help you every step of the way.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially for the over 11 million Americans who find themselves behind on their federal taxes. We understand that the urgency for effective solutions to forgive back taxes is more critical than ever. Individuals are seeking relief from financial burdens that can seem insurmountable. This article explores seven innovative strategies designed not only to provide insights into tax debt relief options but also to empower you to reclaim control over your financial future. How can you effectively leverage these opportunities to alleviate the weight of tax debt and foster a path toward economic stability?

Turnout: Streamlined Tax Debt Relief Services

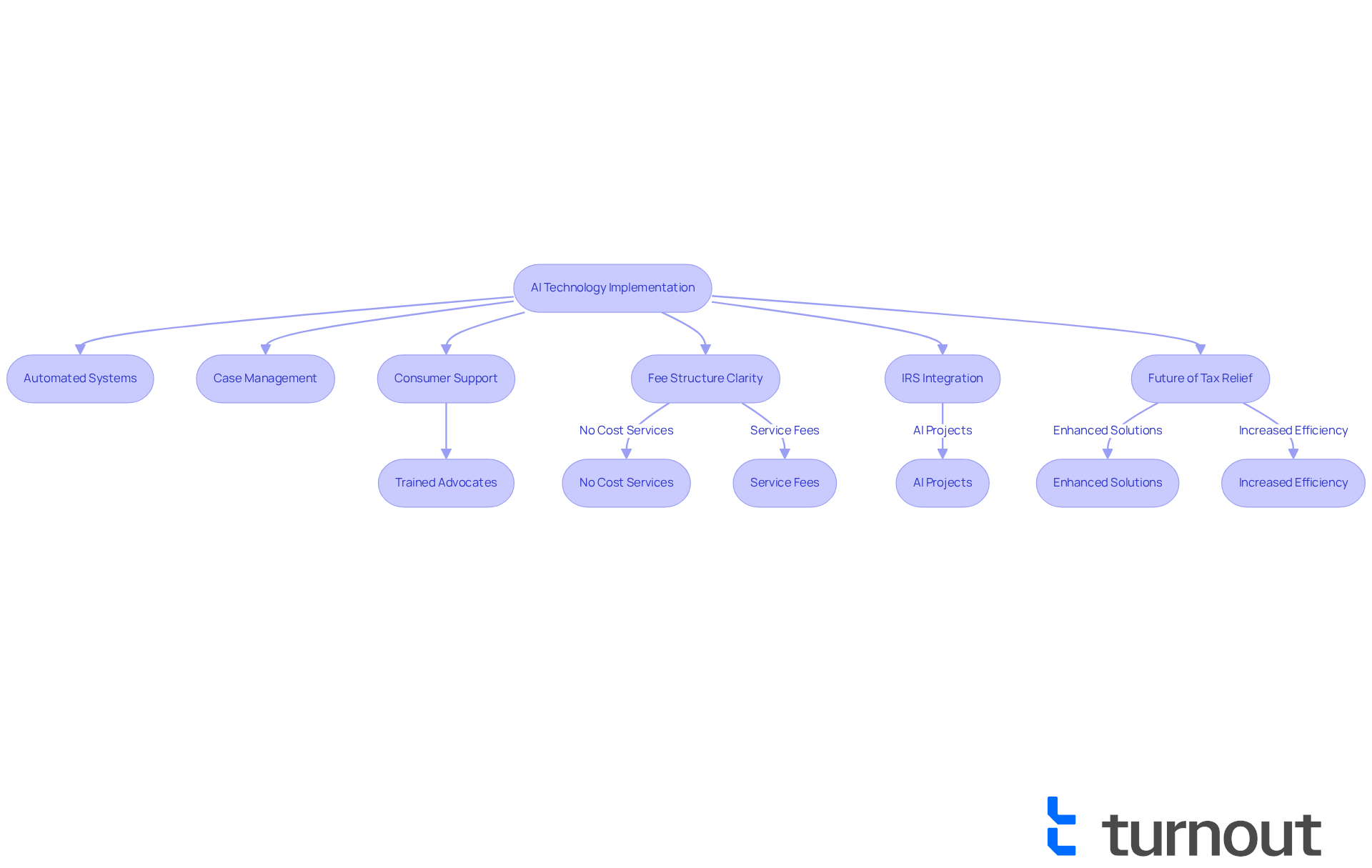

Turnout is transforming the process to forgive back taxes by harnessing AI technology to simplify tax obligation relief for consumers. This modern approach blends automated systems with dedicated support from trained advocates, ensuring that individuals can effectively navigate the often complex landscape of tax debt and explore ways to forgive back taxes. With over 11.3 million Americans behind on federal taxes as of the end of 2023, timely assistance to forgive back taxes and provide clear guidance are more crucial than ever. Turnout's AI-driven platform not only streamlines case management but also enhances communication, allowing clients to stay informed every step of the way.

Understanding Turnout's fee structure is essential for consumers seeking financial support. Some services are provided at no cost, while others come with service fees, and government fees are separate, needing to be settled before any paperwork can be submitted on behalf of clients. This clarity in fees empowers individuals to make informed choices regarding their support options.

The effectiveness of AI in tax relief is underscored by the IRS's commitment to integrating AI into its operations, with 68 projects aimed at improving taxpayer interactions and compliance. This technological advancement is expected to enhance the efficiency of tax resolution processes, making it easier for consumers to forgive back taxes and alleviate their financial burdens. Experts suggest that AI can significantly alleviate the stress associated with tax issues, particularly when experienced professionals collaborate with automated systems to forgive back taxes and achieve better outcomes.

As we look toward 2025, the influence of AI technology on tax relief is likely to expand, providing even more effective solutions for individuals facing economic challenges. Turnout's unique blend of technology and human assistance positions it as a leader in the evolving field of tax obligation resolution, enabling consumers to forgive back taxes and take control of their financial futures. It's important to remember that while the IRS offers options like an offer in compromise, which has a $205 application fee, consumers should be cautious of tax relief companies that impose high upfront fees, as noted by CPA Greg Hudgins. Additionally, the IRS enforces a failure-to-file penalty of 5% of unpaid taxes for each month a return is overdue, capping at 25%, highlighting the urgency of addressing tax obligations. DIY financial repayments can lead to adverse outcomes, making expert assistance all the more crucial.

Offer in Compromise (OIC): Settle Your Tax Debt for Less

An Offer in Compromise (OIC) provides a compassionate solution for individuals seeking to forgive back taxes for less than the total amount due. It serves as a vital option for those facing economic hardships and unable to meet their responsibilities fully. To qualify, individuals must demonstrate their inability to pay and submit detailed documentation, including:

- Bank statements

- Tax returns from the last three years

- Proof that the total amount owed to the department is $15,000 or less to apply online

We understand that this process can be overwhelming, but Turnout's advocates are here to assist in preparing these documents and negotiating with the IRS, significantly enhancing the chances of a favorable outcome.

The potential savings from an OIC can be remarkable. Many individuals have successfully resolved their debts for a fraction of what they owe. For instance, those who navigate the OIC process effectively often report savings that can reach up to 90% of their initial tax obligations, providing much-needed financial relief.

Success stories abound, showcasing the effectiveness of the OIC program. One notable case involved a taxpayer who owed $30,000 in back taxes but, after collaborating with advocates, settled for just $3,000. This real-world example highlights how the OIC can be a means to forgive back taxes, transforming a daunting financial burden into a manageable solution.

Tax professionals consistently emphasize the benefits of the OIC. It not only alleviates immediate financial pressure but also empowers individuals to regain control over their financial futures. As one specialist remarked, 'The OIC is a lifeline for those struggling with tax obligations, providing an opportunity to begin afresh.'

Arthur Godfrey once said, 'I’m proud to pay taxes in the United States; the only thing is, I could be just as proud for half the money.' This sentiment reflects the emotional weight of tax payments and the relief that the OIC can offer.

In summary, the Offer in Compromise program stands as a beacon of hope for those grappling with tax debt. It provides a structured pathway to achieve economic relief and a fresh start. Remember, you are not alone in this journey; we are here to help you navigate these challenges.

Currently Not Collectible (CNC) Status: Temporary Relief from IRS Collections

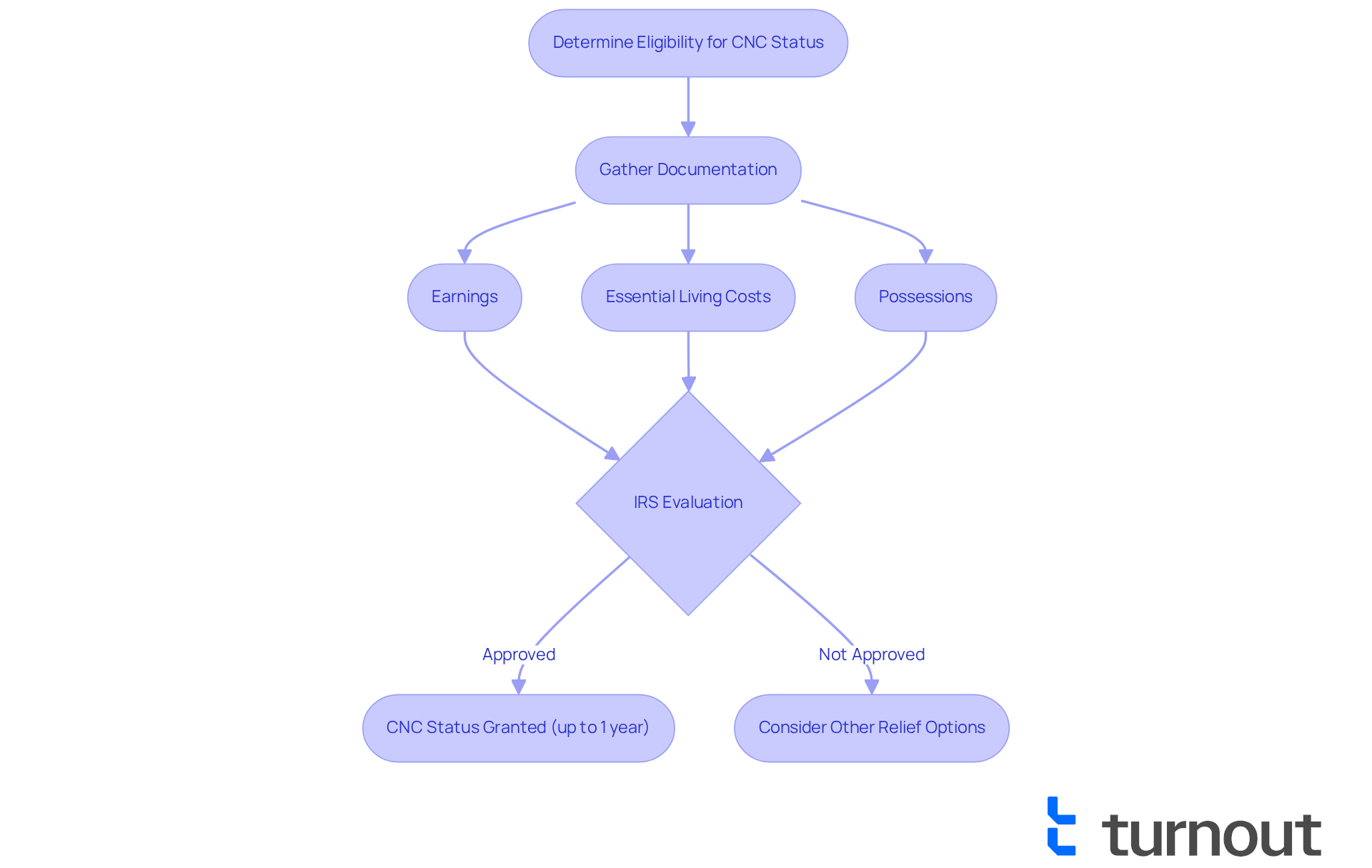

Currently, the Currently Not Collectible (CNC) status is a vital designation that temporarily halts IRS collection efforts against taxpayers. We understand that financial struggles can be overwhelming, and to qualify for this relief, individuals must demonstrate that they cannot afford to make any payments due to significant financial hardship. The IRS evaluates each case individually, considering factors such as employment status, medical expenses, and existing debts. This status provides essential breathing space, enabling individuals to stabilize their finances without the pressure of ongoing collections. In 2025, the IRS increased allowable living expense standards by 8%, making it easier for more individuals to qualify for this relief.

To request CNC status, individuals must gather documentation that reflects their economic condition, including:

- Earnings

- Essential living costs

- Possessions

If authorized, CNC status can offer temporary assistance for up to one year, with the opportunity for extension if the taxpayer's economic hardship continues.

At Turnout, we are here to assist clients in navigating the application process for CNC status. Our goal is to ensure that you meet the necessary criteria and submit the required documentation. This support is crucial for individuals who feel inundated by tax obligations, allowing you to focus on restoring economic stability while halting IRS collection efforts. Moreover, Turnout collaborates with IRS-licensed enrolled agents, who are authorized to provide assistance in tax debt relief. This partnership streamlines access to monetary support and government benefits, ensuring you are not alone in this journey.

First-Time Penalty Abatement: Forgive Your Tax Penalties

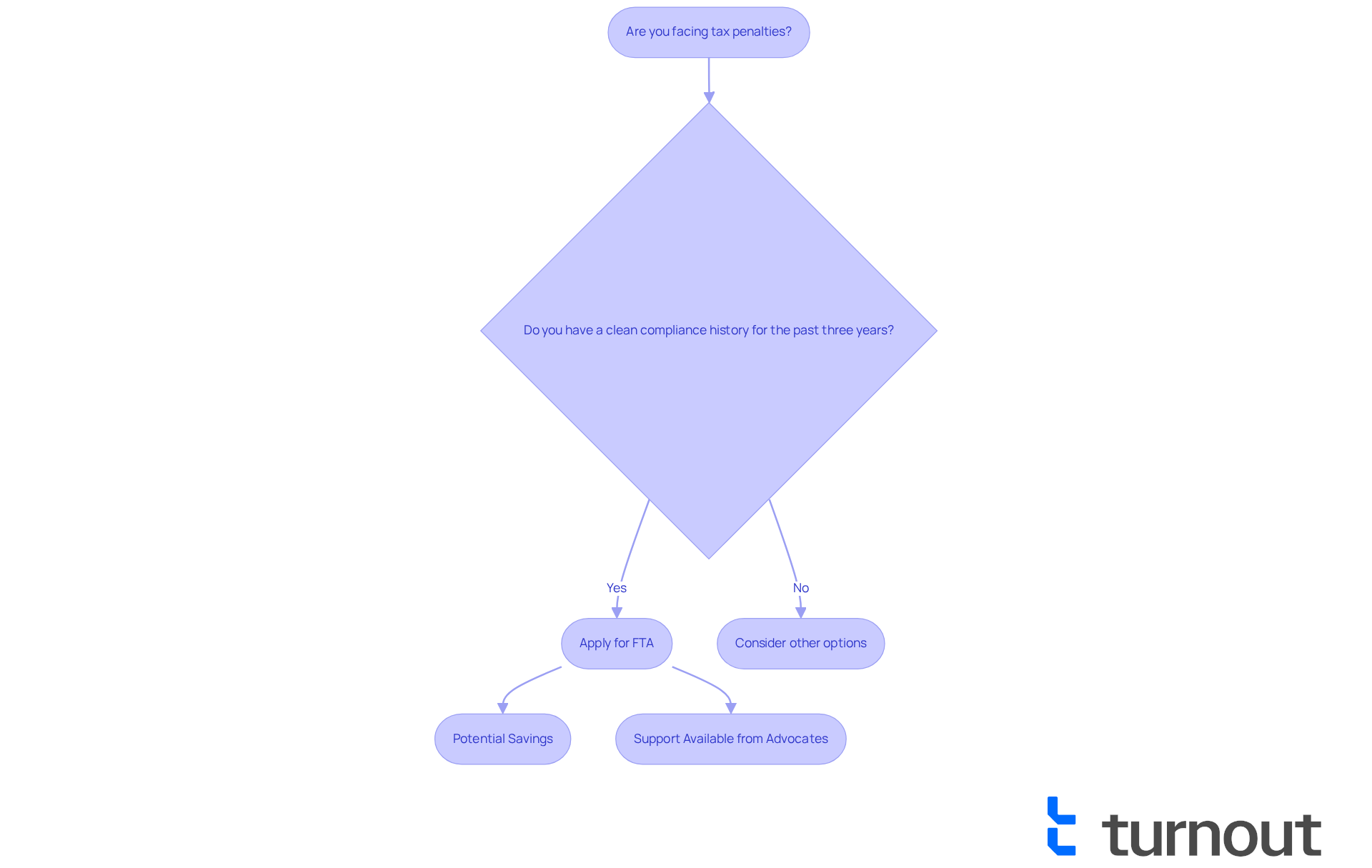

Are you feeling overwhelmed by late filing or payment penalties? The First-Time Penalty Abatement (FTA) program offers a compassionate solution for individuals like you, providing a chance to have those penalties removed. To qualify, you simply need to show a clean compliance history for the past three years and meet specific criteria. This program can be a significant source of financial relief, allowing you to eliminate penalties that can add up quickly.

For instance, did you know that the IRS imposes a failure-to-pay penalty of 0.5% per month on unpaid taxes? This can escalate to 1% if not addressed within ten days of an intent to levy notice. By utilizing the FTA, you could potentially save thousands in penalties, making it a valuable option for those who have faced genuine difficulties.

We understand that navigating this process can be daunting, but Turnout's advocates are here to help you every step of the way. They are equipped to assist you throughout the application process, enhancing your chances of receiving approval and alleviating your financial burdens. Remember, you are not alone in this journey; we’re here to help you find the relief you deserve.

Innocent Spouse Relief: Protect Yourself from Joint Tax Liabilities

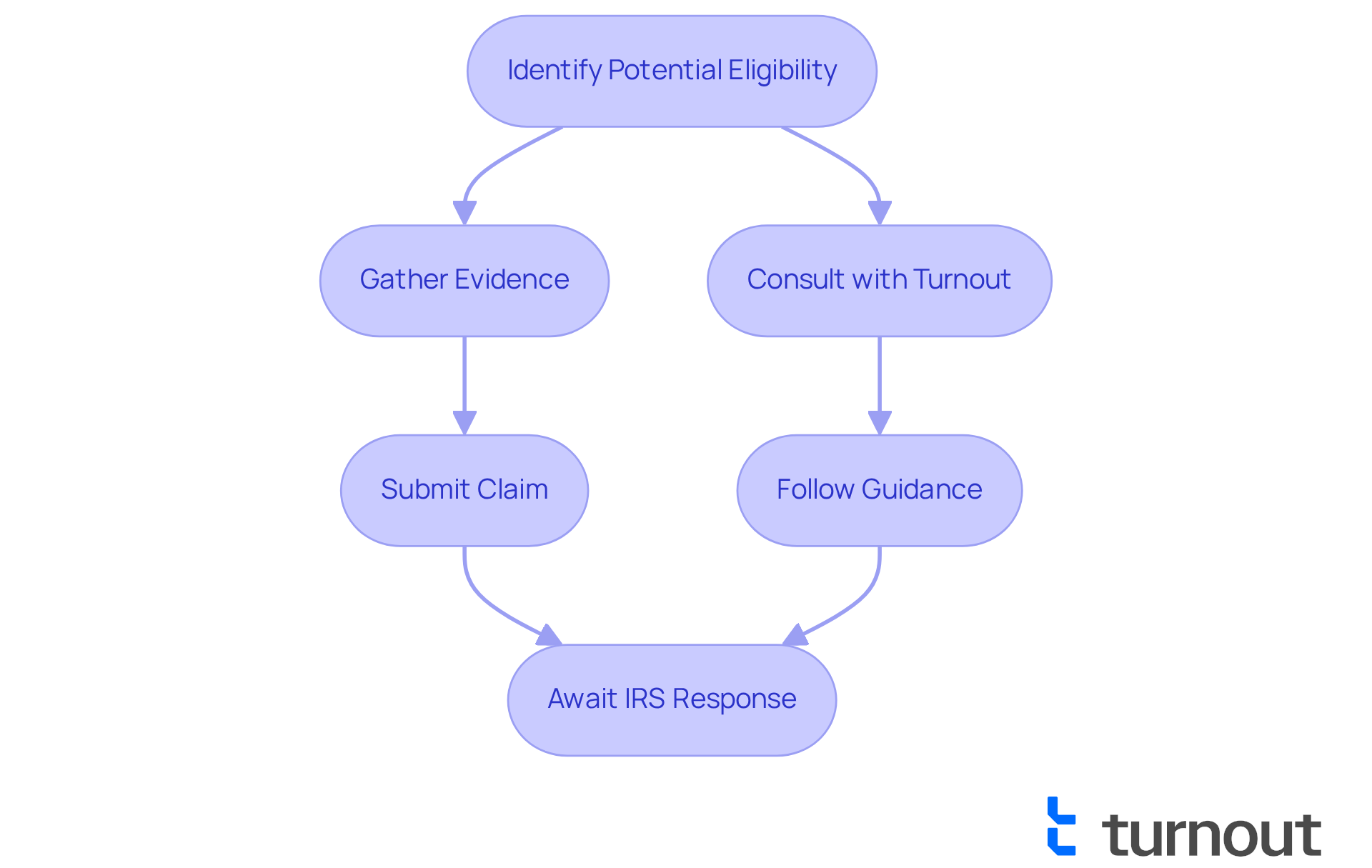

Innocent Spouse Relief is here to protect you from tax liabilities that may have been incurred by your spouse or former spouse. We understand that navigating these issues can be overwhelming, especially when you feel unfairly penalized for someone else's actions. If you can show that you were unaware of the tax problems at the time of submission, you might be eligible for relief from these joint liabilities.

This option is crucial for those who are struggling with the consequences of their partner's decisions. At Turnout, we’re here to help you gather the evidence you need and submit your claims effectively. Our IRS-licensed enrolled agents are qualified to support you through the process of claiming Innocent Spouse Relief, ensuring you don’t have to face this alone. Remember, you're not alone in this journey; we are dedicated to guiding you every step of the way.

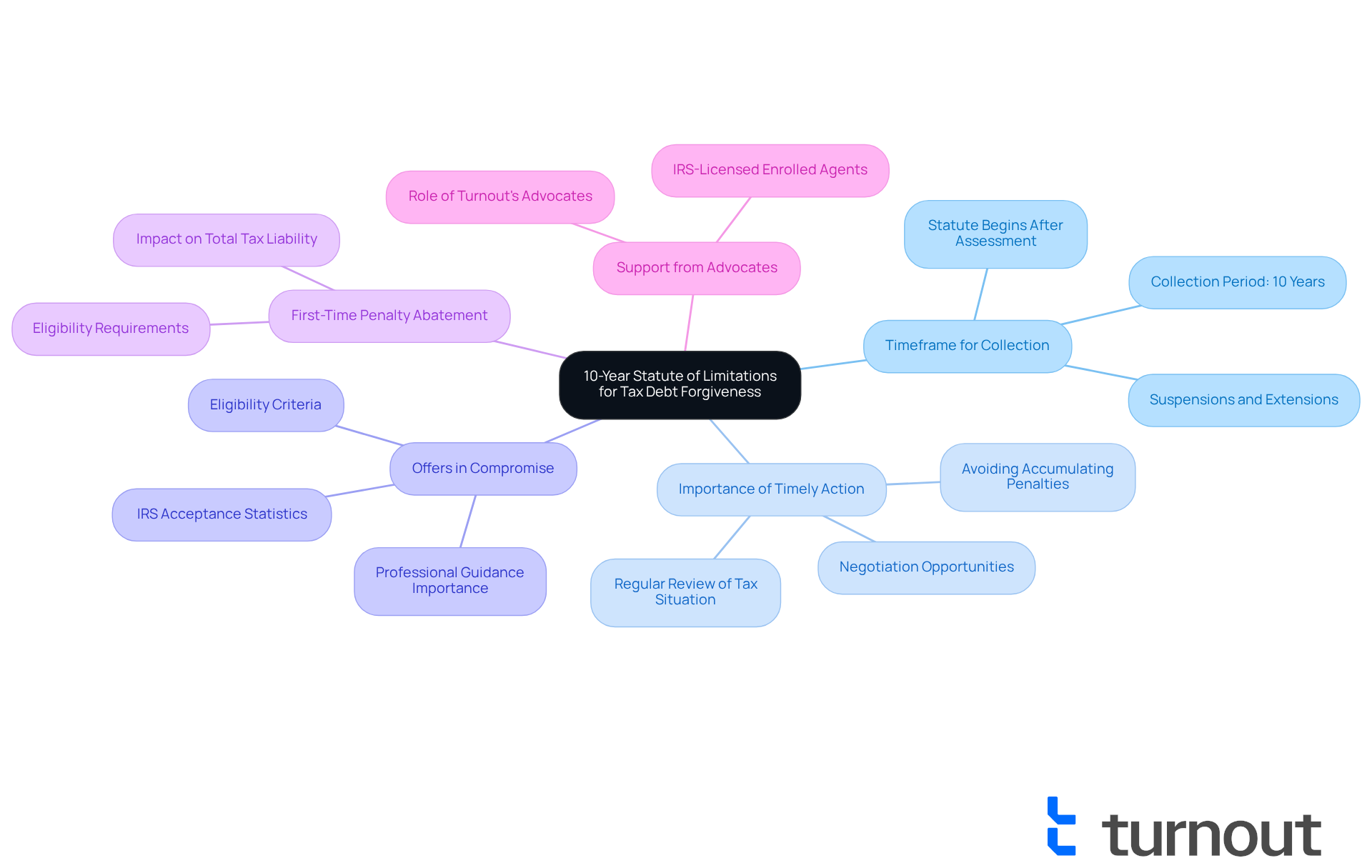

10-Year Statute of Limitations: Know Your Timeframe for Tax Debt Forgiveness

The IRS enforces a 10-year statute of limitations for collecting tax obligations. After this period, the agency can no longer pursue collection efforts, which can be a relief for many. This timeframe begins from the date the tax was assessed, making it essential for individuals to understand how this limit can influence their strategies for managing tax obligations.

We understand that timely action is crucial. Delaying can lead to accumulating penalties and interest, which can significantly increase the overall amount owed. If your obligation is nearing the end of this statute, you might have alternatives to negotiate or resolve your obligation more favorably.

In FY2022, the IRS accepted over 13,000 Offers in Compromise, providing significant relief to eligible individuals. This underscores the importance of acting promptly. Turnout's trained nonlawyer advocates are here to assist clients in tracking their debts and developing effective strategies. Additionally, IRS-licensed enrolled agents provide specialized support for tax-related issues.

By leveraging the statute of limitations, you can potentially forgive back taxes and alleviate your financial burdens while regaining control over your financial future. Furthermore, the IRS's First-Time Penalty Abatement policy allows qualified individuals to reduce specific penalties, enhancing your ability to manage tax obligations effectively.

To maximize these opportunities, we encourage you to regularly review your tax situation and consult with Turnout's advocates to explore your options. Remember, you are not alone in this journey; we're here to help.

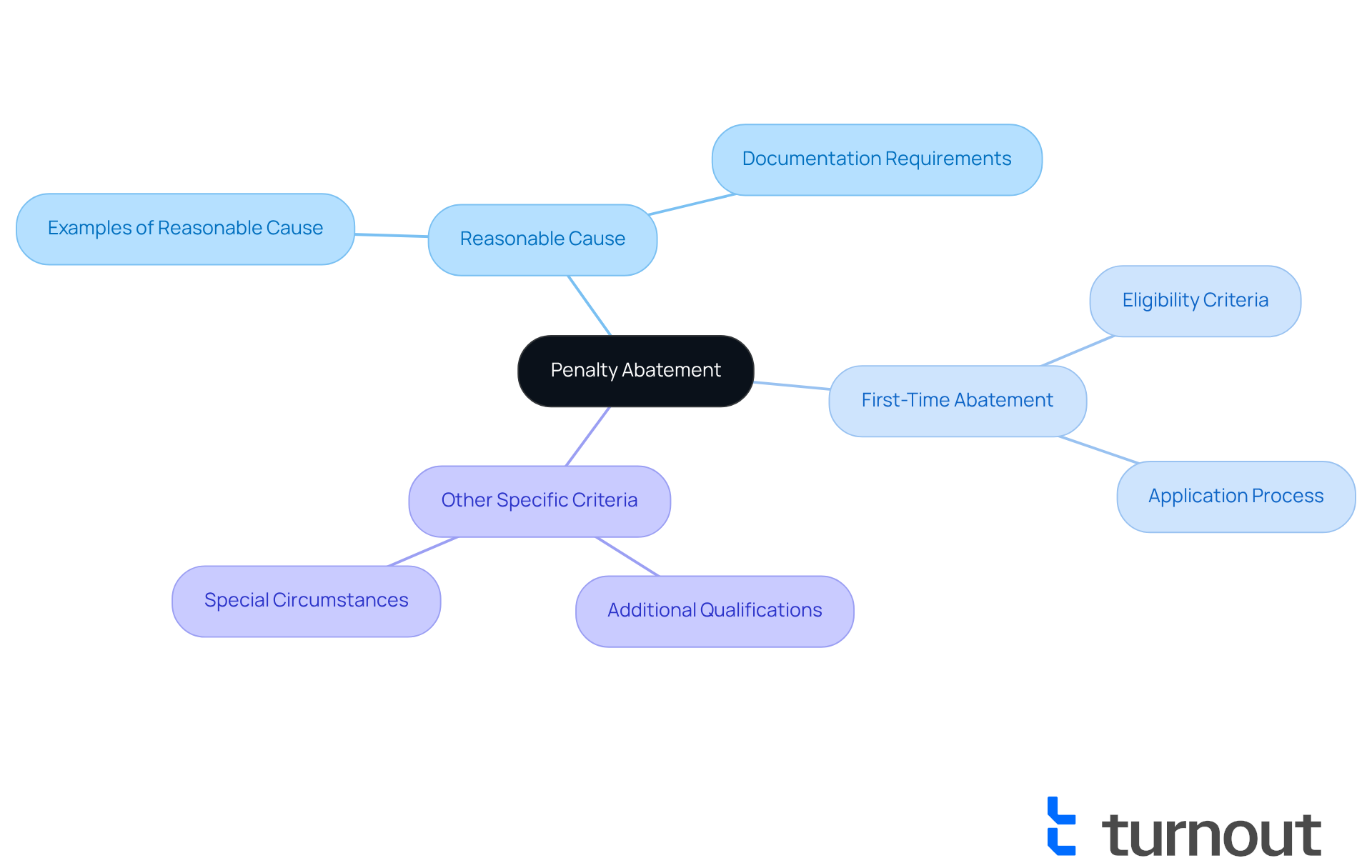

Penalty Abatement: Reduce Your Tax Burden Through Forgiveness

Penalty abatement is a process that can help forgive back taxes and alleviate the stress of penalties imposed by the IRS, whether due to late payments or filings. We understand that facing these penalties can be overwhelming, but there are options available. Taxpayers may qualify for abatement based on:

- Reasonable cause

- First-time abatement

- Other specific criteria

Exploring the different avenues for penalty abatement can significantly ease your financial burdens. Our advocates at Turnout are here to support you in identifying the best options tailored to your unique situation. We will guide you through the application process with care and expertise, ensuring you feel confident every step of the way.

Remember, you are not alone in this journey. Together, we can navigate the complexities of penalty abatement and work towards a brighter financial future.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming, especially for those facing back taxes. We understand that this journey can be daunting, but there are effective strategies to help you forgive back taxes and ease your financial burden. Seeking assistance through innovative solutions like Turnout's AI-driven platform, along with established programs such as the Offer in Compromise and Currently Not Collectible status, can make a significant difference.

Consider the potential for substantial savings through the Offer in Compromise. This option, along with the temporary relief offered by Currently Not Collectible status, can provide immediate support. Additionally, compassionate options like First-Time Penalty Abatement and Innocent Spouse Relief empower you to regain control over your financial future. Understanding the 10-year statute of limitations is also crucial for managing your tax obligations effectively.

Remember, you do not have to embark on this journey toward financial stability alone. By leveraging the resources and support systems available to you, you can explore your options and take proactive steps to alleviate your tax burdens. Engaging with knowledgeable advocates can ensure that you are not facing the challenges of tax debt in isolation. We’re here to help you navigate this path with confidence.

Frequently Asked Questions

What is Turnout and how does it assist with tax debt relief?

Turnout is a service that utilizes AI technology to simplify the process of forgiving back taxes for consumers. It combines automated systems with support from trained advocates to help individuals navigate tax debt complexities and explore forgiveness options.

Why is timely assistance for tax debt relief important?

With over 11.3 million Americans behind on federal taxes as of the end of 2023, timely assistance is crucial for individuals seeking to forgive back taxes and receive clear guidance in managing their tax obligations.

How does Turnout's fee structure work?

Turnout offers some services at no cost, while others come with service fees. Additionally, government fees are separate and must be paid before any paperwork can be submitted on behalf of clients. This transparency helps consumers make informed decisions regarding their financial support options.

What role does AI play in tax relief services?

AI enhances the efficiency of tax resolution processes by improving taxpayer interactions and compliance. It helps streamline case management and communication, making it easier for consumers to forgive back taxes and reduce financial burdens.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is a program that allows individuals to settle their tax debt for less than the total amount due, especially for those facing economic hardships. To qualify, individuals must demonstrate their inability to pay and provide detailed documentation.

What documentation is required to apply for an OIC?

To apply for an OIC, individuals need to submit bank statements, tax returns from the last three years, and proof that the total amount owed is $15,000 or less to apply online.

What potential savings can individuals achieve through an OIC?

Many individuals have reported savings of up to 90% of their initial tax obligations when navigating the OIC process effectively, providing significant financial relief.

Can you provide an example of success with the OIC program?

One notable success involved a taxpayer who owed $30,000 in back taxes but, after working with advocates, was able to settle for just $3,000, demonstrating the program's potential to transform financial burdens into manageable solutions.

What are the penalties for failing to file taxes?

The IRS enforces a failure-to-file penalty of 5% of unpaid taxes for each month a return is overdue, capping at 25%. This highlights the urgency of addressing tax obligations.

How can Turnout help individuals with the OIC process?

Turnout's advocates assist individuals in preparing required documentation and negotiating with the IRS, significantly enhancing the chances of a favorable outcome in the OIC process.