Introduction

Group disability income plans are more than just a safety net; they serve as a vital lifeline that can greatly enhance financial stability for employees. By providing tax-free benefits, these plans enable individuals to maintain a higher net income during tough times, easing financial stress and promoting a better quality of life.

We understand that as financial pressures mount and uncertainties arise, it’s common to feel overwhelmed. So, how can organizations effectively leverage these tax-exempt advantages? By fostering a supportive workplace culture, they can attract and retain talent while ensuring their employees feel valued and secure.

Remember, you are not alone in this journey. Together, we can create an environment where everyone thrives.

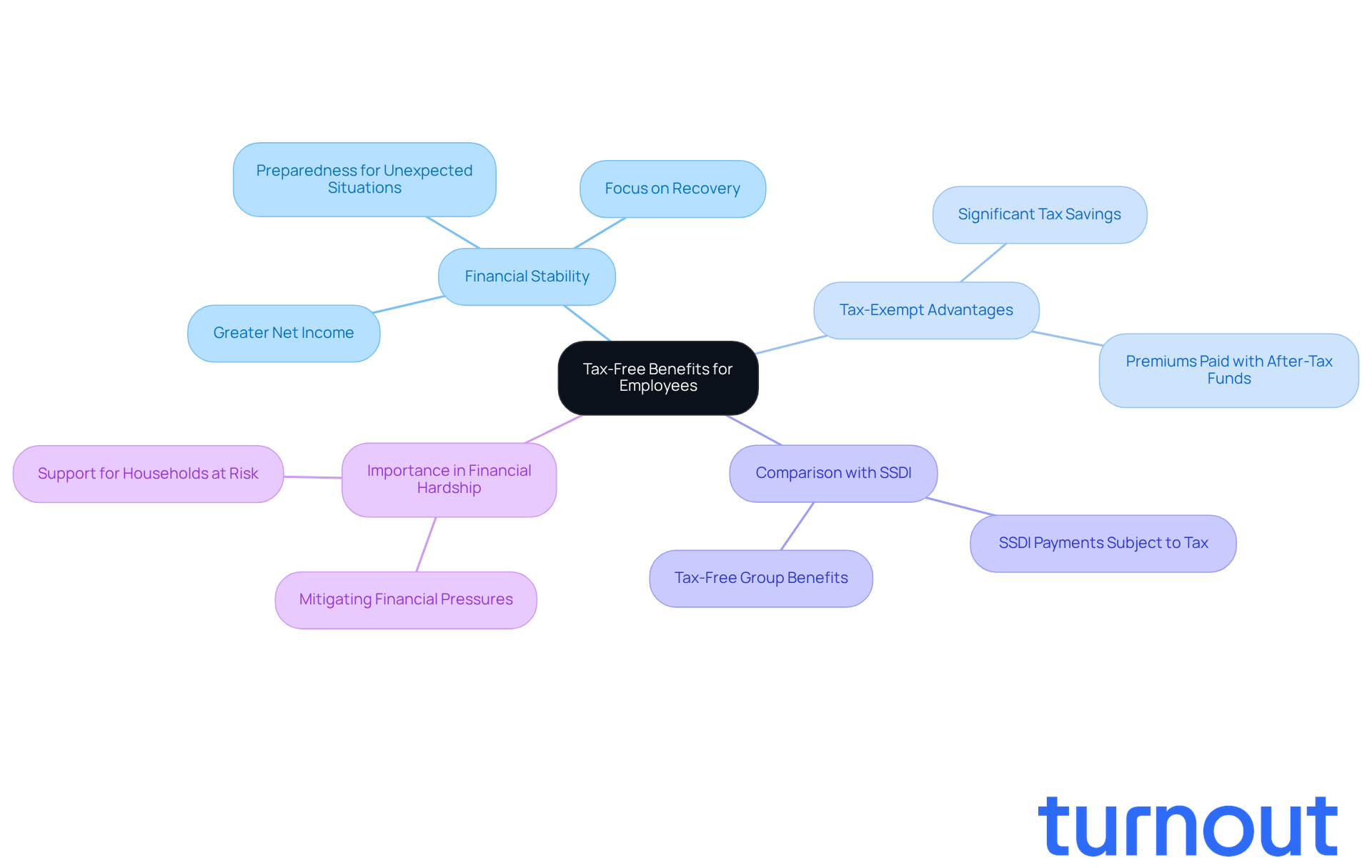

Tax-Free Benefits Enhance Financial Security for Employees

It is important to note that a group disability income plan that pays tax-free benefits to covered employees is considered to offer significant tax-exempt advantages that can greatly enhance your financial stability. When you pay premiums with after-tax funds, a group disability income plan that pays tax-free benefits to covered employees is considered, meaning the payments you receive during a disability are exempt from taxation. This means you can enjoy a greater net income during tough times, which is beneficial since a group disability income plan that pays tax-free benefits to covered employees is considered, helping you maintain your quality of life without the burden of tax deductions on your benefits.

We understand that financial pressures can be overwhelming, especially in 2025 when many may face heightened challenges. Financial advisors emphasize that a group disability income plan that pays tax-free benefits to covered employees is considered to provide crucial tax benefits. For instance, Ed Rossi, a senior financial advisor, highlights how tax-exempt advantages can lead to substantial savings, allowing you to focus on recovery rather than financial stress.

It's important to note that while group assistance payments are tax-free, SSDI payments will still be subject to federal tax calculations in 2025. Understanding the impact of tax-exempt assistance is essential, especially when a group disability income plan that pays tax-free benefits to covered employees is considered, as it empowers you to make informed decisions about your coverage and ensures you are better prepared for unexpected situations.

With nearly half of U.S. households at risk of financial hardship within six months of losing income, the importance of these benefits cannot be overstated. Remember, you are not alone in this journey, and we're here to help you navigate these challenges.

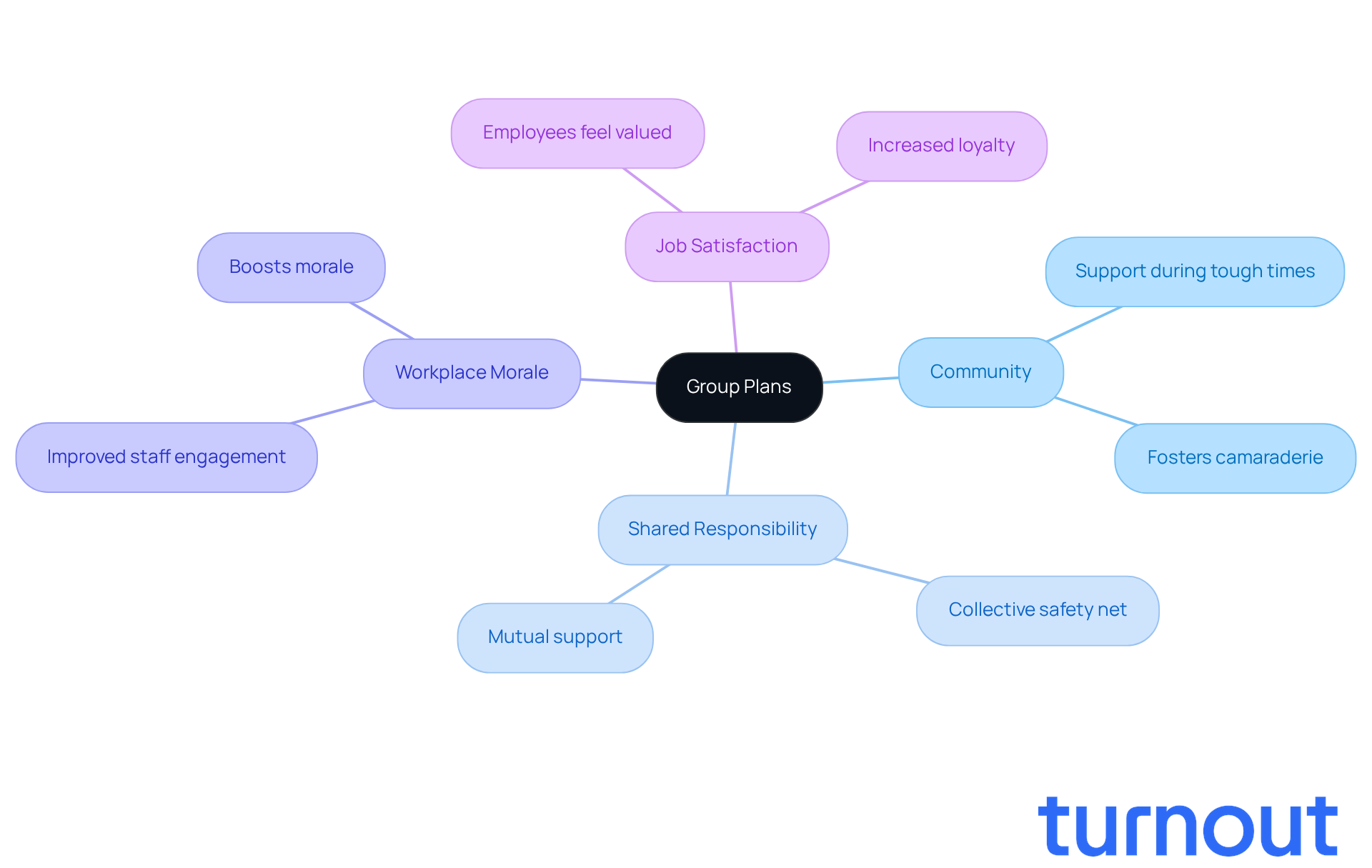

Group Plans Foster Community and Shared Responsibility

Group disability income plans create a strong sense of community among workers. They act as a collective safety net, providing support during tough times. This shared responsibility fosters camaraderie and significantly boosts workplace morale.

When employees see that their colleagues are invested in a system designed to protect them, they feel valued and supported. This sense of belonging can lead to greater job satisfaction and loyalty, ultimately benefiting the entire organization.

For instance, organizations with group health plans often report improvements in staff engagement and retention. Workers appreciate the mutual support and security these plans provide. Experts agree that such initiatives can transform workplace culture, fostering an environment where collaboration and camaraderie thrive.

Imagine a workplace where everyone feels connected and motivated. You are not alone in this journey. Together, we can build a resilient workforce that supports one another. Let's embrace the power of community and make our workplaces a better place for everyone.

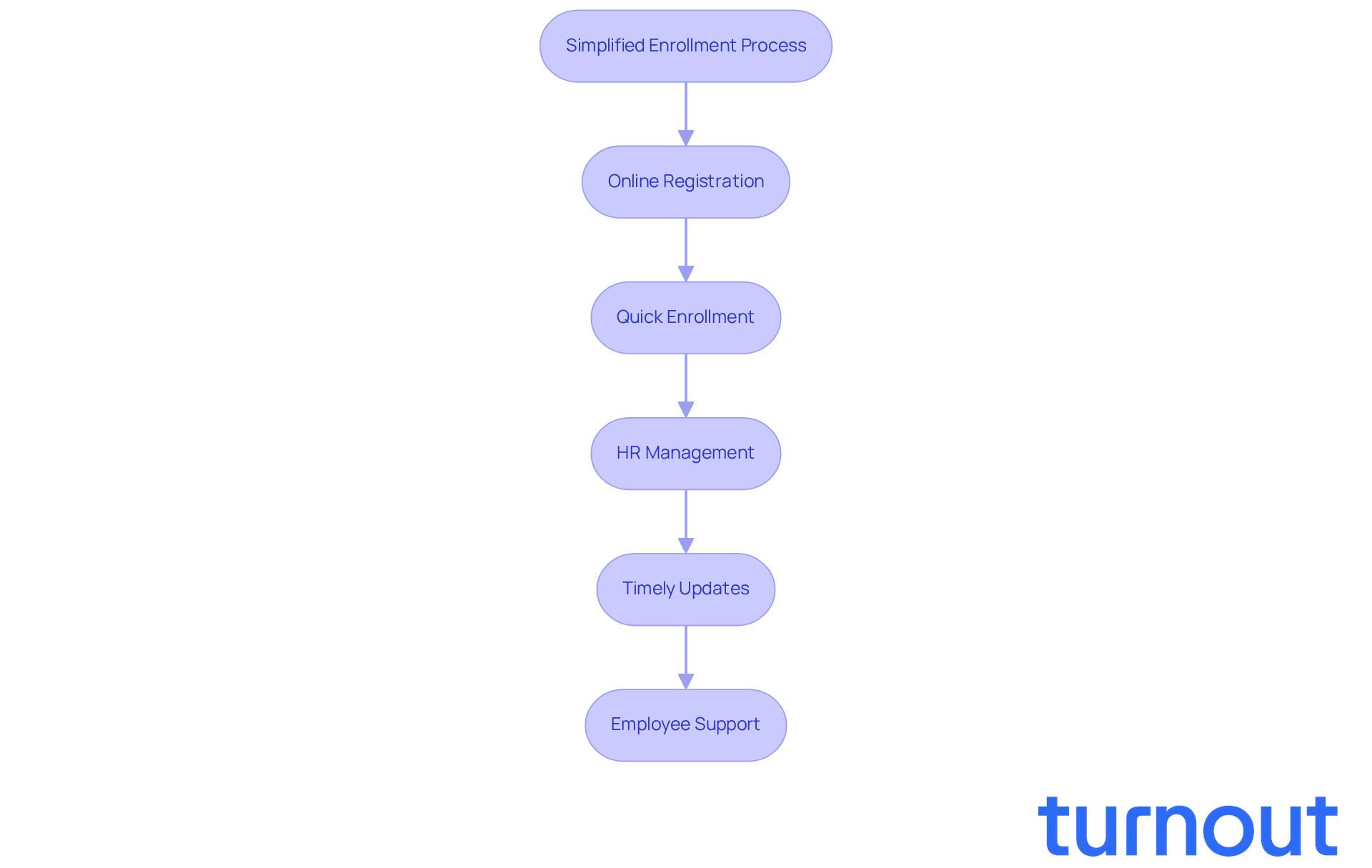

Simplified Enrollment and Management Streamline Access to Benefits

We understand that navigating disability income plans can feel overwhelming. The simplified enrollment and management process is one of the significant advantages when a group disability income plan that pays tax-free benefits to covered employees is considered. Many employers offer easy online registration options, allowing staff to enroll quickly without the hassle of extensive paperwork.

It's common to feel uncertain about the support available during challenging times. Fortunately, when evaluating employee benefits, a group disability income plan that pays tax-free benefits to covered employees is considered to be managed by HR departments or external administrators. This ensures that employees receive timely updates and assistance when they need it most.

This ease of access not only promotes higher participation rates but also keeps staff well-informed about their benefits. Ultimately, this leads to better outcomes during times of need. Remember, you are not alone in this journey; we're here to help you every step of the way.

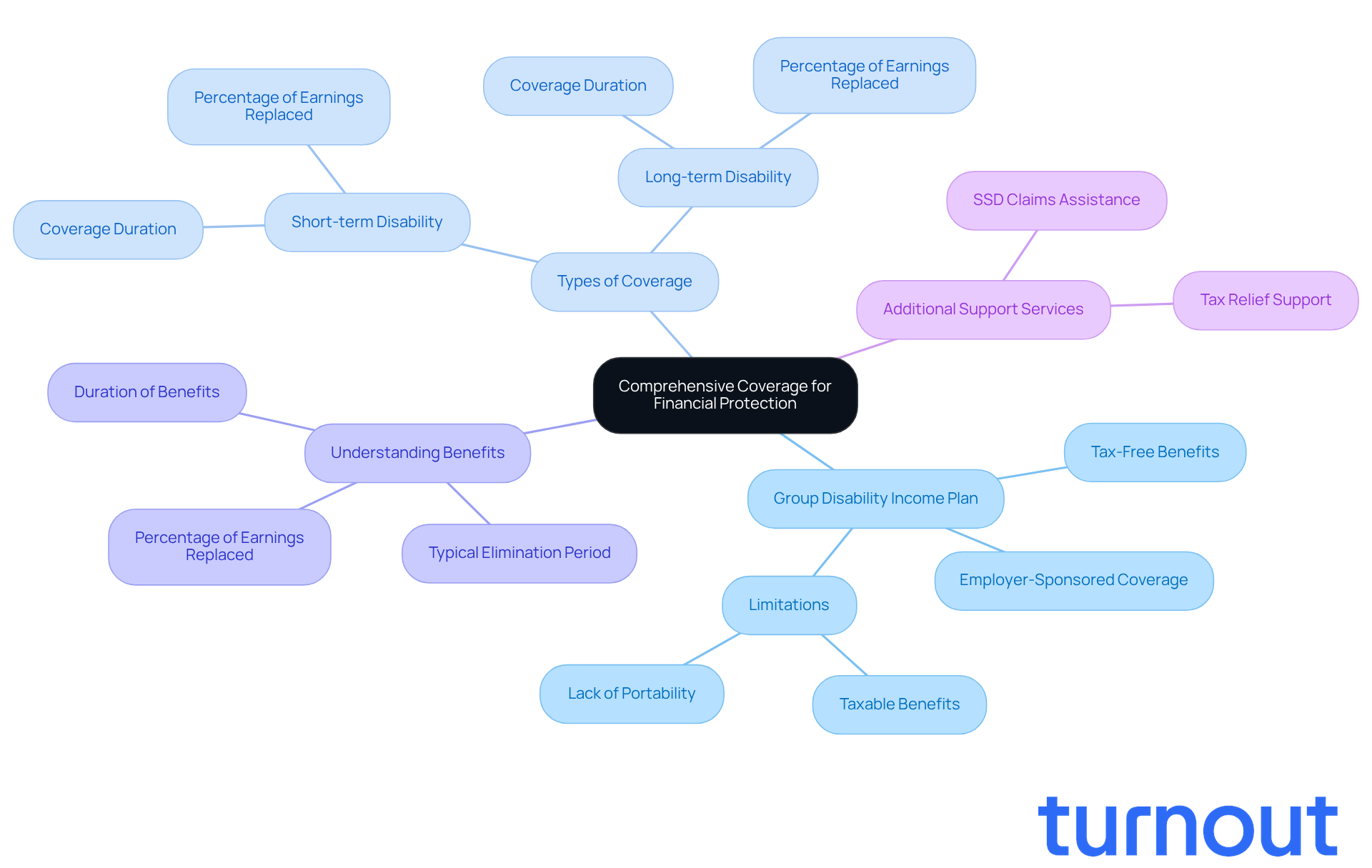

Comprehensive Coverage Offers Robust Financial Protection

It is considered that a group disability income plan that pays tax-free benefits to covered employees offers vital protection by helping to replace a significant portion of your earnings if you face an impairment. This coverage typically includes both short-term and long-term disability assistance, ensuring you receive financial support during various stages of recovery.

We understand that navigating these challenges can be overwhelming. Knowing the specifics - like the percentage of earnings replaced and the duration of benefits - can help you feel more secure in your financial planning. It’s common to feel anxious during tough times, but you’re not alone in this journey.

Additionally, if you're dealing with government assistance like Social Security Disability (SSD) claims, Turnout provides access to trained nonlawyer advocates. They’re here to help you understand and manage your claims effectively. This support, along with the expertise of IRS-licensed enrolled agents for tax debt relief, ensures you can navigate complex financial systems without needing legal representation.

Remember, we’re here to help you every step of the way.

Attract and Retain Talent with Competitive Benefits

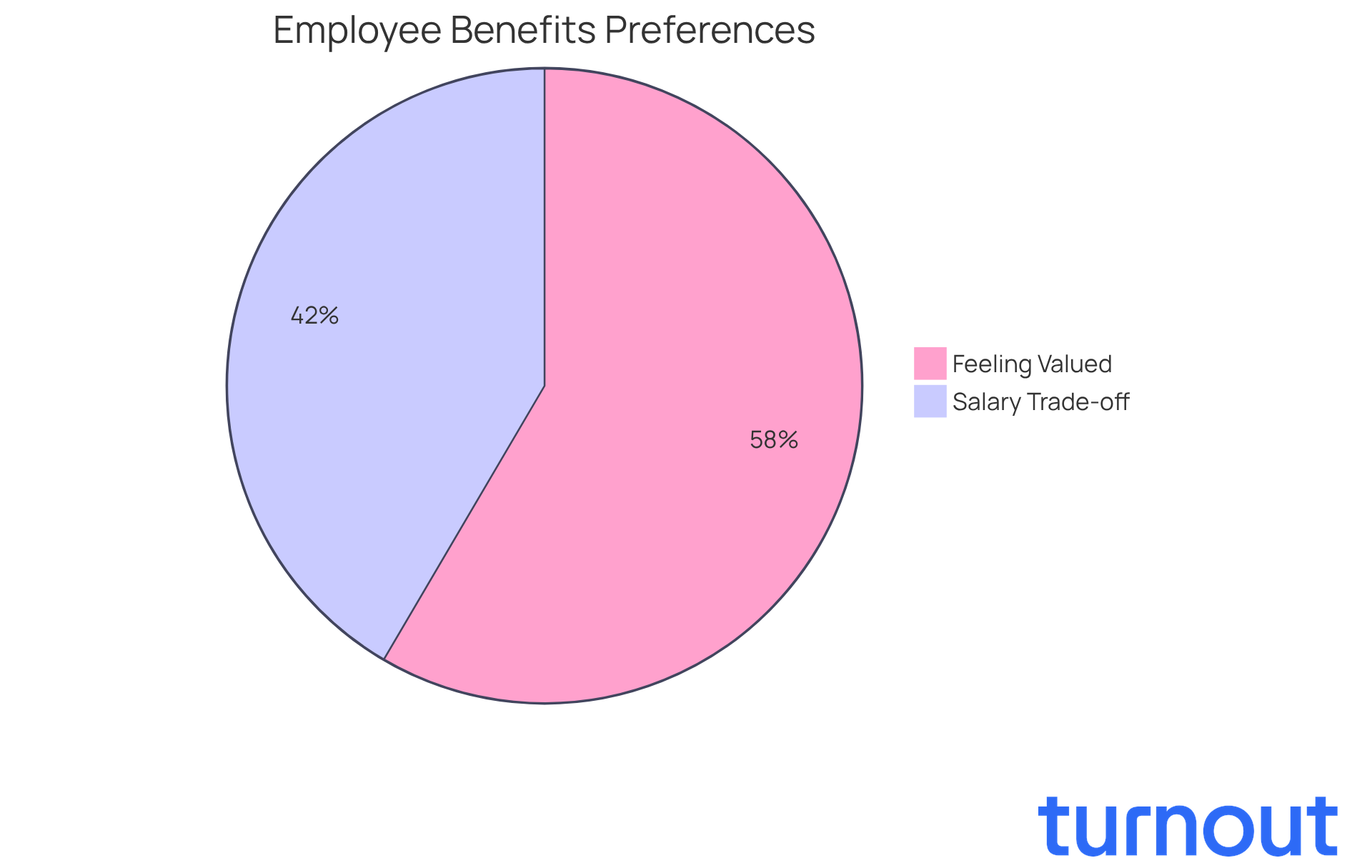

In today’s competitive job market, we understand that attracting and retaining top talent can be challenging. Providing a comprehensive compensation package is essential, as a group disability income plan that pays tax-free benefits to covered employees is considered. Candidates are increasingly evaluating potential employers based on the perks offered. In fact, 59% of workers are willing to forgo part of their salary for better healthcare options.

A strong support plan not only demonstrates an organization’s commitment to employee well-being but also serves as a crucial differentiator in a crowded market. Many workers value perks more than pay, which highlights the importance of showing support during tough times. It’s common to feel uncertain about job security, but knowing that your employer cares can make a significant difference.

Moreover, 83% of employees who feel valued report greater loyalty to their employer. This underscores the vital role a group disability income plan that pays tax-free benefits to covered employees is considered to play in fostering that sense of care. By investing in these competitive advantages, organizations can enhance their appeal, ensuring they attract skilled professionals who appreciate comprehensive support in their workplace.

As we look toward 2025, the demand for flexible and personalized compensation packages will only grow. Employers must adapt their offerings to meet these evolving needs. Remember, you are not alone in this journey; we’re here to help you navigate these changes.

Promote Employee Well-Being and Morale Through Supportive Benefits

Supportive advantages, like group impairment financial plans, play a crucial role in enhancing worker well-being and morale. We understand that when staff members know their employer provides a safety net in case of incapacity, they tend to feel more secure and valued. This sense of security can lead to greater job satisfaction, reduced stress, and improved overall morale.

Organizations that prioritize employee well-being through comprehensive offerings often consider a group disability income plan that pays tax-free benefits to covered employees, leading to higher levels of engagement and productivity among their workforce. It’s common to feel overwhelmed when facing uncertainties, but knowing that support is available can make a significant difference.

Turnout streamlines access to governmental assistance and financial support, helping individuals navigate complex processes like Social Security Disability (SSD) claims and tax debt relief. By utilizing trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout ensures that individuals receive the help they need without the complications of legal representation. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Leverage Technology with Turnout for Seamless Benefit Navigation

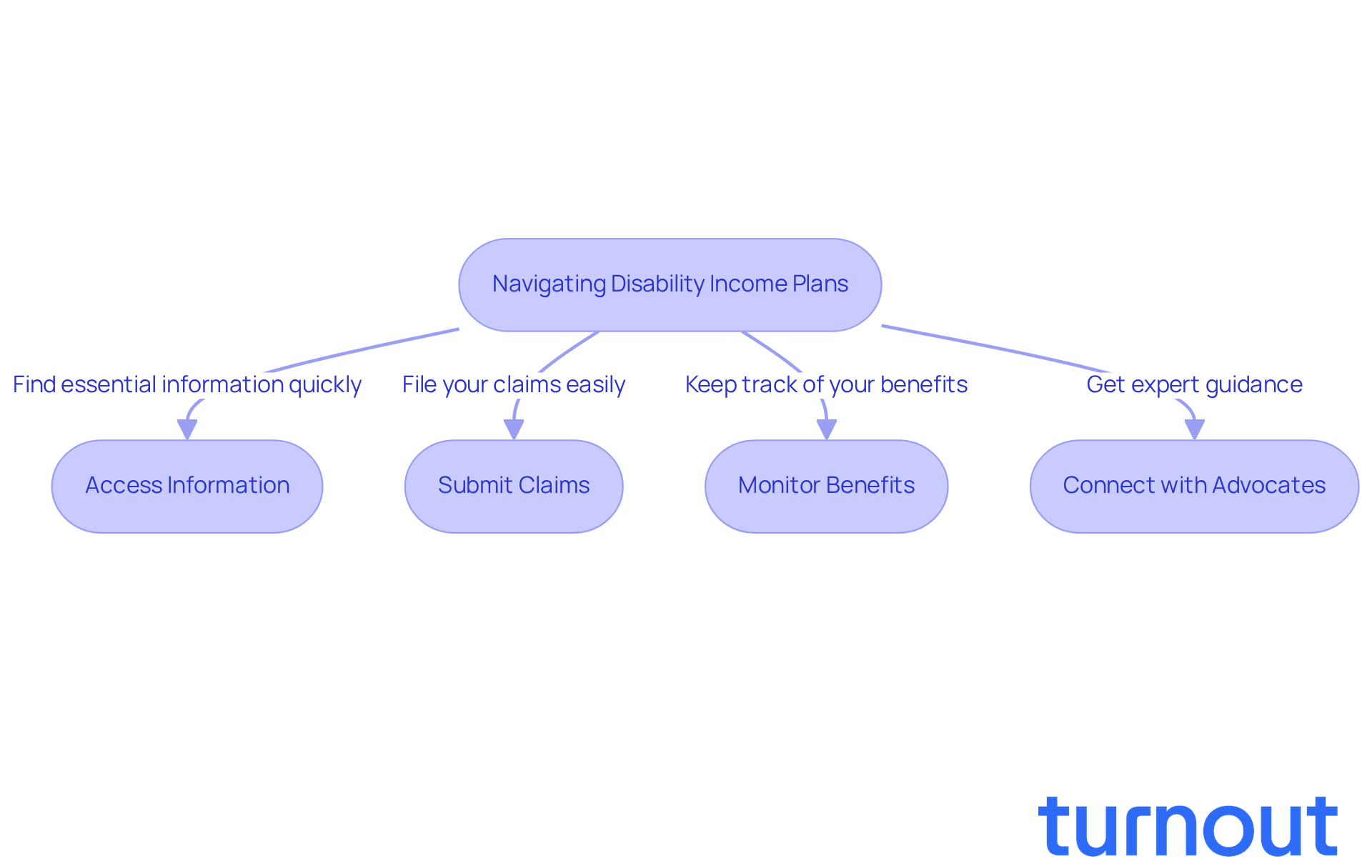

Navigating group disability income plans can be overwhelming. At Turnout, we understand that accessing the right information is crucial for staff. That’s why we utilize cutting-edge technology to make this process easier and more intuitive.

Our platforms are designed with you in mind. With AI-driven support, staff can quickly find essential information, submit claims, and monitor their benefits - all at their fingertips. We’re here to help you every step of the way.

But we don’t stop there. Turnout also connects you with trained nonlawyer advocates for Social Security Disability (SSD) claims. Plus, we collaborate with IRS-licensed enrolled agents for tax debt relief. This means you can receive expert guidance without the stress of navigating legal complexities alone.

This streamlined approach not only enhances your experience but also encourages greater involvement in the programs available to you. By integrating technology with expert support, we create an environment where you feel informed and supported throughout the benefits process.

You are not alone in this journey. Together, we can enhance your engagement with your disability benefits, ensuring you have the resources you need to thrive.

Conclusion

The advantages of a group disability income plan that provides tax-free benefits are truly significant. They enhance financial security for employees during tough times. When benefits are exempt from taxation, individuals can focus on their recovery without the added stress of financial burdens. This tax-exempt nature not only helps maintain a higher net income but also fosters a sense of community and support among employees, reinforcing their value within the workplace.

We understand that navigating employee benefits can be overwhelming. That’s why it’s essential to highlight the importance of these plans. They simplify enrollment processes, making access to benefits easier. They offer comprehensive coverage that provides robust financial protection. Plus, they play a crucial role in attracting and retaining talent. Insights from financial experts emphasize how these plans contribute to a positive workplace culture, ultimately boosting morale and job satisfaction.

As organizations continue to face the complexities of employee benefits, the significance of offering tax-free disability income plans cannot be overstated. Employers are encouraged to invest in these supportive benefits. Not only do they enhance appeal in a competitive job market, but they also promote the well-being of the workforce. By prioritizing such initiatives, companies can create a resilient environment where employees feel valued and secure. Together, we can ensure that they are well-equipped to handle life's uncertainties.

Frequently Asked Questions

What are the benefits of a group disability income plan that pays tax-free benefits?

A group disability income plan that pays tax-free benefits provides significant tax-exempt advantages, enhancing financial stability by ensuring that benefits received during a disability are exempt from taxation, resulting in a greater net income.

How do tax-free benefits impact financial security during tough times?

Tax-free benefits allow employees to maintain their quality of life without the burden of tax deductions on their benefits, which is especially beneficial during challenging financial periods.

What is the significance of group disability income plans in 2025?

In 2025, financial pressures may increase, making tax-exempt advantages from group disability income plans crucial for substantial savings, which can alleviate financial stress and allow focus on recovery.

Are SSDI payments subject to taxes?

Yes, while group assistance payments are tax-free, Social Security Disability Insurance (SSDI) payments will still be subject to federal tax calculations.

How do group plans foster community among employees?

Group disability income plans create a strong sense of community by acting as a collective safety net, providing support during tough times and fostering camaraderie, which boosts workplace morale.

What are the effects of group plans on workplace culture?

Organizations with group health plans often report improvements in staff engagement and retention, as employees feel valued and supported, leading to greater job satisfaction and loyalty.

How can group plans contribute to a resilient workforce?

By providing mutual support and security, group plans can transform workplace culture, fostering an environment of collaboration and camaraderie, ultimately benefiting the entire organization.