Introduction

Navigating the intersection of health insurance and long-term disability can be daunting for many employees, especially during challenging times. With changes to the Employment Standards Act coming in 2025, it’s crucial to understand the nuances of health insurance cancellation during disability. We know this can feel overwhelming, but you’re not alone in this journey.

This article aims to shed light on the rights and protections available to you, offering essential insights on how to maintain your coverage and avoid potential pitfalls. As questions arise about employer discretion and the risk of discrimination, you might be wondering: What steps can you take to ensure your health insurance remains intact during periods of incapacity?

Together, we’ll explore the answers to these pressing concerns, providing you with the knowledge and support you need.

Understand the Employment Standards Act and Health Insurance Cancellation

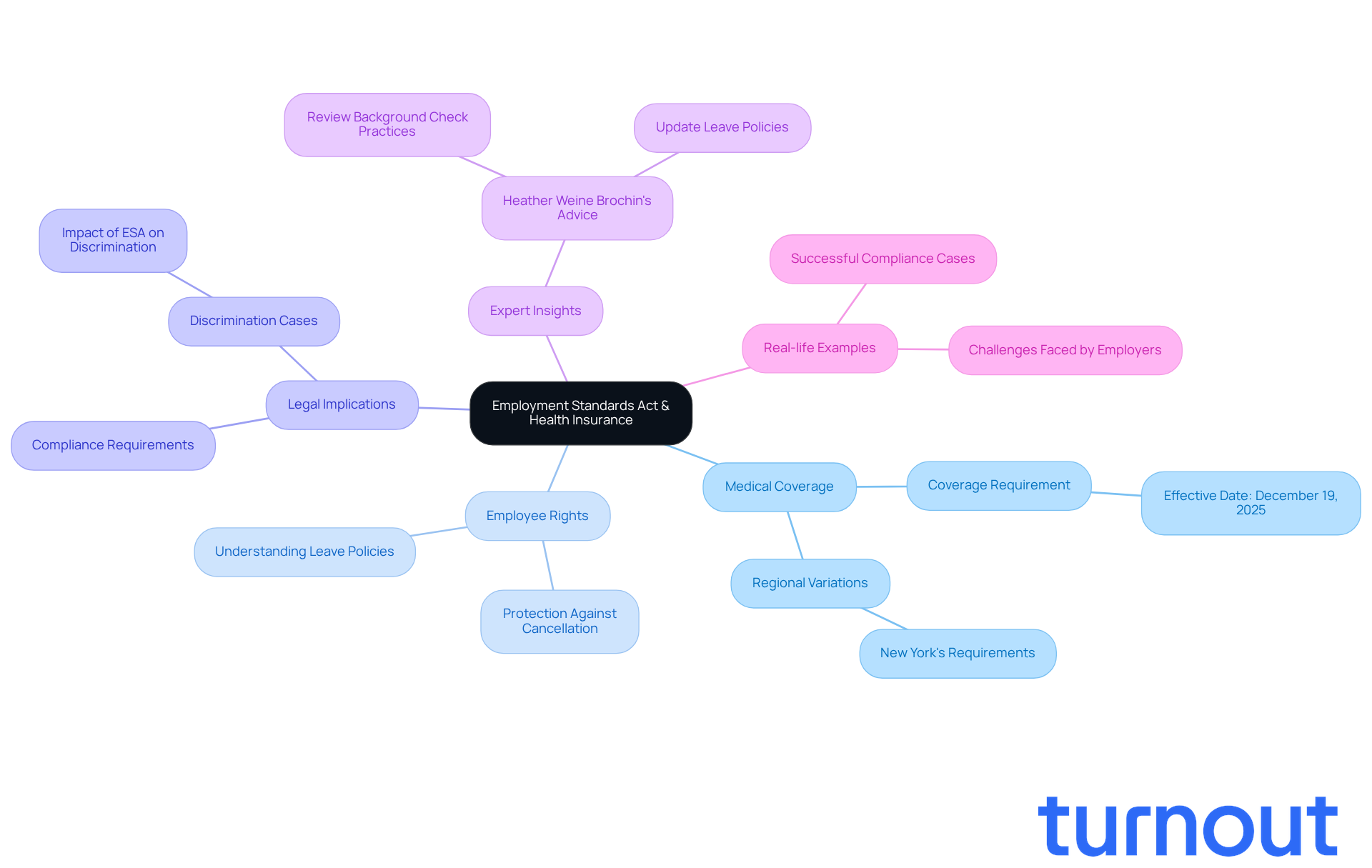

The Employment Standards Act (ESA) plays a crucial role in setting essential employment criteria across various regions, especially regarding medical coverage during leave due to incapacity. Starting December 19, 2025, employers must maintain health insurance coverage for employees on leave due to illness, which makes me wonder: can my employer cancel my health insurance while on long-term disability, according to the specific terms in their employment contracts and applicable laws? This law is particularly significant for employment discrimination cases occurring on or after this date, reinforcing protections for employees during challenging times.

We understand that navigating these provisions can be overwhelming. It's vital for employees to know their rights and how to manage the complexities of health-related leave. For instance, in places like New York, businesses are clearly required to uphold medical benefits for workers on disability leave, but this leads to concerns about whether can my employer cancel my health insurance while on long-term disability. This reflects a growing recognition of the need for comprehensive support during difficult periods.

Expert insights emphasize that the ESA's medical coverage provisions address concerns about whether my employer can cancel my health insurance while on long-term disability, protecting employees from losing essential benefits when they need them most. Heather Weine Brochin, a partner in labor law, advises, "Employers should review their background check and screening practices and update their policies to ensure that consumer credit information is no longer requested or used in employment decisions except where a statutory exemption clearly applies."

Real-life examples from various organizations demonstrate how companies can successfully uphold these standards, particularly in relation to the question of whether can my employer cancel my health insurance while on long-term disability, ensuring that disabled staff members retain their benefits without interruption. This commitment not only nurtures a supportive work environment but also aligns with broader efforts to promote equity and accessibility in the workplace.

Remember, you are not alone in this journey. We're here to help you understand your rights and ensure you receive the support you deserve.

Recognize Employer Discretion in Health Benefit Management

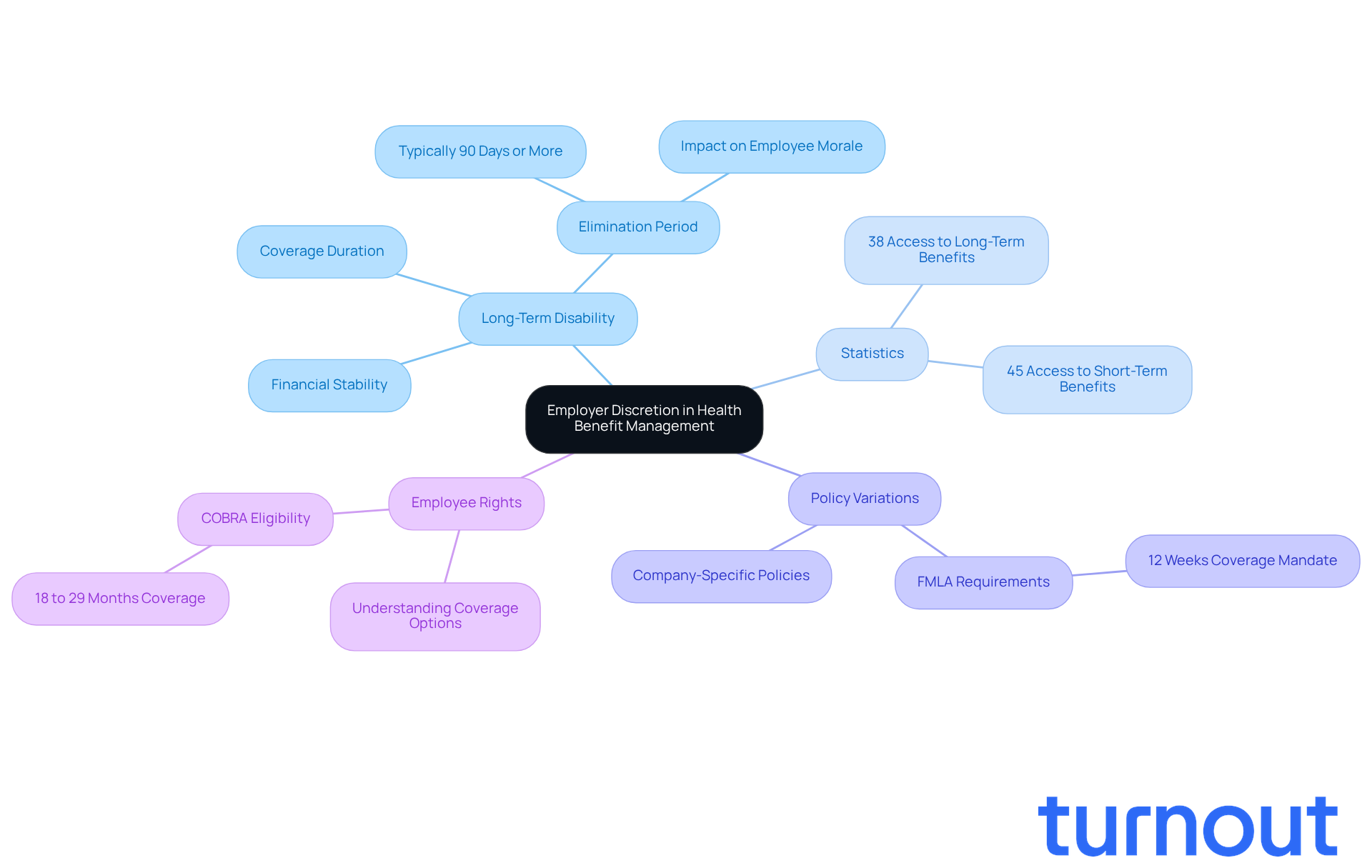

When it comes to managing health benefits, employers hold significant authority, leading many to wonder, can my employer cancel my health insurance while on long-term disability? We understand that navigating these options can be overwhelming. Some companies may choose to maintain coverage for a limited time, while others might discontinue it, leading to the concern of whether can my employer cancel my health insurance while on long-term disability.

As of 2024, access to long-term benefits provided by organizations has risen to 38%. This trend reflects a growing commitment among companies to support their workforce during challenging times. Additionally, access to short-term disability benefits is expected to increase to 45% in 2024, further illustrating the evolving landscape of workplace support.

However, the specifics of these policies, including whether they can my employer cancel my health insurance while on long-term disability, can vary widely. Some companies extend health coverage beyond the Family and Medical Leave Act (FMLA) requirements, which mandate maintaining health benefits for up to 12 weeks. Understanding your organization's unique policies is crucial, particularly to determine if my employer can cancel my health insurance while on long-term disability, as this knowledge can significantly impact your access to necessary healthcare during difficult periods.

Moreover, the duration of waiting periods before benefits commence can affect both staff morale and the overall cost of coverage for businesses. As the landscape of impairment requests evolves - especially in the wake of the COVID-19 pandemic, which has heightened mental health issues and may lead to an increase in future claims - it's essential to stay informed about your rights and your organization's practices. Remember, you are not alone in this journey, and we're here to help you manage your coverage during times of impairment.

Explore the Impact of Long-Term Disability on Health Insurance Coverage

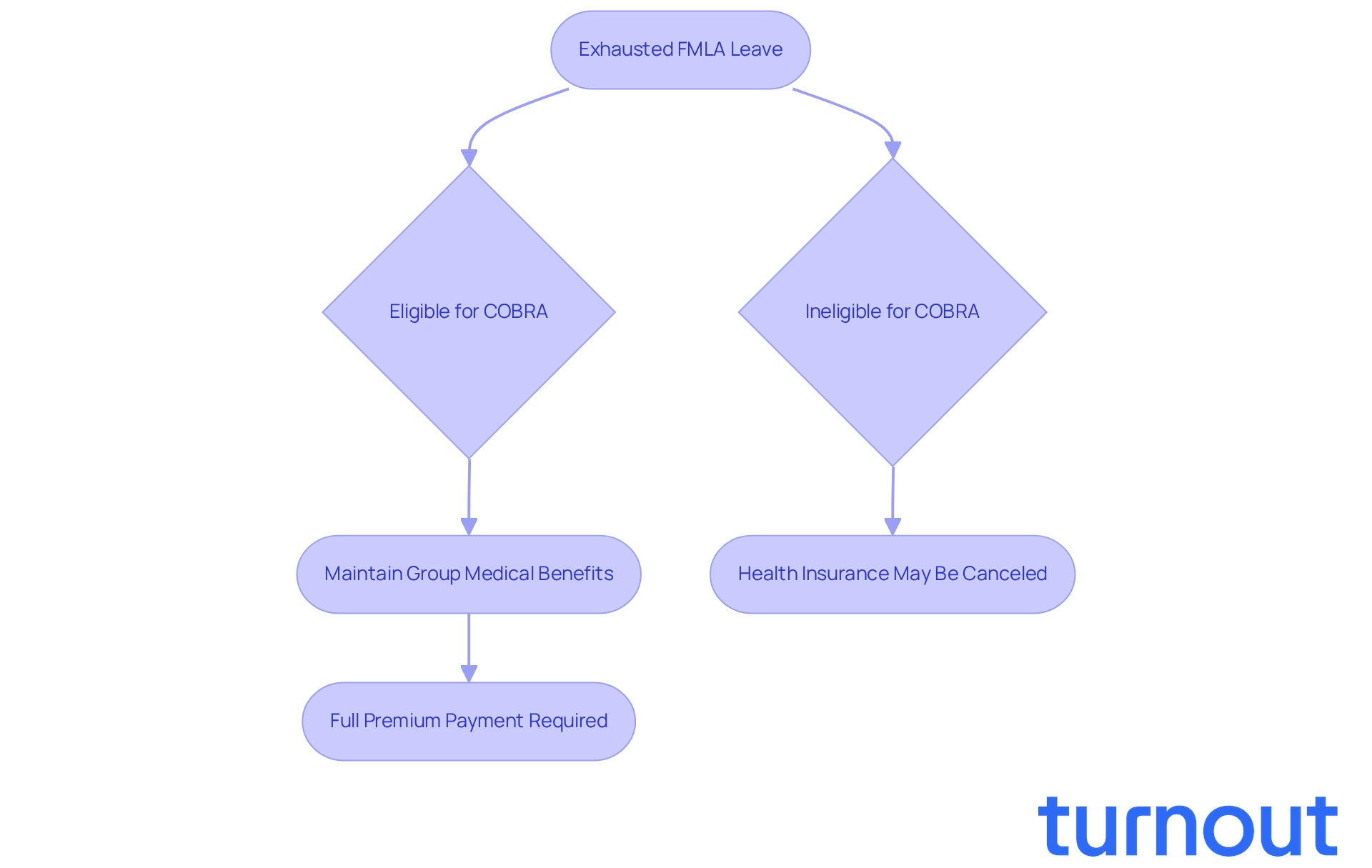

Extended-term impairments can deeply impact your medical coverage, and we understand how concerning this can be. When an employee exhausts their Family and Medical Leave Act (FMLA) leave of up to 12 weeks of unpaid leave, it raises the concern of whether my employer can cancel my health insurance while on long-term disability, unless state laws or company policies provide otherwise. It's important to note that recent data shows about 44 percent of workers are ineligible for unpaid leave under FMLA. This highlights the precarious situation many find themselves in.

For those who do use up their FMLA leave, options like COBRA become essential. COBRA allows individuals to keep their group medical benefits for a limited time after job loss or other qualifying events, including long-term impairment. However, it’s crucial to remember that individuals may need to cover the full premium, which can be a significant financial burden.

It is vital for workers facing prolonged incapacitation to understand the stipulations, particularly about whether my employer can cancel my health insurance while on long-term disability. You’re not alone in this journey, and comprehending how to preserve your medical coverage during these challenging times can make a difference. We’re here to help you navigate these complexities.

Identify Discrimination Risks in Health Insurance Cancellation

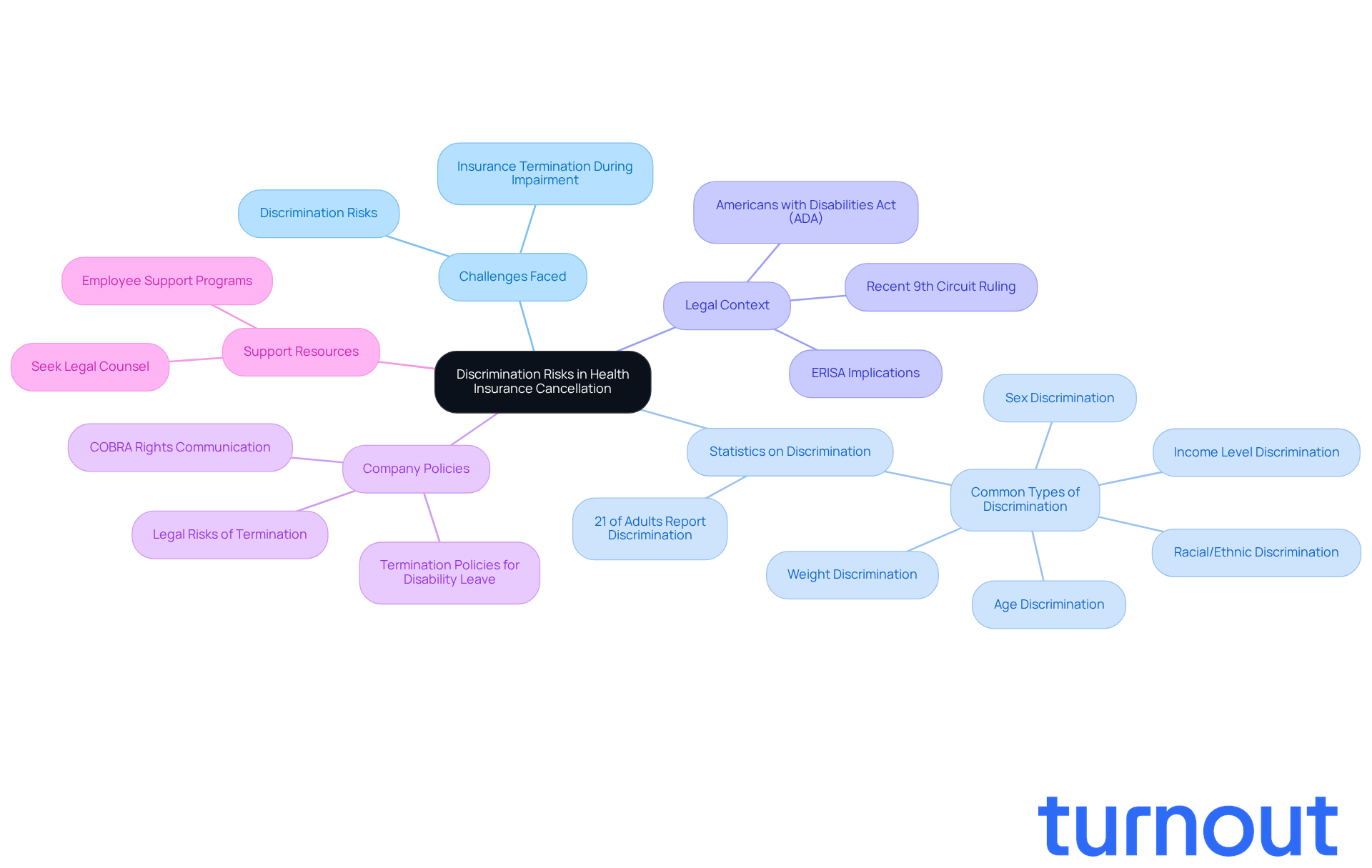

Workers facing insurance termination during impairment often encounter significant challenges, and it’s understandable to feel overwhelmed. Discrimination risks can arise, especially when the termination appears linked to their impairment status. Under regulations like the Americans with Disabilities Act (ADA), it’s crucial to know that employers cannot treat employees unfairly due to their impairment.

Recent studies reveal that over 21% of adults in the U.S. have reported experiencing discrimination in medical care settings. Many attribute these distressing experiences to their medical conditions. It’s alarming to note that about half of U.S. firms may wonder if they can my employer cancel my health insurance while on long-term disability status or shortly thereafter. This highlights a pressing issue that needs our attention.

Legal updates, including the recent 9th Circuit ruling, remind us of the importance of vigilance. Such rulings could lead to increased litigation against companies concerning the question of whether they can my employer cancel my health insurance while on long-term disability for discriminatory practices related to coverage cancellation. If you suspect discrimination, seeking legal counsel can be a vital step in navigating these complex issues and protecting your rights effectively.

Moreover, it’s essential for companies to clearly communicate policies related to COBRA rights. Understanding your options after losing medical coverage is crucial, and we’re here to help you through this journey. Remember, you are not alone in this; support is available.

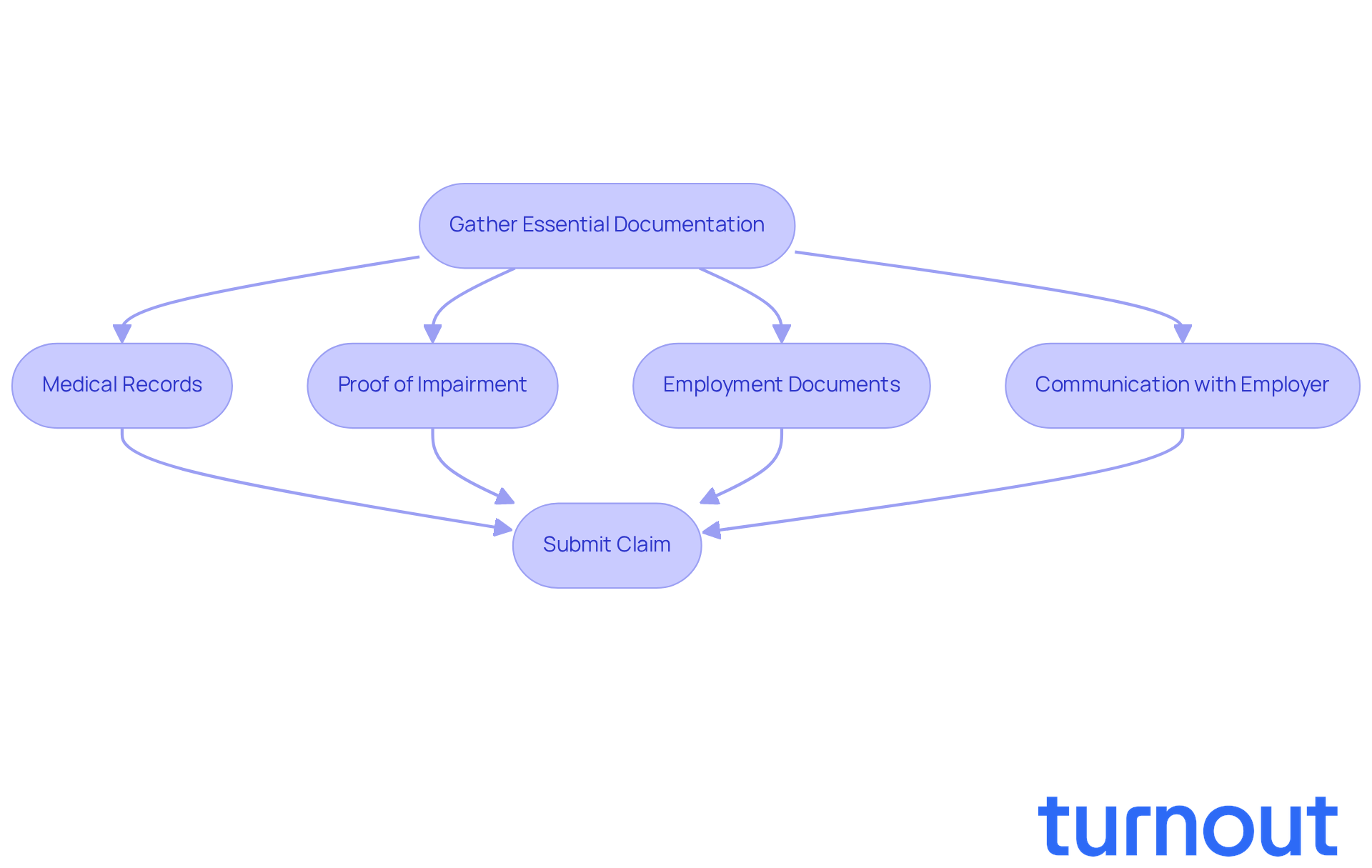

Gather Essential Documentation for Health Insurance Claims

Managing medical claims during a challenging time can feel overwhelming. We understand that gathering the right documentation is crucial. This includes your medical records, proof of impairment, employment documents, and any communication with your workplace about your medical coverage. Did you know that, according to the Social Security Administration, about 68% of claims are denied due to insufficient documentation? This highlights just how important it is to have comprehensive evidence.

Many legitimate claims get initial approval when backed by strong medical documentation. So, it’s vital to collect detailed medical records that clearly outline your condition, including treatment notes and test results. It is essential to maintain an open line of communication with your employer regarding whether they can cancel your health insurance while on long-term disability. Make sure to retain copies of all correspondence to create a thorough record of your claim submission.

You’re not alone in this process. Turnout offers access to trained nonlawyer advocates who can help you navigate the SSD claims process. They’re here to support you in gathering and presenting your documentation effectively. This thorough preparation not only helps in contesting denials but also raises the question of whether your employer can cancel your health insurance while on long-term disability during your time of need. Remember, we’re here to help you every step of the way.

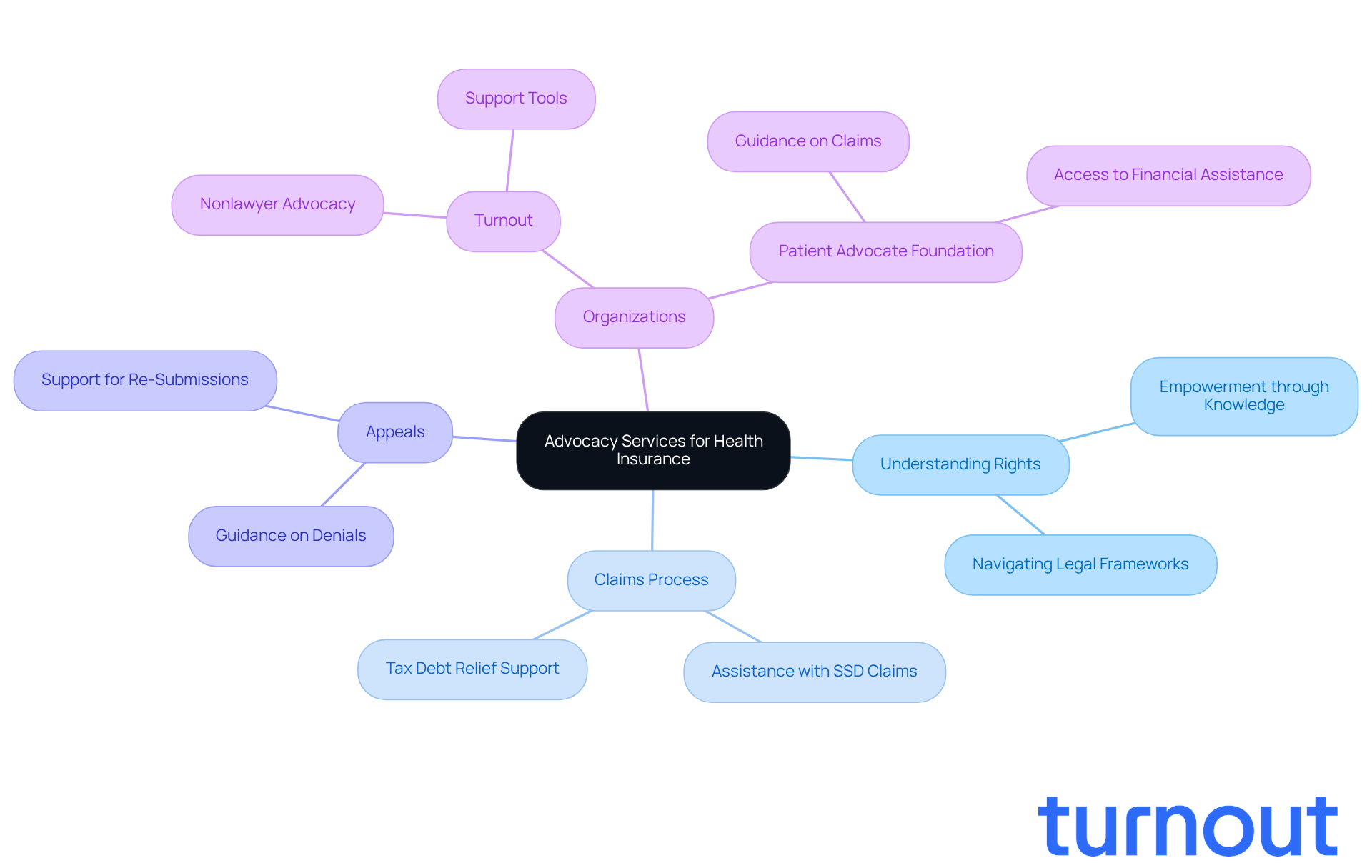

Utilize Advocacy Services for Navigating Health Insurance Issues

Advocacy services are vital for individuals facing coverage challenges during times of disability. We understand how overwhelming this can be. These services empower you to grasp your rights, navigate the claims process, and appeal any denials you might encounter.

Turnout offers tools and services designed to help you maneuver through complex financial and governmental systems. This includes assistance with Social Security Disability (SSD) claims and tax debt relief. While Turnout isn’t a law firm and doesn’t provide legal representation, their trained nonlawyer advocates are here to support you every step of the way.

Organizations like the Patient Advocate Foundation also provide essential resources and support. They offer guidance on navigating complex claims and access to financial assistance programs. It’s common to feel lost in this process, but remember, you’re not alone.

In fact, many individuals have successfully used advocacy services to overcome challenges in their coverage claims. This has led to better outcomes and access to the care they need. For instance, in 2023, advocacy organizations reported that over 1.2 million individuals benefited from their services. This highlights just how crucial these resources are.

As we look ahead to 2026, these resources will continue to be essential for those navigating the complexities of medical coverage, especially with ongoing changes in the healthcare environment. We’re here to help you through this journey.

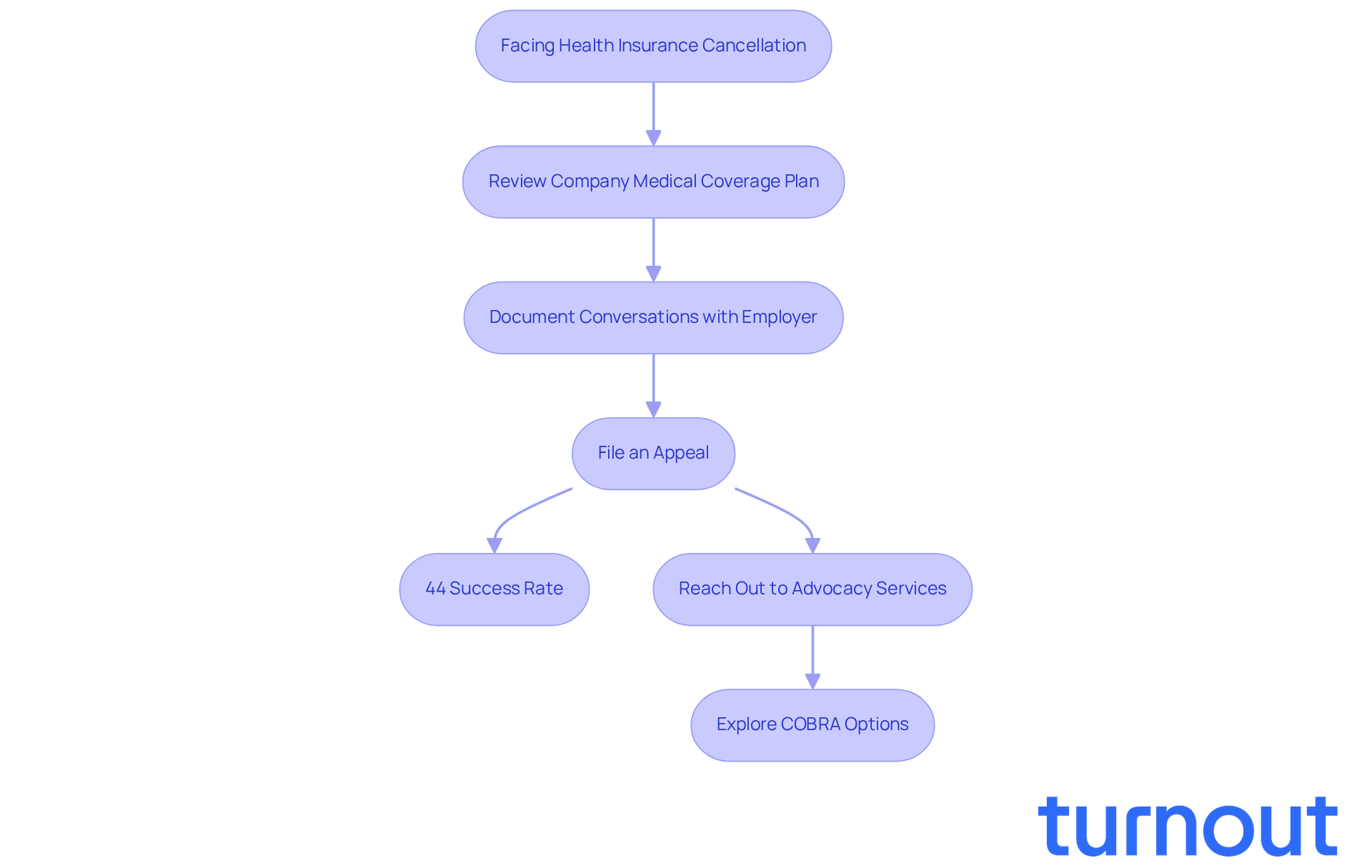

Take Action: Steps to Address Health Insurance Cancellation

Facing coverage cancellation during a disability can be overwhelming, and we understand how crucial it is to act quickly when considering if my employer can cancel my health insurance while on long-term disability. Start by taking a close look at your company's medical coverage plan. Understanding your rights and the specific terms of your protection is vital. Remember to document all your conversations with your employer regarding whether they can my employer cancel my health insurance while on long-term disability. This record can be invaluable if any disputes arise.

If your coverage is denied, don’t hesitate to file an appeal. Did you know that nearly 44% of internal appeals succeed in overturning denials? That’s a significant chance to reclaim your benefits. Additionally, consider reaching out to advocacy services like Turnout. They offer trained nonlawyer advocates who can guide you through the process of navigating SSD claims and financial assistance. Just a reminder: Turnout is not a law firm and doesn’t provide legal advice.

Exploring options like COBRA can help you address the question of whether my employer can cancel my health insurance while on long-term disability during this challenging time. Remember, being proactive can greatly enhance your chances of keeping the health benefits you need. You are not alone in this journey, and taking these steps can make a real difference.

Conclusion

Understanding the complexities surrounding health insurance during periods of disability is crucial for employees facing tough times. With the Employment Standards Act's new provisions coming into effect on December 19, 2025, protections against health insurance cancellation during long-term disability will be significantly strengthened. This underscores the importance of knowing your rights and the legal landscape.

We recognize that navigating these waters can be overwhelming. Throughout this article, we've highlighted:

- How employer discretion plays a role in managing health benefits

- The impact of long-term disability on insurance coverage

- The risks of discrimination that can arise during these transitions

Gathering essential documentation and utilizing advocacy services are vital steps in this journey. Each of these elements helps clarify how to protect your health coverage during periods of incapacity.

Ultimately, you should feel empowered to take action. Familiarizing yourself with your rights and your employer's specific policies is key. Proactive measures - like documenting communications, appealing denied claims, and seeking support from advocacy organizations - can greatly improve your chances of retaining necessary health benefits. The journey through disability is undoubtedly complex, but with the right knowledge and resources, you can navigate these challenges effectively. Remember, you deserve the support you need.

Frequently Asked Questions

What is the Employment Standards Act (ESA) and its significance regarding health insurance?

The ESA sets essential employment criteria, particularly about medical coverage during leave due to incapacity. Starting December 19, 2025, employers must maintain health insurance coverage for employees on leave due to illness, reinforcing protections for employees during challenging times.

Can my employer cancel my health insurance while I am on long-term disability?

Employers have significant discretion in managing health benefits, which means they may choose to maintain or discontinue coverage during long-term disability. The specifics can vary widely by organization, so it is crucial to understand your employer's policies regarding health insurance during such leave.

What protections do employees have regarding health insurance during long-term disability?

The ESA's provisions protect employees from losing essential benefits when they need them most, particularly for those on long-term disability. In places like New York, businesses are required to uphold medical benefits for workers on disability leave.

How do employer policies on health benefits during disability leave vary?

Some companies may extend health coverage beyond the Family and Medical Leave Act (FMLA) requirements, which mandate maintaining health benefits for up to 12 weeks. Others might only maintain coverage for a limited time, so understanding your organization's unique policies is crucial.

What trends are emerging regarding access to long-term and short-term disability benefits?

Access to long-term benefits is expected to rise to 38% in 2024, while access to short-term disability benefits is anticipated to increase to 45%. This reflects a growing commitment among companies to support their workforce during challenging times.

What factors should employees consider regarding their health insurance during long-term disability?

Employees should be aware of their organization's specific policies, the duration of waiting periods before benefits commence, and how these factors can affect their access to necessary healthcare during difficult periods.