Introduction

Navigating tax issues can feel overwhelming, often leading to stress and anxiety. We understand that for many, unresolved tax problems can seem insurmountable. But what if there was a way to regain control and find relief? Hiring a tax resolution company could be the answer you’ve been searching for.

Imagine having expert negotiators by your side, not only alleviating financial burdens but also providing personalized support tailored to your unique situation. It’s common to feel lost in the complexities of tax matters, but exploring the benefits of enlisting a tax resolution firm can turn this taxing ordeal into a manageable journey toward financial stability.

You are not alone in this journey. We’re here to help you navigate these challenges with compassion and understanding. Let’s take the first step together.

Reduce Stress and Anxiety Related to Tax Issues

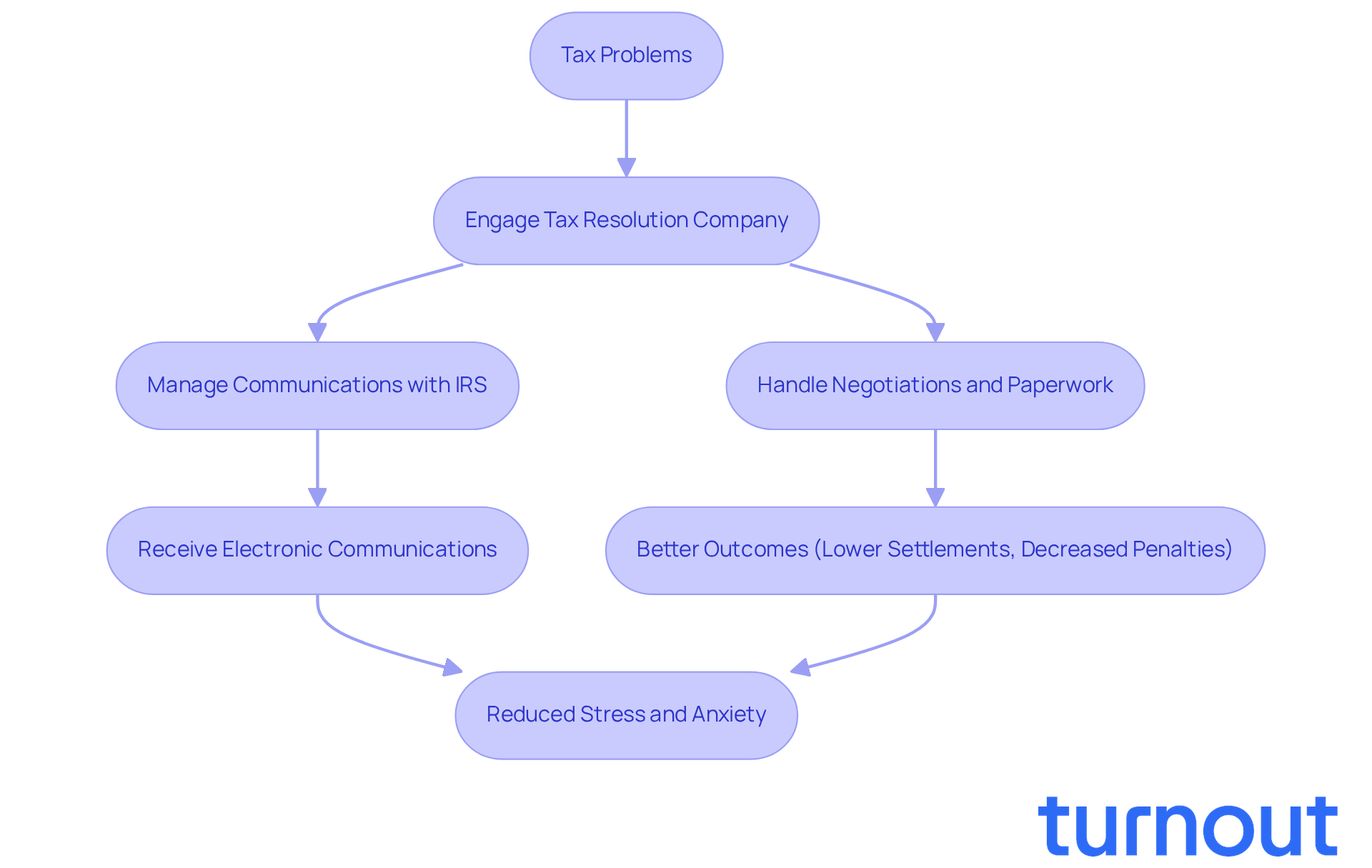

Dealing with tax problems can be incredibly stressful, and we understand that. Involving a tax resolution company like Turnout can significantly ease that burden. These professionals take on the task of managing communications with the IRS and other tax authorities, allowing you to focus on your daily life without the constant worry of unresolved tax issues.

By handling negotiations and the necessary paperwork, a tax resolution company not only provides peace of mind but also helps you regain control over your financial situation. While some of Turnout's services are free, it's important to note that others may incur service fees, and government fees are separate and must be paid before any paperwork can be submitted on your behalf.

Receiving all communications electronically ensures that you stay informed about your financial assistance process. The psychological weight of tax problems can feel overwhelming, often leading to anxiety and emotional distress. Having an expert advocate can transform this daunting experience into something manageable.

Moreover, expert representation often leads to better outcomes, such as lower settlement amounts and decreased penalties, which can further alleviate your anxiety. Ultimately, the support of a tax resolution company fosters a sense of security, empowering you to move forward with confidence and plan for a more stable financial future. Remember, you are not alone in this journey; we're here to help.

Save Money Through Effective Negotiation Strategies

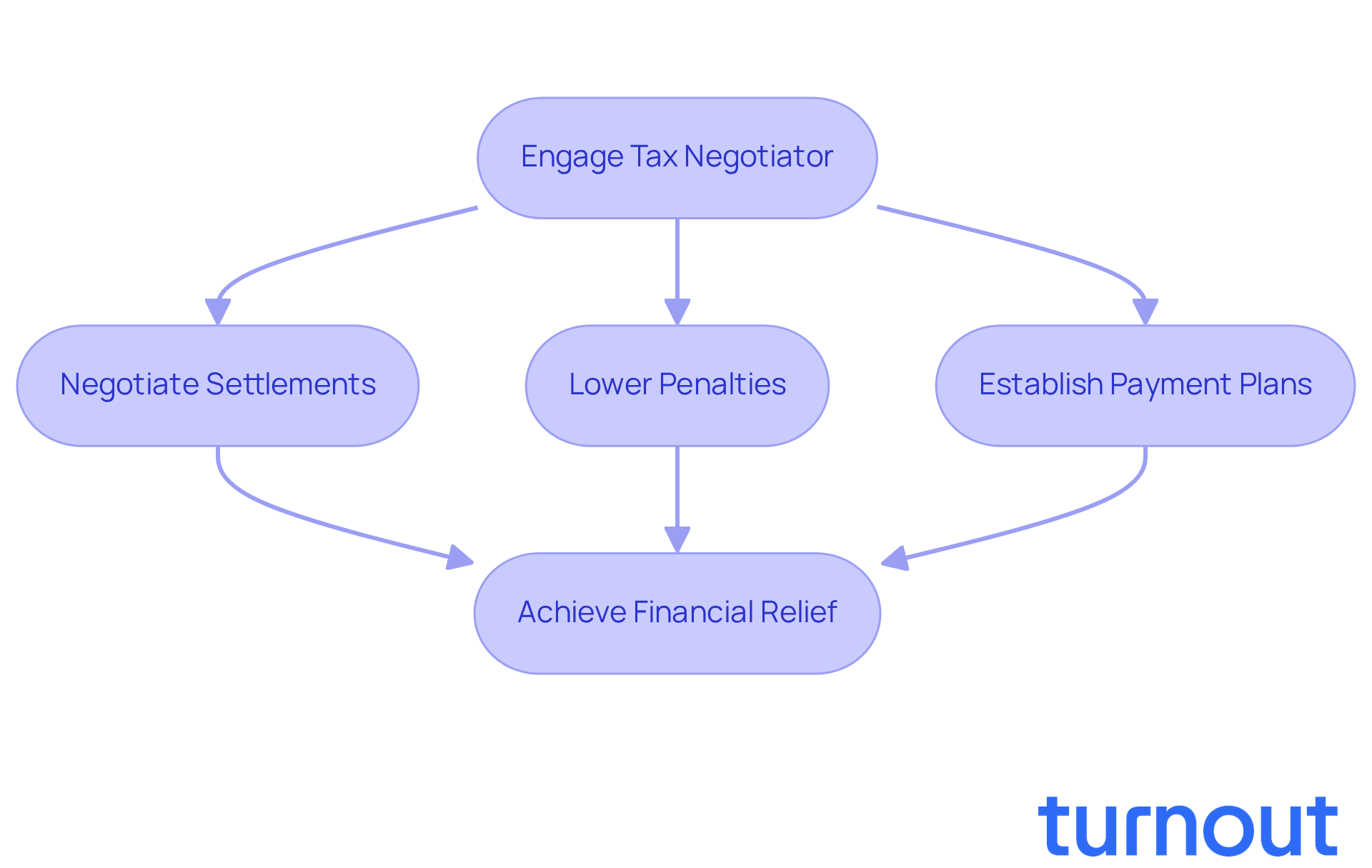

We understand that dealing with tax issues can be overwhelming. Experienced negotiators who truly grasp the complexities of tax law and the IRS's processes are employed by tax resolution companies. These experts can negotiate settlements, lower penalties, and establish manageable payment plans that ultimately save you money.

By leveraging their knowledge, they often achieve results that might be difficult for you to secure on your own. Imagine the relief of having someone in your corner, working tirelessly to alleviate your financial burden. You are not alone in this journey; help is available, and it can lead to significant financial relief.

Leverage Professional Expertise in Tax Law

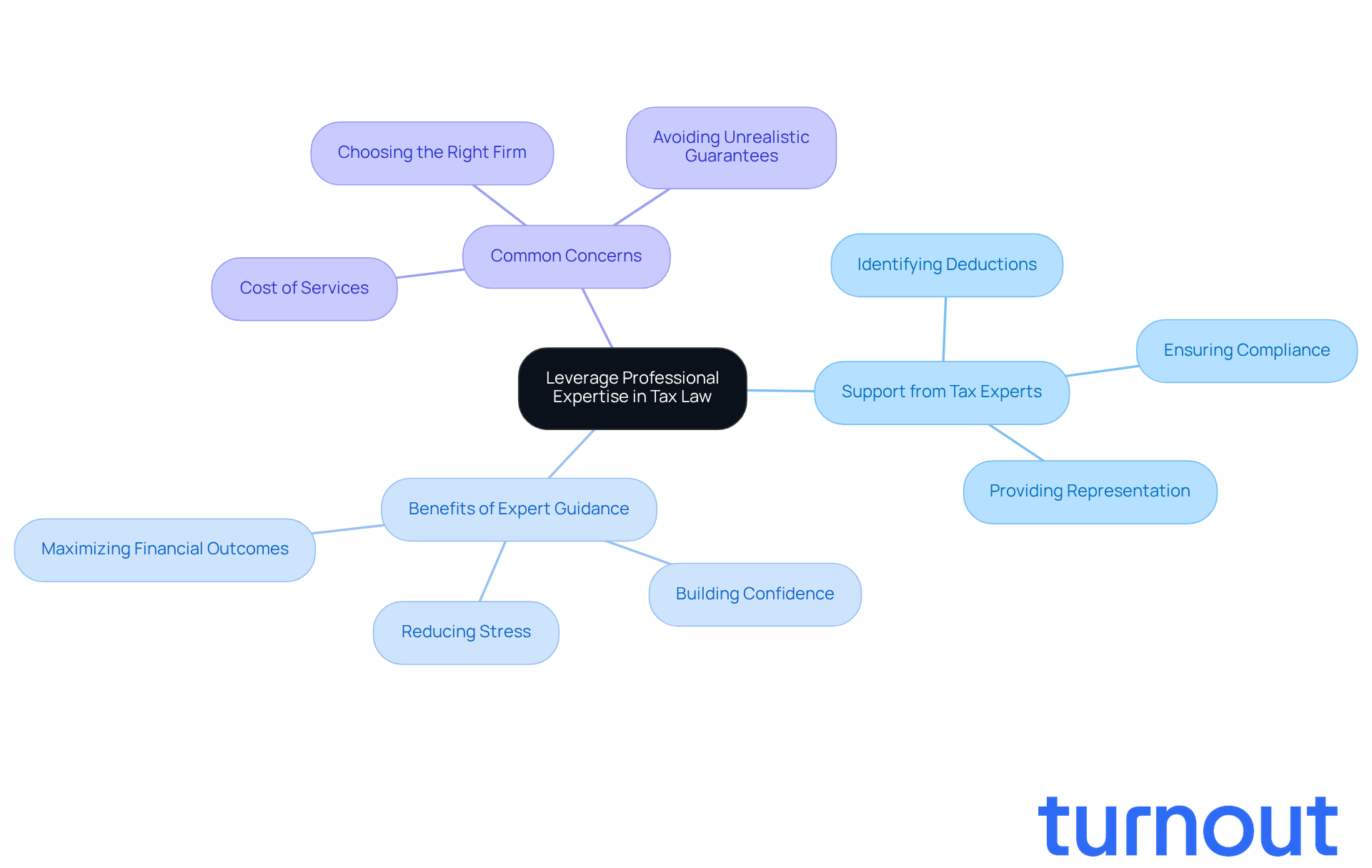

Navigating tax laws can feel overwhelming. We understand that their complexity and frequent changes can leave you feeling lost. But you’re not alone in this journey. A tax resolution company is here to help, employing experts who specialize in tax legislation. These professionals provide precise guidance and representation, ensuring you have the support you need.

Imagine having someone by your side who can identify potential deductions, credits, and strategies that you might overlook. This is where tax experts shine. They maximize your financial outcomes while ensuring compliance with tax regulations. It’s common to feel uncertain about what you might be missing, but with the right help, you can feel confident in your financial decisions.

So, if you’re feeling overwhelmed, remember that expert assistance is just a call away. You deserve to navigate tax laws with clarity and peace of mind.

Receive Personalized Support Tailored to Your Needs

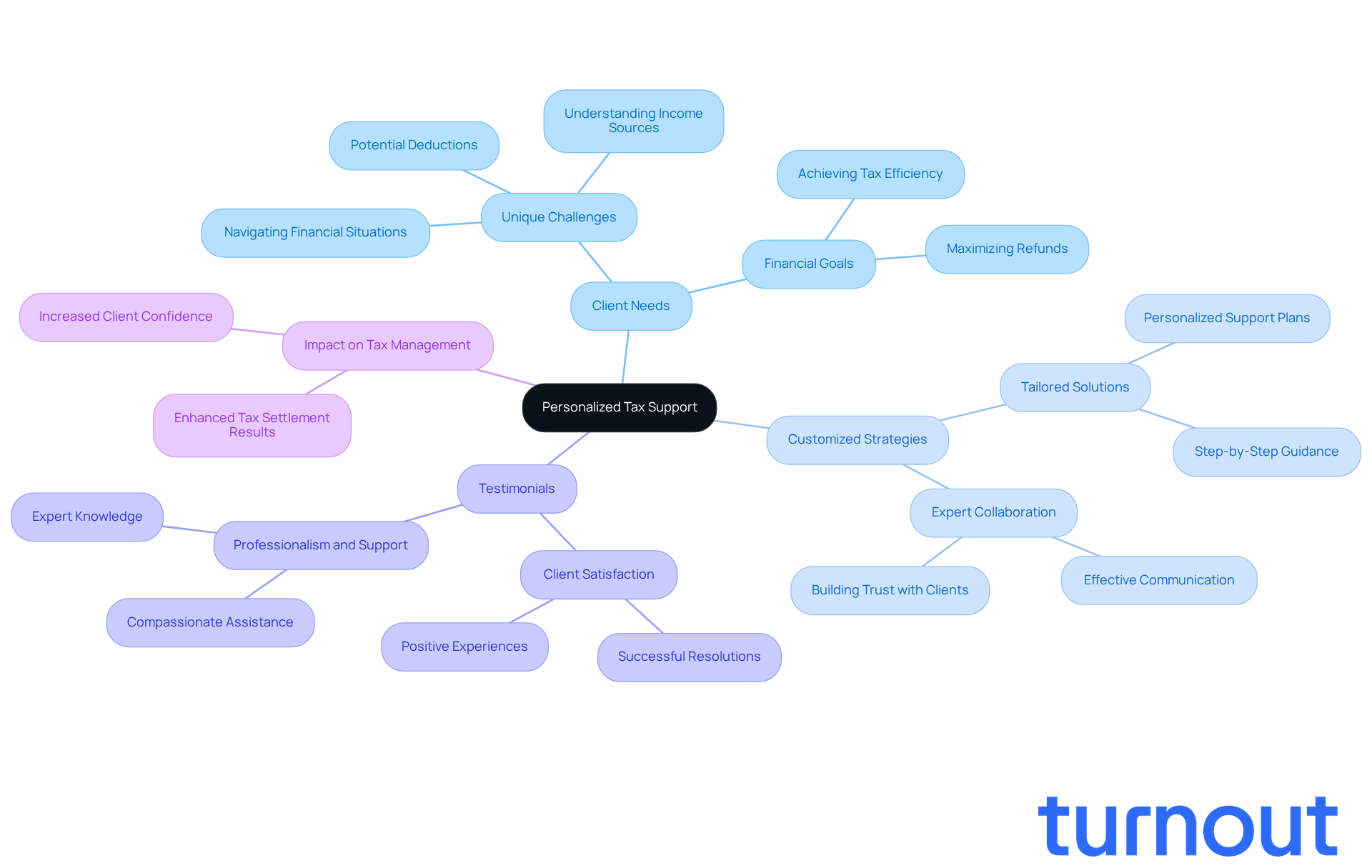

A tax resolution company truly understands the unique challenges you face when it comes to taxes. We know that navigating your financial situation can be overwhelming, especially when considering various income sources and potential deductions. That’s why this tax resolution company offers tailored support designed just for you, ensuring a comprehensive understanding of your tax situation.

By working closely with you, tax experts can develop customized strategies that align with your financial goals. This personalized approach not only leads to more effective solutions but also fosters a sense of trust and confidence. For instance, in 2020, 107 million households owed no federal income taxes, highlighting the significant hurdles many individuals encounter.

Clients who faced substantial tax challenges often express their satisfaction. One customer shared, "They did it. Quick, efficient, and got me some of the best returns I’ve had." This level of personalized service from a tax resolution company makes a significant difference in the solution process.

We understand that you want to feel secure and supported during this journey. Numerous testimonials commend the professionalism and thoroughness of tax experts, reinforcing the value of personalized strategies. Remember, you are not alone in this journey. The emphasis on tailored support provided by a tax resolution company significantly enhances tax settlement results, making it a vital aspect of effective tax management. We're here to help you every step of the way.

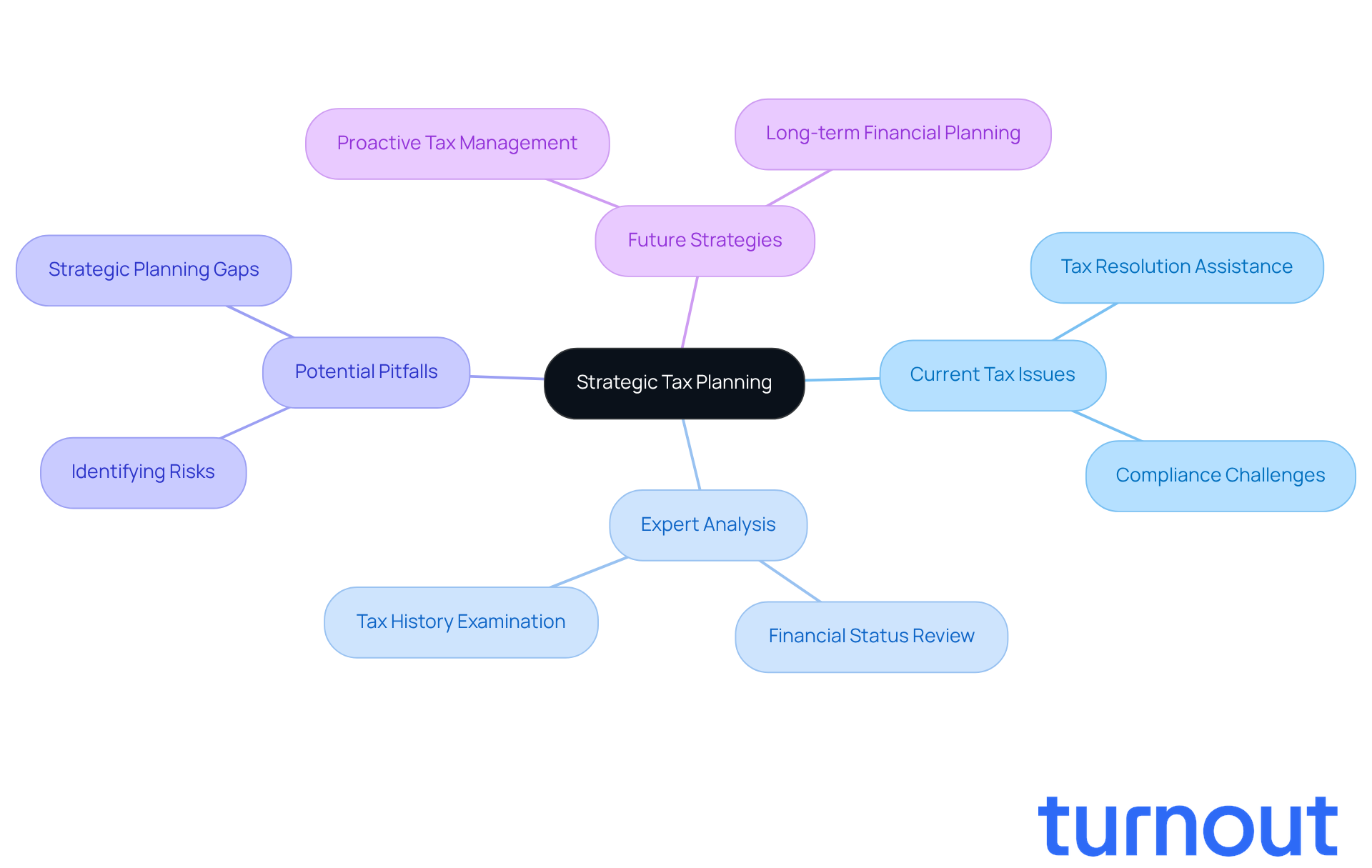

Prevent Future Tax Problems with Strategic Planning

We understand that dealing with tax issues can be overwhelming. A tax resolution company assists in resolving current issues while also providing strategic planning to avoid future tax challenges. By examining your financial status and tax history, these experts can identify potential pitfalls and suggest strategies that minimize the risk of future tax obligations.

This proactive approach empowers you to maintain compliance and avoid unnecessary stress down the road. Imagine having peace of mind knowing that you’re taking steps to safeguard your financial future.

You are not alone in this journey. We're here to help you navigate these complexities with care and expertise. Let’s work together to create a plan that not only addresses your current needs but also sets you up for success in the future.

Negotiate Directly with Tax Authorities for Better Outcomes

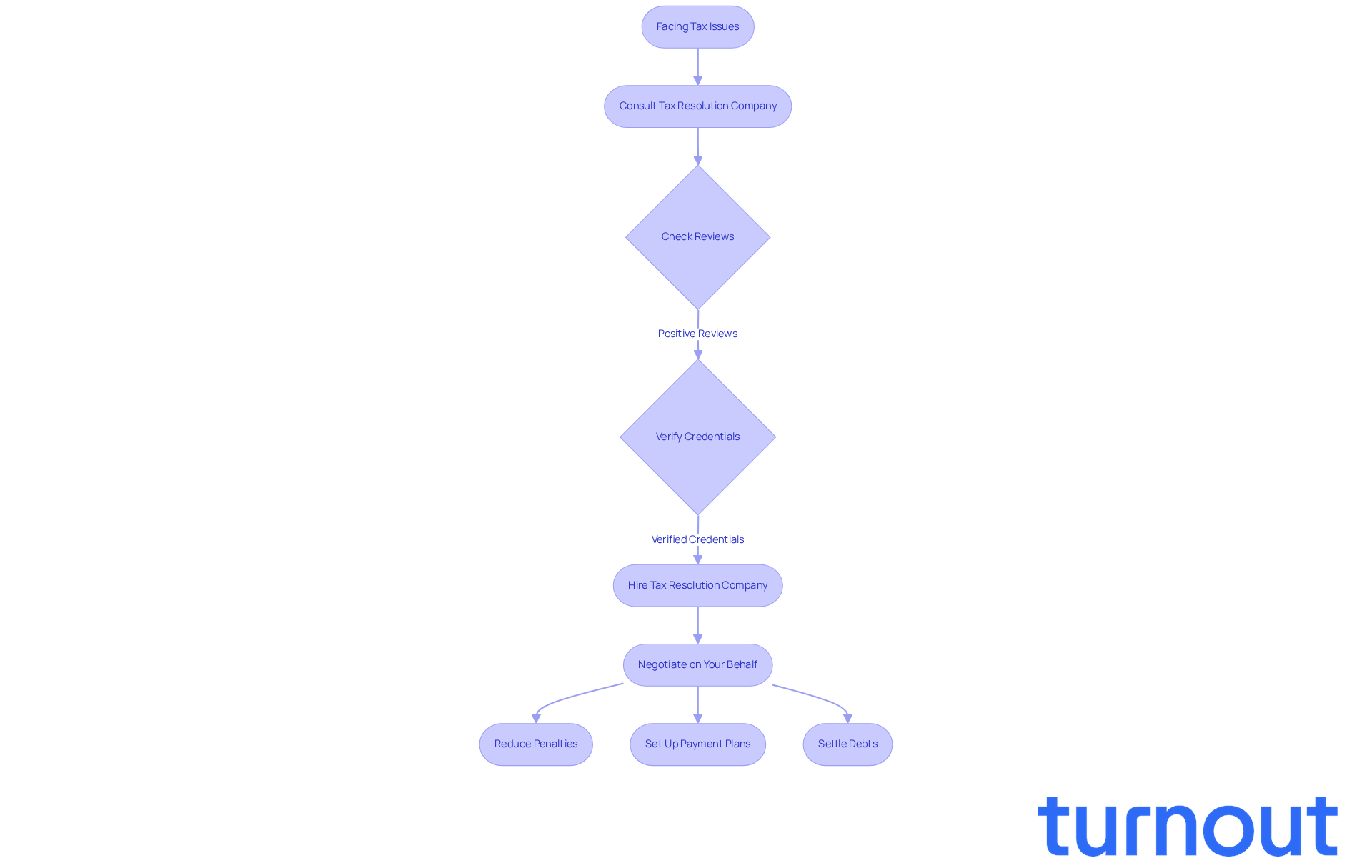

A tax resolution company plays a vital role in bridging the gap between you and tax authorities. They negotiate on your behalf, aiming for outcomes that can truly make a difference in your financial situation. Imagine reducing penalties, setting up manageable payment plans, or even settling debts that seem overwhelming. With their deep understanding of tax regulations and negotiation tactics, these experts navigate the complexities of tax negotiations with ease.

We understand that facing tax issues can be daunting. Many clients who consult tax experts notice a significant drop in penalties, often achieving reductions that alleviate financial stress. In fact, statistics show that taxpayers who utilize expert negotiation services have a higher success rate in resolving their tax problems compared to those who try to negotiate directly with the IRS.

Consider the success stories: individuals settling their tax debts for much less than what they owed. This highlights the real benefits of having a skilled negotiator by your side. However, it’s essential to approach this journey with caution. Before hiring a tax resolution company, take the time to check reviews and verify their credentials. Resources like the IRS's Offer in Compromise (OIC) pre-qualifier tool can help you assess your eligibility for tax relief options.

Furthermore, the possibility of penalty abatement can significantly ease your financial burdens. With over $120 billion owed in back taxes, penalties, and interest in 2022, seeking expert assistance is more important than ever. Remember, you are not alone in this journey. While there are many reputable professionals ready to help, be wary of OIC mills that may take advantage of your situation. We're here to help you navigate these challenges with care and expertise.

Utilize Innovative Solutions Like Turnout for Efficient Tax Resolution

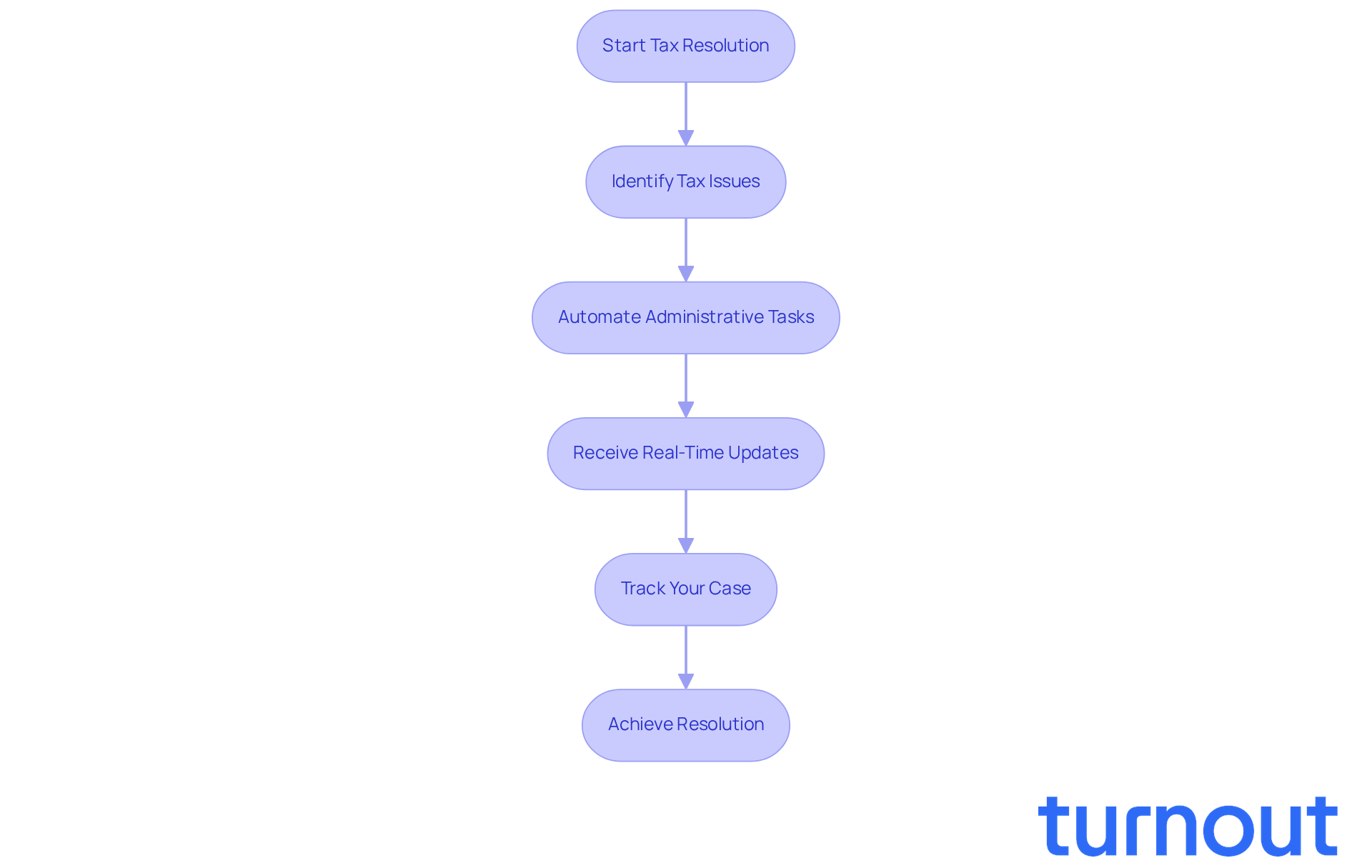

We understand that dealing with taxes can be overwhelming. Turnout is here to help transform the tax settlement process with its AI-driven platform. By simplifying the intricate tasks that often burden consumers, we aim to make your experience smoother and less stressful.

Imagine automating around 60% of those tedious administrative tasks - like retrieving transcripts, verifying eligibility, and pre-filling applications. With Turnout, you can significantly improve the efficiency of your tax services. Our clients enjoy real-time updates and personalized support, allowing them to track their cases and receive timely notifications.

This innovative approach not only saves you valuable time but also empowers you to navigate your tax situation with confidence. You are not alone in this journey; many have found relief and satisfaction through our services. Positive reviews reflect the experiences of users who have reclaimed control over their financial obligations.

If you're feeling lost or burdened by tax issues, know that Turnout is a game-changer as a tax resolution company. Let us help you take the first step towards a brighter financial future.

Conclusion

Engaging a tax resolution company can truly change the way you handle your tax challenges. We understand that dealing with tax issues can be stressful and overwhelming. These specialized firms not only help ease that burden but also offer expert negotiation strategies, personalized support, and innovative solutions to empower you in regaining control over your financial future.

Throughout this article, we’ve highlighted the key benefits of hiring a tax resolution company. From reducing the emotional toll of tax problems to securing better financial outcomes through effective negotiations, the expertise and tailored strategies these professionals provide can lead to substantial savings and peace of mind. Plus, the proactive planning they offer helps prevent future tax issues, ensuring you feel supported every step of the way.

The importance of seeking assistance from a tax resolution company cannot be overstated. By leveraging their knowledge and resources, you can navigate the complexities of tax laws with confidence and clarity. As tax regulations continue to evolve, taking action now can safeguard your financial well-being and minimize stress. Remember, you are not alone in this journey. Embrace the opportunity to partner with experts who can guide you toward a more secure and manageable financial future.

Frequently Asked Questions

How can a tax resolution company help reduce stress related to tax issues?

A tax resolution company, like Turnout, manages communications with the IRS and other tax authorities, allowing you to focus on your daily life without the constant worry of unresolved tax problems.

What services do tax resolution companies provide?

Tax resolution companies handle negotiations, necessary paperwork, and provide expert representation, which can lead to better outcomes such as lower settlement amounts and decreased penalties.

Are there any fees associated with using a tax resolution company?

While some services offered by companies like Turnout are free, others may incur service fees. Additionally, government fees must be paid separately before any paperwork can be submitted on your behalf.

How does electronic communication benefit clients of tax resolution companies?

Receiving all communications electronically ensures that clients stay informed about their financial assistance process, helping to alleviate anxiety related to tax issues.

What psychological benefits can clients expect from working with tax resolution experts?

Having an expert advocate can transform the daunting experience of dealing with tax problems into something manageable, fostering a sense of security and empowering clients to plan for a more stable financial future.

How do experienced negotiators contribute to saving money on tax issues?

Experienced negotiators understand the complexities of tax law and the IRS's processes, allowing them to negotiate settlements, lower penalties, and establish manageable payment plans that ultimately save clients money.

What is the overall message regarding tax resolution support?

The support of a tax resolution company provides relief and fosters confidence, reminding clients that they are not alone in their journey to resolve tax issues.