Introduction

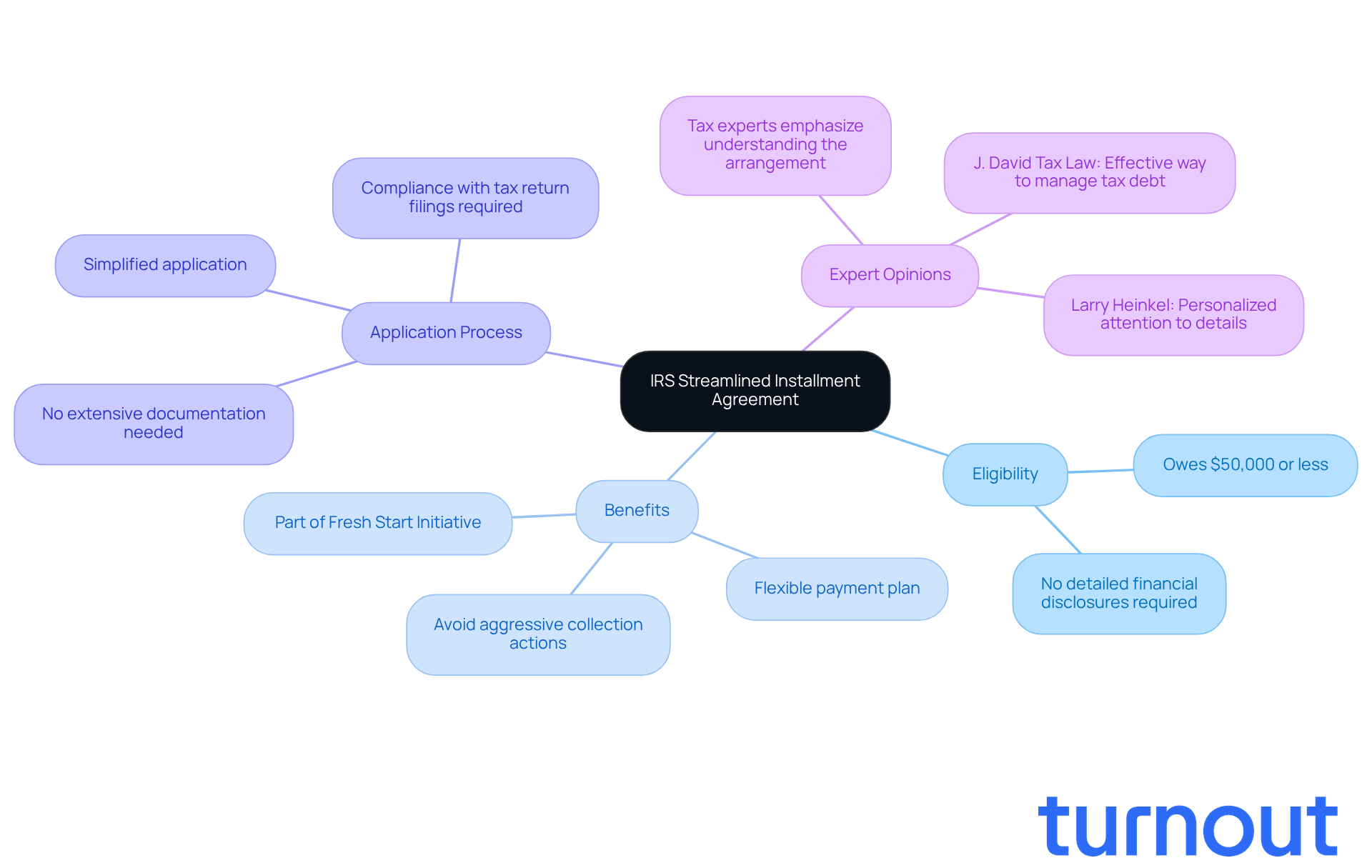

Navigating tax debt can feel overwhelming, and we understand that it may seem like an insurmountable challenge. But there’s hope! The IRS Streamlined Installment Agreement offers a lifeline for those who qualify. This flexible payment plan allows you to manage your tax obligations without the stress of extensive documentation, making it an accessible option for many taxpayers.

However, it’s crucial to grasp the eligibility requirements and the application process. What if the path to financial relief is more complicated than it appears? This guide breaks down the essential steps to secure an IRS Streamlined Installment Agreement. We’re here to help you approach your financial recovery with confidence and clarity.

Understand the IRS Streamlined Installment Agreement

Are you feeling overwhelmed by tax debt? You're not alone. The IRS Streamlined Installment Agreement provides a flexible payment plan that enables you to pay off your tax debts over a duration of up to 72 months. This option is designed specifically for individuals who owe $50,000 or less in combined tax, penalties, and interest, making it a viable choice for many.

One of the most comforting aspects of this arrangement is that it eliminates the need for detailed financial disclosures. This simplification makes the application process more accessible, allowing you to focus on regaining your financial stability without the stress of extensive documentation.

As part of the IRS's Fresh Start Initiative, which continues to evolve in 2026, this agreement aims to help you avoid aggressive collection actions from the IRS. Many taxpayers have successfully used this arrangement to manage their debts effectively, enabling them to stay compliant and avoid wage garnishments or bank levies.

Tax experts emphasize the importance of understanding this arrangement. It provides a structured path to resolving tax liabilities without the burden of extensive paperwork. According to tax attorney J. David Tax Law, "The IRS Fresh Start Program remains one of the most effective ways for taxpayers to manage and resolve federal tax debt in 2026."

With millions of taxpayers eligible for the IRS streamlined installment agreement in 2026, it represents a crucial tool for those looking to navigate their tax challenges with confidence. Remember, you are not alone in this journey, and we're here to help you find the best path forward.

Determine Your Eligibility for the Agreement

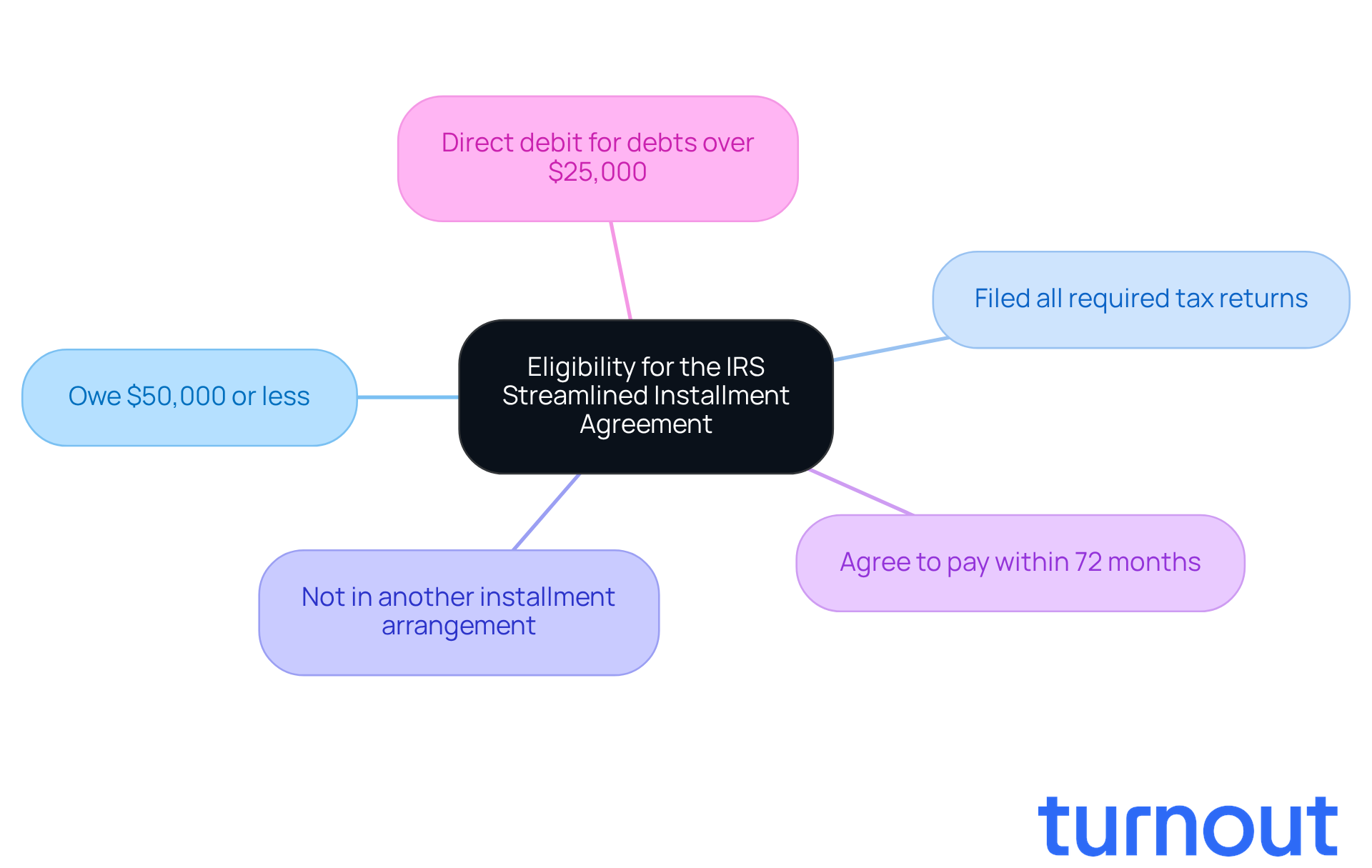

Are you feeling overwhelmed by tax debt? You're not alone, and we're here to help. To qualify for the IRS Streamlined Installment Agreement, you need to meet a few important criteria:

- You owe $50,000 or less in combined tax, penalties, and interest.

- You have filed all required tax returns.

- You are not currently in another installment arrangement.

- You can agree to pay the balance within 72 months.

- If your debt exceeds $25,000, you must agree to make payments via direct debit as part of the IRS Streamlined Installment Agreement to avoid a tax lien.

By confirming your eligibility, you can move forward with confidence. Knowing that you meet these criteria can bring peace of mind as you take this important step toward managing your tax obligations. Remember, we're here to support you every step of the way.

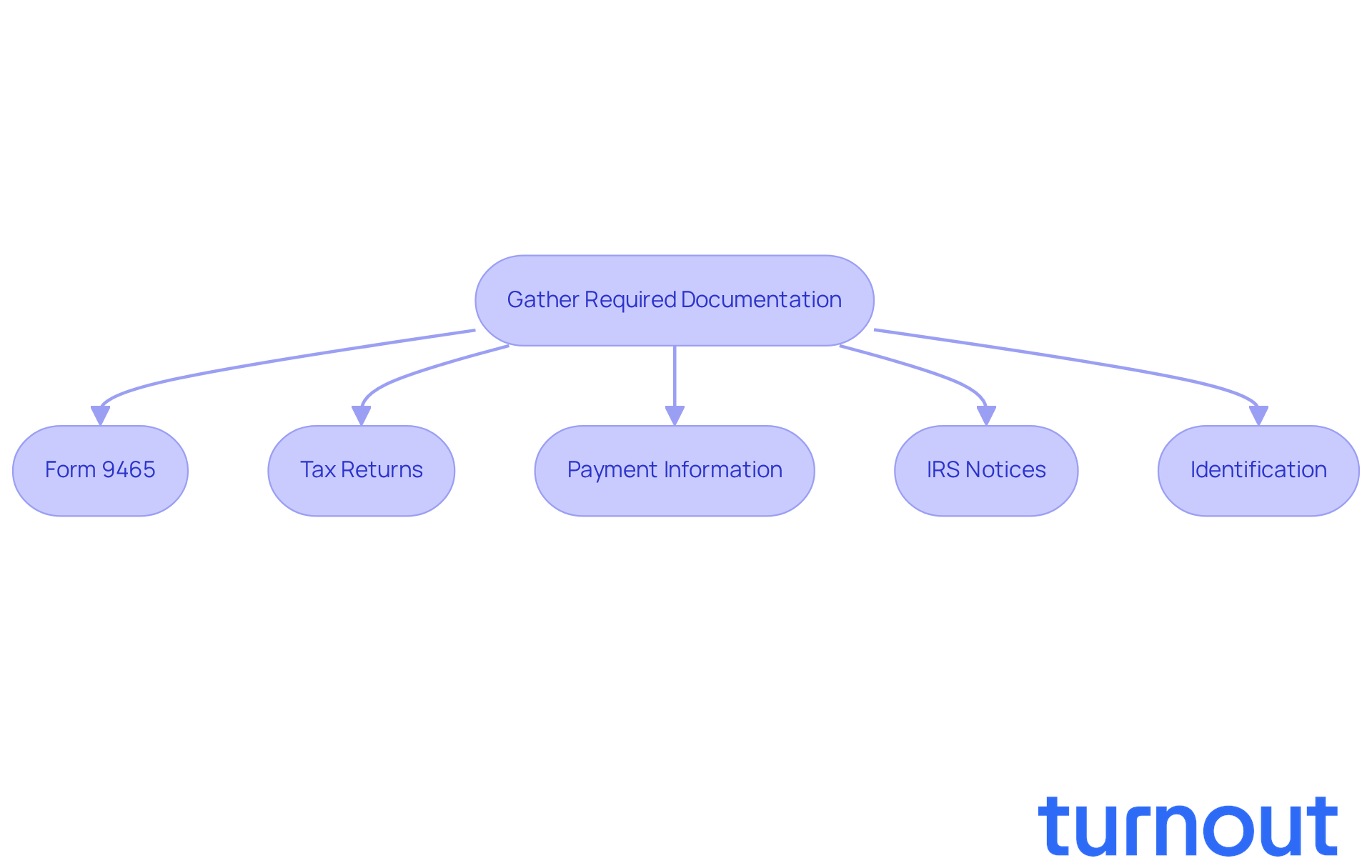

Gather Required Documentation for Your Application

To successfully apply for the IRS streamlined installment agreement, it’s important to gather the right documentation. We understand that this process can feel overwhelming, but having everything in order can make a significant difference.

- Form 9465: Complete this Installment Agreement Request form. It’s essential for your submission.

- Tax Returns: Make sure all your tax returns are submitted and up to date. This is a prerequisite for the contract.

- Payment Information: If you plan to set up direct debit payments, prepare your bank account details in advance.

- IRS Notices: Keep any IRS notices related to your tax debt accessible. They may provide vital information about your outstanding balance.

- Identification: Have your Social Security number or Individual Taxpayer Identification Number ready for verification purposes.

As Eva Hanson, a tax relief author, wisely notes, "Being organized with your documentation can significantly enhance your chances of a successful submission." It’s common to feel anxious about gathering these documents, but remember, it typically takes taxpayers an average of two to three weeks to collect everything needed for an IRS streamlined installment agreement. Real-world examples show that individuals who prepare their documentation meticulously often experience smoother approval processes.

Being well-prepared with these documents can significantly streamline your submission process. This not only reduces potential delays but also increases your chances of approval. As the 2026 filing season opens on January 26, 2026, now is the perfect time to start gathering your materials. You are not alone in this journey; we’re here to help!

Apply for the Streamlined Installment Agreement

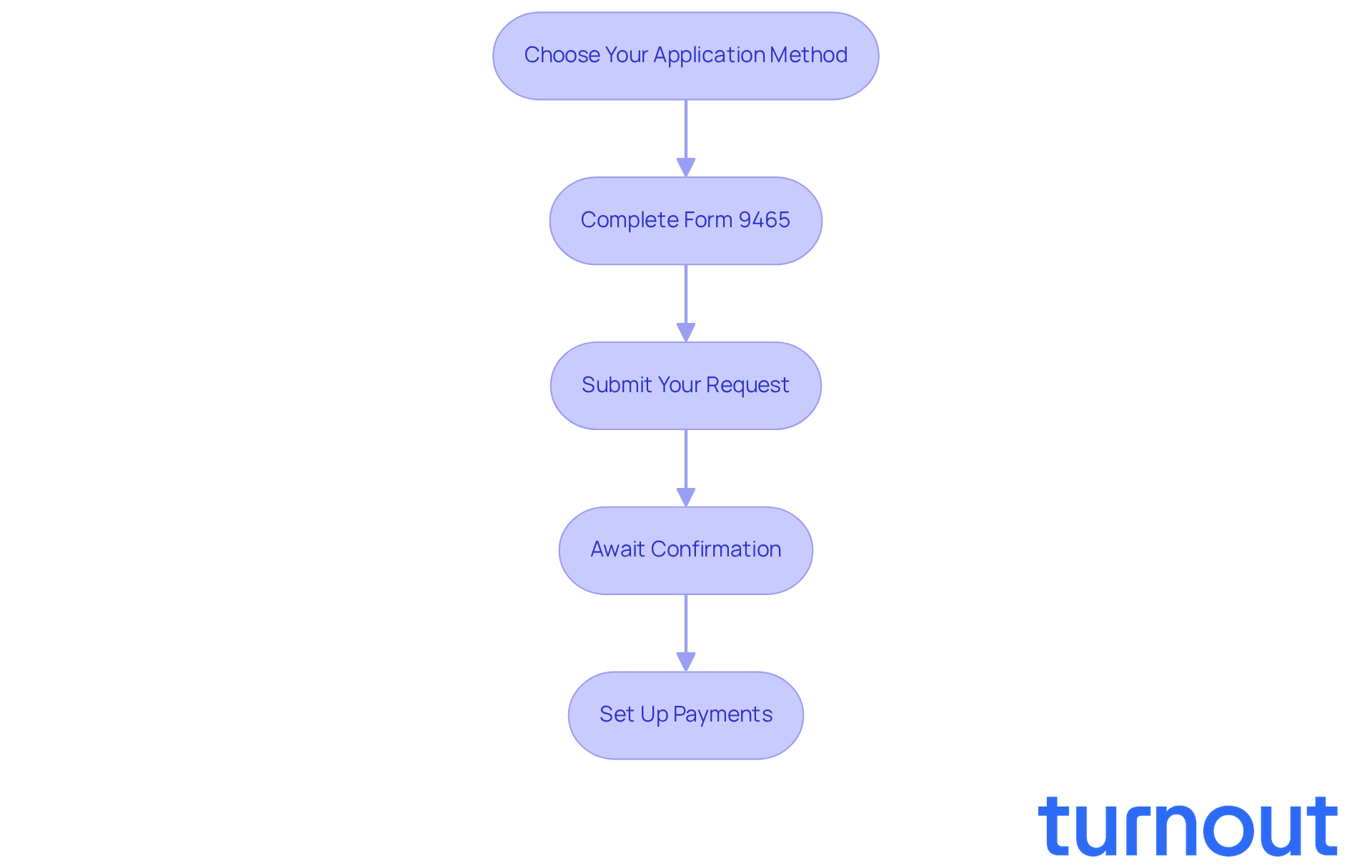

Applying for the IRS streamlined installment agreement can feel overwhelming, but we're here to help you through the process. Just follow these simple steps:

- Choose Your Application Method: You can apply online using the IRS Online Payment Agreement tool, by phone, or by mail with Form 9465. Whatever method you choose, know that support is available.

- Complete Form 9465: Take your time to fill out the form accurately. Make sure to include all required information, like your tax balance and payment preferences. It’s important to get this right.

- Submit Your Request: If you’re applying online, just follow the prompts to send your request. If you prefer to apply by mail, send the completed Form 9465 to the address specified in the instructions. Remember, you’re taking a positive step forward.

- Await Confirmation: After you submit your request, the IRS will review it and send you a confirmation of acceptance or any additional steps you may need to take. It’s common to feel anxious during this waiting period, but rest assured, you’re on the right path.

- Set Up Payments: If your application is approved, you’ll need to set up your payment method. Direct debit is often the easiest option. Just a heads up: there’s a setup fee of $69 for online applications and $178 for those made by phone, mail, or in-person. If you’re facing financial difficulties, you might qualify for a fee waiver if you agree to make electronic debit payments.

Also, keep in mind that any future tax refunds will be applied to your tax debt until it’s fully paid off. If you receive a notice of intent to end your installment plan, it’s crucial to contact the IRS right away to address any issues. By following these steps, you can successfully apply for the IRS streamlined installment agreement and start managing your tax debt. Remember, you are not alone in this journey.

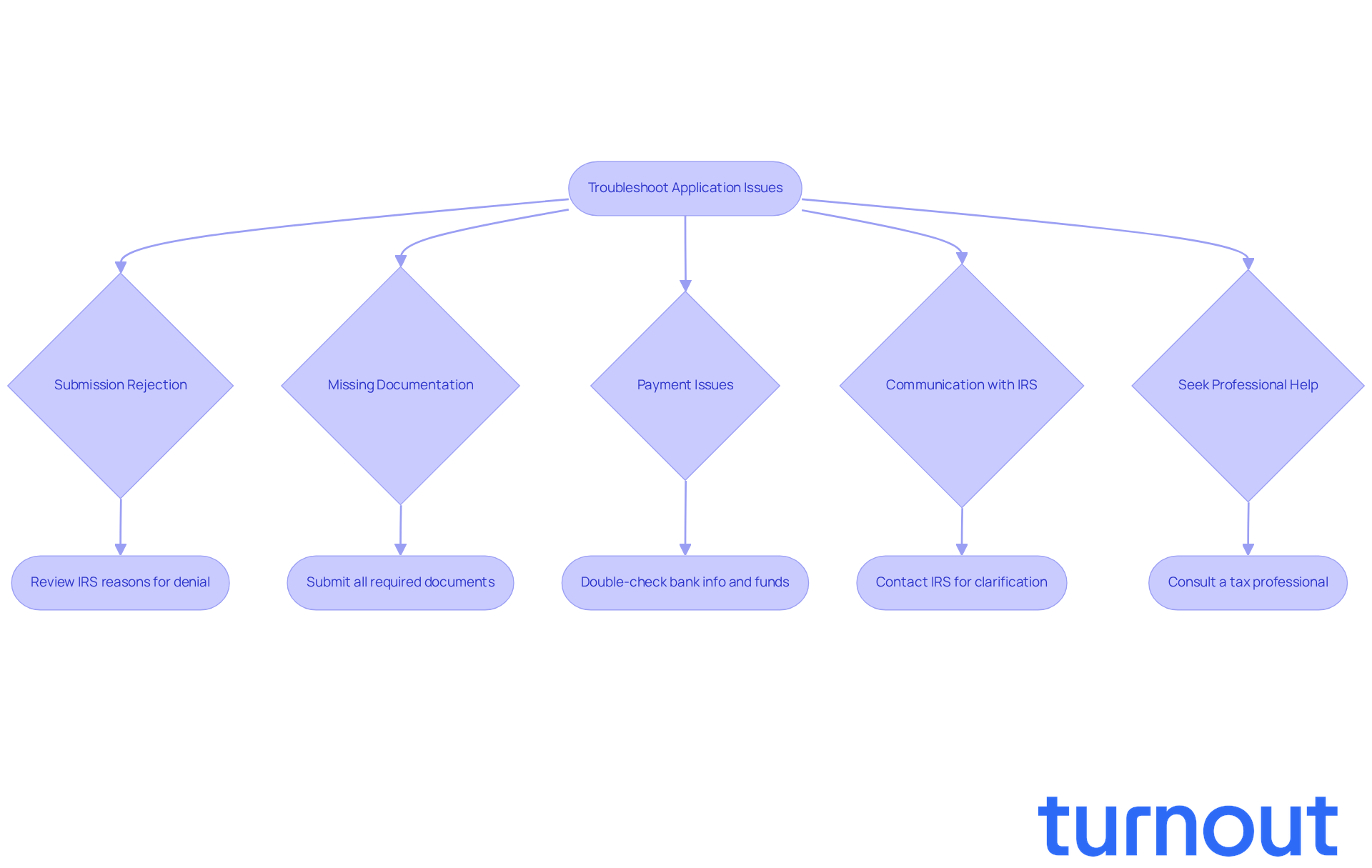

Troubleshoot Common Application Issues

If you’re facing challenges while applying for the IRS streamlined installment agreement, know that you’re not alone. Here are some helpful tips to guide you through the process:

-

Submission Rejection: If your submission is denied, take a moment to review the reasons provided by the IRS. Common issues often stem from incomplete forms or not meeting eligibility criteria. Remember, understanding these reasons is the first step toward resolution.

-

Missing Documentation: Make sure you’ve submitted all required documents. If you receive a notice asking for additional information, respond as quickly as you can. Timely communication can make a big difference.

-

Payment Issues: If you’re having trouble setting up payments, double-check your bank account information and ensure you have enough funds available. It’s common to encounter these hiccups, so don’t hesitate to reach out for help if needed.

-

Communication with the IRS: Should you have any questions or need clarification, please contact the IRS directly using the number in your correspondence. They’re there to assist you, and it’s perfectly okay to ask for guidance.

-

Seek Professional Help: If challenges persist, consider consulting a tax professional or advocate. They can offer personalized assistance tailored to your situation.

By addressing these common issues, you can navigate the application process more smoothly. Remember, we’re here to help you every step of the way, and taking action now can increase your chances of approval.

Conclusion

Navigating tax debt can feel overwhelming, but the IRS Streamlined Installment Agreement offers a structured and manageable way to regain control over your financial obligations. This payment plan is designed for individuals with tax debts of $50,000 or less, allowing for a payment period of up to 72 months without the stress of extensive financial disclosures. By understanding and utilizing this agreement, you can avoid aggressive collection actions and work towards compliance with the IRS.

We understand that taking the first step can be daunting. Throughout this article, we’ve outlined key steps to secure this agreement, from determining eligibility to gathering necessary documentation and applying effectively. Being organized and proactive is essential, and seeking professional assistance can make a significant difference when challenges arise. Each step, from completing Form 9465 to troubleshooting common application issues, is crucial for a successful outcome.

Ultimately, the IRS Streamlined Installment Agreement serves as a vital resource for taxpayers striving to overcome their tax challenges. Taking the initiative to explore this option can lead to greater financial stability and peace of mind. Remember, you are not alone in this journey. Understanding and acting on the information presented can pave the way to a brighter financial future.

Frequently Asked Questions

What is the IRS Streamlined Installment Agreement?

The IRS Streamlined Installment Agreement is a flexible payment plan that allows individuals to pay off their tax debts over a duration of up to 72 months, specifically for those who owe $50,000 or less in combined tax, penalties, and interest.

What are the benefits of the IRS Streamlined Installment Agreement?

The agreement eliminates the need for detailed financial disclosures, making the application process simpler and more accessible. It helps taxpayers avoid aggressive collection actions from the IRS, such as wage garnishments or bank levies.

What is the purpose of the IRS Fresh Start Initiative?

The IRS Fresh Start Initiative aims to assist taxpayers in managing their tax debts effectively and avoiding aggressive collection actions. The Streamlined Installment Agreement is part of this initiative, which continues to evolve.

What are the eligibility criteria for the IRS Streamlined Installment Agreement?

To qualify, you must owe $50,000 or less in combined tax, penalties, and interest, have filed all required tax returns, not be in another installment arrangement, and agree to pay the balance within 72 months. If your debt exceeds $25,000, you must agree to make payments via direct debit to avoid a tax lien.

How can I confirm my eligibility for the IRS Streamlined Installment Agreement?

You can confirm your eligibility by ensuring you meet the criteria: owing $50,000 or less, having filed all required tax returns, not being in another installment arrangement, and being willing to pay within the specified time frame.

How many taxpayers are eligible for the IRS Streamlined Installment Agreement?

Millions of taxpayers are eligible for the IRS Streamlined Installment Agreement, making it a crucial tool for those looking to manage their tax challenges effectively.