Introduction

Navigating tax debt can feel overwhelming, especially when the IRS is demanding immediate payment. We understand that this situation can be stressful and disheartening. For many, an IRS Partial Pay Installment Agreement can be a lifeline. This option allows individuals to manage their tax obligations through more affordable monthly payments.

This structured approach not only eases immediate financial pressure but also paves the way for regaining control over your financial situation. However, securing this agreement can come with its own set of challenges and uncertainties. It's common to feel unsure about how to meet the eligibility requirements and successfully navigate the application process.

But remember, you are not alone in this journey. We're here to help you understand the steps you need to take. Let's explore how you can move forward with confidence.

Understand the IRS Partial Pay Installment Agreement

An IRS partial pay installment agreement can be a lifeline for those grappling with tax debt. The IRS partial pay installment agreement is a structured payment plan that allows you to resolve your tax obligations through manageable monthly payments, often amounting to less than what you owe overall. If you’re facing financial hardship and can’t pay your tax liabilities in full, the IRS partial pay installment agreement may be just what you need. Remember, while this plan doesn’t forgive your debt, it offers a way to repay it gradually over time.

To qualify for this program, you’ll need to demonstrate that your income and essential living costs make it difficult to settle your entire tax obligation. The IRS will take a close look at your financial situation, including your disposable income, to determine a feasible monthly payment amount. For instance, if you owe $60,000 in taxes and earn $3,000 a month, you might be able to set up a plan that requires you to pay $500 each month. This can help you manage your debt more effectively.

However, it’s important to keep in mind that the IRS can adjust your payment amounts if your financial situation changes. This could lead to unexpected challenges, so staying on top of your tax submissions and ongoing contributions is crucial to qualify for and maintain your agreement. The benefits of an IRS partial pay installment agreement include stopping aggressive IRS collection actions like liens, levies, and wage garnishments. Plus, it offers flexibility in payment amounts based on your personal financial circumstances.

You can even make voluntary payments towards specific tax periods or penalties, which can help reduce overall penalties and give you more control over your tax debt. As of 2026, the IRS continues to enforce its 10-year collection statute and conducts periodic reviews every 18-24 months to ensure compliance with the terms. This makes it a viable option for many taxpayers seeking relief from overwhelming tax obligations. Remember, you’re not alone in this journey, and there are paths available to help you regain control.

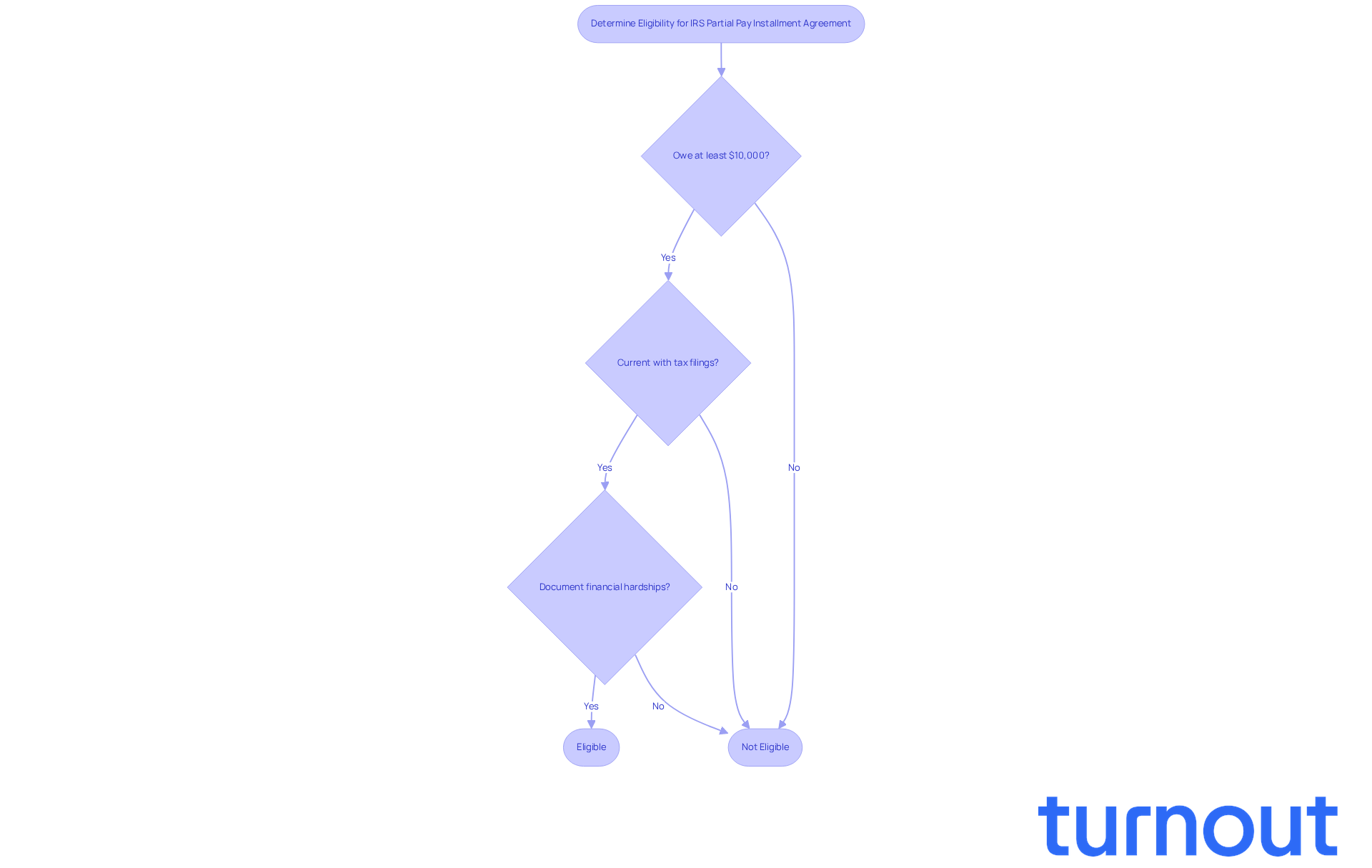

Determine Your Eligibility for the Agreement

If you're feeling overwhelmed by tax obligations, you're not alone. Many taxpayers find themselves in a similar situation, and the IRS partial pay installment agreement is offered to help ease that burden. To qualify, you generally need to owe at least $10,000 in taxes. This threshold reflects the reality that many face significant tax challenges.

It's important to show that you can't pay the full amount within the required timeframe. We understand that life can throw unexpected expenses your way, making it tough to meet these obligations. To be eligible, you also need to stay current with your tax filings and obligations. The IRS will take a close look at your financial situation, including your income, expenses, and assets.

For instance, if you're dealing with financial hardships like high medical bills or a lower income, you might find that you're eligible for the IRS partial pay installment agreement. Tax advisors often stress the importance of documenting your financial difficulties. This can really strengthen your application and show the IRS your genuine need for assistance.

If you meet these criteria, don’t hesitate to take the next step. We're here to help you navigate this process and find a solution that works for you.

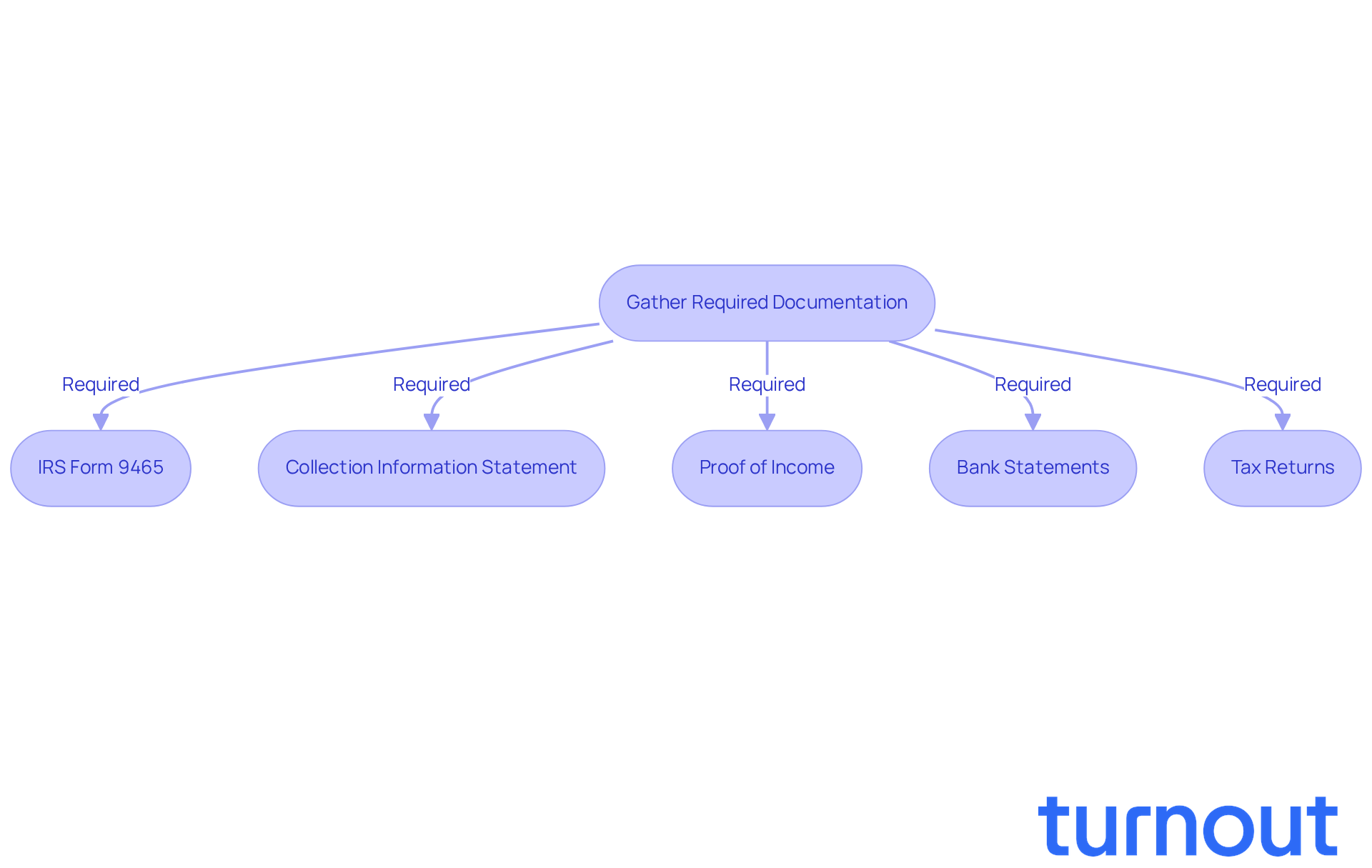

Gather Required Documentation for Your Application

Applying for an IRS partial pay installment agreement can feel overwhelming, but we're here to help you through it. To make the process smoother, gather the following documentation:

- IRS Form 9465: This is the main form you'll need to request your installment agreement.

- Collection Information Statement: Depending on your employment status, you’ll need either Form 433-A (for individuals) or Form 433-F (for self-employed individuals).

- Proof of Income: Collect recent pay stubs, profit and loss statements, or other documents that accurately reflect your current income.

- Bank Statements: Provide statements from all your accounts to give a clear picture of your financial situation.

- Tax Returns: Include copies of your most recent tax returns to confirm your income and tax obligations.

Having these documents ready can really streamline your application process, increasing your chances of a successful outcome. Remember, tax experts emphasize the importance of comprehensive documentation; it can significantly influence whether your application gets accepted. When forms and supporting documents are filled out correctly, it opens the door for favorable negotiations with the IRS for an IRS partial pay installment agreement, helping you manage your tax debt more effectively.

It's also good to know that the program typically takes 30 days or less to process. However, be mindful that missing payments under a payment plan can lead to a reinstatement fee of $89 or even the loss of your installment agreement. Responding quickly to IRS notifications is crucial; it shows your commitment and can demonstrate your eligibility for a payment plan. You are not alone in this journey, and staying aware of your tax circumstances can make all the difference.

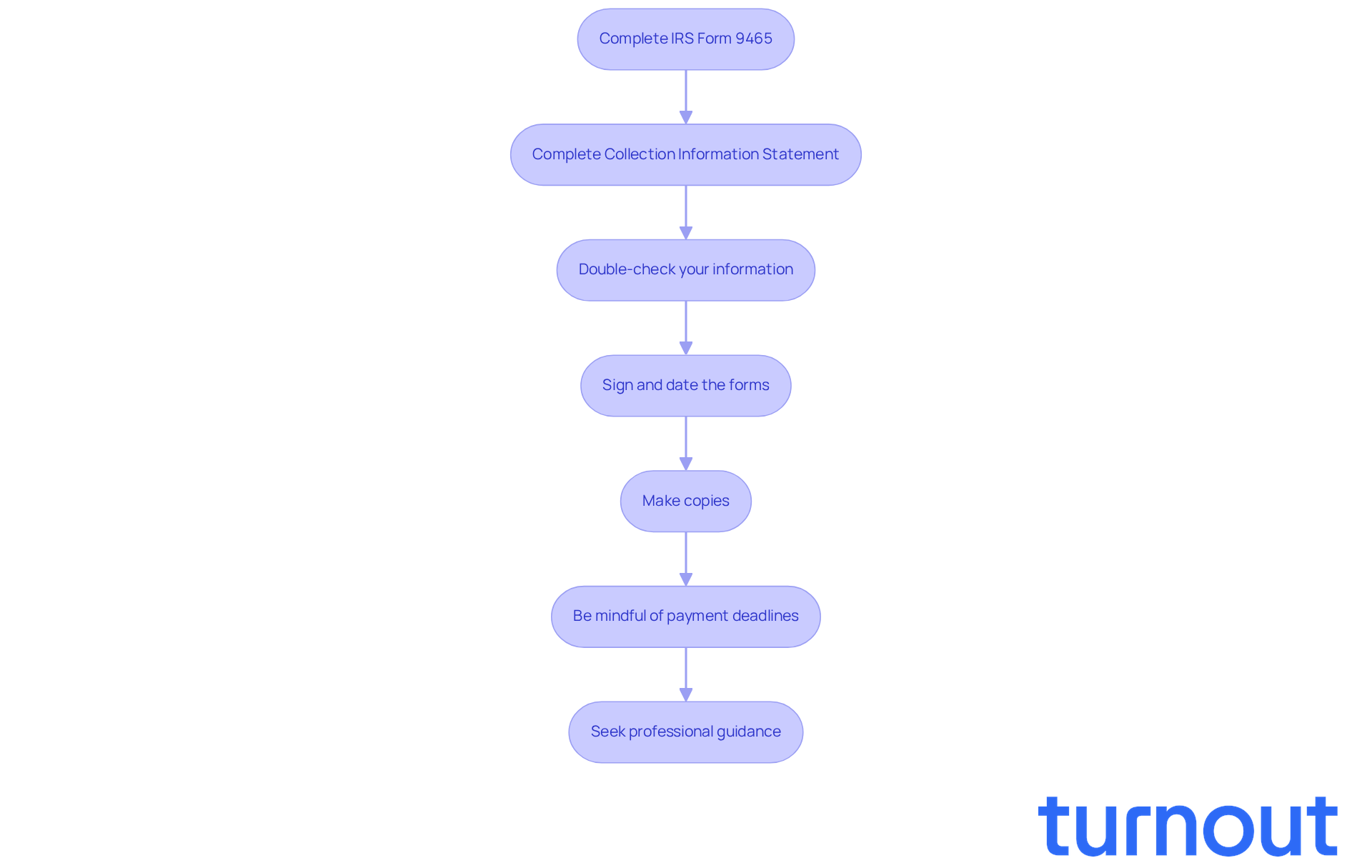

Complete the Application Form Accurately

To successfully complete your application for a Partial Pay Installment Agreement (PPIA), it’s important to follow these essential steps:

-

Complete IRS Form 9465: Clearly indicate the monthly amount you can realistically afford. We understand that underestimating your ability to pay can lead to defaulting on the agreement, which is a common mistake that can complicate your situation.

-

Complete the Collection Information Statement: Provide comprehensive details about your income, expenses, and assets. This information is crucial for the IRS to evaluate your financial condition accurately and determine your eligibility for the program.

-

Double-check your information: Take a moment to review all fields for accuracy and consistency. It’s common for errors or discrepancies to lead to application rejection, which many applicants face. In fact, statistics show that a significant percentage of applications are rejected due to inaccuracies.

-

Sign and date the forms: Remember, an unsigned application is considered incomplete. This simple oversight can significantly delay your application process.

-

Make copies: Retain copies of all submitted documents for your records. This practice is vital for addressing any follow-up inquiries or issues that may arise during the review of your application.

-

Be mindful of payment deadlines: Missing payment deadlines can lead to penalties and interest accrual, complicating your financial situation further. Timeliness is essential in managing your program.

-

Seek professional guidance: As noted by tax professionals, having expert assistance can help you avoid common pitfalls and strengthen your application.

By following these steps and steering clear of typical traps, you can improve your odds of obtaining a position and successfully managing your tax responsibilities. Remember, you’re not alone in this journey; we’re here to help.

Submit Your Application to the IRS

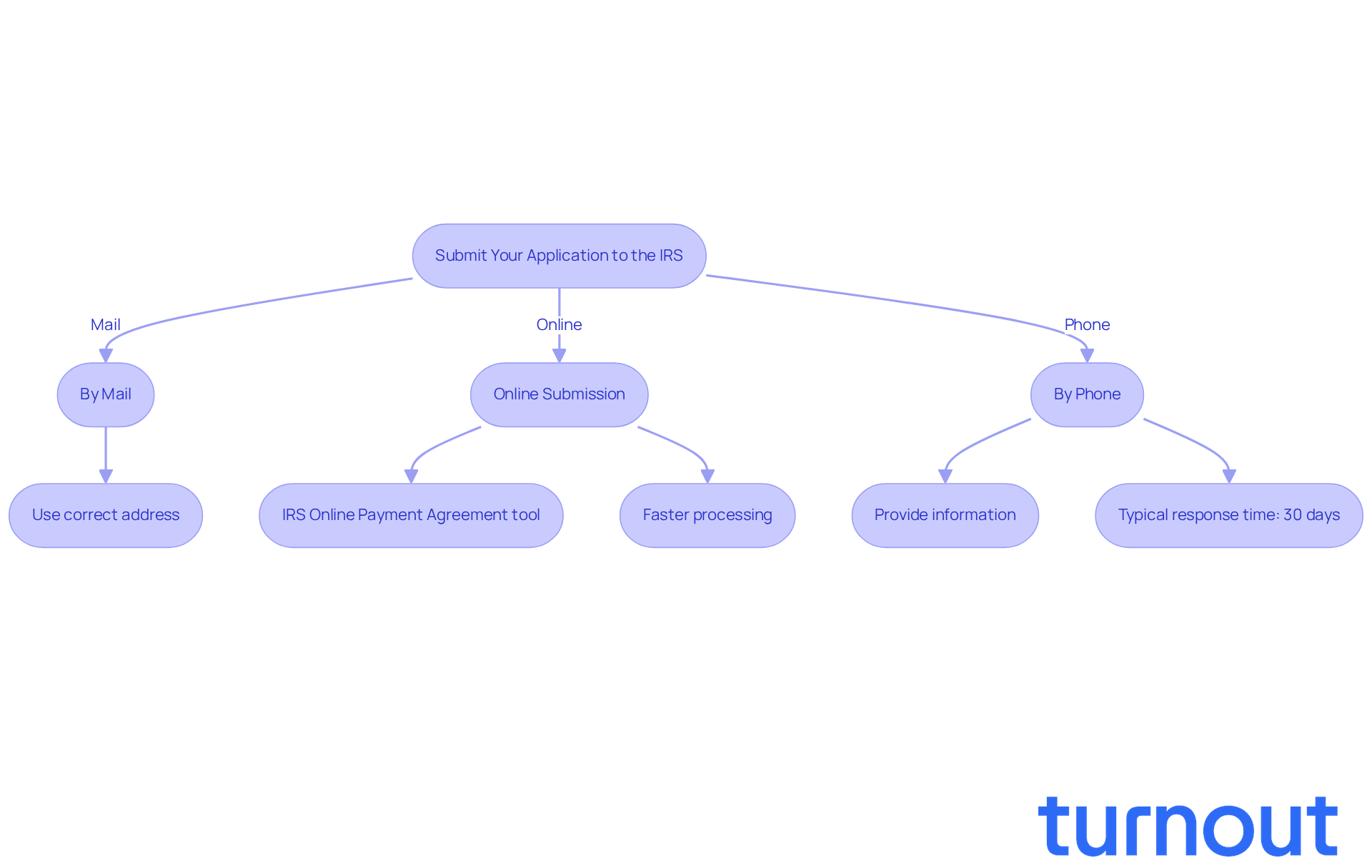

Once you’ve completed your application, you might be wondering how to submit it to the IRS. We understand that navigating this process can feel overwhelming, but there are several straightforward ways to do it:

-

By Mail: You can send your completed forms to the address specified in the instructions for Form 9465. Just make sure to use the correct address based on where you live.

-

Online Submission: If you’re eligible, applying through the IRS Online Payment Agreement tool on their website can be a great option. This method is often faster and gives you immediate confirmation of your submission. In fact, statistics show that online submissions can lead to processing times that are significantly quicker than those for mail submissions, making it a preferred choice for many.

-

By Phone: In some cases, you might be able to start the process by calling the IRS directly. Just be ready to provide your information over the phone. After you submit, the IRS typically responds within 30 days, though it may take longer during peak filing seasons.

Tax professionals often recommend using online tools whenever possible. They can really help streamline the application process and ensure you get timely responses. As the IRS encourages taxpayers to "Get Ready" for the upcoming tax filing season, utilizing online account features - like viewing tax records and managing payments - can empower you to stay organized and informed. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

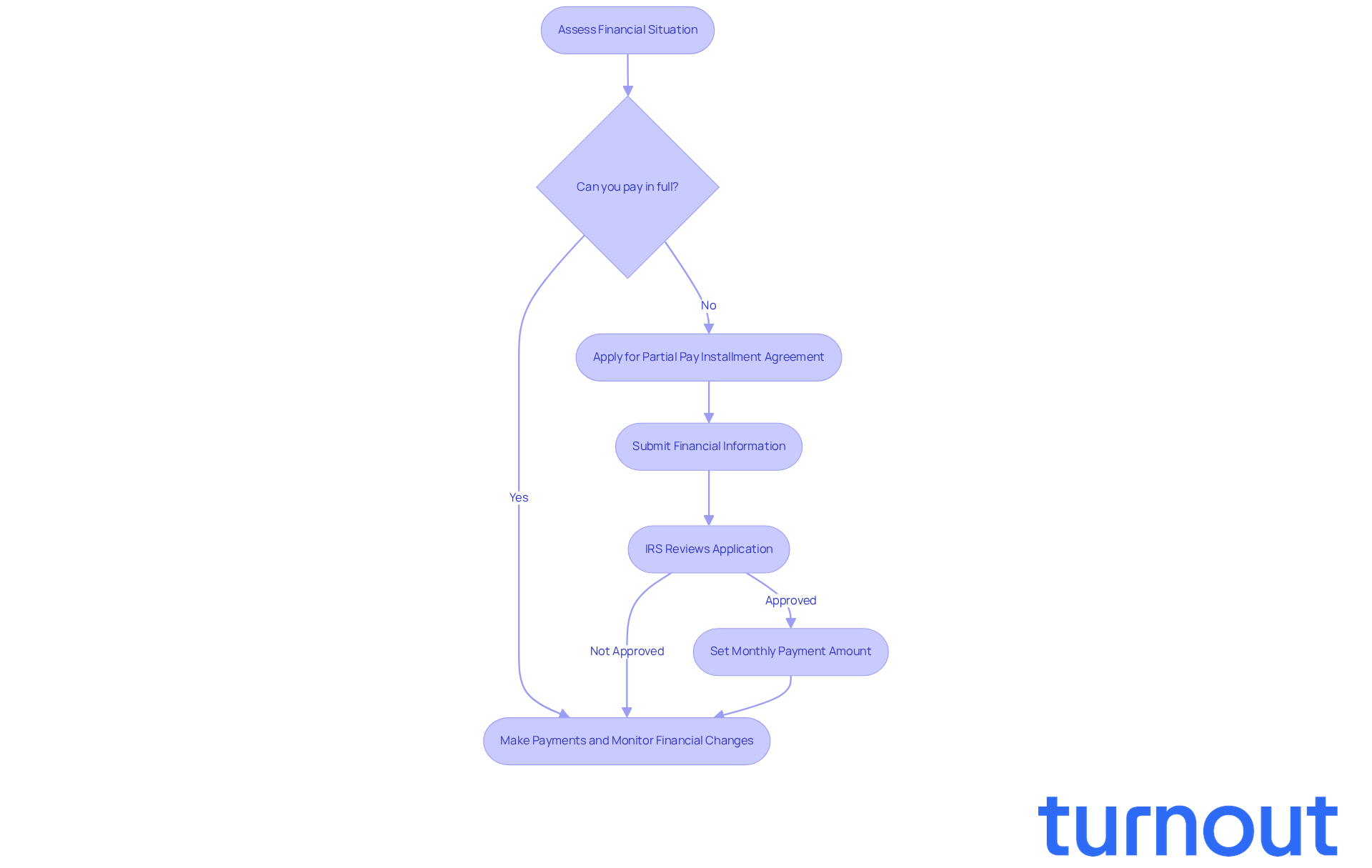

Anticipate the Next Steps After Submission

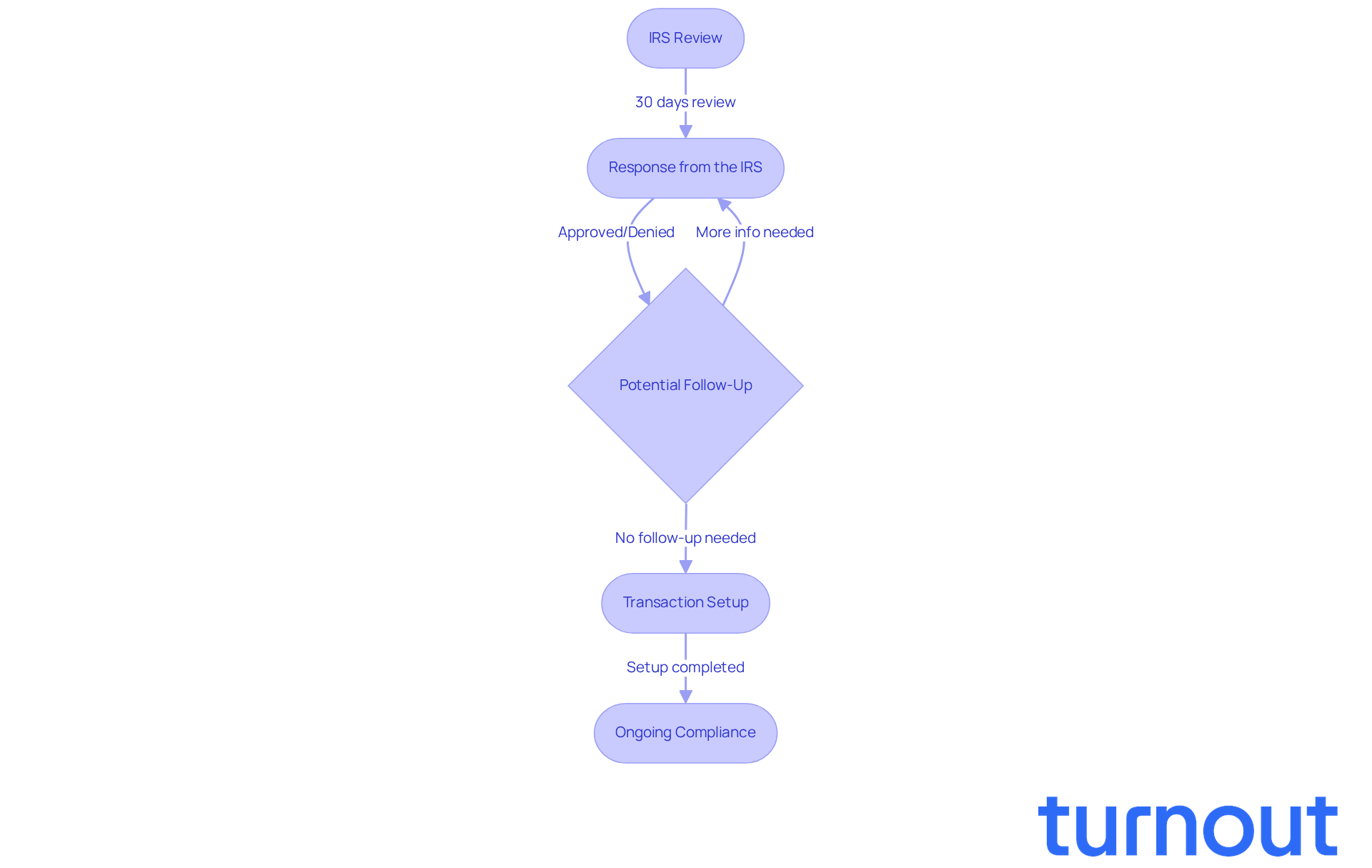

After submitting your application for an IRS partial pay installment agreement, you might be wondering what comes next. Here’s a gentle guide to help you through the process:

-

IRS Review: The IRS will take a close look at your application and financial details. This typically takes around 30 days, but please keep in mind that processing times can vary, especially with the recent delays caused by COVID-19.

-

Response from the IRS: You’ll receive a notice letting you know whether your application has been approved or denied. If it’s approved, this notice will outline your financial schedule, helping you plan ahead with confidence.

-

Potential Follow-Up: If the IRS needs more information or documentation, they will reach out to you. It’s important to respond promptly to any requests to avoid delays in your application process. As tax professional Anthony N. Verni emphasizes, providing a full financial disclosure is crucial during the review of an IRS partial pay installment agreement.

-

Transaction Setup: Once you receive approval, make sure to set up your method for transactions, whether that’s through direct debit or manual contributions. Following your financial schedule is key to maintaining your agreement and preventing cancellation. Remember, missing a payment or not adhering to the terms can lead to the termination of your contract.

-

Ongoing Compliance: Keep in mind that the IRS reviews your financial situation every two years while your agreement is active. As highlighted by Anthony N. Verni, this two-year financial review cycle is standard practice. Staying compliant with your payment obligations and filing your annual tax returns is essential to keep your agreement in good standing. Also, be aware that any tax refund owed during the IRS partial pay installment agreement will be automatically taken by the IRS to pay off your debt.

We understand that navigating this process can be overwhelming, but you are not alone in this journey. We're here to help you every step of the way.

Conclusion

If you're grappling with significant tax debts, an IRS Partial Pay Installment Agreement can be a lifeline. This option allows you to manage your payments in a structured way, easing the burden of full payment. It’s especially helpful for those facing financial hardships, offering a way to gradually settle your tax obligations without overwhelming stress.

In this guide, we’ve outlined essential steps to secure this agreement. Understanding eligibility requirements, gathering necessary documentation, accurately completing the application, and anticipating the IRS's response are all crucial. Each step is vital to ensure a smooth application process, helping you stay compliant with your payment schedule. Remember, staying organized and proactive in your communication with the IRS can significantly boost your chances of success.

Navigating tax obligations can feel daunting, but the IRS Partial Pay Installment Agreement is a viable solution for those in need. By following the steps outlined here, you can regain control over your financial situation and work towards a sustainable resolution. Embracing this opportunity not only alleviates immediate stress but also empowers you to manage your financial future with confidence.

You are not alone in this journey. We’re here to help you take the necessary steps towards a brighter financial outlook.

Frequently Asked Questions

What is an IRS partial pay installment agreement?

An IRS partial pay installment agreement is a structured payment plan that allows taxpayers to resolve their tax obligations through manageable monthly payments, which are often less than the total amount owed.

Who can benefit from an IRS partial pay installment agreement?

Taxpayers facing financial hardship who cannot pay their tax liabilities in full can benefit from this agreement.

What are the eligibility requirements for the IRS partial pay installment agreement?

To qualify, you generally need to owe at least $10,000 in taxes, demonstrate an inability to pay the full amount within the required timeframe, and stay current with your tax filings and obligations.

How does the IRS determine the monthly payment amount?

The IRS evaluates your financial situation, including income and essential living costs, to determine a feasible monthly payment amount.

Can the IRS adjust the payment amounts after the agreement is established?

Yes, the IRS can adjust your payment amounts if your financial situation changes.

What are the benefits of an IRS partial pay installment agreement?

Benefits include stopping aggressive IRS collection actions like liens, levies, and wage garnishments, as well as offering flexibility in payment amounts based on personal financial circumstances.

Is it possible to make voluntary payments towards specific tax periods or penalties?

Yes, you can make voluntary payments towards specific tax periods or penalties to help reduce overall penalties and gain more control over your tax debt.

How often does the IRS review compliance with the terms of the agreement?

The IRS conducts periodic reviews every 18-24 months to ensure compliance with the terms of the agreement.

What should I do if I believe I qualify for the IRS partial pay installment agreement?

If you meet the eligibility criteria, you should document your financial difficulties and consider taking the next step to apply for the agreement.