Introduction

Navigating the complexities of tax relief can feel overwhelming, especially for disabled individuals in Las Vegas. We understand that financial burdens can weigh heavily on your shoulders. Fortunately, there are various programs designed specifically to help alleviate these challenges, offering a pathway to much-needed financial support.

You might be wondering: what are the essential steps to secure this relief? How can you effectively navigate the application process to ensure success? This guide aims to illuminate the available options and provide a clear roadmap for obtaining tax relief in Las Vegas. Remember, you are not alone in this journey. We're here to help empower you to take control of your financial future.

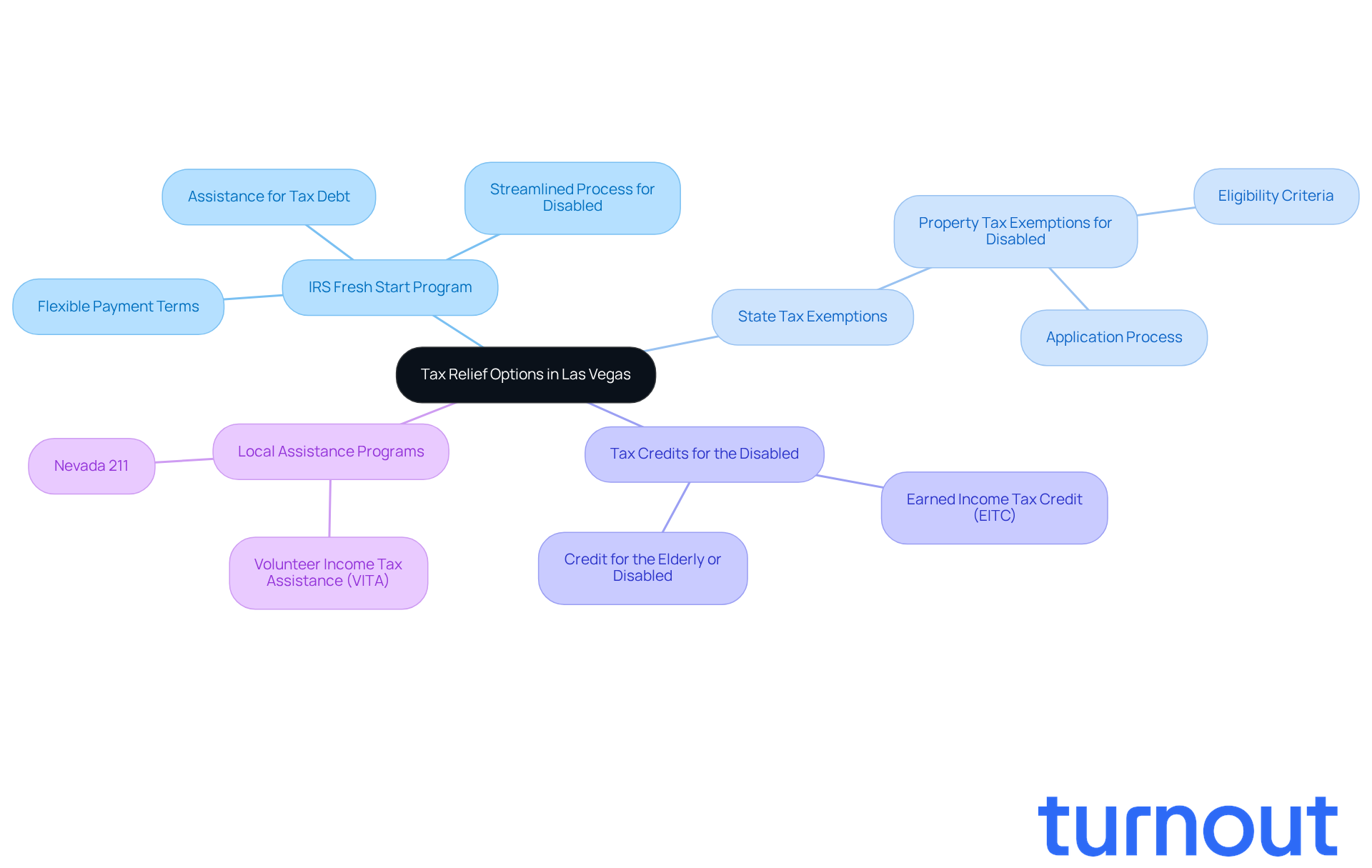

Understand Tax Relief Options Available in Las Vegas

In Las Vegas, we understand that navigating financial challenges can be overwhelming, especially for disabled individuals. Thankfully, there are various options for tax relief Las Vegas designed to ease these burdens. Here’s a look at some key programs that can help you.

-

IRS Fresh Start Program: This initiative is here to assist taxpayers struggling with tax debt. It offers options like installment agreements and offers in compromise. For disabled individuals, the process is often streamlined, making it easier to manage tax obligations. Recent updates show that this program is tailored for those facing financial hardships, allowing for more flexible payment terms.

-

State Tax Exemptions: In Nevada, property tax exemptions are available for disabled individuals, significantly reducing the financial strain of homeownership. We recommend reaching out to the Clark County Assessor's Office to learn about specific eligibility criteria and how to apply.

-

Tax Credits for the Disabled: There are various tax credits available, such as the Earned Income Tax Credit (EITC) and the Credit for the Elderly or the Disabled. These credits can provide extra financial support, helping to offset tax liabilities and improve your overall financial stability.

-

Local Assistance Programs: Organizations like Nevada 211 and Volunteer Income Tax Assistance (VITA) offer free tax preparation services. These resources can help you identify relevant tax assistance options and ensure you’re optimizing your benefits.

Understanding these options is crucial for obtaining the financial assistance you deserve, including tax relief Las Vegas. For instance, many disabled taxpayers have successfully negotiated manageable payment plans through the IRS Fresh Start Program, alleviating the stress of tax debt. It's heartening to know that statistics show a substantial number of participants in this initiative report improved financial circumstances, highlighting its effectiveness in providing support.

Remember, you are not alone in this journey. We’re here to help you navigate these options and find the relief you need.

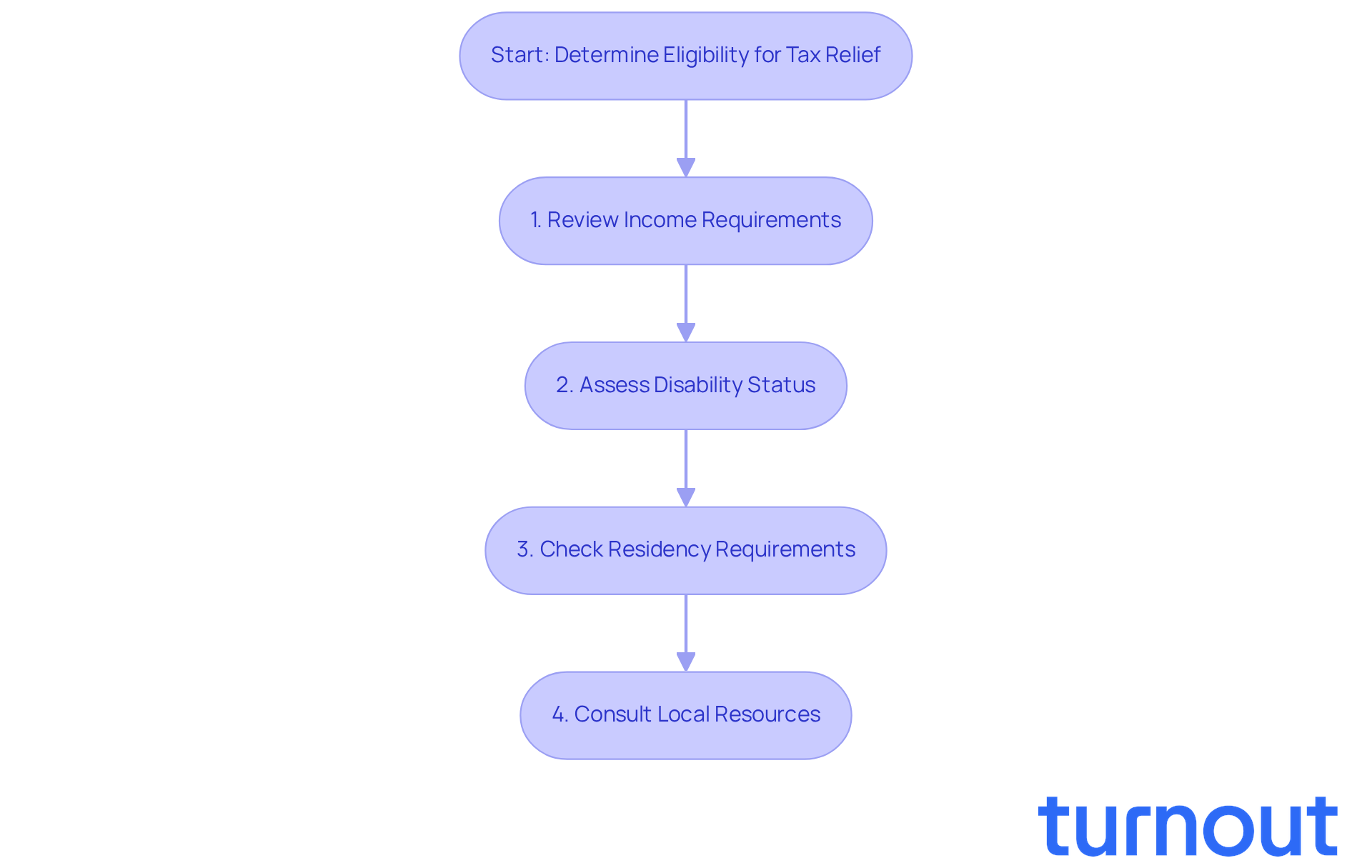

Determine Your Eligibility for Tax Relief Programs

Determining your eligibility for tax relief Las Vegas programs can feel overwhelming, but we are here to assist you. Follow these steps to navigate the process with confidence:

-

Review Income Requirements: It's important to familiarize yourself with the specific income thresholds set by the IRS for the Fresh Start Program, which is $50,000 or less. Don’t forget to check any local state requirements for property tax exemptions. For 2026, ensure your income meets these standards to qualify for assistance.

-

Assess Disability Status: Gathering documentation that verifies your disability status is crucial. This may include a Social Security Disability Insurance (SSDI) award letter or a letter from a healthcare provider. These documents are essential for demonstrating your eligibility.

-

Check Residency Requirements: Verify your residency in Nevada, as many tax relief initiatives are state-specific. Proof of residency, like a utility bill or lease agreement, may be necessary to confirm your request.

-

Consult Local Resources: Engaging with organizations like Nevada 211 or local tax assistance services can provide personalized guidance based on your unique circumstances. Additionally, consider utilizing Turnout's services, which include trained nonlawyer advocates and IRS-licensed enrolled agents. These experts can help you understand your options and navigate the submission process, enhancing your likelihood of acceptance for aid requests.

By thoroughly assessing these factors, you can determine which tax relief Las Vegas options may be available to you. Remember, you are not alone in this journey, and taking these essential steps can lead you toward the financial support you deserve.

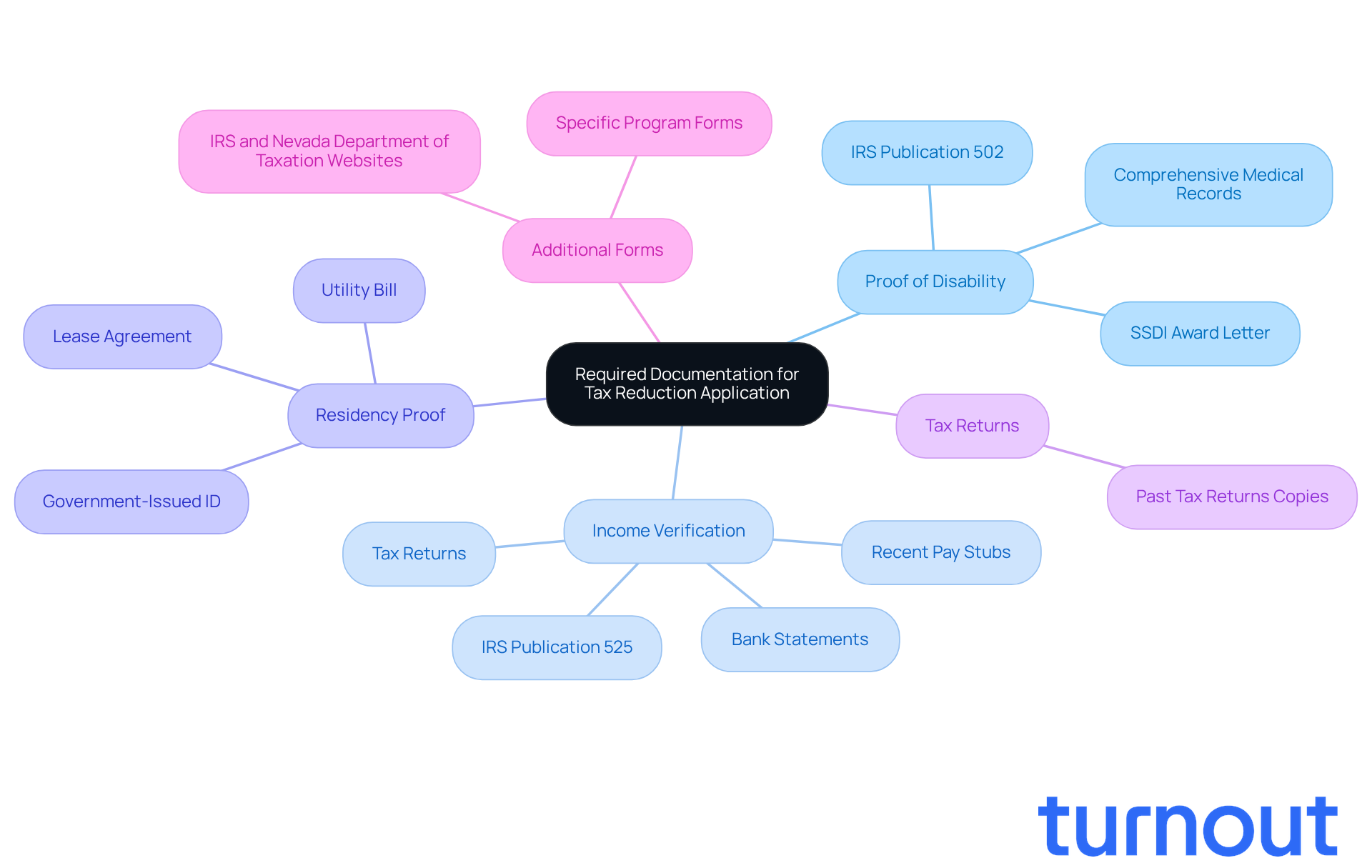

Collect Required Documentation for Your Application

Gathering the right documentation is essential for a successful tax reduction application. We understand that this process can feel overwhelming, but we’re here to help you every step of the way. Here’s what you need to prepare:

-

Proof of Disability: It’s important to include key documents like your Social Security Disability Insurance (SSDI) award letter or comprehensive medical records that validate your disability status. You might also want to check IRS Publication 502 for information on medical and dental expenses that could be relevant to your situation.

-

Income Verification: Collect recent pay stubs, tax returns, or bank statements to show your income level. This is crucial for programs with income limitations. If your gross income is a concern, consult IRS Publication 525 for potential credits or deductions that may apply to you.

-

Residency Proof: Provide evidence of your residency in Nevada. This could be a utility bill, lease agreement, or a government-issued ID.

-

Tax Returns: Keep copies of your past tax returns handy, as they might be required for specific assistance initiatives.

-

Additional Forms: Depending on the program, you may need to complete extra forms. It’s a good idea to check the IRS and Nevada Department of Taxation websites for any additional requirements.

By ensuring you have all the necessary documents, you can simplify the process and enhance your chances of receiving the tax assistance you need. Remember, you are not alone in this journey. Turnout is here to assist you, utilizing trained nonlawyer advocates and IRS-licensed enrolled agents to support your path toward financial assistance.

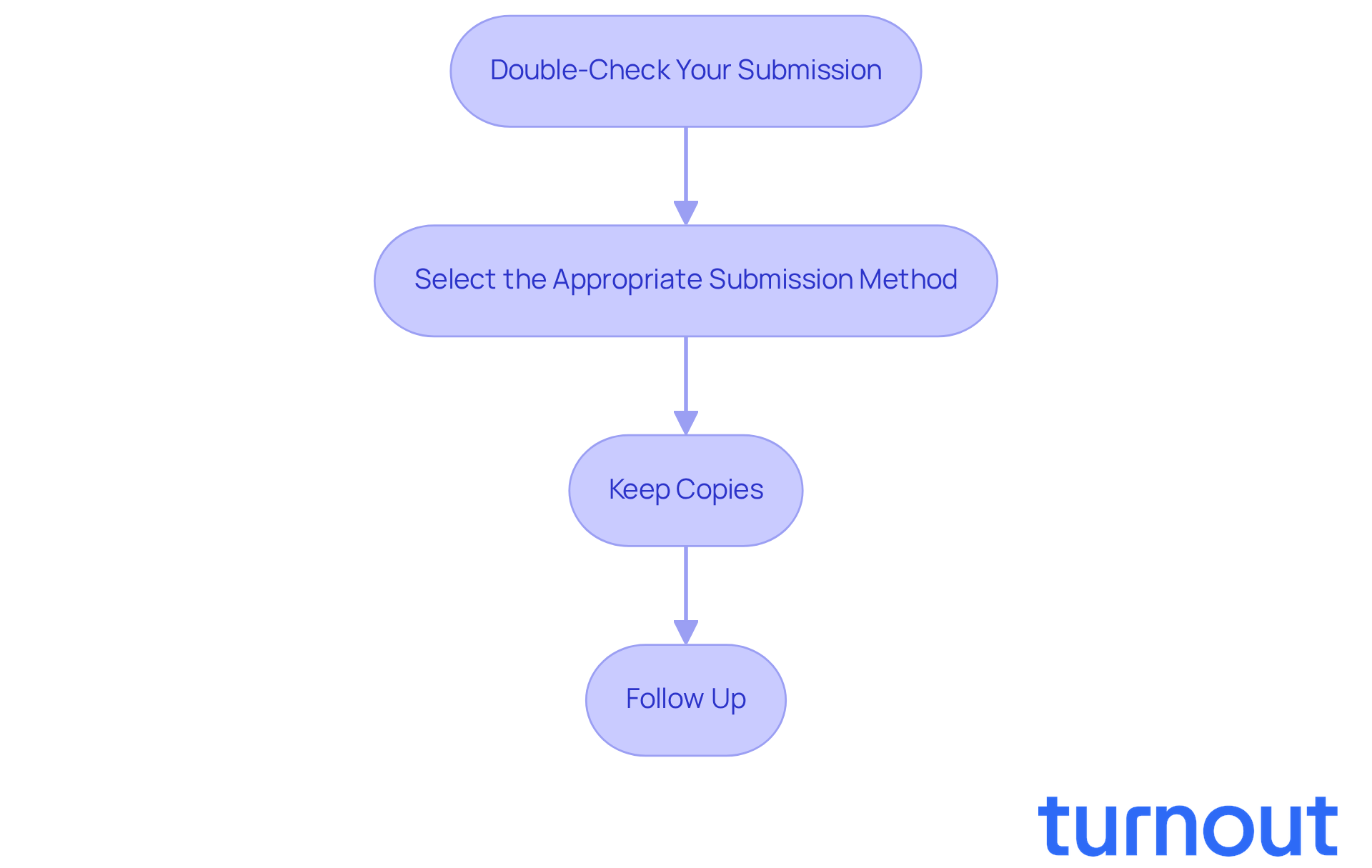

Submit Your Tax Relief Application Effectively

To submit your tax relief application effectively, let’s walk through these essential steps together:

-

Double-Check Your Submission: We understand that this process can feel overwhelming. Take a moment to thoroughly review your submission for completeness and accuracy. Ensure that all required fields are filled out and that you have included all necessary documentation. Remember, small errors, like incorrect Social Security numbers or missing forms, can lead to significant delays or denials.

-

Select the Appropriate Submission Method: It’s common to feel unsure about how to send your request. Depending on the specific tax relief scheme, you might have options to submit your request online, by mail, or in person. Verify the submission method outlined in the program's instructions to ensure compliance and efficiency.

-

Keep Copies: Make duplicates of your submission and all supporting documents for your records. This practice is crucial, as it allows you to reference your submission if you need to follow up or provide additional information later. You’re not alone in this journey; having your documents organized can ease your mind.

-

Follow Up: After submitting your request, monitor its status. If you don’t receive confirmation within a reasonable timeframe, don’t hesitate to reach out to the appropriate agency to ask about your submission. Staying proactive can help you address any issues promptly, and we’re here to support you through this.

By following these steps, you can improve the precision and effectiveness of your request for tax relief Las Vegas, boosting your likelihood of a favorable result. Remember, you are not alone in this process, and we’re here to help!

Troubleshoot Common Issues in the Tax Relief Application Process

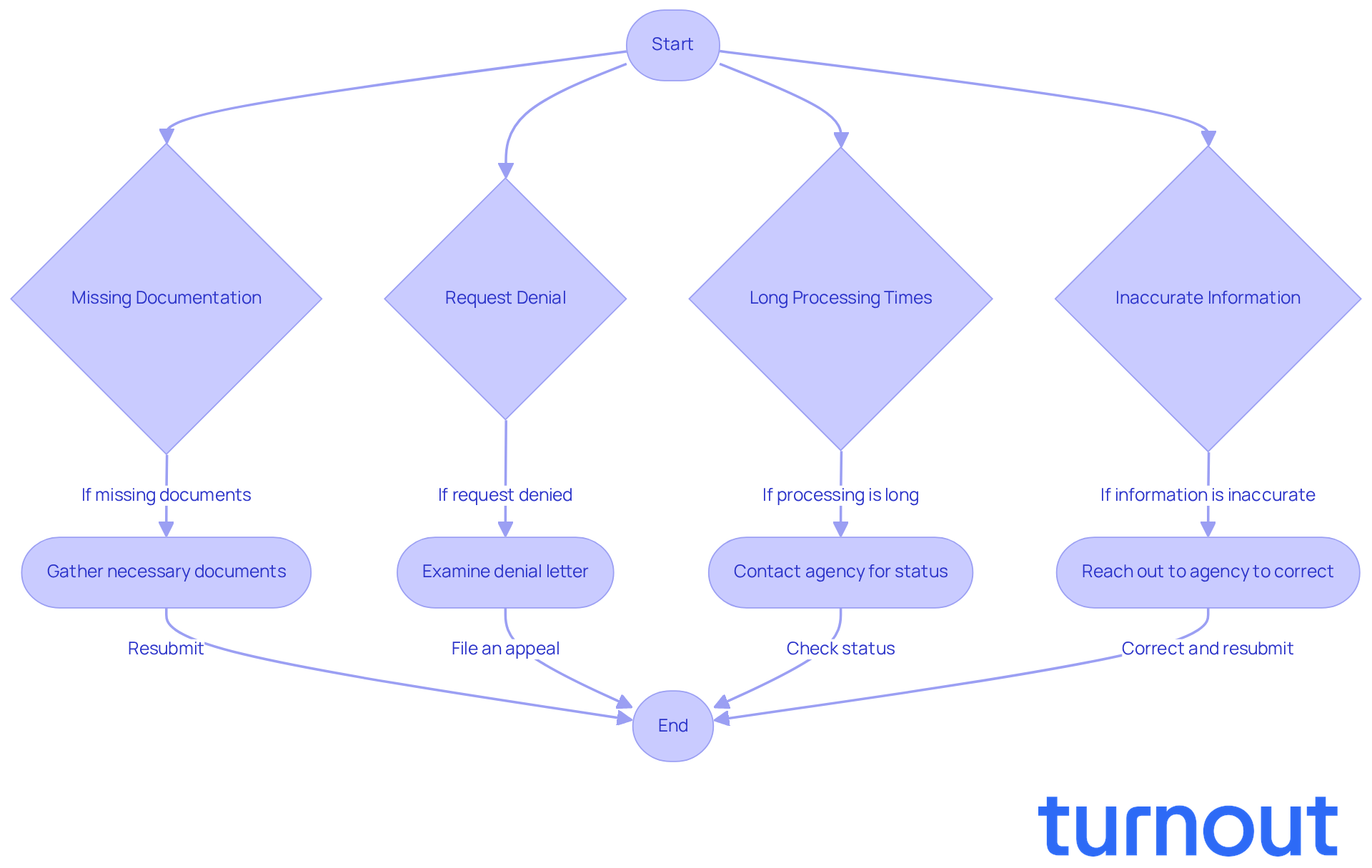

When applying for tax relief, it’s common to face a few bumps along the way. But don’t worry; we’re here to help you troubleshoot effectively:

-

Missing Documentation: If your submission comes back due to missing documents, take a deep breath. Review the checklist provided by the agency carefully. Gather the necessary documents, like W-2s, 1099s, and any supporting evidence, and resubmit as soon as you can. For example, if you’re missing a W-2, reach out to your employer for a replacement or consider using Form 4852 as a substitute.

-

Request Denial: If your request is denied, it’s important to examine the denial letter closely for specific reasons. You usually have the option to appeal the decision. Collect relevant documents, including your original submission and any IRS rejection notices, to support your case during the appeal process. Remember, the IRS typically allows 30 days to file an appeal, so it’s best to act quickly.

-

Long Processing Times: If your request is taking longer than expected, don’t hesitate to contact the agency to check on its status. Be prepared to provide your submission details for reference. Staying organized and monitoring your submission can help you manage expectations and follow up effectively.

-

Inaccurate Information: If you realize you submitted incorrect information, reach out to the agency right away to correct it. Providing accurate information is crucial for a successful submission. Double-check all entries to ensure that your personal information, income, deductions, and calculations are correct before resubmitting.

By being proactive and prepared to tackle these common issues, you can navigate the application process more smoothly and improve your chances of securing the tax relief you need. Remember, you’re not alone in this journey.

Conclusion

Navigating the complexities of tax relief options in Las Vegas for disabled individuals can feel overwhelming. We understand that achieving financial stability is a crucial goal, and knowing the available programs is the first step. By determining eligibility and effectively submitting applications, you can access the assistance you need to ease financial burdens.

This guide has highlighted essential steps, such as:

- Exploring IRS programs like the Fresh Start initiative

- Utilizing state tax exemptions

- Tapping into local resources for support

Each of these components is vital in ensuring that eligible individuals can secure the financial relief they deserve, ultimately leading to a better quality of life.

The journey to tax relief may seem daunting, but remember, support is available. Engaging with local organizations and utilizing the strategies outlined can empower you to navigate this process more effectively. Taking action today can pave the way for a more secure financial future, ensuring that disabled individuals in Las Vegas can thrive despite the challenges they may face. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What tax relief options are available in Las Vegas for disabled individuals?

In Las Vegas, disabled individuals can access several tax relief options, including the IRS Fresh Start Program, state property tax exemptions, various tax credits like the Earned Income Tax Credit (EITC), and local assistance programs such as Nevada 211 and Volunteer Income Tax Assistance (VITA).

What is the IRS Fresh Start Program?

The IRS Fresh Start Program assists taxpayers struggling with tax debt by offering options like installment agreements and offers in compromise. For disabled individuals, the process is often streamlined to make managing tax obligations easier.

How can disabled individuals benefit from state tax exemptions in Nevada?

Nevada offers property tax exemptions for disabled individuals, significantly reducing the financial burden of homeownership. Individuals should contact the Clark County Assessor's Office for specific eligibility criteria and application processes.

What tax credits are available for disabled individuals?

Disabled individuals may qualify for various tax credits, including the Earned Income Tax Credit (EITC) and the Credit for the Elderly or the Disabled, which can help offset tax liabilities and improve financial stability.

What local resources are available to assist with tax preparation in Las Vegas?

Organizations like Nevada 211 and Volunteer Income Tax Assistance (VITA) provide free tax preparation services and can help individuals identify relevant tax assistance options to optimize their benefits.

What steps should I take to determine my eligibility for tax relief programs?

To determine eligibility, review income requirements (e.g., the IRS Fresh Start Program income threshold of $50,000 or less), assess disability status by gathering necessary documentation, check residency requirements in Nevada, and consult local resources for personalized guidance.

What documentation is needed to verify disability status for tax relief programs?

Documentation may include a Social Security Disability Insurance (SSDI) award letter or a letter from a healthcare provider to verify disability status.

How can local organizations assist in navigating tax relief options?

Local organizations like Nevada 211 and Turnout provide personalized guidance and support from trained nonlawyer advocates and IRS-licensed enrolled agents to help individuals understand their options and navigate the submission process for tax relief.