Introduction

Navigating the complexities of tax payments can often feel overwhelming. We understand that for many, especially those unfamiliar with the digital landscape, this process can be daunting. With over 91% of taxpayers opting for online platforms in the past year, knowing how to pay Illinois taxes online has become essential.

This guide is here to help you through the straightforward steps to complete your tax payments via the MyTax Illinois portal. We’ll also address common challenges that may arise along the way. How can you ensure your transactions are secure and accurate while adapting to this evolving digital tax landscape? You're not alone in this journey, and we're here to support you every step of the way.

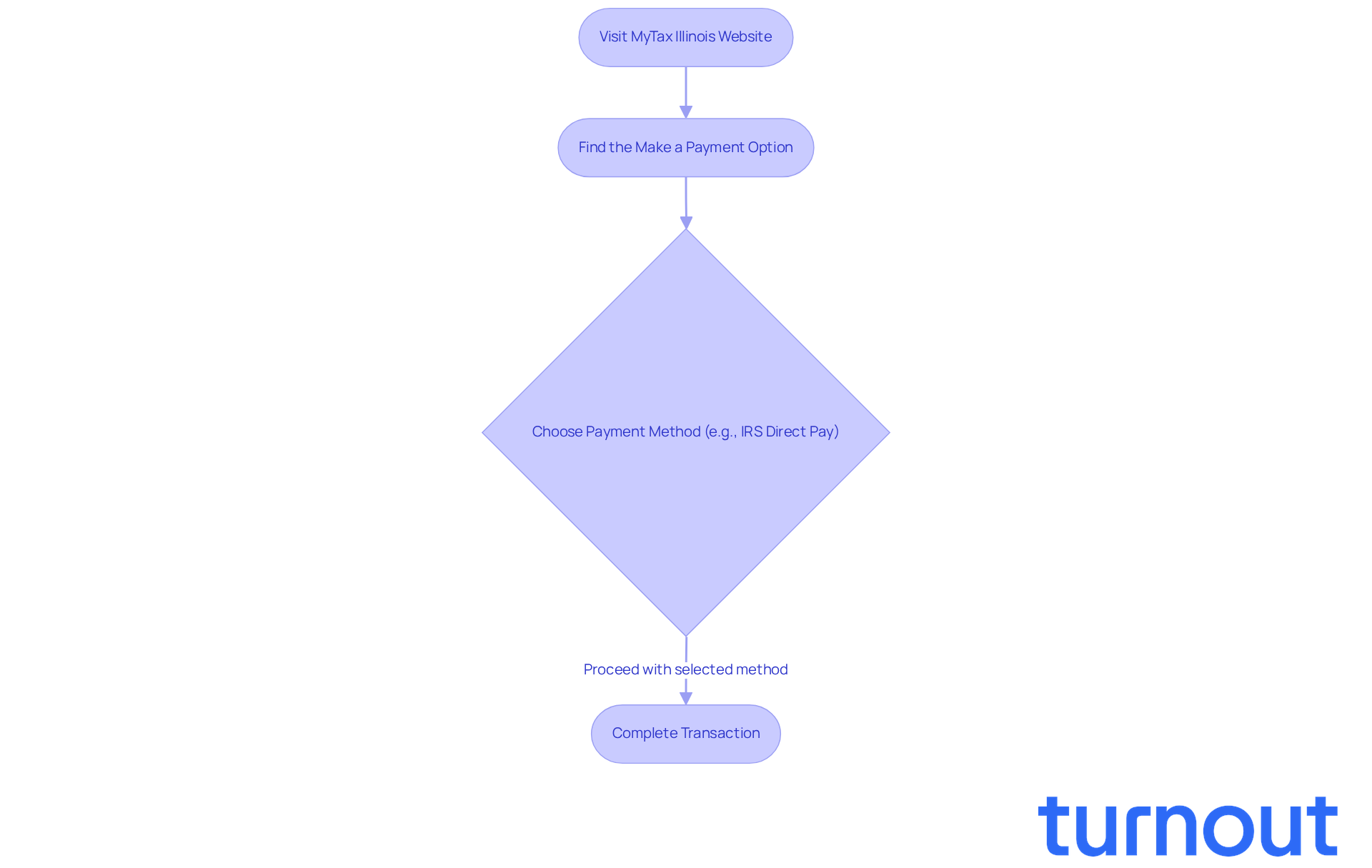

Visit the Illinois Tax Payment Website

Are you looking for information on how to pay Illinois taxes online? We understand that navigating tax payments can be overwhelming, but you’re not alone in this journey. To get started on how to pay Illinois taxes online, visit the official Illinois Tax Payment website at MyTax Illinois. This platform serves as your central hub for managing tax transactions and accessing a variety of tax-related services. It’s crucial to ensure you’re on the legitimate site to protect yourself from phishing scams. Once you’re on the homepage, simply find the 'Make a Payment' option, which will show you how to pay Illinois taxes online and guide you to the transaction portal.

As we move into 2026, MyTax continues to evolve, with updates designed to enhance your experience and security. Did you know that last year, 91.3% of taxpayers filed their returns electronically? This statistic highlights the growing reliance on online platforms for tax management. Using MyTax not only simplifies the transaction process but also allows you to set up automatic withdrawals on designated days, ensuring you never miss a deadline.

For added peace of mind, consider using IRS Direct Pay. This option lets you pay directly from your checking or savings account, with funds typically credited to your IRS account within one business day. This method minimizes the risk of fraud and provides immediate confirmation of your payment. Remember, the deadline to file individual income tax returns for the state is April 15, 2026. By navigating MyTax successfully, you can manage your tax obligations with confidence and ease.

We’re here to help! Free language support is available for individuals with Limited English Proficiency, ensuring that everyone can access the services they need. You are not alone in this process, and we’re committed to supporting you every step of the way.

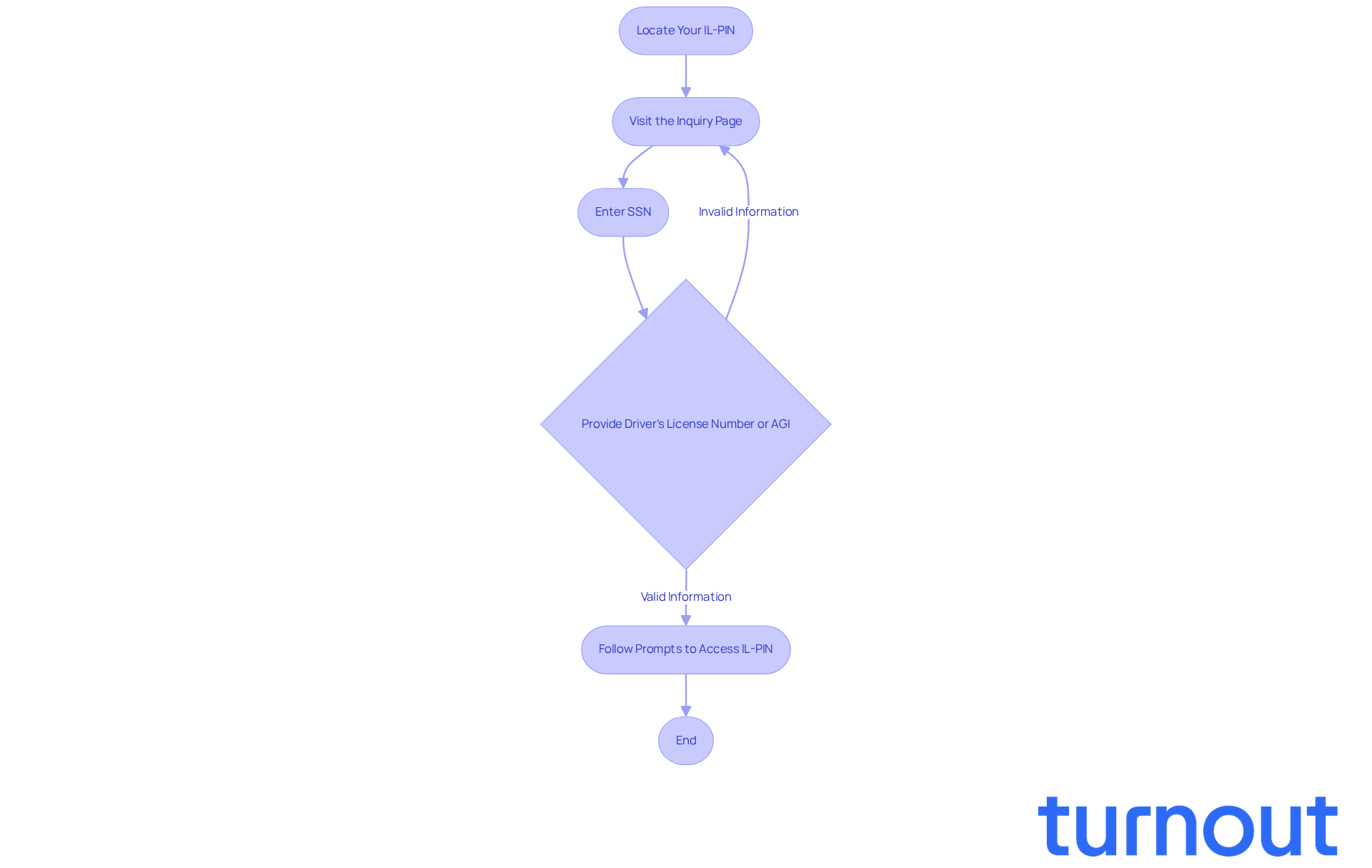

Locate Your Illinois Personal Identification Number (IL-PIN)

Your state Personal Identification Number (PIN) is crucial for completing online tax transactions. This unique identifier not only verifies your identity but is also necessary to activate your MyTax account, file your IL-1040 return, or make payments. We understand that first-time filers may feel overwhelmed, as they do not receive a state identification number and cannot submit their 1040 return or pay using MyTax. To obtain your identification number, simply visit the Inquiry page on the Department of Revenue website for the state. You'll need your Social Security Number (SSN) and either your state driver's license number or the Adjusted Gross Income (AGI) from your most recent tax return. Follow the prompts on the page to securely access your identification number.

As stated by the Illinois Department of Revenue, to understand how to pay Illinois taxes online, an identification number is required to activate a MyTax Illinois account or request a Letter ID. It's common to feel confused about this process. For instance, a retired individual faced uncertainty when asked for their identification number after a break from filing taxes. However, they successfully resolved their issue by following the retrieval steps, highlighting the importance of understanding this requirement.

Tax specialists emphasize that understanding how to pay Illinois taxes online is simplified by having your IL-PIN easily accessible. This minimizes delays and ensures you adhere to state tax regulations. If you encounter challenges, remember, you are not alone in this journey. Consider reaching out to the Department of Revenue directly for assistance. We're here to help!

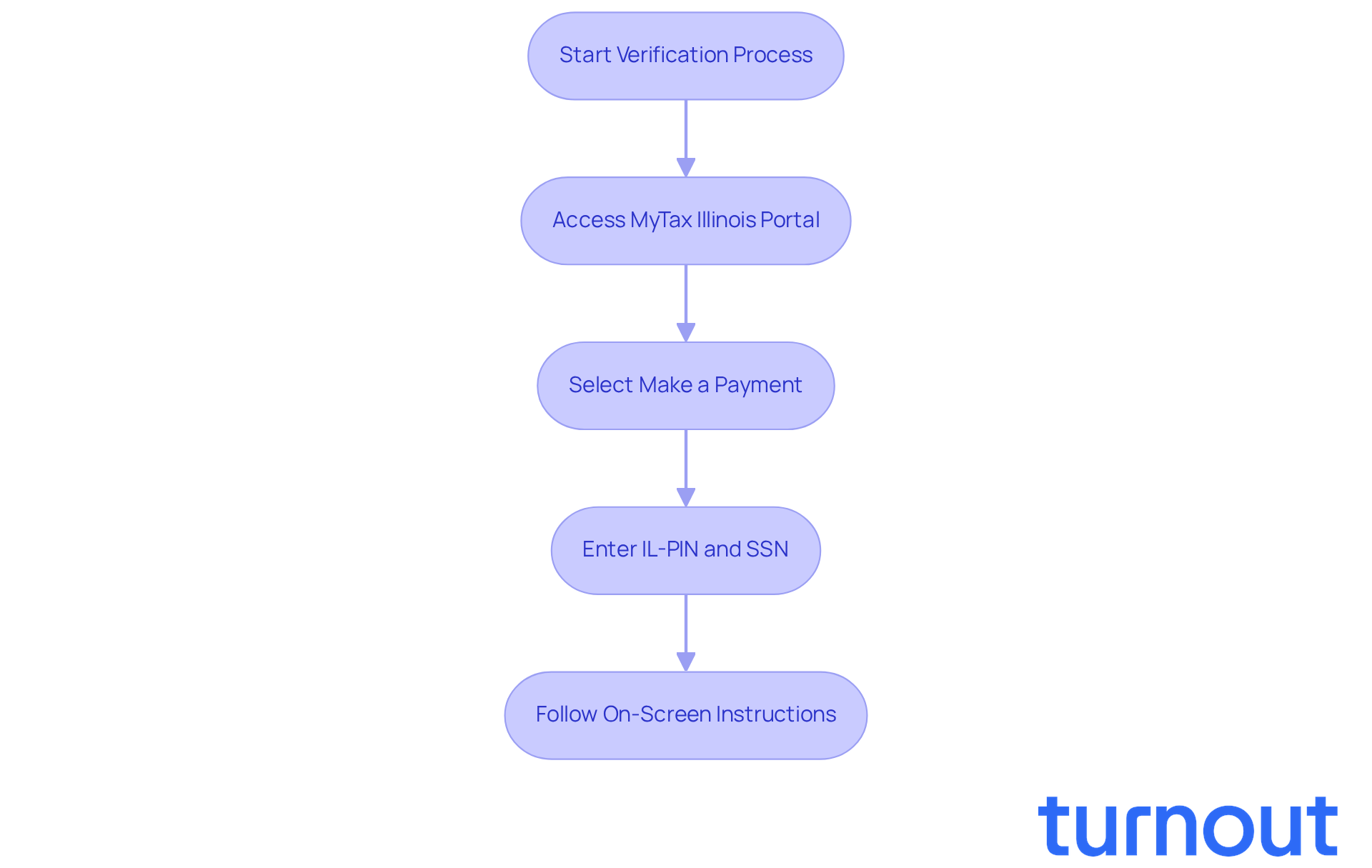

Verify Your Identity for Secure Payment

We understand that navigating tax transactions can be daunting, especially when it comes to protecting your identity. The first essential step in this process is to verify your identity through the MyTax Illinois portal. By selecting the 'Make a Payment' option, you’ll need to enter your IL-PIN along with other identifying details, like your Social Security Number (SSN). Following the on-screen instructions will guide you through this important verification process.

This step is crucial for ensuring your transaction is processed securely. It helps protect against unauthorized access and potential security breaches. With the rise in identity theft, secure identity verification has become increasingly important in online tax transactions. It safeguards both your financial information and the integrity of the tax system.

In 2024, over 1 million tax returns involving refunds exceeding $6.3 billion were flagged by the IRS as potentially filed by identity thieves. This underscores the critical need for robust identity verification measures. Additionally, the IRS has expanded Individual Online Accounts in early 2026, allowing taxpayers to view and download important tax documents. This further emphasizes the importance of maintaining secure access to your tax information.

As Jay McTigue, GAO Director of Strategic Issues, noted, "IRS has seen tremendous improvements in performance and its processes allowing taxpayers to get through and access the service." Therefore, it is highly recommended to learn how to pay Illinois taxes online to protect against identity theft. Remember, you are not alone in this journey; we’re here to help you every step of the way.

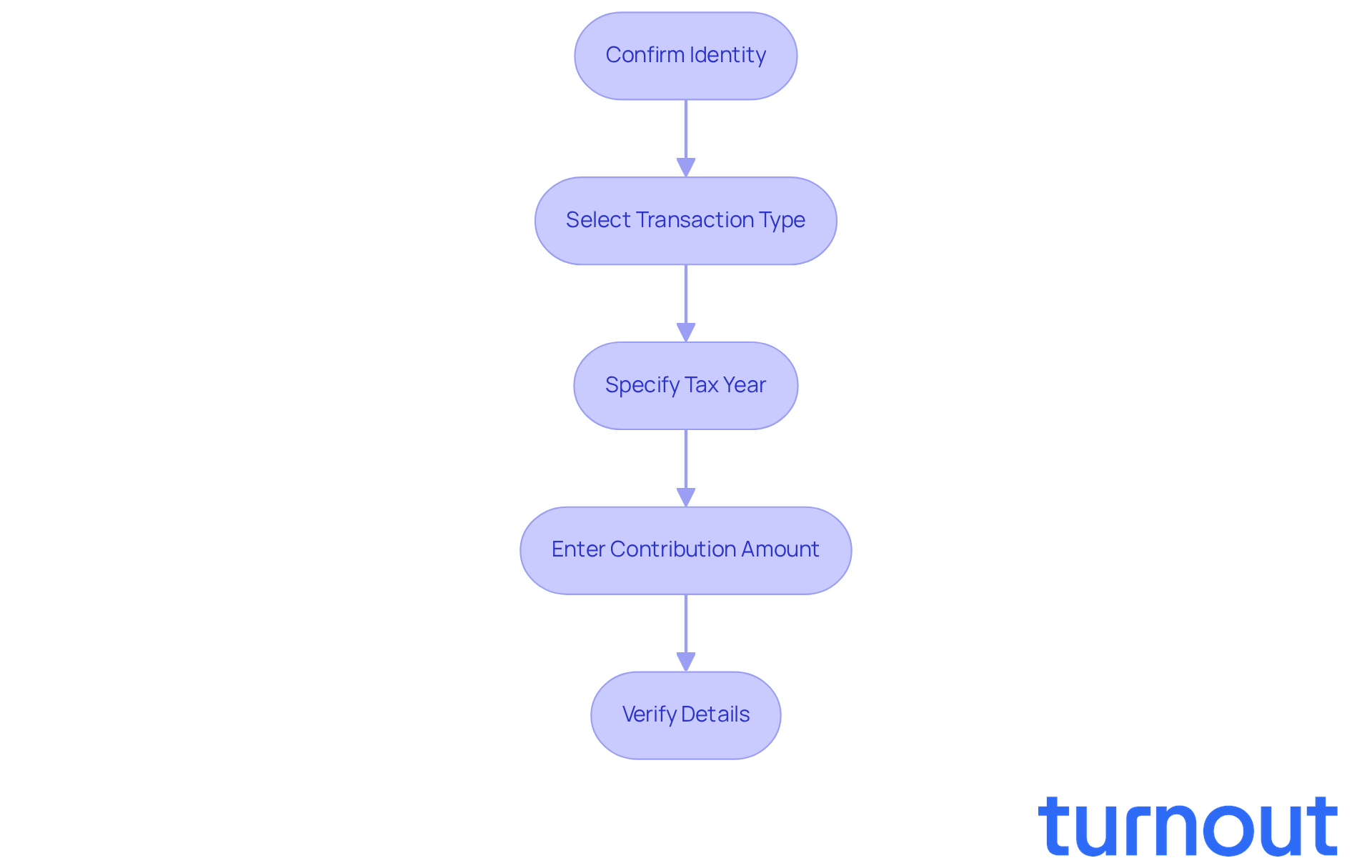

Select Payment Details and Amount

We understand that navigating tax transactions can be daunting. Once you've confirmed your identity, you'll find yourself on the billing details page. Here, you’ll need to select the type of transaction you’re making, like individual income tax, and specify the relevant tax year. It’s important to enter the amount you wish to contribute, making sure it aligns with average tax contributions in your state. Remember, these can vary significantly based on your income and deductions.

For example, in Illinois, the average personal income tax contribution is around $2,500, but this can change depending on individual circumstances. Before you move forward, take a moment to verify all your details. This step is crucial; it ensures that your transaction is applied correctly to the right account and tax period.

It’s common to feel overwhelmed, but tax experts often highlight that typical errors occur when taxpayers overlook these details. This can lead to delays or incorrect applications. As one tax specialist wisely noted, "Neglecting to confirm your financial information can lead to unnecessary complications and delays in processing your tax responsibilities."

By taking the time to review your entries, you can avoid these pitfalls and ensure a smoother transaction process. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Complete Payment Information and Submit

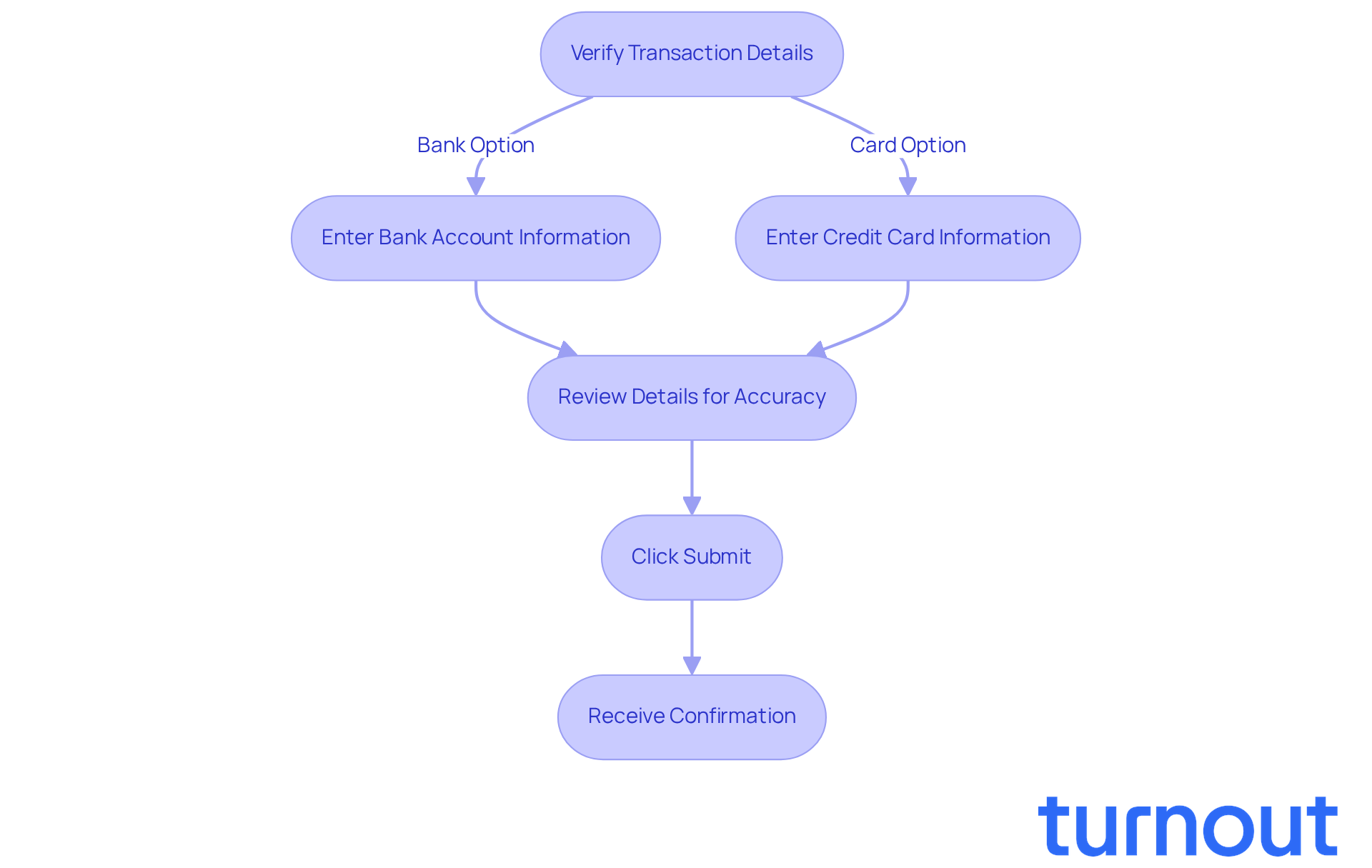

We understand that entering your financial information can feel daunting. After verifying your transaction details, please enter your bank account specifics for direct debit or your credit card information for card transactions. It’s crucial to review everything meticulously to ensure accuracy. Once you’ve confirmed that all details are correct, simply click the 'Submit' button to complete your transaction.

Typically, you’ll receive a confirmation of your transaction shortly after submission. This confirmation is important to keep for your records. Did you know that electronic transactions are processed quickly, often within just a few minutes? This allows taxpayers to complete their dealings efficiently.

Financial advisors often recommend double-checking all details before submission to avoid any delays. Even minor errors can lead to complications in processing, and we want to help you avoid that. Remember, keeping precise records of your confirmation is essential for future reference.

It’s also important to recognize that 22.3% of households in Illinois are unbanked or underbanked, which may pose challenges in accessing electronic transaction options. As the IRS transitions away from paper checks for tax refunds after September 30, 2025, adapting to electronic payments becomes increasingly urgent for all taxpayers. You are not alone in this journey; we’re here to help you navigate these changes.

Conclusion

Navigating the process of paying Illinois taxes online can feel overwhelming, but we’re here to help. With the right guidance, it becomes a straightforward task. This article has outlined essential steps to ensure a smooth experience, from accessing the MyTax Illinois website to securely submitting your payment. Understanding each phase not only alleviates confusion but also empowers you to manage your obligations efficiently.

Key insights include:

- The importance of obtaining your Illinois Personal Identification Number (IL-PIN)

- Verifying your identity for secure transactions

- Carefully selecting and confirming payment details

Each of these components plays a critical role in ensuring that your tax payments are processed accurately and securely. Remember, staying vigilant against potential identity theft is crucial.

As the landscape of tax payments evolves, embracing online methods is not just a convenience but a necessity for many. We understand that taking proactive steps to familiarize yourself with the Illinois tax payment process can lead to greater confidence and peace of mind. If you still feel uncertain, reaching out for support and utilizing available resources can make all the difference.

Embrace the digital age of tax payments. You are not alone in this journey, and together, we can ensure that your financial responsibilities are met with ease and security.

Frequently Asked Questions

How can I pay my Illinois taxes online?

You can pay your Illinois taxes online by visiting the official Illinois Tax Payment website at MyTax Illinois. Once on the homepage, look for the 'Make a Payment' option to guide you to the transaction portal.

What is MyTax Illinois?

MyTax Illinois is the central hub for managing tax transactions and accessing various tax-related services in Illinois. It is designed to simplify the tax payment process and enhance user experience and security.

Why is it important to ensure I’m on the legitimate tax payment site?

It is crucial to access the legitimate site to protect yourself from phishing scams and ensure that your tax transactions are secure.

What percentage of taxpayers filed their returns electronically last year?

Last year, 91.3% of taxpayers filed their returns electronically, indicating a growing reliance on online platforms for tax management.

Can I set up automatic withdrawals for my tax payments?

Yes, using MyTax Illinois allows you to set up automatic withdrawals on designated days to help ensure you never miss a payment deadline.

What is IRS Direct Pay?

IRS Direct Pay is an option that lets you pay directly from your checking or savings account, with funds typically credited to your IRS account within one business day, minimizing the risk of fraud and providing immediate confirmation of your payment.

When is the deadline to file individual income tax returns in Illinois?

The deadline to file individual income tax returns for the state of Illinois is April 15, 2026.

How can I locate my Illinois Personal Identification Number (IL-PIN)?

To locate your IL-PIN, visit the Inquiry page on the Department of Revenue website. You will need your Social Security Number (SSN) and either your state driver's license number or the Adjusted Gross Income (AGI) from your most recent tax return.

Why is the IL-PIN important for online tax transactions?

The IL-PIN is important because it verifies your identity and is necessary to activate your MyTax account, file your IL-1040 return, or make payments.

What should I do if I encounter challenges while trying to obtain my IL-PIN?

If you encounter challenges, consider reaching out to the Department of Revenue directly for assistance. They are available to help you through the process.