Overview

Navigating back taxes can feel overwhelming, and it's important to know that you're not alone in this journey. The article outlines five essential steps to effectively address back taxes:

-

Understanding the Situation: It's common to feel anxious about your tax situation. Acknowledging your current status is the first step towards resolution.

-

Gathering Necessary Documents: Collecting the right documents can seem daunting, but it’s crucial for moving forward. Take it one step at a time.

-

Filing Overdue Returns: Filing those overdue returns may feel like a mountain to climb, yet prompt action is vital to avoid accumulating penalties.

-

Navigating Common Challenges: You might encounter hurdles along the way. Remember, these challenges are common, and there are solutions available.

-

Seeking Professional Help: Utilizing resources like tax professionals can provide you with tailored support in managing your tax debt successfully.

Taking prompt action is crucial, and by following these steps, you can start to regain control. Remember, we’re here to help, and with the right support, you can navigate this path with confidence.

Introduction

Navigating the complexities of back taxes can feel overwhelming for many individuals. We understand that missed deadlines and looming financial consequences can create a heavy burden. It's essential to grasp the nuances of overdue payments to regain control over your financial future. This guide offers a clear roadmap through five actionable steps, empowering you to tackle your tax issues head-on.

But what happens when the weight of tax debt feels too heavy to bear? Where can you turn for reliable support during these trying times? Remember, you are not alone in this journey, and we are here to help you find the path forward.

Understand Back Taxes: Definition and Importance

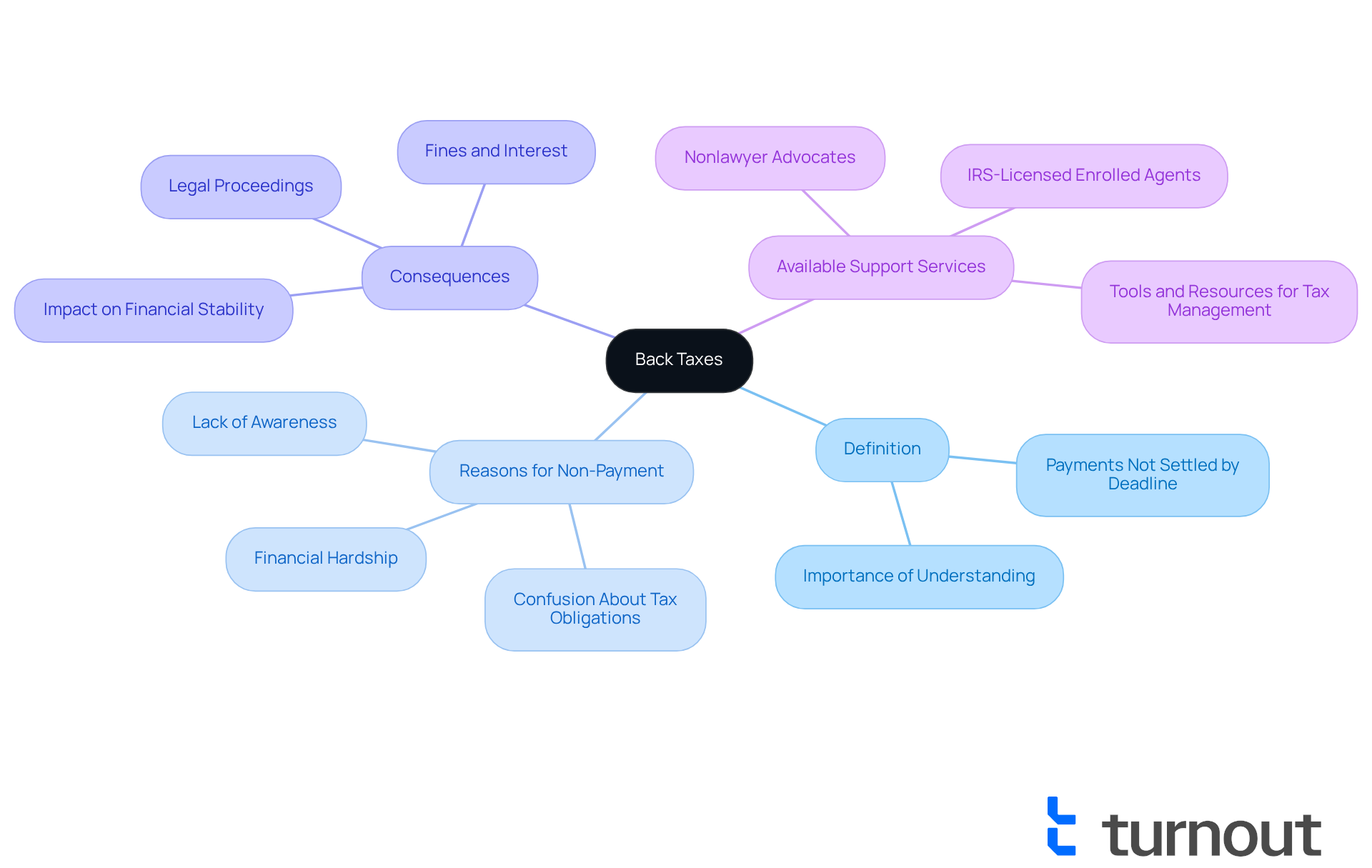

Back dues refer to payments that have not been settled by the deadline. We understand that this can happen for various reasons, including financial hardship, lack of awareness, or confusion about tax obligations. Grasping overdue payments is crucial, as they may lead to fines, interest, and even legal proceedings if not handled swiftly. Acknowledging the significance of settling overdue taxes can encourage you to take action and pursue solutions to your tax issues.

At Turnout, we're here to help. We provide access to tools and services that help with back taxes and assist you in navigating these complex financial challenges. This includes support to help with back taxes through IRS-licensed enrolled agents. Our trained nonlawyer advocates are dedicated to helping you understand your options and can help with back taxes without the need for legal representation.

It’s important to note that Turnout is not a legal practice. Our services are structured to assist you in navigating government benefits and financial support effectively. You are not alone in this journey; we are here to support you every step of the way.

Assess Your Back Tax Situation: Key Steps to Take

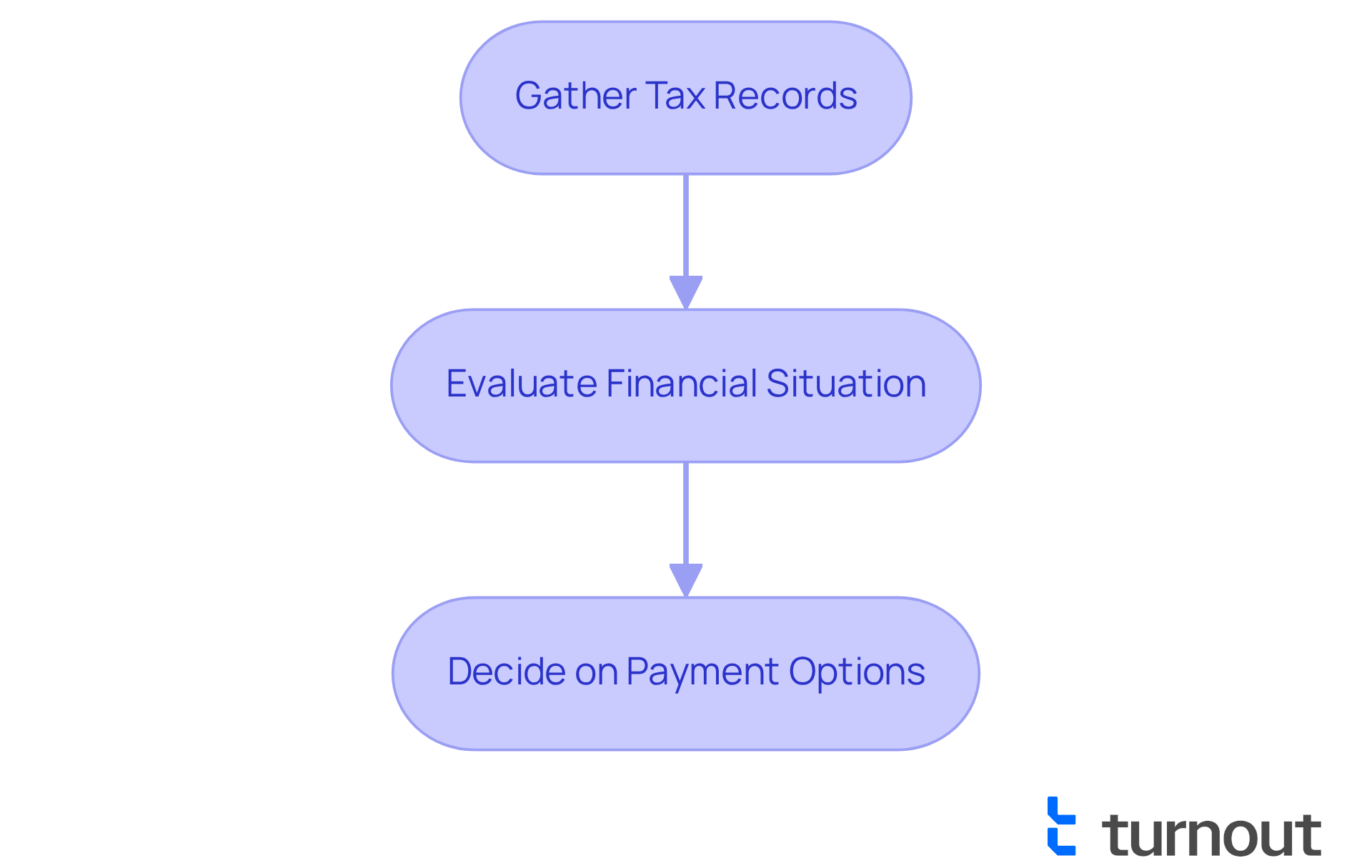

We understand that dealing with tax submissions and payments can be overwhelming, and we are here to help with back taxes. Start by gathering all the details regarding your tax filings and payments. Check your tax records to see how much you owe, including any penalties or interest that may have accrued. You can easily obtain your tax transcripts from the IRS website or by reaching out to them directly.

Next, take a moment to evaluate your financial situation. It's important to understand your ability to pay, considering factors such as your income, expenses, and any assets that could be liquidated. This self-assessment will help with back taxes by determining whether you can settle the overdue payments in full or if it might be more feasible to explore installment options or other alternatives.

Remember, you are not alone in this journey. We're here to help you navigate these challenges with compassion and understanding.

Gather Required Documents and File Your Back Taxes

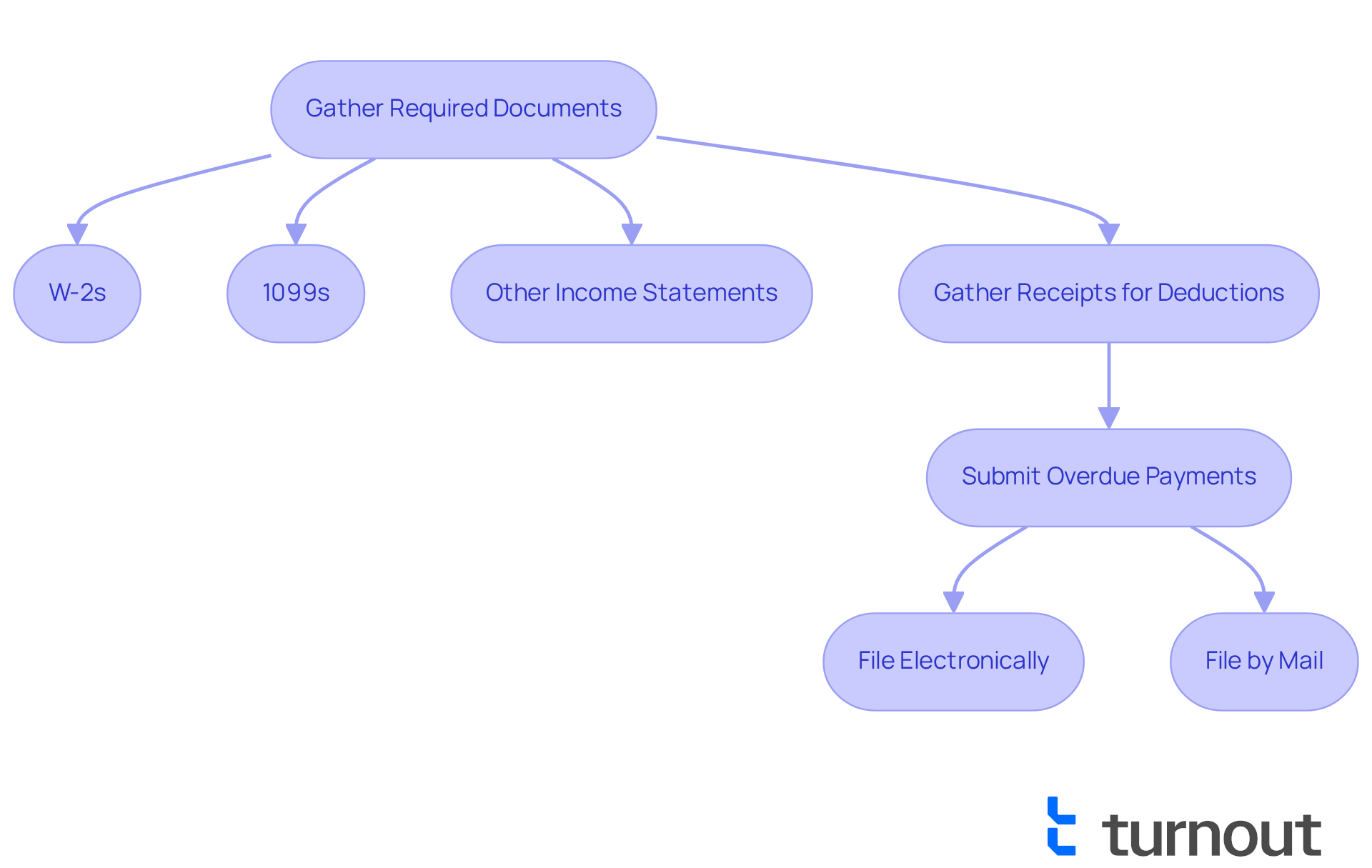

We understand that submitting your previous filings can feel overwhelming, and we are here to help with back taxes. To ease this process, you'll need several essential documents, including:

- Your W-2s

- 1099s

- Any other income statements for the years you're submitting

It's also important to gather receipts for any deductions and credits you plan to claim.

Once you have all the required documents, you can submit your overdue payments using the appropriate forms for each fiscal year. The IRS provides these forms on their website, allowing you to file either electronically or by mail. Remember, it's common to feel anxious about this, so take your time and double-check your information to help with back taxes and avoid mistakes that could lead to further complications. We're here to help with back taxes as you navigate this journey.

Navigate Challenges: Troubleshooting Common Filing Issues

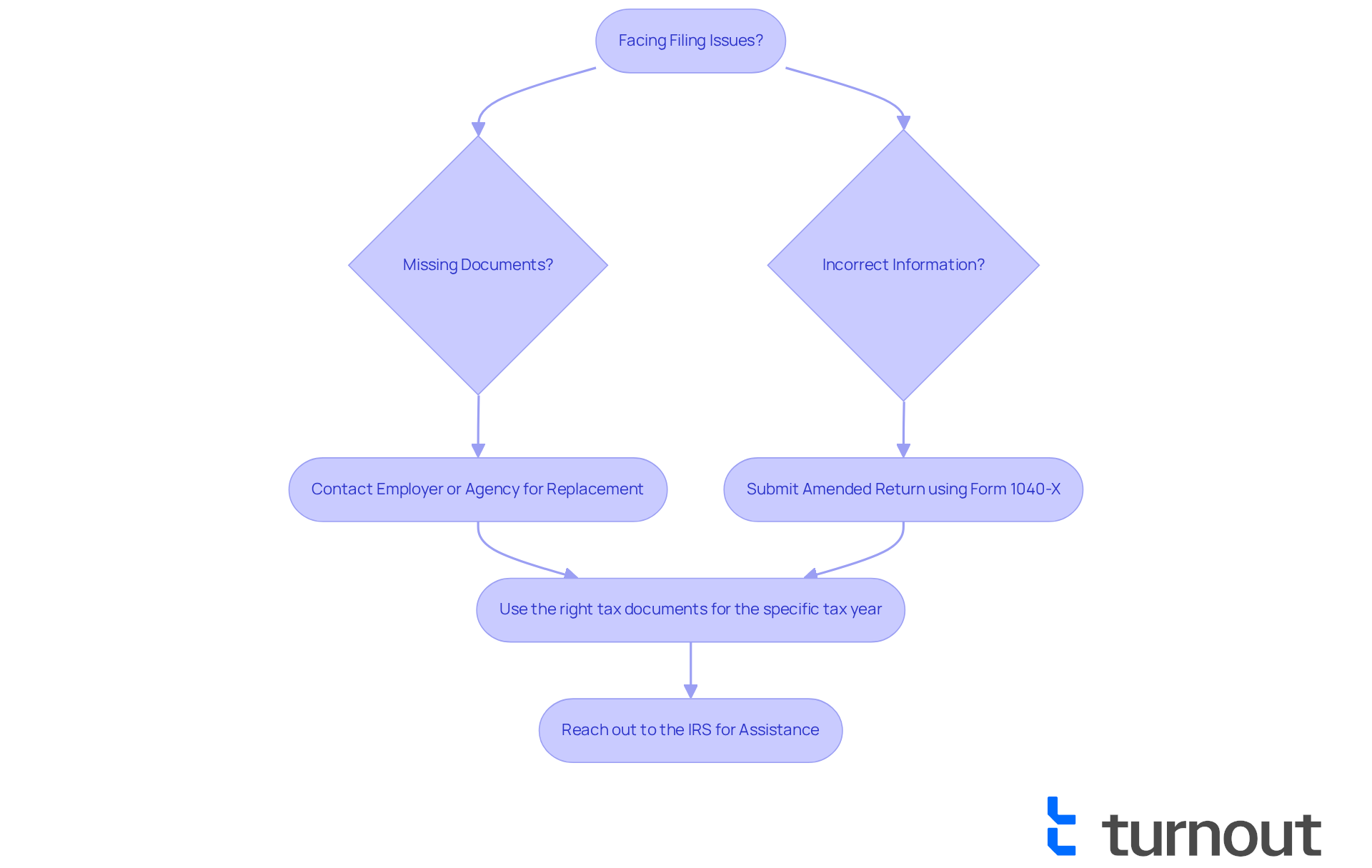

Filing back taxes can be overwhelming, and it's common to face challenges like missing documents or incorrect information when you need help with back taxes. If you find yourself without a W-2 or 1099, don’t worry. The first step is to reach out to your employer or the issuing agency to request a replacement copy. We understand that mistakes happen, and if you've realized you've made an error on your tax return, you can correct it by submitting an amended return using Form 1040-X.

It's essential to use the right tax documents for the specific tax year. This helps prevent mistakes and ensures that your overdue returns are submitted successfully. The IRS website offers tailored guidance based on your unique circumstances. If you encounter difficulties, remember that you can always reach out to the IRS directly for assistance. You're not alone in this journey.

Did you know that approximately 37% of taxpayers qualify for 100% complimentary tax submission with TurboTax Free Edition? This highlights how common submission problems can be. Additionally, keep in mind that penalties and interest can accumulate on overdue taxes each month they are delayed, which underscores the urgency of getting help with back taxes promptly.

By actively gathering the necessary documentation and seeking help when needed, you can navigate the complexities of tax filing more effectively. As a TurboTax expert wisely states, "Your past-due returns need to be filed using the tax forms and instructions applicable to that tax year." We’re here to help you through this process.

Seek Professional Help: Resources for Tax Debt Relief

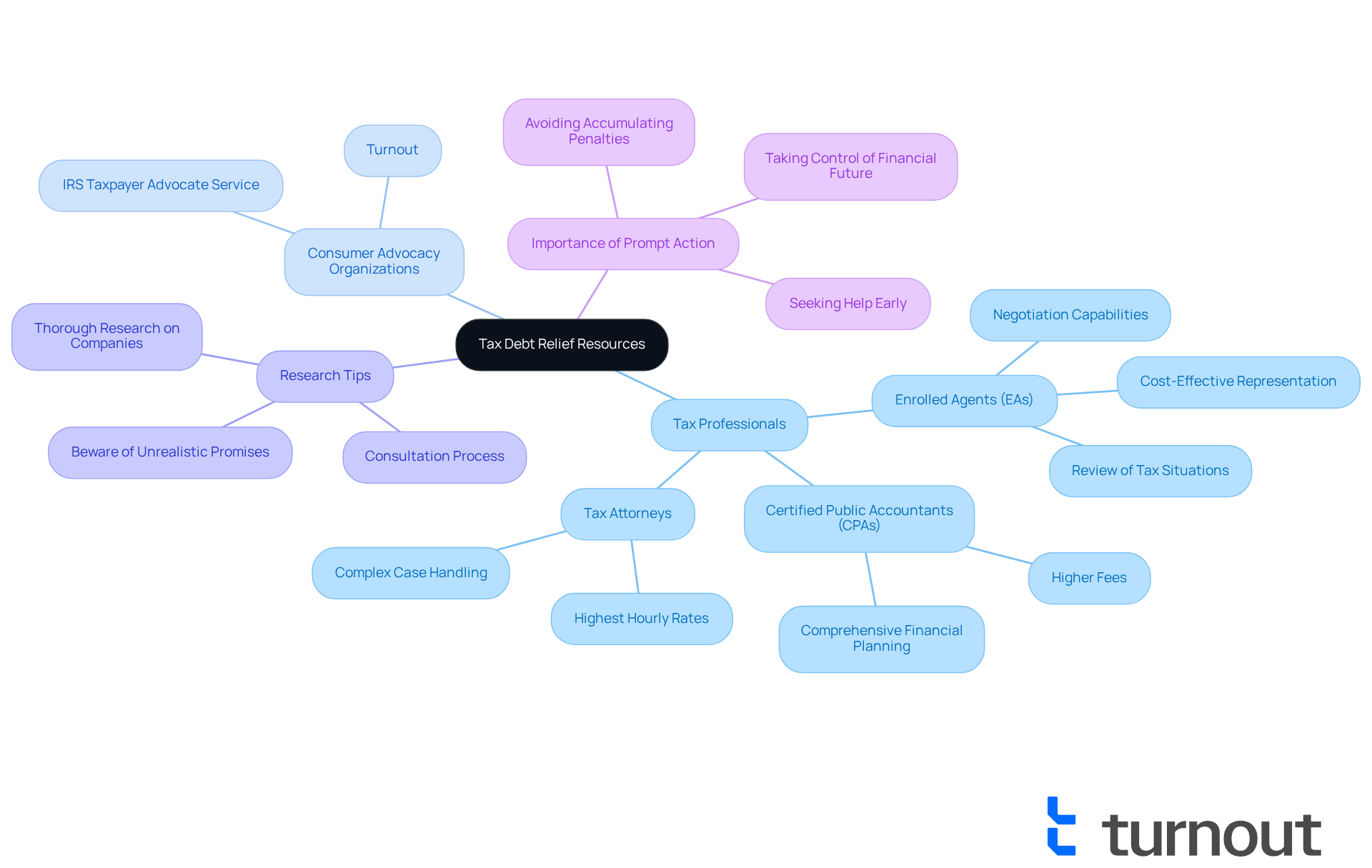

If you're feeling overwhelmed and need help with back taxes, know that you're not alone. Seeking assistance from a tax professional or a consumer advocacy organization can help with back taxes and be a crucial step toward relief. Resources like the IRS Taxpayer Advocate Service provide customized support tailored to your specific needs. Additionally, organizations such as Turnout are dedicated to helping individuals facing tax debt by offering services that help with back taxes and simplifying the complexities of the tax system. We encourage you to research local resources and consider scheduling a consultation to explore your options for tax debt relief.

In 2025, various consumer advocacy organizations are stepping up to provide essential support. For example, enrolled agents (EAs) can conduct thorough reviews of your tax situation, including unfiled returns, and develop effective strategies for addressing tax debt. They often charge less than CPAs while offering similar representation capabilities, making them a cost-effective choice for many.

The impact of these organizations on tax debt resolution is significant. They can help with back taxes by assisting in managing overwhelming IRS tax debt through the development of a resolution strategy that may include submitting missing returns and negotiating with the IRS. However, it's important to remember that the quality of service can vary among tax relief companies. Some may make unrealistic promises or impose high upfront fees. Therefore, thorough research is vital before engaging with any tax relief company to ensure you receive reliable and effective assistance.

Taking prompt action is essential. Delaying can lead to accumulating penalties and interest, complicating your situation further. By seeking professional help now, including the support offered by Turnout, you can regain control over your financial future and work toward a fresh start. Remember, we're here to help you through this journey.

Conclusion

Understanding and effectively managing back taxes is essential for regaining your financial stability and avoiding further complications. We recognize that addressing overdue payments can feel overwhelming, but taking proactive steps is the key to resolving your tax issues and preventing potential legal consequences.

In this guide, we’ve outlined key strategies to support you, including:

- Assessing your tax situation

- Gathering necessary documents

- Navigating common filing challenges

- Seeking professional assistance

Each step is crucial in creating a comprehensive plan to tackle back taxes, ensuring you have the knowledge and resources needed to move forward with confidence.

Ultimately, taking action is paramount. We understand that delaying the resolution of back taxes can lead to escalating penalties and increased stress, complicating your financial situation further. By utilizing available resources and seeking professional help, you can effectively manage your tax obligations, paving the way for a brighter financial future. The journey may seem daunting, but with the right support and guidance, overcoming back tax challenges is entirely achievable. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are back taxes?

Back taxes refer to payments that have not been settled by their deadline, which can occur due to reasons like financial hardship, lack of awareness, or confusion about tax obligations.

Why is it important to understand back taxes?

Understanding back taxes is crucial because overdue payments can lead to fines, interest, and potentially legal proceedings if not addressed promptly.

How can Turnout assist with back taxes?

Turnout provides access to tools and services to help with back taxes, including support from IRS-licensed enrolled agents and trained nonlawyer advocates who can guide you through your options without the need for legal representation.

Is Turnout a legal practice?

No, Turnout is not a legal practice. Its services are designed to assist individuals in navigating government benefits and financial support effectively.

What steps should I take to assess my back tax situation?

Start by gathering details about your tax filings and payments, checking your tax records for amounts owed, including penalties and interest. You can obtain your tax transcripts from the IRS website or by contacting them directly.

How can I evaluate my financial situation regarding back taxes?

Evaluate your financial situation by considering your income, expenses, and any assets that could be liquidated. This self-assessment will help determine if you can pay the overdue taxes in full or if you should explore installment options or other alternatives.