Introduction

Navigating the complexities of IRS penalties and interest can feel overwhelming. We understand that many taxpayers face this daunting task, and it’s completely normal to feel stressed about it. Recognizing the different types of penalties and the possibility of abatement is essential for anyone looking to ease their financial burden.

But here’s the good news: with the right knowledge and a strategic approach, you can significantly improve your chances of successfully removing these penalties. What steps can you take to effectively challenge these fines and secure a favorable outcome? Let’s explore this journey together, because you are not alone in this.

Understand IRS Penalties and Interest

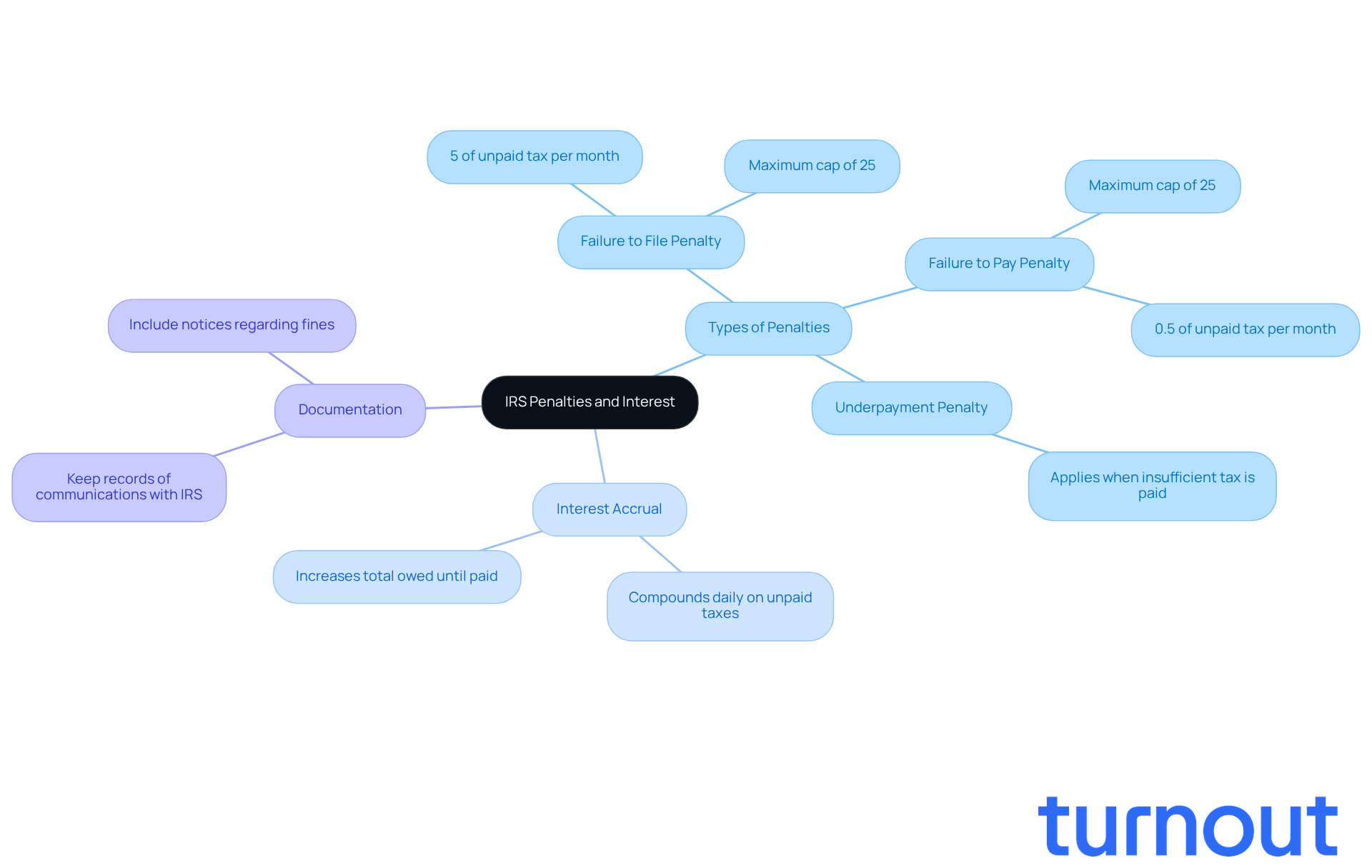

Understanding how to get the IRS to remove penalties and interest can feel overwhelming, but you’re not alone in this journey. It’s essential to grasp what these fines entail. The IRS imposes penalties for several reasons, such as not filing your tax return on time, failing to pay taxes owed, or underpaying estimated taxes. Each penalty comes with specific criteria and consequences, often leading to additional interest fees that can accumulate quickly.

-

Types of Penalties: Let’s take a moment to familiarize ourselves with some common penalties:

- Failure to File Penalty: This is typically 5% of the unpaid tax for each month your return is late, up to a maximum of 25%.

- Failure to Pay Penalty: Generally, this is 0.5% of the unpaid tax for each month, also capping at 25%.

- Underpayment Penalty: This applies when you haven’t paid enough tax throughout the year.

-

Interest Accrual: It’s important to know that interest on unpaid taxes compounds daily. The longer you wait to pay, the more you’ll owe. Understanding how interest is calculated can help you prioritize your payments effectively.

-

Documentation: Keeping records of all communications with the IRS and any notices regarding fines is crucial. This documentation will be invaluable as you learn how to get the IRS to remove penalties and interest.

We understand that dealing with these issues can be stressful, but remember, we’re here to help you navigate through it.

Qualify for First-Time Penalty Abatement

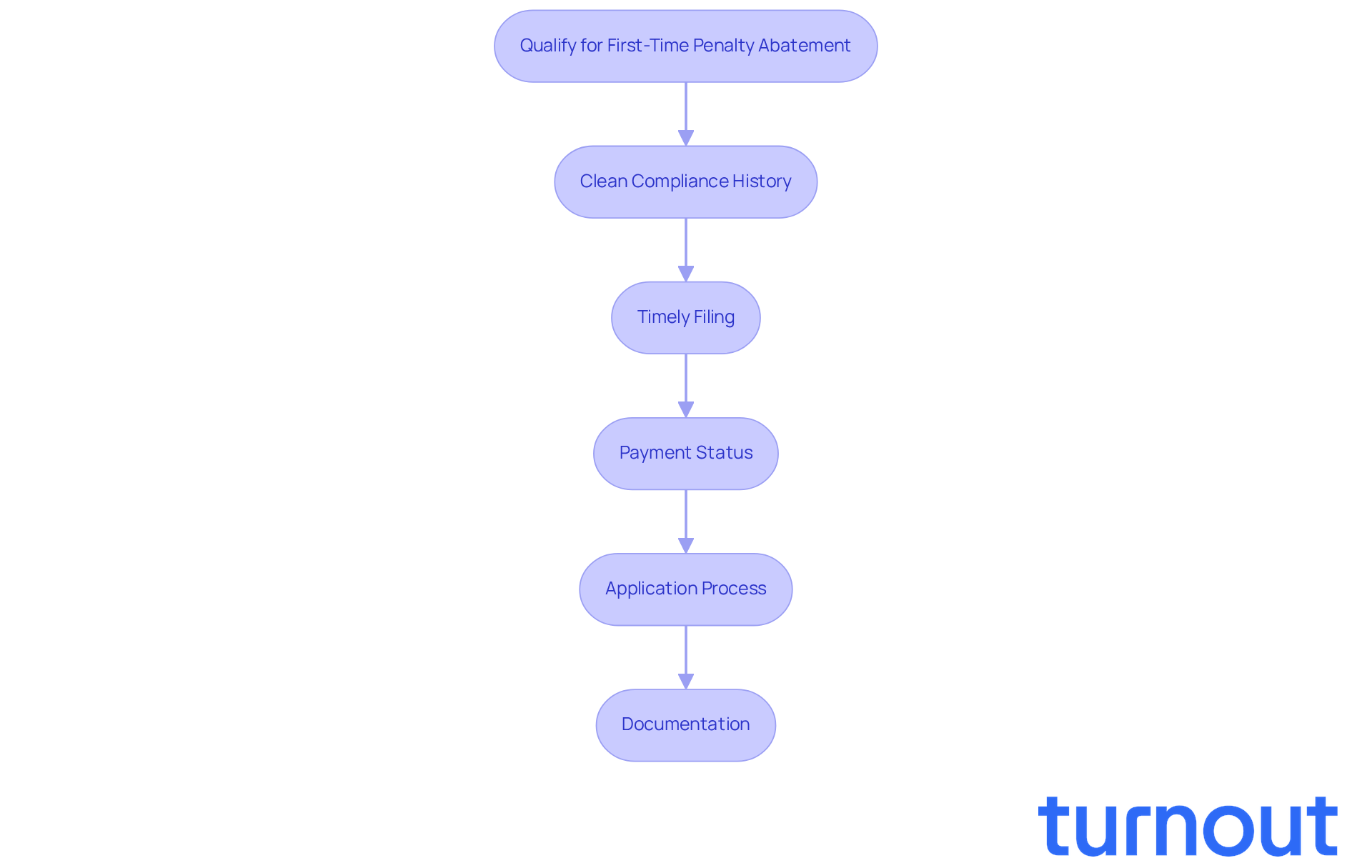

The First-Time Abatement (FTA) offers a valuable opportunity for taxpayers with a solid compliance history on how to get the IRS to remove penalties and interest. We understand that navigating tax issues can be stressful, and we’re here to help. To qualify for FTA, you’ll need to meet the following criteria:

- Clean Compliance History: It’s important that you haven’t incurred any penalties in the past three years, except for the one you’re currently addressing.

- Timely Filing: Make sure all required tax returns are filed on time. If you have any outstanding returns, please submit them before applying for FTA.

- Payment Status: You should have either paid or arranged to pay any taxes owed. If you’re on a payment plan, ensure it’s up to date. Remember, you don’t need to have paid your outstanding tax bill in full to apply for first-time abatement.

- Application Process: To obtain FTA, reach out to the IRS using the number on your notice or submit a written appeal. Be prepared to provide your tax identification number and details about your compliance history.

- Documentation: Keep records of your inquiry and any communication with the IRS. This will be crucial for follow-up if necessary.

It’s common to feel overwhelmed, but know that taxpayers can typically seek a reduction of fines within three years from the date the return was submitted or two years after the fine was settled. In 2026, statistics revealed that only 12% of first-time abatement applications were approved, with many initial submissions rejected for not following basic guidelines. Understanding how to get the IRS to remove penalties and interest can significantly enhance your chances of success. For instance, many taxpayers who have successfully navigated the FTA process often highlight the importance of timely filing and maintaining a clean compliance record as key factors in their approval.

If your FTA application is denied, don’t lose hope. You have the option to appeal the decision within 30 days of rejection. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

Build a Compelling Case for Reasonable Cause

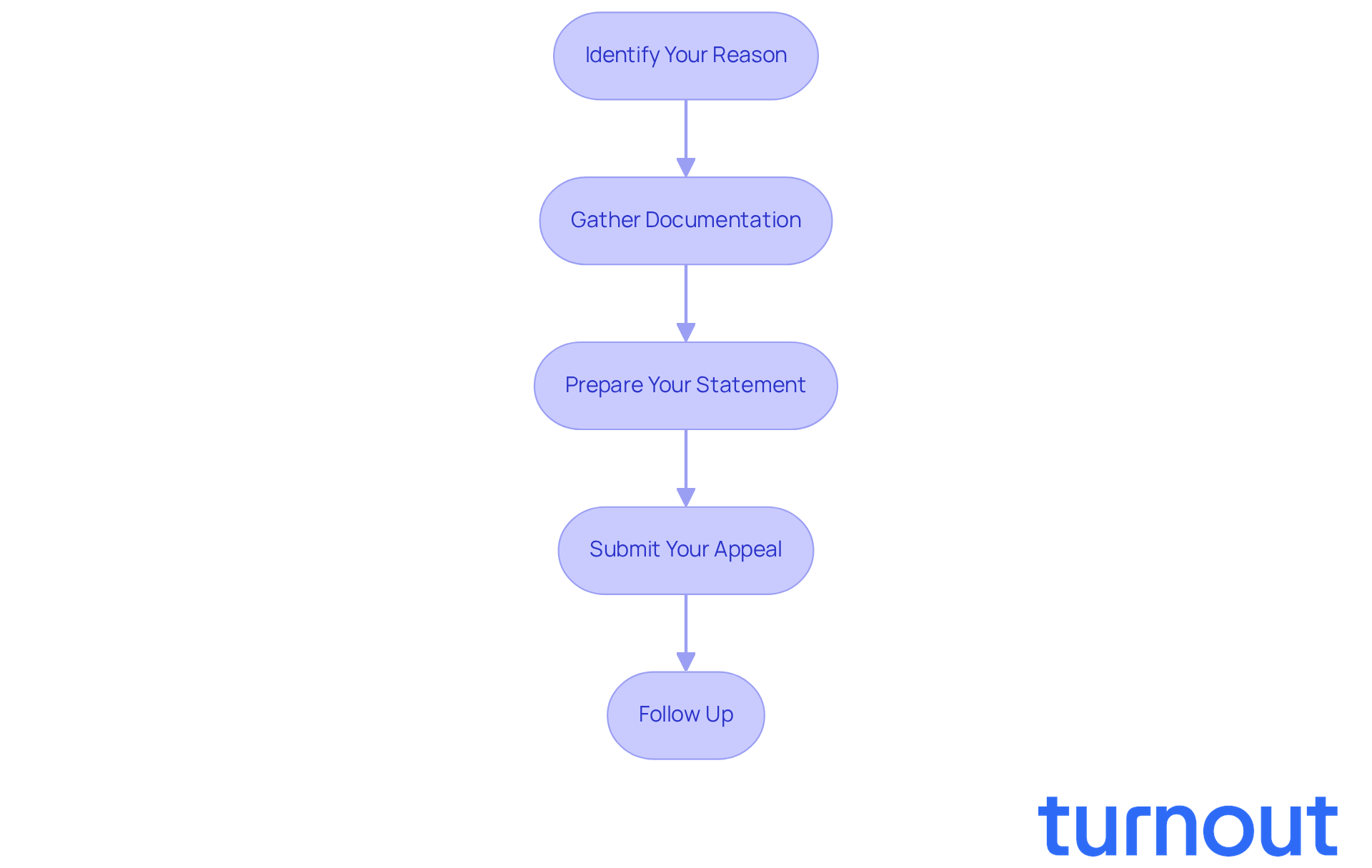

If you find yourself in a situation where you don’t qualify for First-Time Penalty Abatement, don’t worry. You can still seek relief by demonstrating reasonable cause, which is important in understanding how to get the IRS to remove penalties and interest. Here’s how to build a compelling case:

-

Identify Your Reason: It’s important to recognize that many people face challenges. Common acceptable reasons include:

- Serious illness or injury.

- Natural disasters that impacted your ability to file.

- The death of an immediate family member.

- Relying on erroneous advice from a tax professional.

-

Gather Documentation: Collecting evidence to support your claim is crucial. This may include medical records, insurance claims, or correspondence with tax professionals. Remember, having the right documents can make a difference.

-

Prepare Your Statement: Take a moment to write a clear and concise statement explaining your situation. Include details about how these circumstances prevented you from meeting your tax obligations. This is your chance to share your story about how to get the IRS to remove penalties and interest.

-

To understand how to get the IRS to remove penalties and interest, submit your appeal using IRS Form 843 to formally seek abatement for reasonable cause. Don’t forget to attach your statement and any supporting documentation. We’re here to help you through this process.

-

Follow Up: After submission, keep an eye on your inquiry. Be prepared to respond to any questions from the IRS. It’s common to feel anxious during this time, but staying proactive can help ease your worries.

Master the Request Process for IRS Penalty Abatement

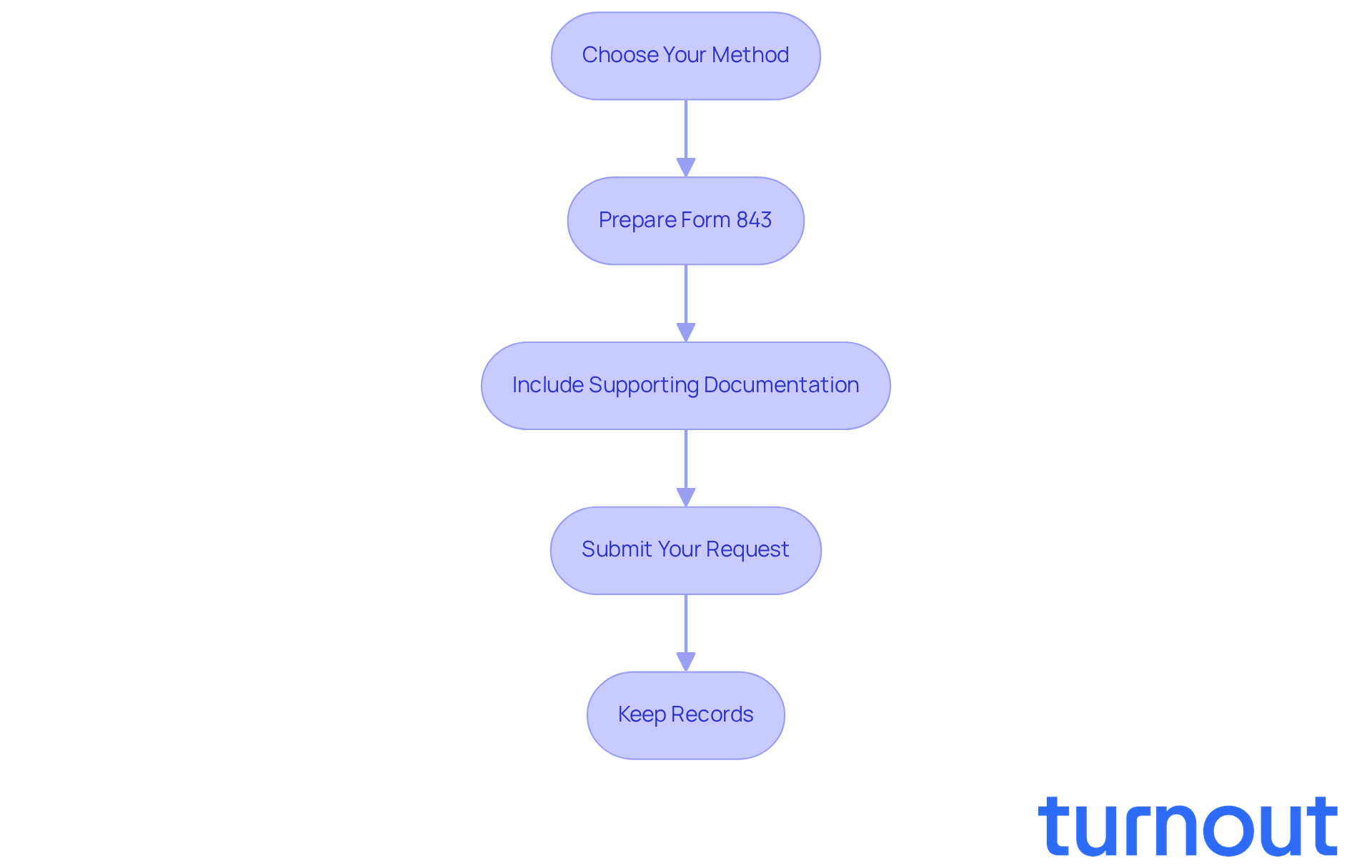

If you're feeling overwhelmed by IRS penalties, it's important to learn how to get the IRS to remove penalties and interest, knowing that you're not alone. Requesting how to get the IRS to remove penalties and interest can seem daunting, but with the right steps, you can confidently navigate this process. Here’s how to get started:

-

Choose Your Method: You can request abatement either by phone or in writing. For straightforward cases, a quick phone call might do the trick. However, if your situation is more complex, a written appeal is often the best way to ensure clarity and thoroughness.

-

Prepare Form 843: If you opt for a written appeal, make sure to complete IRS Form 843, Claim for Refund and Request for Abatement. It’s crucial to fill out all sections accurately, as incomplete forms can lead to delays or even denials.

-

Include Supporting Documentation: Don’t forget to attach any relevant documents that support your case. This could include medical records, proof of natural disasters, or other evidence that illustrates your circumstances. Having this documentation is vital for strengthening your appeal.

-

Submit Your Request: Once you’ve completed Form 843 and gathered your supporting documents, send them to the address specified in the IRS notice you received. If you decide to call, have your tax information ready for verification to make the process smoother.

-

Keep Records: It’s important to document the date of your inquiry and any confirmation numbers provided by the IRS. This will help you track your submission and ensure it’s processed in a timely manner.

Typically, the average processing time for IRS Form 843 applications is about 2-3 months for straightforward cases. However, this can vary based on the complexity of your situation. Tax experts recommend acting quickly and keeping thorough records to boost your chances of a successful abatement. As Jim Buttonow, Senior Vice President for Post-Filing Tax Services at Jackson Hewitt, notes, "Initial fine reduction submissions typically take 2-3 months for a decision."

Additionally, the IRS offers relief under various programs, such as the First-Time Penalty Abatement (FTA) program for taxpayers with a good compliance history, or administrative waivers for those facing circumstances beyond their control. Understanding how to get the IRS to remove penalties and interest can significantly influence your eligibility for these programs. Remember, we're here to help you through this process.

Appeal a Denial to the IRS Independent Office of Appeals

If your appeal for a fee reduction is denied, know that you have the right to contest that decision. We understand how overwhelming this process can feel, but here’s how to navigate the appeals process effectively:

-

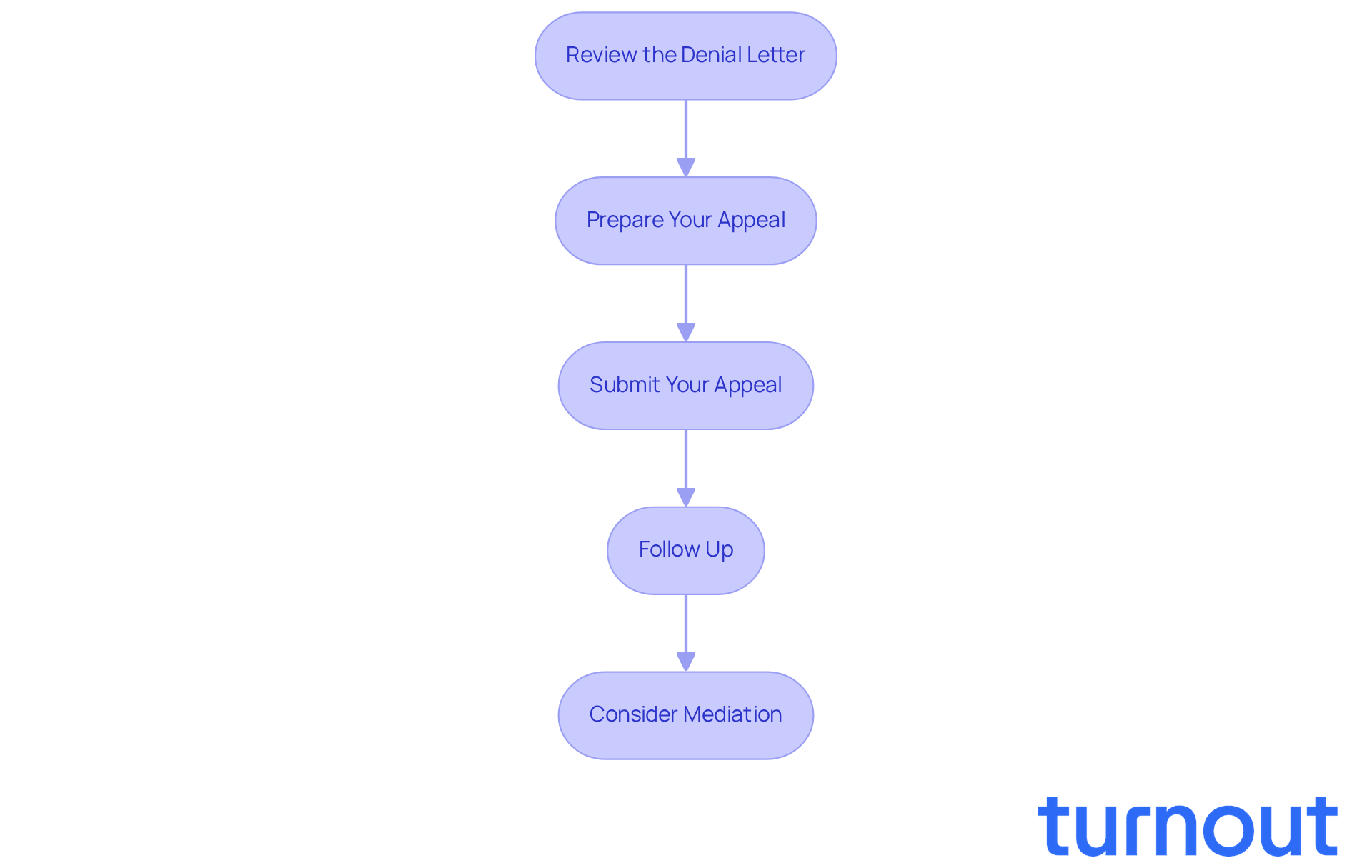

Review the Denial Letter: Take a moment to carefully examine the letter from the IRS. Understanding the reasons for the denial is crucial. This insight will help you address specific concerns in your appeal.

-

Prepare Your Appeal: Draft a formal appeal letter that includes:

- Your contact information.

- A clear statement indicating that you are appealing the denial.

- A detailed explanation of why you believe the denial was incorrect, referencing any supporting documentation.

-

Submit Your Appeal: Send your appeal to the address specified in the denial letter. Make sure to submit it within the required timeframe, typically 30 days from the date of the denial. Remember, timely action is important.

-

Follow Up: After submitting your appeal, keep an eye on the status of your request. Be prepared to provide additional information if the IRS asks for it. The average wait time for a response can range from 2 to 3.5 months, so patience is key during this period.

-

Consider Mediation: If your appeal is denied again, explore mediation options through the IRS Independent Office of Appeals. This can offer a less formal resolution process, which may be beneficial in reaching a satisfactory outcome. As Erin Collins, National Taxpayer Advocate, notes, utilizing this office can significantly improve your chances of a favorable resolution, as it aims to resolve disputes fairly and impartially. Additionally, starting April 15, 2026, the IRS will automatically provide penalty relief to about 1 million taxpayers who file their returns late, which may also be relevant to your situation.

Remember, you are not alone in this journey. We're here to help you through it.

Conclusion

Navigating the complexities of IRS penalties and interest can feel overwhelming. We understand that many taxpayers are searching for relief, and it’s essential to know that there are options available. This article highlights the pathways to seek the removal of penalties and interest through established processes, like the First-Time Penalty Abatement and reasonable cause claims. By following the outlined steps, you can advocate for yourself and potentially ease your financial burdens.

Throughout this article, we’ve shared key insights, including the types of penalties imposed by the IRS and the importance of maintaining documentation. Timely filing and payment are crucial, and we’ve detailed the processes for qualifying for First-Time Penalty Abatement and building a compelling case for reasonable cause. Remember, persistence can lead to favorable outcomes, especially when appealing a denial.

Ultimately, this information is more than just about compliance; it empowers you to take control of your financial responsibilities. Whether you’re making direct requests for abatement or appealing to the IRS Independent Office of Appeals, understanding these processes can bring you relief and peace of mind. Taking action now can pave the way for a more manageable tax experience, allowing you to focus on your financial well-being rather than being weighed down by penalties and interest. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are the common reasons for IRS penalties?

The IRS imposes penalties for reasons such as not filing your tax return on time, failing to pay taxes owed, or underpaying estimated taxes.

What is the Failure to File Penalty?

The Failure to File Penalty is typically 5% of the unpaid tax for each month your return is late, up to a maximum of 25%.

What is the Failure to Pay Penalty?

The Failure to Pay Penalty is generally 0.5% of the unpaid tax for each month, also capping at 25%.

What is the Underpayment Penalty?

The Underpayment Penalty applies when you haven’t paid enough tax throughout the year.

How does interest on unpaid taxes work?

Interest on unpaid taxes compounds daily, meaning the longer you wait to pay, the more you’ll owe.

Why is documentation important when dealing with IRS penalties?

Keeping records of all communications with the IRS and any notices regarding fines is crucial as it will be invaluable when seeking to remove penalties and interest.

What is the First-Time Abatement (FTA)?

The First-Time Abatement (FTA) is an opportunity for taxpayers with a solid compliance history to request the IRS to remove penalties and interest.

What are the eligibility criteria for First-Time Abatement?

To qualify for FTA, you need a clean compliance history (no penalties in the past three years), timely filing of all required tax returns, and either paid or arranged to pay any taxes owed.

How do I apply for First-Time Abatement?

To obtain FTA, you can reach out to the IRS using the number on your notice or submit a written appeal, providing your tax identification number and details about your compliance history.

What should I do if my First-Time Abatement application is denied?

If your FTA application is denied, you can appeal the decision within 30 days of rejection.