Introduction

Navigating the complexities of federal tax obligations can feel overwhelming, especially when financial constraints make it hard to pay in full. We understand that this can be a source of stress. Fortunately, a CRA payment plan offers a structured way to manage these responsibilities over time, providing relief from the pressure of immediate payments.

However, many individuals are unsure about how to establish such a plan effectively. What are the essential steps to create a payment plan that not only meets eligibility criteria but also aligns with your financial capabilities? You're not alone in this journey, and we're here to help you find the answers.

Understand the Purpose of a CRA Payment Plan

A CRA arrangement is a type of payment plan for federal taxes that allows you to settle your tax liabilities gradually, rather than all at once. We understand that financial constraints can make it difficult to establish a payment plan for federal taxes to pay your obligations in full. This arrangement, which includes a payment plan for federal taxes, is especially beneficial for individuals facing such challenges. By establishing a payment plan for federal taxes, you can avoid urgent collection measures like wage garnishments or bank levies, allowing you to manage your tax responsibilities in a more organized way.

It's common to feel overwhelmed by tax obligations, but understanding this option can provide encouragement. A CRA arrangement offers a feasible choice for setting up a payment plan for federal taxes. You are not alone in this journey; many have found relief through this approach. We’re here to help you navigate these challenges and find a solution that works for you.

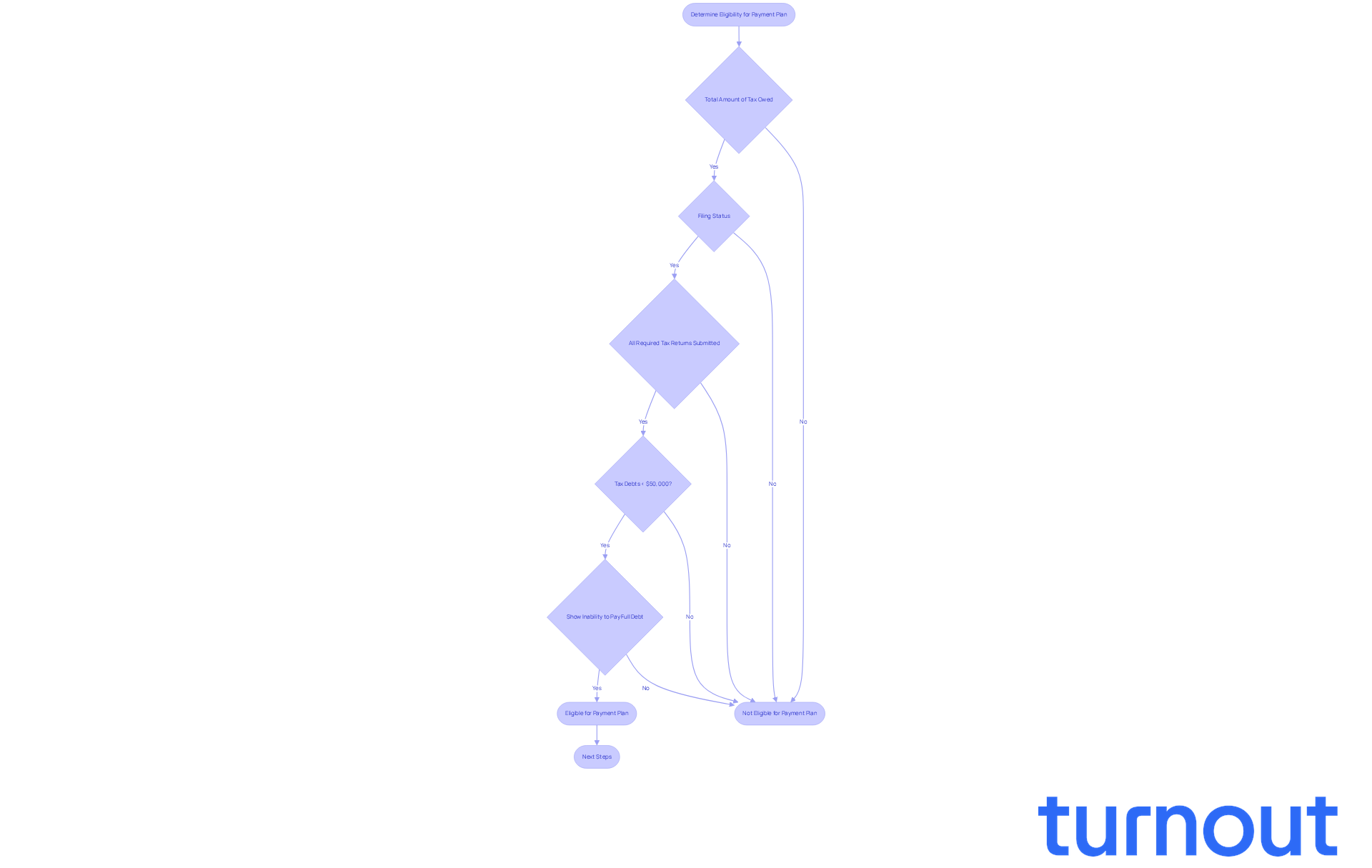

Determine Your Eligibility for a Payment Plan

Establishing your eligibility for a CRA funding arrangement can feel overwhelming, but we're here to help. Several key factors need to be evaluated. First, consider the following:

- The total amount of tax owed

- Your filing status

- Whether all required tax returns have been submitted

If your tax debts, including penalties and interest, are less than $50,000, you may qualify for a payment plan for federal taxes. It's important to show that you can't pay the full tax debt upfront. If you meet these requirements, you can take the next step in establishing your payment plan for federal taxes.

We understand that navigating your financial situation can be challenging. Tax professionals emphasize that understanding your circumstances is crucial. As one expert wisely noted, "Being proactive about your tax obligations can significantly ease the burden of repayment." With around 1.5 million taxpayers eligible for CRA financial plans based on tax owed, many find relief through these structured options. You're not alone in this journey; support is available.

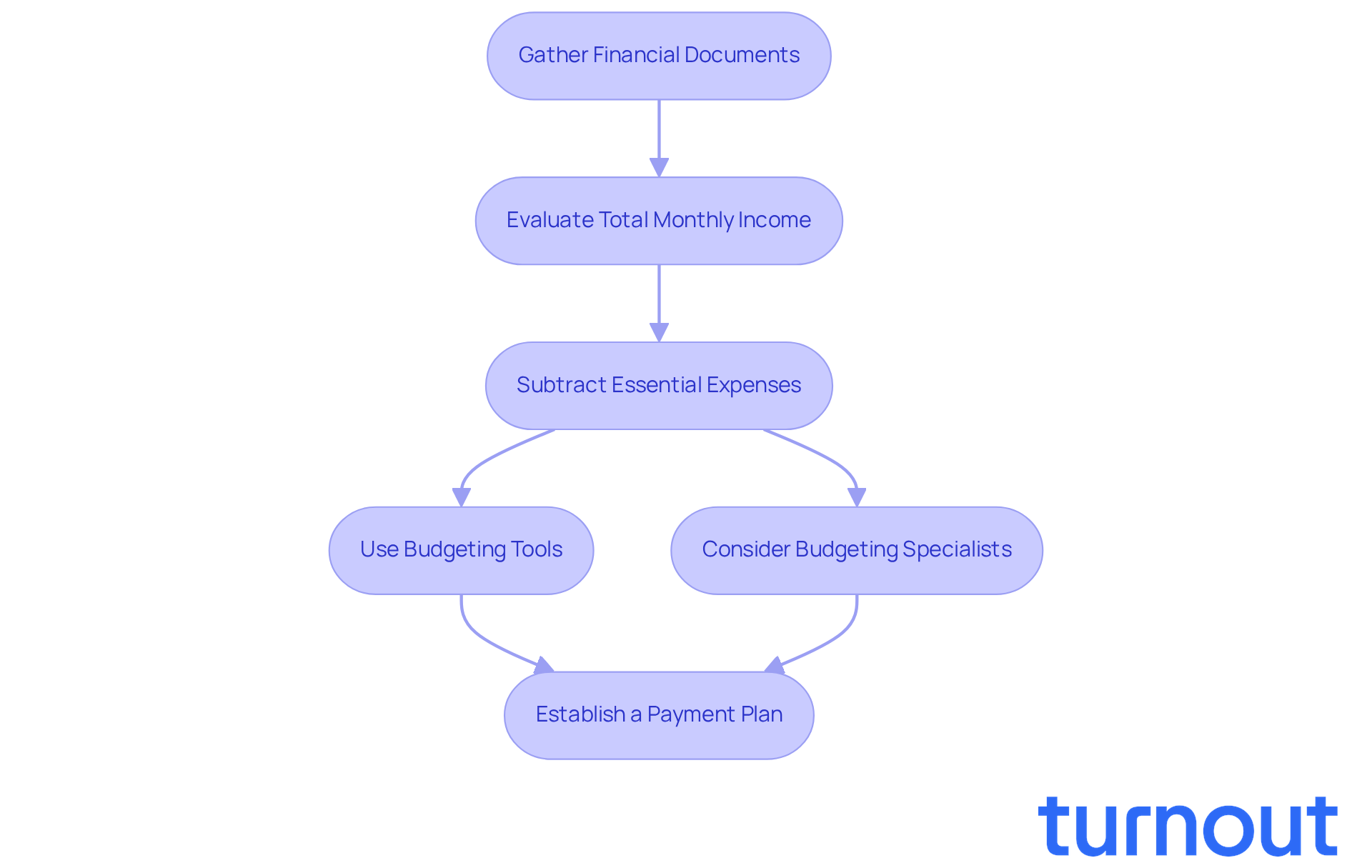

Assess Your Financial Situation

Gathering your financial documents can feel overwhelming, but it’s a crucial first step. Start by collecting your income statements, bank statements, and records of monthly expenses. This foundational work helps you understand your financial landscape better.

Next, let’s take a look at your total monthly income. Subtract your essential expenses - like housing, food, and transportation - to see how much you can realistically set aside for taxes. This evaluation is key; it allows you to suggest a sum that’s manageable and acceptable to the IRS.

Using budgeting tools or apps, such as EveryDollar, can make tracking your finances easier. These tools provide a clear overview of your financial situation, helping you stay organized. Additionally, consider reaching out to budgeting specialists. They can offer tailored advice on managing your finances while addressing tax debt.

We understand that ignoring tax bills can lead to serious consequences, including wage garnishments and bank levies. It’s important to take action. By applying these strategies, you can establish a payment plan for federal taxes that aligns with your monetary capabilities. Remember, you are not alone in this journey; we’re here to help.

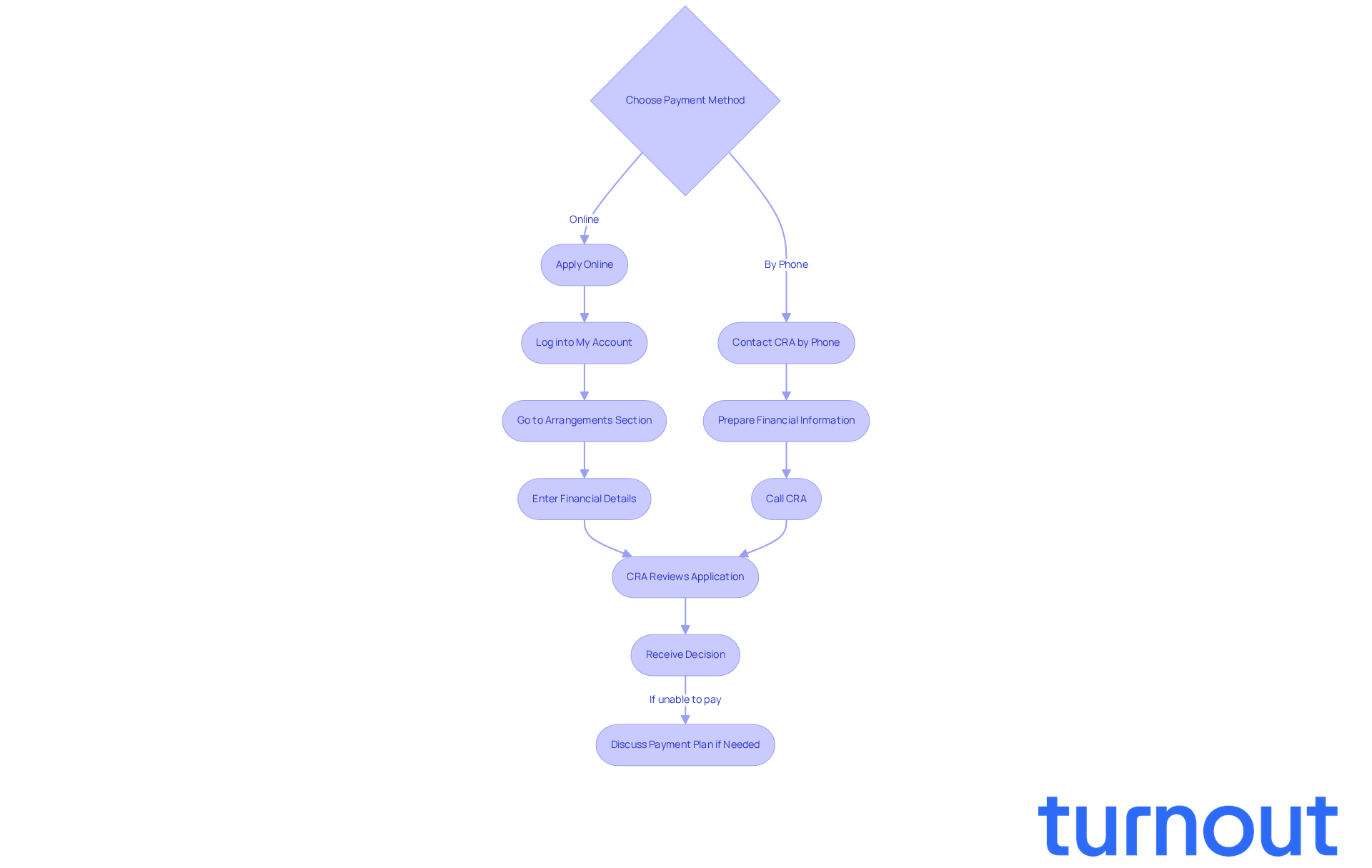

Set Up Your CRA Payment Plan

Setting up your CRA financial plan can feel overwhelming, but you have two main choices to make it easier:

- You can apply online through the CRA's My Account portal.

- You can reach out to the CRA directly by phone.

If you choose the online option, simply log into your account and head to the arrangements section. Here, you’ll enter your financial details, including how much you can contribute each month.

It’s worth noting that applications submitted online often have a higher success rate than those made by phone. This is because the online system is designed for efficiency and accuracy, which can help ease your worries. However, if you prefer to speak with someone, that’s perfectly fine too! Just be ready to discuss your financial situation and what you can manage.

Once you submit your application, the CRA will review your information and let you know their decision. Remember, if you find yourself unable to pay your taxes, it’s crucial to contact the CRA to discuss a payment plan for federal taxes as soon as possible. They may be able to help you set up a payment plan for federal taxes or offer relief options.

Participating in a CRA debt relief program might affect your credit score, but generally, owing money to the Canada Revenue Agency doesn’t show up on your credit report. If you need assistance, don’t hesitate to reach out to the CRA at their dedicated contact number for individual accounts. We’re here to help you navigate this process-you’re not alone in this journey.

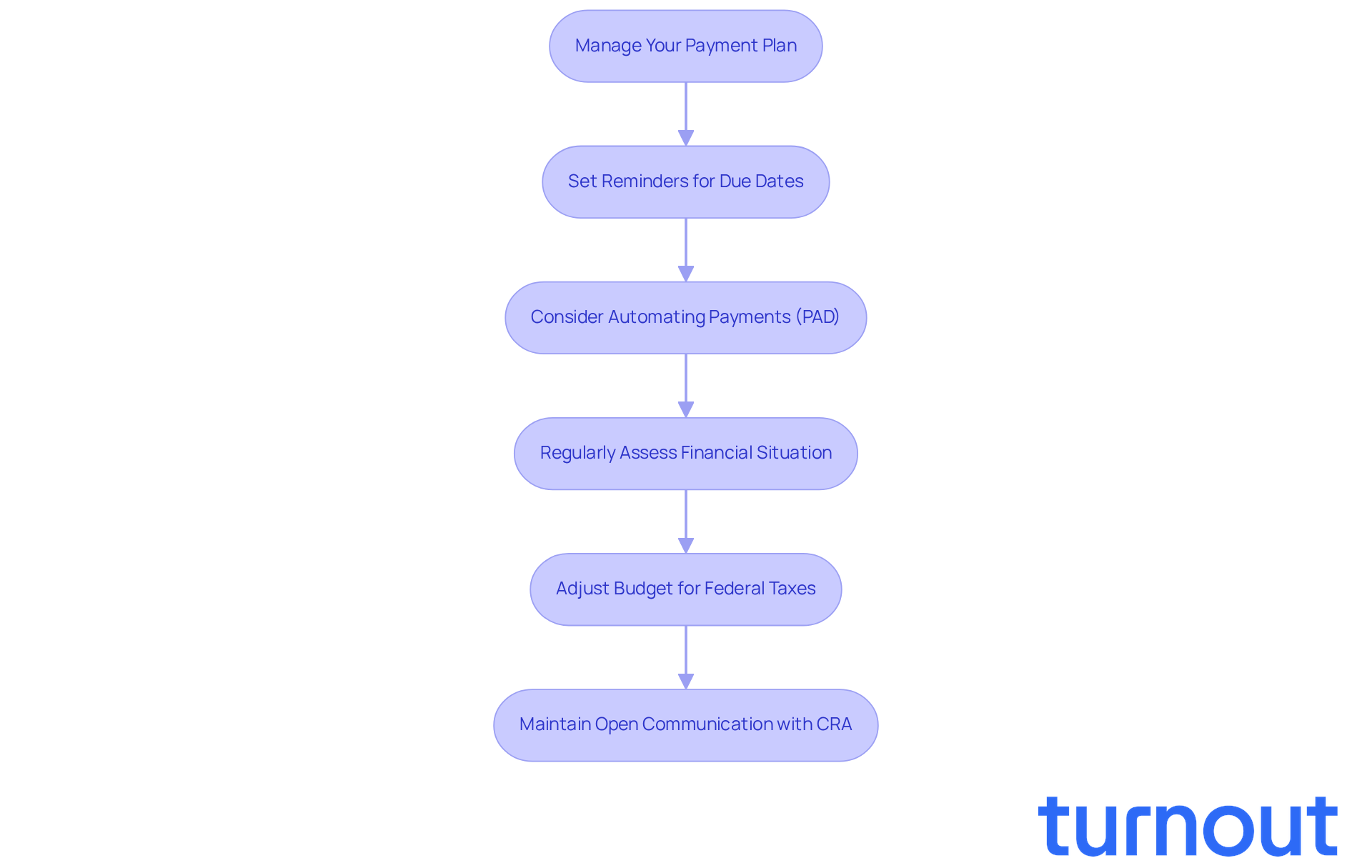

Manage Your Payment Plan Effectively

Once your financial plan is in place, we understand that managing it effectively can feel overwhelming. Setting reminders for due dates is a great first step. Have you considered automating your payments through pre-authorized debit (PAD)? This simple action can help ensure you never miss a transaction.

It's common to feel uncertain about your financial condition. Regularly assessing your situation and adjusting your budget to create a payment plan for federal taxes is crucial. Remember, you're not alone in this journey. If you encounter any challenges with processing transactions, don’t hesitate to reach out to the CRA. They’re there to discuss your options and help you navigate any difficulties.

Maintaining open communication can prevent penalties and help keep your payment plan for federal taxes on track. We're here to help you every step of the way.

Conclusion

Establishing a payment plan for federal taxes through the CRA can be a lifeline for many. We understand that managing tax obligations can feel overwhelming. By recognizing the purpose and benefits of a CRA payment plan, you can ease the stress of tax debts and steer clear of severe collection actions. This structured approach paves the way toward financial stability.

In this article, we’ve outlined key steps to help you create your payment plan effectively:

- Start by assessing your eligibility based on the tax owed and your filing status.

- Next, take a close look at your personal finances and set up your payment plan.

Each of these stages is vital for ensuring a successful arrangement. Remember, managing your plan with reminders and open communication with the CRA can help you avoid potential pitfalls and keep everything on track.

Ultimately, taking proactive steps to establish and manage a CRA payment plan not only addresses your tax liabilities but also empowers you to regain control over your financial situation. Engaging with this structured approach can lead to peace of mind and a clearer financial future. You are not alone in this journey; seeking assistance and acting decisively when facing tax challenges is crucial. We're here to help you every step of the way.

Frequently Asked Questions

What is a CRA payment plan?

A CRA payment plan is a type of arrangement that allows individuals to settle their federal tax liabilities gradually, rather than paying the full amount all at once. This option is particularly beneficial for those facing financial constraints.

How does a CRA payment plan help taxpayers?

By establishing a CRA payment plan, taxpayers can avoid urgent collection measures such as wage garnishments or bank levies, allowing them to manage their tax responsibilities in a more organized manner.

What factors determine eligibility for a CRA payment plan?

Eligibility for a CRA payment plan is determined by several factors, including the total amount of tax owed, your filing status, and whether all required tax returns have been submitted.

What is the maximum amount of tax debt to qualify for a CRA payment plan?

To qualify for a CRA payment plan, your total tax debts, including penalties and interest, must be less than $50,000.

What should I demonstrate to qualify for a CRA payment plan?

You need to show that you cannot pay the full tax debt upfront to qualify for a CRA payment plan.

How many taxpayers are estimated to be eligible for CRA payment plans?

Approximately 1.5 million taxpayers are eligible for CRA payment plans based on the amount of tax owed.