Introduction

Navigating the complexities of tax obligations can be particularly challenging for low-income individuals. We understand that securing the financial relief you need is often overwhelming. Form 13844 serves as a crucial tool in this process, offering a pathway to reduced user fees for installment agreements with the IRS. This can significantly ease the burden of tax debts.

However, the intricacies of completing this form can lead to confusion and mistakes. It’s common to feel uncertain about how to ensure your application is successful and free from common pitfalls. This guide will illuminate the essential steps to effectively complete Form 13844, empowering you to take control of your financial future. Remember, you are not alone in this journey; we're here to help.

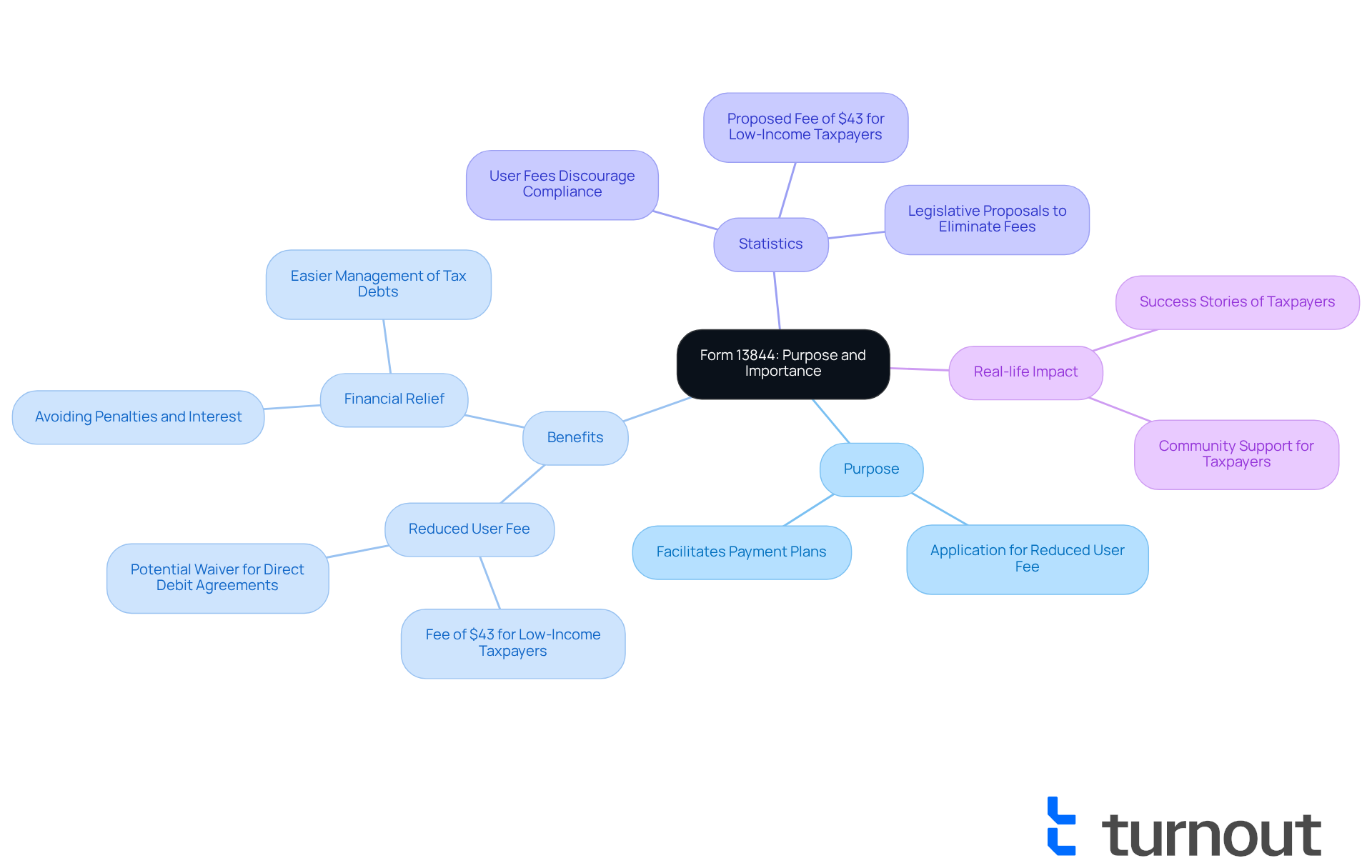

Understand Form 13844: Purpose and Importance

Form 13844, which is the Application for Reduced User Fee for Installment Agreements, is a vital resource for low-income taxpayers looking to set up a payment plan with the IRS. By filling out form 13844, you can apply for a reduced user fee of just $43, which may even be waived or reimbursed under certain conditions. This form 13844 is essential because it helps you manage your tax debts more affordably, allowing you to meet your obligations without facing overwhelming financial strain.

We understand that dealing with tax issues can be daunting, especially when you're feeling overwhelmed. Form 13844 provides a structured way to seek relief, making the tax system more accessible. For example, if you’re a low-income taxpayer who commits to a direct debit installment agreement, you could have your user fee waived entirely. This can significantly lighten your financial load.

Statistics show that user fees can discourage low-income individuals from entering installment agreements, which are crucial for effectively managing tax liabilities. Recent legislative discussions have proposed eliminating these fees to promote compliance and ease the financial burden on vulnerable taxpayers.

At Turnout, we’re dedicated to simplifying this process for disabled individuals seeking benefits. Real-life stories illustrate the positive impact of form 13844; many have successfully used form 13844 to negotiate manageable payment plans, helping them avoid penalties and interest. By making reduced fees accessible, form 13844 empowers you to take control of your financial situation, ensuring you can navigate the complexities of tax obligations with greater confidence.

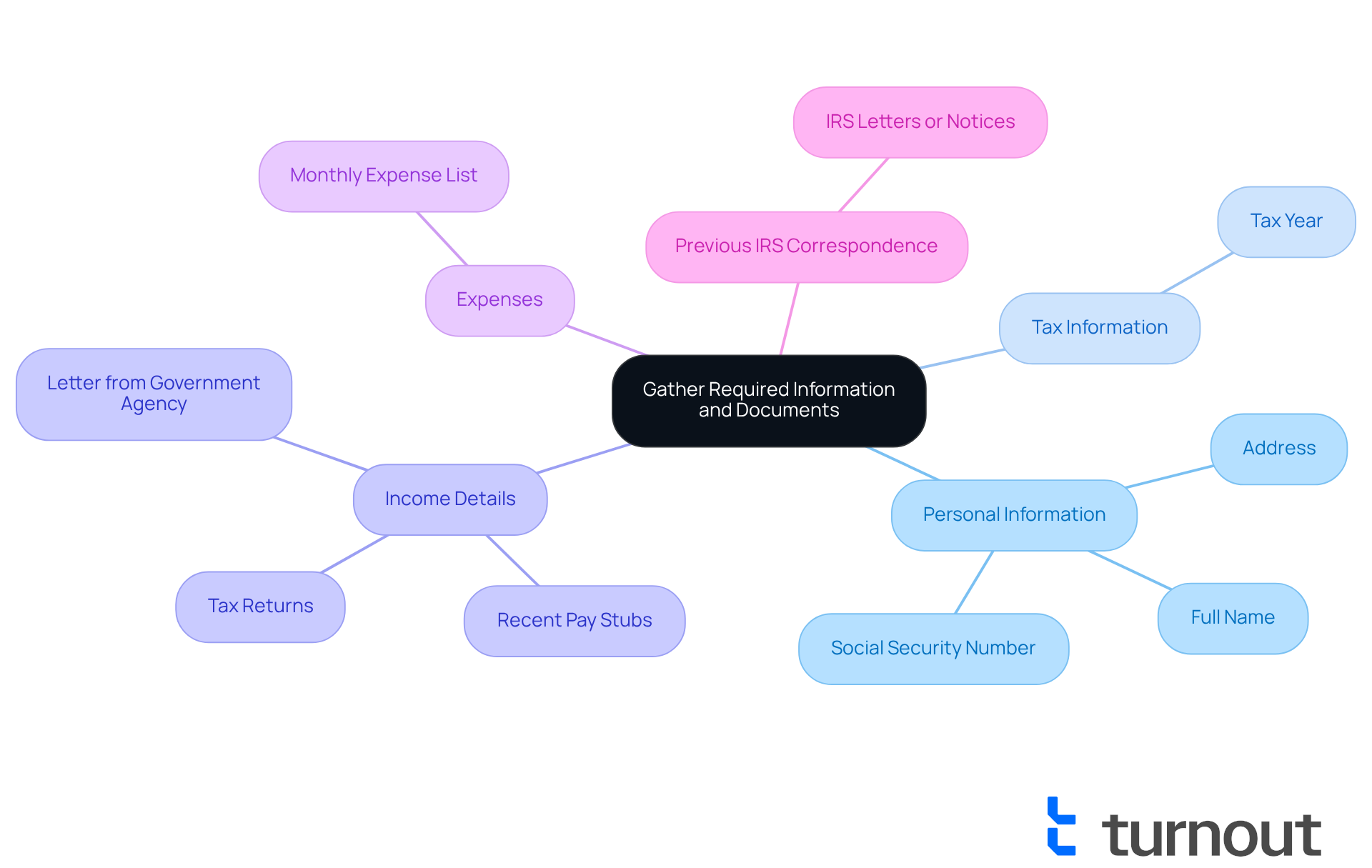

Gather Required Information and Documents

Before you complete Form 13844, it’s important to gather some key information and documents. We understand that this process can feel overwhelming, but having everything ready can make a big difference.

- Personal Information: Your full name, address, and Social Security number.

- Tax Information: The tax year for which you’re applying for the installment agreement.

- Income Details: Documentation proving your low-income status, like recent pay stubs, tax returns, or a letter from a government agency.

- Expenses: A list of your monthly expenses to show your financial situation.

- Previous IRS Correspondence: Any letters or notices from the IRS about your tax debt.

Gathering these documents will simplify the process and help ensure your submission is complete and accurate. Financial advisors often stress that thorough documentation is crucial for successful tax submissions, as it can prevent delays and complications.

On average, collecting the necessary documents might take several hours, depending on your financial situation and how well you keep records. It’s also good to know that payments made with debit cards come with a processing fee of about $2, while credit card payments can incur fees close to 2% of the total payment. If you qualify as a low-income applicant, you might be able to waive setup fees for Direct Debit Installment Agreements.

By staying organized and proactive, you can improve your chances of a positive outcome with your form 13844 application. Remember, you’re not alone in this journey, and we’re here to help.

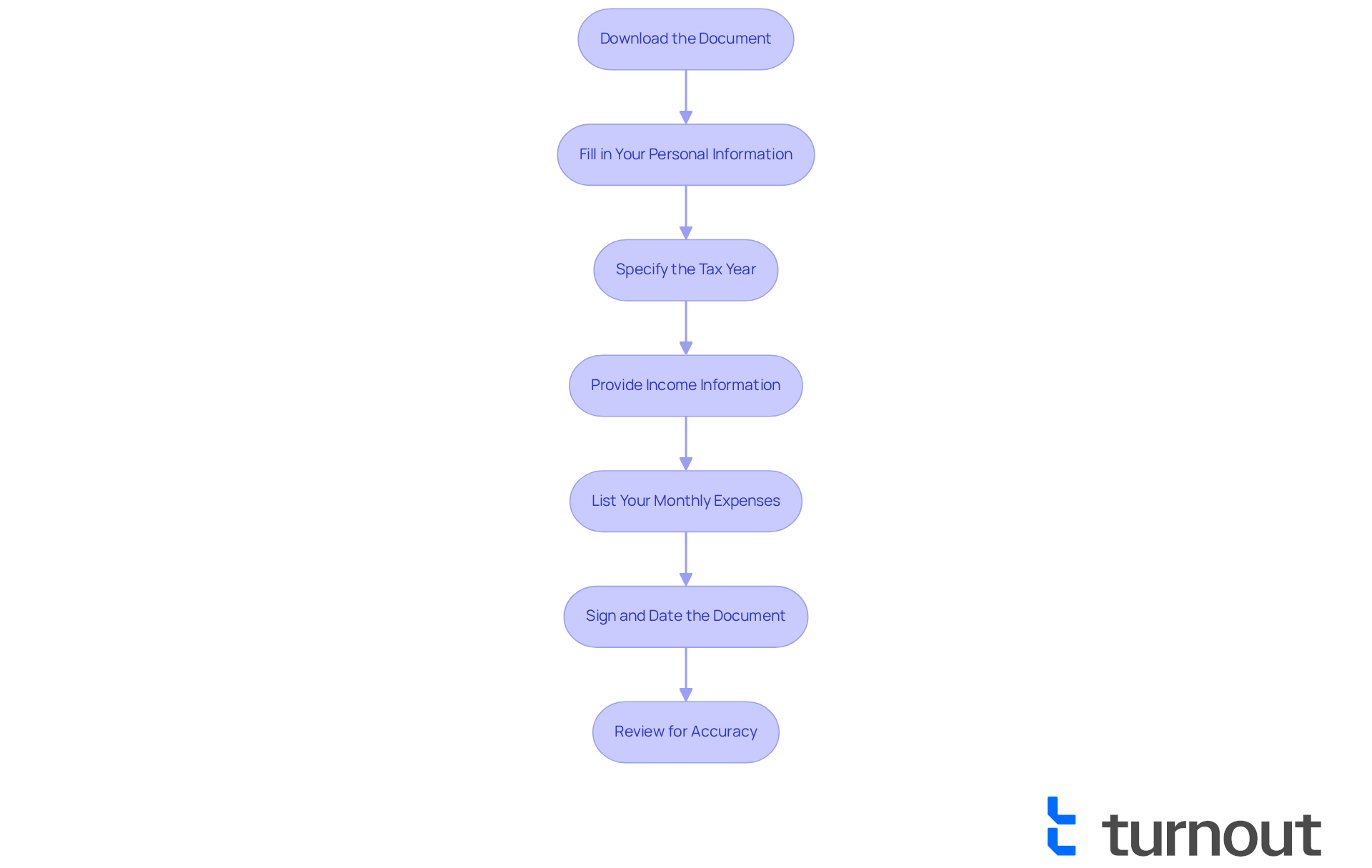

Complete Form 13844: Step-by-Step Instructions

To successfully complete IRS Form 13844, follow these detailed steps:

- Download the Document: Obtain the form 13844 from the IRS website or through the provided PDF link.

- Fill in Your Personal Information: Accurately enter your name, address, and Social Security number in the specified fields.

- Specify the Tax Year: Clearly indicate the tax year for which you are requesting the installment agreement.

- Provide Income Information: Complete the section detailing your income, including any government assistance or disability benefits you receive.

- List Your Monthly Expenses: Document your essential monthly expenses to substantiate your request for a reduced fee.

- Sign and Date the Document: Ensure that you sign and date the document at the bottom before submission.

- Review for Accuracy: Thoroughly double-check all entries for accuracy and completeness to prevent processing delays.

We understand that filling out tax forms can be daunting. Once you have completed these steps, you are prepared to submit the form. Common errors in tax form submissions can lead to significant delays. In fact, statistics show that nearly 30% of taxpayers make mistakes on their forms, often due to incomplete information or incorrect calculations. By following these instructions carefully, you can avoid such pitfalls and enhance your chances of a successful submission.

Additionally, if you're a low-income taxpayer, you may qualify for a reduced setup fee of $43 or even have the fee waived entirely if you commit to a Direct Debit Installment Agreement (DDIA). Remember, it’s important to submit form 13844 within 30 days of receiving the IRS installment agreement acceptance letter to ensure your request is processed on time. If you require help, please consider reaching out to Community Tax for support with your request. You're not alone in this journey, and we're here to help.

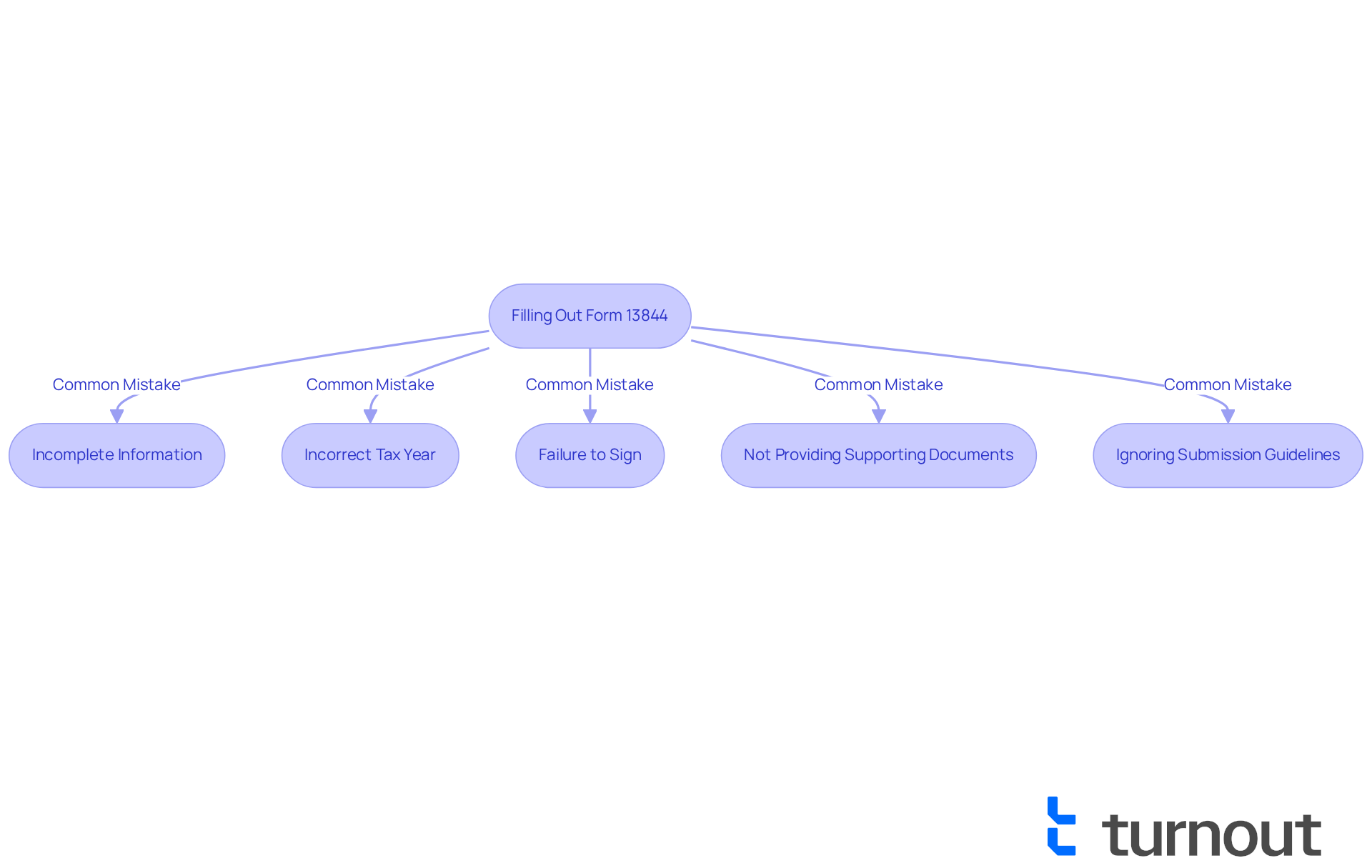

Avoid Common Mistakes When Filling Out the Form

We understand that completing Form 13844 can be a bit overwhelming. To help you navigate this process smoothly, let’s look at some common pitfalls to avoid:

-

Incomplete Information: It’s essential to fill out all required fields completely. Missing information can significantly delay processing times. For instance, a taxpayer who left out their Social Security number faced a two-month delay in their submission. We want to help you avoid that.

-

Incorrect Tax Year: Make sure you’re applying for the correct tax year related to your installment agreement. Applying for the previous year is a common mistake that can lead to rejection. Double-checking this detail can save you time and frustration.

-

Failure to Sign: Don’t forget to sign and date the form! An unsigned submission will be considered invalid and won’t be processed. As one tax consultant wisely noted, "An unsigned form is one of the most frequent reasons for delays." We want your form 13844 application to go through without a hitch.

-

Not Providing Supporting Documents: Be sure to include all necessary documentation to verify your low-income status. Omitting these documents can result in the denial of your request. For example, a taxpayer who failed to provide proof of income was denied benefits. We’re here to help you ensure everything is in order.

-

Ignoring Submission Guidelines: Adhere strictly to IRS submission guidelines, including sending the form to the correct address. This ensures it reaches the right department. Disregarding these guidelines can lead to your submission being lost or delayed, and we know how frustrating that can be.

By steering clear of these errors, you can significantly improve your chances of a successful application for disability benefits when using form 13844. Remember, maintaining open communication with the IRS is also essential. Responding promptly to any inquiries can help avoid complications. You are not alone in this journey; we’re here to help you every step of the way.

Submit Form 13844 and Follow Up

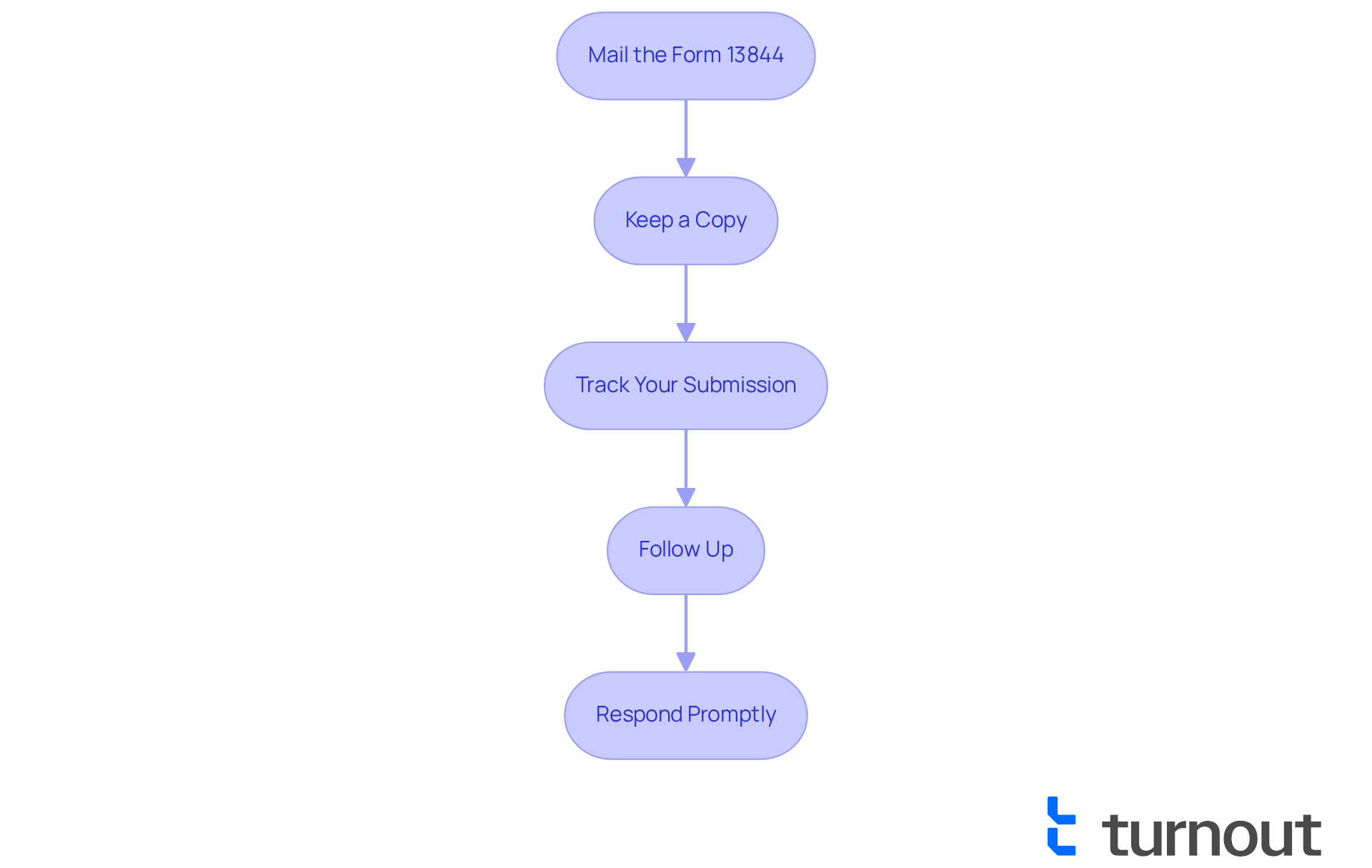

After completing Form 13844, it’s important to follow these essential steps to ensure your submission is handled effectively:

- Mail the Form 13844: Send your completed form to the address specified in the instructions. Remember to use the correct postage to avoid any delays.

- Keep a copy of the completed form 13844 along with any supporting documents for your records. This is crucial for your reference and future correspondence.

- Track Your Submission: We understand that waiting can be stressful. Utilize a mailing method that offers tracking capabilities. This way, you can verify that the IRS has received your submission, giving you peace of mind during the waiting period.

- Follow Up: It’s common to feel anxious about the response time. Anticipate a reply from the IRS, which typically takes a few weeks. If you don’t hear back within this timeframe, it’s advisable to contact the IRS to inquire about the status of your request. Statistics show that proactive follow-up can significantly improve response times and outcomes for taxpayers. For instance, a study indicated that taxpayers who followed up within two weeks of submission received responses 30% faster than those who did not.

- Respond Promptly: Should the IRS request additional information or documentation, respond as quickly as possible. Timely responses are critical to avoiding delays in processing your request. As tax experts remind us, "Prompt correspondence with the IRS can have a considerable impact on the result of your request."

By diligently following these steps, you can enhance the likelihood of a smooth submission process and stay informed every step of the way. Remember, you are not alone in this journey; tracking your submissions is vital. It not only helps in managing your application but also empowers you to take necessary actions promptly.

Conclusion

Form 13844 is a vital resource for low-income taxpayers who are looking to create manageable payment plans with the IRS, especially for those navigating the complexities of disability benefits. We understand that this process can feel overwhelming, but by grasping its purpose and the steps involved in completing it, you can significantly lighten your financial load and gain the confidence to address your tax obligations.

In this guide, we’ve shared essential insights on:

- Gathering the necessary documents

- Carefully filling out the form

- Steering clear of common pitfalls

- Following up on your submissions

Each step not only simplifies the process but also underscores the importance of accuracy and thoroughness in your application, ensuring a smoother experience with the IRS.

Taking the time to understand and correctly complete Form 13844 can truly empower you to take charge of your financial situation. It’s important to stay proactive and informed throughout this journey. Remember, every step you take toward completing this form is a step toward effectively managing your tax obligations.

If you ever feel overwhelmed, know that support is available. You are not alone in this journey, and we’re here to help. Embrace this opportunity to secure a greater sense of financial stability.

Frequently Asked Questions

What is Form 13844 and why is it important?

Form 13844, the Application for Reduced User Fee for Installment Agreements, is a vital resource for low-income taxpayers seeking to set up a payment plan with the IRS. It allows applicants to apply for a reduced user fee of $43, which may be waived or reimbursed under certain conditions, making tax debt management more affordable.

How can Form 13844 help low-income taxpayers?

Form 13844 helps low-income taxpayers manage their tax debts more affordably by providing a structured way to apply for reduced fees, thus allowing them to meet their obligations without significant financial strain.

What are the potential benefits of committing to a direct debit installment agreement when using Form 13844?

If a low-income taxpayer commits to a direct debit installment agreement, they may qualify to have their user fee waived entirely, significantly reducing their financial burden.

What information and documents are required to complete Form 13844?

To complete Form 13844, you need to gather the following: - Personal Information: Full name, address, and Social Security number. - Tax Information: The tax year for which you're applying for the installment agreement. - Income Details: Documentation proving low-income status (e.g., recent pay stubs, tax returns). - Expenses: A list of monthly expenses to illustrate your financial situation. - Previous IRS Correspondence: Any letters or notices from the IRS regarding your tax debt.

How long might it take to gather the necessary documents for Form 13844?

Collecting the necessary documents may take several hours, depending on your financial situation and how well you keep records.

Are there any fees associated with making payments when using Form 13844?

Yes, payments made with debit cards incur a processing fee of about $2, while credit card payments can have fees close to 2% of the total payment. However, low-income applicants may be able to waive setup fees for Direct Debit Installment Agreements.

What impact do user fees have on low-income individuals seeking installment agreements?

User fees can discourage low-income individuals from entering installment agreements, which are essential for effectively managing tax liabilities. Recent discussions have proposed eliminating these fees to ease the financial burden on vulnerable taxpayers.