Introduction

Navigating the complexities of state tax refunds can often feel overwhelming. We understand that many taxpayers face this daunting task. Knowing how to check the status of a Missouri state income tax refund is essential for your financial peace of mind. This guide offers clear, actionable steps to simplify the tracking of refunds, ensuring you can easily access your reimbursement status with confidence.

But what happens when the expected refund doesn’t arrive on time? It’s common to feel anxious in such situations. Exploring common challenges and solutions can empower you to take control of your refund journey. Remember, you are not alone in this process, and we’re here to help.

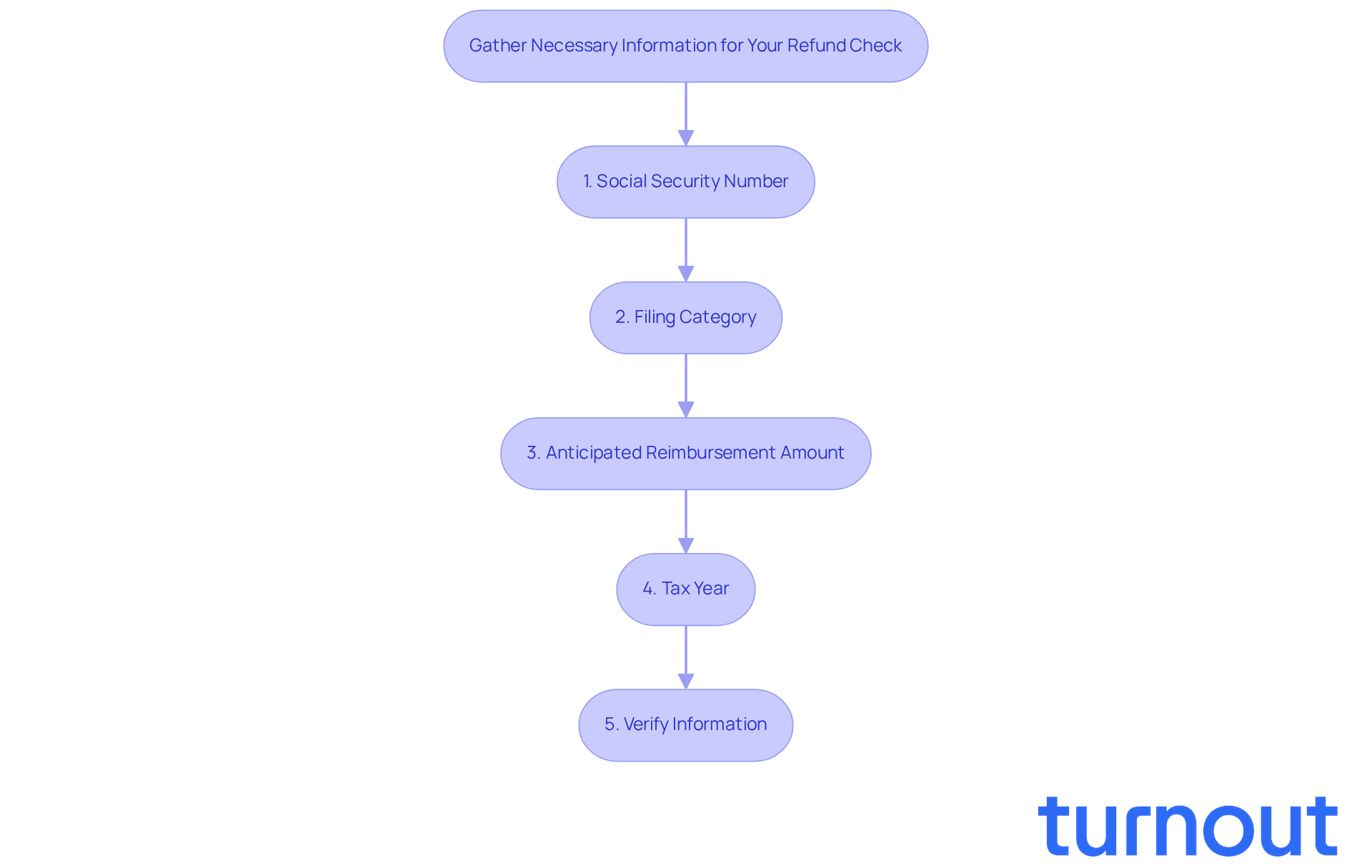

Gather Necessary Information for Your Refund Check

Before you check your Missouri state income tax refund, let’s gather a few important details from your tax return. We understand that this process can feel overwhelming, but having the right information will make it easier for you.

- Social Security Number: Start with the first Social Security number listed on your tax return.

- Filing Category: Identify your filing category, whether it’s single, married filing jointly, or another option.

- Anticipated Reimbursement Amount: Enter the whole dollar amount you expect to receive as a reimbursement.

- Tax Year: Specify the tax year for which you’re checking the reimbursement status.

By preparing this information, you’ll simplify the process and help avoid any potential issues when accessing the Missouri state income tax refund tracker. It’s common to feel anxious about this, especially since reimbursements for returns submitted in January can be processed within a week, while those submitted in April might take longer due to processing delays.

Many taxpayers face challenges with state tax returns, often due to errors in the information submitted. That’s why it’s crucial to ensure your details are correct for a timely resolution. Remember, you’re not alone in this journey. To verify your reimbursement situation, visit the Department of Revenue's Return/Refund Tracker page and click on the Return Inquiry link. We’re here to help you every step of the way.

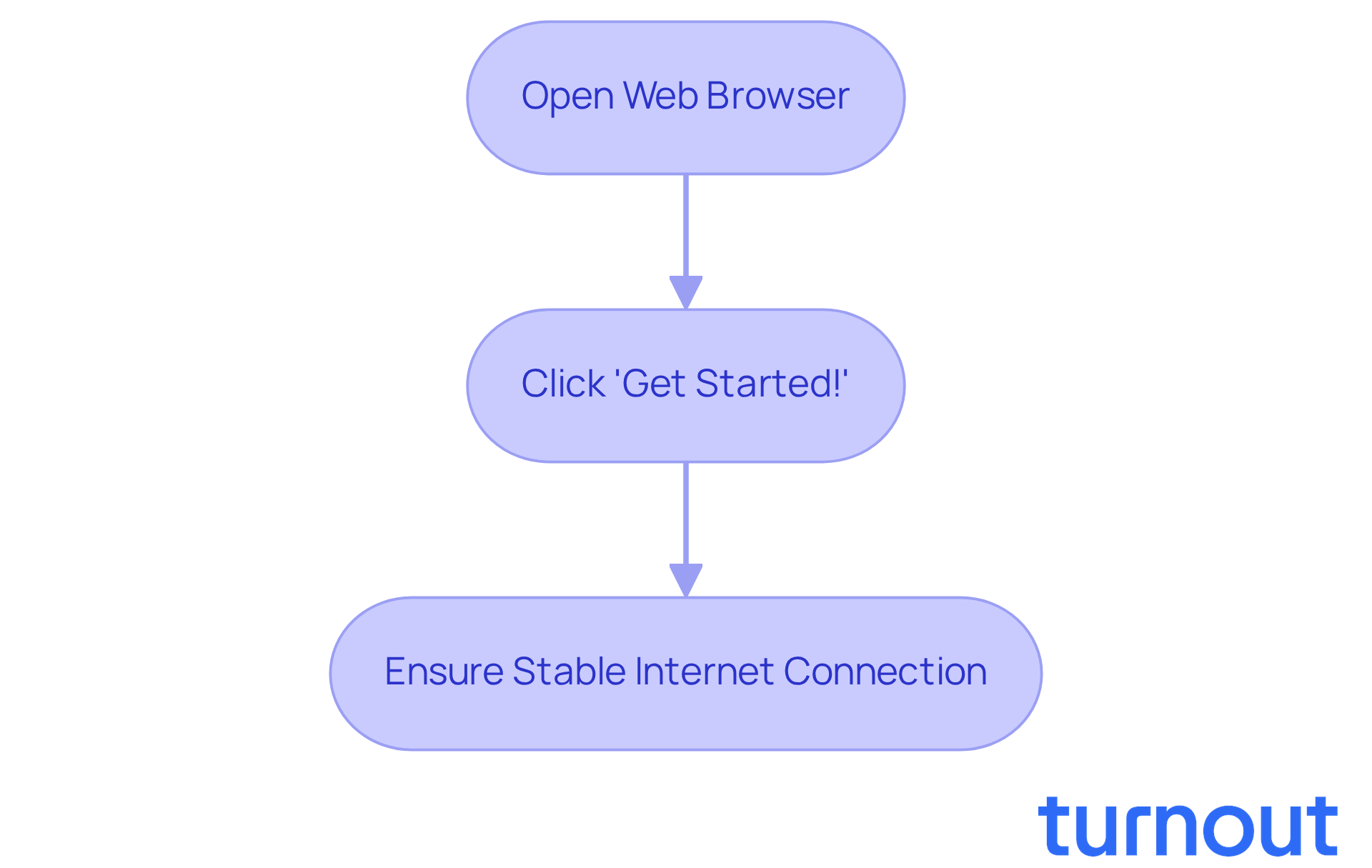

Access the Missouri State Tax Refund Tracker Online

If you're looking to check on your Missouri state income tax refund, we understand how important it is to stay informed. You can easily access the State Return Tracker online, and we’re here to guide you through the process:

- Open your web browser and visit the Department of Revenue's reimbursement tracker page: Return Tracker.

- Click the 'Get Started!' button to begin tracking your reimbursement.

- Make sure you have a stable internet connection to avoid any interruptions while using the site.

Many taxpayers have shared their positive experiences with the Return Tracker, finding it to be a straightforward tool for monitoring their Missouri state income tax refund. It's common to feel a bit anxious about the process, but rest assured, a growing number of people are turning to online resources to verify their reimbursement progress. This shift towards digital solutions in tax administration is a reassuring trend.

Experts have noted that state tax refund tracking systems have become more efficient, allowing users to access their information quickly and securely. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

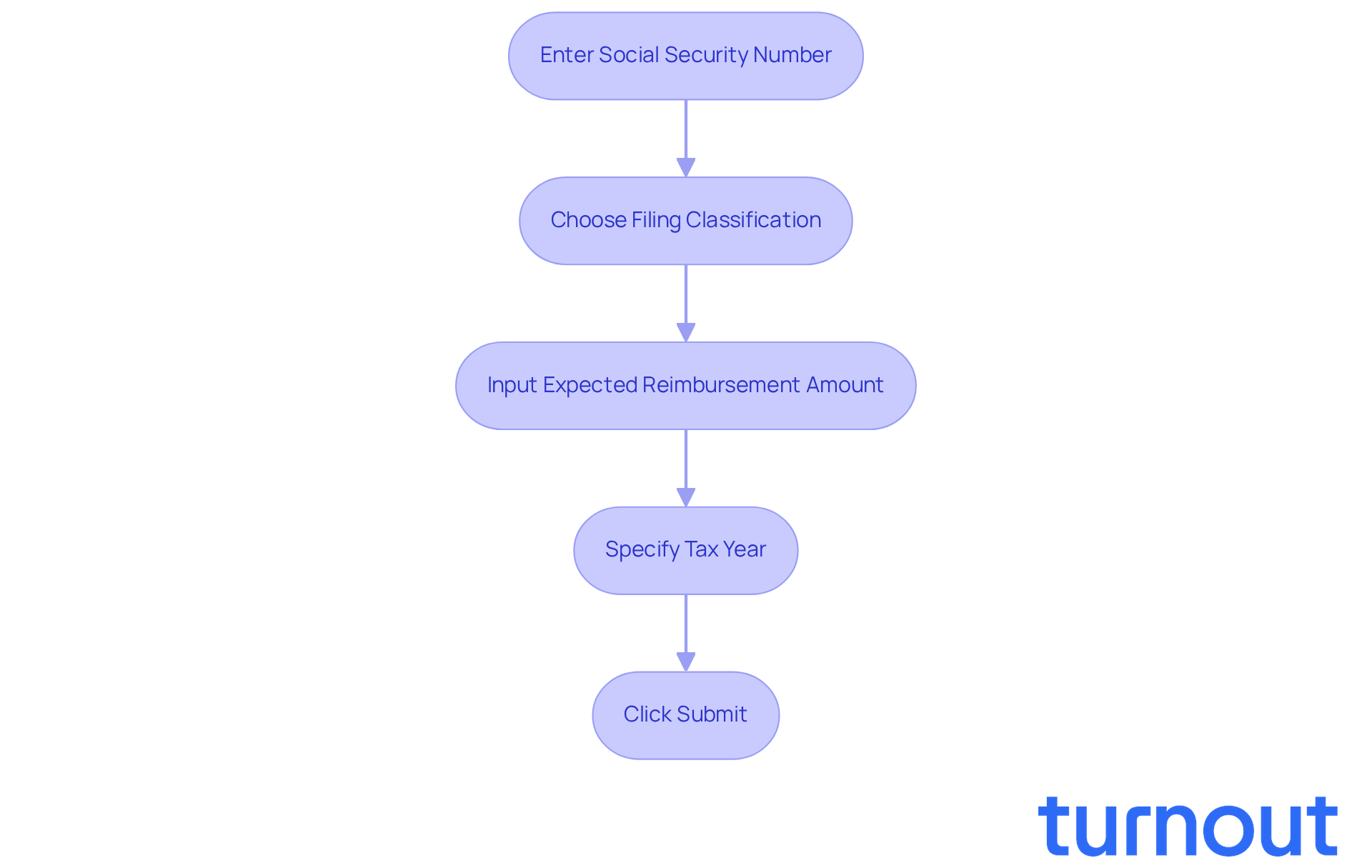

Input Your Details to Check Refund Status

Checking the status of your Missouri State Income Tax Refund can feel overwhelming, but we’re here to help. Just follow these simple steps on the Missouri Return Tracker page:

- Enter the first Social Security number listed on your tax return.

- Choose your filing classification from the dropdown menu.

- Input the whole dollar amount of your expected reimbursement.

- Specify the tax year for which you are verifying the situation.

- After inputting all necessary details, click the 'Submit' button to see your reimbursement progress.

We understand that accuracy is crucial; even minor mistakes can lead to delays in retrieving your information. Did you know that the IRS found almost 17 million math errors on 2021 individual income tax returns during the agency's 2022 fiscal year? This highlights just how important it is to enter your details carefully. Common mistakes include entering an incorrect Social Security number or selecting the wrong filing status, which can significantly affect your return processing.

According to the Department of Revenue, the timing of your reimbursement depends on when your return is submitted and the volume of incoming returns. By ensuring all your entries are correct, you can avoid unnecessary complications and speed up the monitoring of your Missouri state income tax refund. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Troubleshoot Common Issues with Refund Tracking

When verifying your Missouri state income tax refund progress, it’s common to encounter some challenges. We understand that this can be a frustrating experience, but here are some effective troubleshooting tips to help you navigate through it:

- Verify Your Information: Make sure your Social Security number, filing status, reimbursement amount, and tax year are entered accurately. Even small mistakes can lead to errors in tracking your refund.

- Check for System Errors: If the Missouri Department of Revenue's website is down or unresponsive, don’t worry. Try accessing it later or using a different browser. System maintenance or high traffic can cause temporary issues, and it’s something many people experience.

- Be Patient with Processing Times: If you’ve recently submitted your return, it may take a few days for the system to reflect your status. Generally, it’s best to wait at least five business days after e-filing or three to four weeks after sending a paper return before checking your progress. Remember, many taxpayers face delays during peak filing seasons, so patience is key.

- Reach Out for Support: If you’re still having trouble, please don’t hesitate to contact the Missouri Department of Revenue at (573) 751-3505. Their support team is there to assist you with any ongoing issues. Just keep in mind that average wait times can vary, so be prepared for potential delays when reaching out.

By following these steps, you can more effectively navigate typical reimbursement tracking issues and stay informed about your Missouri state income tax refund. Additionally, consider consulting with tax advisors who can provide insights into common challenges faced by consumers and offer tailored advice. Remember, you are not alone in this journey, and we’re here to help.

![]()

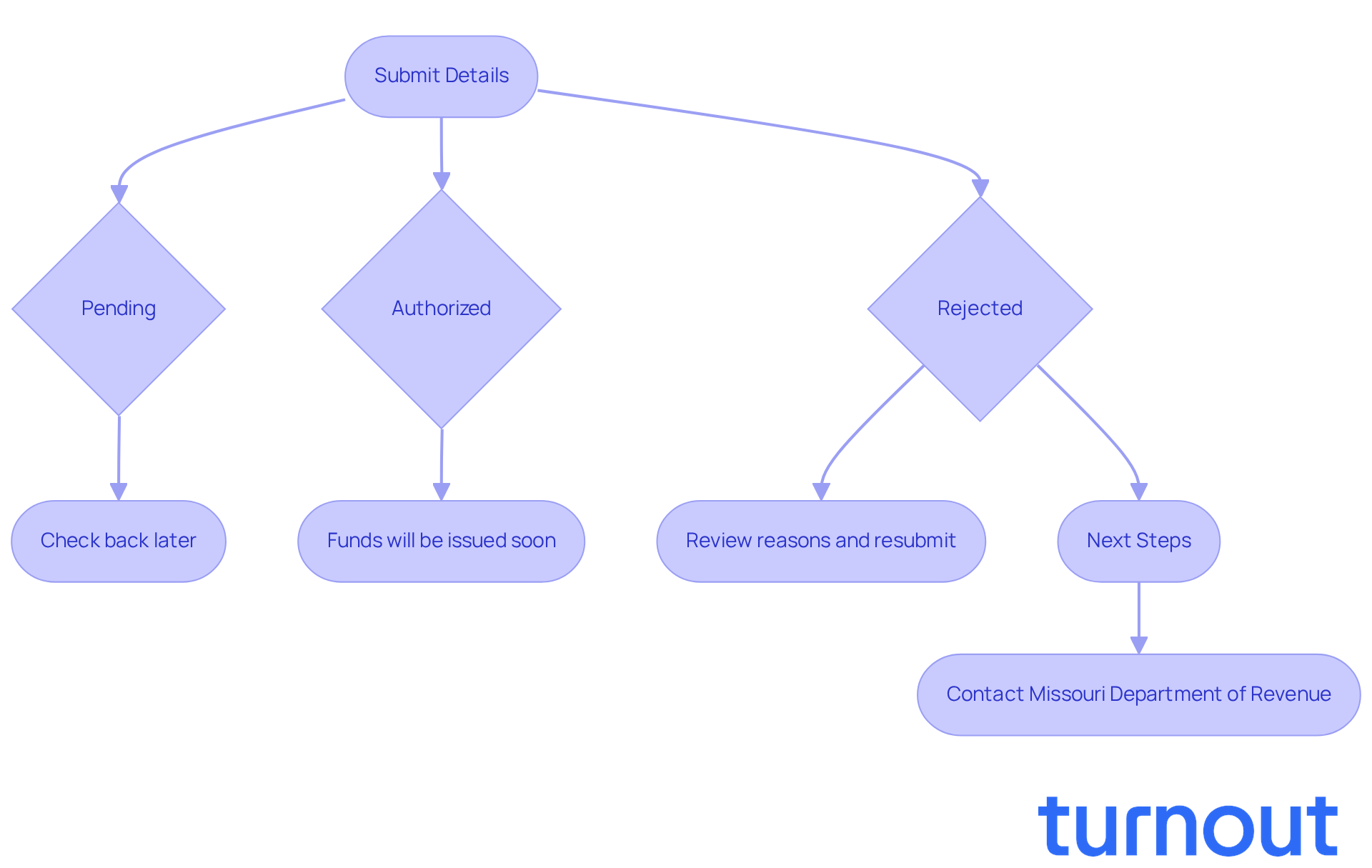

Understand Your Refund Status and Next Steps

When you submit your details, you’ll receive updates about your reimbursement status. Here’s how to interpret what you see:

- Pending: Your return is still being processed. We understand that waiting can be tough, so check back later for updates.

- Authorized: Great news! Your reimbursement has been approved and will be issued soon. Expect it to be deposited into your account or mailed as a check.

- Rejected: If your return was rejected, don’t worry. Review the reasons provided, correct any errors, and resubmit. You’re not alone in this process.

- Next Steps: If your reimbursement is delayed beyond the expected timeframe, please reach out to the Missouri Department of Revenue for further assistance. Remember to document your communications for future reference.

It’s common to feel a mix of emotions when it comes to tax return results. Many people express relief and satisfaction when their reimbursements are approved, seeing it as a much-needed financial boost. On the flip side, those facing delays or refusals often experience frustration and anxiety. This highlights how important it is to understand the return process.

Financial specialists, like Andrew D. White, emphasize that after checking your tax return status, it’s time to prepare for the next steps. Whether that means planning for the anticipated funds or addressing any issues that led to a rejection, being proactive can help ease your mind.

In Missouri, around 90% of Missouri state income tax refunds are approved, while about 10% of them face rejection. This underscores the importance of accuracy in your submissions to avoid complications. As Suze Orman wisely states, 'A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.' Remember, we’re here to help you navigate this journey.

Conclusion

Navigating the Missouri state income tax refund process can feel overwhelming at first. But don’t worry! With the right information and steps, it becomes much more manageable. We understand that checking your refund status can alleviate anxiety and empower you to stay informed about your financial matters.

This guide has outlined essential steps to ensure a smooth experience when checking your Missouri tax refund status. Start by gathering necessary information, like your Social Security number and filing category. Then, utilize the Missouri Department of Revenue’s online Return Tracker. Each step is designed to make the process as straightforward as possible. It’s also helpful to recognize common issues and know how to troubleshoot them, easing any frustrations that may arise along the way.

Ultimately, being proactive and informed is key to successfully managing your tax refund status. Whether you’re anticipating a reimbursement or addressing potential issues, understanding the process allows for better financial planning and peace of mind. Remember, accuracy in submissions significantly impacts the efficiency of the refund process.

We encourage you to take these steps seriously. By staying engaged and utilizing available resources, you can navigate your tax journey with confidence. You are not alone in this journey; we’re here to help!

Frequently Asked Questions

What information do I need to gather before checking my Missouri state income tax refund?

You need to gather your Social Security number, filing category (e.g., single, married filing jointly), anticipated reimbursement amount, and the tax year for which you are checking the reimbursement status.

Why is it important to have the correct information when checking my refund?

Having the correct information is crucial to avoid potential issues and ensure a timely resolution, as many taxpayers face challenges due to errors in their submitted information.

How can I check the status of my Missouri state income tax refund?

You can check the status by visiting the Department of Revenue's Return/Refund Tracker page and clicking on the Return Inquiry link.

What steps do I need to follow to access the Missouri State Tax Refund Tracker online?

Open your web browser, visit the Department of Revenue's reimbursement tracker page, and click the 'Get Started!' button to begin tracking your reimbursement.

What should I ensure before using the State Return Tracker?

Make sure you have a stable internet connection to avoid any interruptions while using the site.

How have taxpayers generally found the Return Tracker experience?

Many taxpayers have found the Return Tracker to be a straightforward tool for monitoring their Missouri state income tax refund, which has helped alleviate some anxiety about the process.

Has the efficiency of state tax refund tracking systems improved?

Yes, experts have noted that state tax refund tracking systems have become more efficient, allowing users to access their information quickly and securely.