Introduction

Navigating the complexities of disability back pay can feel overwhelming, and we understand that. For many, this financial support is a vital safety net, helping to replace lost income during the waiting period for Social Security benefits. However, figuring out the maximum entitlement can be challenging, and it’s common to worry about receiving the full compensation you deserve.

So, what steps can you take to accurately determine this amount? And how can you avoid potential pitfalls along the way? Let’s explore these questions together, ensuring you feel supported and informed throughout this journey.

Understand Disability Back Pay: Definition and Importance

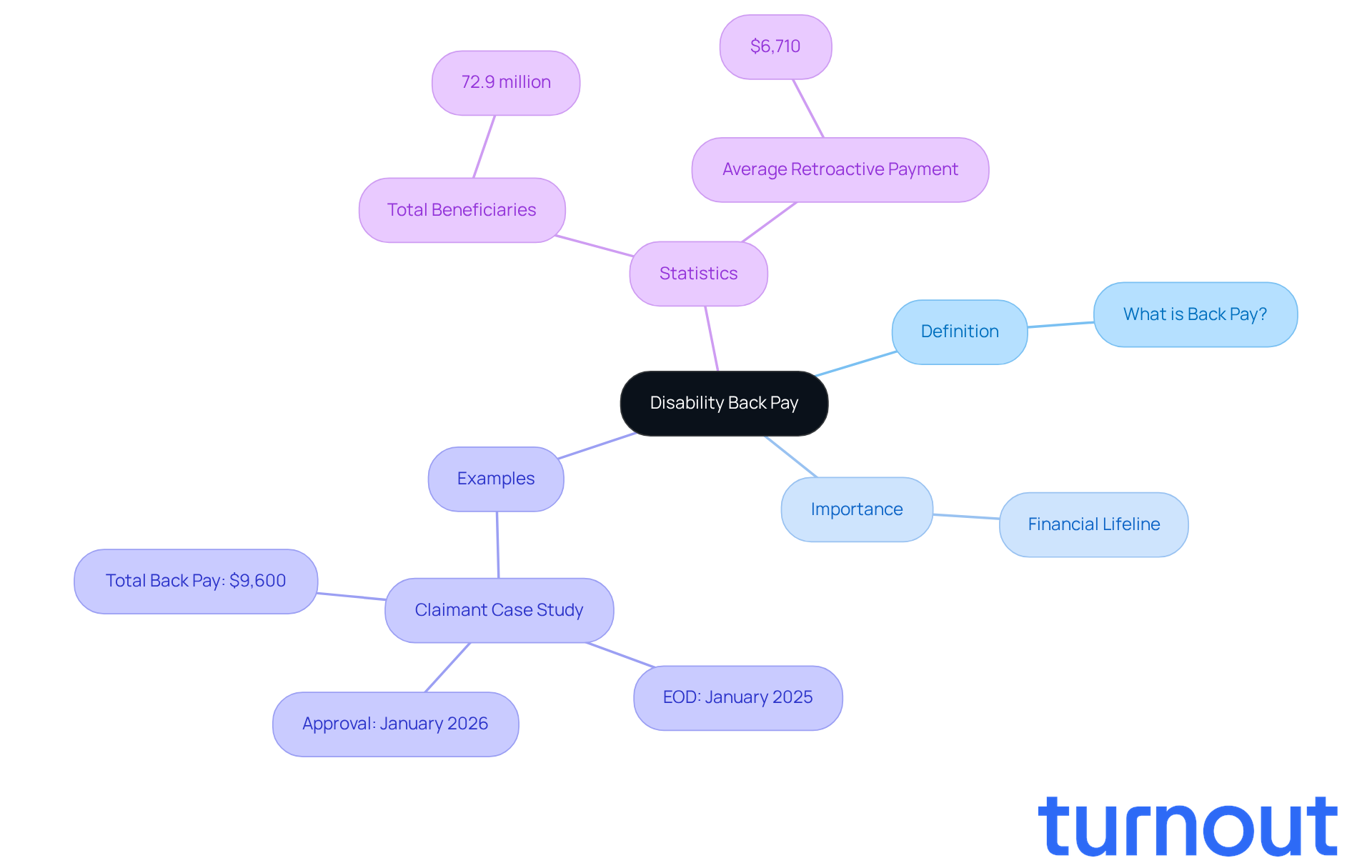

Compensation for incapacity payments is more than just a financial term; it represents a lifeline for those who have faced challenges due to their disabilities. These retroactive sums are owed to individuals approved for benefits, covering the time from their Established Onset Date (EOD) until their application approval date. This payment is crucial as it compensates for the period when individuals couldn’t work but hadn’t yet received benefits.

We understand that navigating this process can be overwhelming. For instance, imagine a claimant with an EOD of January 2025, who is approved in January 2026. They could receive retroactive pay totaling $9,600, covering eight months of benefits after the mandatory five-month waiting period. Such substantial payments can make a real difference, helping individuals catch up on bills and medical expenses incurred during their waiting period.

Statistics show that in 2024, around 72.9 million people received payments from Social Security programs, highlighting how many rely on these benefits. The typical retroactive payment was approximately $6,710, highlighting the importance of understanding the disability back pay maximum for effective budgeting and financial planning.

By recognizing the significance of retroactive pay, we encourage you to pursue your claims diligently. You're not alone in this journey, and taking action can help maximize your entitled compensation, ultimately enhancing your financial stability. Remember, we're here to help you every step of the way.

Identify Eligibility Criteria for Disability Back Pay

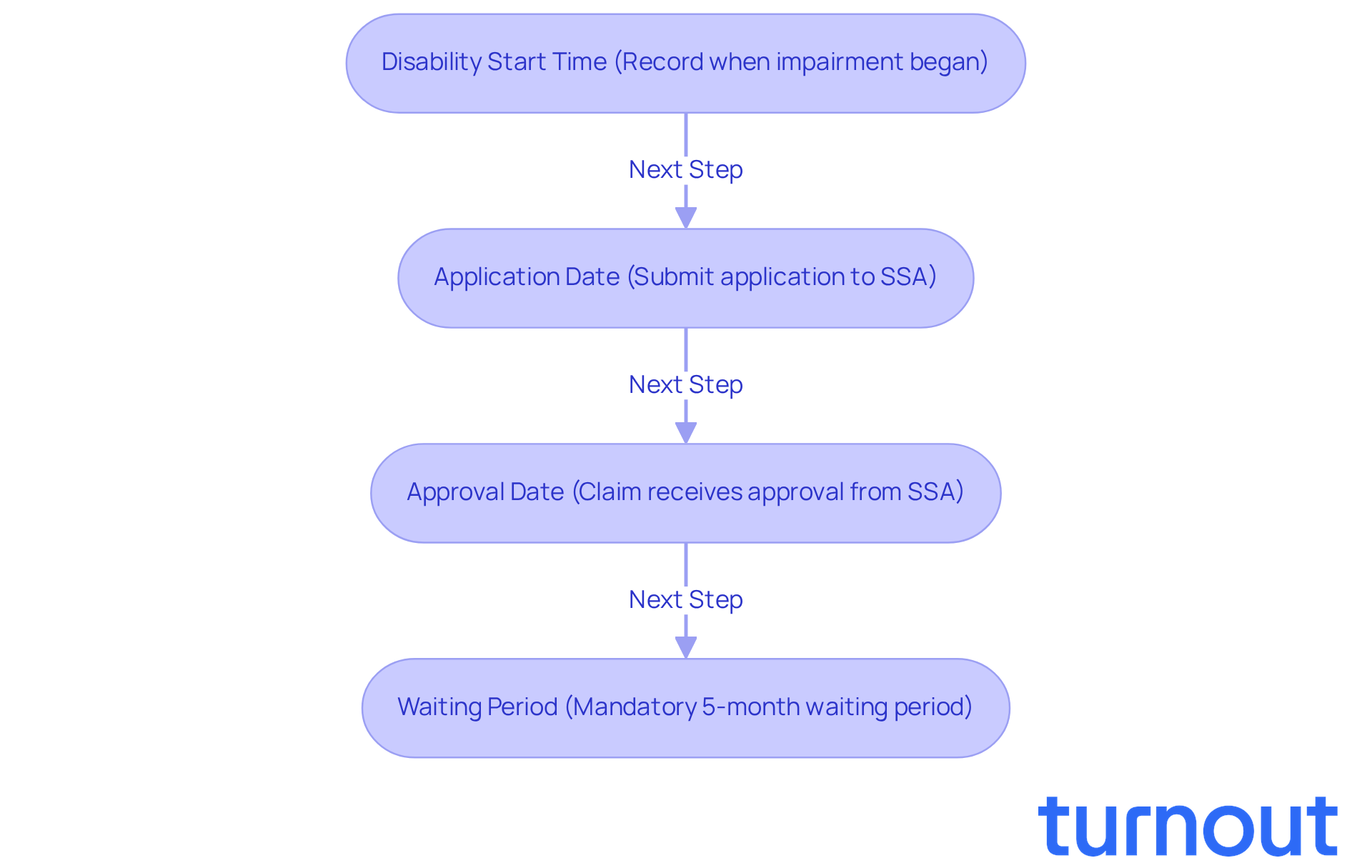

Navigating the world of retroactive payments can feel overwhelming, but understanding the eligibility criteria set by the Social Security Administration (SSA) is a crucial first step. Here’s what you need to know:

- Disability Start Time: It’s essential to have a clear record of when your impairment began. This information is key for calculating any back pay you might receive.

- Application Date: Don’t forget to submit your application for benefits to the SSA. This is your gateway to support.

- Approval Date: This is the moment your claim receives the green light from the SSA, marking a significant milestone in your journey.

- Waiting Period: After your condition onset date, there’s a mandatory five-month waiting period before benefits can start flowing.

We understand that these criteria can be daunting, but they are vital for determining your eligibility and ensuring you receive the maximum disability back pay you deserve. Did you know that approval rates for initial impairment applications typically hover between 31% and 36%? This highlights just how important it is to have thorough documentation and to follow SSA guidelines closely.

Experts agree that strong initial applications-those that include comprehensive medical records and detailed statements about your functional limitations-greatly improve your chances of approval. Many individuals who have successfully navigated this process emphasize the importance of clearly stating the onset of their condition and submitting their applications promptly.

You’re not alone in this journey. Turnout is here to help simplify the process. We provide access to trained nonlawyer advocates who can guide you through the complexities of SSD claims. With their support, you can focus on what matters most-ensuring you receive the financial assistance you need without the stress of legal representation.

Gather Required Documentation for Calculation

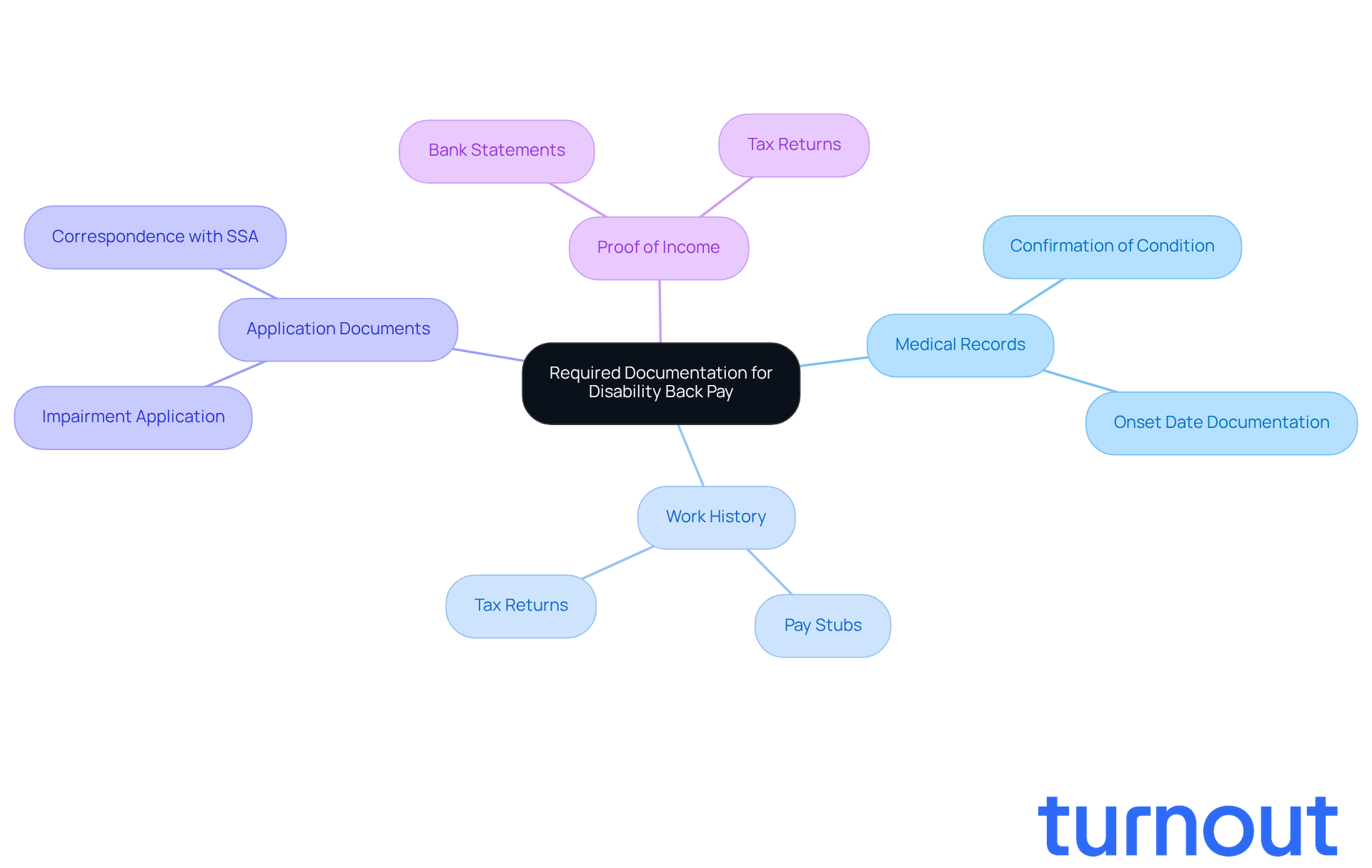

Gathering the right documents is crucial for accurately calculating the disability back pay maximum. We understand that this process can feel overwhelming, but having everything in order can make a significant difference.

-

Medical Records: These are essential. They provide confirmation of your condition and its onset date from your healthcare providers.

-

Work History: You'll need documents that outline your employment background. This includes pay stubs and tax returns, which help establish your earnings before your condition.

-

Application Documents: Don’t forget to include a copy of your impairment application and any correspondence with the SSA. This information is vital for your claim.

-

Proof of Income: It's important to show your income during the time you were unable to work. This could be bank statements or tax returns.

Arranging these documents will not only streamline the calculation process but also help ensure you receive the full compensation you deserve. Remember, you’re not alone in this journey. Turnout is here to assist you, with trained nonlawyer advocates ready to guide you through your SSD claims. We’re committed to helping you understand your rights and entitlements, all without the need for legal representation. You deserve support, and we’re here to provide it.

Calculate Your Maximum Disability Back Pay

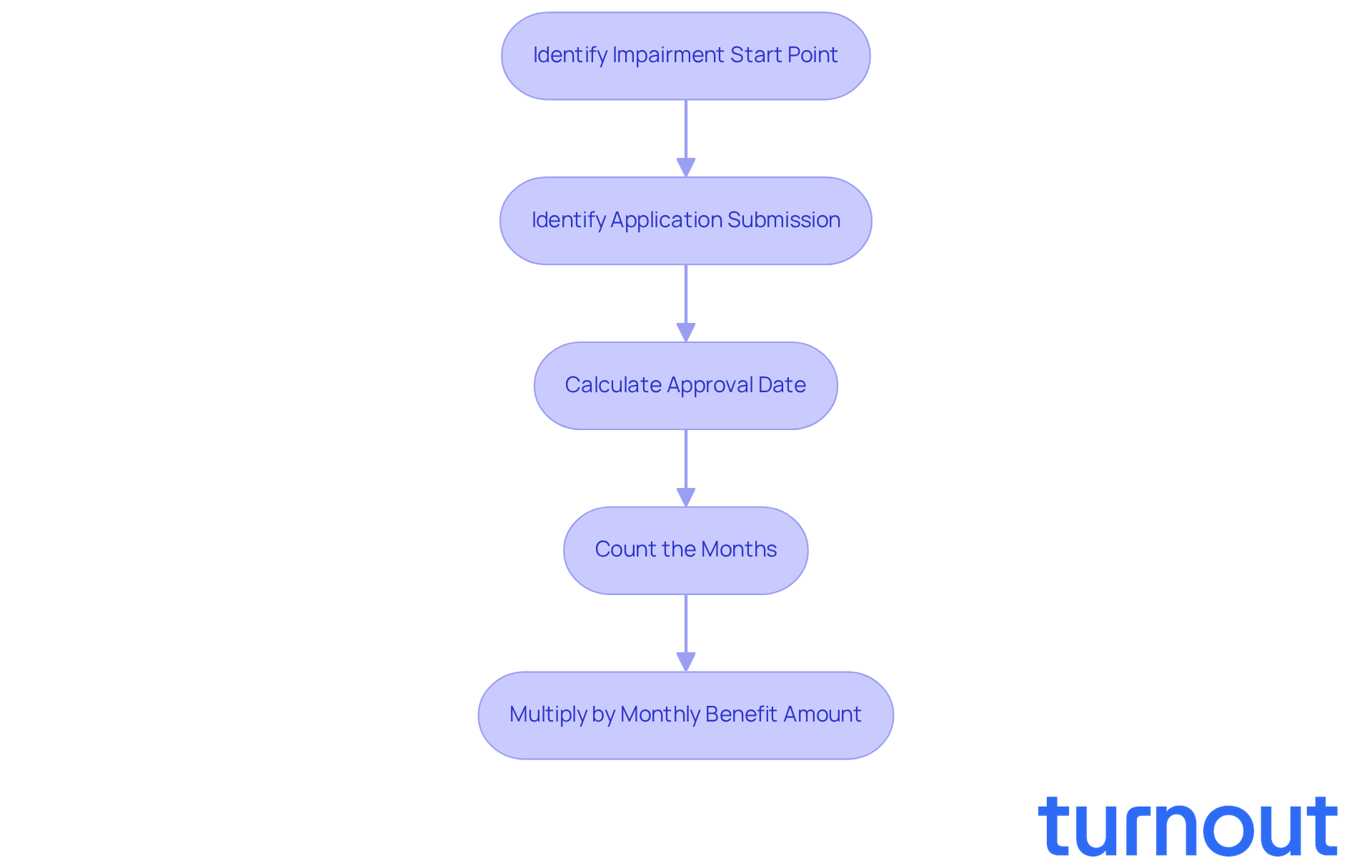

Calculating the disability back pay maximum can feel overwhelming, but we're here to help you through it. Follow these simple steps to ensure you understand the process:

- Identify Your Impairment Start Point: This is when your condition began, and it’s crucial for determining your eligibility.

- Identify Your Application Submission: Note when you submitted your application for benefits; this marks the start of your claim process.

- Calculate the Approval Date: This is the date when the Social Security Administration (SSA) formally approves your claim.

- Count the Months: Count the months between your disability onset and your approval, then subtract the five-month waiting period mandated by the SSA. For example, if your onset date is January 1, 2023, your application date is June 1, 2023, and your approval date is January 1, 2024, you would count the months from June 2023 to January 2024, resulting in a total of 19 months of retroactive pay.

- Multiply by Monthly Benefit Amount: Multiply the total number of qualifying months by your approved monthly benefit amount to calculate your total retroactive pay. For instance, if your monthly benefit is $1,500, your total retroactive payment would be 19 months multiplied by $1,500, amounting to $28,500.

It is vital to understand the calculation related to disability back pay maximum. Many individuals mistakenly believe that benefits only start upon application or approval. In reality, retroactive pay compensates for the gap between your onset date and the approval date, providing essential financial support during a challenging time.

It’s also important to note that SSDI retroactive payments can be considered taxable income, so consulting a tax professional is a wise step. Keeping thorough documentation of your medical condition, treatment history, work history, and work limitations is crucial to support your claim effectively.

For additional help, consider using a complimentary SSDI retroactive payment calculator to estimate your possible retroactive compensation. Turnout offers support through trained nonlawyer advocates and various tools to help you navigate the SSD claims process. Remember, you are not alone in this journey, and we’re here to ensure you receive the benefits you deserve.

Troubleshoot Common Calculation Issues

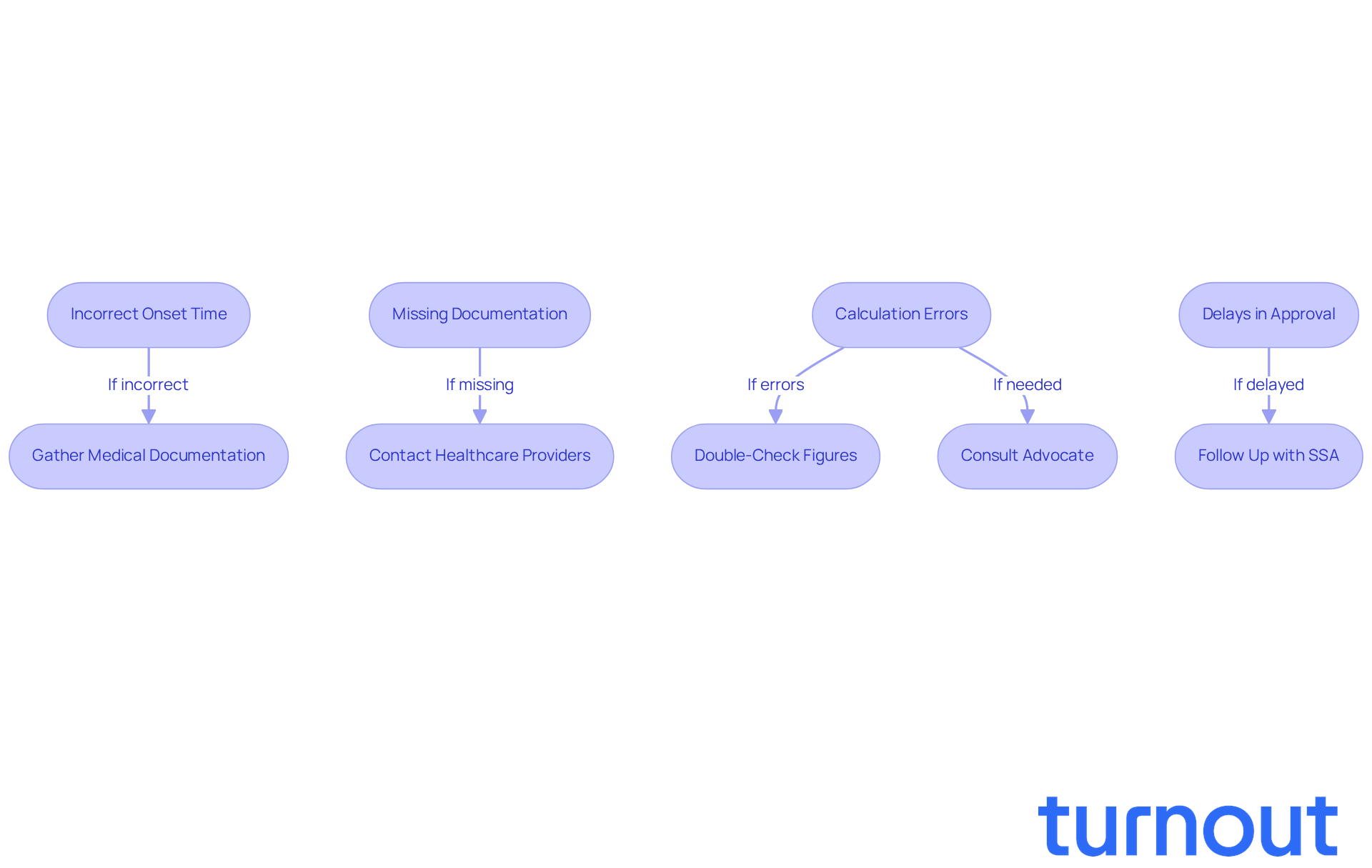

Calculating your disability back pay maximum can be challenging, and we understand how overwhelming it can feel. Here are some helpful tips to guide you through common issues:

-

Incorrect Onset Time: If the Social Security Administration (SSA) has noted a different onset time than what you believe is correct, gather medical documentation that supports your claim. This evidence is crucial in establishing the right date.

-

Missing Documentation: If you find yourself lacking essential documents, don’t hesitate to reach out to your healthcare providers or former employers to obtain the necessary records. Having complete documentation is vital for a successful claim.

-

Calculation Errors: To ensure your calculations are accurate, double-check your figures. You might find it helpful to use online calculators designed for benefits or consult with an advocate for assistance if needed.

-

Delays in Approval: If your claim is taking longer than expected, it’s common to feel anxious. Proactively follow up with the SSA to inquire about the status of your application. Staying informed can help alleviate uncertainty and speed up the process.

By addressing these common issues proactively, you can create a smoother experience in calculating and receiving your disability back pay maximum. Remember, in 2024, over 8.6 million disabled beneficiaries received nearly $12.9 billion in benefits. This highlights the importance of navigating this system effectively. You're not alone in this journey, and we're here to help.

Conclusion

Understanding how to calculate disability back pay is essential for anyone navigating the complexities of Social Security benefits. We know that this crucial financial support can significantly ease the burden of living with a disability. It’s important to ensure that you receive the compensation you’re owed for the time you were unable to work. By grasping the calculation process, you can take meaningful steps to secure your entitled benefits and improve your financial well-being.

In this guide, we’ve explored key points that matter, like:

- understanding eligibility criteria

- gathering necessary documentation

- following a systematic approach to calculate the maximum back pay

Accurate records and thorough applications are vital; they greatly influence approval rates and the amount of retroactive pay you may receive. It’s common to encounter calculation issues, but troubleshooting these can streamline the process and enhance your chances of a successful claim.

Ultimately, you don’t have to face the journey to securing disability back pay alone. With the right resources and support, you can navigate this complex system more effectively. Taking action to understand and calculate disability back pay not only ensures you receive rightful compensation but also reinforces the importance of advocating for your financial stability and well-being. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is disability back pay and why is it important?

Disability back pay refers to retroactive payments owed to individuals approved for benefits, covering the period from their Established Onset Date (EOD) until their application approval date. It is important because it compensates for the time individuals could not work before receiving benefits, providing financial support during that waiting period.

How is the amount of disability back pay calculated?

The amount of disability back pay is calculated based on the time from the Established Onset Date (EOD) until the application approval date, minus a mandatory five-month waiting period. For example, if a claimant has an EOD of January 2025 and is approved in January 2026, they could receive retroactive pay for the eight months following the waiting period.

What statistics highlight the significance of disability back pay?

In 2024, approximately 72.9 million people received payments from Social Security programs, with the typical retroactive payment being around $6,710. These statistics underscore the reliance on disability benefits and the importance of understanding back pay for financial planning.

What are the eligibility criteria for receiving disability back pay?

The eligibility criteria for disability back pay include having a clear record of when the impairment began (Disability Start Time), submitting an application for benefits to the Social Security Administration (SSA), receiving approval from the SSA (Approval Date), and understanding the mandatory five-month waiting period after the condition onset date.

What is the approval rate for initial impairment applications?

The approval rate for initial impairment applications typically ranges between 31% and 36%. This highlights the importance of thorough documentation and adherence to SSA guidelines for a successful claim.

How can individuals improve their chances of being approved for disability benefits?

Individuals can improve their chances of approval by submitting strong initial applications that include comprehensive medical records and detailed statements about their functional limitations. Clearly stating the onset of their condition and submitting applications promptly is also crucial.

What support is available for individuals navigating the disability claims process?

Individuals can seek help from trained nonlawyer advocates who can simplify the process of Social Security Disability (SSD) claims. These advocates provide guidance, allowing claimants to focus on receiving the financial assistance they need without the stress of legal representation.