Introduction

Navigating the complexities of the IRS can feel overwhelming, especially when financial hardships make tax obligations seem impossible to manage. We understand that achieving a Currently Not Collectible (CNC) status can offer a much-needed lifeline for those struggling to meet their tax responsibilities. This article provides a step-by-step guide to help you understand the process and requirements for obtaining this designation.

But what happens when the road to financial relief is filled with obstacles and confusion? It’s common to feel lost in this journey. Exploring these essential steps may reveal the path to alleviating your tax burdens and regaining financial stability. Remember, you are not alone in this journey; we're here to help.

File All Required Tax Returns

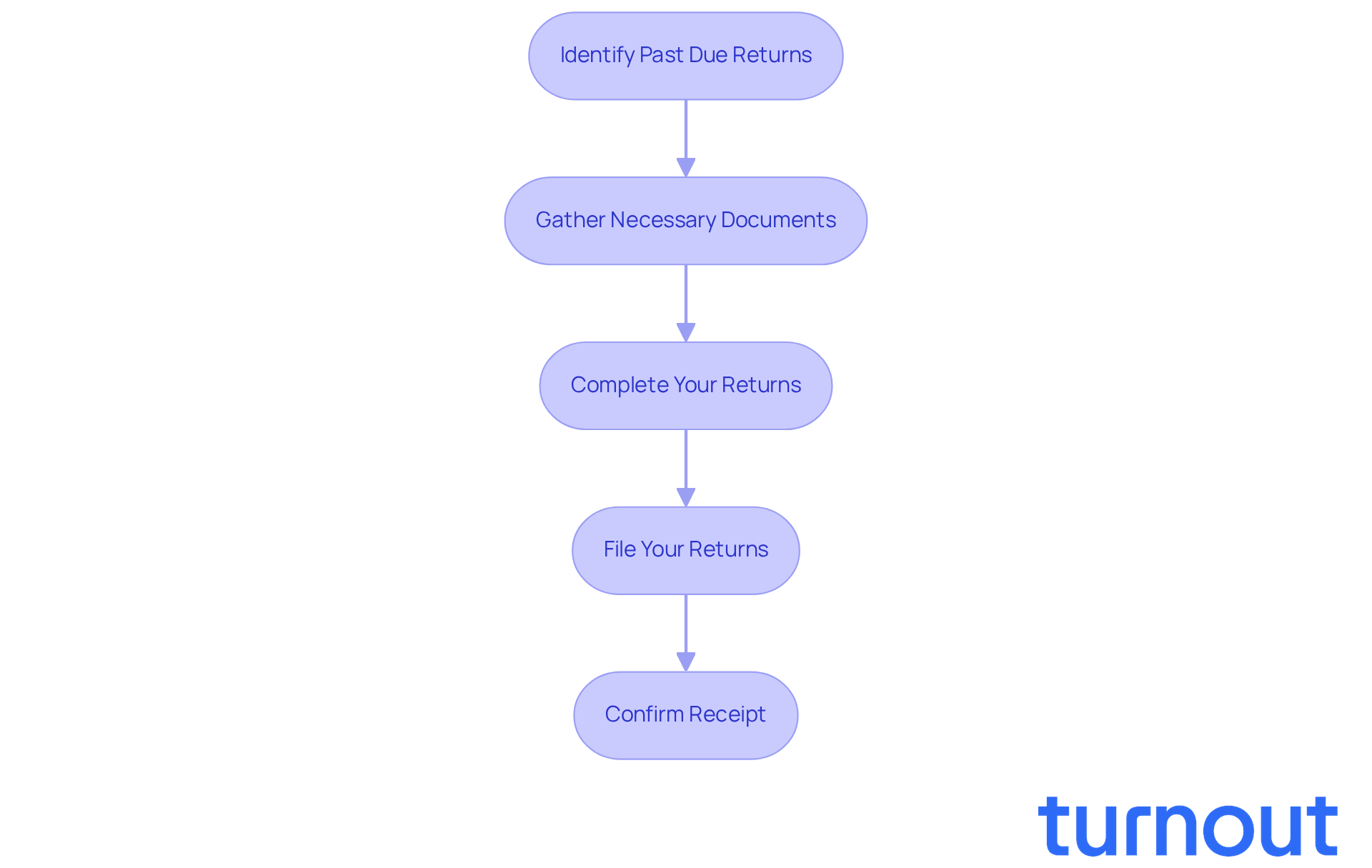

Starting the journey to acquire a Currently Not Collectible IRS designation can feel overwhelming, but you’re not alone. It’s essential to ensure that all required tax returns are filed. Here’s a step-by-step guide to help you through this process:

-

Identify Past Due Returns: Take a moment to review your tax history and pinpoint which returns are outstanding. You can easily verify your filing status through the IRS website or by reaching out to them directly. We understand that this can be a daunting task, but it’s a crucial first step.

-

Gather Necessary Documents: Collect all relevant documents, such as W-2s, 1099s, and any other income statements for the years you need to file. Keep in mind that due to new tax laws in 2025, you might need to gather additional forms like Form 1099-DA for crypto sales and Form 1098-VLI for vehicle loan interest. It’s common to feel a bit lost here, but gathering these documents will set you up for success.

-

Complete Your Returns: Consider using tax software or consulting a tax professional to accurately complete your returns. It’s important to ensure that all income and deductions are reported correctly. Remember, many Americans file their tax returns late, which can complicate their financial situations. You’re taking a positive step by addressing this now.

-

File Your Returns: Once your returns are complete, submit them to the IRS. You can choose to file electronically or by mail, depending on what feels right for you. The IRS encourages electronic filing for faster processing, which can ease some of the stress.

-

Confirm Receipt: If you file by mail, consider using certified mail to confirm that the IRS has received your returns. For electronic filings, don’t forget to save the confirmation receipt. This small step can provide peace of mind.

Completing these steps is essential, as the IRS will not consider your application for currently not collectible IRS status until all returns are filed. Familiarizing yourself with IRS guidelines on filing past due tax returns can help ensure compliance and avoid potential issues. Remember, we’re here to help you navigate this process, and you’re taking a significant step toward financial relief.

Gather Comprehensive Financial Documentation

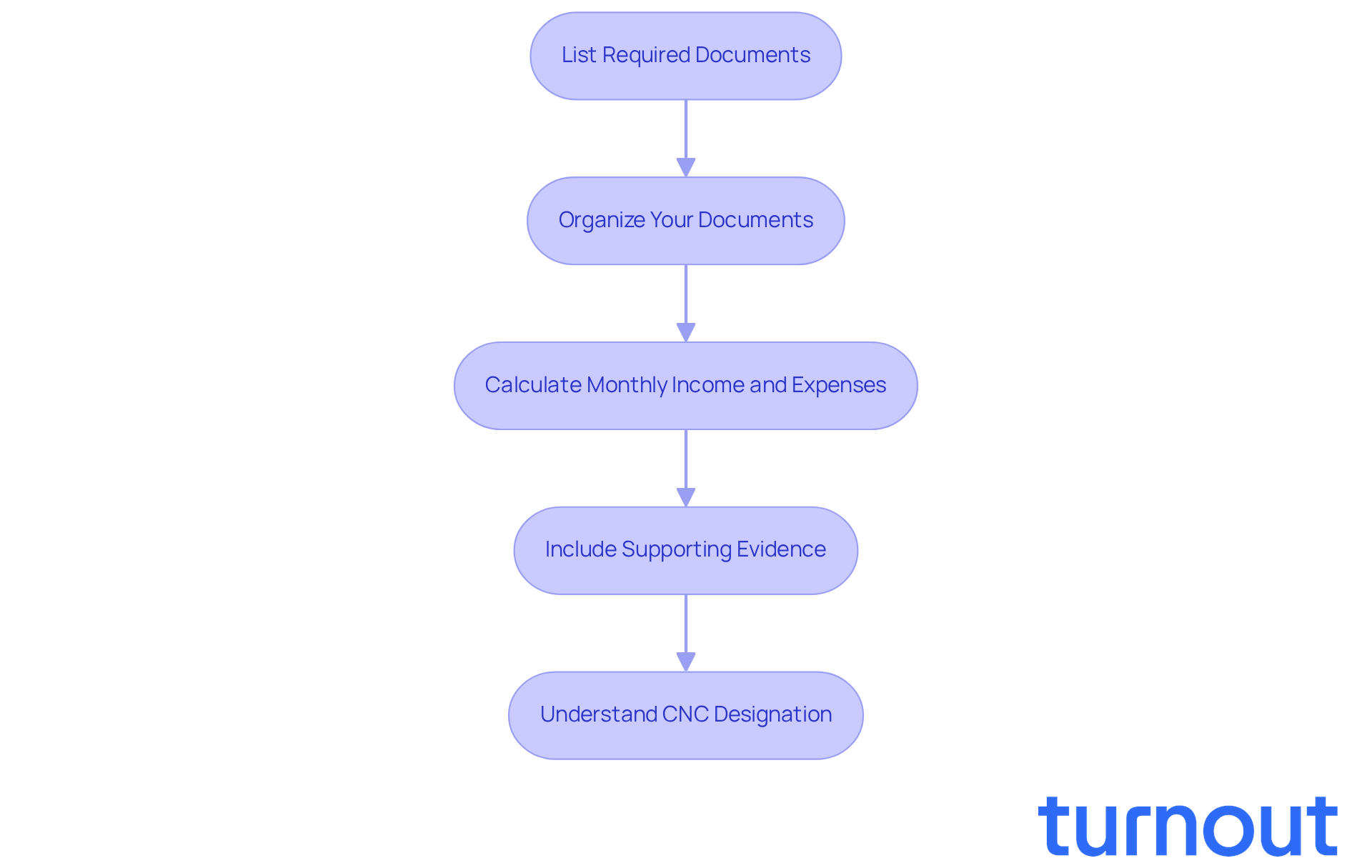

Once you’ve filed your tax returns, the next step is to gather all the financial documentation you’ll need for your CNC application. This paperwork is crucial to support your claim of financial hardship. Let’s walk through the steps together:

-

List Required Documents: Start by preparing a list of documents that the IRS typically asks for, including:

- Recent pay stubs or income statements

- Bank statements for the last three months

- Monthly expense statements (like rent, utilities, groceries, etc.)

- Documentation of any other income sources (e.g., Social Security, unemployment benefits)

- Don’t forget to file any past-due tax returns, usually for the last six years, before applying for CNC status.

-

Organize Your Documents: Create a folder-whether physical or digital-to keep all your financial documents in one place. This will make submitting your CNC request much easier.

-

Calculate Monthly Income and Expenses: Take the time to prepare a detailed account of your monthly income and expenses. This will help clearly illustrate your financial situation, as the IRS evaluates these figures to determine if you are currently not collectible IRS. Remember, the IRS reviews financial information for CNC classification every one to two years, so keeping accurate records is essential.

-

Include Supporting Evidence: If you have any additional documentation that supports your claim of financial hardship, like medical bills or eviction notices, include those as well. This evidence can strengthen your case, as the IRS requires proof of financial hardship to grant CNC designation.

It’s important to understand that while CNC designation protects you from levies and garnishments, it doesn’t erase your tax debt. Also, consider the potential indirect costs of hiring a tax professional for assistance, as this may be necessary for some individuals navigating the CNC application process.

Having this documentation ready is vital for the next steps in the CNC process, as it directly impacts your eligibility for relief from currently not collectible IRS collection actions. As Peter Salinger, a former IRS Revenue Officer, wisely said, 'You should think about applying for CNC designation when you can’t afford to make any payments toward your tax debt without sacrificing essentials such as housing, food, or medical care.'

Remember, you’re not alone in this journey. We’re here to help you through it.

Complete the Collection Information Statement

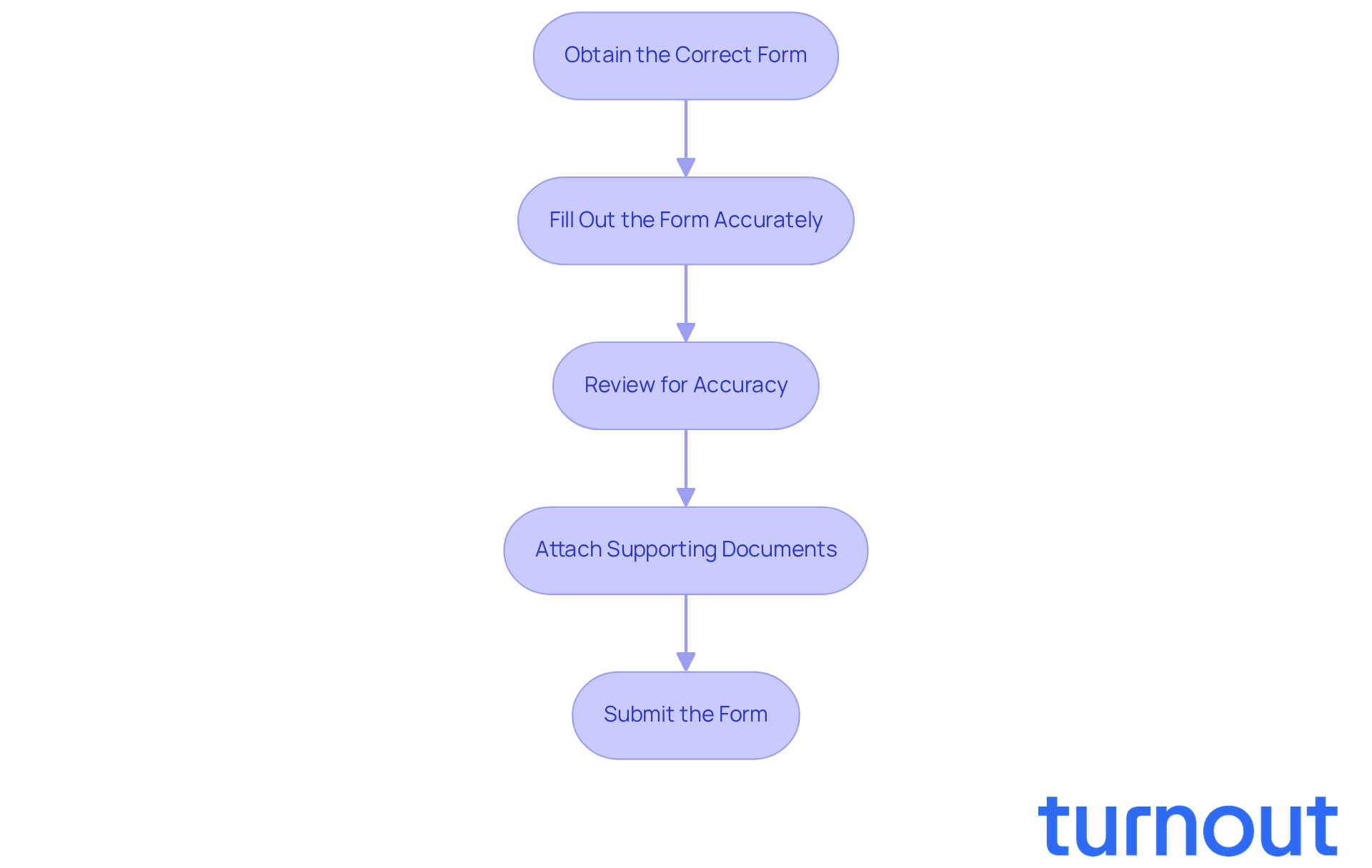

Filling out the Collection Information Statement (CIS) is a crucial step in your application for currently not collectible IRS status. We understand that this process can feel overwhelming, but we’re here to guide you through it with a streamlined approach:

-

Obtain the Correct Form: Depending on your situation, you’ll need either Form 433-F (for individuals) or Form 433-A/B (for self-employed or business taxpayers). These forms are easy to find and download on the IRS website.

-

Fill Out the Form Accurately: It’s important to provide detailed information about your:

- Personal details (name, address, Social Security number)

- Income sources and amounts

- Monthly expenses (housing, utilities, food, etc.)

- Assets (bank accounts, vehicles, property)

-

Review for Accuracy: We know how vital it is to double-check all entries for accuracy and completeness. Discrepancies can lead to delays in your inquiry. IRS experts emphasize that precision in the CIS is essential for a successful CNC application, particularly for cases that are currently not collectible by the IRS. With over 266.6 million tax returns processed in FY 2024, accurate submissions are more important than ever.

-

Attach Supporting Documents: Include copies of financial documents that support the information in your CIS. This may include pay stubs, bank statements, and bills that reflect your monthly expenses. The IRS's Collection Financial Standards for 2025 outline specific monthly expense allowances, helping you accurately represent your financial situation.

-

Submit the Form: Once you’ve completed everything, send the CIS along with your CNC application to the IRS. Don’t forget to keep a copy for your records.

Completing this form thoroughly is essential for the IRS to assess your financial hardship accurately. Success rates for CNC applications improve significantly when precise CIS submissions are made, especially for cases that are currently not collectible by the IRS. Many taxpayers have successfully attained CNC designation through careful preparation. As IRS specialists remind us, "Accuracy in the CIS is not merely a formality; it is the basis for the success of your submission." You're not alone in this journey, and with the right steps, you can navigate this process with confidence.

Contact the IRS to Request CNC Status

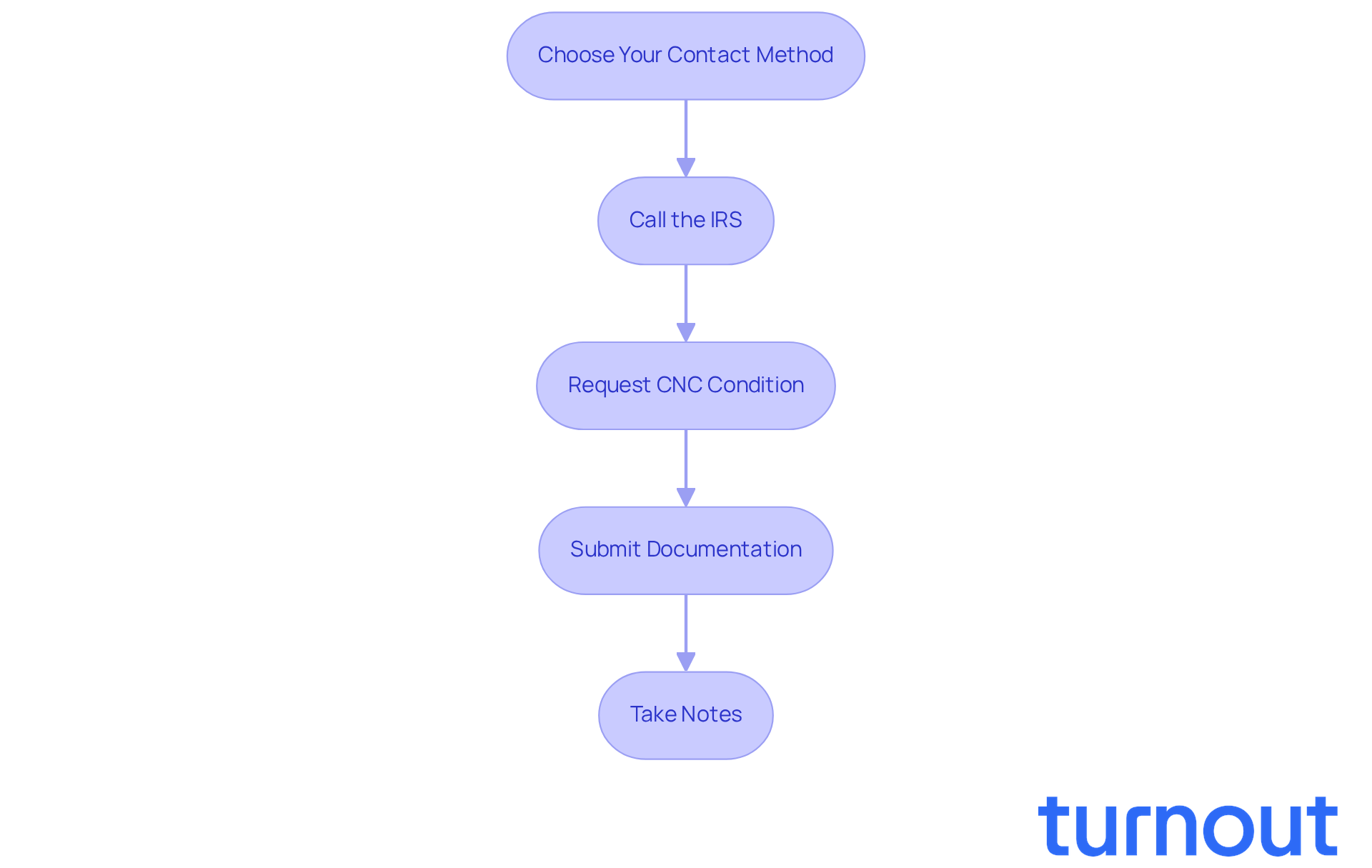

After you’ve completed the necessary forms and gathered your documentation, the next step is to reach out to the IRS to formally request a currently not collectible IRS designation. We understand that this process can feel overwhelming, but we’re here to guide you through it.

- Choose Your Contact Method: You can connect with the IRS by phone or mail. Calling is often quicker, but make sure you have all your documentation ready for reference.

- Call the IRS: Dial 800-829-1040 and follow the prompts to speak with a representative. Be prepared to share your personal information and clearly explain your financial situation. Remember, it’s okay to be honest about your struggles.

The taxpayer's account is currently not collectible by the IRS.

Request CNC Condition: Clearly state that you’re seeking Currently Not Collectible IRS classification due to financial hardship. Offer a brief overview of your financial circumstances to help the representative understand your situation. As the IRS states, 'If the IRS agrees you can’t both pay your taxes and your basic living expenses, it may classify your account as currently not collectible IRS.' - Submit Documentation: If asked, submit your Collection Information Statement and any supporting documents. Depending on the representative's instructions, you may need to send these via fax or mail. Keep in mind that the IRS review process for CNC status can take several weeks or even months, so timely submission is crucial.

- Take Notes: Document the date, time, and name of the representative you spoke with, along with any reference numbers provided. This information is vital for tracking your inquiry.

This step is essential as it kicks off the IRS's examination of your application. While in CNC status, which is currently not collectible IRS, the IRS may keep your tax refunds and apply them to your outstanding debts, so thorough documentation is key. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Respond Promptly to IRS Requests

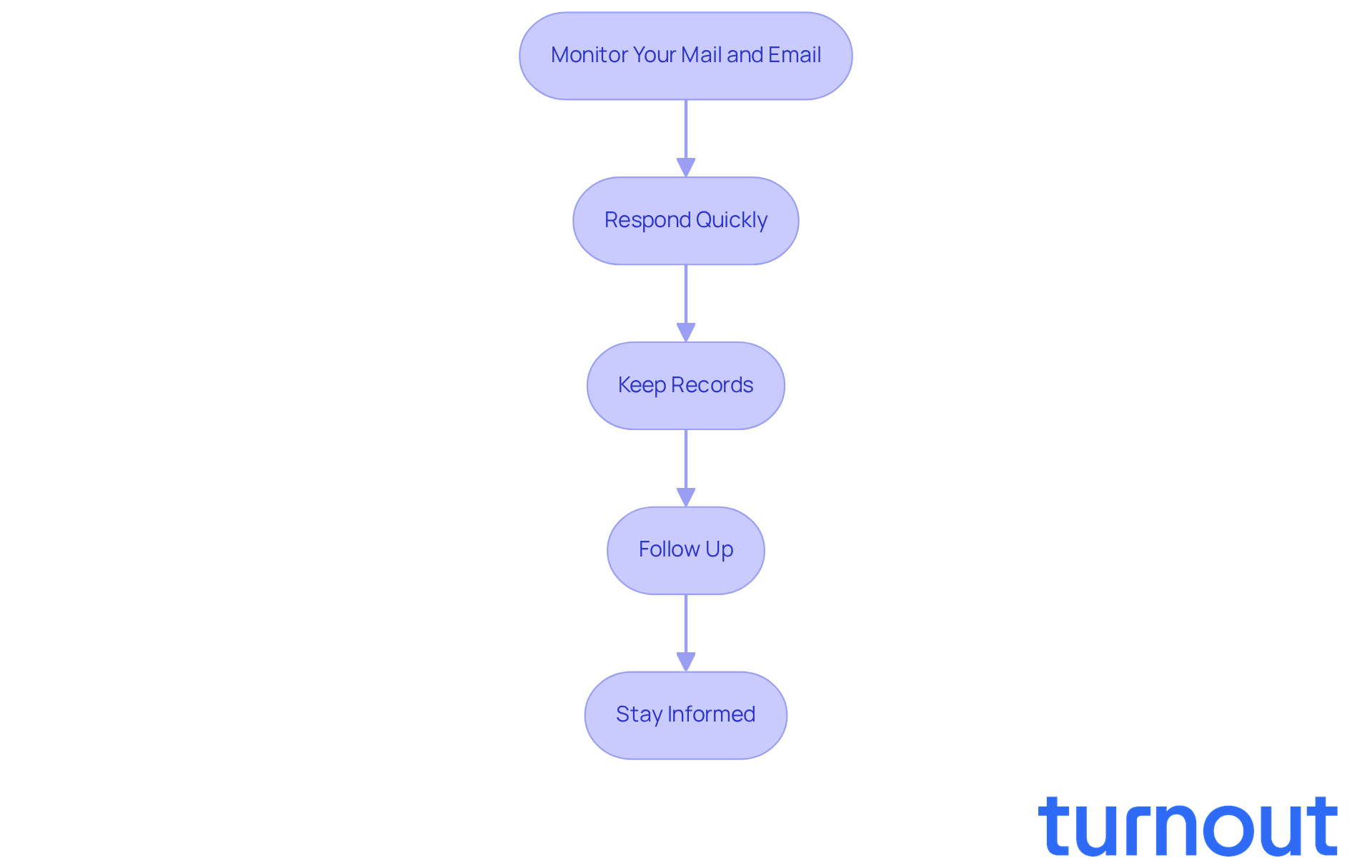

After submitting your Currently Not Collectible IRS application, managing communication with the IRS is crucial. We understand that this process can feel overwhelming, but you’re not alone. Here’s how to navigate this journey effectively:

- Monitor Your Mail and Email: Stay vigilant for any correspondence from the IRS. They may reach out for additional information or clarification regarding your CNC application.

- Respond Quickly: If you receive a demand, act promptly. Gather the necessary information and return it to the IRS without delay. Remember, quick replies can greatly enhance your chances of a positive outcome.

- Keep Records: Maintain detailed documentation of all communications with the IRS. Note the dates, content of inquiries, and your responses. This will be invaluable for future reference.

- Follow Up: If you haven't received a reply within a reasonable timeframe, don’t hesitate to follow up. Asking about the progress of your inquiry shows your commitment to resolving the matter.

- Stay Informed: Understand your rights as a taxpayer and familiarize yourself with IRS procedures. Insights from tax advisors suggest that being well-informed can empower you to navigate any additional steps that may arise. Consider sending responses via certified mail with a return receipt for proof of delivery, as this is a recommended best practice.

Proactive communication can significantly influence the outcome of your request regarding the currently not collectible IRS status. It ensures that you remain compliant and informed throughout the process. Remember, failing to respond within the 30-day deadline can lead to penalties or further complications. We’re here to help you every step of the way.

Conclusion

Achieving Currently Not Collectible (CNC) status with the IRS is a crucial step for those grappling with financial difficulties. We understand that navigating this process can feel overwhelming. By following the necessary steps - filing all tax returns, gathering financial documentation, completing the Collection Information Statement, contacting the IRS, and responding promptly to requests - you can make this journey smoother. Each step builds on the last, creating a clear path toward relief from tax collection actions.

Preparation and accurate documentation are key throughout the CNC application process. Ensuring all past tax returns are filed and meticulously completing the Collection Information Statement strengthens your case for financial relief. It's also vital to maintain open communication with the IRS and respond swiftly to their inquiries. This proactive approach can significantly enhance your chances of a favorable outcome.

Ultimately, the journey to obtaining CNC status is about more than just easing immediate financial pressure; it’s about regaining control over your financial future. We encourage you to take these steps seriously, seek assistance if needed, and stay engaged in your communication with the IRS. By doing so, you can pave the way for a more manageable financial situation and focus on rebuilding your life without the weight of overwhelming tax debt. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What is the first step to acquire a Currently Not Collectible (CNC) IRS designation?

The first step is to ensure that all required tax returns are filed. You should review your tax history to identify any past due returns.

How can I verify my filing status with the IRS?

You can verify your filing status through the IRS website or by contacting them directly.

What documents do I need to gather for filing past due tax returns?

You need to collect relevant documents such as W-2s, 1099s, and any other income statements for the years you need to file. In light of new tax laws in 2025, you might also need additional forms like Form 1099-DA for crypto sales and Form 1098-VLI for vehicle loan interest.

Should I use tax software or a tax professional to complete my returns?

Yes, it is advisable to use tax software or consult a tax professional to ensure that your returns are completed accurately and that all income and deductions are reported correctly.

How do I file my tax returns once they are complete?

You can submit your returns to the IRS either electronically or by mail. The IRS encourages electronic filing for faster processing.

How can I confirm that the IRS has received my tax returns?

If you file by mail, consider using certified mail to confirm receipt. For electronic filings, save the confirmation receipt as proof.

What documentation do I need to gather for my CNC application?

You will need to prepare a list of documents including recent pay stubs, bank statements for the last three months, monthly expense statements, and documentation of any other income sources.

Why is it important to organize my financial documents?

Organizing your financial documents into a folder (physical or digital) makes it easier to submit your CNC request and ensures that you have everything in one place.

How should I calculate my monthly income and expenses for the CNC application?

You should prepare a detailed account of your monthly income and expenses to clearly illustrate your financial situation, as the IRS evaluates these figures for CNC classification.

What additional evidence should I include to support my claim of financial hardship?

Include any supporting documentation such as medical bills or eviction notices, as this evidence can strengthen your case for CNC designation.

Does CNC designation erase my tax debt?

No, CNC designation protects you from levies and garnishments but does not erase your tax debt.

What should I consider when hiring a tax professional for assistance with the CNC process?

Consider the potential indirect costs of hiring a tax professional, as their assistance may be necessary for navigating the CNC application process.