Introduction

Navigating the complexities of tax debt can feel like wandering through a maze, especially when you're seeking forgiveness for back taxes. We understand that with various types of tax obligations and relief options available, it’s easy to feel overwhelmed. This guide aims to demystify the steps necessary for achieving back tax forgiveness. We’ll offer essential insights into eligibility criteria, required documentation, and common pitfalls to avoid.

As the landscape of tax relief evolves, particularly with upcoming changes in 2025, it’s common to wonder how you can effectively position yourself to take advantage of these opportunities. You are not alone in this journey, and we’re here to help you alleviate your financial burden.

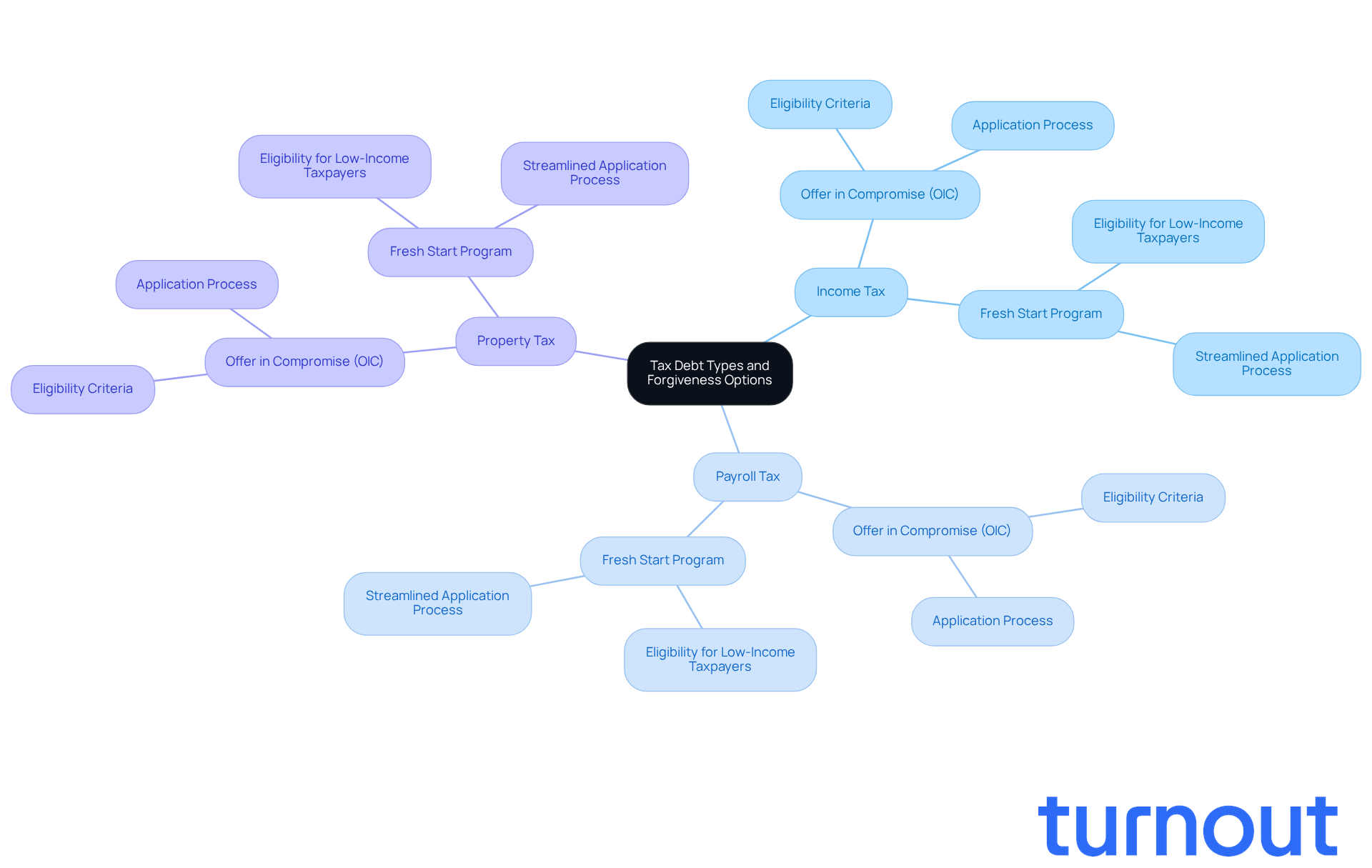

Understand Your Tax Debt Types and Forgiveness Options

Understanding the various types of tax debts you may owe is crucial for effectively pursuing back tax forgiveness. We know that dealing with tax issues can be overwhelming, but you're not alone in this journey. Here are some common categories:

- Income Tax: Taxes on earnings from employment or investments.

- Payroll Tax: Taxes withheld from employee wages to support Social Security and Medicare.

- Property Tax: Taxes based on property ownership.

Each type of tax obligation comes with unique relief options. The Offer in Compromise (OIC) is a valuable opportunity that allows taxpayers to settle their tax debt for less than the total amount owed. This can be especially beneficial for those who find it challenging to pay their full tax bill. In 2025, the OIC program will expand eligibility, focusing more on your ability to pay rather than just the size of your debt. This change makes it a viable option for many.

Additionally, the Fresh Start Program offers relief for individuals owing less than $50,000, streamlining the process for quicker approvals. Remember, all tax returns must be filed before applying for IRS tax relief options like OIC or installment agreements. Maintaining communication with the IRS throughout this process is essential for successfully navigating your tax situation.

Grasping these options is key to effectively finding your way to tax relief. We’re here to help you through this challenging time.

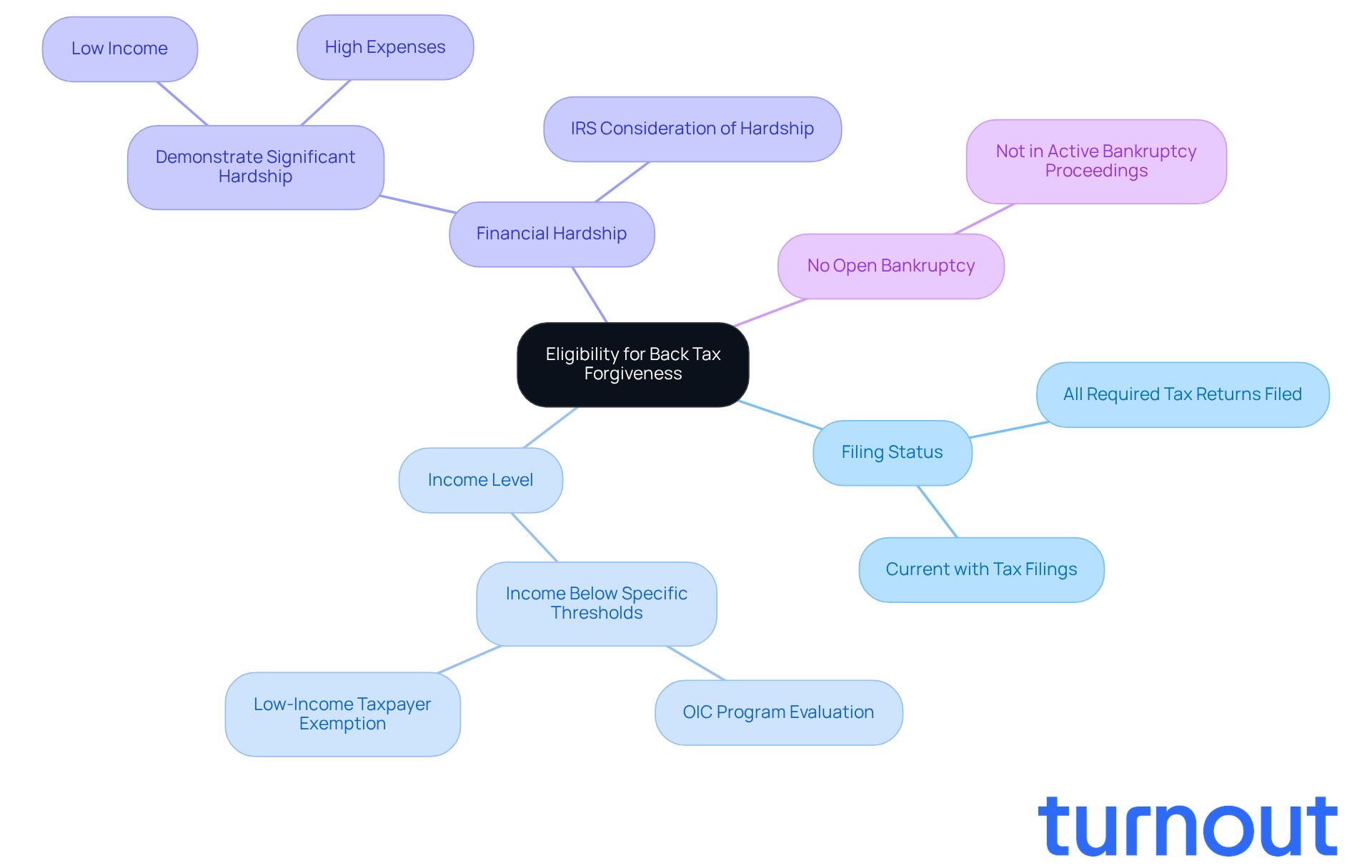

Determine Eligibility for Back Tax Forgiveness

If you're seeking back tax forgiveness, it's important to know that you must meet specific eligibility criteria. We understand that navigating tax issues can be overwhelming, so let’s break down the key factors you need to consider:

- Filing Status: First and foremost, ensure that all required tax returns are filed. To qualify for back tax forgiveness, the IRS typically requires you to be current with your tax filings.

- Income Level: Your income must fall below certain thresholds, which can vary by program. For example, the Offer in Compromise (OIC) program evaluates your ability to pay based on your income and expenses. If you're a low-income taxpayer, you may even be exempt from the $205 processing fee and initial payment.

- Financial Hardship: It’s crucial to demonstrate that paying your tax debt would cause significant financial hardship. This might involve showing low income or high expenses, as the IRS considers these factors when reviewing requests. As tax advisors often say, "It’s better for the government to collect something from taxpayers facing genuine hardship than to collect nothing at all." This highlights the importance of illustrating your financial situation in your submission.

- No Open Bankruptcy: Lastly, you cannot be in an active bankruptcy proceeding when applying for tax relief.

While your Offer in Compromise is being assessed, the IRS will halt collection activities, providing you with some relief during this process. We encourage you to review the specific requirements for the OIC and Fresh Start programs to ensure you qualify for back tax forgiveness. Understanding these guidelines is essential, as they will help you assess your eligibility for relief options and navigate the complexities of tax debt resolution. Remember, you are not alone in this journey; we’re here to help.

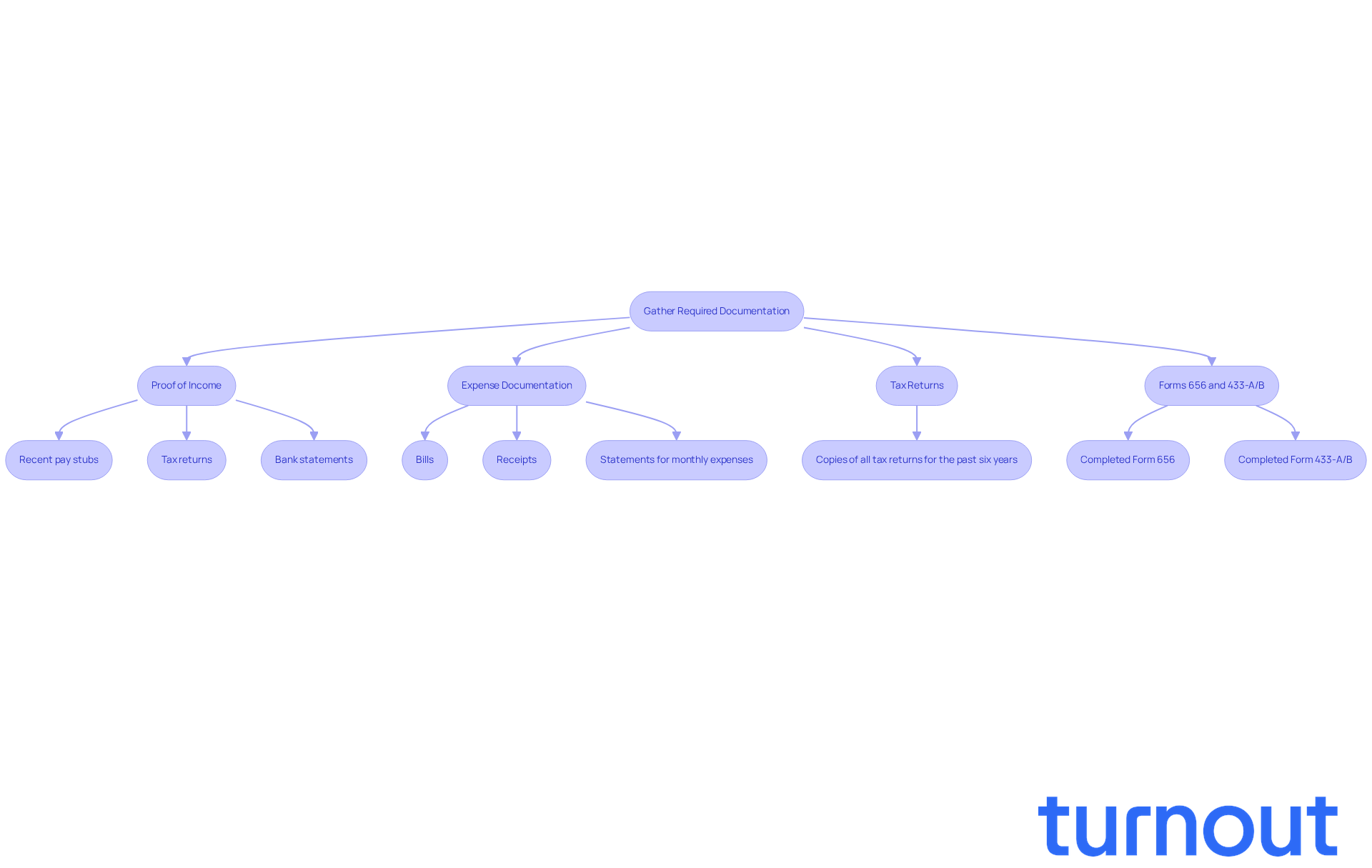

Gather Required Documentation for Your Application

If you're looking to apply for back tax forgiveness, gathering the right documentation is key. We understand that this process can feel overwhelming, but having everything in order can make a significant difference.

-

Proof of Income: Start by collecting recent pay stubs, tax returns, or bank statements to verify your income. Accurate income documentation is essential, as the IRS often scrutinizes this information. Remember, you’re not alone in this; many people face similar challenges.

-

Expense Documentation: Next, compile bills, receipts, and statements that detail your monthly expenses, including housing, utilities, and medical costs. This information helps establish your financial situation and supports your claim for relief. It’s common to feel anxious about sharing this information, but it’s a crucial step toward your financial freedom.

-

Tax Returns: Make sure you have copies of all tax returns for the past six years. The IRS requires these documents to assess your overall financial health and determine your eligibility for back tax forgiveness programs. Keeping these organized can ease some of the stress.

-

Forms 656 and 433-A/B: Complete Form 656, the Offer in Compromise request, along with Form 433-A (for individuals) or Form 433-B (for businesses). These forms provide detailed financial information. Properly completed forms are essential; mistakes can lead to rejections, and we want to help you avoid that.

It’s also important to note that all necessary federal tax deposits must be current for the quarter of submission and the two preceding quarters for businesses. Statistics show that the IRS accepts fewer than half of all requests, which highlights the significance of detailed documentation and preparation for a successful Offer in Compromise submission. Submitting a request with incomplete or incorrect documentation can lead to rejection, so meticulous attention to detail is vital.

The IRS review process can take six to 24 months, so be prepared for a potentially lengthy wait. Having these documents organized and ready will streamline your submission process, significantly reducing the likelihood of delays. Remember, we're here to help you through this journey.

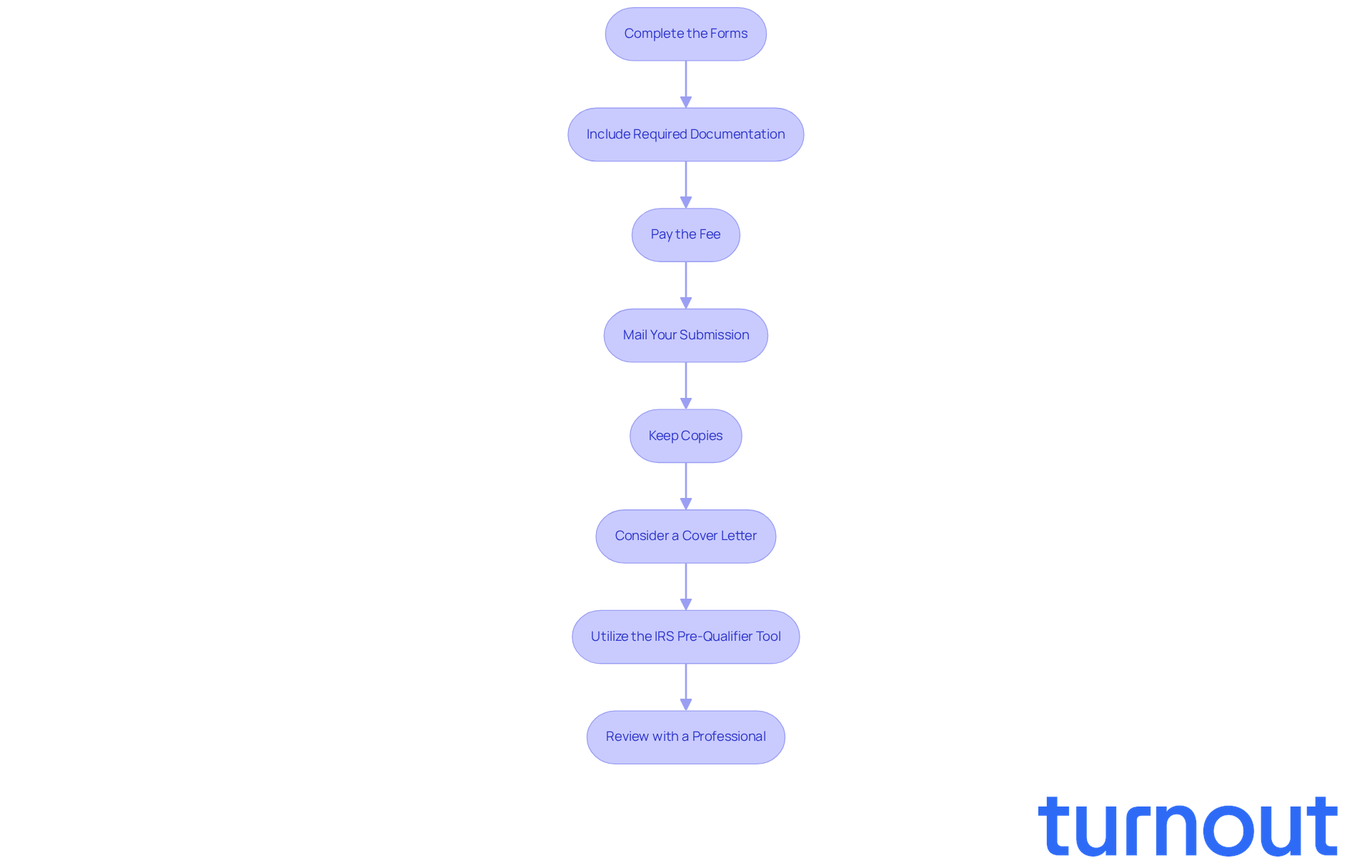

Submit Your Application for Back Tax Forgiveness

To successfully submit your application for back tax forgiveness, follow these essential steps:

-

Complete the Forms: We understand that filling out IRS Form 656 and Form 433-A/B can feel overwhelming. Take your time to accurately fill them out. Frequent mistakes, like inaccurate financial figures or missing signatures, can lead to delays or even denial of your submission. Ensuring all information is correct is crucial.

-

Include Required Documentation: It’s important to attach all necessary supporting documents that reflect your financial situation. This includes proof of income, such as pay stubs or profit and loss statements, and documentation of expenses like mortgage statements and utility bills. Remember, incomplete submissions are a common reason for rejection.

-

Pay the Fee: Don’t forget to include the non-refundable fee of $205 with your submission, unless you qualify for a fee waiver due to low income. This fee is essential for processing your request.

-

Mail Your Submission: When you’re ready, send your completed documents to the correct IRS address specified in the instructions for Form 656. Using a secure mailing method, like certified mail, ensures you can track your submission and confirm its delivery.

-

Keep Copies: It’s wise to retain copies of all documents submitted, including your request and supporting materials. This is crucial for your records and can be helpful if you need to reference your submission later.

-

Consider a Cover Letter: Including a detailed cover letter summarizing your request can clarify your intent and help organize your submission. This makes it easier for the IRS to review your case.

-

Utilize the IRS Pre-Qualifier Tool: Before submitting your request, consider using the IRS pre-qualifier tool to assess your eligibility for an Offer in Compromise (OIC). This can help you determine if pursuing an OIC is worthwhile.

-

Review with a Professional: If possible, review Form 433-A with a qualified tax professional. This can eliminate mistakes and strengthen your submission, significantly improving its accuracy.

By meticulously following these steps, you can enhance your chances of a successful request for back tax forgiveness. We know that failing to pay IRS tax liabilities can lead to penalties or asset seizure, so it’s crucial to approach this process with care. Remember, you are not alone in this journey; we’re here to help.

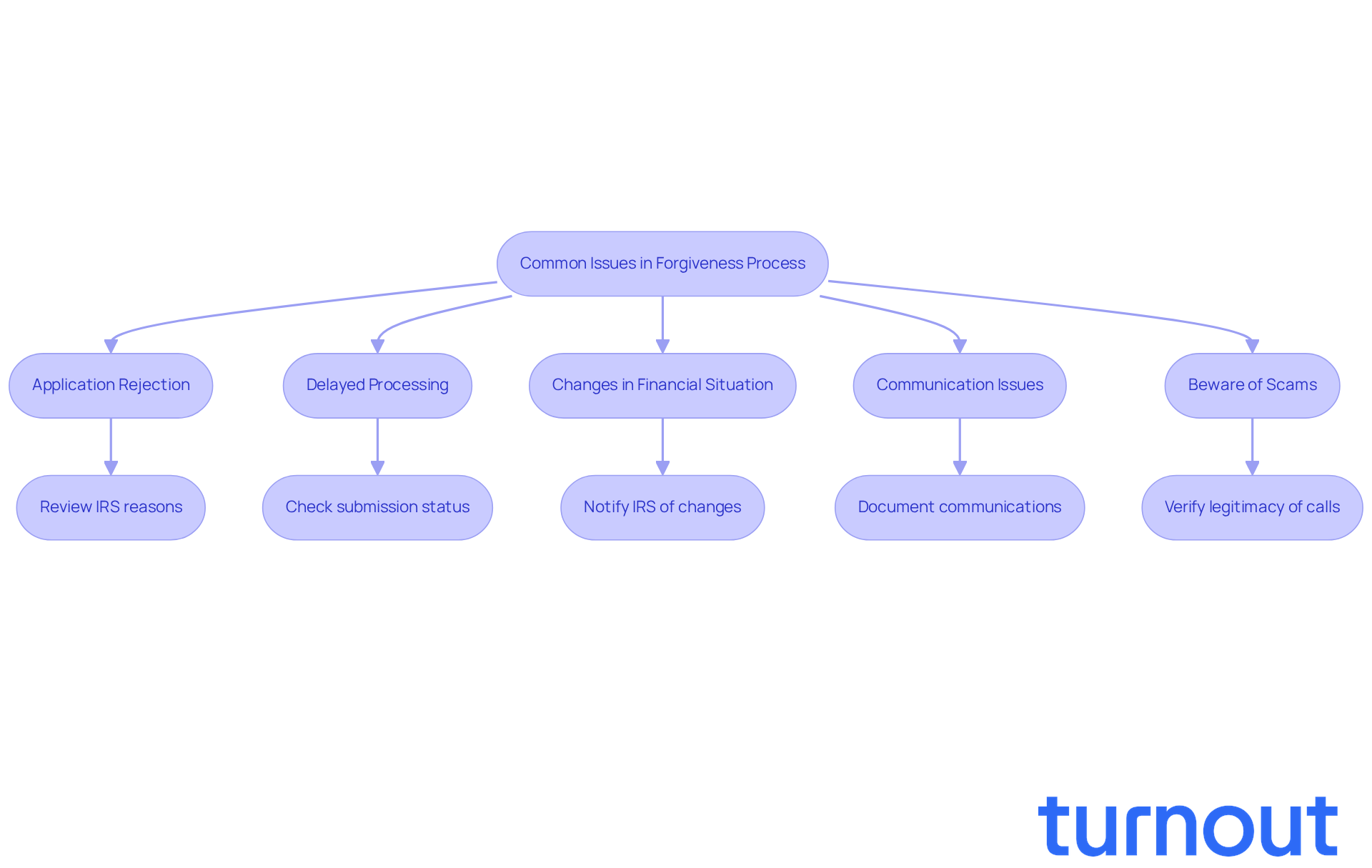

Troubleshoot Common Issues in the Forgiveness Process

Navigating the procedure for back tax forgiveness can be tough, and we recognize the challenges you may encounter. Here’s how to troubleshoot some common issues effectively:

-

Application Rejection: If your application gets rejected, take a moment to review the reasons provided by the IRS. Often, rejections stem from incomplete forms or insufficient documentation. Address these issues and resubmit your request as soon as you can. Remember, persistence is key.

-

Delayed Processing: If your submission is taking longer than expected, it’s important to reach out to the IRS to check the status. Be prepared to share your submission details. Delays can happen due to high volumes of entries or missing information. The IRS generally prefers to work with taxpayers to resolve debt issues, so keeping the lines of communication open is crucial.

-

Changes in Financial Situation: If your financial circumstances change after you’ve submitted your application, let the IRS know right away. Situations like job loss or unexpected medical expenses can greatly impact your eligibility for relief. You’re not alone in this; many face similar challenges.

-

Communication Issues: Keep thorough records of all your communications with the IRS. If you have questions or need clarification, don’t hesitate to reach out for help. Documenting every interaction can clear up misunderstandings and speed up the process. Tax advisors often recommend being proactive in your communications to boost your chances of success.

-

Beware of Scams: It’s essential to be cautious of tax debt relief calls, as some may be scams targeting those in vulnerable situations. Always verify the legitimacy of any communication regarding your tax matters. Legitimate organizations won’t ask for personal information over the phone without prior contact.

By being proactive and prepared, you can navigate these common issues more effectively. Remember, you have the support of Turnout's trained nonlawyer advocates and IRS-licensed enrolled agents. We’re here to assist you in achieving back tax forgiveness.

Conclusion

Navigating the path to back tax forgiveness can feel overwhelming, and we understand that. But knowing your options and the processes available can empower you to take control of your tax situation. By recognizing the different types of tax debts and their corresponding relief programs - like the Offer in Compromise and the Fresh Start Program - you can approach your application for forgiveness with confidence.

Throughout this journey, we’ve outlined essential steps to help you. From determining your eligibility and gathering necessary documentation to submitting your application and troubleshooting common issues, each step is crucial. Key factors such as your filing status, income level, and financial hardship play a vital role in qualifying for relief. Remember, meticulous preparation of your paperwork can significantly impact your application’s success. Engaging with the IRS and maintaining clear communication is essential to overcoming any challenges that may arise.

Ultimately, the journey toward back tax forgiveness is not just about alleviating financial burdens; it’s about reclaiming your peace of mind. By taking proactive steps, staying informed, and seeking assistance when needed, you can effectively work toward resolving your tax debts. Embracing these strategies will pave the way for a brighter financial future. Remember, understanding and utilizing available tax forgiveness options is key, and you are not alone in this journey.

Frequently Asked Questions

What are the main types of tax debts?

The main types of tax debts include Income Tax (taxes on earnings from employment or investments), Payroll Tax (taxes withheld from employee wages for Social Security and Medicare), and Property Tax (taxes based on property ownership).

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program that allows taxpayers to settle their tax debt for less than the total amount owed, making it a beneficial option for those struggling to pay their full tax bill.

How will the OIC program change in 2025?

In 2025, the OIC program will expand its eligibility criteria, focusing more on a taxpayer's ability to pay rather than just the size of their debt, making it a viable option for more individuals.

What is the Fresh Start Program?

The Fresh Start Program offers relief for individuals who owe less than $50,000, streamlining the process for quicker approvals for tax relief.

What must be done before applying for IRS tax relief options?

All tax returns must be filed before applying for IRS tax relief options like the Offer in Compromise or installment agreements.

What are the eligibility criteria for back tax forgiveness?

The eligibility criteria for back tax forgiveness include having all required tax returns filed, meeting specific income level thresholds, demonstrating financial hardship, and not being in an active bankruptcy proceeding.

How does financial hardship affect eligibility for tax relief?

To qualify for tax relief, you must demonstrate that paying your tax debt would cause significant financial hardship, which may involve showing low income or high expenses.

What happens to collection activities while the OIC is being assessed?

While the Offer in Compromise is being assessed, the IRS will halt collection activities, providing the taxpayer with some relief during this process.