Overview

Facing unfiled tax returns can be overwhelming, and it's important to understand the consequences of non-filing. We recognize that many individuals may feel anxious about their situation. That's why we've outlined five actionable steps to help you navigate this challenge with confidence.

- First, gather all necessary documentation. This step is crucial in preparing for what lies ahead.

- Next, consider seeking professional assistance. Experts can provide valuable guidance tailored to your unique circumstances.

- Additionally, the Voluntary Disclosures Program (VDP) is a helpful resource. It allows individuals to come forward and address their tax obligations without facing harsh penalties.

- Remember, you are not alone in this journey; many have successfully restored their compliance through proactive measures.

- Finally, maintaining ongoing compliance is essential. By staying informed and organized, you can mitigate future issues.

Each of these steps is supported by expert advice and real-world examples, illustrating how taking action can lead to a more secure financial future. We’re here to help you every step of the way.

Introduction

Understanding unfiled tax returns can feel overwhelming, especially when considering the potential consequences that may arise for those who overlook their responsibilities. We understand that the thought of penalties, compounded interest, and even legal issues can be daunting. It's essential for taxpayers to recognize the importance of confronting this matter directly.

In this article, we offer a clear roadmap through five actionable steps designed to empower you to regain compliance with your tax filings. But you may wonder: what are the most effective strategies to navigate the complexities of unfiled tax returns, and how can you avoid the pitfalls that lead to greater financial strain?

You're not alone in this journey, and we're here to help guide you through it.

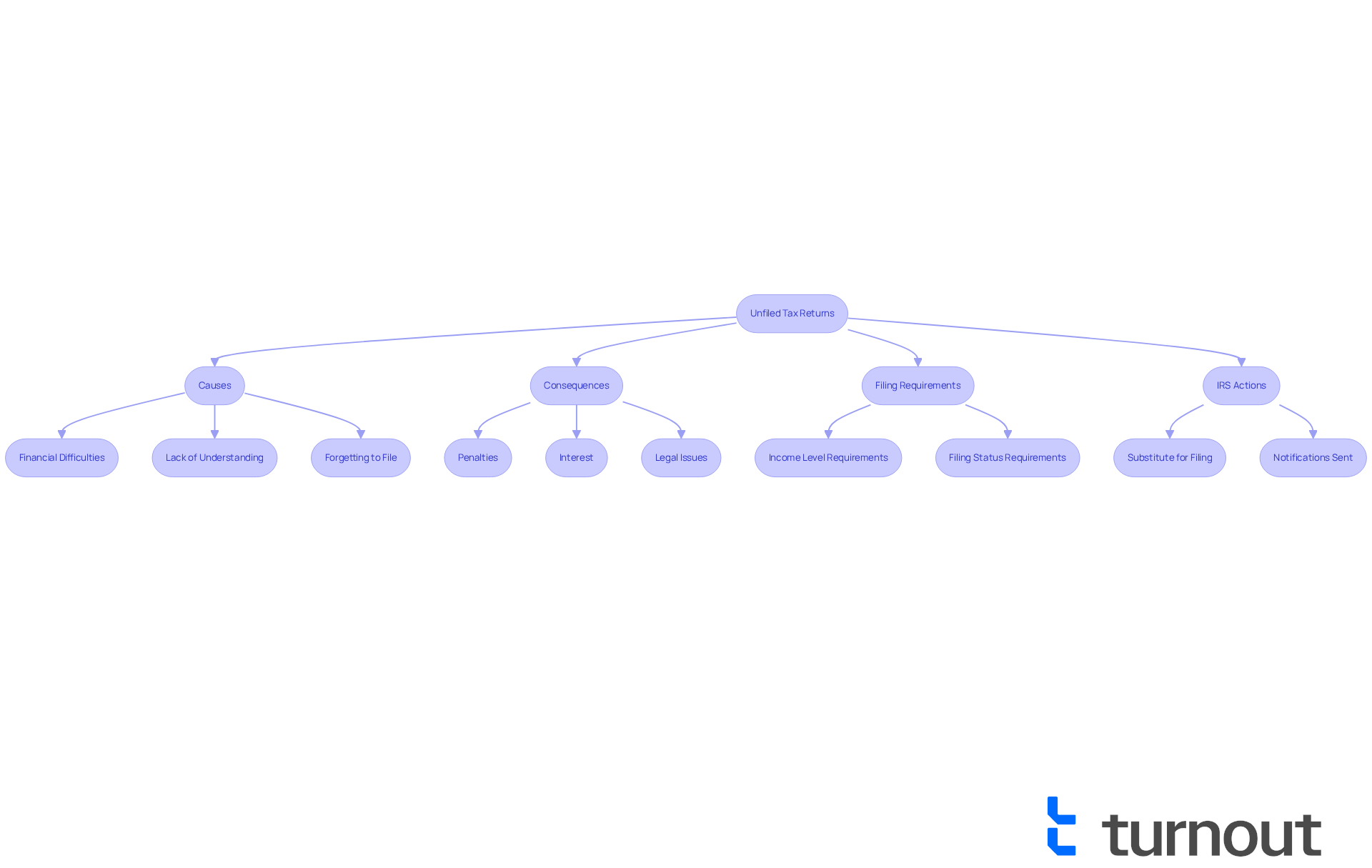

Understand Unfiled Tax Returns

Unfiled tax documents refer to any federal income tax form that has not been submitted by its due date. We understand that this situation can arise for various reasons, such as financial difficulties, lack of understanding of tax obligations, or even forgetting to file. The consequences of failing to file can be severe, including hefty penalties, interest on unpaid taxes that compounds daily, and potential legal repercussions. Grasping these consequences is the initial phase in receiving unfiled tax returns help efficiently. It's crucial to acknowledge that the IRS can seek unsubmitted filings indefinitely, making it vital to act sooner rather than later.

Many individuals mistakenly assume that if they do not owe taxes, they are not required to submit a declaration. However, filing requirements depend on income level, filing status, and age. For example:

- Single filers under 65 must file if they earned $14,600 or more.

- Married couples filing jointly need to file if their combined income exceeds $29,200.

- Individuals over the age of 65 and self-employed individuals have different filing requirements that must be understood to ensure compliance.

Real-world examples demonstrate the seriousness of unsubmitted tax filings. The IRS has intensified efforts to pursue individuals who fail to file, particularly targeting high-income earners. In early 2024, the agency sent notifications to 125,000 individuals making over $400,000 each year, encouraging them to submit documents for absent tax years since 2017. This initiative led to compliance from 26,000 taxpayers, resulting in nearly $292 million in recovered taxes.

Tax specialists emphasize that unfiled tax returns help in addressing the significance of dealing with outstanding filings swiftly. As one specialist remarked, 'Addressing overdue tax submissions can be stressful, but taking proactive measures to submit unfiled tax returns helps in evading additional penalties, interest, and severe IRS enforcement actions.' Ignoring the issue can lead to severe penalties, including potential IRS actions such as liens and wage garnishments, which can significantly impact financial stability. Additionally, if filings are not submitted, the IRS may create a Substitute for Filing (SFF), which usually does not encompass qualifying deductions or credits and can considerably increase tax liabilities.

In summary, grasping the consequences of unsubmitted tax documents is the initial step in effectively tackling them, as unfiled tax returns help in understanding the issues. By collecting required paperwork and submitting overdue filings, you can restore compliance and reduce the anxiety related to unpaid obligations. Consulting a tax professional for guidance can also provide valuable support in navigating these complexities. Remember, you are not alone in this journey, and we're here to help.

Gather Necessary Documentation

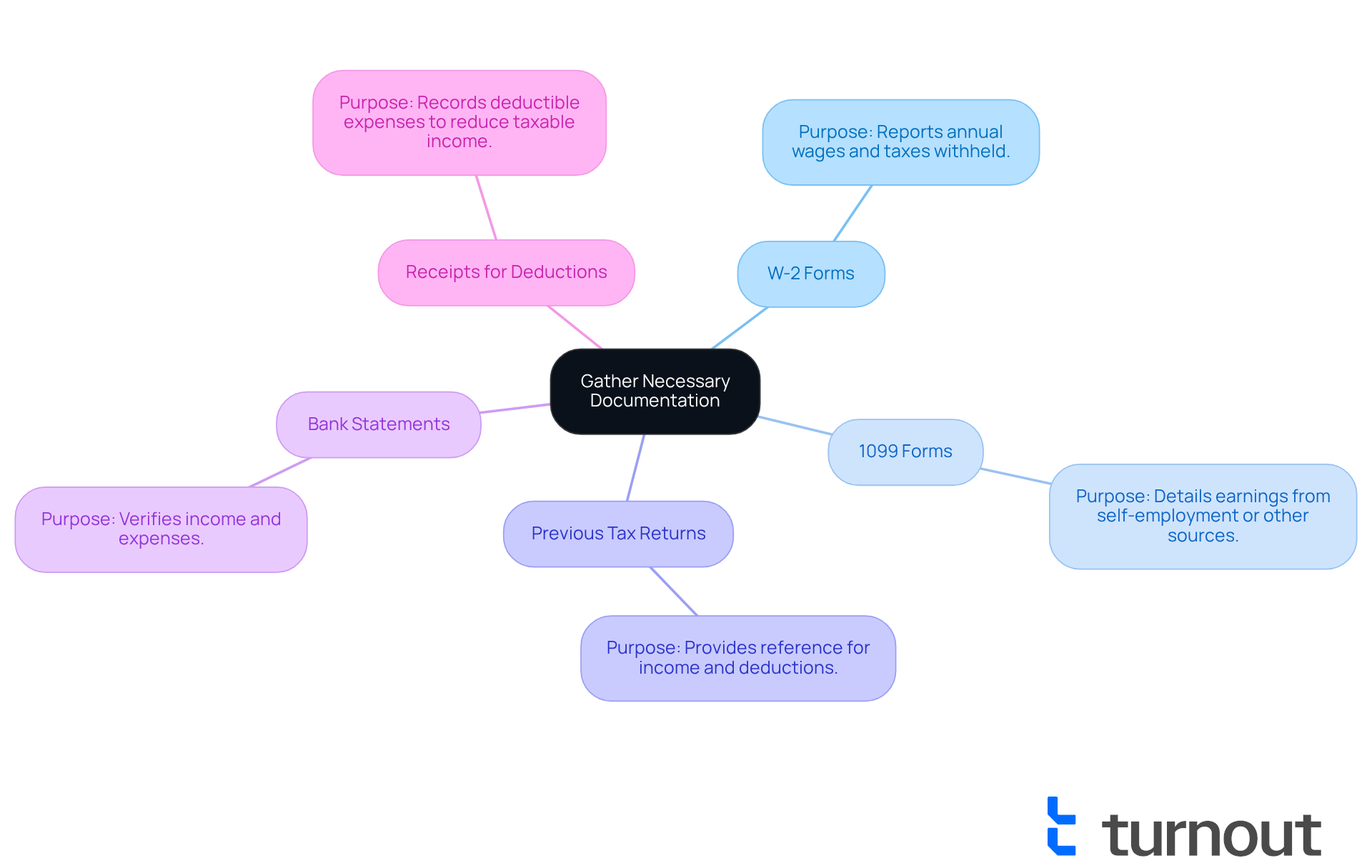

To successfully file your unfiled tax returns help, we understand that gathering key documents can feel overwhelming. Here are some essential items to collect:

- W-2 Forms: These forms report your annual wages and the taxes withheld from your paycheck, serving as a primary source of income verification.

- 1099 Forms: If you are self-employed or received income from other sources, these forms detail your earnings and are essential for accurate reporting.

- Previous Tax Returns: If available, these can provide a reference for your income and deductions, helping to ensure consistency in your filings.

- Bank Statements: These documents can help verify income and expenses, offering a comprehensive view of your financial situation.

- Receipts for Deductions: Keep records of any deductible expenses, such as medical bills or business expenses, as they can significantly reduce your taxable income.

It's common to feel uncertain about what you need, but typically, individuals may need to collect approximately five to ten various kinds of documents to effectively seek unfiled tax returns help for the 2025 tax year. Organizing these documents not only streamlines the filing process but also enhances accuracy, reducing the likelihood of errors that could lead to penalties. Tax experts emphasize the importance of having all necessary documentation ready, as unfiled tax returns help simplify the process and ensure compliance with IRS requirements.

Additionally, the IRS advises taxpayers to file on time and request an extension if needed to avoid penalties. For further guidance, we encourage you to visit the IRS's 'Get ready' page on IRS.gov, which offers practical tips and resources for tax preparation. Taking these proactive steps can save time and prevent potential legal issues down the line. Remember, you are not alone in this journey; we're here to help you navigate through it.

Seek Professional Assistance

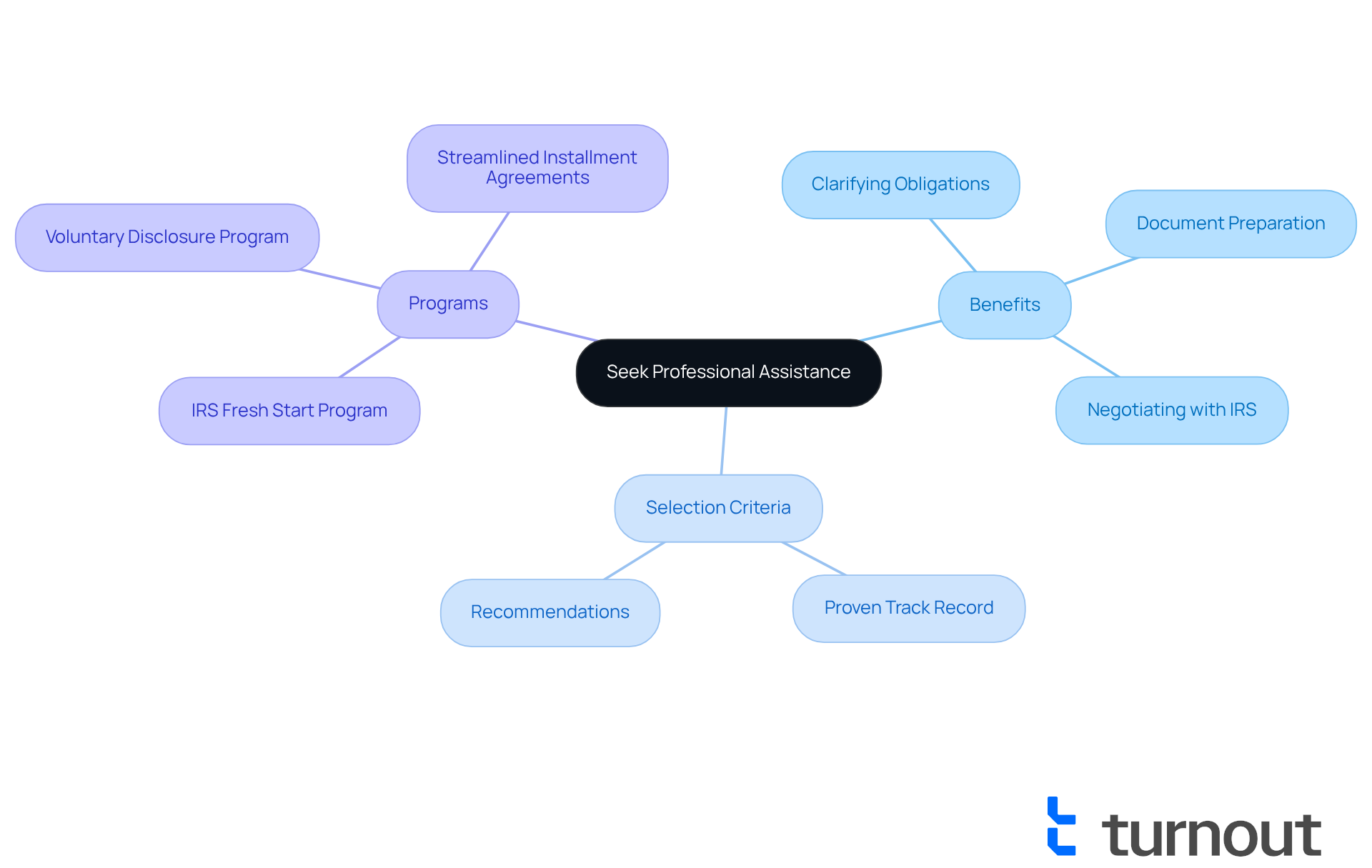

It's common to feel overwhelmed by the thought that unfiled tax returns help when submitting overdue tax documents. We understand that this can be a stressful time, and seeking help from a skilled tax expert can truly make a difference. These professionals provide invaluable insights and can guide you through the complexities of the tax system with compassion and care.

When selecting a specialist, consider those with a proven track record in managing uncategorized filings and positive feedback from clients. Recommendations from friends or family can be invaluable, and online reviews might also assist you in making an informed choice. A skilled professional can support you in several ways:

- Clarifying your tax obligations, ensuring you fully understand what is required.

- Accurately preparing and submitting your documents to avoid future complications.

- Negotiating with the IRS on your behalf, if necessary, to secure favorable terms.

Investing in professional assistance not only saves you time but can also significantly reduce potential penalties. Many taxpayers who engage professionals report successful outcomes, such as lowered penalties and smoother filing processes. The cost of hiring a tax expert for unsubmitted filings in 2025 varies, yet many find that unfiled tax returns help to make the benefits far outweigh the expenses—especially when considering the potential for penalty reduction and compliance reinstatement.

Additionally, programs like the IRS Fresh Start Program can provide further support in managing tax obligations and outstanding filings. Taking proactive steps now can lead to a more manageable tax situation and peace of mind. Remember, you are not alone in this journey; we're here to help.

Utilize the Voluntary Disclosures Program (VDP)

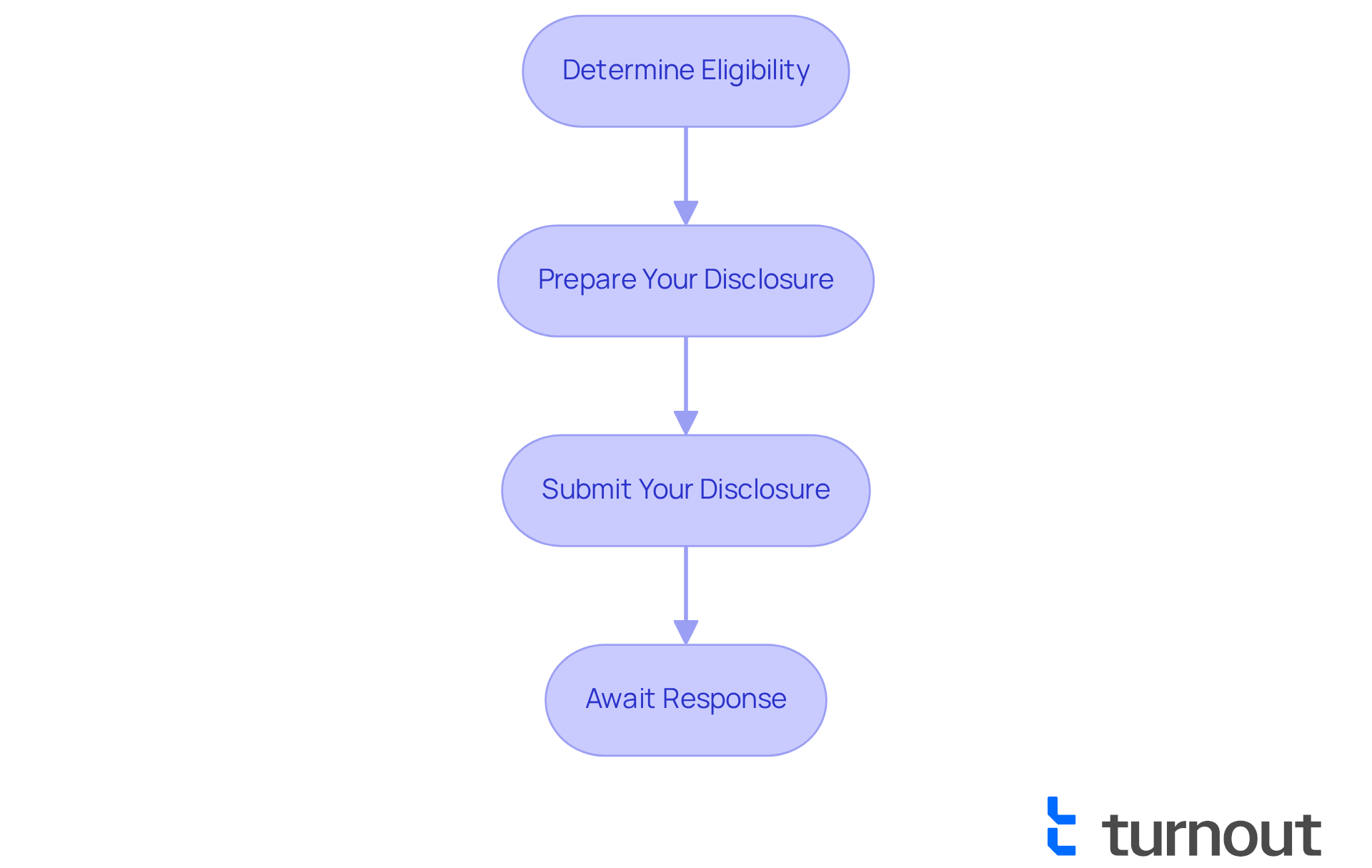

The Voluntary Disclosures Program (VDP) offers unfiled tax returns help by allowing taxpayers with unsubmitted filings the chance to come forward voluntarily. This can lead to lower penalties and help you avoid criminal prosecution. Let’s explore how to make the most of the VDP together:

-

Determine Eligibility: First, confirm that you meet the program's criteria. Generally, this means you are non-compliant with your tax obligations. Remember, this program is here for those who want to correct their tax status without facing severe penalties.

-

Prepare Your Disclosure: Next, gather all required documentation and organize your tax filings for the years you haven’t submitted. Accurate and complete disclosures are crucial for a successful application, and we’re here to support you in this process.

-

Submit Your Disclosure: Once you’re ready, file your submissions and any necessary forms under the VDP. This may involve submitting a specific application form to the IRS. Be sure that all information is truthful and complete, as this will help ease your journey.

-

Await Response: After submission, the IRS will review your disclosure and inform you of any penalties or actions required. The VDP aims to facilitate a smoother resolution process for taxpayers like you.

Utilizing the VDP can significantly simplify the resolution of unfiled tax returns help. In 2025, many taxpayers who engaged with the VDP reported a notable increase in relief from penalties. These individuals often experienced reduced penalties and improved compliance status, showcasing the program's effectiveness.

As one expert noted, "The interest and penalty relief available to successful VDP applicants has been increased," highlighting the advantages of the program. It’s important to stay informed about upcoming changes to the VDP set to take effect on October 1, 2025. However, we understand that the VDP process can be complex. It’s essential to recognize the challenges that may arise, but remember, you are not alone in this journey. We are here to help you navigate through it.

File Outstanding Returns

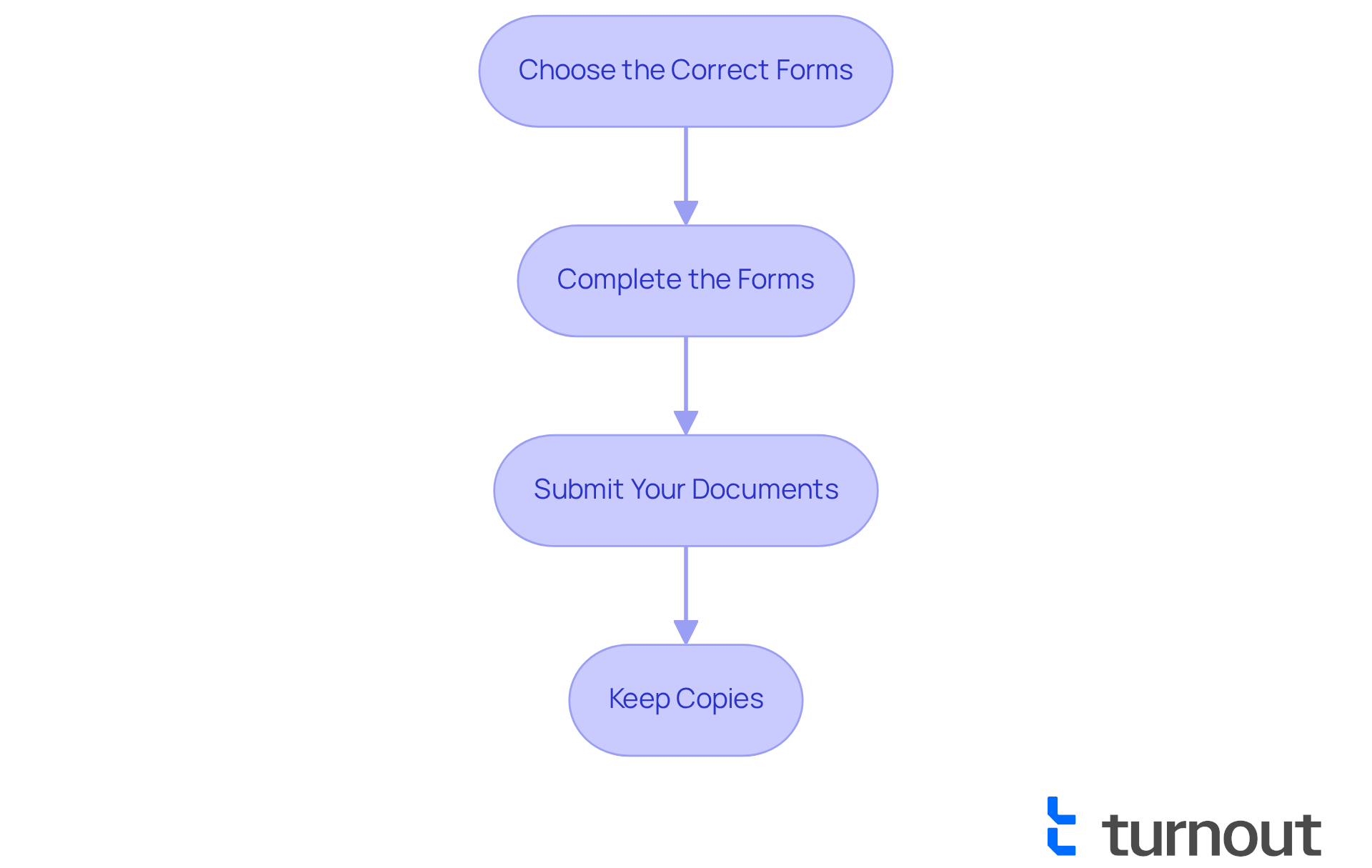

Once you have gathered your documentation and sought expert help if needed, it’s time to submit your overdue tax filings. We understand that this can be a daunting process, but following these steps can make it easier:

- Choose the Correct Forms: Start by using the appropriate tax forms for each year you are filing. You can find these on the IRS website, ensuring you have the latest versions.

- Complete the Forms: Take your time to fill out the forms accurately, ensuring that all income and deductions are reported correctly. If you feel uncertain about any entries, consulting a tax professional can help clarify common mistakes that often lead to penalties. Remember, over fifty percent of taxpayers seek assistance from a tax expert when submitting their tax documents.

- Submit Your Documents: Once your paperwork is complete, file it either electronically or by mail. If you choose to mail your documents, consider using a certified mail service to confirm delivery. This can provide you with peace of mind.

- Keep Copies: It’s important to retain copies of all submitted forms and any correspondence with the IRS for your records. This documentation is crucial for tracking your filing status and any future communications.

Submitting your pending filings is a vital step in restoring compliance, and unfiled tax returns help you avoid additional penalties. Remember, the IRS tends to be more lenient with those who voluntarily submit overdue filings. Taking action sooner rather than later can save you money and prevent unnecessary legal troubles. It’s also important to be aware that the IRS can pursue taxpayers indefinitely for unfiled tax returns help, making it essential to address this matter swiftly. After filing, keep an eye on IRS correspondence to confirm receipt and understand the next steps. You are not alone in this journey; we’re here to help.

Maintain Ongoing Compliance

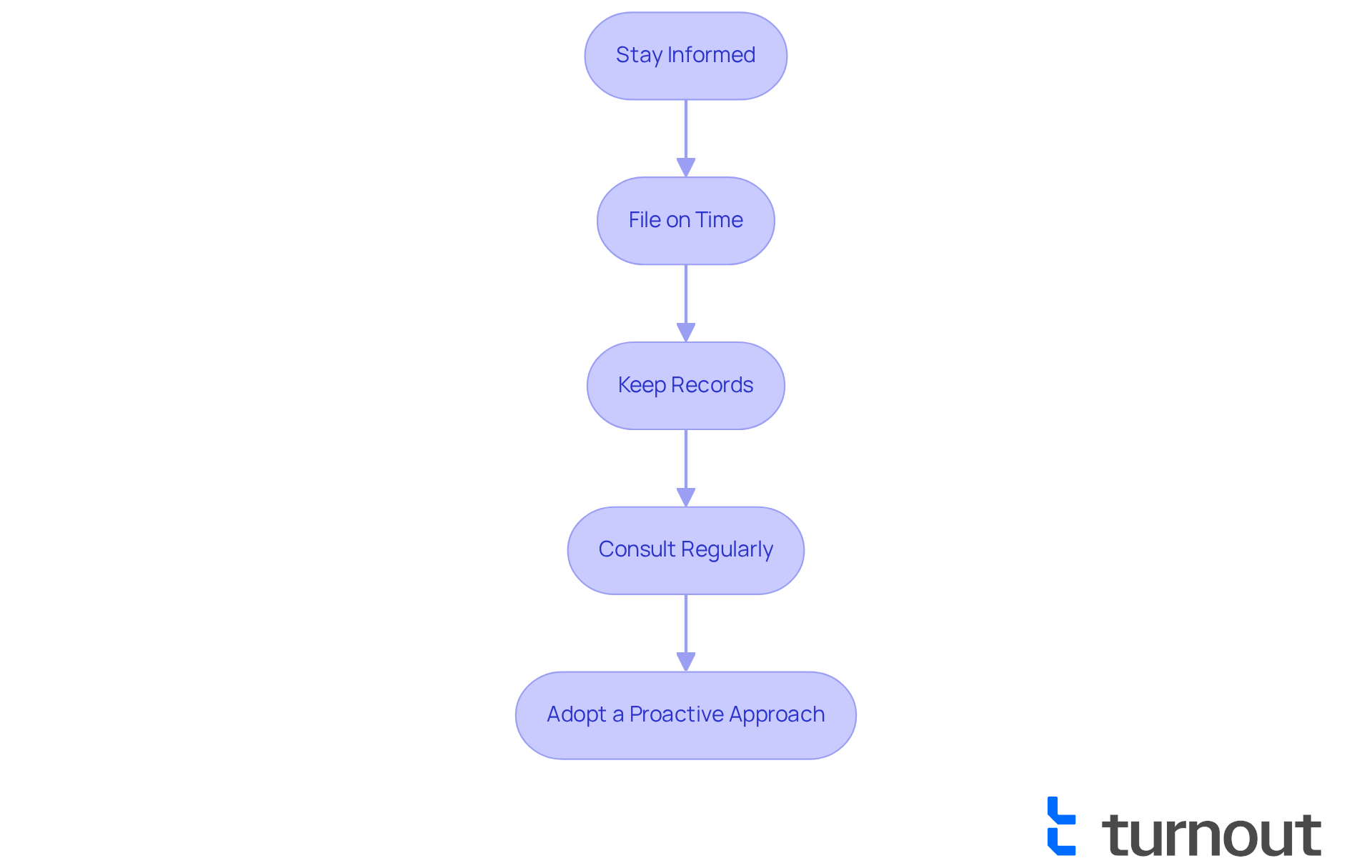

After successfully submitting your overdue tax documents, we understand that maintaining ongoing compliance is crucial to avoid future issues. Here are some supportive tips to help you stay on track:

- Stay Informed: Keeping up with tax laws and deadlines is essential. The IRS website is a valuable resource for updates. In 2025, the IRS is intensifying its enforcement against high-income individuals who did not submit their filings, highlighting the importance of remaining compliant.

- File on Time: Developing a routine to submit your tax documents by the deadline each year can alleviate stress. Consider setting reminders or using tax software that alerts you. Timely filing significantly impacts compliance statistics, reducing the likelihood of penalties.

- Keep Records: Maintaining organized records of your income, expenses, and tax documents throughout the year will make filing easier and help you avoid mistakes.

- Consult Regularly: If your financial situation changes, consulting with a tax professional is wise to ensure you meet your obligations. As Jamie Roman, a Case Management Operations Manager at Tax Law Advocates, highlights, "Remaining proactive and knowledgeable can assist you in evading the anxiety of unresolved tax documents in the future."

By adopting a proactive approach and staying informed, unfiled tax returns help you significantly reduce the stress associated with them in the future. Remember, you're not alone in this journey, and we're here to help you navigate these challenges.

Conclusion

Addressing unfiled tax returns is a crucial step toward restoring your financial stability and ensuring compliance with the IRS. We understand that the implications of failing to file, such as potential penalties and legal repercussions, can feel overwhelming. Recognizing these challenges sets the foundation for proactive measures that can alleviate your concerns.

Taking action promptly not only mitigates risks but also opens pathways for effective resolution. By doing so, you can move forward without the burden of unresolved tax issues. Key strategies to consider include:

- Gathering essential documentation

- Seeking professional assistance

- Utilizing programs like the Voluntary Disclosures Program (VDP)

- Maintaining ongoing compliance

Each of these steps plays a vital role in simplifying the filing process and reducing anxiety associated with overdue tax obligations.

Engaging with tax experts can provide invaluable support, while organized documentation can streamline submissions and enhance accuracy. It's common to feel uncertain about where to start, but remember, you are not alone in this journey. Ultimately, the path toward resolving unfiled tax returns is manageable with the right approach and resources.

By taking decisive action and remaining informed about your tax obligations, you can navigate these challenges effectively. Embracing a proactive mindset not only alleviates immediate concerns but also fosters long-term compliance, ensuring a more secure financial future. We're here to help you every step of the way.

Frequently Asked Questions

What are unfiled tax returns?

Unfiled tax returns refer to any federal income tax form that has not been submitted by its due date. This situation can arise due to various reasons, including financial difficulties, lack of understanding of tax obligations, or forgetting to file.

What are the consequences of not filing tax returns?

Failing to file tax returns can lead to severe consequences, including hefty penalties, interest on unpaid taxes that compounds daily, and potential legal repercussions. The IRS can seek unsubmitted filings indefinitely.

Do I need to file a tax return if I don’t owe taxes?

Many individuals mistakenly believe that if they do not owe taxes, they are not required to file. However, filing requirements depend on income level, filing status, and age.

What are the filing requirements for single filers and married couples?

Single filers under 65 must file if they earned $14,600 or more. Married couples filing jointly need to file if their combined income exceeds $29,200. Different requirements apply to individuals over 65 and self-employed individuals.

How has the IRS responded to unfiled tax returns in recent years?

The IRS has intensified efforts to pursue individuals who fail to file, particularly targeting high-income earners. In early 2024, they sent notifications to 125,000 individuals making over $400,000 annually, resulting in compliance from 26,000 taxpayers and nearly $292 million in recovered taxes.

What should I do if I have unfiled tax returns?

It is important to address overdue tax submissions promptly to avoid additional penalties, interest, and severe IRS enforcement actions. Consulting a tax professional can provide valuable support in navigating these complexities.

What documentation do I need to gather for filing unfiled tax returns?

Essential documents include W-2 forms, 1099 forms, previous tax returns, bank statements, and receipts for deductions. Collecting approximately five to ten various kinds of documents can help streamline the filing process.

How can I ensure compliance when filing my unfiled tax returns?

Organizing necessary documentation before filing enhances accuracy and reduces the likelihood of errors. The IRS also advises filing on time and requesting an extension if needed to avoid penalties.

Where can I find more guidance on tax preparation?

For further guidance, you can visit the IRS's 'Get ready' page on IRS.gov, which offers practical tips and resources for tax preparation.