Introduction

Navigating the labyrinth of tax settlement services can often feel like an uphill battle, especially for those weighed down by tax debts. We understand that this journey can be overwhelming. These specialized services promise a lifeline, offering various avenues for relief - from Offers in Compromise to installment agreements. Yet, the path to financial recovery is fraught with challenges, including the critical need for accurate documentation and realistic expectations regarding outcomes.

How can you ensure you make the most of these services while avoiding common pitfalls? It’s common to feel uncertain, but this article delves into essential best practices that empower you to navigate tax settlement services effectively. Together, we can pave the way toward a more secure financial future.

Understand Tax Settlement Services and Their Functionality

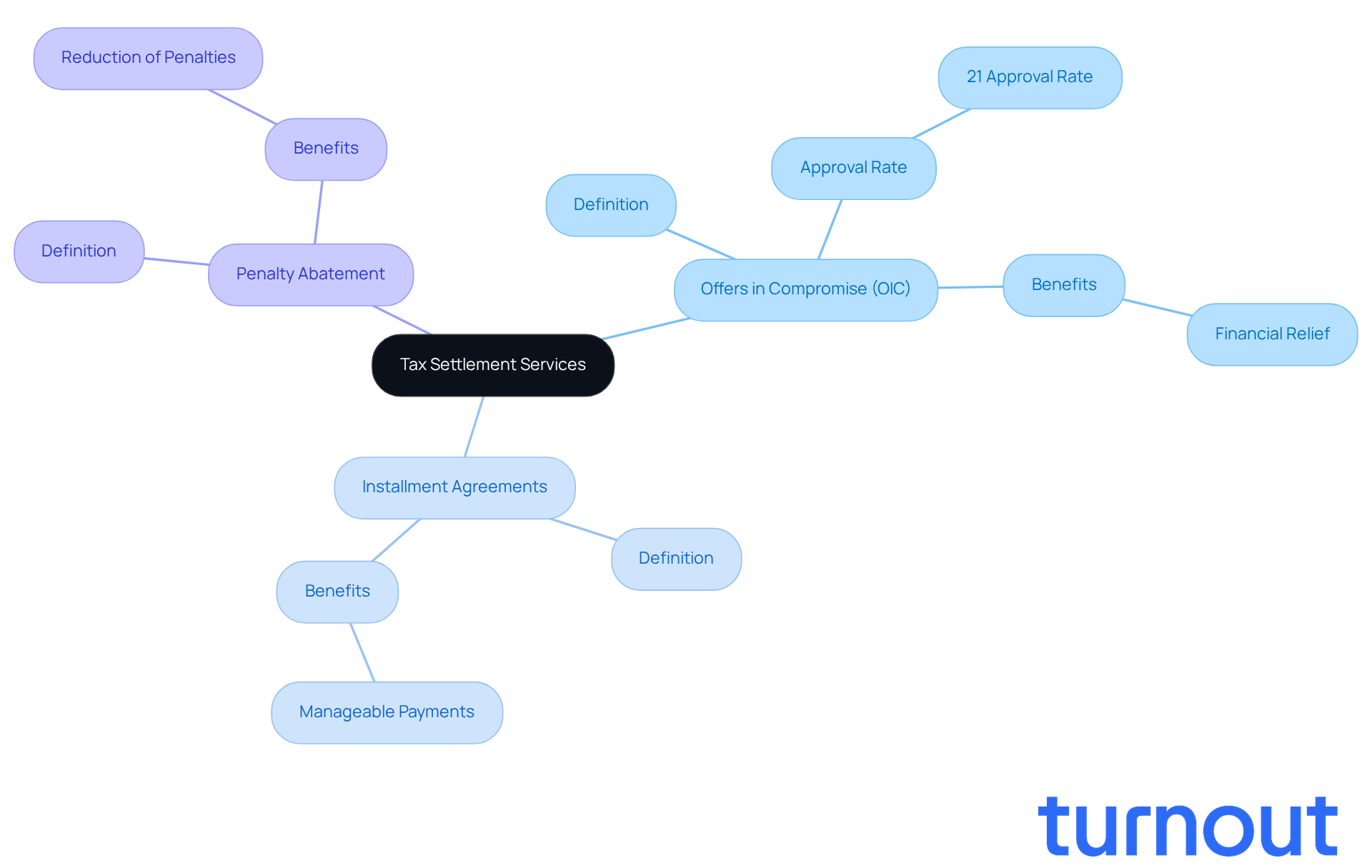

Tax resolution assistance is vital for those grappling with tax debts, whether to the IRS or state tax authorities. We understand that this can be a daunting experience. These services offer various options, such as:

- Offers in Compromise (OIC)

- Installment agreements

- Penalty abatement

An OIC, for instance, allows taxpayers to settle their debts for less than the total amount owed, providing much-needed financial relief. However, it's important to note that only 21% of OIC submissions are approved, highlighting the need for accuracy and thoroughness in disclosures during the evaluation process.

Tax settlement services are here to help. They typically offer consultations to assess individual situations and recommend the best strategies tailored to your needs. For example, a recent case study revealed that taxpayers who worked with professionals often enjoyed a smoother negotiation process, leading to more favorable outcomes. By exploring these options, you can take proactive steps to resolve your tax debts effectively. Remember, you are not alone in this journey; we’re here to support you as you navigate the complexities of tax negotiations.

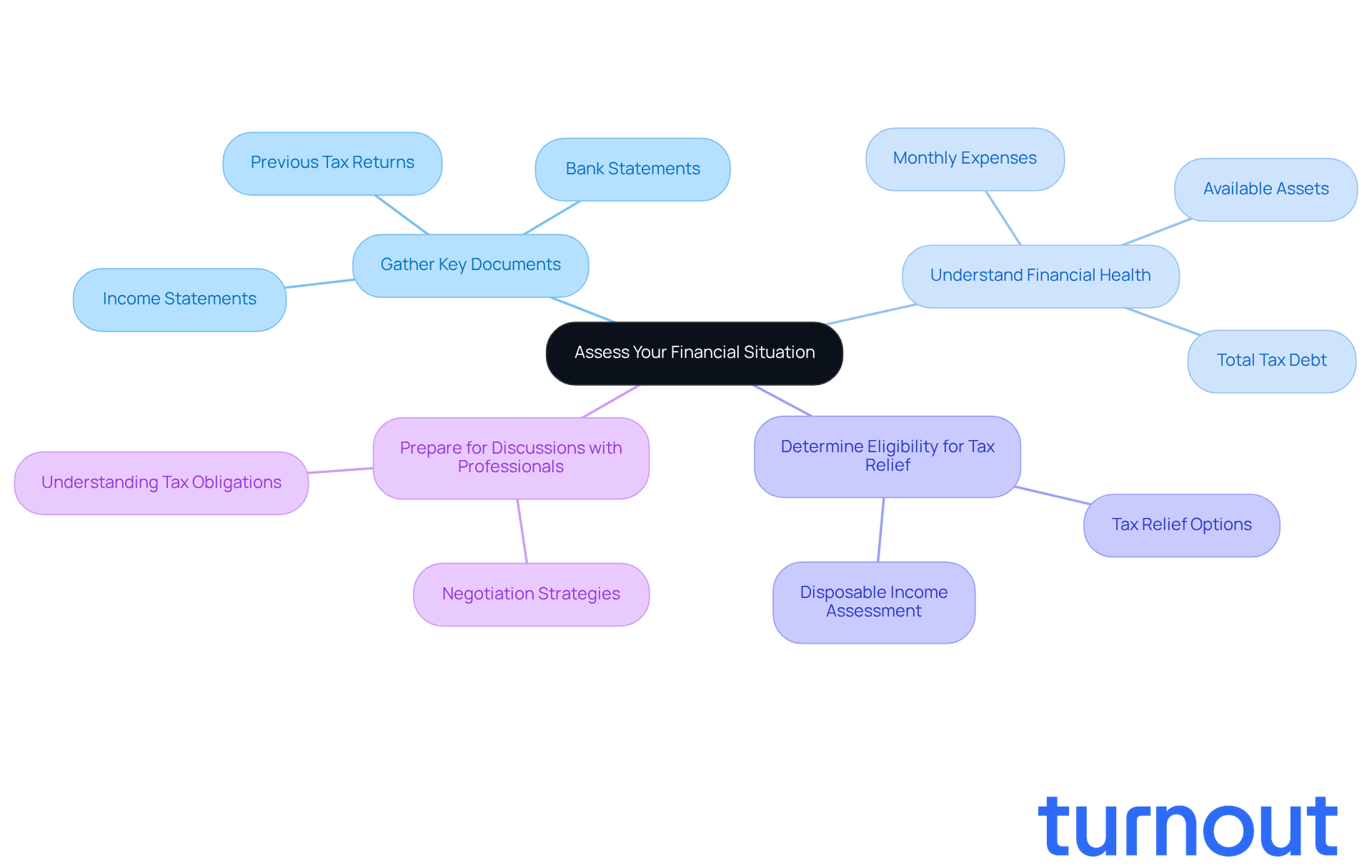

Assess Your Financial Situation Before Seeking Help

It’s important to take a moment for a thorough evaluation of your financial situation before reaching out to tax settlement services. We understand that this can feel overwhelming, but gathering key documents like income statements, bank statements, and previous tax returns is a crucial first step. By understanding your total tax debt, monthly expenses, and available assets, you’ll gain a clearer picture of your financial health.

This self-assessment not only helps you determine your eligibility for various tax relief options but also prepares you for meaningful discussions with tax professionals about tax settlement services. For instance, knowing your disposable income can empower you to negotiate a more favorable settlement with the IRS. Remember, as Richard M. Nixon once said, 'Paying taxes is essential to avoid trouble.' This highlights the importance of being informed about your financial obligations.

Research shows that individuals who conduct thorough financial evaluations before pursuing tax resolution options are more likely to achieve favorable results. This step is essential in your journey toward financial relief. Additionally, reflecting on John F. Kennedy's insight that high tax rates can lead to low revenues underscores the significance of understanding your financial landscape during negotiations.

You are not alone in this journey. We’re here to help you navigate these challenges and find the best path forward.

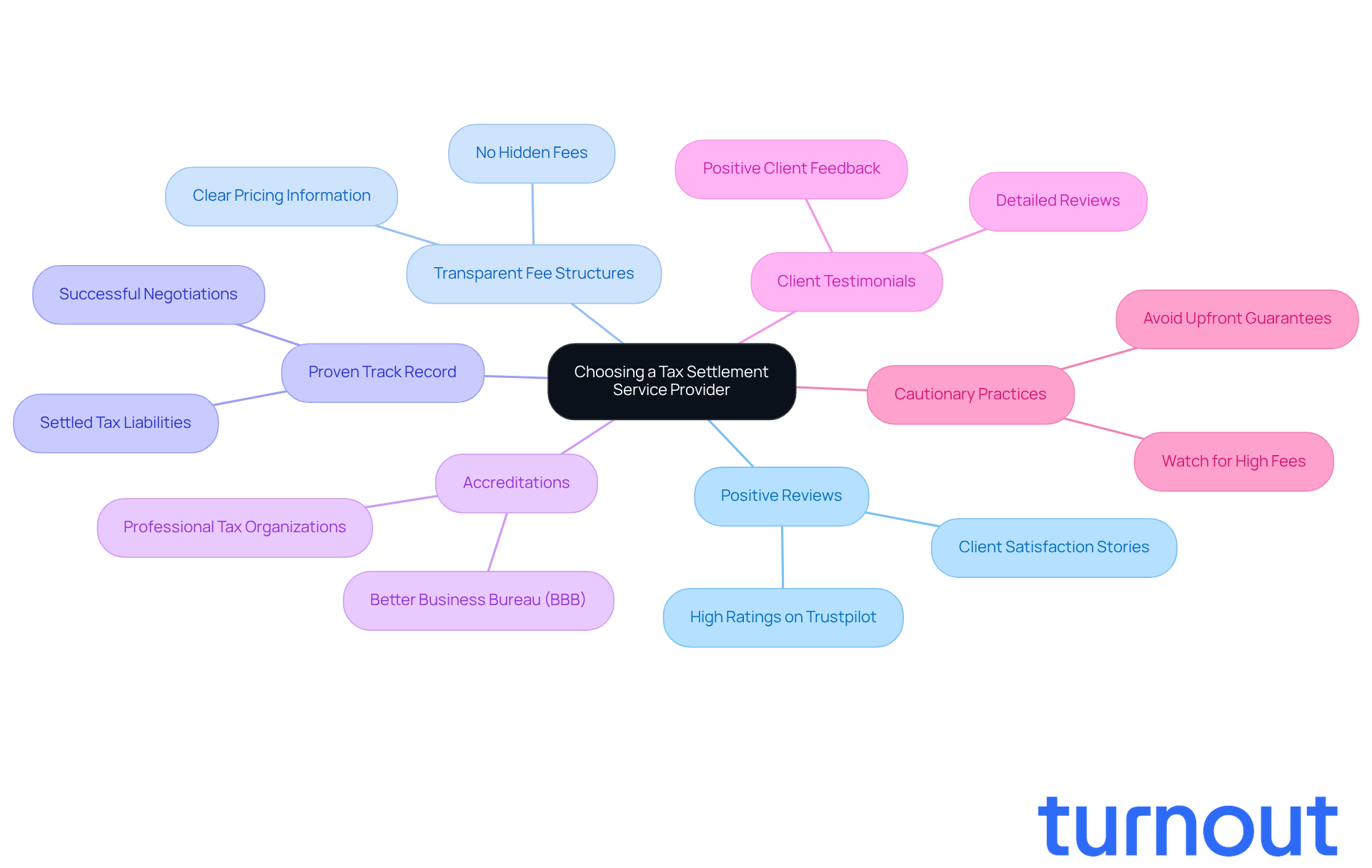

Choose a Reputable Tax Settlement Service Provider

Choosing a tax settlement services provider can feel overwhelming, and we understand that. It’s crucial to do your homework. Look for companies that have positive reviews and transparent fee structures. A proven track record of successful negotiations is essential.

Check for accreditations from trusted organizations like the Better Business Bureau (BBB). Reading testimonials from previous clients can also provide valuable insights. Remember, it’s common to feel uncertain about whom to trust.

Be cautious of firms that provide tax settlement services and make improbable guarantees or ask for advance payments without clearly explaining their services. Respected companies often offer a complimentary consultation to assess your situation before discussing costs. This way, you’ll know exactly what to expect from their offerings.

You are not alone in this journey. We’re here to help you navigate these choices with confidence.

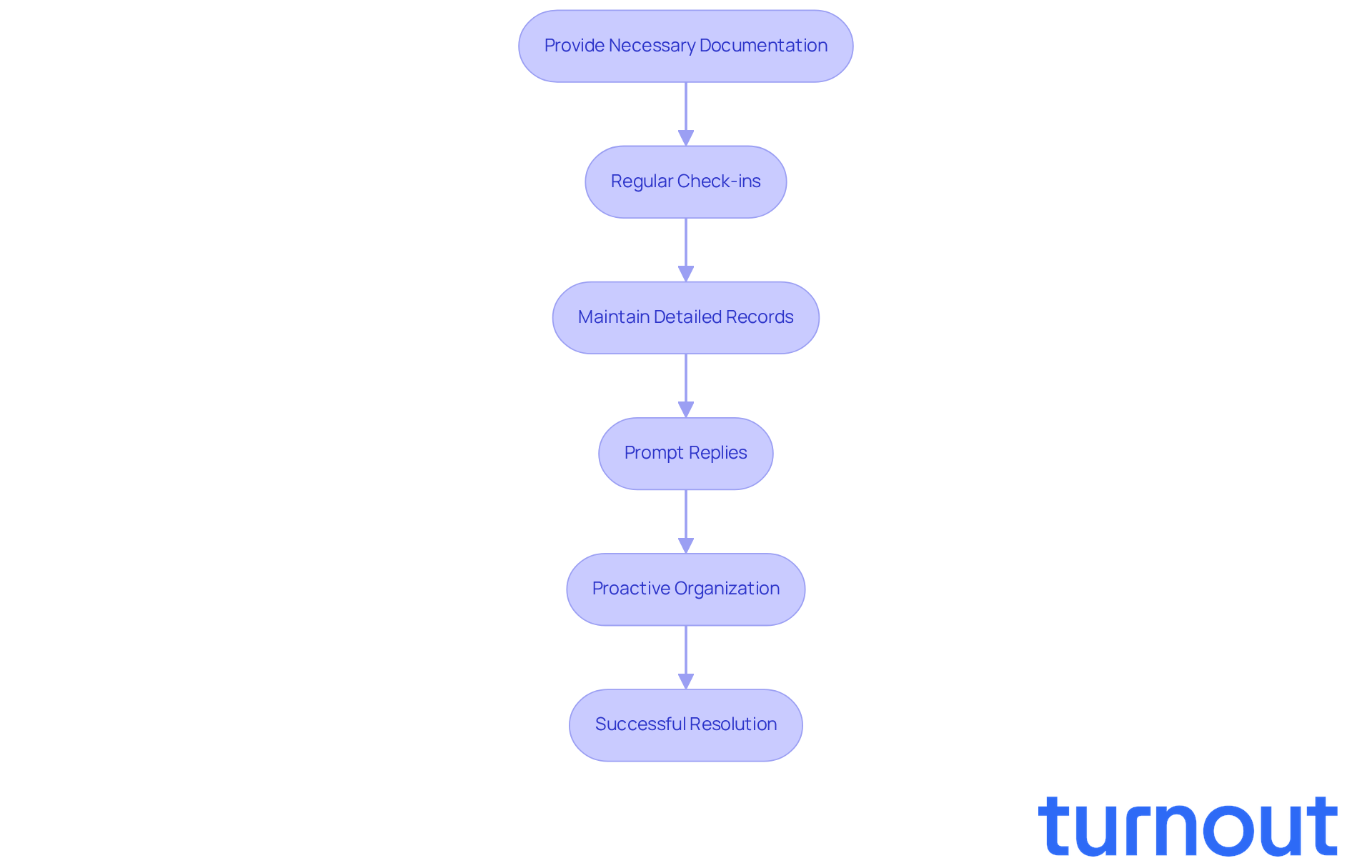

Maintain Clear Communication and Documentation

Effective communication with your tax settlement services provider is essential for finding a successful resolution. We understand that navigating this process can be overwhelming. That’s why it’s important to promptly provide all necessary documentation, including financial statements and any correspondence from the IRS. Regular check-ins with your provider can help you stay informed about your case's progress, easing some of that stress.

Additionally, maintaining a detailed record of all communications - emails, phone calls, and meetings - creates a comprehensive history of your interactions. This meticulous documentation can be invaluable in resolving any disputes that may arise during negotiations. Tax experts emphasize that organized documentation not only simplifies the process but also significantly affects the speed of resolution. Prompt replies and well-maintained records can accelerate communication with the IRS.

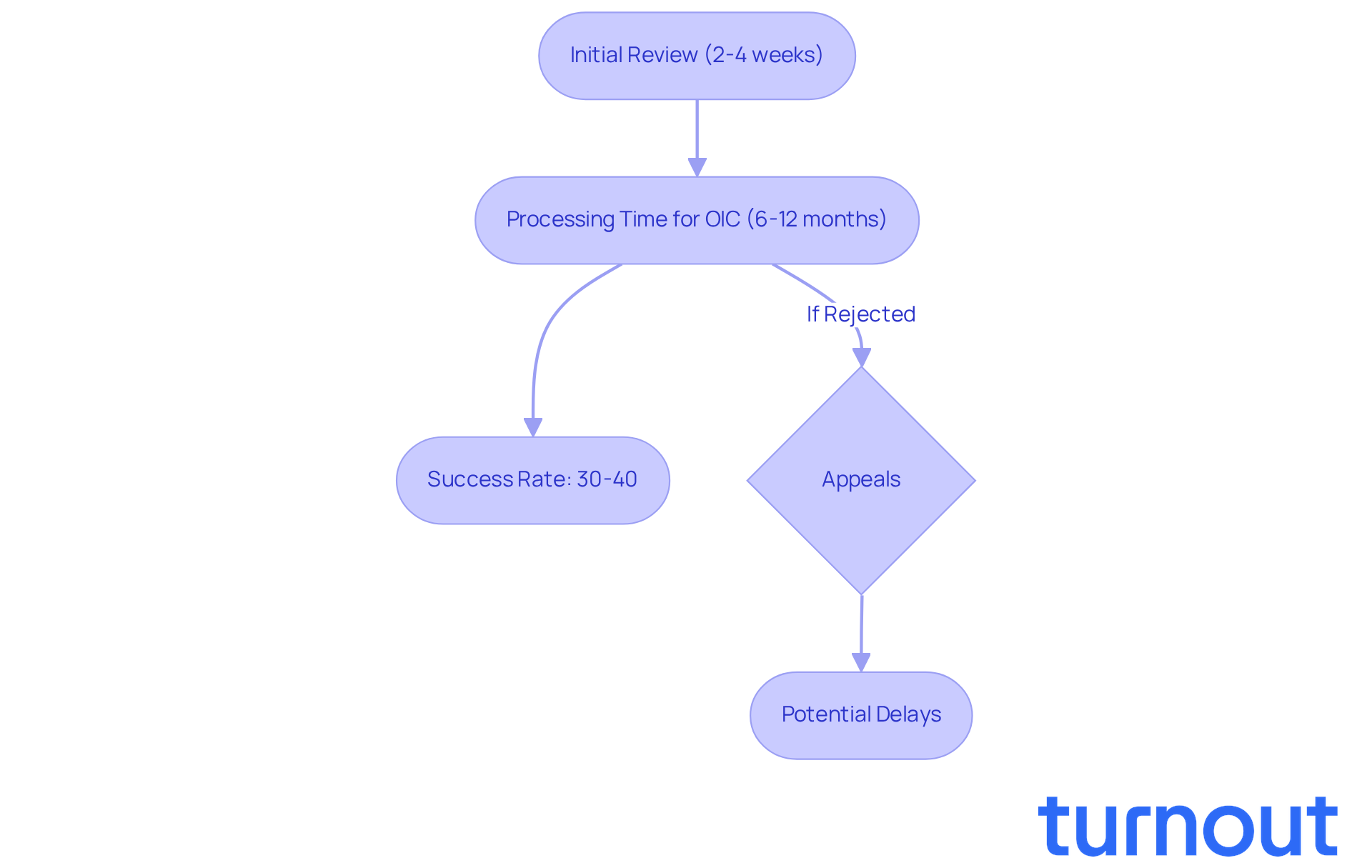

Typically, the IRS requires about 4-6 weeks to respond to requests for further information. This makes it crucial to remain proactive and organized throughout the negotiation. Remember, the initial review period for an Offer in Compromise usually takes around 2-4 weeks. Acting quickly can help prevent enforcement actions and improve your chances of a favorable outcome. You're not alone in this journey; we're here to help you every step of the way.

Set Realistic Expectations for Outcomes and Timelines

When it comes to tax settlement services, we recognize that setting realistic expectations can seem overwhelming. The process can stretch over several months, especially when pursuing an Offer in Compromise (OIC). This often requires extensive documentation and negotiation, which can be daunting.

Typically, the IRS starts with an initial review period of about 2 to 4 weeks. After that, the total processing time for an OIC can take anywhere from 6 to 12 months. It’s important to know that success rates hover around 30-40%. For instance, in the last fiscal year, out of approximately 50,000 offers filed, just over 15,000 were accepted.

We also want to highlight that appeals can extend the timeline. If applications are incomplete or incorrect, it may lead to delays and ongoing correspondence with the IRS. Understanding these timelines and success rates can help you remain patient and focused throughout the process. Remember, not all offers will be accepted, and individual circumstances can significantly influence outcomes.

You're not alone in this journey. We’re here to help you navigate through it with care and support.

Conclusion

Navigating tax settlement services can feel overwhelming, and we understand that. But by grasping some key practices, you can take meaningful steps toward achieving favorable outcomes. Understanding how these services work, assessing your financial situation, and selecting reputable providers can make a significant difference in resolving your tax debts effectively.

Consider conducting thorough financial evaluations. This can lead to better negotiations and outcomes. Choosing a trustworthy tax settlement service provider is essential, as is maintaining clear communication and setting realistic expectations. Each of these steps contributes to a smoother process, increasing your chances of a successful resolution.

Remember, being informed and proactive is crucial. You have the power to take control of your financial situation. Seeking professional assistance when needed is a wise choice. By implementing these best practices, you can navigate tax settlement services with confidence, paving the way for a more secure financial future. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What are tax settlement services?

Tax settlement services assist individuals dealing with tax debts to the IRS or state tax authorities. They offer options like Offers in Compromise (OIC), installment agreements, and penalty abatement to help resolve these debts.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) allows taxpayers to settle their tax debts for less than the total amount owed, providing financial relief. However, only 21% of OIC submissions are approved, making accuracy and thoroughness in disclosures essential during the evaluation process.

How can tax settlement services help me?

Tax settlement services provide consultations to assess individual financial situations and recommend tailored strategies for resolving tax debts. Professionals can facilitate a smoother negotiation process, often leading to more favorable outcomes.

What should I do before seeking help from tax settlement services?

Before reaching out to tax settlement services, it's important to evaluate your financial situation thoroughly. Gather key documents like income statements, bank statements, and previous tax returns to understand your total tax debt, monthly expenses, and available assets.

Why is it important to assess my financial situation?

Conducting a thorough financial evaluation helps determine your eligibility for various tax relief options and prepares you for meaningful discussions with tax professionals. Understanding your disposable income can empower you to negotiate better settlements.

What impact does financial self-assessment have on tax resolution outcomes?

Research shows that individuals who perform thorough financial evaluations before pursuing tax resolution options are more likely to achieve favorable results, making this step crucial in the journey towards financial relief.