Introduction

Navigating the complexities of retroactive SSDI payments can feel overwhelming. Many applicants share this struggle, and it’s completely understandable. These payments represent funds owed by the Social Security Administration for periods of eligibility before you applied. They can make a significant difference in your financial stability.

However, there are many misconceptions about the timelines, calculations, and eligibility criteria for these benefits. It’s common to feel confused or uncertain about what to expect. So, how can you effectively navigate this intricate landscape and secure the financial support you deserve?

We’re here to help you understand the process better. By breaking down the information and addressing your concerns, we aim to empower you on this journey. Remember, you are not alone in this. Together, we can explore the steps you need to take to ensure you receive the assistance you need.

Define SSDI Back Pay and Retroactive Benefits

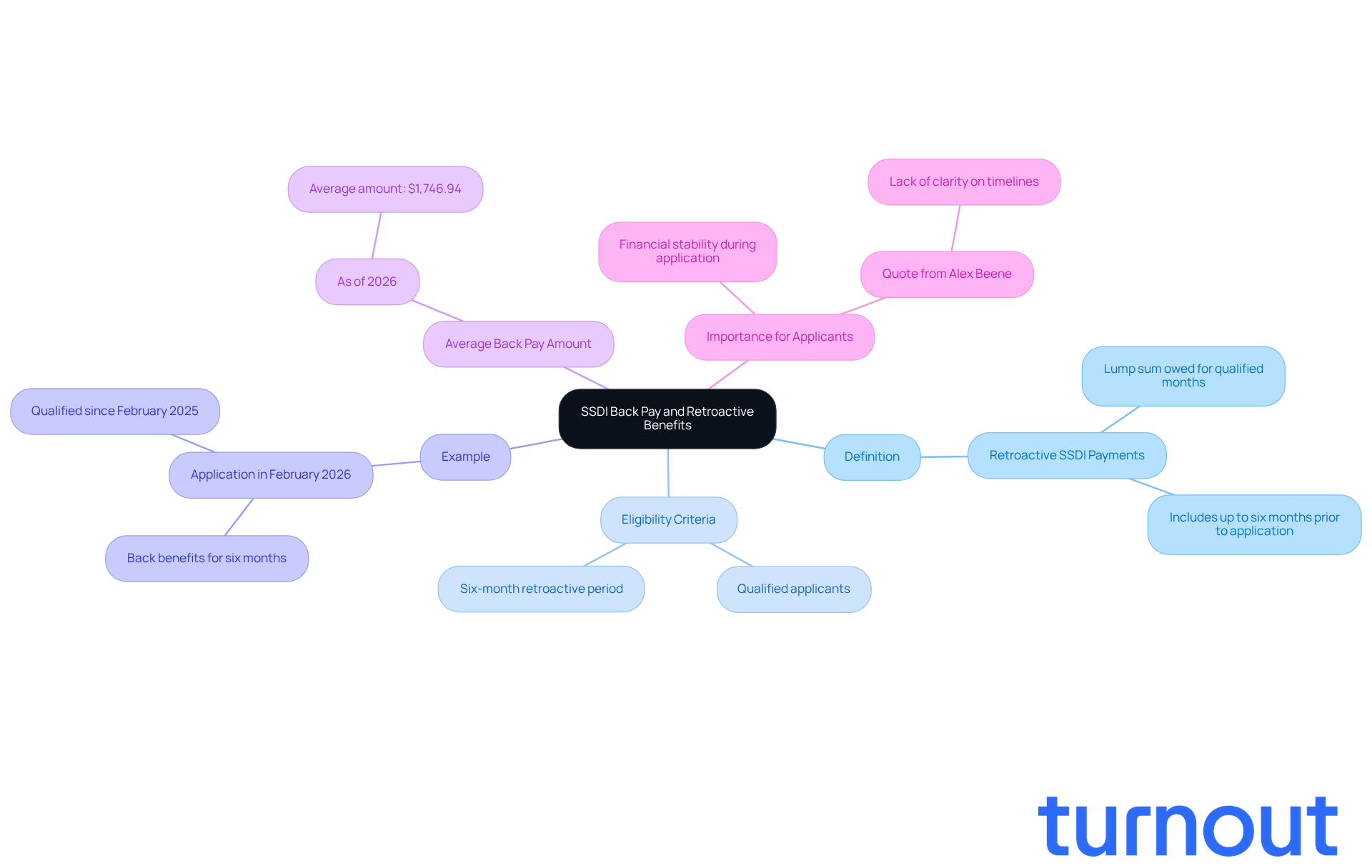

Retroactive SSDI payments refer to the lump sum amount owed by the Social Security Administration (SSA) for the months you qualified for assistance but didn’t receive funds. Retroactive assistance can also include disbursements for up to six months prior to your application date, as long as you meet the eligibility criteria. For instance, if you applied for SSDI in February 2026 and were qualified starting in February 2025, you could receive back benefits for that six-month period.

Understanding these definitions is crucial for applicants to gauge the financial support they can expect. As of 2026, the average SSDI back pay amount is around $1,746.94, reflecting ongoing adjustments in payment calculations. We understand that being aware of these figures is important, as they can significantly impact your financial stability during the application process. Alex Beene, a financial literacy instructor, shared, "The act didn't make some elements clear in terms of time, namely what would be the period of time in which retroactive benefits would be received and what, if any, would be the beginning date for beneficiaries to qualify."

Turnout offers access to skilled nonlawyer advocates who can help you navigate these complex processes. They ensure you understand your rights and the possibility of obtaining significant retroactive compensation. Many recipients have successfully obtained these funds, which have helped them manage their expenses during uncertain times. Staying informed about updates concerning retroactive SSDI payments is essential, especially given the recent changes in legislation that may influence eligibility and payment schedules. Remember, you are not alone in this journey; we’re here to help.

Calculate Your SSDI Back Pay: Key Factors and Methods

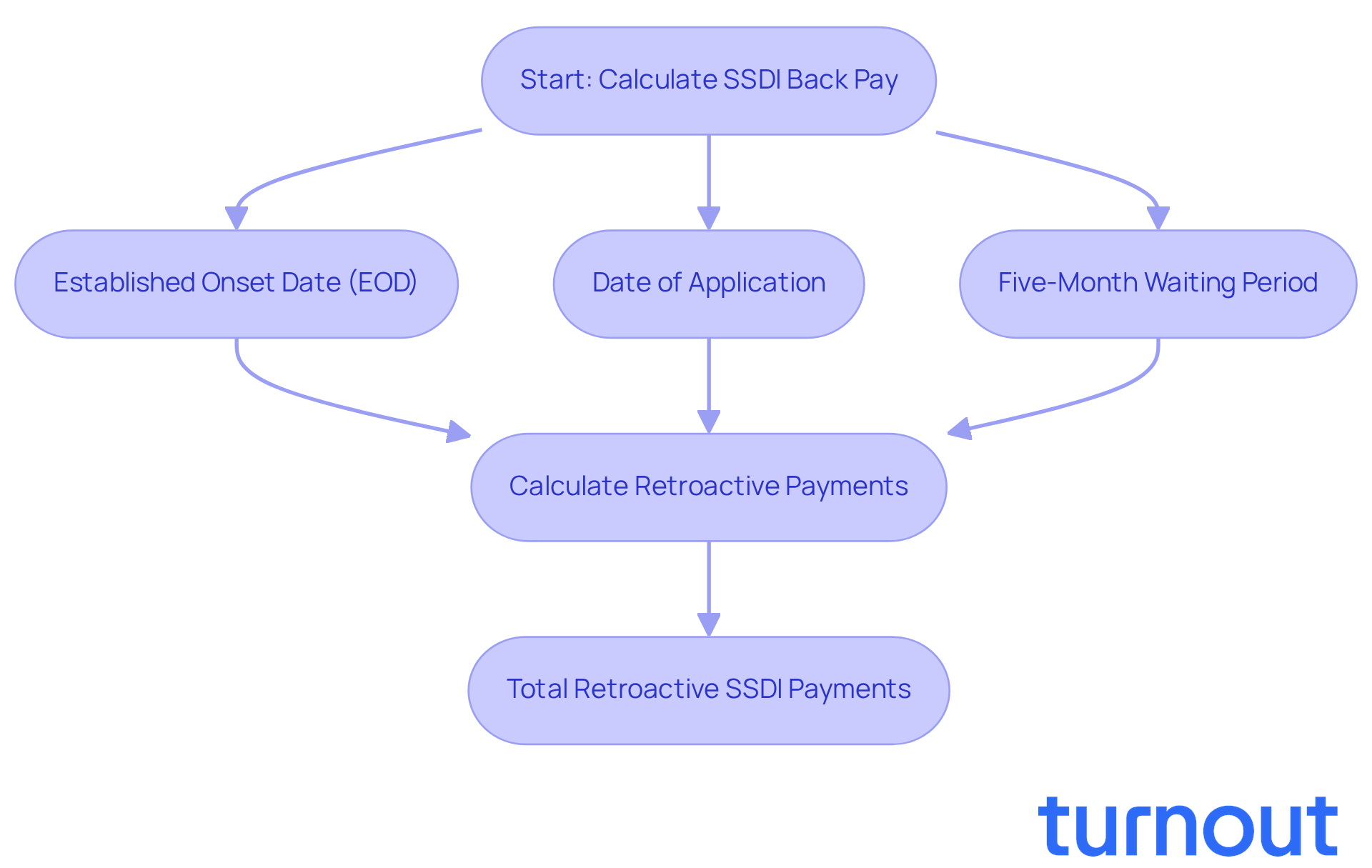

Calculating your retroactive SSDI payments can feel overwhelming, but we’re here to help you understand the key factors involved. First, consider:

- Your established onset date (EOD)

- The date you applied

- The mandatory five-month waiting period

Knowing how these elements work together is crucial for setting realistic financial expectations.

The retroactive SSDI payments amount is determined by multiplying your monthly benefit by the number of months you qualify for benefits. For instance, if your EOD is January 2024 and you submitted your application in June 2024, your compensation will be calculated from January to June 2024, excluding the five-month waiting period. This means you’ll receive retroactive SSDI payments for the months after the waiting period until your claim is approved.

It’s also important to know that retroactive SSDI payments can potentially be obtained back to the year before your application date, allowing for a maximum of 12 months of retroactive pay. Understanding these calculations can help you feel more in control of your financial future.

At Turnout, our trained nonlawyer advocates are ready to assist you in navigating these complexities. You are not alone in this journey; we’re here to ensure you understand your rights and the potential benefits available to you.

Understand the Timeline for Receiving SSDI Back Pay

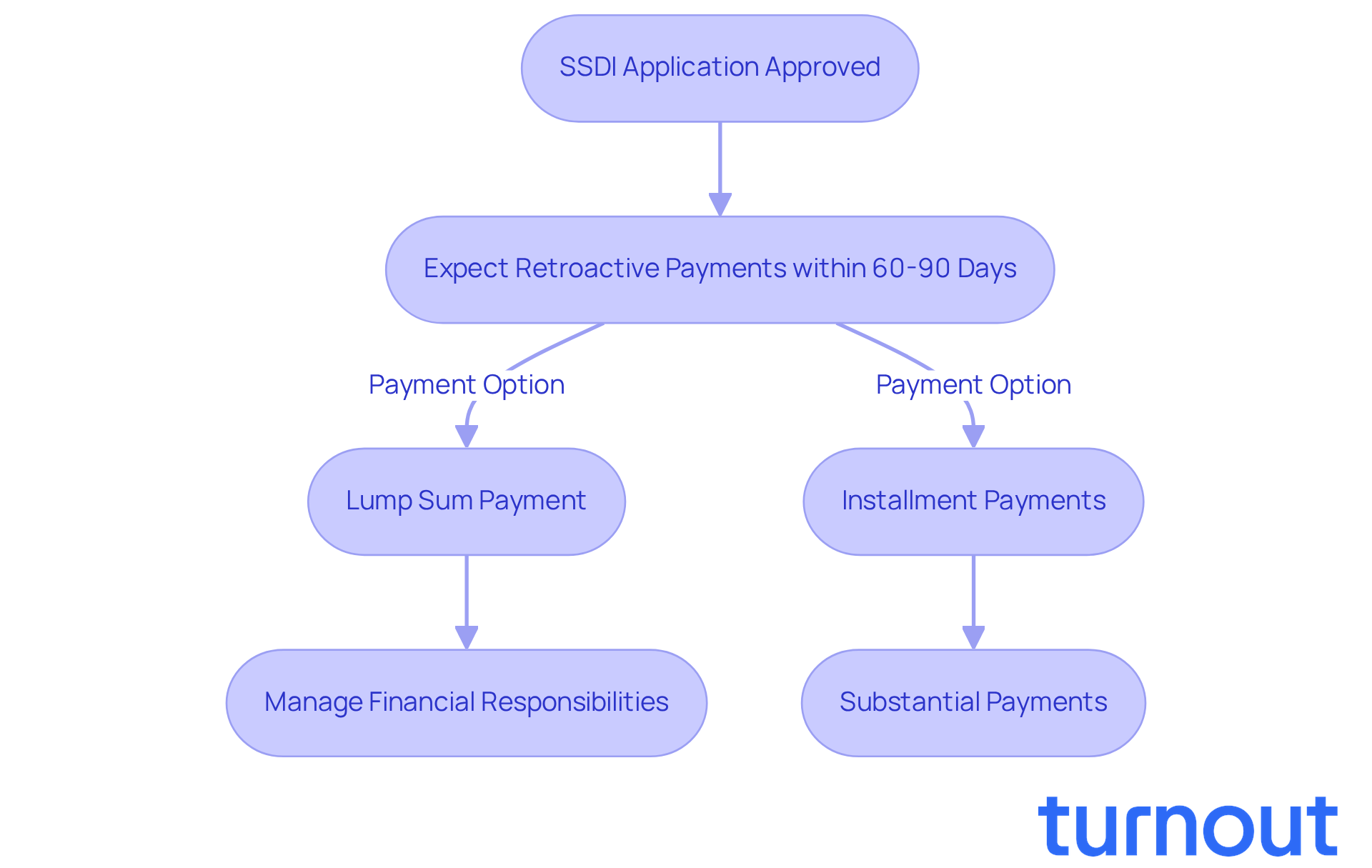

Once your SSDI application gets approved, we understand that you might be anxious about what comes next. Typically, you can expect to receive your retroactive SSDI payments within 60 to 90 days. However, this timeframe can vary due to the Social Security Administration's (SSA) processing times and any existing backlogs.

Usually, retroactive SSDI payments are issued as a lump sum in your first check after approval. This can be a significant help in managing your financial responsibilities during the waiting period. Most applicants receive their compensation within 60 days of claim approval, though some may encounter delays due to administrative issues. If the retroactive SSDI payments are substantial, the SSA may opt to pay them in installments rather than a lump sum.

Understanding this timeline is crucial for planning your finances effectively. It’s common to feel uncertain, especially with the SSDI payment schedule for February 2026, which includes specific payment dates based on beneficiaries' birth dates.

At Turnout, we’re here to help you navigate this process without the need for legal representation. Our trained nonlawyer advocates are ready to assist you with your SSD claims. You are not alone in this journey; we provide the tools and support you need to move forward with confidence.

Debunk Common Misconceptions About SSDI Payments

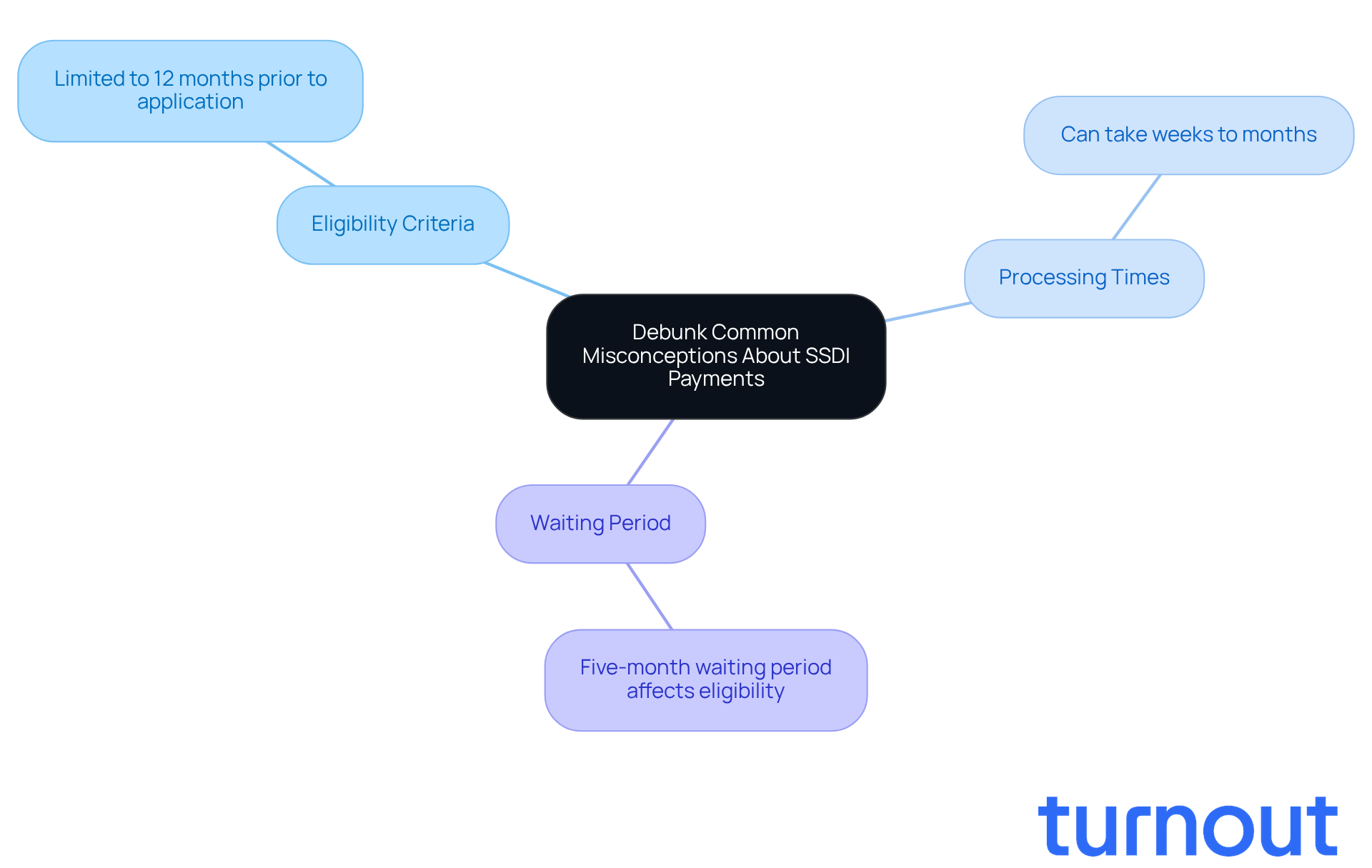

Many people struggle with the complexities of retroactive SSDI payments, often believing they are automatically provided for the entire duration of disability before application. It’s important to understand that retroactive SSDI payments are limited to a maximum of 12 months prior to the application date, depending on specific eligibility criteria.

You might think that once approved, all applicants receive their retroactive pay immediately. However, it’s common for the Social Security Administration (SSA) to take several weeks to months to process retroactive SSDI payments. For instance, if a claim is approved in May 2026 and benefits start in June, retroactive SSDI payments could reach back to June 2025, depending on when the disability began.

Keep in mind that there’s a five-month waiting period that affects pay eligibility. Understanding these realities about retroactive SSDI payments can help you set realistic expectations and avoid unnecessary frustration. As advocates in the field, including Turnout's trained nonlawyer advocates, often emphasize, being informed about the nuances of retroactive SSDI payments can significantly impact your financial planning and overall well-being.

Remember, Turnout is not a law firm and does not provide legal advice. We’re here to support you without legal representation as you navigate these complexities. You are not alone in this journey.

Conclusion

Navigating the complexities of Social Security Disability Insurance can be overwhelming, and understanding retroactive SSDI payments and back pay is crucial for anyone in this situation. This article has aimed to shed light on what retroactive SSDI payments involve, how they are calculated, the timelines for receiving them, and some common misconceptions that can cause confusion. By clarifying these aspects, we hope to empower you to prepare for your financial future and ensure you receive the benefits you deserve.

Key points we've discussed include:

- The definitions of SSDI back pay and retroactive benefits

- The critical factors that influence payment calculations

- The expected timelines for receiving these funds

It's important to remember that retroactive payments can only be claimed for a limited period before your application date. Additionally, be aware of the five-month waiting period that affects eligibility. Having knowledgeable advocates by your side can make a significant difference, ensuring you don’t have to navigate this journey alone.

Ultimately, staying informed about your rights and the nuances of the SSDI system is vital. By understanding how SSDI back pay works and what to expect, you can take proactive steps toward securing your financial stability. Engaging with resources and advocates can empower you, helping you navigate this critical aspect of your life with confidence and clarity. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are SSDI back pay and retroactive benefits?

SSDI back pay refers to the lump sum amount owed by the Social Security Administration (SSA) for the months you qualified for assistance but did not receive funds. Retroactive benefits can include payments for up to six months prior to your application date, provided you meet eligibility criteria.

How far back can retroactive SSDI benefits be claimed?

Retroactive SSDI benefits can be claimed for up to six months prior to your application date, as long as you meet the eligibility requirements.

Can you provide an example of how SSDI back pay works?

For instance, if you applied for SSDI in February 2026 and were qualified starting in February 2025, you could receive back benefits for that six-month period.

What is the average amount of SSDI back pay as of 2026?

As of 2026, the average SSDI back pay amount is approximately $1,746.94.

Why is it important for applicants to understand SSDI back pay and retroactive benefits?

Understanding these definitions is crucial for applicants to gauge the financial support they can expect, which significantly impacts their financial stability during the application process.

How can Turnout assist individuals with SSDI back pay?

Turnout offers access to skilled nonlawyer advocates who can help navigate the complex processes related to SSDI back pay and ensure individuals understand their rights and the possibility of obtaining retroactive compensation.

What should applicants be aware of regarding recent changes in legislation?

Applicants should stay informed about updates concerning retroactive SSDI payments, especially recent changes in legislation that may influence eligibility and payment schedules.