Introduction

Navigating tax obligations can often feel like an uphill battle, especially when you’re facing outstanding debts. We understand that this can be overwhelming. Fortunately, the IRS offers a lifeline through online payment plans, allowing you to manage your liabilities in a more manageable way.

This guide will explore the straightforward steps required to set up an IRS payment plan online. We’ll highlight the benefits and eligibility criteria that can pave the way to financial relief. But what if the complexities of the application process seem daunting? It’s common to feel this way, and understanding how to simplify this journey is crucial for anyone looking to regain control over their financial situation. Remember, you are not alone in this journey; we’re here to help.

Understand IRS Payment Plans

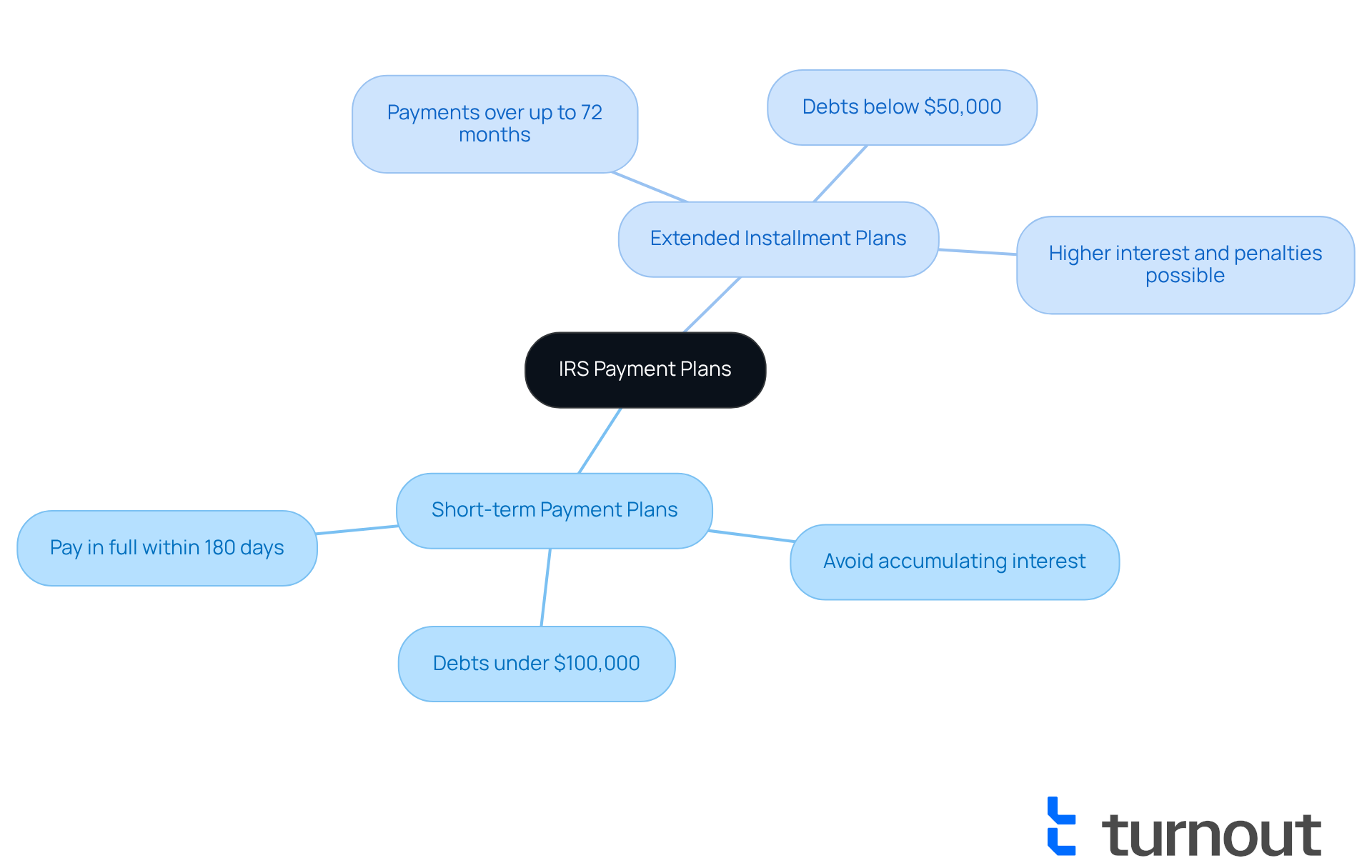

Taxpayers can set up a payment plan with IRS online, as IRS installment arrangements, often called installment agreements, allow them to settle their tax obligations gradually rather than in one lump sum. We understand that managing tax debt can be overwhelming, and one way to find relief is to set up a payment plan with the IRS online. There are two primary types of payment plans:

-

Short-term Payment Plans: If you can pay your balance in full within 180 days, this option might be for you. It’s available for debts under $100,000 and helps you avoid accumulating interest by settling your debts quickly.

-

Extended Installment Plans: For those facing ongoing financial challenges, these arrangements allow for payments over an extended period, typically up to 72 months, for debts below $50,000. While this option offers essential flexibility, it’s important to remember that longer durations can lead to higher interest and penalties.

To make transactions easier, we encourage taxpayers to set up a payment plan with IRS online. This not only eliminates the need for checks but also lowers user fees. In 2025, the IRS established over 3.4 million new installment agreements, highlighting the growing reliance on these financial options among taxpayers.

Tax experts emphasize that while short-term strategies can help reduce interest expenses, long-term arrangements provide vital adaptability. For instance, many low-income taxpayers have successfully used long-term plans to manage their tax responsibilities without incurring excessive penalties or interest. This showcases how these agreements can work effectively in real-life situations.

Additionally, it’s crucial for taxpayers to stay current with their tax return filings to qualify for a Simple Payment Plan. Remember, you are not alone in this journey; we’re here to help you navigate your options.

Determine Your Eligibility for a Payment Plan

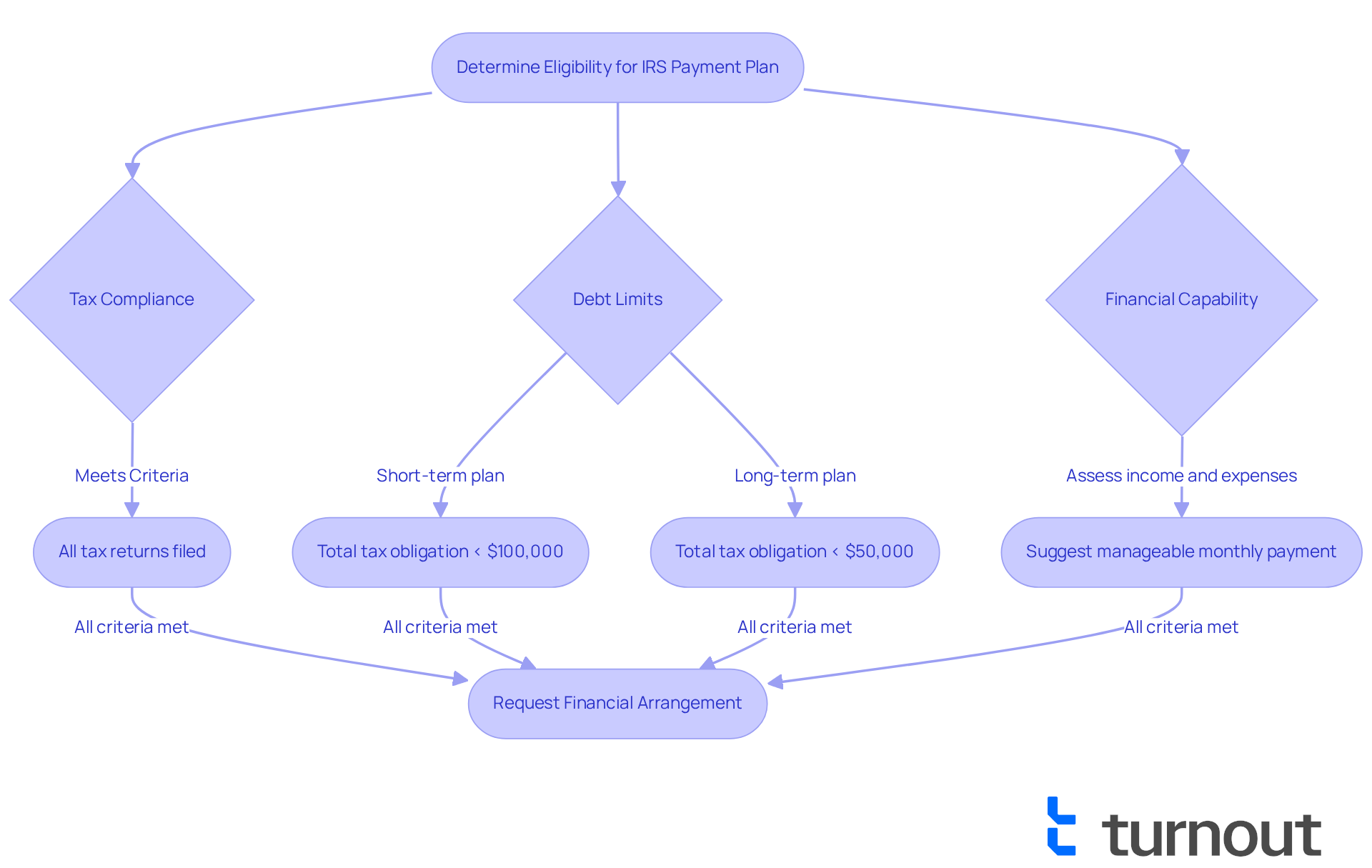

If you're considering how to set up a payment plan with IRS online, it's important to know that you must meet specific criteria. We understand that navigating tax obligations can be overwhelming, but we're here to help you through it.

- Tax Compliance: First and foremost, ensure that all your tax returns are filed and current. This step is crucial, as the IRS requires up-to-date filings to consider your application.

- Debt Limits: If you're looking at a short-term settlement strategy, your total tax obligation should be less than $100,000. For a long-term plan, aim for a debt under $50,000.

- Financial Capability: Think about suggesting a monthly payment that aligns with your financial situation. By assessing your income and expenses, you can identify a manageable amount to pay.

It's also good to be aware that some IRS financial arrangements may involve setup fees. After you complete the online application, you’ll receive prompt notification of your approval to set up a payment plan with IRS online, which can bring you peace of mind. Remember, penalties and interest will continue to accrue until your balance is paid in full, so it's important to act as soon as you can.

Additionally, using the Online Payment Agreement tool, you can set up a payment plan with IRS online to adjust your monthly payment amount or due date. This flexibility can really help as you manage your expenses. In fact, in 2025, over 90% of individual taxpayers with a balance due qualify for a Simple Payment Plan, making it a viable option for many.

If you meet these criteria, you can confidently move forward to request a financial arrangement through your IRS Online Account. You're not alone in this journey, and taking this step can lead you toward financial relief.

Apply for an IRS Payment Plan Online

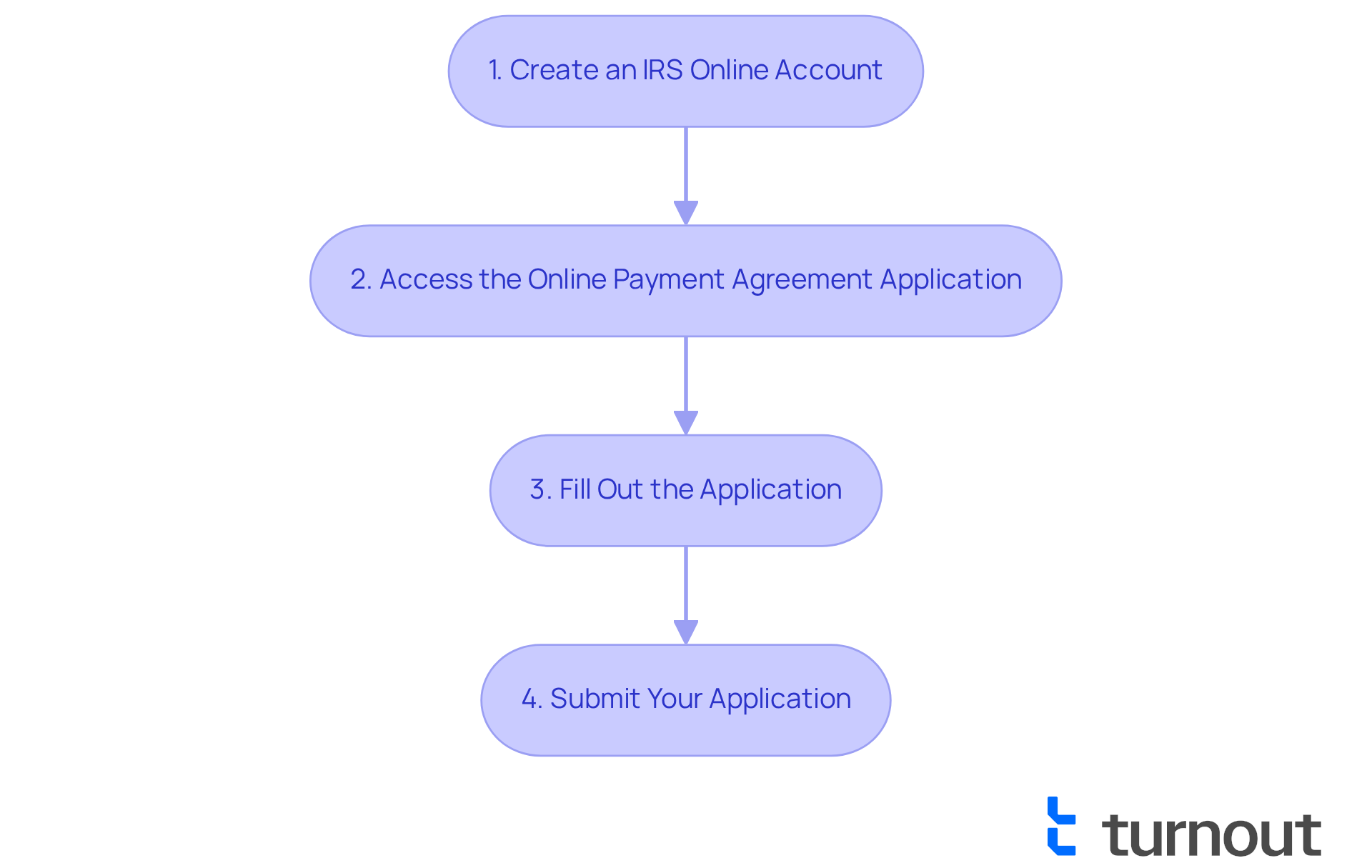

Although it can feel overwhelming, we're here to help you as you set up a payment plan with IRS online. Follow these simple steps to ease your journey:

-

Create an IRS Online Account: Start by visiting the IRS website to create an account if you don’t already have one. This account is essential for managing your billing arrangement and accessing your tax details. You’ll need to verify your identity using ID.me, ensuring secure access to your account. In 2025, many taxpayers are choosing online applications, with 88% of individual taxpayers owing less than $25,000. This makes streamlined installment agreements (SLIAs) a popular choice for many.

-

Access the Online Payment Agreement Application: Once your account is set up, navigate to the Online Payment Agreement application on the IRS website. This tool simplifies the process, allowing you to manage your tax obligations efficiently.

-

Fill Out the Application: Complete the application by providing necessary details, including your personal information, tax specifics, and the suggested amount. It’s common to feel anxious about this step, but tax professionals emphasize the importance of accuracy to avoid delays. Remember, you must have submitted all necessary tax returns before applying for a financial arrangement.

-

Submit Your Application: After reviewing your information for accuracy, submit the application. You’ll receive immediate confirmation of your application status, streamlining the process and eliminating the need for phone calls or in-person visits.

This accessible procedure is designed to empower taxpayers like you, simplifying the navigation of tax responsibilities and enabling you to set up a payment plan with IRS online. Remember, you are not alone in this journey, and taking these steps can lead to a brighter financial future.

Review Costs and Fees Involved

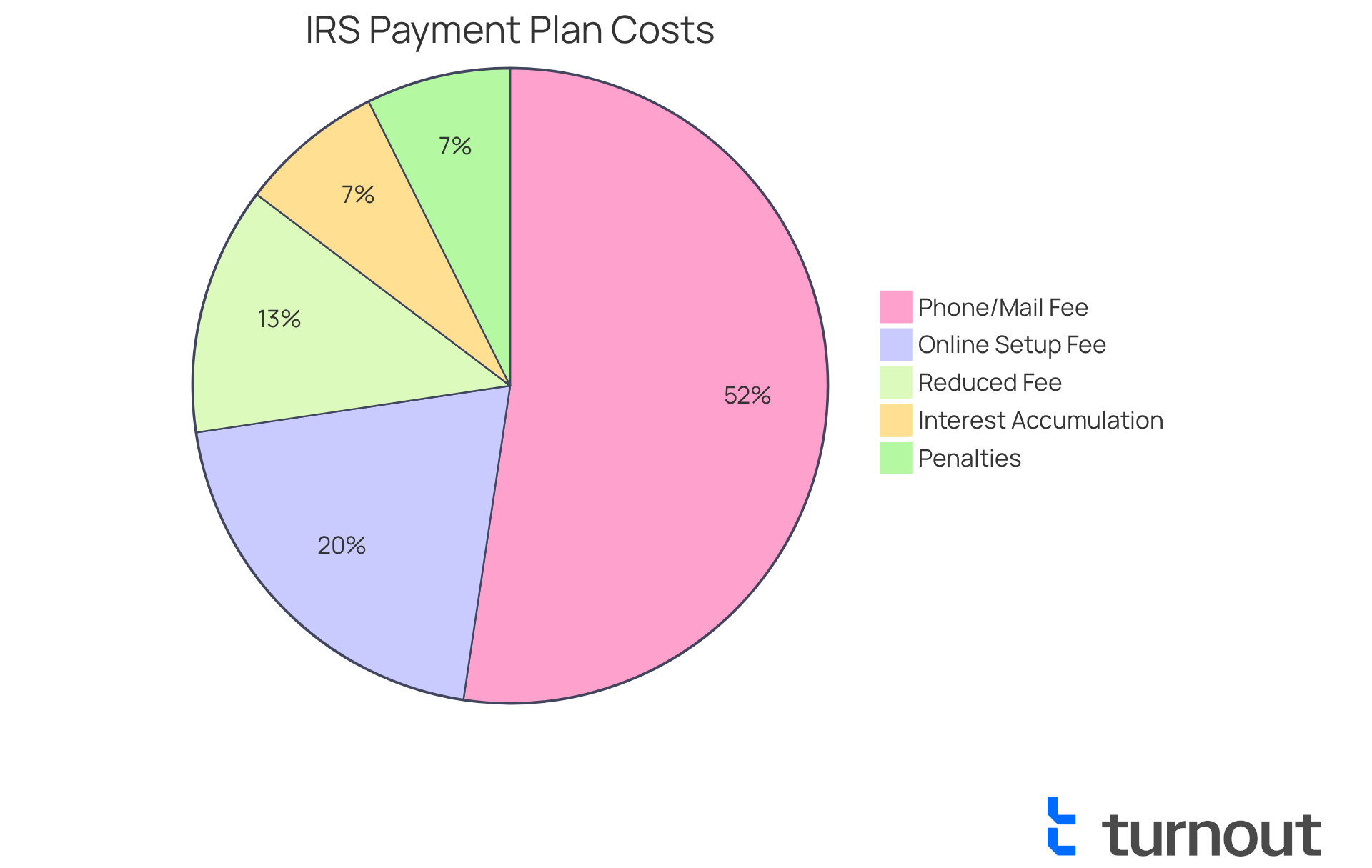

When it comes to how to set up a payment plan with the IRS online, we understand that navigating the costs can feel overwhelming. Here are some important factors to consider:

-

Setup Fees: If you apply online, you’ll face a fee of about $69. However, if you choose to apply via phone or mail, that fee can climb to $178. But don’t worry - if you’re a low-income taxpayer, you might qualify for reduced fees, sometimes as low as $43. This can make a significant difference for those experiencing financial hardship.

-

Interest and Penalties: It’s crucial to be aware that interest will accumulate on any outstanding balance. Missing payments can lead to additional penalties, which can add 25% or more to your original tax bill. This can really impact your financial situation. Understanding these potential costs is key to avoiding unexpected burdens.

-

Installment Options: For those with balances under $100,000, there’s a short-term arrangement available. This allows you up to 180 days to pay off your balance in full. It’s a great option for taxpayers who need to manage their debts quickly and effectively.

Being informed about these fees ahead of time empowers you to make better choices regarding your financial arrangements. Tax professionals often recommend that individuals set up a payment plan with the IRS online. This can help reduce fees and ensure you make timely payments, lowering the risk of default.

If you’re facing financial challenges, exploring options like the Offer in Compromise might be a viable path. This can allow you to settle your tax debts for less than what you owe. Remember, you’re not alone in this journey, and we’re here to help you find the best solution.

Conclusion

Setting up an IRS payment plan online can feel daunting, but it doesn’t have to be. We understand that managing tax obligations can be overwhelming, and that’s why this process is designed to be straightforward. By familiarizing yourself with the types of payment plans available and determining your eligibility, you can find a manageable way to address your tax debt. This structured approach not only offers flexibility in managing payments but also helps you feel more confident in navigating the complexities of your tax responsibilities.

It’s important to be tax compliant and to know your debt limits before applying for a payment plan. Assessing your financial capability is crucial, too. Understanding the difference between short-term and extended installment plans allows you to choose the option that best fits your situation. Additionally, being aware of the associated costs and fees, such as setup charges and potential interest, empowers you to make informed decisions about managing your tax liabilities.

Taking proactive steps to set up an IRS payment plan online can lead to greater financial stability. Remember, you’re not alone in this journey. We encourage you to leverage the available resources and tools to simplify the process. By doing so, you can resolve your tax issues and pave the way for a brighter financial future. Embracing this opportunity for financial relief is a significant step towards achieving peace of mind and regaining control over your financial landscape.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment agreements, allow taxpayers to settle their tax obligations gradually rather than in one lump sum.

What are the two primary types of IRS payment plans?

The two primary types of IRS payment plans are Short-term Payment Plans and Extended Installment Plans.

What is a Short-term Payment Plan?

A Short-term Payment Plan is available for taxpayers who can pay their balance in full within 180 days. It is offered for debts under $100,000 and helps avoid accumulating interest by settling debts quickly.

What is an Extended Installment Plan?

An Extended Installment Plan allows for payments over an extended period, typically up to 72 months, for debts below $50,000. This option provides flexibility but may result in higher interest and penalties due to the longer duration.

How can taxpayers set up a payment plan with the IRS?

Taxpayers can set up a payment plan with the IRS online, which simplifies the transaction process and lowers user fees.

How many new installment agreements did the IRS establish in 2025?

In 2025, the IRS established over 3.4 million new installment agreements.

Why is it important for taxpayers to stay current with their tax return filings?

Staying current with tax return filings is crucial to qualify for a Simple Payment Plan.

Can long-term payment plans be beneficial for low-income taxpayers?

Yes, many low-income taxpayers have successfully used long-term plans to manage their tax responsibilities without incurring excessive penalties or interest.