Overview

We understand that navigating tax debts can be a daunting experience, especially during challenging financial times. This article outlines four essential steps to secure an IRS payments agreement that can help you regain control over your financial situation.

- First, it's important to understand the various payment options available to you.

- Next, determining your eligibility is crucial in this process.

- Gathering the required documentation may seem overwhelming, but it is a necessary step to ensure your application is complete.

- Finally, applying online can streamline the process and make it more manageable.

These steps are not just procedural; they are designed to guide you through setting up installment plans that fit your needs, allowing you to resolve your tax debts effectively.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when faced with the burden of significant debts. We understand that this can be a daunting experience.

Fortunately, the IRS provides payment agreements that allow taxpayers to manage their liabilities more comfortably through installment plans. This guide aims to illuminate the essential steps to secure an IRS payment agreement, ensuring that you not only comprehend your options but also know how to effectively apply for a solution tailored to your financial situation.

What challenges might arise during this process? It's common to feel apprehensive, but rest assured, there are ways to overcome these obstacles and achieve peace of mind with your tax commitments.

Understand IRS Payment Agreements

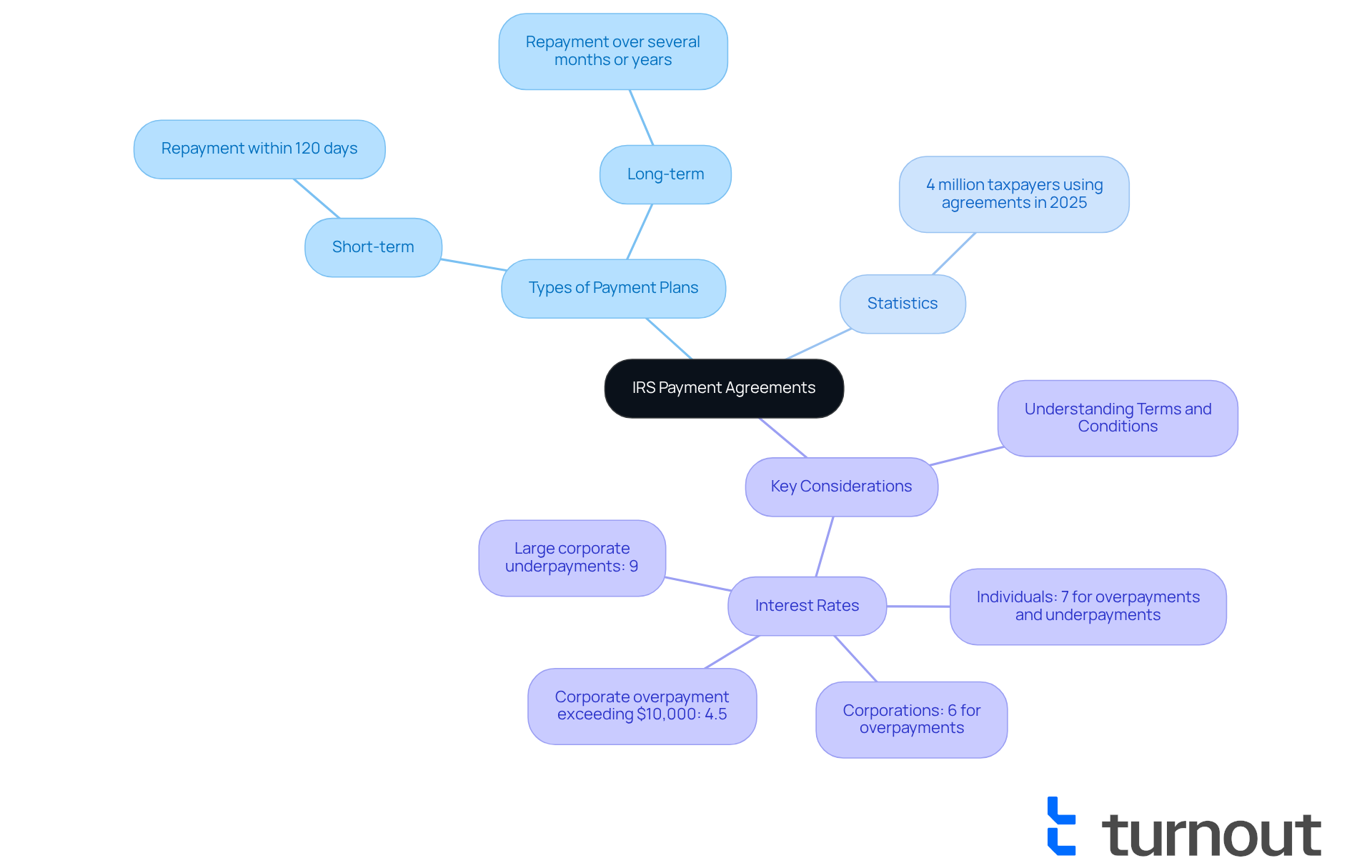

The IRS payments agreement, often referred to as installment plans, provides a compassionate way for taxpayers to gradually resolve their tax debts instead of making a single, overwhelming payment. This option is especially beneficial for individuals facing financial hardships who may struggle to pay their tax liabilities in full. Understanding the various forms of payment contracts is crucial for making informed choices that align with your situation.

As we look ahead to 2025, taxpayers will have the option to choose between short-term and long-term payment plans. Short-term contracts typically allow for repayment within 120 days, while long-term contracts can extend over several months or even years, depending on the total amount owed. For instance, if you find yourself with a significant tax liability, opting for a long-term plan could help ease your financial burden over time.

It's heartening to note that recent statistics indicate around 4 million taxpayers are utilizing the IRS payments agreement in 2025. This trend highlights their growing appeal as a practical method for managing tax debts. Tax specialists emphasize the importance of fully understanding the terms and conditions associated with IRS payments agreements. As one expert wisely stated, "Navigating the IRS payment options can be daunting, but with the right information, taxpayers can find a manageable path forward."

Additionally, the IRS has announced that interest rates for overpayments and underpayments will remain at 7% for individuals and 6% for corporations. This understanding is vital for grasping the financial implications of these arrangements. By familiarizing yourself with these options, you can make strategic choices as you move forward with your application. Remember, you are not alone in this journey; we're here to help you find the best path forward.

Determine Your Eligibility for Payment Plans

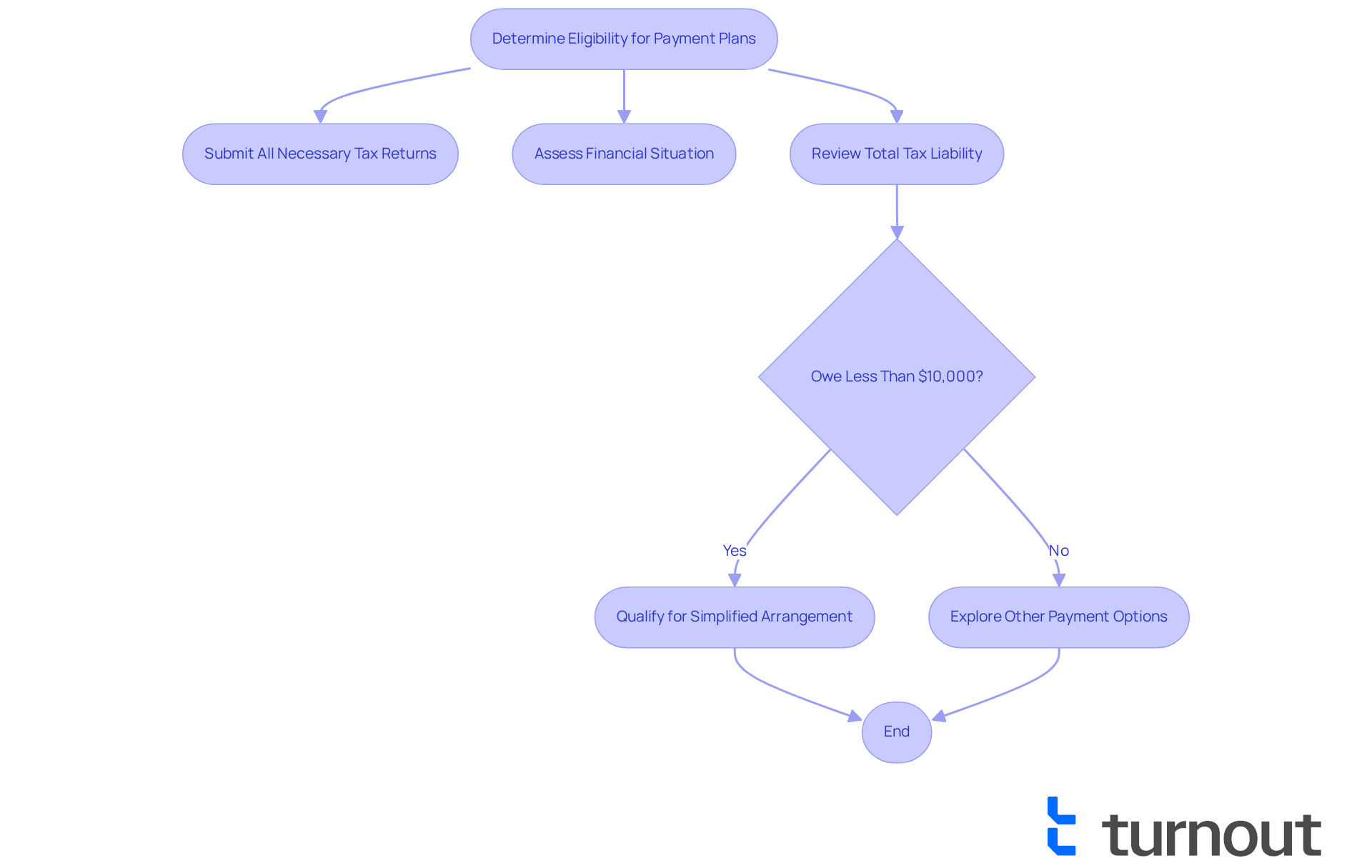

Navigating the IRS payments agreement can feel overwhelming, but you're not alone in this journey. To qualify, it's essential to meet specific criteria. First, ensure you've submitted all necessary tax returns; the IRS won't accept your proposal if there are pending returns. Next, take a moment to assess your financial situation, including your income, expenses, and any debts you may have.

It's common to feel uncertain about your total tax liability, which shouldn't exceed a certain threshold that varies based on your circumstances. If you owe less than $10,000, you might qualify for a simplified arrangement, making the application process easier for you.

Before moving forward, we encourage you to review the IRS payments agreement to confirm your eligibility. Remember, we're here to help you through this process, and taking these steps can lead you to a more manageable solution.

Gather Required Documentation for Your Application

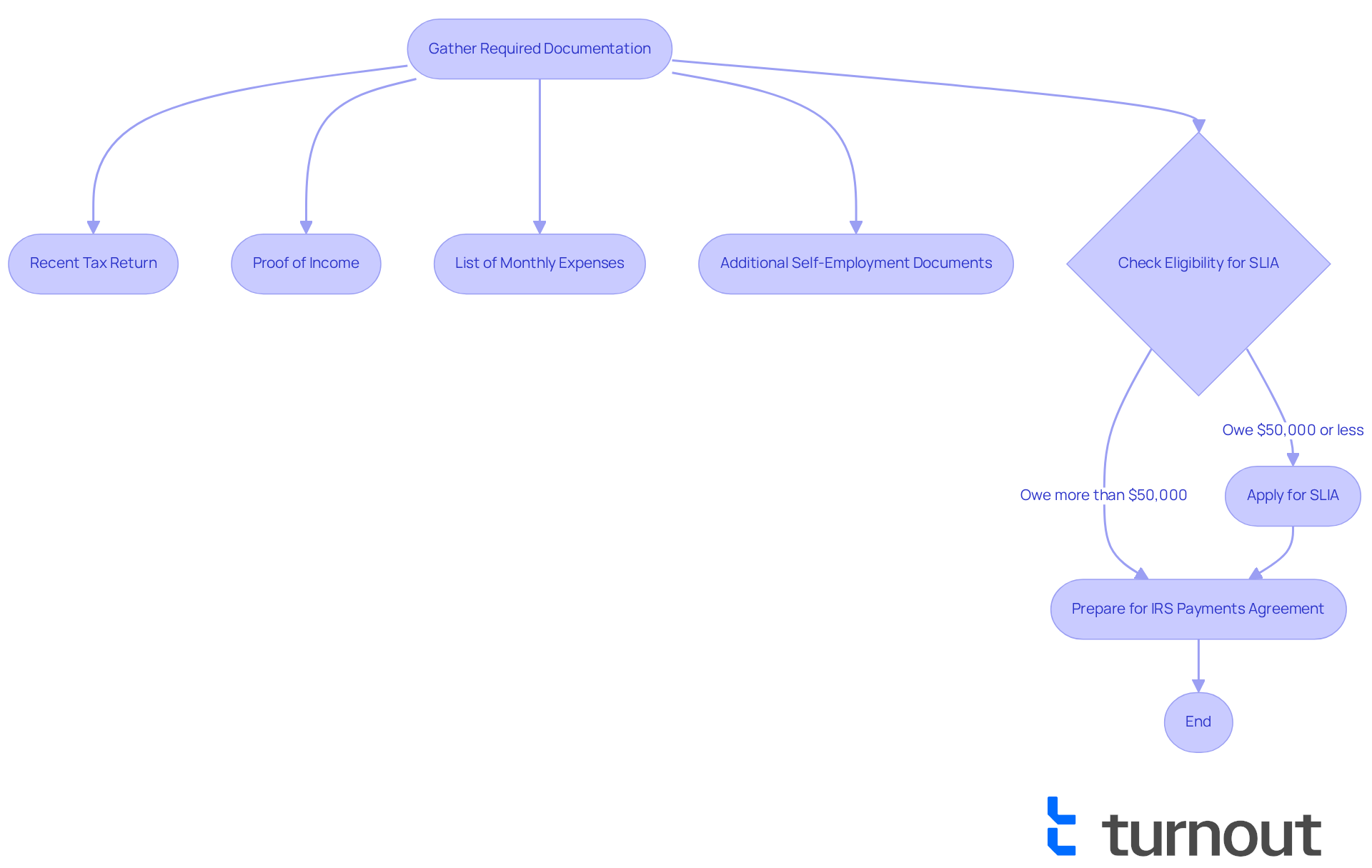

Before you apply for your IRS payments agreement, we understand how important it is to gather all the necessary documentation to support your application. Start with your most recent tax return, proof of income—such as pay stubs or bank statements—and a detailed list of your monthly expenses. If you are self-employed, additional documentation like profit and loss statements will be required. By arranging this information beforehand, you can simplify the application process and help the IRS evaluate your economic situation accurately.

Ensure that all documents are up-to-date and reflect your current economic status to avoid any processing delays. Remember, if you owe under $50,000, you can apply for an IRS payments agreement through a streamlined payment plan (SLIA). This option simplifies the process and allows for payments over 72 months without extensive monetary disclosures. In fact, according to Jim Buttonow, "88% of individual taxpayers owe less than $25,000 to the IRS," which makes SLIAs a popular choice for many.

Additionally, setting up an SLIA before an IRS payments agreement is filed can help you avoid complications. By preparing your documentation carefully, you can enhance your chances of a successful application. You're not alone in this journey; we're here to help you navigate these challenges.

Apply for Your IRS Payment Agreement Online

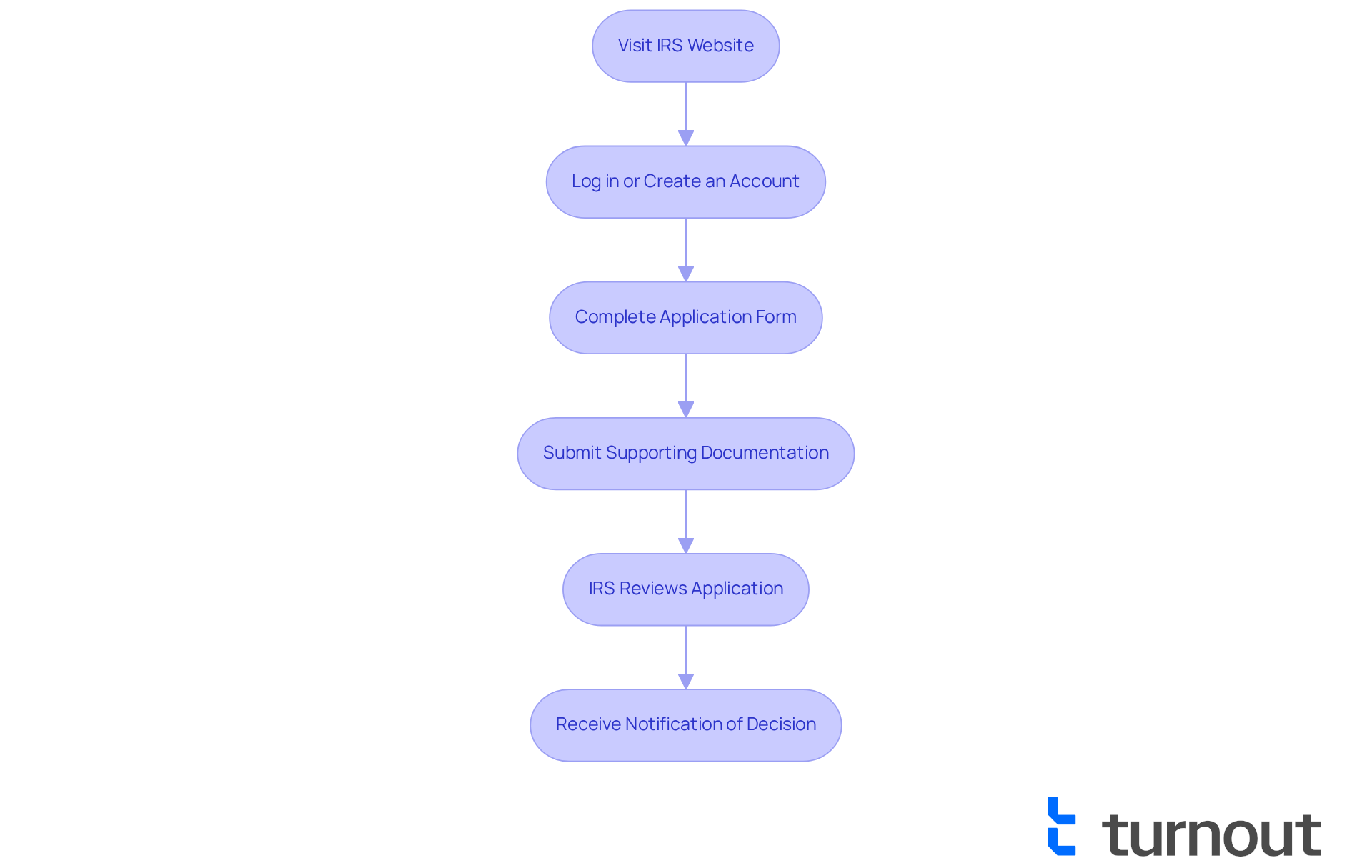

Are you feeling overwhelmed by your IRS payment obligations? You're not alone. To apply for your IRS payments agreement online, we encourage you to visit the IRS website and navigate to the 'Payment Plans' section. Here, you'll need to create an account or log in to your existing account.

Once you're logged in, follow the prompts to complete the application form. It's important to provide accurate information regarding your financial situation and the amount you owe. We understand that gathering this information can be challenging, so be prepared to submit the documentation you've collected.

After you submit your application, the IRS will review it and notify you of their decision about the IRS payments agreement, typically within a few weeks. Remember to keep a record of your application confirmation for your records. If you don’t receive a response within the expected timeframe, don’t hesitate to follow up. We're here to help you through this process, and you deserve peace of mind.

Conclusion

Securing an IRS payments agreement is a vital step for taxpayers seeking relief from overwhelming tax debts. We understand that navigating this process can feel daunting, but by exploring the various payment options available, individuals can take control of their financial situation and work towards a manageable resolution. This guide has outlined the necessary steps to navigate the IRS payment agreement process effectively.

Key points discussed include the importance of:

- Determining eligibility

- Gathering required documentation

- Applying online for the payment agreement

Each of these steps plays a crucial role in ensuring a smooth application process, ultimately leading to a successful agreement that aligns with your financial capabilities. The statistics highlighting the growing number of taxpayers utilizing these agreements further emphasize their relevance and effectiveness.

As you face financial challenges, the significance of understanding IRS payment agreements cannot be overstated. Taking proactive steps to secure an agreement not only alleviates immediate financial pressure but also fosters a sense of empowerment and control over your financial future. By following the guidance provided in this article, you can confidently approach your tax obligations and pave the way towards financial stability. Remember, you're not alone in this journey, and we're here to help you every step of the way.

Frequently Asked Questions

What is an IRS payment agreement?

An IRS payment agreement, often referred to as an installment plan, allows taxpayers to gradually resolve their tax debts instead of making a single, overwhelming payment. This option is especially beneficial for individuals facing financial hardships.

What are the types of IRS payment plans available?

Taxpayers can choose between short-term and long-term payment plans. Short-term contracts typically allow for repayment within 120 days, while long-term contracts can extend over several months or even years, depending on the total amount owed.

How many taxpayers are utilizing IRS payment agreements in 2025?

Approximately 4 million taxpayers are utilizing IRS payment agreements in 2025, indicating their growing appeal as a practical method for managing tax debts.

What is the importance of understanding the terms of IRS payment agreements?

It is crucial to fully understand the terms and conditions associated with IRS payment agreements to make informed choices that align with your financial situation.

What are the current interest rates for overpayments and underpayments?

The IRS has announced that interest rates for overpayments and underpayments will remain at 7% for individuals and 6% for corporations.

How can taxpayers find help with IRS payment agreements?

Taxpayers are encouraged to seek assistance to navigate the IRS payment options and find a manageable path forward in resolving their tax debts.