Introduction

Navigating tax obligations can feel overwhelming, especially when unexpected circumstances create financial strain. We understand that facing penalties due to filing errors or unforeseen hardships can be daunting. That’s where the IRS's one-time tax forgiveness program comes in - a beacon of hope for those in need.

This initiative not only offers a pathway to financial relief but also raises important questions about eligibility and the application process. How can you effectively secure this forgiveness? What steps should you take to ensure your application has the best chance of success?

You're not alone in this journey, and we're here to help you through it.

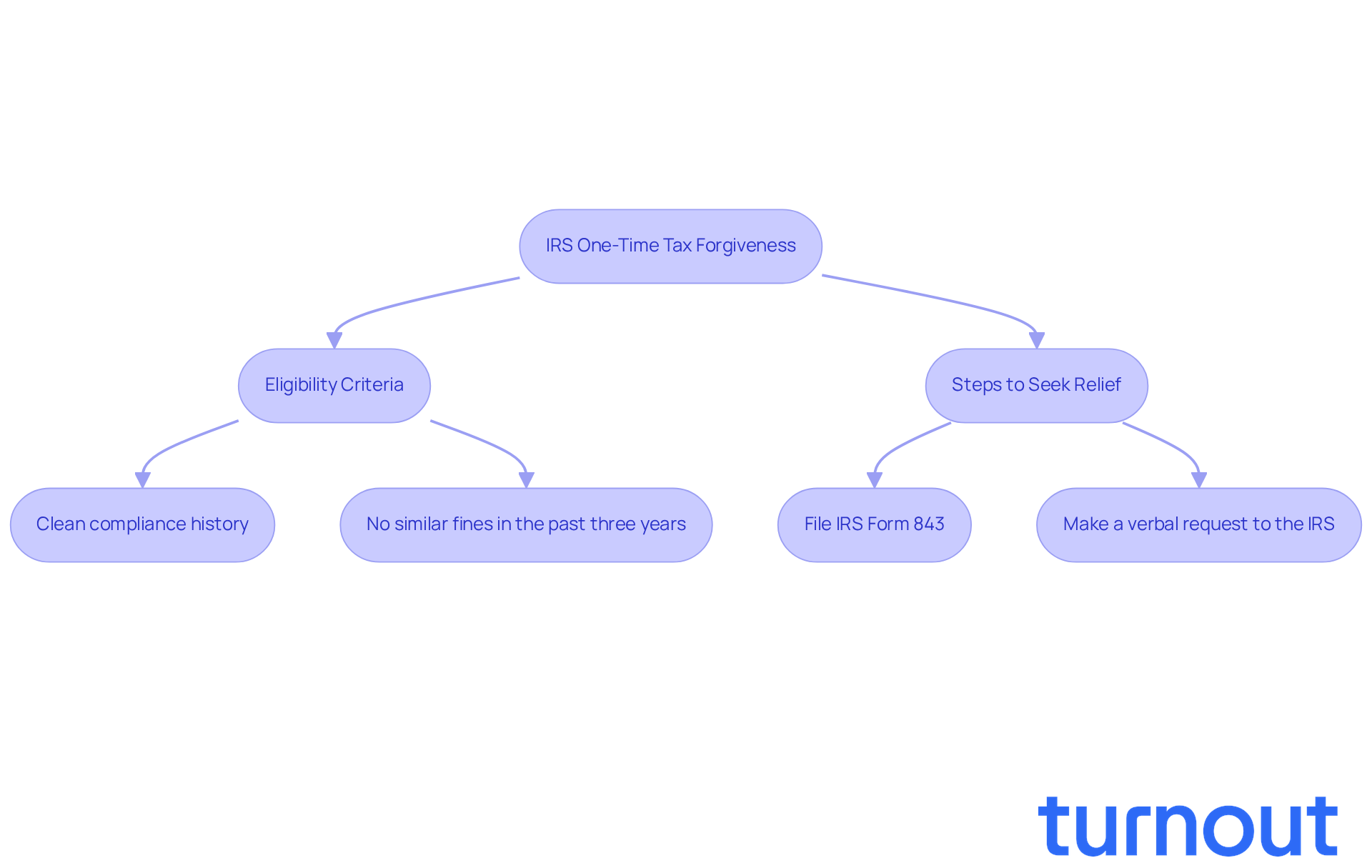

Understand IRS One-Time Tax Forgiveness

IRS one time tax forgiveness, often referred to as fee abatement, is an essential program aimed at assisting taxpayers who have made errors in filing or payment. We understand that life can throw unexpected challenges your way, and this initiative is especially beneficial for those with a clean compliance history who have faced consequences due to unforeseen circumstances. By waiving fees that may have piled up from late filings or payments, the program offers significant financial relief.

To qualify for this program, you typically need to show that you’ve submitted all necessary returns and haven’t encountered similar fines in the past three years. It’s important to note that this program doesn’t provide universal forgiveness of tax obligations; rather, it focuses on specific fines, making it a helpful option for those navigating tax compliance difficulties.

Recent updates reveal that around 1.6 million taxpayers are expected to benefit from the IRS's relief program, which automatically removes failure-to-file fees for the 2019 and 2020 tax years as part of a broader initiative. This proactive approach by the IRS aims to lighten the load for taxpayers who may have struggled during these years. As the National Taxpayer Advocate mentioned, "Those that have already filed their 2019 and 2020 returns do not have to do anything to qualify."

Real-world examples highlight the success of the fee reduction program, showing how individuals have effectively lowered their tax liabilities through this initiative. If you qualify for one time tax forgiveness from the IRS, you could experience substantial financial relief, allowing you to focus on your recovery without the added stress of fines.

If you’re looking to seek relief from fines, there are clear steps you can take:

- You can file IRS Form 843.

- You can make a verbal request to the IRS.

Remember, you’re not alone in this journey, and we’re here to help you navigate these options.

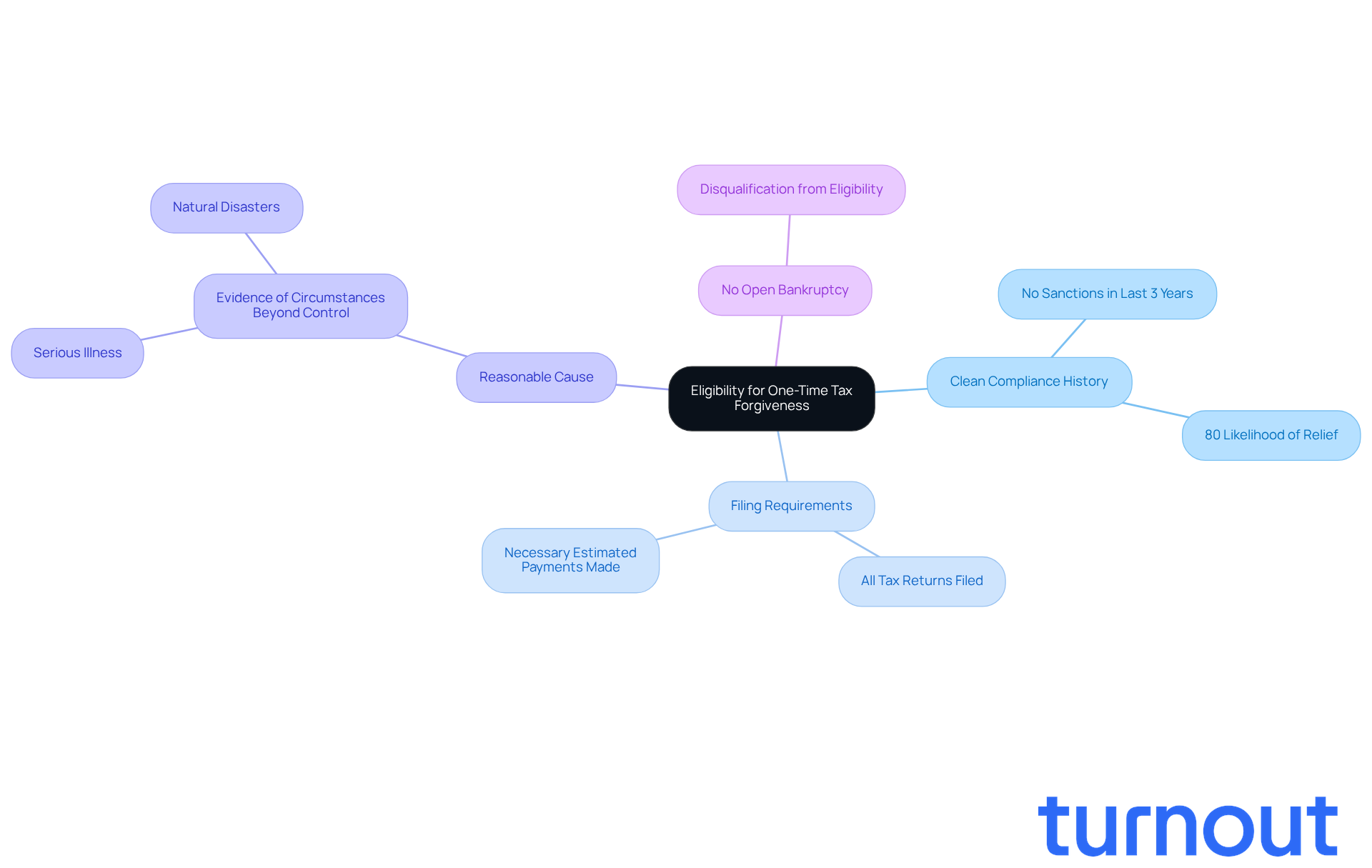

Determine Your Eligibility for One-Time Forgiveness

If you're looking to qualify for IRS One-Time Tax Forgiveness, it’s important to know that there are several essential criteria you need to meet:

-

Clean Compliance History: Having no sanctions in the past three years-except for the estimated tax charge-is crucial. This clean record shows the IRS that you’re a reliable taxpayer. Did you know that around 80% of taxpayers with a clean compliance history are more likely to receive relief from fines?

-

Filing Requirements: Make sure all required tax returns are filed and that necessary estimated payments have been made. Meeting these obligations is a fundamental part of your eligibility.

-

Reasonable Cause: You’ll need to provide evidence that any failure to comply was due to circumstances beyond your control, like serious illness or natural disasters. This helps demonstrate to the IRS that your non-compliance wasn’t due to negligence.

-

No Open Bankruptcy: If you’re involved in an open bankruptcy proceeding, unfortunately, this disqualifies you from eligibility.

Tax professionals often emphasize how crucial a solid compliance record is for qualifying for one time tax forgiveness. Kelly Wallace, a CPA, shares, "A clean compliance history is frequently the key to unlocking opportunity for reducing sanctions." If you meet these requirements, you can confidently move forward with the application process.

Looking ahead, recent updates suggest that by 2026, the IRS may be more lenient in granting fee waivers to those who demonstrate a clean compliance history. It’s inspiring to hear stories of taxpayers who have successfully navigated this process. For instance, John T. faced no fines for three years and was able to obtain forgiveness. To show a clean compliance history, keep thorough records of your filings and payments, and ensure timely submissions to the IRS. Remember, you’re not alone in this journey-we’re here to help!

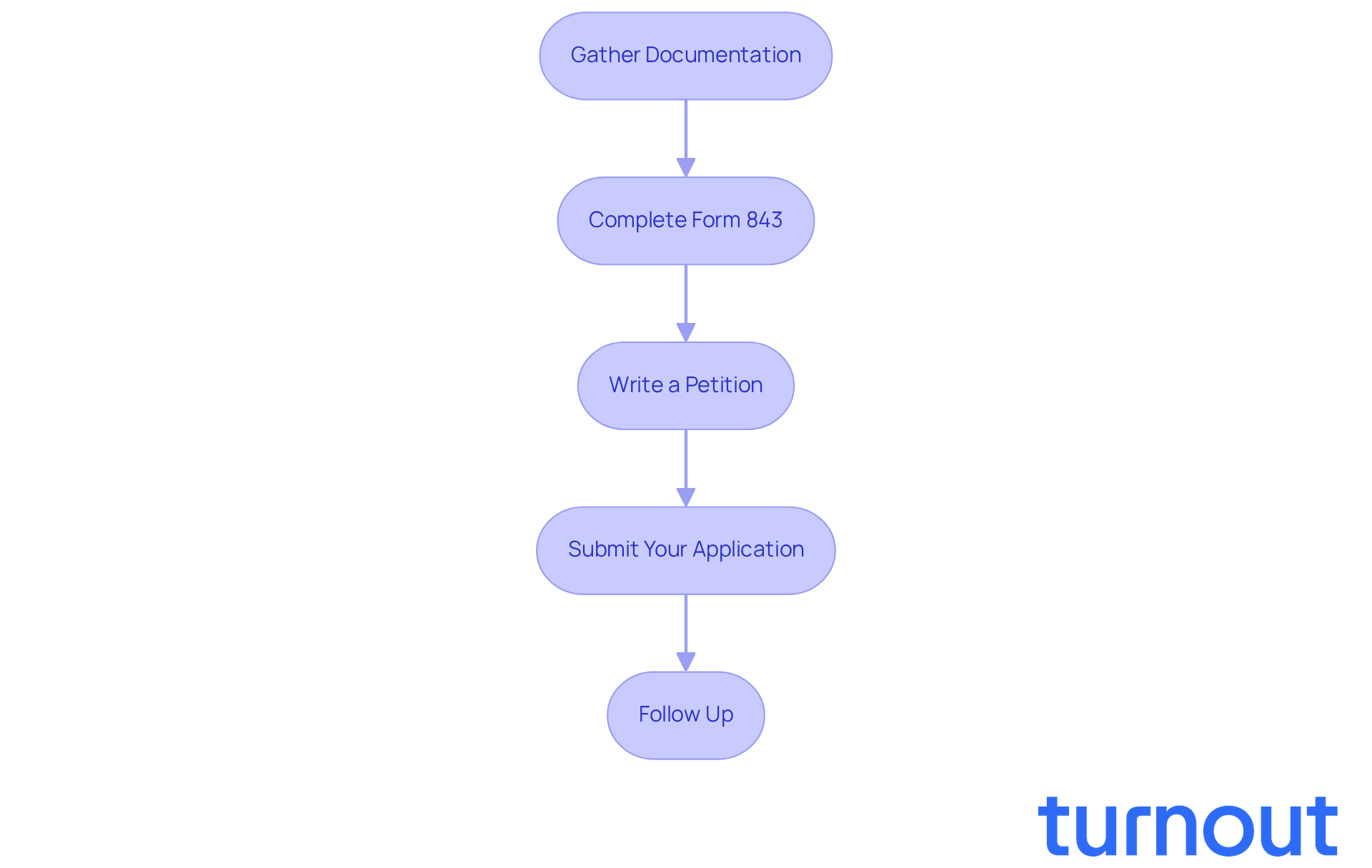

Follow the Application Process for One-Time Forgiveness

If you're feeling overwhelmed by tax issues, you're not alone. Applying for one time tax forgiveness from the IRS can seem daunting, but we're here to help you through it. Just follow these steps:

-

Gather Documentation: Start by collecting all necessary documents. This includes your tax returns for the past three years and any correspondence from the IRS about fines. If you received incorrect written guidance from the IRS, you can request a statutory exception for fee relief by submitting Form 843.

-

Complete Form 843: Next, fill out IRS Form 843, titled 'Claim for Refund and Request for Abatement.' This form is crucial for requesting fee relief. Be sure to specify the fees you want reduced and include your personal taxpayer information. To qualify for one time tax forgiveness, you must have filed a tax return for at least three years prior to receiving a fine and not incurred another fine in the last three years.

-

Write a Petition: It's important to include a clear and concise written statement explaining why you believe the penalties should be abated. Support your request with relevant evidence, such as documentation of any extenuating circumstances that contributed to your tax issues. Consulting a tax expert before seeking a reduction can also enhance your chances of success.

-

Submit Your Application: Once everything is ready, send your completed Form 843 along with all supporting documents to the address specified in the IRS instructions. Remember to keep copies of everything for your records.

-

Follow Up: After submission, monitor your application status. If you don’t receive a response within a reasonable timeframe-typically several weeks to a few months-don’t hesitate to contact the IRS. Be aware that the results of your application can include approval, partial reduction, or denial.

We understand that navigating tax issues can be stressful, but taking these steps can help you find relief. You're not alone in this journey.

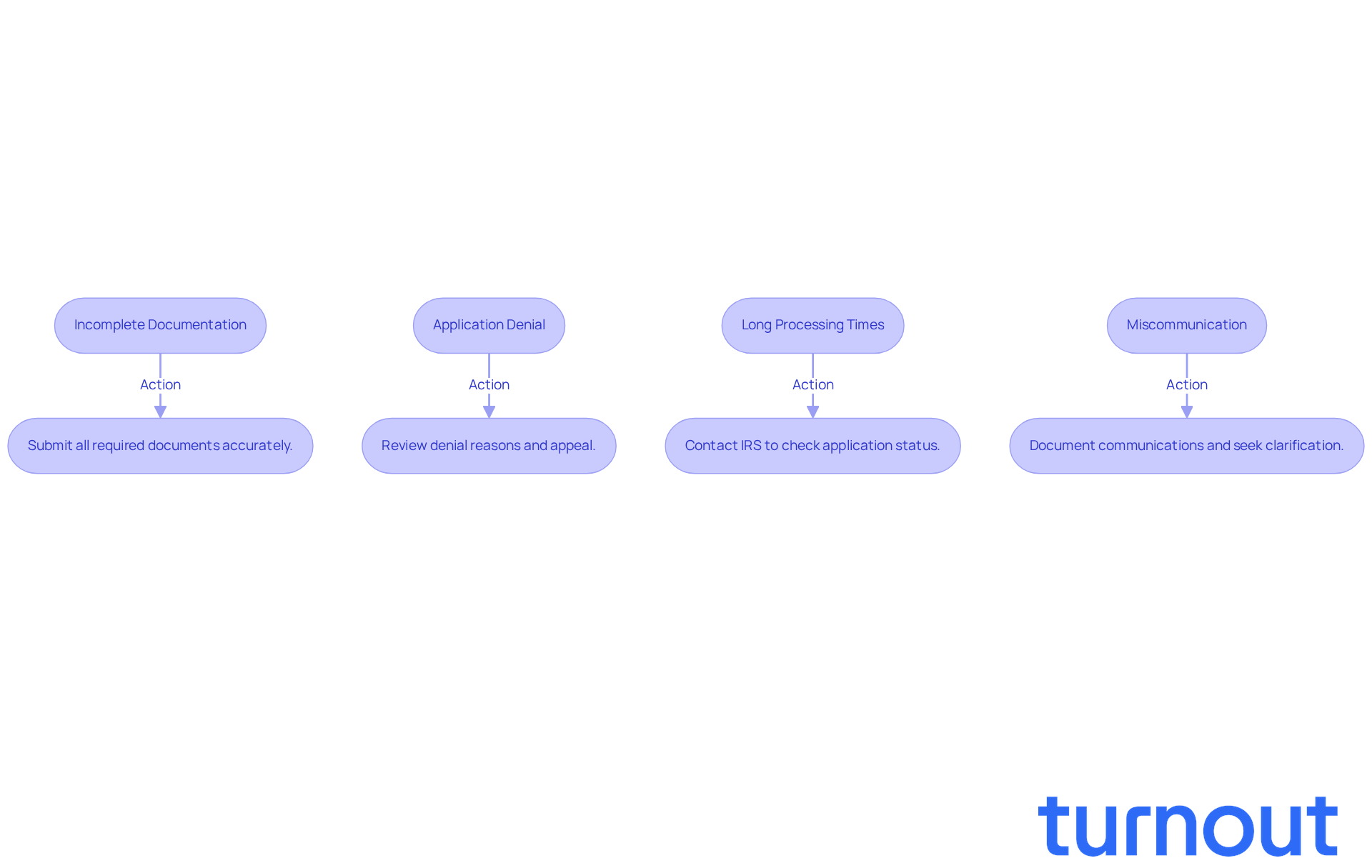

Troubleshoot Common Issues in Your Application

When applying for one time tax forgiveness from the IRS, it’s common to face a few hurdles. We understand that navigating this process can be overwhelming, but you’re not alone. Here are some common issues you might encounter:

-

Incomplete Documentation: It’s crucial to submit all required documents accurately. The IRS often denies applications due to missing information. If they request additional documentation, respond promptly to avoid delays. Remember, you’re taking a step toward relief.

-

Application Denial: If your application is denied, take a moment to carefully review the reasons provided by the IRS. Common denial reasons include insufficient evidence of hardship or not meeting eligibility criteria. You can appeal the decision by submitting a written request for reconsideration. It’s important to note that nearly 40% of penalty abatement applications are denied, so understanding the reasons behind any denial can empower you.

-

Long Processing Times: Delays can be frustrating, and it’s normal to feel anxious during this time. If you experience extended processing times, don’t hesitate to contact the IRS to check the status of your application. Be ready to provide your application details; this can help speed things up.

-

Miscommunication: Conflicting information from the IRS can lead to confusion. Document all communications and seek clarification on any discrepancies. If issues persist, consider consulting a tax professional who can provide expert guidance and support as you navigate the appeals process.

By being proactive and informed, you can effectively troubleshoot these challenges. Remember, we’re here to help you improve your chances of securing one time tax forgiveness.

Conclusion

Navigating the IRS's one-time tax forgiveness program can truly offer essential relief for those of you facing financial burdens due to unexpected circumstances. We understand that these situations can be overwhelming, and this initiative is here to assist individuals with a clean compliance history who have encountered difficulties. It allows you to alleviate the stress of accumulated fines and focus on your financial recovery.

In this article, we’ll outline the crucial steps to successfully secure this forgiveness. It’s important to understand the eligibility criteria, gather the necessary documentation, and follow the application process carefully. Remember, maintaining a clean compliance history and demonstrating reasonable cause for any lapses are key. And don’t worry - being prepared to troubleshoot common application issues can make a big difference.

Ultimately, the significance of the IRS one-time tax forgiveness program cannot be overstated. It offers a beacon of hope for many taxpayers, fostering a sense of financial relief and encouraging proactive engagement with the tax system. If you find yourself eligible, taking the necessary steps to apply can lead to a more manageable financial future. Remember, being informed and prepared in tax matters is crucial, and we’re here to help you every step of the way.

Frequently Asked Questions

What is IRS one-time tax forgiveness?

IRS one-time tax forgiveness, also known as fee abatement, is a program designed to assist taxpayers who have made errors in filing or payment, particularly those with a clean compliance history facing unforeseen circumstances.

Who can qualify for the IRS one-time tax forgiveness program?

To qualify, you typically need to show that you have submitted all necessary tax returns and have not encountered similar fines in the past three years.

Does the program provide universal forgiveness of tax obligations?

No, the program does not offer universal forgiveness; it specifically focuses on waiving certain fines associated with late filings or payments.

How many taxpayers are expected to benefit from the IRS's relief program?

Approximately 1.6 million taxpayers are expected to benefit from the IRS's relief program, which includes automatic removal of failure-to-file fees for the 2019 and 2020 tax years.

What should taxpayers do to qualify for the automatic relief for 2019 and 2020 returns?

Taxpayers who have already filed their 2019 and 2020 returns do not need to take any additional action to qualify for the automatic relief.

What steps can you take to seek relief from fines under the one-time tax forgiveness program?

You can seek relief by filing IRS Form 843 or by making a verbal request to the IRS.

Are there real-world examples of the program's effectiveness?

Yes, there are examples showing how individuals have successfully lowered their tax liabilities through the fee reduction initiative.

What is the overall aim of the IRS's one-time tax forgiveness program?

The program aims to provide significant financial relief to taxpayers, allowing them to focus on recovery without the added stress of fines.