Introduction

Navigating the complexities of income tax debt can often feel like an uphill battle, especially for those facing financial strain. We understand that this situation can be overwhelming. Fortunately, income tax forgiveness programs, like the Offer in Compromise, provide a beacon of hope. They allow taxpayers to settle their obligations for less than what they owe.

However, it’s common to wonder: what does it truly take to secure this financial relief? With a competitive acceptance rate and stringent eligibility requirements, many may feel uncertain. This article delves into the essential steps and strategies to successfully navigate the income tax forgiveness process. We’re here to equip you with the knowledge needed to turn your financial situation around.

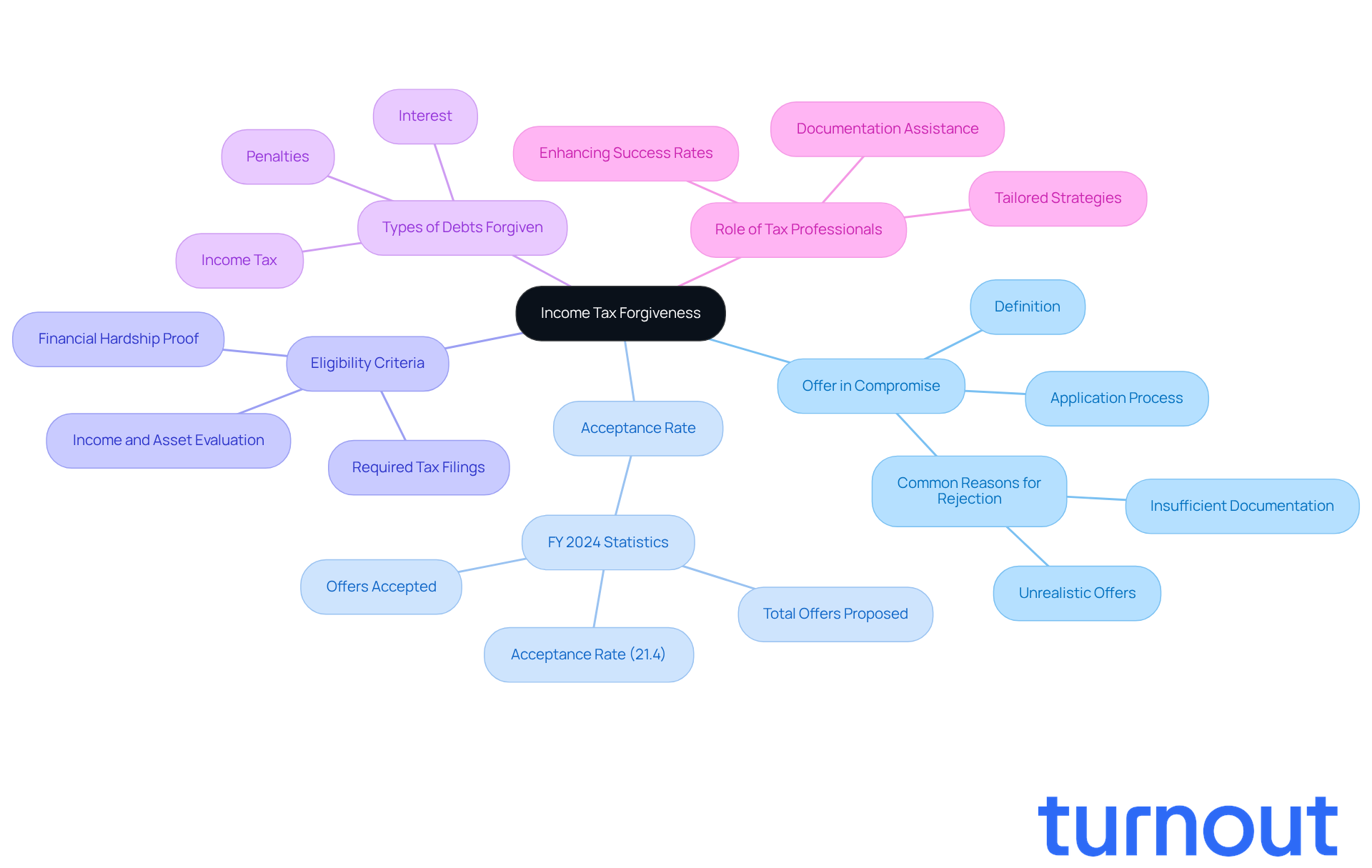

Understand Income Tax Forgiveness

For many taxpayers struggling with overwhelming debts, income tax forgiveness can feel like a lifeline. Programs like the Offer in Compromise (OIC) allow you to settle your tax obligations for less than what you owe, providing a path toward relief. In FY 2024, the IRS accepted 7,199 out of 33,591 proposed OICs, which means an acceptance rate of about 21.4%. This statistic highlights how competitive the program can be, as many applications face rejection due to insufficient documentation or unrealistic offers.

We understand that navigating tax debt can be daunting. The IRS Fresh Start Program provides various relief options, including income tax forgiveness through the OIC, to assist those in need. It's essential to know the eligibility criteria and the types of debts that can be forgiven, such as penalties and interest. Filing your tax returns on time is crucial; it helps prevent additional penalties and keeps you eligible for relief options.

Engaging with tax professionals can significantly enhance your chances of a successful outcome. They can provide tailored strategies and support throughout this process. Remember, you are not alone in this journey. We're here to help you find the best course of action.

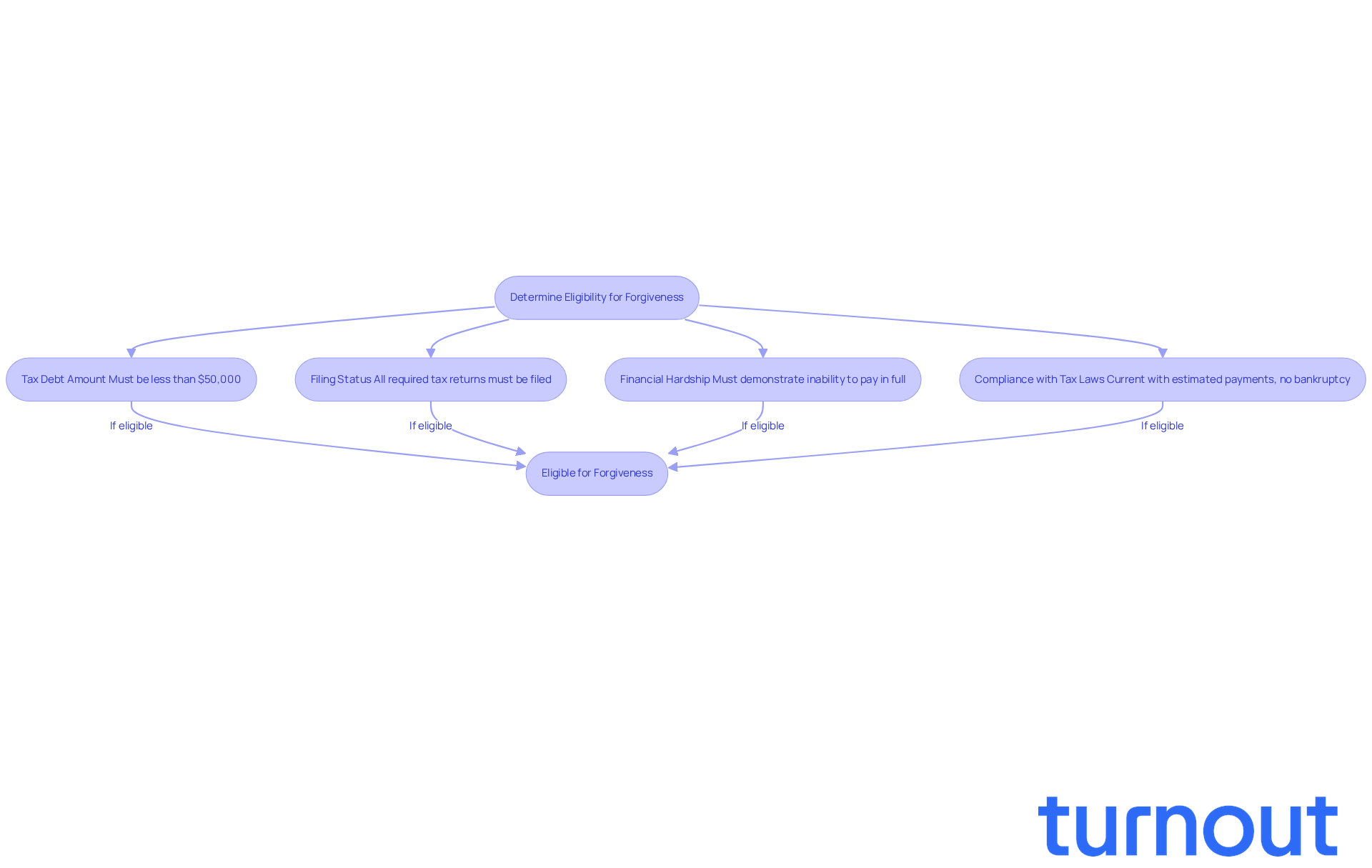

Determine Your Eligibility for Forgiveness

If you're wondering about your eligibility for income tax forgiveness, it’s important to begin by evaluating your economic situation. We understand that navigating tax debt can be overwhelming, so let’s break down some key factors that can help you.

-

Tax Debt Amount: To qualify for the Offer in Compromise (OIC) program, your tax debt generally needs to be less than $50,000. In 2026, a significant number of taxpayers find themselves within this threshold, making them eligible for various relief options. Many are turning to the IRS Offer in Compromise for income tax forgiveness to settle their tax debt for less than what they owe, and you might be able to do the same.

-

Filing Status: It’s crucial to ensure that all required tax returns are filed. The IRS won’t consider forgiveness requests from individuals with unfiled returns, as compliance is a must for any relief. In FY 2024, the IRS assessed $17.8 billion in additional taxes for late returns, highlighting just how important it is to file on time.

-

Financial Hardship: You’ll need to show that you can’t pay your tax debt in full. This often means providing detailed financial documentation, like income statements, expense reports, and asset information. For instance, Dana, a nurse practitioner, faced significant self-employment tax responsibilities but was able to demonstrate her economic hardship through a decrease in her income. If you’re experiencing similar challenges, know that you’re not alone.

-

Compliance with Tax Laws: It’s essential that you’re not in an open bankruptcy proceeding and that you’re current with estimated tax payments. The IRS looks at your overall financial situation when reviewing your request, so maintaining compliance is key. They have strict eligibility guidelines, ensuring that only those who meet the criteria are considered.

Before you proceed with an application, we encourage you to utilize the IRS's Offer in Compromise Pre-Qualifier tool. This proactive step can help clarify your standing and prepare you for the next stages of the process. Remember, you’re not alone in this journey, and we’re here to help.

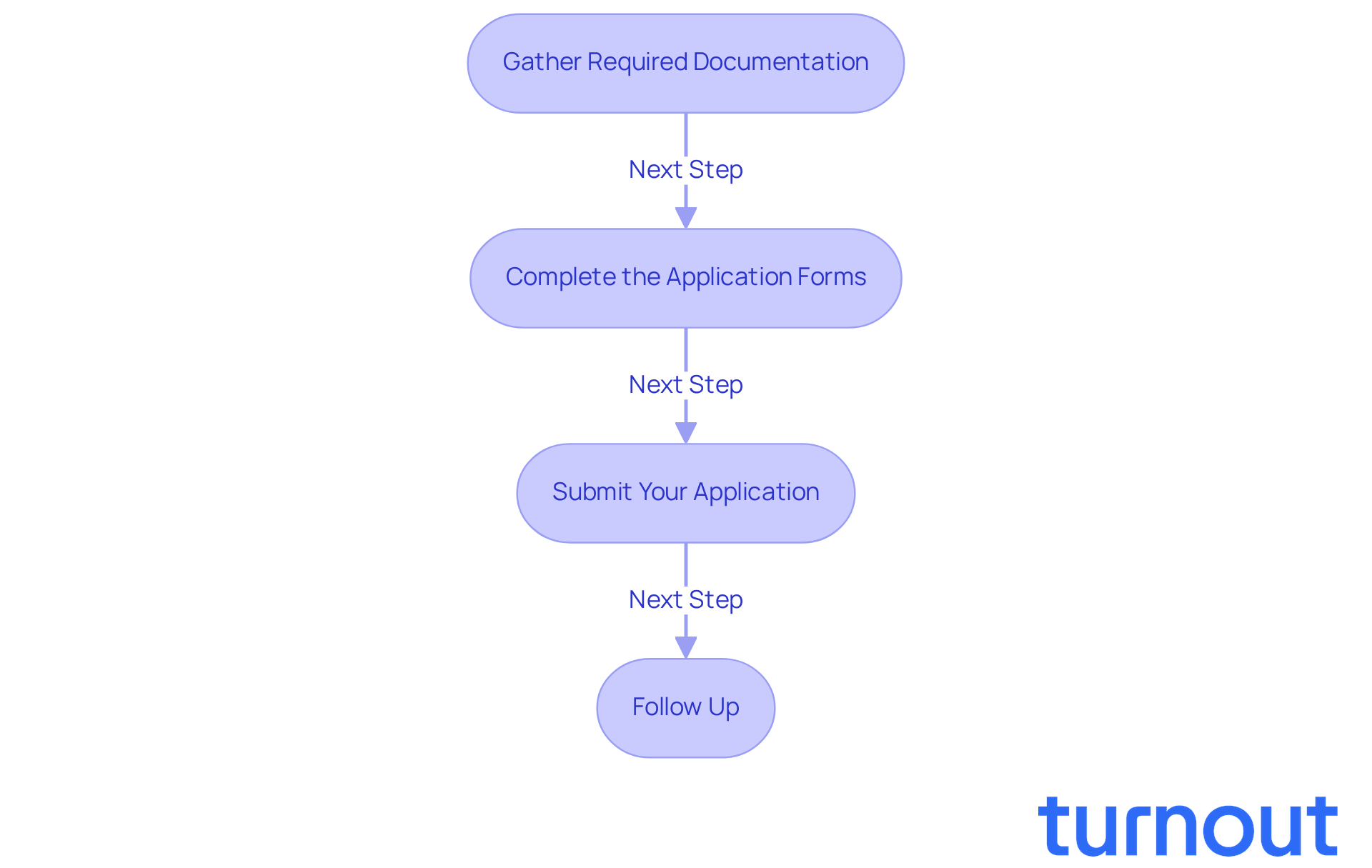

Apply for Income Tax Forgiveness

While applying for income tax forgiveness can feel overwhelming, we are here to help you navigate the process. Follow these steps to make the process smoother:

-

Gather Required Documentation: Start by collecting all necessary documents. This includes:

- Completed IRS Form 656 (Offer in Compromise)

- Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses

- Proof of income, like pay stubs or bank statements

- Documentation of expenses, such as housing, utilities, and other living costs

- You may also need tax returns from the past three years and any relevant statements of account. Remember, it’s important to file all required tax returns and make necessary estimated payments to qualify for income tax forgiveness under the Offer in Compromise.

-

Complete the Application Forms: Take your time filling out the forms accurately. Ensure all financial information is complete and truthful. Common mistakes, like underreporting assets or overstating expenses, can lead to delays or denials, and we want to help you avoid that.

-

Submit Your Application: Once your forms are ready, send them along with any required fees (typically $205, which can be waived for low-income applicants) to the appropriate IRS address. Keep copies of everything you submit for your records; this will help you track your status.

-

Follow Up: After you submit your application, monitor its status through your IRS online account or by contacting the IRS directly. It’s common to feel anxious during this waiting period, but be ready to respond quickly to any inquiries or requests for further details. The IRS may take several months to evaluate your submission, but they have increased staffing to help speed up the review process.

Remember, you are not alone in this journey. We understand that seeking assistance can be daunting, but taking these steps can lead you toward relief.

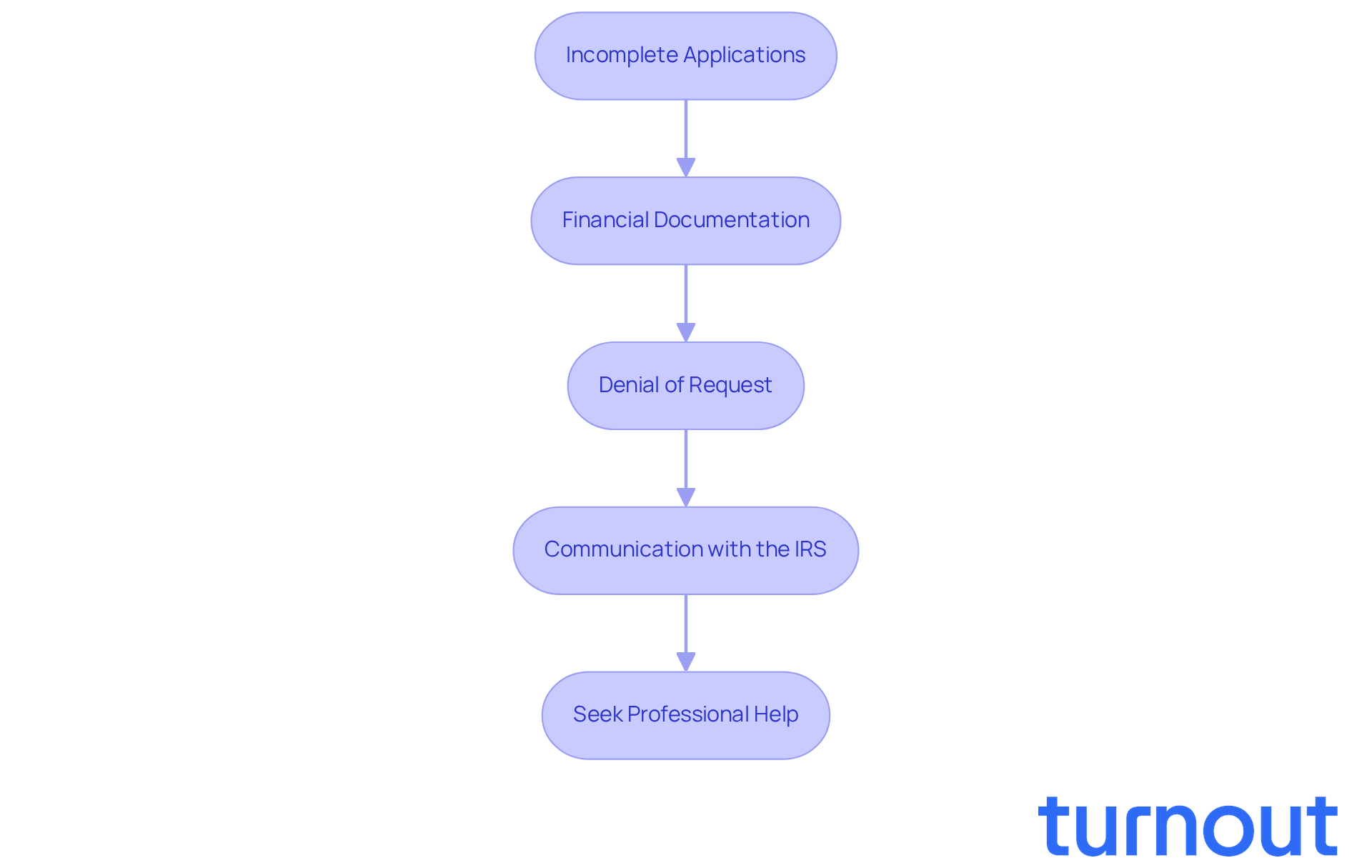

Navigate Challenges in the Application Process

Navigating the procedure for income tax forgiveness can feel overwhelming, and you are not alone on this path. Here are some essential steps to help you overcome common obstacles:

-

Incomplete Applications: We understand that filling out forms can be daunting. Make sure to complete all forms thoroughly, ensuring that no signatures or required documentation are missing. In 2026, a significant percentage of requests for income tax forgiveness were rejected due to incompleteness, which highlights the importance of being meticulous.

-

Financial Documentation: It's common to feel anxious about the IRS requesting additional financial information. Keeping your documents organized and easily accessible will allow you to respond swiftly to any inquiries. This is crucial for maintaining the momentum of your submission.

-

Denial of Request: If your request is denied, take a moment to carefully review the reasons provided by the IRS. You have the option to appeal the decision or reapply after addressing the specific issues that led to the denial. Understanding these reasons can significantly improve your chances of obtaining income tax forgiveness in future attempts.

-

Communication with the IRS: Maintaining proactive communication with the IRS can make a difference. Quickly reply to any notices or requests for information to prevent unnecessary delays in handling your submission. Effective communication can often expedite the resolution of issues.

-

Seek Professional Help: If the process feels too much to handle, consider reaching out to Turnout's trained nonlawyer advocates or IRS-licensed enrolled agents. Their expertise can provide personalized guidance and support, helping you navigate the complexities of tax forgiveness applications more effectively. Remember, we're here to help!

Conclusion

Securing income tax forgiveness can be a lifeline for those weighed down by tax debt. We understand that navigating programs like the Offer in Compromise (OIC) can feel overwhelming. But with the right knowledge and steps, you can find your way toward financial recovery. This process, while intricate, shines a light of hope for those who qualify and are ready to engage with the IRS.

Throughout this journey, it’s crucial to gather accurate documentation, meet filing requirements, and stay compliant with tax laws. Knowing your eligibility - based on factors like the amount of tax debt, financial hardship, and timely filing - can significantly boost your chances of acceptance. And remember, seeking professional help can be invaluable, ensuring your application is thorough and truly reflects your financial situation.

Reflecting on the importance of income tax forgiveness, it’s clear this isn’t just about settling debts. It’s about reclaiming your financial stability and peace of mind. If you’re facing daunting tax obligations, taking proactive steps to understand and apply for forgiveness can pave the way to a brighter financial future. Engaging with resources, whether through self-education or professional support, empowers you to overcome challenges and seize the opportunity for relief.

You are not alone in this journey. We’re here to help you every step of the way.

Frequently Asked Questions

What is income tax forgiveness?

Income tax forgiveness refers to programs that allow taxpayers to settle their tax obligations for less than the full amount owed, providing a way to relieve overwhelming tax debt.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program that enables taxpayers to settle their tax debts for less than what they owe, but it is competitive and requires sufficient documentation to be accepted.

What was the acceptance rate for OICs in FY 2024?

In FY 2024, the IRS accepted 7,199 out of 33,591 proposed OICs, resulting in an acceptance rate of approximately 21.4%.

Why might an OIC application be rejected?

OIC applications may be rejected due to insufficient documentation or offers that are considered unrealistic by the IRS.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program offers various relief options for taxpayers, including income tax forgiveness through the OIC, to help those struggling with tax debts.

What types of debts can be forgiven through these programs?

Debts that can be forgiven include penalties and interest, in addition to the principal tax owed.

Why is it important to file tax returns on time?

Filing tax returns on time is crucial as it helps prevent additional penalties and maintains eligibility for relief options like income tax forgiveness.

How can tax professionals assist taxpayers seeking forgiveness?

Tax professionals can provide tailored strategies and support throughout the process, enhancing the chances of a successful outcome in resolving tax debts.