Introduction

Receiving an IRS notice of intent to levy can be incredibly stressful. It’s a signal that the federal agency is ready to seize your assets to settle unpaid tax debts. This important document not only details the amount you owe but also acts as a final call to action. Typically, you have just 30 days to respond before the IRS takes further steps.

We understand that the potential for serious financial consequences can feel overwhelming. The stakes are high, and it’s crucial to act quickly and knowledgeably. How can you navigate this challenging situation and protect your financial future? You're not alone in this journey, and there are steps you can take to find relief.

Understand the IRS Notice of Intent to Levy

Receiving an IRS notice of intent to levy can be a daunting experience. This formal notification is an IRS notice of intent to levy, indicating that the IRS plans to seize your assets to settle an unpaid tax debt. Often referred to as a CP504 or LT11 document, the IRS notice of intent to levy serves as a final reminder before the IRS takes action against your wages, bank accounts, or other assets.

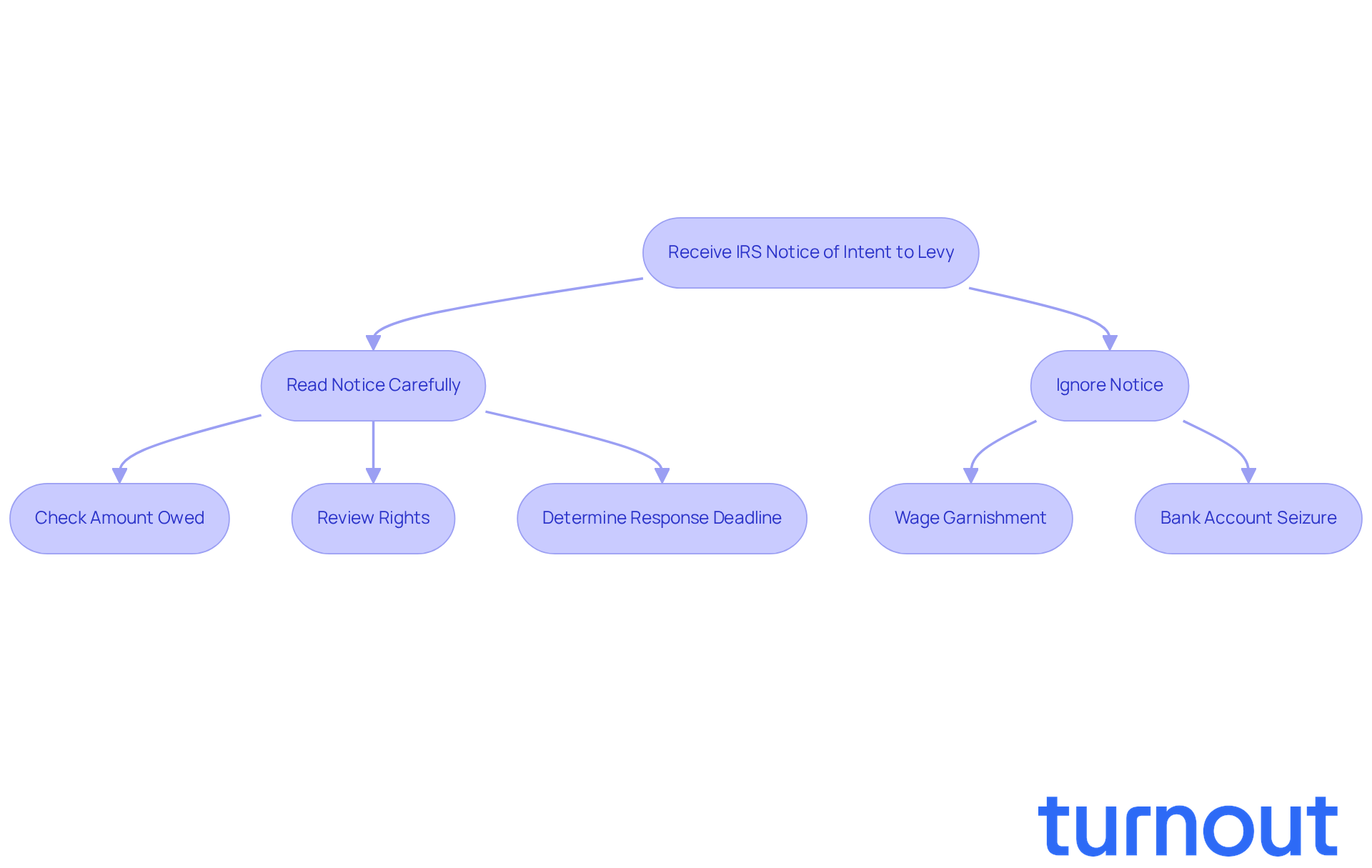

We understand that this news can be overwhelming. It’s crucial to read this announcement carefully, as it outlines your rights and the actions you can take in response to the IRS notice of intent to levy. The IRS notice of intent to levy will specify the amount owed and the deadline for responding, usually allowing you 30 days to act before the IRS proceeds with the levy.

Ignoring the IRS notice of intent to levy can lead to serious financial repercussions, such as wage garnishment or the seizure of your bank funds. Remember, you are not alone in this journey. There are steps you can take to address this situation, and we’re here to help you navigate through it.

Take Immediate Action to Protect Your Assets

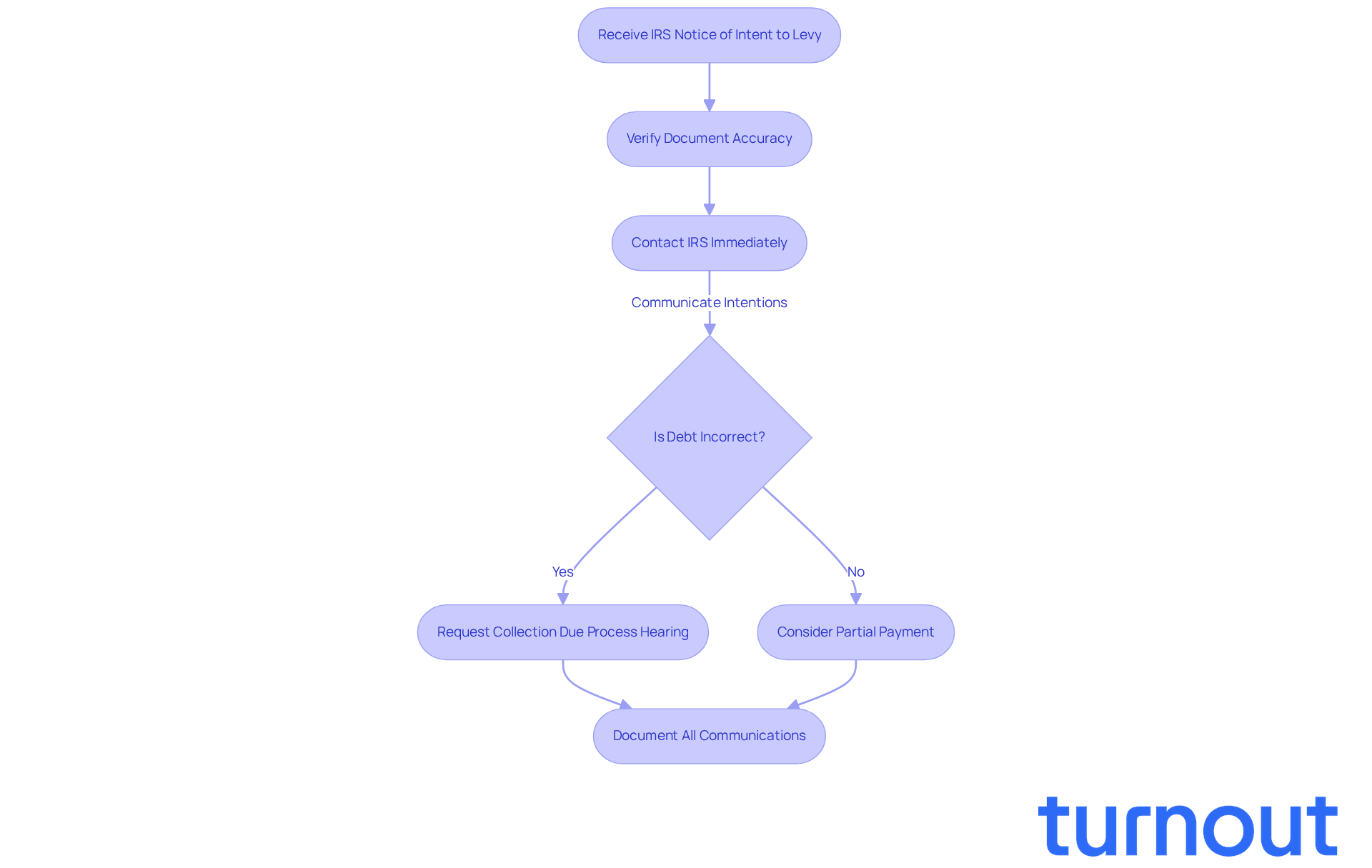

Receiving an IRS notice of intent to levy can be overwhelming. We understand that this notice may bring up feelings of anxiety and uncertainty. Your first step is to verify the accuracy of the document. Take a moment to carefully check the details, including the amount owed and the response deadline. Acting quickly is crucial, as the IRS can levy bank accounts, garnish wages, and take property without further warning after a 30-day period expires.

Contact the IRS immediately using the number provided on the notice. Clearly communicate your intention to resolve the issue and ask about your alternatives. If you believe the debt is incorrect, you can request a Collection Due Process (CDP) hearing. This allows you to contest the levy and typically takes 3-6 months, during which collection actions are suspended. This gives you valuable time to negotiate a resolution.

Additionally, consider making a partial payment if possible. This may temporarily halt the levy process while you work towards a solution. Always document all communications with the IRS for your records; this can be vital in your case.

Remember, as Steven N. Klitzner states, 'Receiving an IRS notice of intent to levy is intimidating, but it could also be a turning point for you.' You are not alone in this journey, and we're here to help you navigate through it.

Explore Resolution Options for Your Tax Debt

If you've received an IRS notice of intent to levy, it’s completely understandable to feel overwhelmed. You're not alone in this journey, and there are several alternatives available to help you address your tax debt.

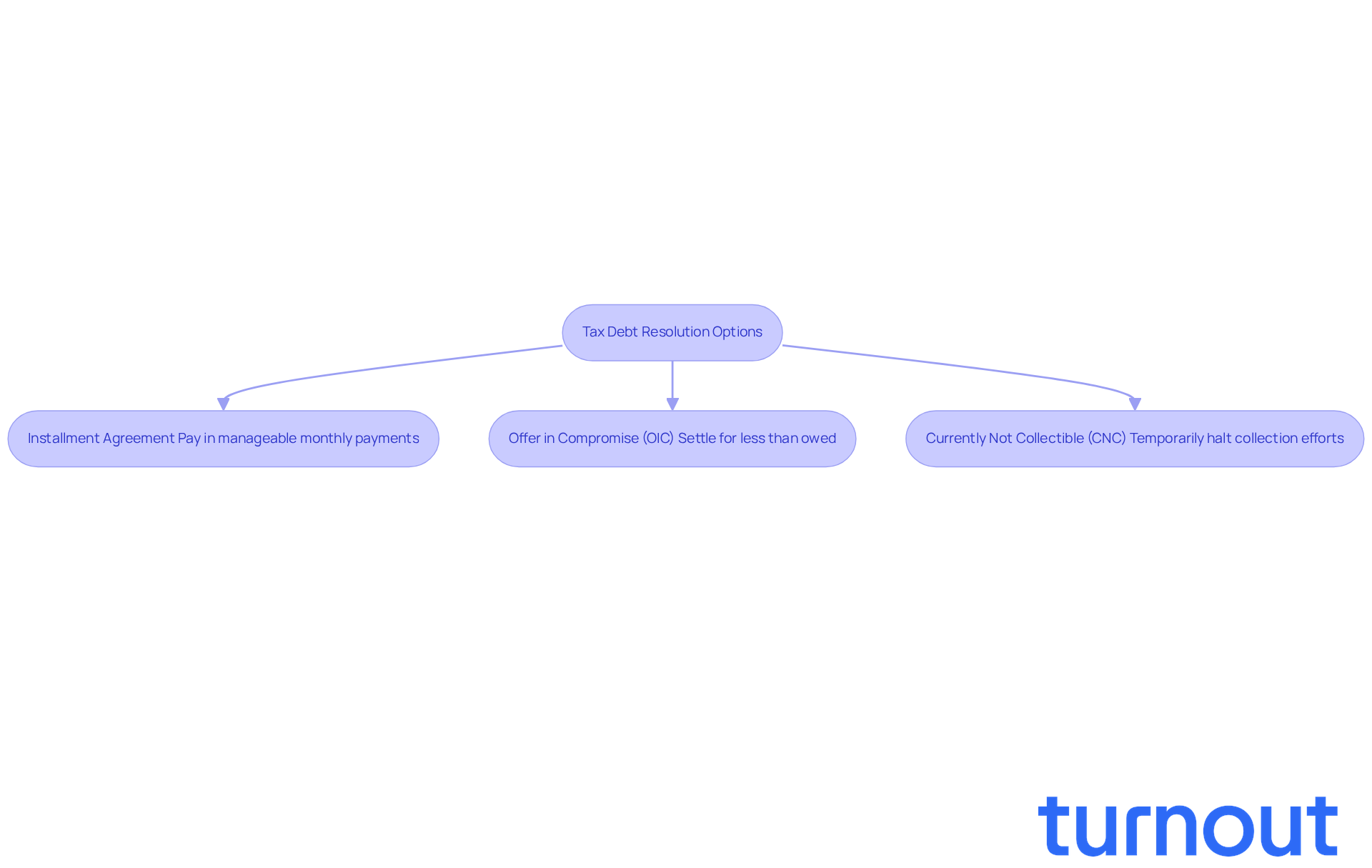

One option is to establish an Installment Agreement. This allows you to pay your debt in manageable monthly payments, making it easier to handle your finances.

Alternatively, you might qualify for an Offer in Compromise (OIC). This option enables you to settle your tax debt for less than the full amount owed, especially if you can show that you're facing financial hardship.

Another choice is to request Currently Not Collectible (CNC) status. This can temporarily halt collection efforts if you're unable to pay right now.

Each of these choices has specific eligibility criteria and application processes. It’s crucial to assess your financial situation carefully and select the best path forward. Remember, we're here to help you navigate these options.

Consider Hiring a Tax Professional for Guidance

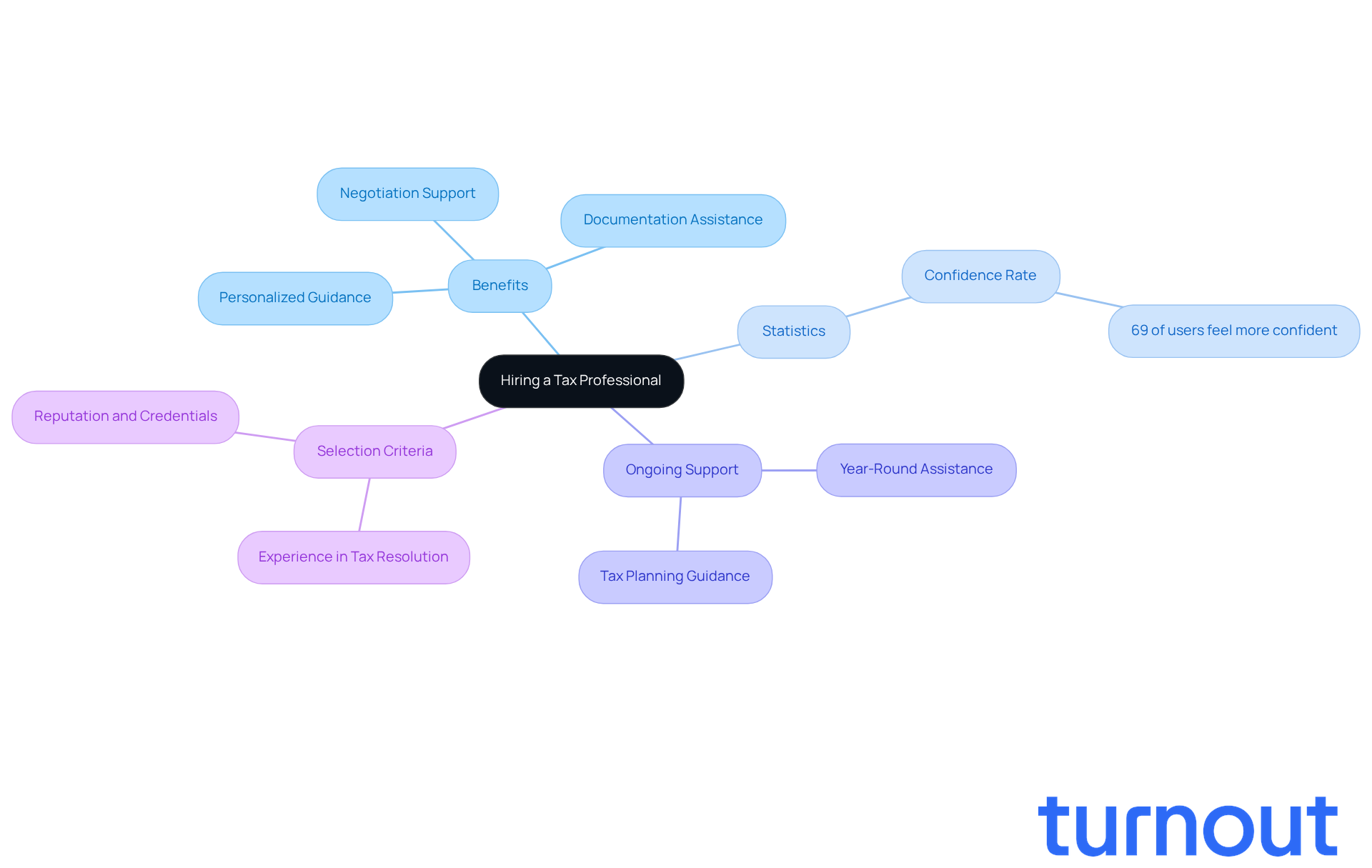

Navigating the IRS can feel overwhelming, and it’s common to worry about tax resolution options. That’s where the expertise of a qualified tax professional becomes invaluable. A skilled tax advisor or attorney can provide personalized guidance tailored to your unique situation, helping you understand your rights and effectively negotiate with the IRS.

They ensure that all necessary documentation is accurately submitted, which is crucial for a successful outcome. Imagine having someone by your side who can explore various resolution options, potentially saving you both time and money in the long run. In fact, statistics show that 69% of those who use tax preparers feel more confident about filing their returns. This underscores just how important professional guidance can be in these complex situations.

Moreover, tax advisors offer year-round support, assisting clients with ongoing tax planning and financial questions. When choosing a tax advisor, it’s essential to prioritize those with proven experience in tax resolution and a solid reputation. These factors can significantly influence the success of your case. Remember, as one tax advisor noted, "A lot of ways a tax advisor can save you money, even after paying their fees."

You are not alone in this journey. We’re here to help you navigate these challenges with confidence.

Conclusion

Receiving an IRS notice of intent to levy can feel overwhelming. We understand that this situation may weigh heavily on your mind. But remember, with the right approach, it can also be an opportunity for resolution.

Taking immediate action is crucial. Start by verifying the accuracy of the notice and contacting the IRS promptly. Consider exploring various resolution options, like installment agreements or offers in compromise. Each of these steps is vital to help you avoid unnecessary financial strain.

Don’t hesitate to seek help from a qualified tax professional. They can provide personalized support, making this process more manageable and increasing your chances of a favorable outcome.

You are not alone in this journey. With the right knowledge and resources, you can effectively address the IRS notice of intent to levy. Taking proactive steps not only safeguards your assets but also empowers you to regain control over your financial situation. Embrace this opportunity to resolve your tax issues, and remember, we’re here to help you move forward with confidence.

Frequently Asked Questions

What is an IRS notice of intent to levy?

An IRS notice of intent to levy is a formal notification indicating that the IRS plans to seize your assets to settle an unpaid tax debt. It is often referred to as a CP504 or LT11 document.

What does the IRS notice of intent to levy signify?

The notice serves as a final reminder before the IRS takes action against your wages, bank accounts, or other assets due to unpaid tax debts.

What should I do upon receiving an IRS notice of intent to levy?

It is crucial to read the notice carefully, as it outlines your rights and the actions you can take in response. The notice will specify the amount owed and the deadline for responding, usually allowing you 30 days to act.

What happens if I ignore the IRS notice of intent to levy?

Ignoring the notice can lead to serious financial repercussions, such as wage garnishment or the seizure of your bank funds.

How much time do I have to respond to the IRS notice of intent to levy?

You typically have 30 days to respond before the IRS proceeds with the levy.

Can I get help with my situation after receiving an IRS notice of intent to levy?

Yes, there are steps you can take to address the situation, and assistance is available to help you navigate through it.