Overview

We understand that managing tax payments can be overwhelming. This article outlines a simple four-step process to help you pay your IRS online installment agreement with confidence.

- Visit the IRS website.

- Apply for the agreement by providing the necessary information.

- Choose a payment method that works best for you.

Each step is explained in detail, emphasizing the importance of accuracy to ensure a smooth process. There are various payment options available, designed to help you manage your tax liabilities effectively. Remember, you're not alone in this journey; we're here to help you navigate through it.

Introduction

Navigating tax debts can feel overwhelming, especially when dealing with the complexities of the IRS. We understand that for many, the IRS Online Installment Agreement can be a vital lifeline. It allows taxpayers to manage their liabilities over time, rather than facing the pressure of a single lump sum payment. This guide is designed to demystify the application process, offering essential insights into selecting the best payment method and troubleshooting common issues.

However, it’s common to encounter unexpected challenges during this seemingly straightforward process. Understanding the nuances of these agreements could be the key to achieving the financial peace of mind you deserve. Remember, you are not alone in this journey; we’re here to help you navigate these waters with confidence.

Understand IRS Online Installment Agreements

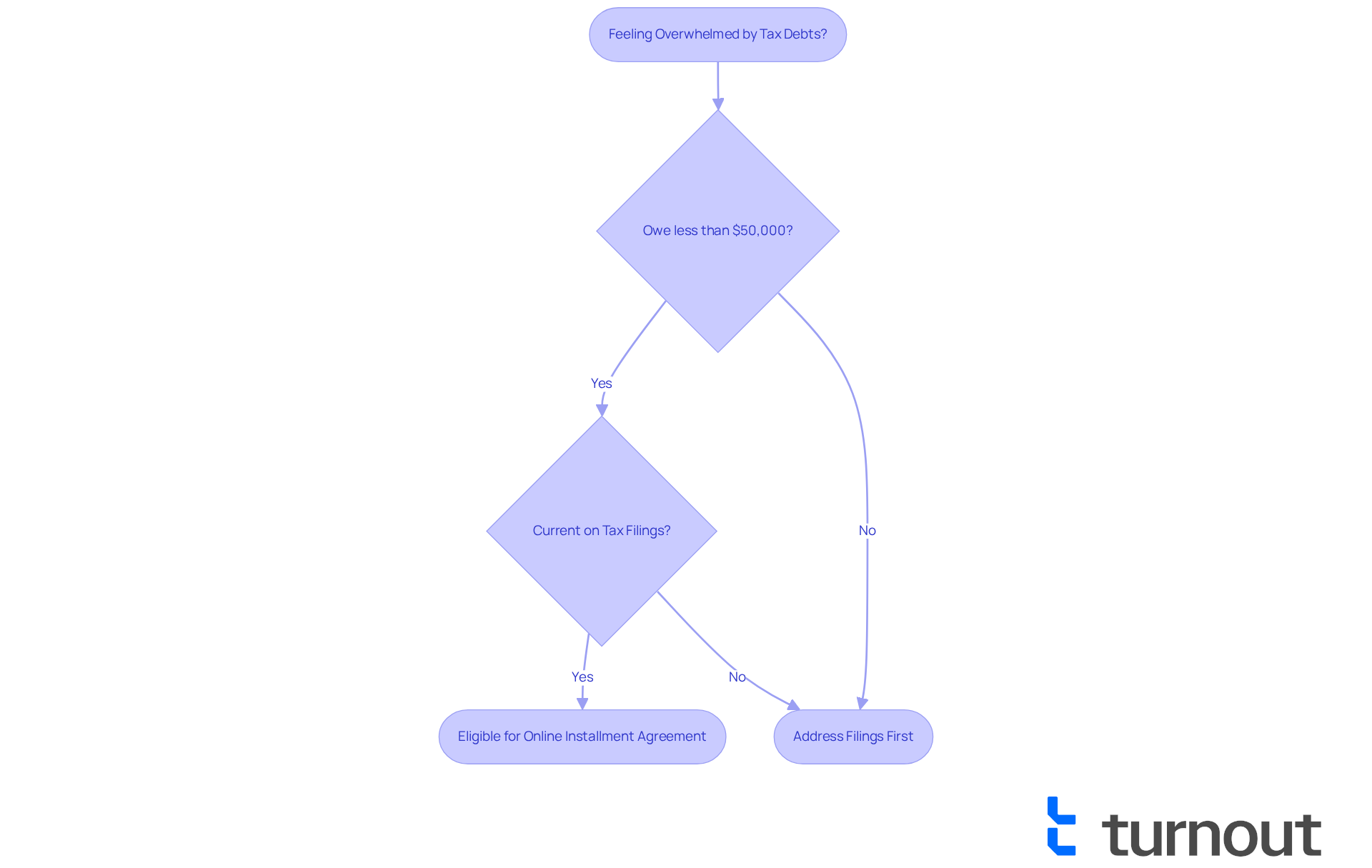

If you're feeling overwhelmed by tax debts, you might find that paying the IRS online installment agreement is the solution you need. This option allows you to pay off your tax liabilities over time, rather than all at once. It's especially beneficial for those who may not have the full amount available right now but want to avoid the stress of penalties and interest that come with unpaid taxes.

To qualify for this agreement, you'll typically need to owe less than $50,000 in total tax, penalties, and interest. It's also important that you're current on your tax filings. We understand that navigating these requirements can be daunting, but knowing the terms of the agreement—such as the payment duration and amounts—can significantly aid in your financial planning.

Remember, you're not alone in this journey. Understanding these conditions is crucial for staying compliant with IRS regulations and ensuring a smoother path forward. We're here to help you every step of the way.

Apply for an Online Installment Agreement

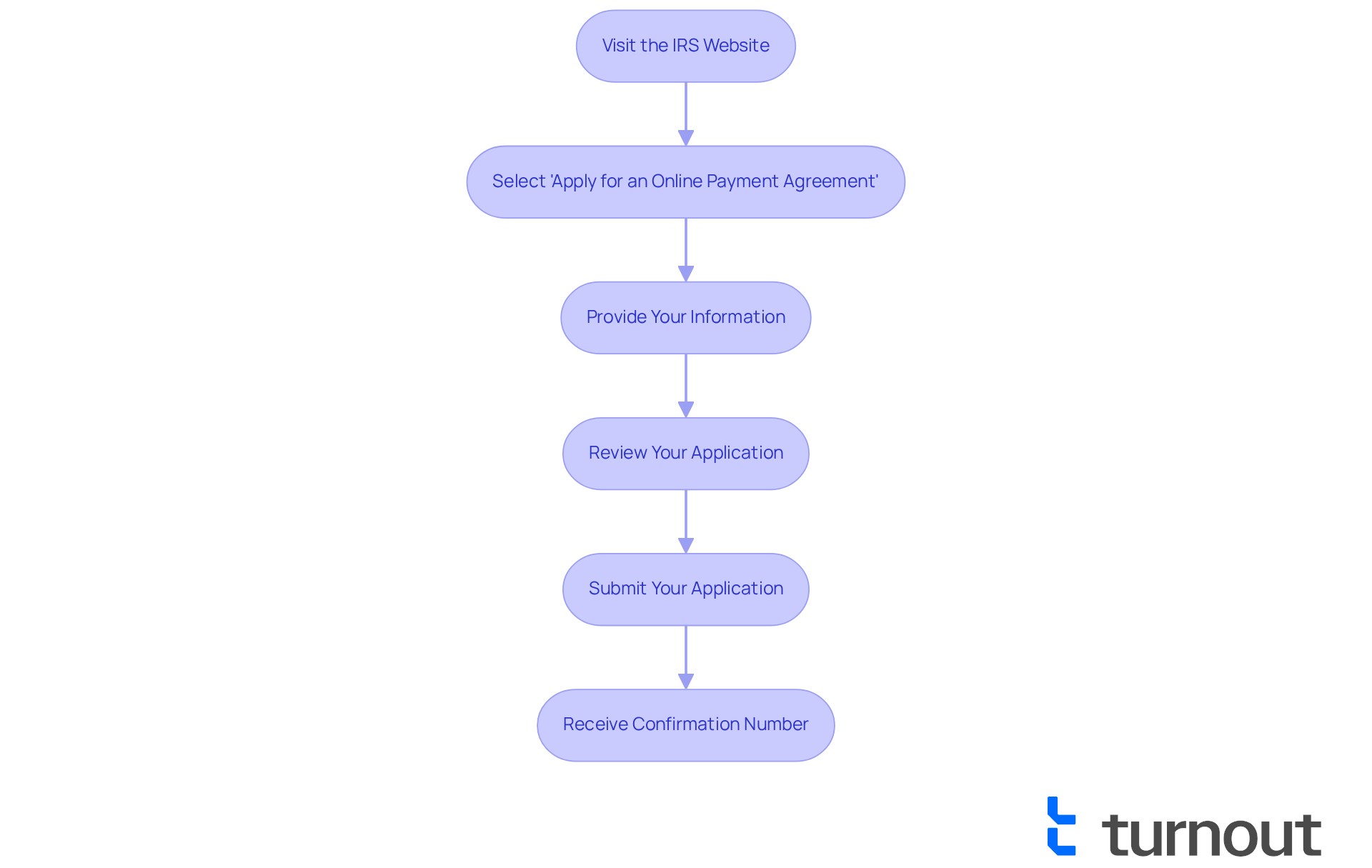

Applying for an Online Installment Agreement can feel daunting, but we're here to help you through it. Follow these simple steps to make the process smoother:

- Visit the IRS Website: Start by navigating to the official IRS website and locating the 'Payment Plans' section.

- Select 'Apply for an Online Payment Agreement': Click the link to begin your application.

- Provide Your Information: Fill in the required fields with your personal details, tax information, and the total amount owed. Remember, accurate information is key to avoiding delays.

- Review Your Application: Take a moment to double-check everything before submission. This can prevent common mistakes that might slow down processing.

- Submit Your Application: Once you're satisfied, submit your application. You'll receive a confirmation number—make sure to keep this for your records.

We understand that the application process is designed to be straightforward, usually taking just a few minutes, and it requires no paperwork or direct contact with the IRS. Most taxpayers qualify for an IRS installment arrangement, which enables them to pay IRS online installment agreement, and you will receive prompt notification of approval upon successful submission. It's crucial to ensure that all your details are correct to avoid unnecessary complications.

If you have excellent credit, you might want to consider whether a bank loan or using credit could be a more cost-effective option than an Installment Agreement. Please be aware that some types of IRS financing plans may involve setup fees.

Lastly, ensure your contact information and billing preferences are up to date so you can continue receiving IRS notices and correspondence. Remember, the IRS will never reach out to you via phone, text, or social media to demand immediate payment. You are not alone in this journey; we are here to support you every step of the way.

Choose Your Payment Method

When establishing your Online Installment Agreement, it's important to choose a way to pay IRS online installment agreement that feels right for you. We understand that this process can be overwhelming, so let’s explore your options together:

- Direct Debit: This method automatically withdraws your funds from your bank account on the due date, ensuring timely transactions. It’s a hassle-free way to stay on track.

- Credit or Debit Card: You can use a credit or debit card to make transactions. Just keep in mind that processing fees may apply, which can add up over time.

- Check or Money Order: Sending a check or money order by mail is another option. However, this method may delay processing, so plan accordingly.

- Electronic Funds Transfer: This allows you to transfer funds directly from your bank account to the IRS, making it a straightforward choice.

Take a moment to evaluate your financial circumstances and select the approach that allows you to pay IRS online installment agreement in a way that best suits your needs. Remember, choosing the right method can help you avoid late fees and penalties. We're here to help you navigate this process, ensuring you feel supported every step of the way.

Troubleshoot Common Payment Issues

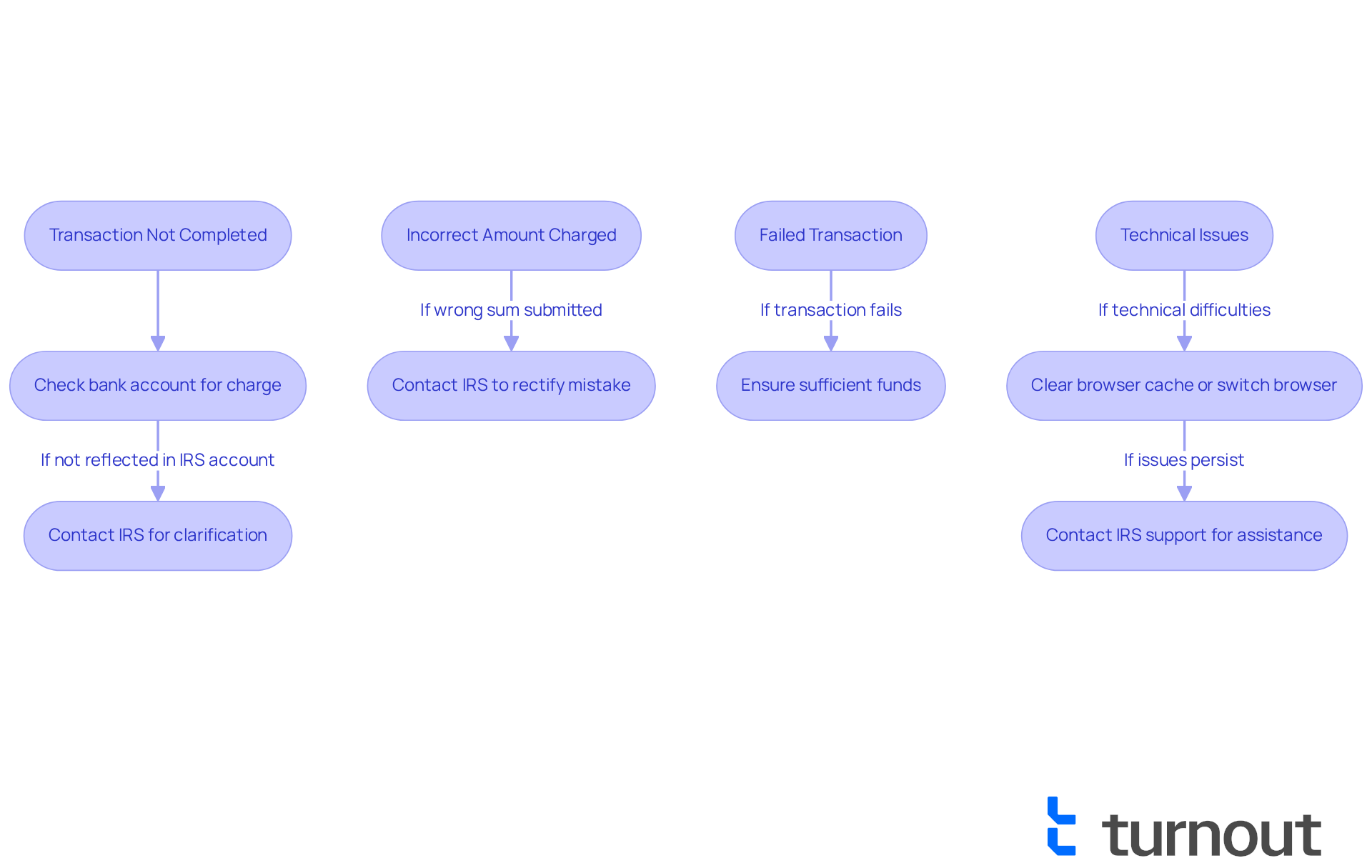

When facing issues with your IRS payments, we understand how stressful this can be. Here are some helpful troubleshooting tips to resolve them effectively:

-

Transaction Not Completed: If your transaction hasn’t been processed, first check your bank account to confirm whether the charge was deducted. If it appears to have been deducted but is not reflected in your IRS account, please reach out to the IRS for clarification. It's common to experience delays in processing certain electronic transactions, which may influence your status.

-

Incorrect Amount Charged: If you inadvertently submit the wrong sum, don’t hesitate to contact the IRS promptly to rectify the mistake. Taking quick action can help you avoid penalties or complications with your installment agreement.

-

Failed Transaction: If a transaction fails due to insufficient funds, please be aware that the IRS may impose a penalty. To prevent this, ensure that you have sufficient funds in your account prior to the due date. Remember, any penalties and interest will be automatically modified once transactions are accurately processed by the IRS.

-

Technical Issues: If you encounter technical difficulties on the IRS website, try clearing your browser cache or switching to a different browser. If the issues persist, please don’t hesitate to contact IRS support for assistance.

By proactively addressing these common payment issues, you can pay IRS online installment agreement smoothly and avoid unnecessary complications. It’s reassuring to know that nearly 62.2 million taxpayers received assistance from the IRS in FY 2024, highlighting the agency's commitment to helping individuals navigate payment-related challenges effectively. Additionally, if you receive a notice indicating a balance due but have paid in full and on time, you do not need to respond to that notice. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of tax debts can feel overwhelming, and it’s completely understandable to seek support. Utilizing the IRS Online Installment Agreement offers a practical solution that allows you to manage your tax liabilities over time, alleviating the immediate pressure of full payment. By understanding the eligibility criteria and the application process, you can take control of your financial obligations and avoid the pitfalls of penalties and interest.

This article outlines a clear, step-by-step approach to applying for an Online Installment Agreement. From visiting the IRS website to selecting the most suitable payment method, you’ll find guidance every step of the way. It's essential to provide accurate information during your application, and there are various payment options available, such as direct debit and electronic funds transfers. If you encounter common payment issues, troubleshooting tips are provided to help you proactively address any complications, ensuring compliance and peace of mind.

Ultimately, the significance of the IRS Online Installment Agreement cannot be overstated. It empowers you to manage your debts effectively while fostering a sense of financial security. Embracing this option not only helps you avoid unnecessary penalties but also paves the way for a more manageable financial future. If you’re facing tax challenges, taking the first step towards an installment agreement is a crucial move towards regaining control over your financial situation. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is an IRS online installment agreement?

An IRS online installment agreement allows taxpayers to pay off their tax liabilities over time rather than in a single payment, which can help manage tax debts without incurring penalties and interest for unpaid taxes.

Who can qualify for an IRS online installment agreement?

To qualify, you typically need to owe less than $50,000 in total tax, penalties, and interest, and you must be current on your tax filings.

Why is it important to understand the terms of the installment agreement?

Understanding the terms, such as payment duration and amounts, can significantly aid in financial planning and help ensure compliance with IRS regulations.

What should I do if I am feeling overwhelmed by tax debts?

If you are feeling overwhelmed, considering an IRS online installment agreement may be a viable solution to manage your tax debts over time.