Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially for California residents facing financial strain. We understand that this can be a challenging time, but there’s hope. California Tax Payment Plans offer a lifeline, allowing you to manage your tax liabilities without the immediate burden of full payment.

In this guide, we’ll walk you through the essential steps for successfully navigating these plans. You’ll find valuable insights on eligibility, application processes, and how to troubleshoot common issues. But what happens when unexpected challenges arise? How can you ensure a smooth experience while securing the financial relief you deserve?

You are not alone in this journey. Together, we can explore the options available to you and find a path forward.

Understand California Tax Payment Plans

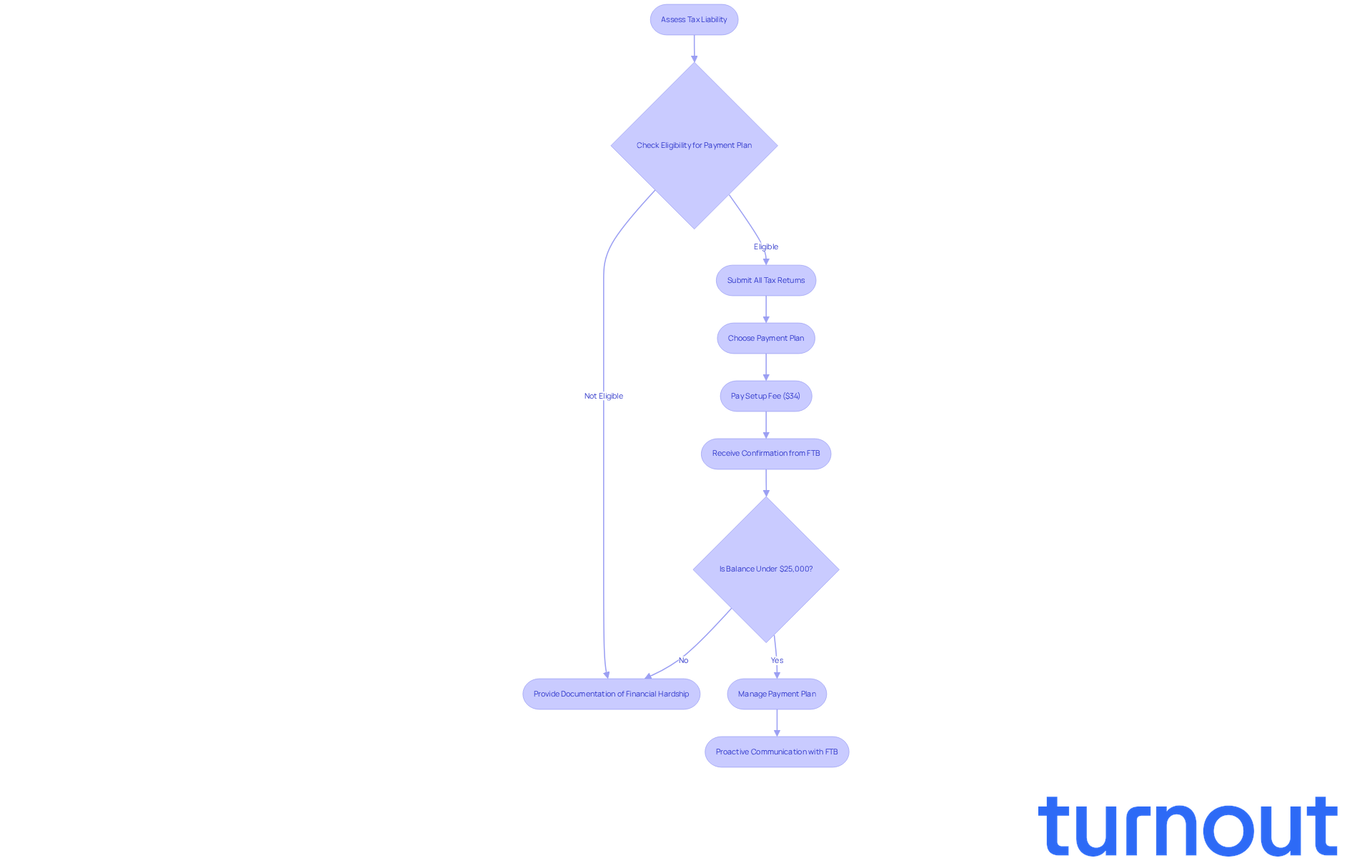

California Tax Payment Plans are created to help you manage your tax liabilities without the burden of immediate financial strain. If you’re feeling overwhelmed, know that the California Franchise Tax Board (FTB) and the California Department of Tax and Fee Administration (CDTFA) provide options that can help. These plans typically cater to individuals with balances under $25,000, allowing you to repay your total amount, including interest and penalties, over a flexible period of up to 60 months.

We understand that navigating these arrangements can be daunting. It’s important to grasp the conditions, as interest and fees may apply. For example, setting up a personal installment agreement comes with a fee of $34, and the FTB may take up to 90 days to process your request. Remember, you must have submitted all tax returns to qualify for an installment agreement, and your balance will continue to accrue interest and penalties if payments are missed. Missing a due amount can lead to late charges or even termination of the arrangement, so proactive communication with the FTB is crucial.

Real-world examples show how effective these strategies can be. If you owe less than $25,000, qualifying for a repayment arrangement is often straightforward. However, if your debt exceeds $10,000 or you need more than 36 months to pay, you’ll need to provide documentation of financial hardship. Successfully registering for a financing arrangement can lead to manageable monthly contributions, although it may result in a state tax lien that could affect your credit score. As Andrea Miller points out, registering for a California tax installment may subject you to a state tax lien, but making regular contributions can lead to its removal.

If your financial situation changes, you can request adjustments to your payment plan, ensuring it remains manageable. Overall, a California tax payment plan offers a compassionate solution for those seeking relief from tax debt. You’re not alone in this journey, and with these options, you can navigate your financial obligations with confidence.

Determine Your Eligibility for a Payment Plan

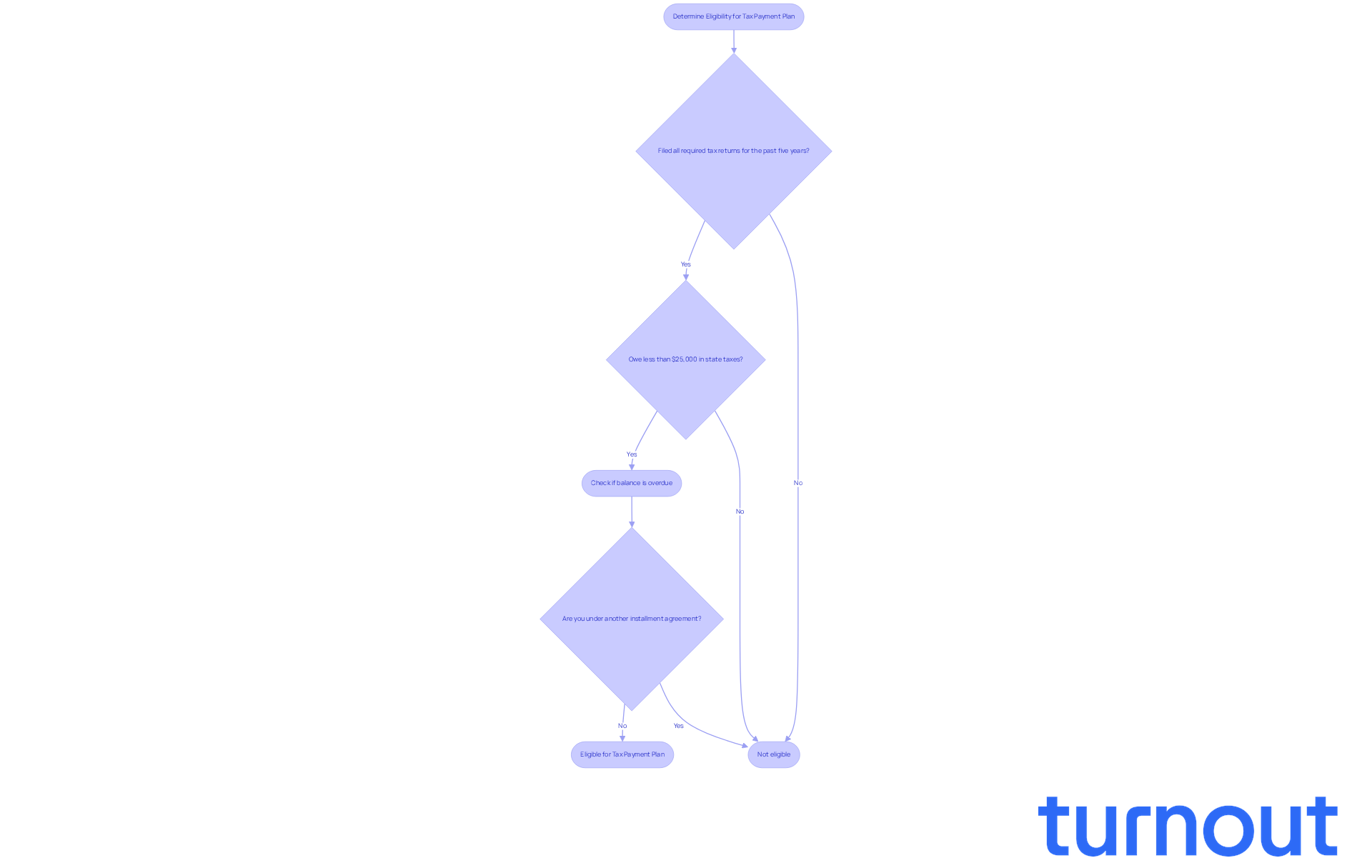

Are you feeling overwhelmed by your tax situation? You're not alone, and we're here to help. To determine your eligibility for a California Tax Payment Plan, begin by carefully assessing your tax situation. It's essential that:

- You've filed all required tax returns for the past five years.

- You owe less than $25,000 in state taxes.

Remember, the Franchise Tax Board (FTB) typically requires that your balance be overdue to qualify for an arrangement. If you're currently under another installment agreement, you won't be eligible for a new one.

Additionally, keep in mind that there's a $34 setup fee for those requesting a California tax payment plan. Staying updated on new tax returns and upcoming contributions is crucial to prevent the cancellation of your arrangement. Take a moment to review your financial documents and ensure you meet these criteria before moving forward with your application.

Many taxpayers have successfully navigated this process, proving that with the right preparation, securing a financial arrangement is within reach. Tax experts often emphasize the importance of proactive communication with the FTB. Acting early can help you avoid complications down the road. By understanding your financial responsibilities and ensuring you adhere to them, you can significantly enhance your chances of qualifying for a financial arrangement. Remember, you're not alone in this journey, and there are resources available to support you.

Apply Online for Your Tax Payment Plan

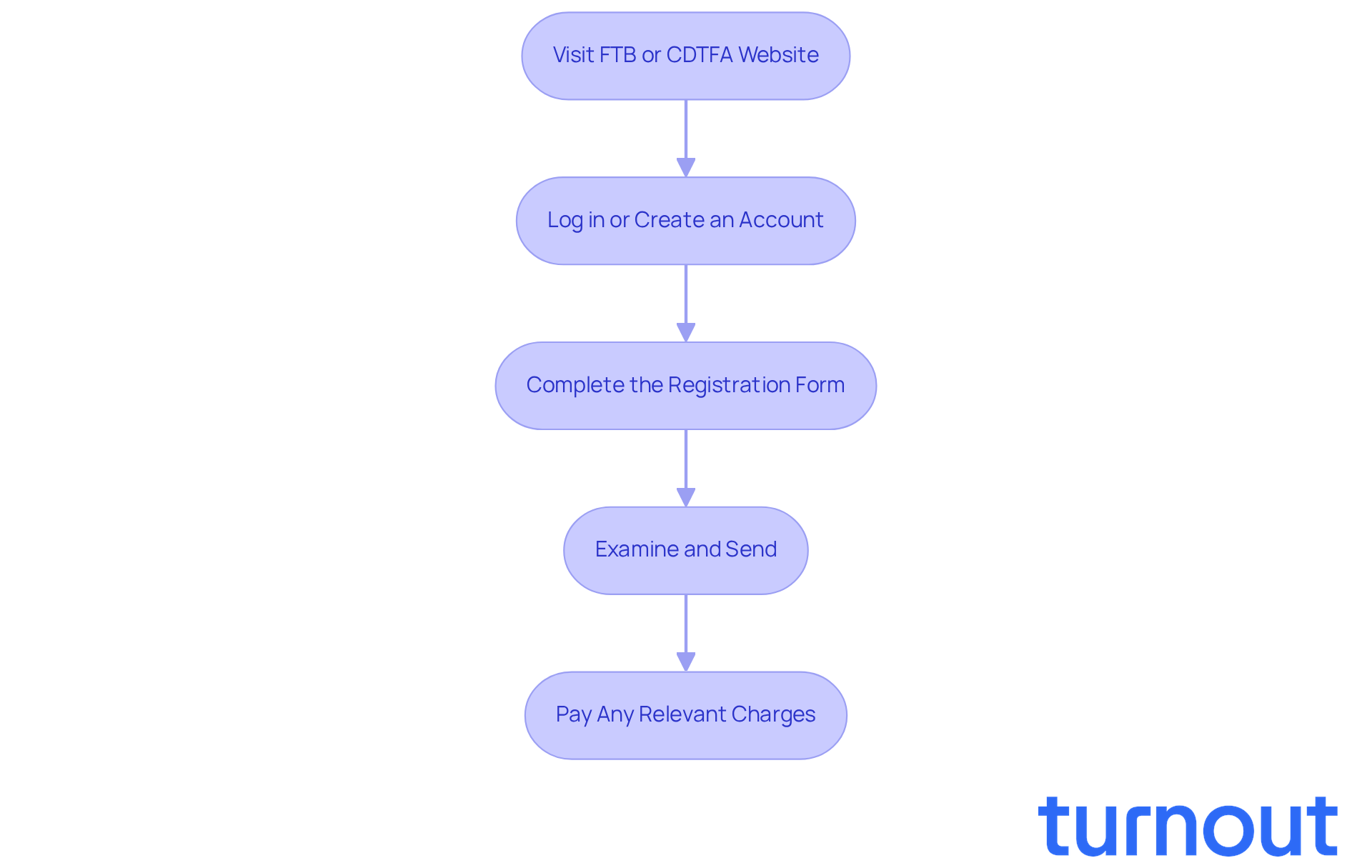

Applying for a California Tax Payment Plan online may seem overwhelming, but we're here to assist you throughout the process. Just follow these simple steps:

- Visit the FTB or CDTFA website: Start by navigating to the official site where you can find the section for submitting your financial arrangement.

- Log in or create an account: If you already have an account, log in with your credentials. If not, creating an account is easy-just provide your personal information, including your Social Security number and tax identification number.

- Complete the registration form: Fill out the online registration form carefully, making sure all required fields are completed correctly. You’ll need to share details about your tax liability and your proposed payment plan.

- Examine and send: Before you hit send, take a moment to check your form for any errors. Once everything looks good, submit your request. You should receive a confirmation email about your submission status.

- Pay any relevant charges: Keep in mind that there may be a setup fee associated with your financial arrangement, which will be added to your balance due.

It's common to feel anxious about tax matters, but recent data shows that about 50% of submitted Offer in Compromise (OIC) requests are accepted after appeal. This highlights the potential benefits of engaging in the tax settlement process. For instance, one client successfully reduced a $700,000 tax obligation to just over $100,000 through an OIC settlement, showcasing how effective these strategies can be.

Additionally, the Franchise Tax Board (FTB) has reminded taxpayers that the deadline for filing 2024 state personal income tax returns is October 15, 2025. Timely submissions are crucial, and following these steps can significantly improve your chances of successfully setting up a California tax payment plan. Remember, you are not alone in this journey, and taking these steps can lead to a brighter financial future.

Troubleshoot Common Application Issues

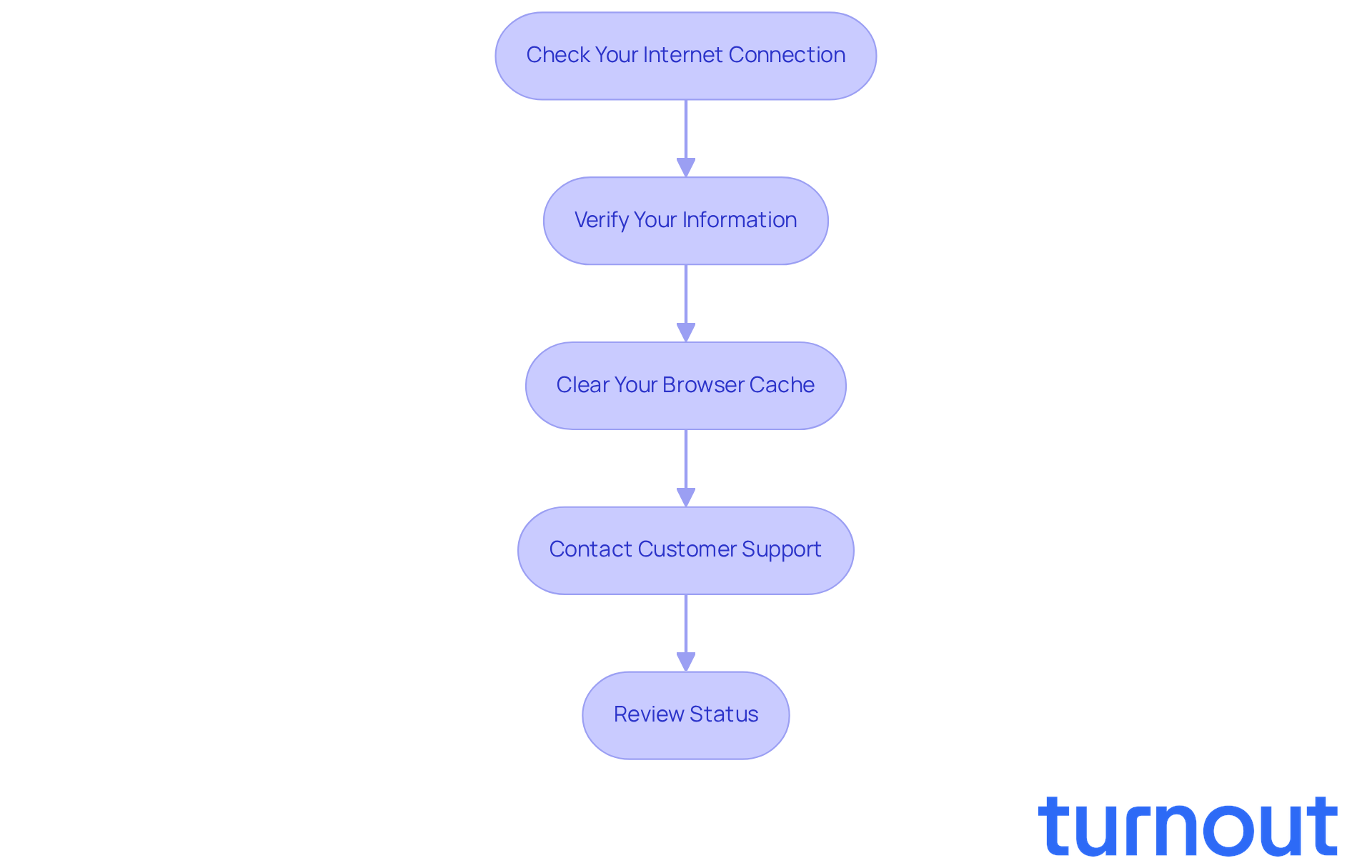

When applying for your California tax payment plan, we understand that you may encounter some common challenges. Here are some helpful tips to guide you through the process:

- Check Your Internet Connection: A stable internet connection is essential. Make sure your connection is reliable to avoid any disruptions while submitting your application.

- Verify Your Information: Accuracy matters. Take a moment to double-check that all your personal and tax information is correct. Mistakes like incorrect Social Security numbers or tax identification numbers can happen, but ensuring accuracy can speed up the approval process for your payment plan.

- Clear Your Browser Cache: If the form isn’t loading properly, try clearing your browser's cache or switching to a different browser. This simple step can often resolve the issue.

- Contact Customer Support: If you continue to experience problems, please don’t hesitate to reach out to the Franchise Tax Board (FTB) or California Department of Tax and Fee Administration (CDTFA) customer support. They’re here to help you with any technical difficulties you may encounter. Remember, many applicants seek assistance during this stage, so you’re not alone.

- Review Status: After you submit your request, make it a habit to check your status online. This will confirm that your request has been received and is being processed. If any issues arise, you’ll be notified through your account.

By following these guidelines, you can improve your chances of a smooth application experience. Proactive communication with the FTB can help prevent stricter actions, like enforcement or levies, if you are enrolled in a California tax payment plan and a payment is going to be late. Remember, we’re here to help you every step of the way.

Conclusion

Navigating a California Tax Payment Plan can feel daunting, but it’s a practical way to manage your tax liabilities without the burden of immediate financial strain. We understand that many face challenges in this area, and knowing the eligibility criteria, application process, and potential hurdles is crucial for anyone looking to ease their tax burdens. With the right approach and preparation, you can secure a payment plan that fits your financial situation.

It’s important to remember a few key points:

- Filing all required tax returns is essential

- Understanding the setup fees can save you surprises

- Proactive communication with the Franchise Tax Board (FTB) is vital

Typically, qualifying for a payment plan means owing less than $25,000 and having a clear grasp of your financial obligations. Troubleshooting common application issues and knowing how to adjust your payment plan as needed are also important steps to ensure a smooth experience.

Ultimately, taking the initiative to explore and apply for a California Tax Payment Plan can lead to significant relief from tax debt. By following the outlined steps and addressing potential hurdles, you can navigate this process with confidence. Remember, you’re not alone in this journey. Engaging in open communication with tax authorities and leveraging available resources can transform what seems overwhelming into a manageable path toward financial stability.

Frequently Asked Questions

What are California Tax Payment Plans?

California Tax Payment Plans are designed to help individuals manage their tax liabilities without immediate financial strain, allowing repayment of total amounts, including interest and penalties, over a flexible period of up to 60 months.

Who qualifies for a California Tax Payment Plan?

Typically, individuals with tax balances under $25,000 qualify for a repayment arrangement. However, if your debt exceeds $10,000 or you need more than 36 months to pay, you must provide documentation of financial hardship.

What fees are associated with setting up a California Tax Payment Plan?

Setting up a personal installment agreement incurs a fee of $34.

How long does it take to process a payment plan request?

The California Franchise Tax Board (FTB) may take up to 90 days to process your request for a payment plan.

What happens if I miss a payment on my tax installment agreement?

Missing a payment can lead to late charges, the accrual of interest and penalties, or even termination of the payment arrangement.

Do I need to submit all tax returns to qualify for an installment agreement?

Yes, you must have submitted all tax returns to qualify for a California Tax Payment Plan.

Will registering for a payment plan affect my credit score?

Yes, registering for a California tax installment may result in a state tax lien, which could affect your credit score.

Can I adjust my payment plan if my financial situation changes?

Yes, you can request adjustments to your payment plan if your financial situation changes to ensure it remains manageable.

What is the benefit of making regular contributions to my payment plan?

Making regular contributions can lead to the removal of a state tax lien associated with your tax installment agreement.