Introduction

Navigating the world of life insurance can feel overwhelming, especially for those living with HIV. We understand that this raises an important question: can you obtain life insurance with this condition? It's crucial to grasp the eligibility criteria and application process, as this knowledge can lead to peace of mind and financial security.

Many individuals are left wondering about the specific steps and documentation needed to secure a policy. It’s common to feel uncertain about how to navigate these challenges. So, how can you effectively prepare for the underwriting process and ensure you’re ready to take the next steps?

We’re here to help you through this journey.

Verify Your Eligibility for Life Insurance with HIV

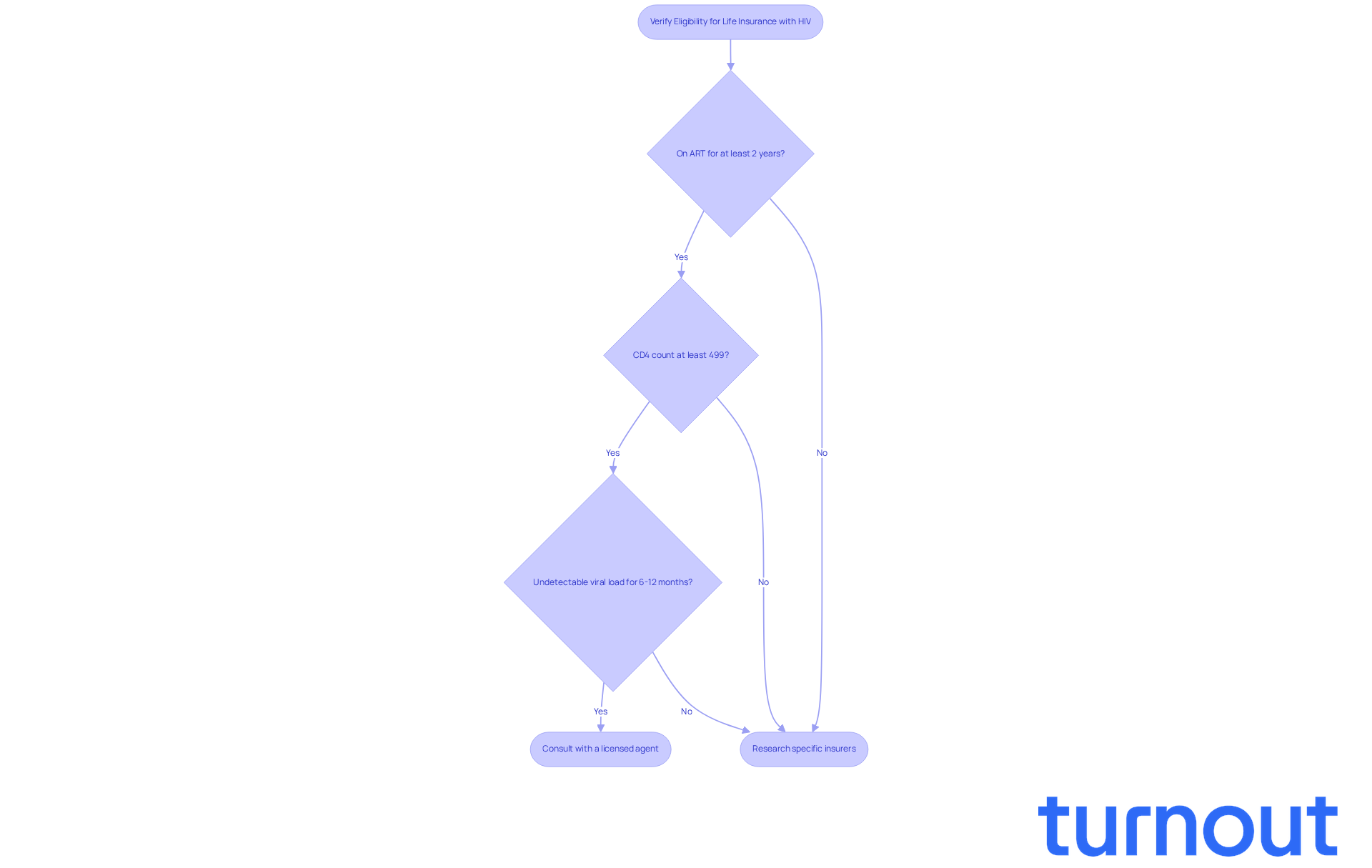

We understand that navigating life insurance can be challenging, and many may wonder, 'can I get life insurance if I have HIV,' especially for those within the usual age bracket recognized by insurance companies, typically ranging from 20 to 65 years.

- It's important to ensure you've been on highly active antiretroviral therapy (ART) for at least two years, as this often raises the question, can I get life insurance if I have HIV, since it is a requirement for coverage.

- Confirming that your CD4 count is at least 499 can be crucial, as some providers may view this level as acceptable. Additionally, maintaining an undetectable viral load for a minimum of 6-12 months greatly impacts underwriting choices.

It is essential to research specific insurers that answer the question, 'can I get life insurance if I have HIV,' for HIV-positive individuals. In 2026, around 70% of insurers started to answer the question, 'can I get life insurance if I have HIV,' by accepting applicants with well-managed HIV.

- Don't forget to review any state-specific regulations that might affect your eligibility for life coverage.

Consulting with a licensed agent who specializes in HIV-related life coverage can clarify any questions, especially about whether I can get life insurance if I have HIV, and help you navigate the application process effectively. As Nichole Myers, Chief Underwriter, wisely states, "If you’re declined for life insurance due to HIV, it doesn’t mean coverage is impossible."

- While premiums may be higher for HIV-positive applicants, remember that once a policy is issued, it cannot be canceled due to a later HIV diagnosis, as long as premiums are paid on time. You're not alone in this journey, and we're here to help.

Gather Required Documentation for Your Application

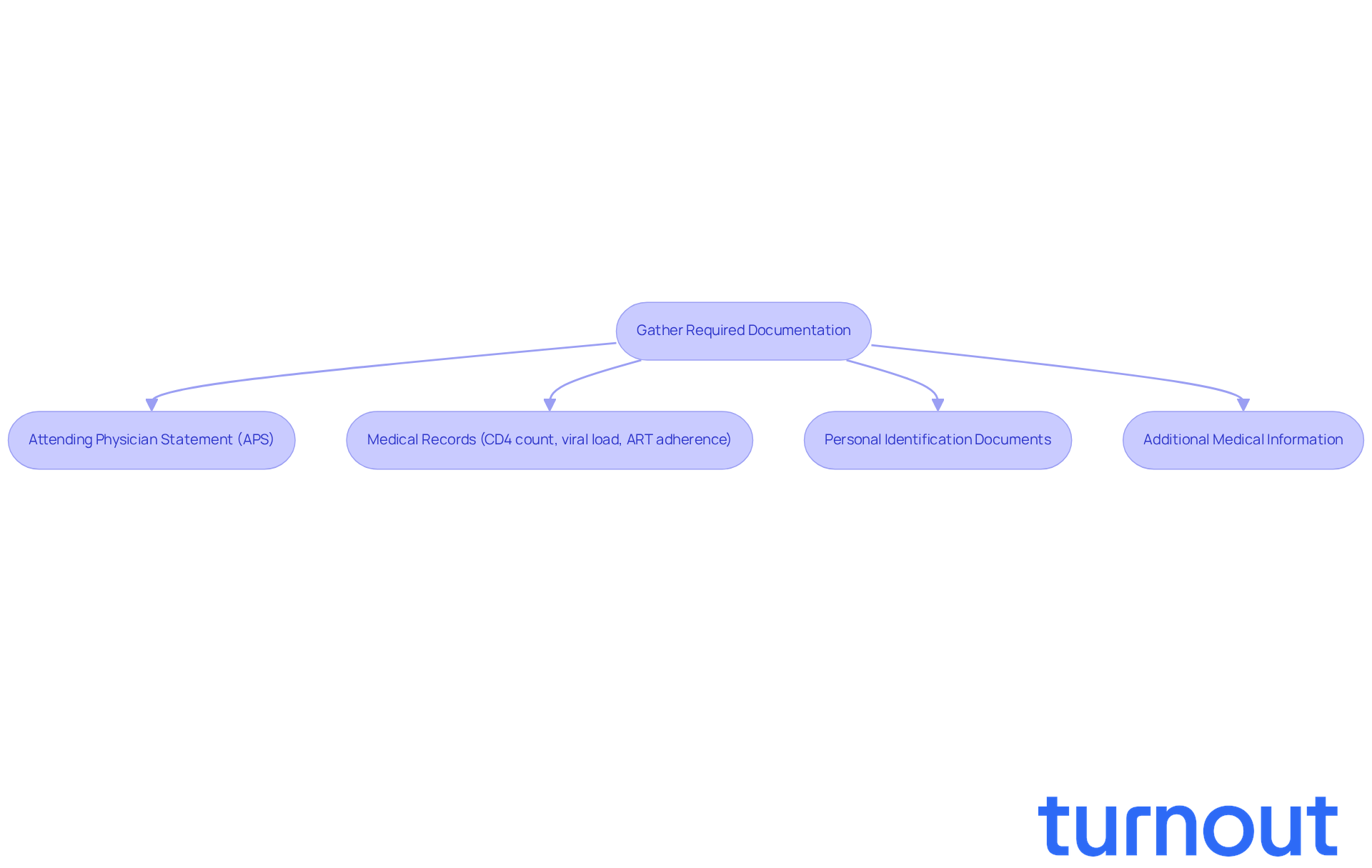

Obtaining a recent Attending Physician Statement (APS) is a crucial first step. This document outlines your HIV status, treatment history, and overall wellness management. It’s vital because it gives insurers a comprehensive view of your medical condition, helping to illustrate your wellness stability and treatment adherence - key factors that can significantly influence your eligibility for coverage.

Next, gather your medical records that detail your CD4 count, viral load, and adherence to antiretroviral therapy (ART). These indicators are essential for demonstrating your wellness stability and treatment effectiveness. By showcasing this information, you can enhance your chances of securing life insurance, which raises the question, 'can I get life insurance if I have HIV'.

Don’t forget to prepare your personal identification documents, including a government-issued ID and your Social Security number. These are necessary for verifying your identity during the application process.

It’s also wise to collect any additional medical information that may be relevant, such as family medical history and lifestyle factors. This context can help insurers evaluate your overall wellness profile more accurately.

We understand that for individuals wondering 'can I get life insurance if I have HIV', the application process may involve extra paperwork and requirements compared to standard applicants, which can feel overwhelming. Make sure all your documents are up to date and accurately reflect your well-being status. Prompt and accurate documentation can simplify the application procedure and boost your chances of obtaining life coverage.

As medical experts emphasize, keeping precise medical records is essential for showcasing your wellness management and stability. This can greatly influence your life coverage application. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Understand the Underwriting Process for Life Insurance

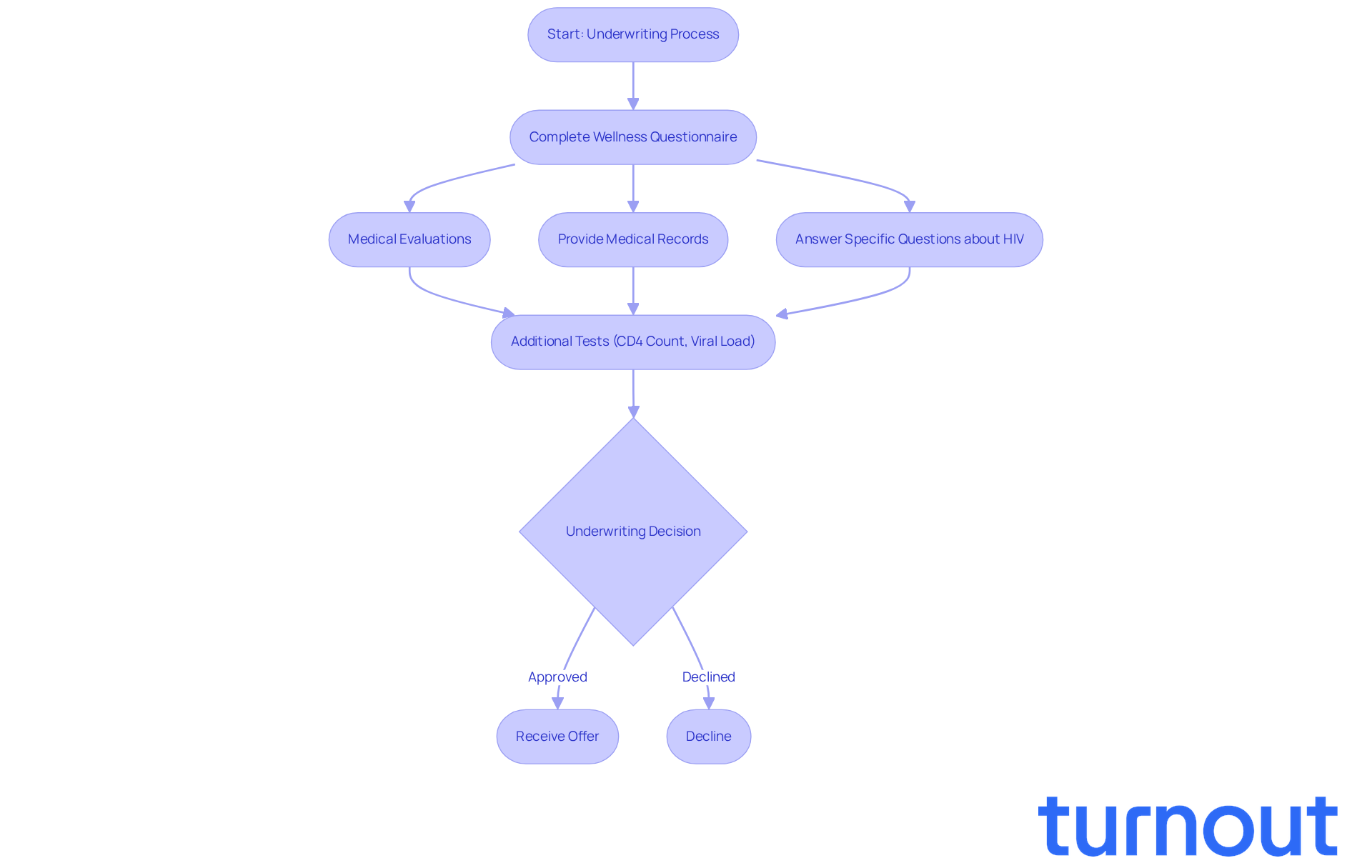

Acquainting yourself with the underwriting procedure can feel overwhelming, particularly when considering, can I get life insurance if I have HIV? This process typically includes medical evaluations and wellness questionnaires for those who want to know, 'can I get life insurance if I have HIV'. Insurers focus on objective wellness indicators when assessing life insurance, which is crucial for your peace of mind.

Be prepared to answer specific questions about your HIV status, treatment plan, and overall well-being, particularly about can I get life insurance if I have HIV. These details significantly influence underwriting decisions. Having complete and accurate medical records can help underwriters assess your risk with greater confidence, making the process smoother for you.

We understand that the underwriting process may take several weeks, and it’s essential to plan accordingly and remain patient. Some insurers might ask for additional tests, like CD4 counts (often needing a count of 499 or higher) and viral load assessments. These tests help evaluate your health stability and treatment effectiveness. Remember, well-managed HIV can lead to lower life premiums, so can I get life insurance if I have HIV?

Maintain open communication with your insurance agent throughout this journey. Addressing any concerns or questions that arise can ensure a smoother experience. If you’ve been declined in the past, don’t lose hope. Consider reapplying once your medical profile shows sustained stability. You're not alone in this journey, and we're here to help.

Evaluate How HIV Affects Your Life Insurance Premiums

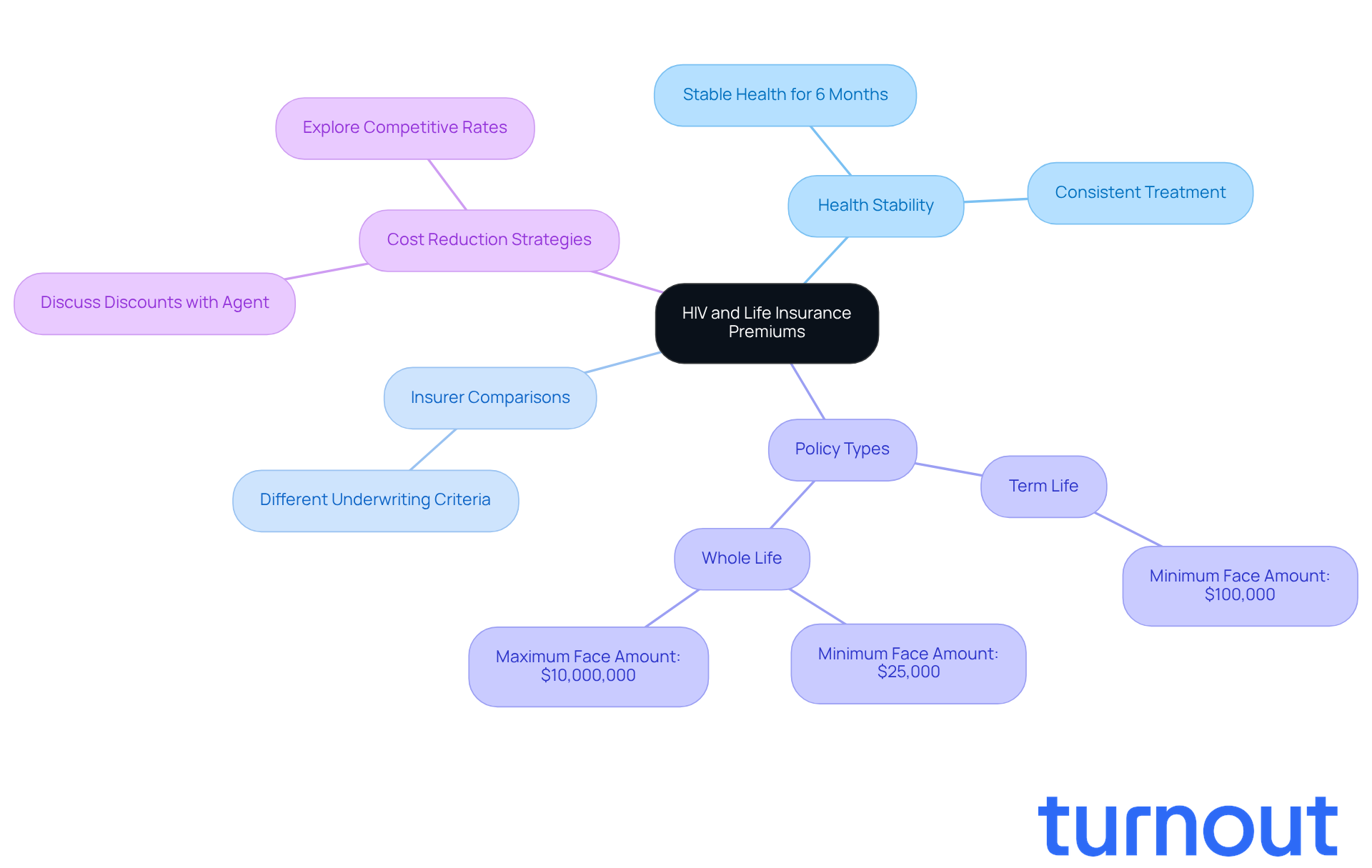

For those living with HIV, navigating insurance options can feel overwhelming, leading to the question, can I get life insurance if I have HIV? We understand that establishing realistic expectations around premium rates is crucial. Typically, when considering can I get life insurance if I have HIV, the premiums for HIV-positive individuals are higher than standard rates due to the chronic nature of the condition. However, if you can show at least six months of stable health and consistent treatment, it may help answer the question of can I get life insurance if I have HIV, potentially leading to more favorable pricing.

It's important to compare quotes from different insurers. Each company has its own underwriting criteria, which can significantly impact the premiums they offer. By exploring your options, you can identify the best rates that suit your medical condition.

When selecting a policy, consider the type of coverage that fits your needs. Term life insurance generally offers lower premiums compared to whole life insurance, which has a minimum face amount of $25,000 and can go up to $10,000,000 for qualified applicants. Evaluating which option aligns best with your long-term financial goals is essential.

While premiums may seem high due to perceived risk, remember that competitive rates are available for individuals who maintain stable health and a consistent treatment history, leading to the question, can I get life insurance if I have HIV? You're not alone in this journey; many have successfully navigated these challenges.

Don’t hesitate to discuss potential discounts or strategies for lowering your premiums with your insurance agent. Many insurers offer options that can help reduce costs, especially for those who demonstrate good health management. We're here to help you find the best path forward.

Conclusion

Navigating the complexities of life insurance can feel overwhelming, especially for those living with HIV. But understanding the process is essential to securing the coverage you deserve. This article highlights key steps to help you confidently pursue life insurance, showing that eligibility is within reach with proper health management and treatment.

- First, it’s important to verify your eligibility by maintaining a stable health profile.

- Gathering necessary documentation, such as medical records and identification, is also crucial.

- Understanding the underwriting process and how HIV may impact your insurance premiums can make a significant difference.

Each of these steps addresses the pressing question, "Can I get life insurance if I have HIV?" By adhering to your treatment and presenting an accurate medical history, you can greatly enhance your chances of obtaining coverage.

Ultimately, securing life insurance as an HIV-positive individual is not just possible; it’s a vital step toward achieving financial security. We understand that this journey can be daunting, but remaining proactive about your health and exploring various insurance options is key. Engaging with knowledgeable agents and comparing different policies can lead to favorable outcomes. Remember, you are not alone in this journey. Advocate for your needs and seek the best possible solutions.

Frequently Asked Questions

Can I get life insurance if I have HIV?

Yes, you can get life insurance if you have HIV, especially if you meet certain health criteria and have been managing your condition effectively.

What are the eligibility requirements for obtaining life insurance with HIV?

To be eligible for life insurance with HIV, you typically need to have been on highly active antiretroviral therapy (ART) for at least two years, maintain a CD4 count of at least 499, and have an undetectable viral load for a minimum of 6-12 months.

How have insurance companies changed their policies regarding HIV-positive applicants?

As of 2026, around 70% of insurers began accepting applicants with well-managed HIV, indicating a shift in how they evaluate applications from individuals with this condition.

Are there any specific regulations I should be aware of when applying for life insurance with HIV?

Yes, it is important to review any state-specific regulations that may affect your eligibility for life insurance coverage.

Should I consult a professional when applying for life insurance with HIV?

Yes, consulting with a licensed agent who specializes in HIV-related life coverage can help clarify your questions and assist you through the application process.

What happens if I am declined for life insurance due to my HIV status?

A decline for life insurance due to HIV does not mean that coverage is impossible; there are options available for individuals with well-managed HIV.

Will my premiums be higher if I have HIV?

Yes, premiums may be higher for HIV-positive applicants; however, once a policy is issued, it cannot be canceled due to a later HIV diagnosis, as long as premiums are paid on time.