Introduction

Finding the right contact information for state tax offices can often feel like searching for a needle in a haystack. We understand that navigating the complexities of tax inquiries can be overwhelming. Having the Mississippi State Tax phone number at hand is crucial; it can streamline this process and provide clarity on issues like tax returns and filing obligations.

But what happens when the information isn’t as accessible as it should be? It’s common to feel frustrated in these situations. This guide will walk you through four essential steps to not only locate the Mississippi State Tax phone number but also ensure that every interaction with the tax office is efficient and productive. Remember, you’re not alone in this journey - we’re here to help.

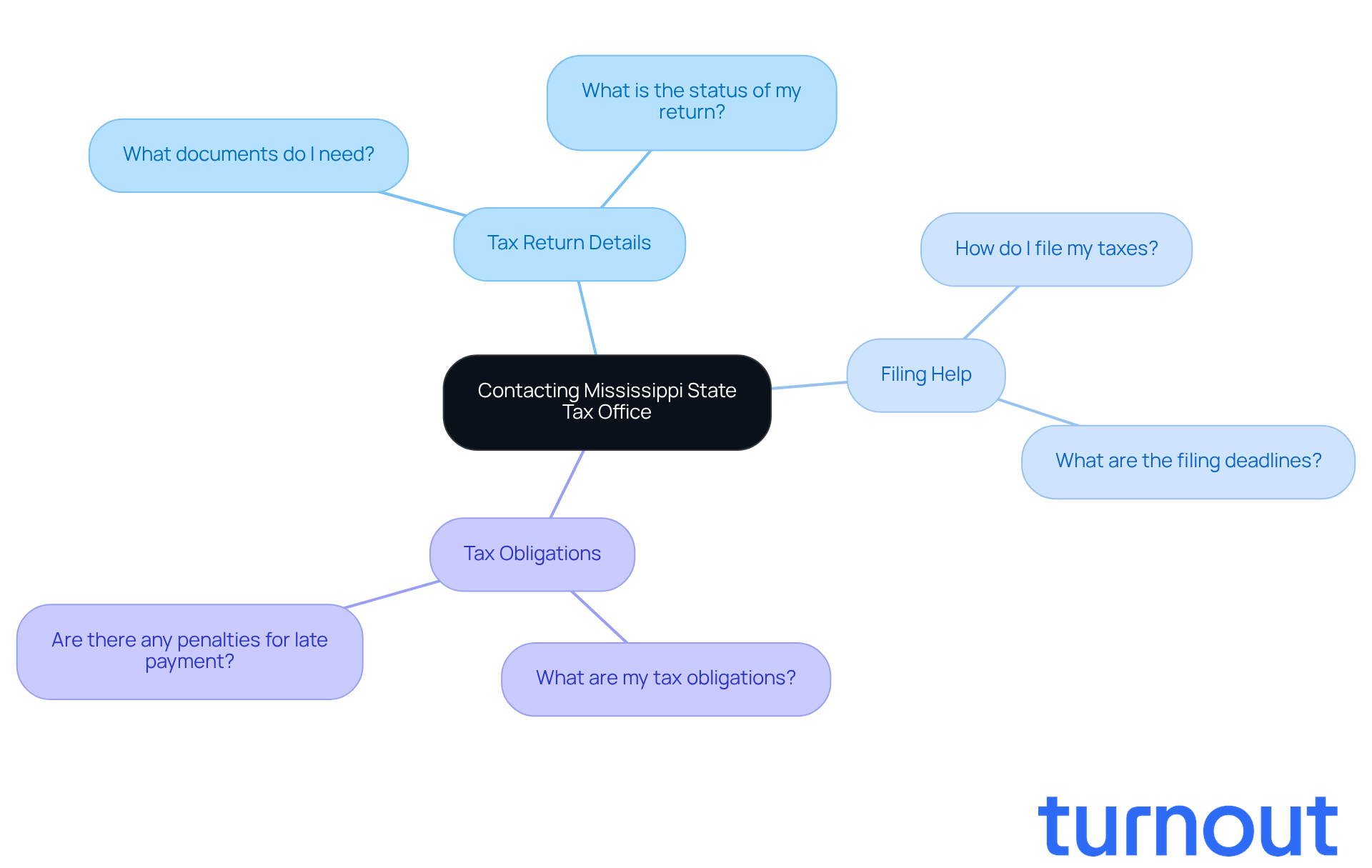

Identify Your Need for the Mississippi State Tax Phone Number

Before reaching out to the Mississippi State Tax Office, it’s essential to identify your specific needs, and having the Mississippi State Tax phone number can be helpful. Are you looking for details about your tax return? Do you need help with filing, or are you inquiring about your tax obligations? Knowing your purpose will help you communicate effectively and get the answers you need.

Take a moment to write down your questions or concerns. This simple step can guide your conversation with the tax office and ensure you cover everything important. Remember, you’re not alone in this journey; we’re here to help you navigate through it.

Locate Official Resources for Mississippi State Tax Information

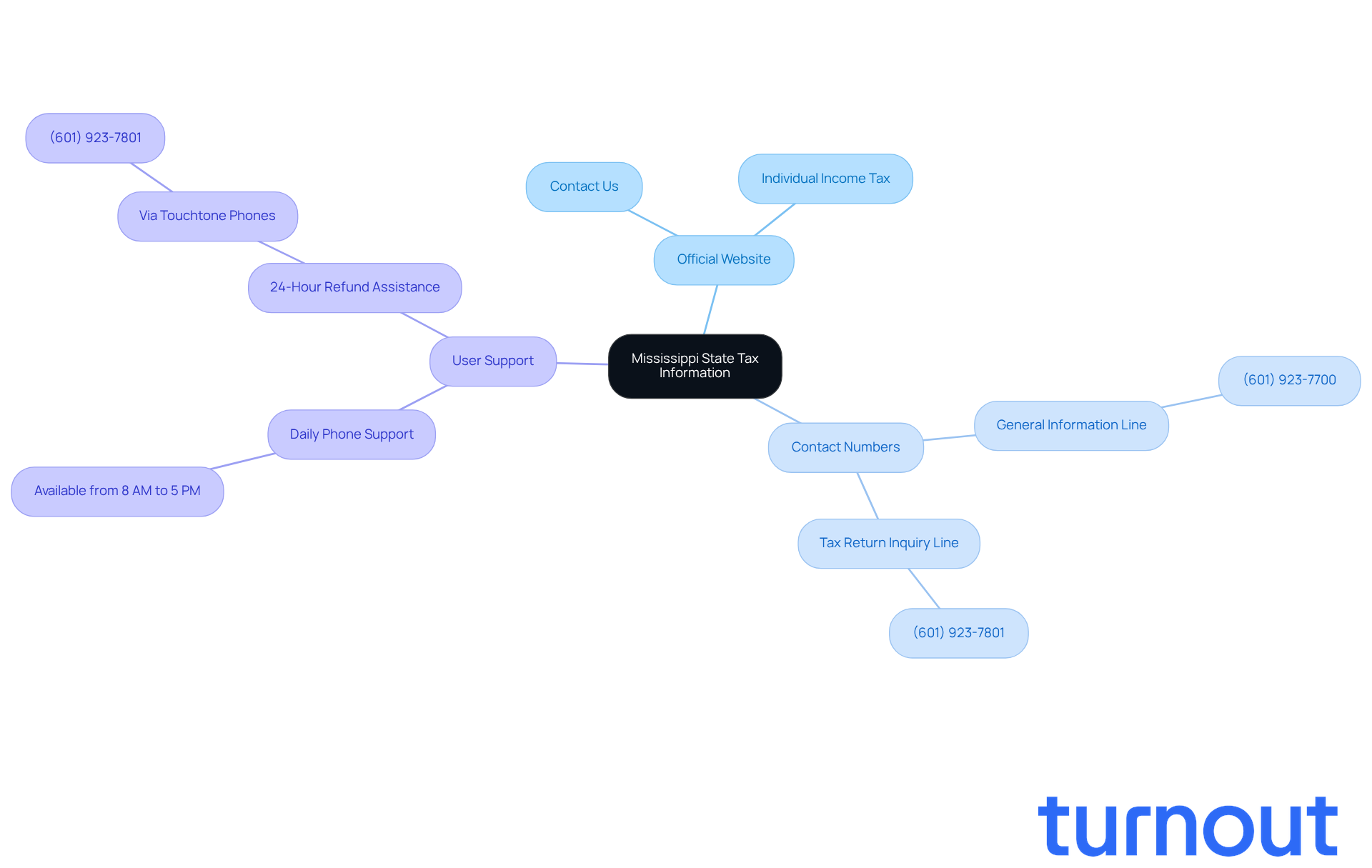

If you're trying to find the Mississippi State Tax phone number, we recognize that it can feel overwhelming. Start by visiting the official Mississippi Department of Revenue website. This site is a treasure trove of resources, offering essential contact information and answers to frequently asked questions. Look for sections labeled 'Contact Us' or 'Individual Income Tax' to find the Mississippi state tax phone number that you need.

For your convenience, the general information line is (601) 923-7700. If you have questions about tax returns, you can reach out to (601) 923-7801. Remember, daily phone support for tax returns is available at (601) 923-7700 from 8 AM to 5 PM. Plus, if you need help with returns at any hour, you can access support via touchtone phones at (601) 923-7801. It might be helpful to bookmark these pages for easy access in the future.

Using official state tax department websites is crucial. Research shows that over 70% of users find the information they need through these resources, ensuring you get accurate and timely support. As Treasury Secretary Scott Bessent mentioned, "Prior to the passage of the One, Big, Beautiful Bill, Treasury and IRS were diligently preparing to update forms and processes for the benefit of hardworking Americans." This highlights just how important it is to access reliable tax resources. Remember, you're not alone in this journey; we're here to help!

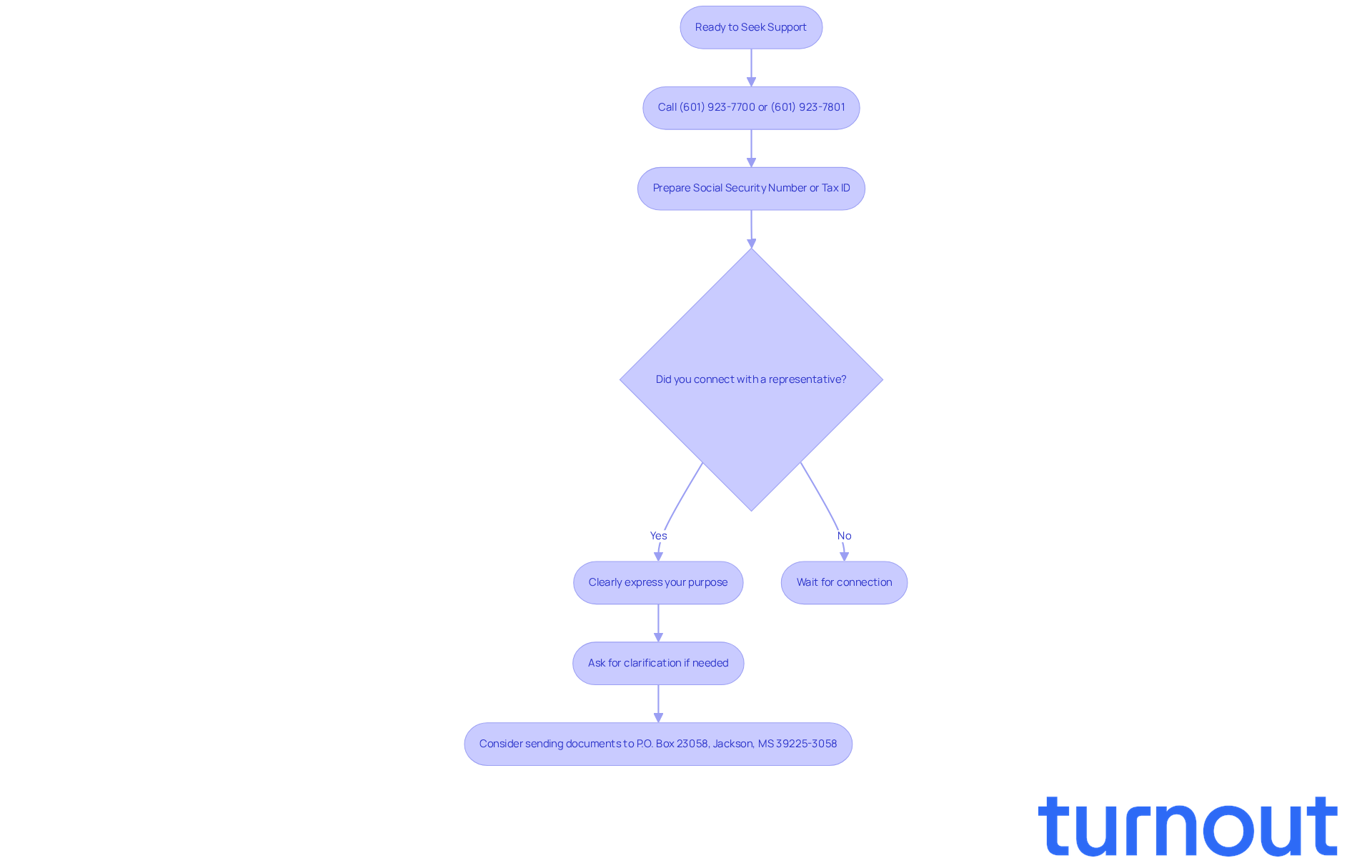

Contact the Mississippi State Tax Office Directly

When you're ready to seek support, we’re here to help. You can call (601) 923-7700 for general inquiries or (601) 923-7801 specifically for questions related to the Mississippi state tax phone number. Once you connect with a representative, clearly express your purpose and have your Social Security number or tax identification number ready. We understand that wait times can vary, so patience is key. If you encounter any challenges during the call, please don’t hesitate to ask for clarification or request to speak with a supervisor. Many consumers have successfully resolved their tax issues through direct communication, which highlights the importance of persistence and clarity in these interactions.

It’s reassuring to know that taxpayer satisfaction with state tax office interactions has improved significantly, reflecting the effectiveness of direct engagement. Tax consultants often emphasize that being prepared and concise can lead to quicker resolutions, making your call more productive. Additionally, for tax refund inquiries, you can access 24-hour refund support via touchtone phones, and having the Mississippi state tax phone number along with your Social Security Number may be necessary to retrieve refund details.

If you need to send documents or inquiries, the mailing address for Individual Income - Refund Returns is P. O. Box 23058, Jackson, MS 39225-3058. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

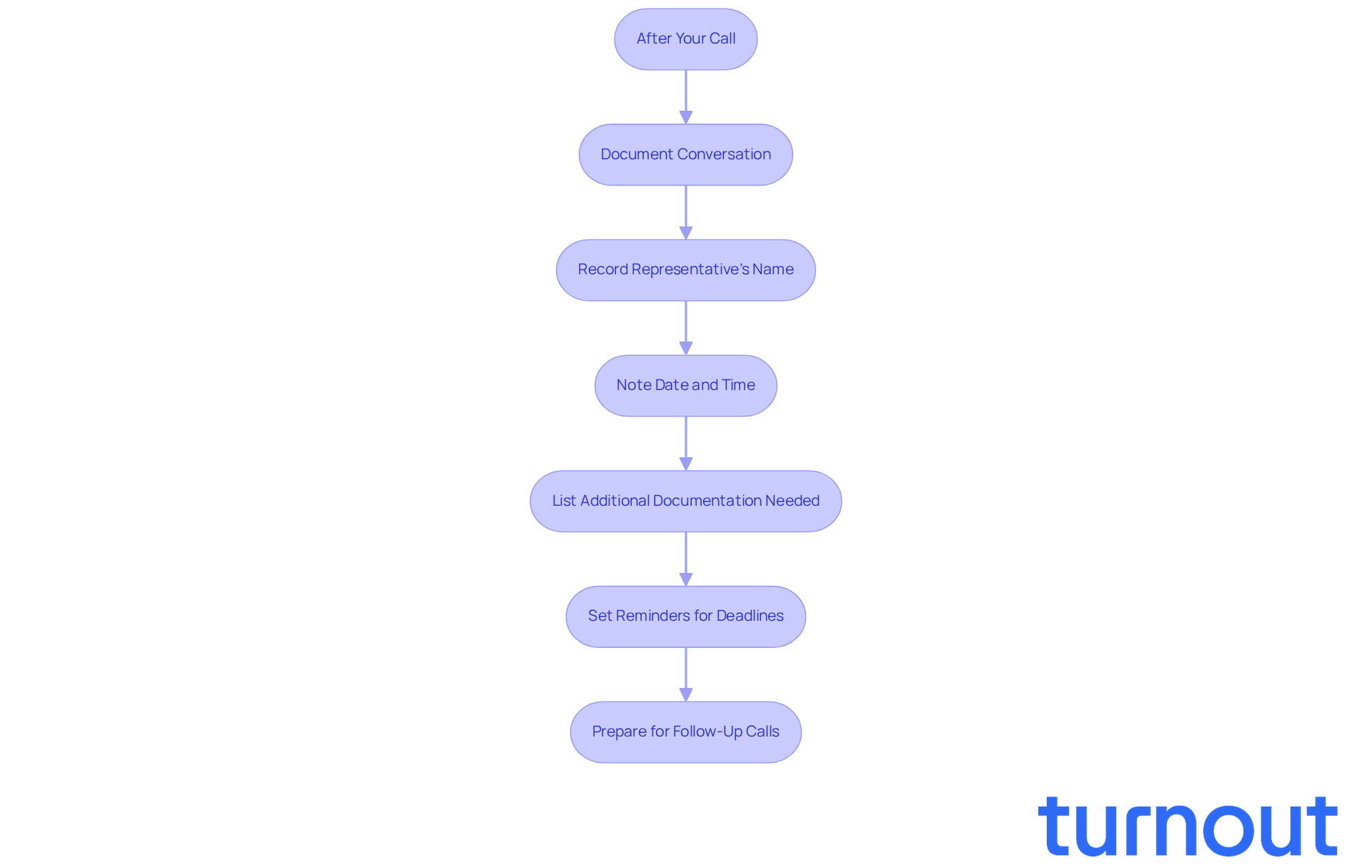

Prepare for Follow-Up Actions After Your Call

After your call using the Mississippi State Tax phone number, it’s essential to document the conversation thoroughly. Make sure to record the representative's name, the date and time of the call, and any information or instructions provided. If you were advised to submit additional documentation or follow up on a specific issue, note these tasks clearly. Setting reminders for any deadlines mentioned during the call can help you stay organized and on track.

We understand that navigating tax inquiries can be overwhelming. Keeping accurate records of your communications can significantly improve your chances of a favorable outcome. For instance, consumers who meticulously document their conversations with tax offices often find it easier to resolve issues and provide necessary evidence when disputes arise.

Tax professionals emphasize the importance of follow-up actions. As one expert noted, "Timely responses can help avoid additional interest and penalties." This highlights that proactive follow-up is essential in managing your tax affairs effectively. Prepare for any follow-up calls by gathering additional information that may be required, ensuring you are ready to address any outstanding issues efficiently.

You are not alone in this journey. If you need assistance navigating these processes, Turnout is here to help. We provide access to trained nonlawyer advocates and IRS-licensed enrolled agents who can guide you through SSD claims and tax debt relief, simplifying your access to government benefits and financial support.

Conclusion

Finding the Mississippi State Tax phone number can feel overwhelming, but it doesn’t have to be. We understand that tax-related inquiries can be stressful, and having the right information at your fingertips can make all the difference. By identifying your specific needs, using official resources, and preparing for direct communication, you can navigate your tax concerns with greater ease.

Before making that call, take a moment to reflect on your purpose. What do you need clarity on? The Mississippi Department of Revenue's official website is a reliable source for accurate contact information. And remember, documenting your conversations can be a helpful way to keep track of important details for future reference.

By following these steps, you can enhance your experience and increase the chances of resolving your issues promptly. The contact numbers and resources provided are valuable tools in this journey.

Ultimately, being proactive and organized in your approach to tax inquiries not only alleviates stress but also empowers you to take control of your financial responsibilities. Whether you’re seeking clarification on tax obligations or resolving issues related to returns, using the Mississippi State Tax phone number and following up diligently can lead to successful outcomes.

Embrace these steps with confidence. You are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

Why is it important to identify my needs before contacting the Mississippi State Tax Office?

Identifying your specific needs helps you communicate effectively with the tax office and ensures you get the answers you need regarding your tax return, filing assistance, or tax obligations.

What should I do before reaching out to the Mississippi State Tax Office?

Before contacting the office, take a moment to write down your questions or concerns. This will guide your conversation and help you cover all important topics.

How can having the Mississippi State Tax phone number assist me?

Having the Mississippi State Tax phone number allows you to directly reach out for assistance with your tax-related inquiries, making it easier to obtain the information or help you need.

Am I alone in navigating tax-related questions?

No, you’re not alone. There are resources available to help you navigate your tax questions and concerns.