Overview

Navigating the world of taxes can be overwhelming, especially for those relying on SSI disability benefits. It's important to know that SSI payments are generally not taxable. This means that if SSI is your only source of income, you likely do not need to file a tax return.

However, we understand that your situation may involve additional income. In such cases, it’s essential to consider your overall earnings against IRS thresholds. This will help you determine if you have any tax filing obligations or potential liabilities.

Remember, you're not alone in this journey. If you have questions or concerns about your specific circumstances, seeking assistance can provide clarity and peace of mind. We're here to help you through this process.

Introduction

Navigating the complexities of filing taxes on Supplemental Security Income (SSI) disability benefits can feel overwhelming. We understand that as recipients, you may have questions and concerns about your financial situation. While SSI payments are generally not taxable, the ever-changing tax laws and potential additional income sources can lead to confusion about your filing obligations.

How can you ensure compliance while maximizing your benefits in the midst of these complexities? This article outlines four crucial steps to help you approach your tax filing process in 2025 with confidence.

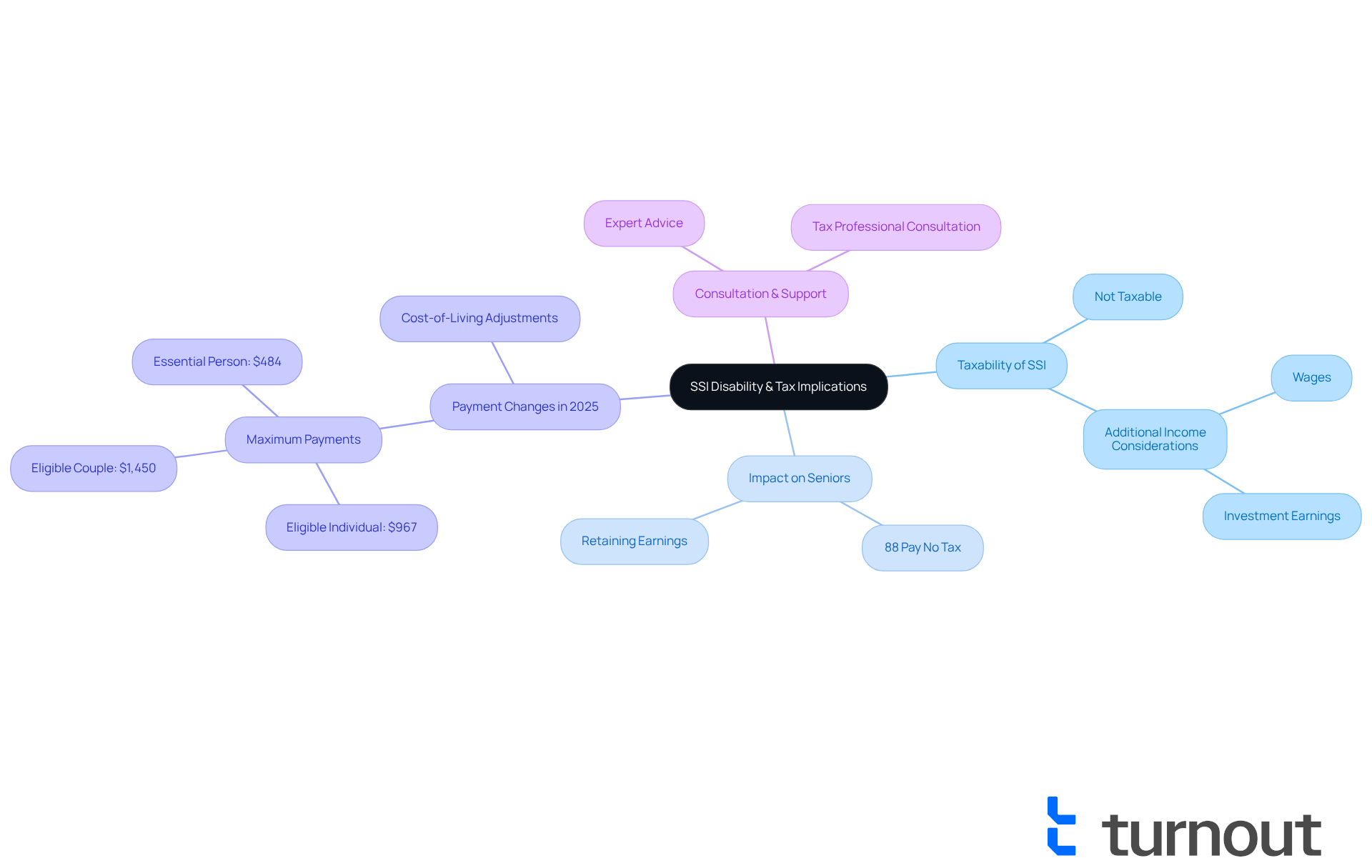

Understand SSI Disability and Tax Implications

In 2025, understanding whether you can file taxes on is crucial for recipients. Generally, SSI payments are not taxable, so if SSI is your sole source of funds, you might wonder, ; typically, you do not need to submit a tax return. This is particularly beneficial, as around 88% of seniors receiving Social Security will pay no tax on their benefits, allowing them to retain a larger portion of their earnings.

However, we understand that it’s important to stay informed about any changes in . While SSI itself is not taxable, it raises the question of can you file taxes on SSI disability, especially since any additional earnings could affect your tax responsibilities. If you receive other forms of income, such as wages or investment earnings, you might wonder, can you file taxes on SSI disability?

In 2025, the will increase, with eligible individuals receiving up to $967 monthly, and couples receiving up to $1,450. These adjustments are made annually based on cost-of-living increases, ensuring that benefits keep pace with inflation. Additionally, some states provide supplemental SSI assistance, which can further enhance your .

At , we are committed to making access to government services and financial aid simpler. We offer expert advice to assist individuals in navigating these challenges, including support with SSD claims and . Real-world examples can illustrate these points: an individual taxpayer receiving the average retirement benefit of around $24,000 will likely have deductions that exceed their taxable earnings. This reinforces the idea that many seniors can manage their finances without the burden of taxes on their SSI benefits. As tax laws evolve, consulting a can help you maximize available deductions and ensure compliance with current regulations.

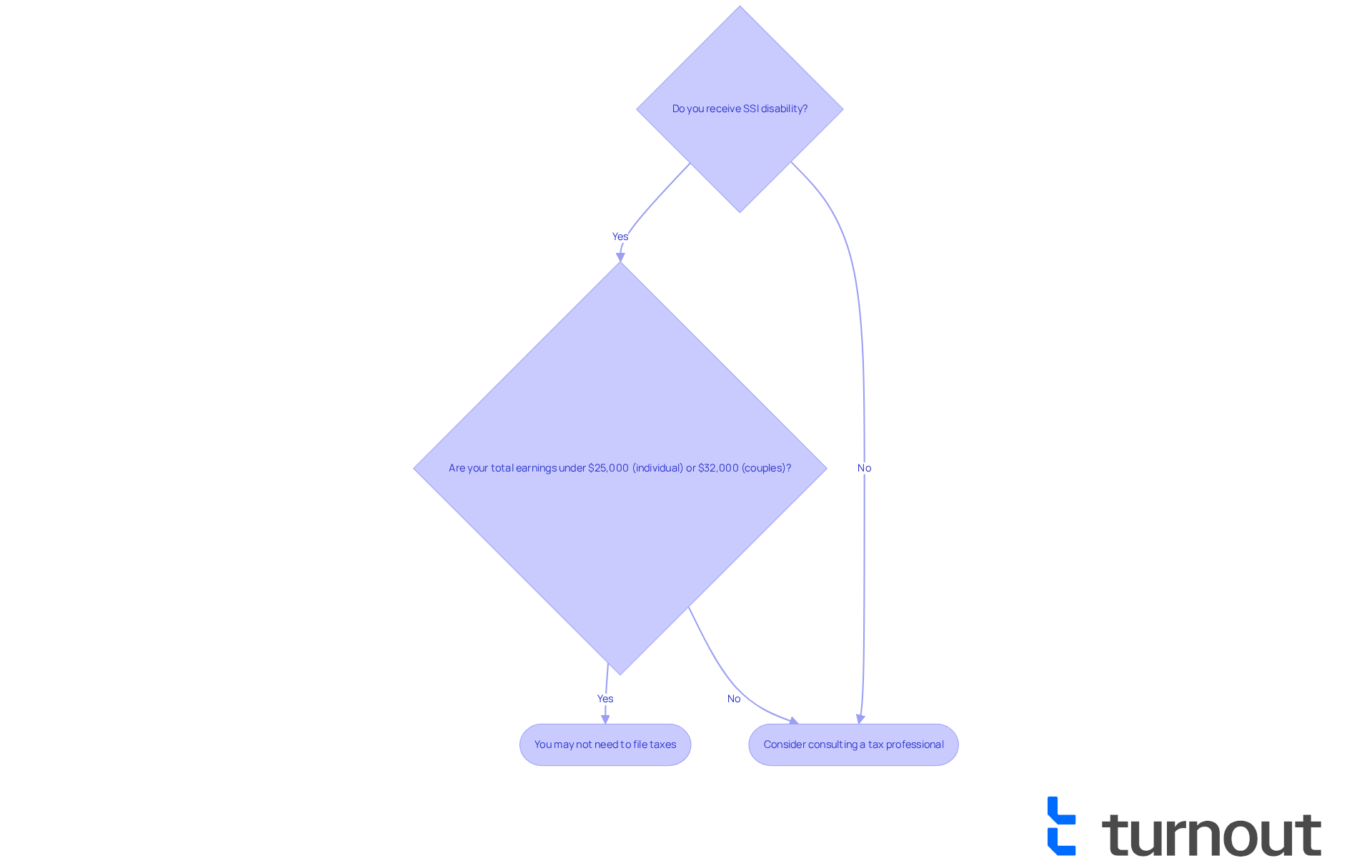

Verify Your Eligibility to File Taxes on SSI

If you're feeling uncertain about your qualifications, you might be wondering, can you file taxes on ? You're not alone. Start by comparing your overall earnings with the IRS filing limits for 2025. If your earnings exceed $25,000 as an individual or $32,000 for couples filing together, you might be asking, can you ? It's important to know that individual taxpayers with total earnings under $25,000 may wonder, can you file taxes on SSI disability without incurring taxes on .

We understand that can be challenging. Utilize the IRS's online tools, like the 'Get My Payment' tracker, to assess your filing needs accurately. If you still have questions about your requirements, consider reaching out to a who can provide personalized guidance tailored to your situation.

For instance, [can you file taxes on SSI disability](https://smartasset.com/retirement/is-social-security-income-taxable) if a single filer receives a monthly SSI payment of $1,900 along with additional earnings of $18,600? This totals $30,000. The taxable amount is determined as the lesser of half of the annual payments or half the difference between combined income and the IRS base amount, which could lead to a taxable sum of $2,500 for their Social Security payments.

Additionally, keep in mind the , which may influence your overall financial situation and tax filing obligations. and calculations is essential for ensuring compliance and . Remember, we're here to help you navigate this journey, and you are not alone in this process.

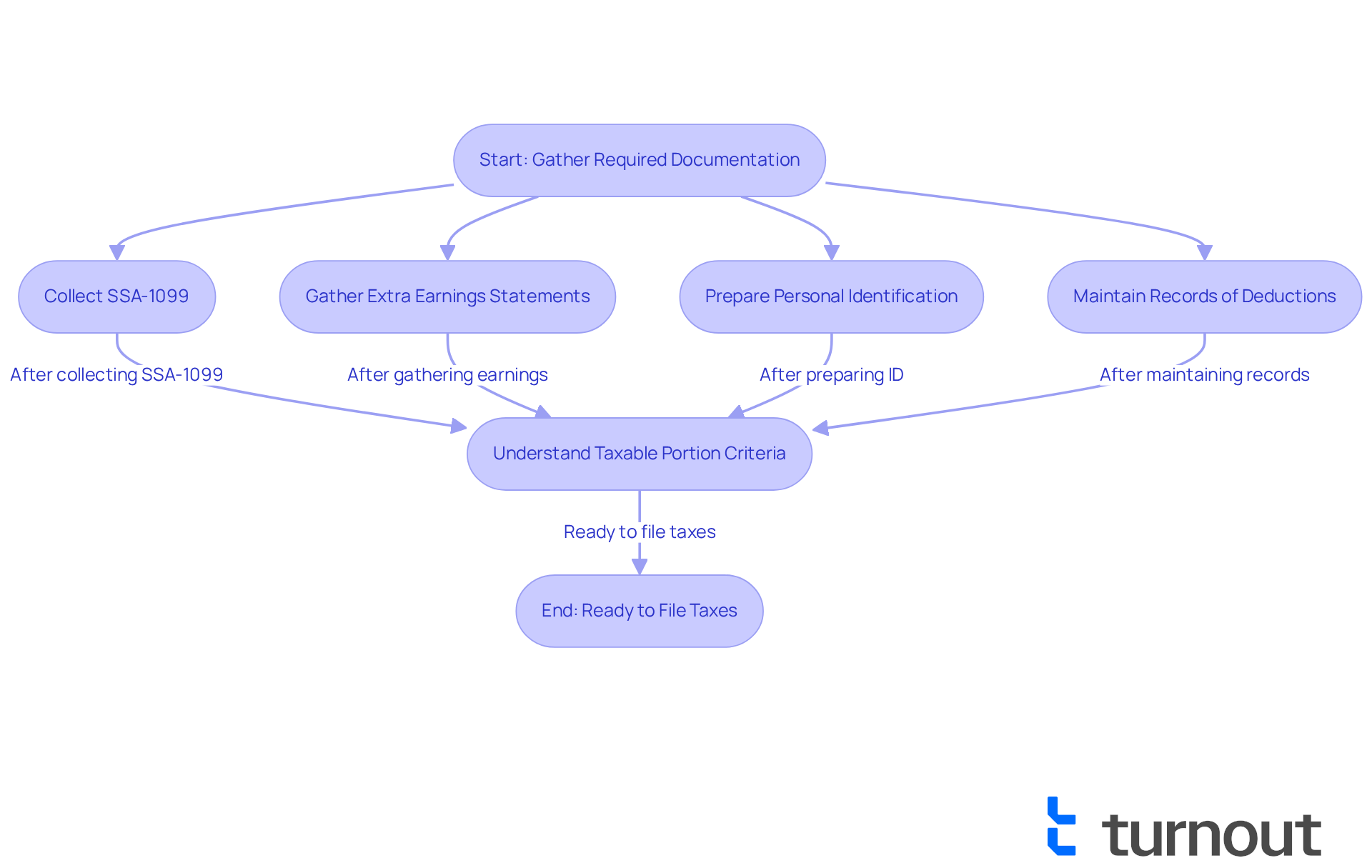

Gather Required Documentation for Tax Filing

If you're wondering, can you file , it can feel overwhelming, but we're here to help you through it. Start by gathering the essential documentation you need:

- Collect your (SSA-1099): This important statement, mailed every January, details the total amount of Social Security benefits you received during the tax year, including monthly retirement, survivor, and disability benefits. Make sure you have the correct form; it’s essential for .

- Gather any : If you have other sources of income, such as W-2s or 1099s, be sure to collect these documents as well. This will help you assess your overall earnings for the year, which is crucial for calculating the . Remember, as your gross income rises, a larger percentage of your may become taxable—up to a maximum of 85%.

- Prepare : Keep your Social Security card and driver's license handy. You may need these for verification purposes when filing your taxes.

- Maintain records of deductions or credits: Document any deductions or credits you plan to claim, such as the Mortgage Interest Deduction. This can increase your refund and ensure you’re making the most of available tax advantages.

As we look ahead to 2025, understanding the criteria for the SSA-1099 remains crucial. The taxable component of Social Security payments can vary depending on your overall earnings. For instance, if your total earnings exceed $32,000 for married couples filing jointly, a portion of your benefits may be taxable. If you receive a lump-sum payment, specific guidelines will dictate how to report it, which can affect your tax liability. It’s important to declare the taxable portion of lump-sum Social Security payments received in the current year as income, even if the payment includes amounts from previous years.

By organizing these documents and understanding the requirements, you can navigate the tax filing process with confidence. Remember, you are not alone in this journey; we’re here to support you every step of the way.

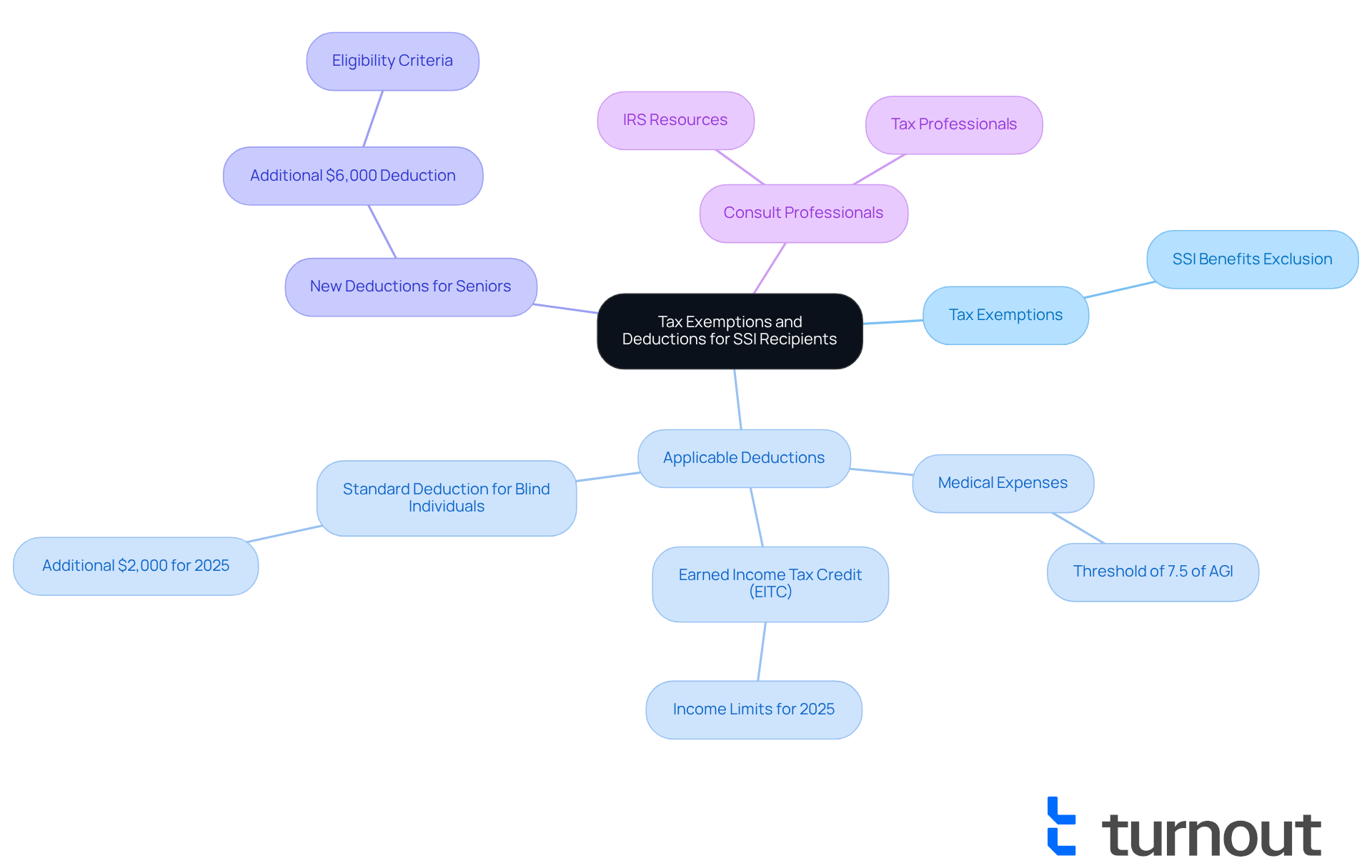

Identify Tax Exemptions and Deductions for SSI Recipients

Identifying is crucial for SSI recipients to optimize their advantages. We understand that navigating taxes can be overwhelming, but knowing your options can make a significant difference. Here are some key considerations to help you along the way:

- Research Available Tax Exemptions: If you receive , it’s important to know that all SSI benefits are excluded from taxable income. This means you do not need to report these benefits when filing your taxes, so it’s important to know, , which can provide peace of mind.

- Applicable Deductions: You may be eligible for various deductions, such as (AGI). Additionally, the Earned Income Tax Credit (EITC) could be available if you have earned income, offering substantial tax relief. For 2025, single filers without children can qualify for the EITC if their earnings are below $17,640, while married couples filing jointly need to have earnings below $24,210.

- New $6,000 Deduction for Seniors: Starting in 2025, seniors aged 65 and over can benefit from an . This new deduction is designed to help reduce taxable earnings, potentially lowering .

- : To ensure you claim all eligible deductions, it’s advisable to consult IRS resources or a tax professional. They can guide you on specific deductions, such as impairment-related work expenses (IRWE), which allow individuals with disabilities to deduct necessary work-related costs from their employment or self-employment income.

Real-world examples can illustrate the advantages of these deductions. For instance, if you, as an SSI recipient, incurred $2,000 in medical expenses, you could potentially deduct this amount if it exceeds the 7.5% threshold of your AGI. Furthermore, individuals who are visually impaired or aged 65 and older can benefit from a greater standard deduction, enhancing their tax advantages. Specifically, blind individuals receive an additional $2,000 standard deduction for the 2025 tax year, making their total standard deduction $17,000.

By understanding and applying these exemptions and deductions, you can . Remember, we’re here to help you to you. You're not alone in this journey, and taking these steps can lead to a more favorable financial situation.

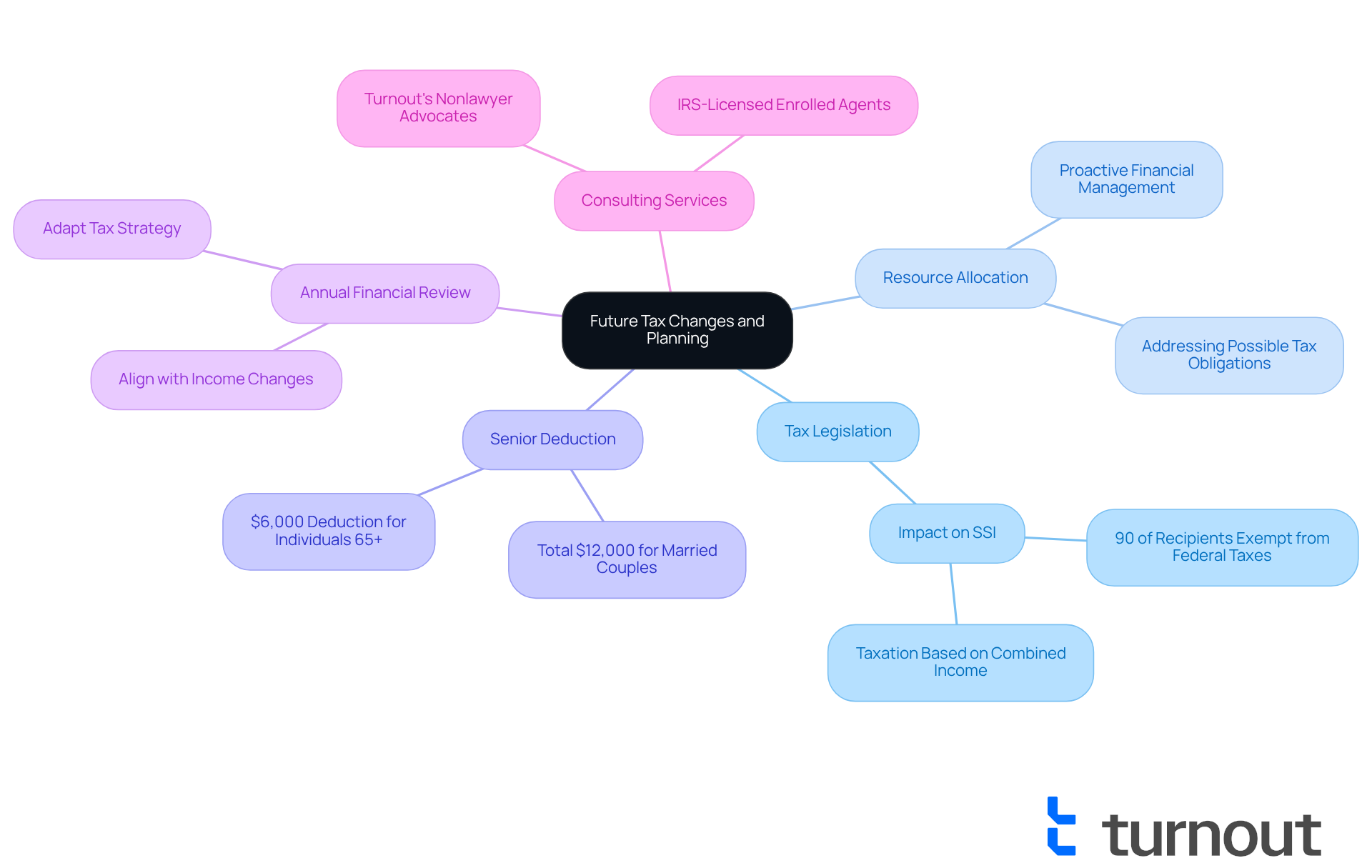

Consider Future Tax Changes and Planning

Stay informed about tax legislation that could influence your SSI support. Changes may affect your overall tax liability, and it's common to feel uncertain about these shifts. Almost 90% of Social Security recipients will , which can offer reassurance concerning your tax obligations.

Allocate your resources wisely to address possible tax obligations, especially if your earnings rise. This proactive approach can help prevent unforeseen financial pressure. Have you considered the , effective from 2025? This could be a potential tax relief option for you.

Conducting an annual review of your financial situation is essential. This allows you to adapt your tax strategy accordingly, ensuring it aligns with any changes in income or tax laws. Recent legislation has provided , which may enhance your planning and ease your worries.

We encourage you to or IRS-licensed enrolled agents. They can help you develop a long-term planning strategy that considers your unique circumstances and . Remember, and tax relief can provide valuable guidance without the need for legal representation. You are not alone in this journey; we're here to help.

Conclusion

Understanding the intricacies of filing taxes on SSI disability benefits is essential for recipients seeking to manage their finances effectively. While SSI payments are generally not taxable, being aware of potential tax implications and the criteria for filing taxes can significantly impact your financial planning. This article has provided a comprehensive overview of the steps needed to navigate the tax landscape for SSI recipients, ensuring clarity and confidence in the process.

We know that verifying eligibility based on earnings, gathering necessary documentation, and identifying available tax exemptions and deductions can feel overwhelming. It's important to recognize that while SSI benefits themselves are not taxable, additional income may influence your tax obligations. Furthermore, the introduction of new deductions for seniors in 2025 offers an opportunity for many to reduce their taxable income, thereby enhancing their financial situation.

As tax laws continue to evolve, staying informed and proactive is vital. Consulting with tax professionals or utilizing resources like Turnout can provide valuable support in maximizing your benefits and ensuring compliance with regulations. By taking these steps, you can not only simplify your tax filing process but also secure a more favorable financial future. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

Are SSI disability payments taxable?

Generally, SSI payments are not taxable, so if SSI is your sole source of funds, you typically do not need to submit a tax return.

What percentage of seniors pay no tax on their Social Security benefits?

Around 88% of seniors receiving Social Security will pay no tax on their benefits.

What should SSI recipients consider regarding tax filing?

While SSI itself is not taxable, recipients should consider any additional earnings, such as wages or investment income, which may affect their tax responsibilities.

What are the maximum Federal SSI payment amounts for 2025?

In 2025, eligible individuals will receive up to $967 monthly, and couples will receive up to $1,450.

How do cost-of-living adjustments affect SSI payments?

SSI payment amounts are adjusted annually based on cost-of-living increases to ensure that benefits keep pace with inflation.

What resources are available for individuals needing assistance with SSI and taxes?

Turnout offers expert advice to assist individuals in navigating government services, including support with SSD claims and tax debt relief.

How can I determine if I need to file taxes based on my SSI and other income?

Compare your overall earnings with the IRS filing limits for 2025. If your earnings exceed $25,000 as an individual or $32,000 for couples filing together, you may need to file taxes.

What should I do if I'm unsure about my tax filing requirements?

Utilize the IRS's online tools, like the 'Get My Payment' tracker, or reach out to a tax professional for personalized guidance.

How is the taxable amount determined for someone receiving SSI and additional earnings?

The taxable amount is determined as the lesser of half of the annual payments or half the difference between combined income and the IRS base amount.

What is the significance of the upcoming $1,390 relief payment?

The $1,390 relief payment may influence an individual's overall financial situation and tax filing obligations.