Introduction

Navigating the complexities of VA disability benefits can feel overwhelming for many veterans. We understand that figuring out how these benefits impact your financial situation is no small task. This article outlines four essential steps to help clarify whether VA disability counts as income for Social Security. Our goal is to provide you with the knowledge you need to make informed decisions about your finances.

It's common to feel uncertain about how VA assistance interacts with Social Security. This interplay can significantly affect your eligibility for various programs. So, how can you ensure that you're maximizing your benefits while staying compliant with regulations? We're here to help you through this journey.

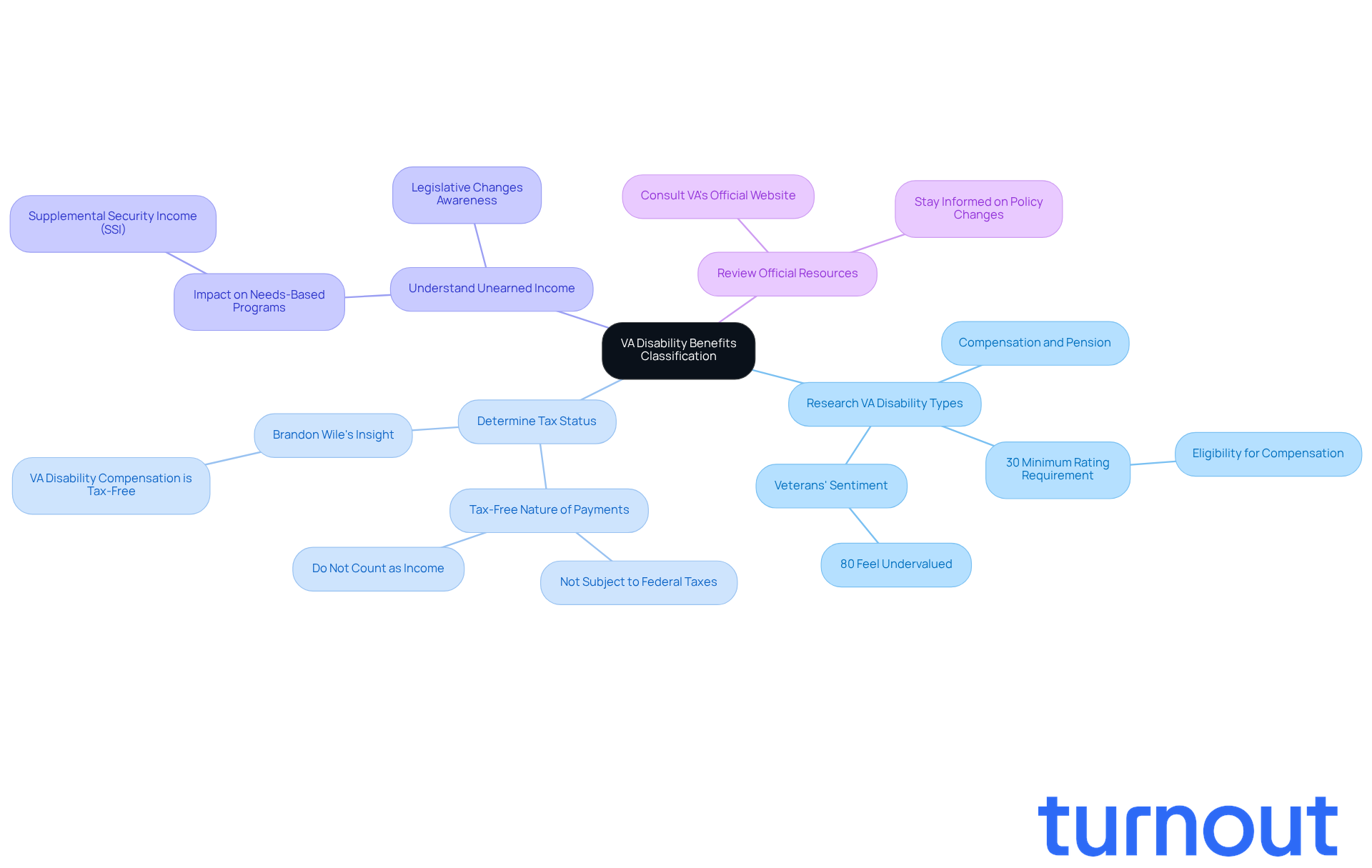

Understand VA Disability Benefits Classification

Research VA Disability Types: We understand that navigating the world of VA disability assistance can be overwhelming. Familiarizing yourself with the various classifications, such as compensation and pension, is a crucial first step. As of 2026, a minimum disability rating of 30% is necessary for compensation eligibility. This knowledge is essential for grasping the benefits available to our brave veterans. It's important to note that a staggering 80% of veterans feel undervalued by the VA, highlighting the challenges many face in securing their rightful entitlements.

Determine Tax Status: It's common to feel uncertain about how VA disability payments relate to the question of does VA disability count as income for social security and how they affect your finances. The good news is that these payments are typically not subject to taxation and do not count as earned revenue for federal tax purposes. As Brandon Wile wisely states, "VA disability compensation is tax-free earnings. Don't report it to the IRS. Don't pay taxes on it." This means that former service members can access these benefits without the burden of taxation, allowing them to focus on their recovery and well-being.

Understand Unearned Income: We recognize that understanding how VA assistance is classified can be confusing. When discussing VA assistance, which is considered unearned income, it is important to consider whether does VA disability count as income for social security, as it may impact eligibility for needs-based programs like Supplemental Security Income (SSI). For instance, individuals rated at 10% or 20% might face challenges if new proposals require a 30% rating for compensation. Staying informed about legislative changes is vital, as these can significantly influence the support you receive.

Review Official Resources: We encourage you to seek the most accurate and updated information regarding classifications and potential changes. Consulting the VA's official website or publications is a great way to stay informed. Remember, policies concerning VA assistance can evolve, and being aware of current discussions and proposals is crucial for understanding how they may affect your financial situation.

Identify Situations Where VA Benefits Count as Income

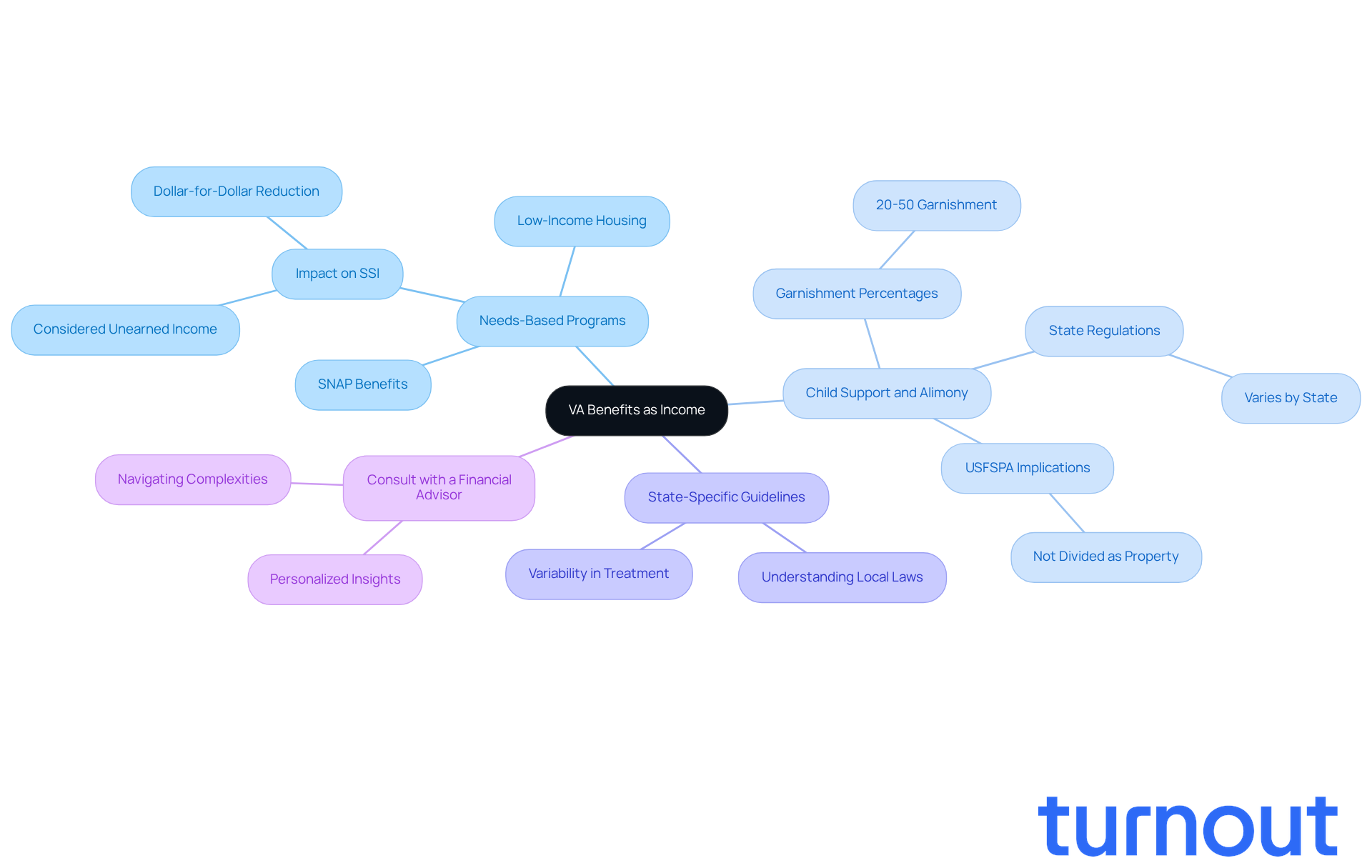

Assess Needs-Based Programs: If you're applying for needs-based programs like Supplemental Security Income (SSI), it’s important to understand how does VA disability count as income for social security, as this assistance is considered unearned income. This can affect your SSI eligibility or payment amounts, often on a dollar-for-dollar basis after a small exclusion. We know this can be confusing, but being informed is the first step.

-

Consider Child Support and Alimony: VA assistance is generally considered earnings when it comes to child support and alimony. Courts often take these benefits into account when determining financial responsibilities. This could lead to garnishment of 20 to 50% of payments for overdue child support or alimony, depending on your state’s regulations. It’s common to feel overwhelmed by these financial obligations, but understanding them can help you navigate your situation better.

-

Assess State-Specific Guidelines: Each state has its own rules regarding how VA assistance is treated in earnings calculations for state support programs. Knowing these details is crucial, as some states may offer more favorable regulations regarding whether does VA disability count as income for social security, protecting your benefits. Remember, you’re not alone in this; many have faced similar challenges and found ways to manage them.

-

Consult with a Financial Advisor: Connecting with a financial advisor who specializes in veteran assistance can provide you with personalized insights into how your VA support may influence your financial landscape. They can guide you through the complexities of child support and alimony calculations, ensuring you make informed decisions tailored to your unique circumstances. Additionally, it’s vital to recognize that the Uniformed Services Former Spouses’ Protection Act (USFSPA) prohibits the division of VA entitlements as marital property during divorce proceedings. We’re here to help you navigate these waters with confidence.

Evaluate Tax Implications and Additional Benefit Eligibility

-

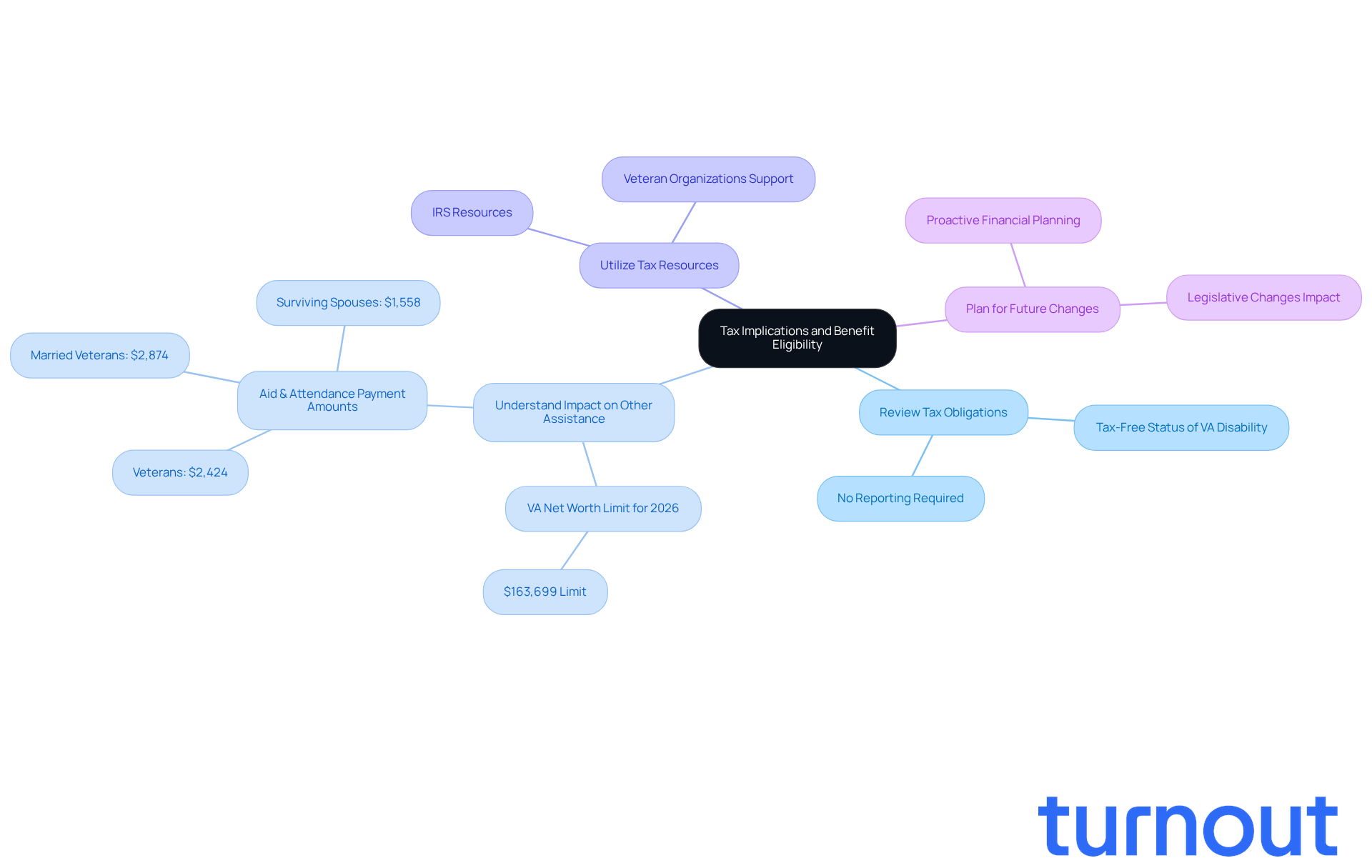

Review Tax Obligations: We understand that navigating tax obligations can be overwhelming. The good news is that VA disability payments are entirely tax-free at both federal and state levels. This means you don’t need to report them on your tax returns. This exemption ensures that former service members can keep the full amount of their entitlements without any tax deductions.

-

Understand Impact on Other Assistance: It's common to feel uncertain about how VA disability counts as income for social security and how it might affect your eligibility for other programs, especially Medicaid. For example, the VA net worth limit for 2026 is set at $163,699, which can influence how service members qualify for needs-based assistance. Additionally, the highest monthly Aid & Attendance payments are $2,424 for former service members, $2,874 for married former service members, and $1,558 for surviving spouses. Even minor increases in income from VA assistance can affect eligibility for programs like food aid or housing support, especially when considering if VA disability counts as income for social security. Turnout offers tools and services to help you navigate these complexities, ensuring you understand how your entitlements interact with other forms of assistance.

-

Utilize Tax Resources: We encourage veterans to leverage resources from the IRS and veteran organizations to effectively navigate the tax implications of their entitlements. These resources can provide essential guidance on managing benefits without jeopardizing eligibility for other assistance. Turnout's trained nonlawyer advocates are here to support you in this process, offering tailored assistance to meet your individual needs.

-

Plan for Future Changes: Staying informed about potential legislative changes is crucial. Adjustments to VA provisions or tax laws could impact your financial planning. Ongoing discussions about the treatment of VA assistance in family court systems highlight the importance of proactive planning to ensure continued access to necessary support. Remember, Turnout is dedicated to helping veterans stay informed and prepared for any changes that might affect their entitlements.

Gather Necessary Documentation and Verify Income Status

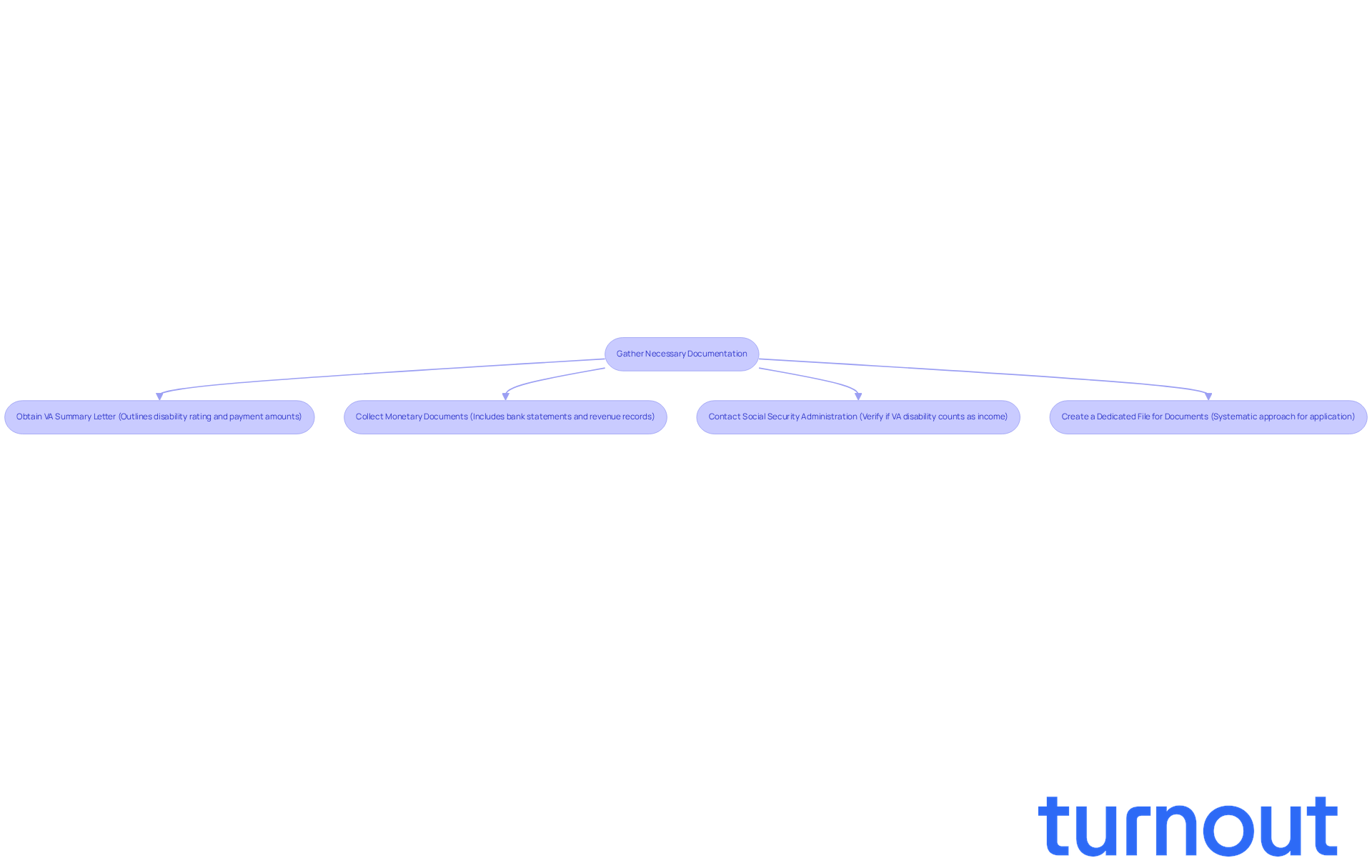

Start by obtaining your VA summary letter. This letter outlines your disability rating and the corresponding payment amounts, and it’s essential for confirming your earnings and understanding your benefits. In 2026, VA disability compensation ranges from $180.42 for a Veteran with a 10 percent rating to $4,671.47 for a Veteran rated at 100 percent with dependents.

Next, collect vital monetary documents, including bank statements and any records that indicate your revenue sources. These documents are crucial for your VA assistance application and can help clarify your financial situation. We understand that navigating these processes can be overwhelming. That’s why Turnout's trained nonlawyer advocates are here to assist you, ensuring you have the necessary support without needing legal representation.

Be sure to contact the Social Security Administration to find out if does VA disability count as income for social security. Keeping all information up-to-date will help avoid complications in your application process for assistance. As Rikki Almanza, Web Content Coordinator for the American Legion, observed, "Together, these adjustments offer modest yet significant support for Veterans and their families as they deal with increasing expenses in 2026." This emphasizes the importance of precise income verification, particularly regarding whether does VA disability count as income for social security in the assistance process.

Create a dedicated file for all relevant documents. This systematic approach will simplify your application procedure for any extra benefits and ensure you have everything you need at your fingertips. Remember, the 2026 Cost-of-Living Adjustment (COLA) is set at 2.8%, which may influence your benefits and planning. Turnout's trained nonlawyer advocates are available to guide you through these steps, making your access to government benefits and financial support easier.

Conclusion

Navigating the complexities of VA disability benefits can feel overwhelming for many veterans. Understanding how these benefits interact with financial assistance programs is crucial. This article highlights important steps to determine if VA disability counts as income for Social Security, ensuring you’re informed about these interactions.

We recognize that VA benefits are classified as unearned income and are tax-exempt. However, there are specific situations where they might affect your eligibility for needs-based programs like Supplemental Security Income (SSI) or child support calculations. Gathering the right documentation and staying updated on legislative changes is essential. This way, you can manage your benefits and financial obligations effectively.

We encourage you to take proactive steps in understanding your VA disability benefits and their implications for Social Security and other assistance programs. By consulting official resources, seeking personalized advice from financial professionals, and keeping your documentation organized, you can navigate your financial landscape with confidence. Remember, you are not alone in this journey, and support is available to help you secure the benefits you deserve.

Frequently Asked Questions

What are the main classifications of VA disability benefits?

The main classifications of VA disability benefits include compensation and pension. Familiarizing yourself with these classifications is essential for understanding the benefits available to veterans.

What is the minimum disability rating required for compensation eligibility as of 2026?

As of 2026, a minimum disability rating of 30% is necessary for eligibility for compensation.

Are VA disability payments taxable?

No, VA disability payments are typically not subject to taxation and do not count as earned income for federal tax purposes.

How should veterans treat VA disability compensation for tax purposes?

Veterans should not report VA disability compensation to the IRS, as it is considered tax-free earnings.

What is considered unearned income in relation to VA assistance?

VA assistance is classified as unearned income, which can affect eligibility for needs-based programs like Supplemental Security Income (SSI).

How might changes in legislation impact veterans receiving VA disability benefits?

Legislative changes can significantly influence the support veterans receive, particularly if new proposals require a higher disability rating for compensation eligibility.

Where can veterans find accurate and updated information about VA disability benefits?

Veterans can consult the VA's official website or publications to stay informed about classifications and potential changes to VA disability benefits.