Introduction

Navigating the complexities of payroll tax law can feel overwhelming. We understand that as an employer, you’re tasked with ensuring compliance while managing employee compensation. It’s a lot to juggle, and the stakes are high. But remember, understanding payroll taxes not only protects your business but also supports essential social programs.

So, how do you choose the right payroll tax attorney to address your unique challenges? It’s common to feel uncertain in this process. This guide outlines four critical steps to help you find a qualified legal professional:

- Assess your specific needs.

- Research potential attorneys.

- Schedule consultations.

- Make an informed decision.

With the right support, you can navigate the intricacies of payroll tax issues and ensure you receive the best possible representation when you need it most.

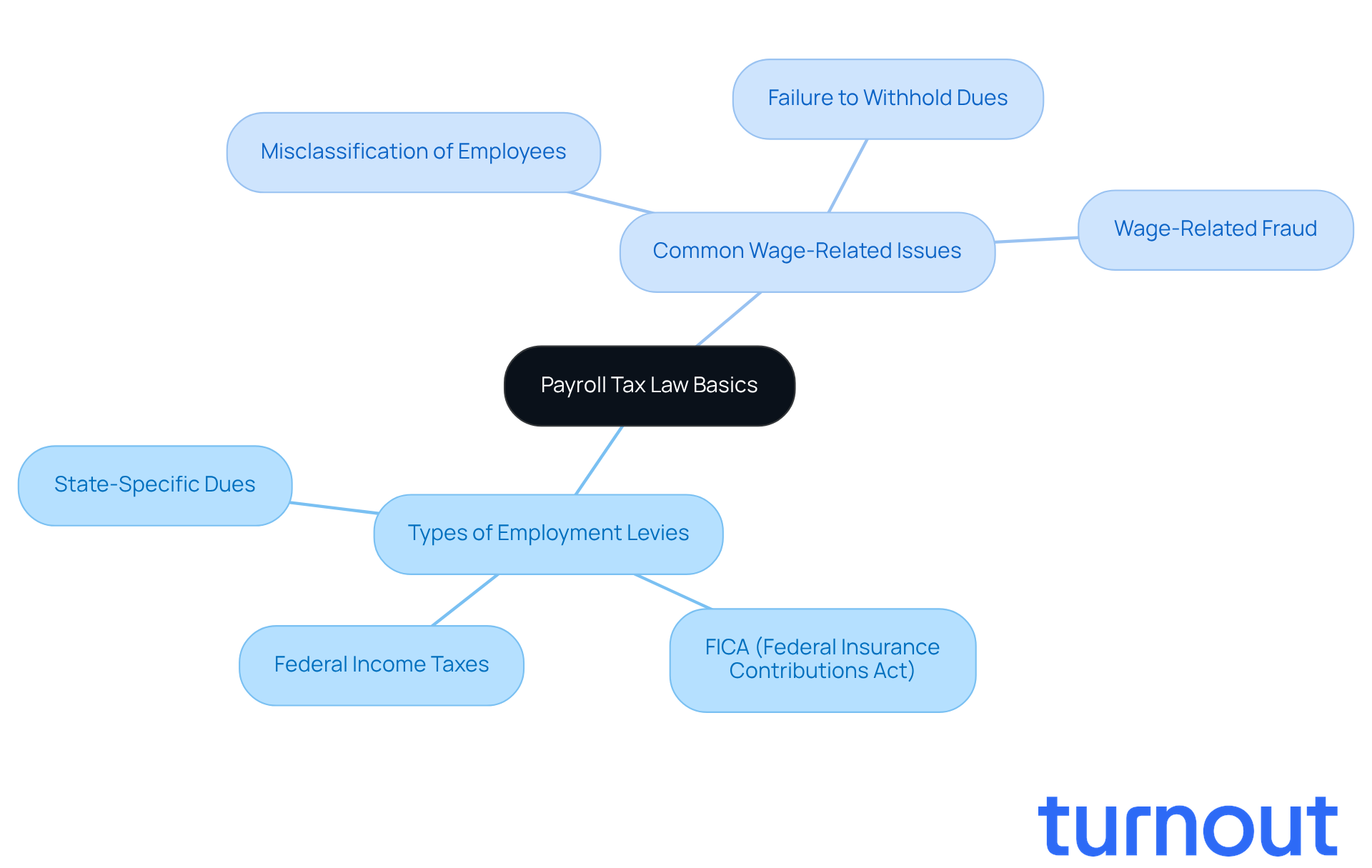

Understand Payroll Tax Law Basics

Before you begin your search for a tax lawyer, it’s important to grasp the basics of tax law. We understand that navigating this landscape can feel overwhelming. Payroll levies are mandatory contributions that employers must deduct from employees' earnings. These funds support essential social insurance programs like Social Security and Medicare. By familiarizing yourself with the different types of employment levies, such as:

- Federal income taxes

- FICA (Federal Insurance Contributions Act)

- State-specific dues

you’ll be better equipped to discuss your situation with a payroll tax attorney.

It’s also helpful to understand common wage-related issues. These include:

- Misclassification of employees

- Failure to withhold dues

- Repercussions of wage-related fraud

Resources like the IRS website offer valuable insights into these matters, helping you build a solid foundation for your conversations with legal professionals. Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

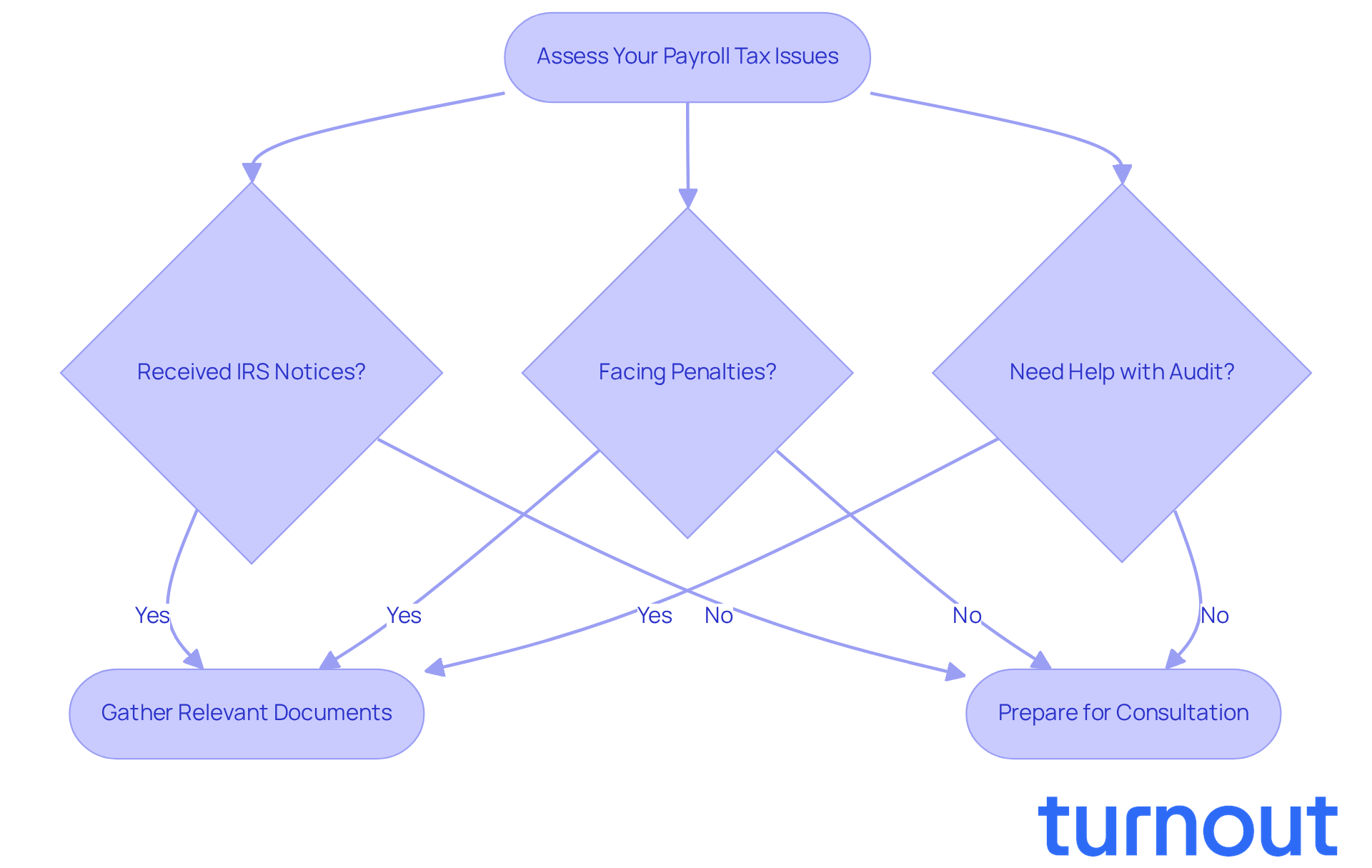

Assess Your Specific Payroll Tax Issues

Before reaching out to a tax attorney, it’s important to take a moment to reflect on your specific tax concerns related to employee compensation. We understand that this can be a challenging time, so consider these key questions:

- Have you received any notices from the IRS about unpaid payroll taxes?

- Are you facing penalties for late payments or misclassifications?

- Do you need help with an audit or negotiating with the IRS?

Taking the time to record your worries and gather relevant documents - like tax returns, IRS notices, and wage records - will give you a clearer picture of your situation. This preparation not only enhances your understanding of your needs but also helps the lawyer assess your case more effectively during initial consultations.

With the IRS emphasizing compliance, being well-prepared can significantly influence the outcome of your discussions with legal professionals. Remember, you have until April 15, 2026, to file your 2025 tax returns, making timely preparation crucial. As the IRS reminds us, "Any future failures to file or pay on time could result in another withholding lock-in letter." This highlights the importance of promptly addressing your tax issues with a payroll tax attorney.

Additionally, consider using electronic filing methods. They can greatly reduce errors compared to paper returns, streamlining the process and minimizing the chances of mistakes. You are not alone in this journey; we’re here to help you navigate these challenges.

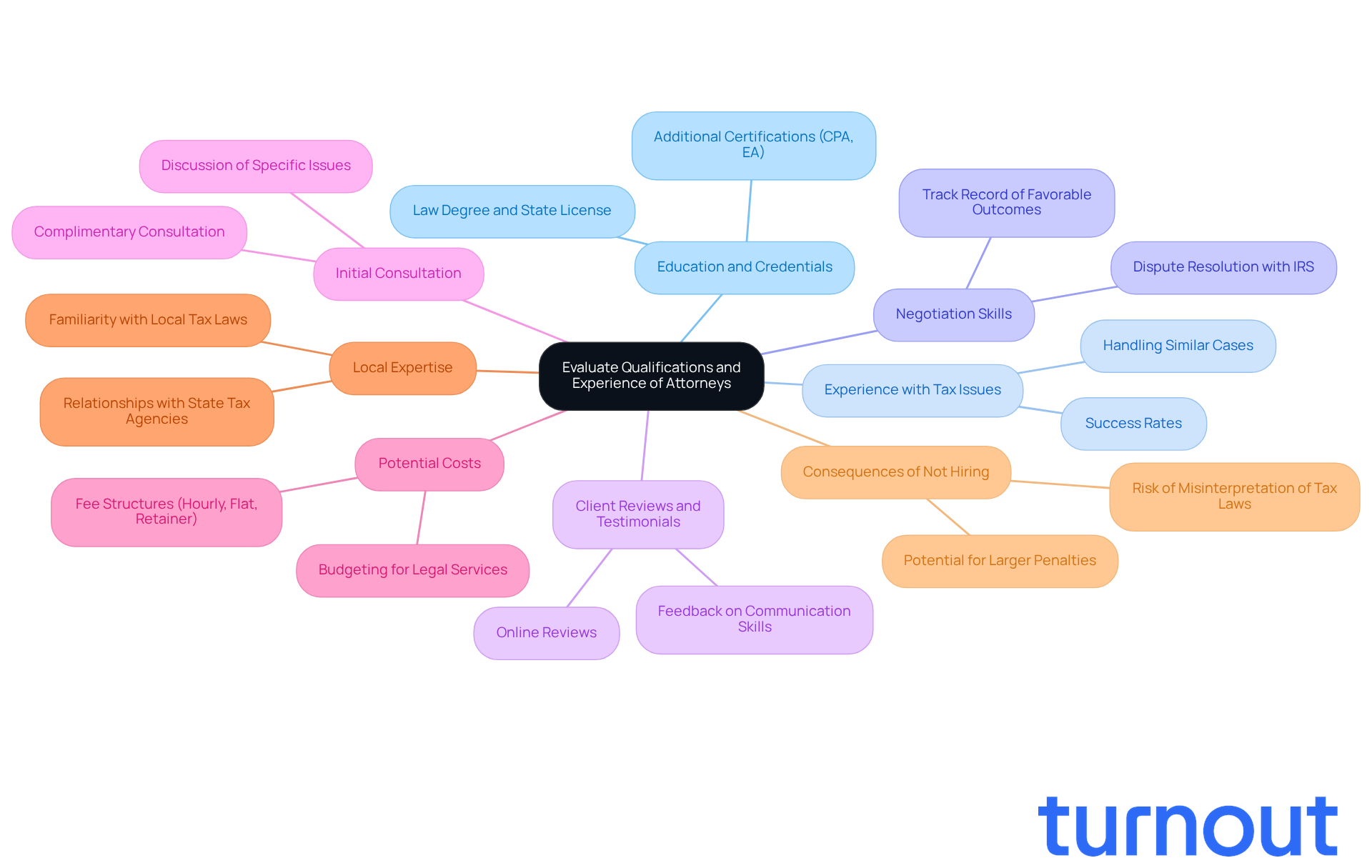

Evaluate Qualifications and Experience of Attorneys

When you're looking for a tax professional, it’s essential to thoroughly evaluate their qualifications and experience. We understand that this process can feel overwhelming, but focusing on a few key factors can help you find the right support.

- Education and Credentials: Make sure the attorney has a law degree and is licensed to practice in your state. Additional certifications in tax law, like being a Certified Public Accountant (CPA) or an Enrolled Agent (EA), can really enhance their expertise.

- Experience with Tax Issues: It’s important to ask about their experience with tax matters related to employee compensation. How many similar cases have they handled? What are their success rates? This information can provide you insight into their ability to effectively navigate complex payroll tax regulations with the help of a payroll tax attorney.

- Negotiation Skills: A tax lawyer's negotiation skills are crucial when resolving disputes with the IRS. This can save you both time and money. Look for a lawyer who has a proven track record of negotiating favorable outcomes for their clients.

- Client Reviews and Testimonials: Researching online reviews and testimonials from previous clients can help you gauge their satisfaction with the lawyer's services. Positive feedback can reassure you about the lawyer's communication skills and effectiveness in managing cases.

- Initial Consultation: Many legal professionals offer a complimentary initial consultation. This is a great opportunity to discuss your specific payroll tax issues with a payroll tax attorney and inquire about their approach to resolving them. This meeting can help you assess their understanding of your situation and their proposed strategies for assistance.

- Potential Costs: It’s important to understand the fee structures associated with hiring a tax specialist. This may include hourly rates, flat fees, or retainers. Knowing the costs upfront can help you budget for legal services effectively.

- Local Expertise: Hiring a tax specialist who is familiar with local tax laws and procedures can enhance their ability to navigate state-specific challenges.

- Consequences of Not Hiring an Experienced Legal Professional: Be aware that failing to engage a qualified tax expert can lead to misinterpretations of tax laws and potentially larger penalties. Having professional representation can protect your rights and improve your chances of a favorable outcome.

Remember, you’re not alone in this journey. We’re here to help you find the right tax professional who can guide you through these challenges with care and expertise.

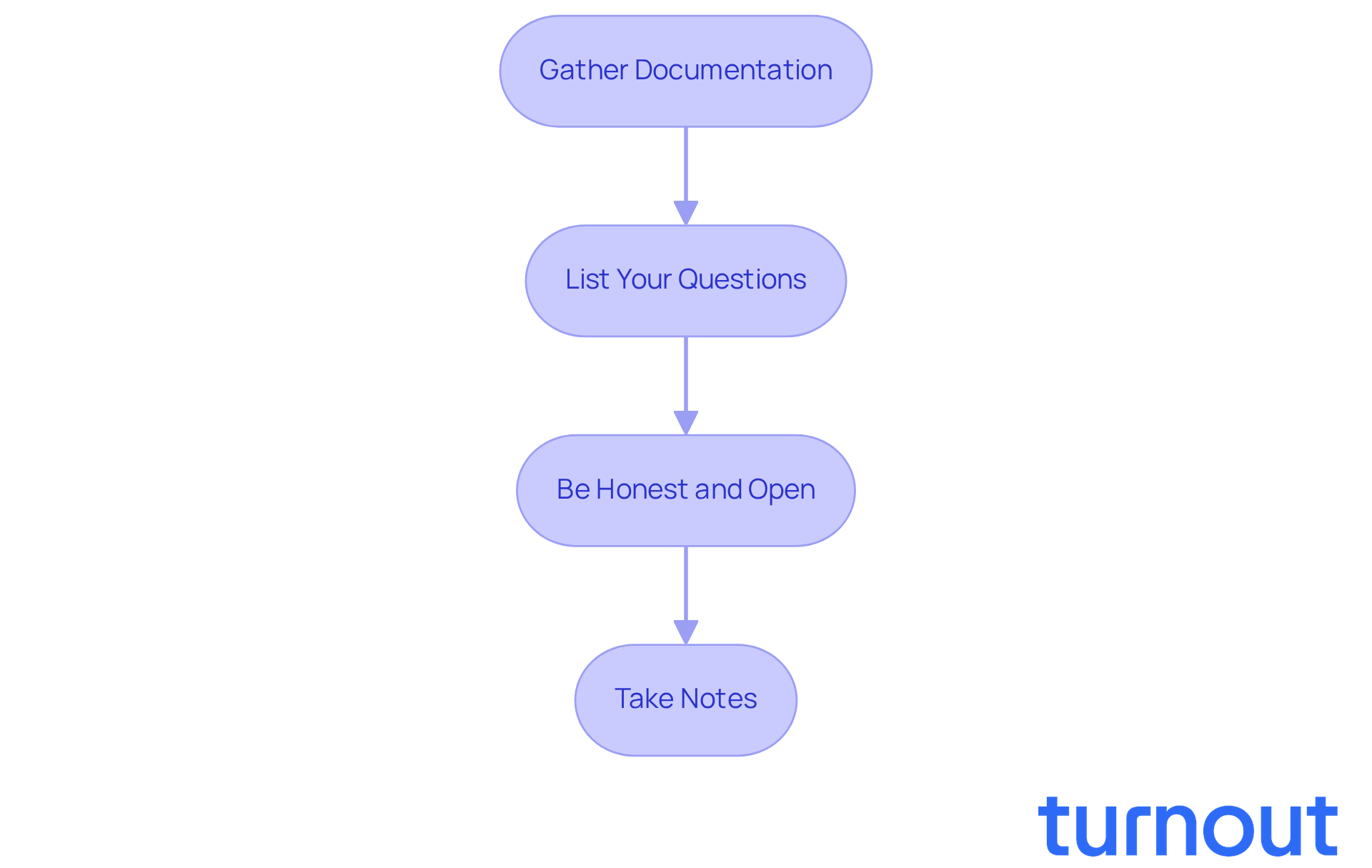

Prepare for Initial Consultations with Attorneys

To enhance the effectiveness of your initial meetings with tax specialists, thorough preparation is crucial. We understand that navigating tax issues can be overwhelming, but taking these steps can make a significant difference:

- Gather Documentation: Assemble all pertinent documents, including tax returns, IRS notices, payroll records, and any correspondence related to your tax issues. This foundational information is essential for the lawyer to assess your situation accurately. Specific examples of documentation that a payroll tax attorney may require include W-2 forms, 1099s, and any notices received from the IRS regarding payroll tax debts.

- List Your Questions: Prepare a set of questions to ask during the consultation. Focus on their experience, fee structure, and strategies for resolving your specific issues. This will help you gauge their expertise and approach. Inquire about their credentials, such as whether they hold a Juris Doctor (JD) degree and specialize in tax law, ideally with a Master of Laws (LL.M.) in taxation.

- Be Honest and Open: Transparency is vital during your consultation. Share all pertinent details about your situation to enable the lawyer to understand your case completely and provide customized advice. Remember, delaying a consultation can lead to serious consequences, including escalating penalties and fines.

- Take Notes: Document the lawyer's responses and recommendations during the meeting. This will assist you in comparing different attorneys and making an informed decision later on. Consider firms like the Law Offices of Darrin T. Mish, P.A., which specializes in IRS problem resolution and has a proven track record of resolving significant tax debts.

You're not alone in this journey. We're here to help you navigate these challenges with confidence.

Conclusion

Choosing the right payroll tax attorney is a vital step for anyone grappling with tax-related issues tied to employee compensation. We understand that navigating these complexities can feel overwhelming. By grasping the basics of payroll tax law and assessing your personal tax concerns, you can significantly improve your chances of resolving disputes favorably. Evaluating potential attorneys and preparing for initial consultations are crucial steps in this journey. This comprehensive approach ensures that the legal professional you choose is not just qualified but also well-suited to meet your specific needs.

Throughout this article, we've highlighted key points that matter. It's essential to understand payroll tax basics and to self-assess your tax issues. When evaluating an attorney's qualifications, consider critical factors that can make a difference. By being proactive and prepared, you can enter consultations with clarity and confidence. This empowers you to make informed decisions that will positively impact your financial and legal standing.

Ultimately, we know that facing payroll tax challenges can be daunting. But taking action is essential. Engaging a knowledgeable payroll tax attorney can provide the guidance you need to tackle complex issues effectively. By following these steps, you can ensure you're well-equipped to confront your tax matters head-on. Remember, you're not alone in this journey; we're here to help you transform uncertainty into empowerment.

Frequently Asked Questions

What are payroll taxes?

Payroll taxes are mandatory contributions that employers must deduct from employees' earnings to support essential social insurance programs like Social Security and Medicare.

What types of employment levies should I be aware of?

Key types of employment levies include federal income taxes, FICA (Federal Insurance Contributions Act), and state-specific dues.

Why is it important to understand payroll tax law basics before consulting a tax lawyer?

Understanding payroll tax law basics helps you better discuss your situation with a payroll tax attorney and navigate the complexities of tax law.

What are some common wage-related issues associated with payroll taxes?

Common wage-related issues include misclassification of employees, failure to withhold dues, and repercussions of wage-related fraud.

Where can I find more information about payroll taxes and related issues?

Valuable insights can be found on resources like the IRS website, which can help you build a solid foundation for discussions with legal professionals.