Overview

Navigating tax obligations can be overwhelming, and we understand that many taxpayers face challenges when seeking assistance. This article outlines four essential steps to effectively call the IRS payment plan: preparing necessary information, initiating the call, understanding the call process, and managing follow-up actions. By being organized and informed, you can take control of your situation and establish feasible payment arrangements with the IRS.

-

Prepare Your Information: Gather all necessary documents and details before making the call. This preparation can ease your mind and help streamline the process.

-

Initiate the Call: When you're ready, make the call. Remember, it's okay to feel anxious; many people share this experience.

-

Understand the Call Process: Familiarize yourself with the steps involved in the call. Knowing what to expect can make the conversation less daunting.

-

Manage Follow-Up Actions: After your call, keep track of any agreements or next steps. This will ensure you stay on top of your payment plan.

By following these steps, you can approach the IRS with confidence. You're not alone in this journey; we're here to help you navigate your tax obligations with compassion and support.

Introduction

Navigating tax obligations can often feel daunting. We understand that dealing with the IRS may seem overwhelming. For many, establishing a payment plan to manage outstanding debts is a crucial step toward financial stability. This guide offers a clear roadmap for effectively calling the IRS to set up a payment plan, ensuring that you are well-prepared and informed throughout the process.

But what happens if unexpected challenges arise during the call? It's common to feel anxious if the terms of the agreement become overwhelming. Understanding how to tackle these potential hurdles can make all the difference in achieving a successful resolution. Remember, you are not alone in this journey—we're here to help.

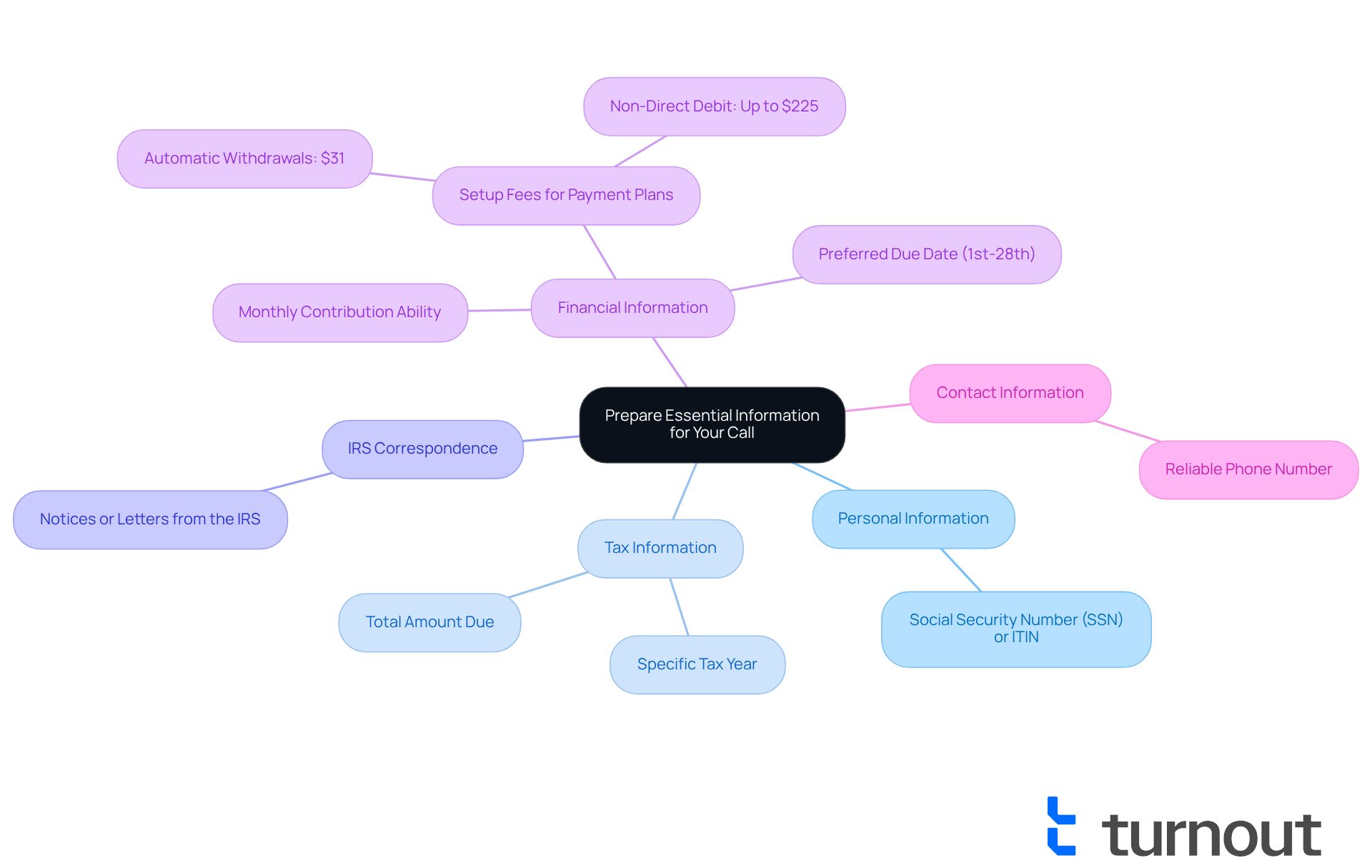

Prepare Essential Information for Your Call

Before you call the , it’s important to gather some key information to ensure that your conversation is smooth and effective. We understand that dealing with can be stressful, and having the right details at hand can make a world of difference.

- Personal Information: Please have your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) ready.

- Tax Information: Be aware of the specific tax year for which you owe taxes and the total amount due; this will be crucial for your discussion.

- : Keep any notices or letters from the IRS handy, as they contain vital details about your account and any previous communications.

- Financial Information: Prepare to discuss your and your preferred due date, which can be set between the 1st and 28th of the month. Remember, long-term financing arrangements may incur a setup fee of $31 for automatic withdrawals when submitted online.

- Contact Information: Make sure you have a reliable phone number where the IRS can reach you if necessary.

Having this information organized will not only streamline your conversation but also enhance the likelihood of a successful outcome. In 2025, the average wait time for IRS calls can be significant, so being prepared can help you make the most of your time on the line. We suggest reviewing your tax documents, checking your IRS account online, and ensuring all relevant paperwork is accessible before making the call.

Furthermore, it's important to be aware that if you fail to comply with an IRS installment agreement, you may want to call the IRS payment plan to avoid further penalties and potential federal tax liens on your property. Tax specialists emphasize that understanding the criteria and consequences of is essential for effectively managing your . Remember, you are not alone in this journey; we’re here to help you navigate through these challenges.

Initiate the Call to the IRS

To initiate your call, we understand that it can feel overwhelming. Here are some steps to help you with ease:

- Choose the Right Time: Consider calling early in the morning or midweek (Wednesday to Friday). This can help you avoid , as call volume tends to peak on Mondays and Tuesdays.

- Dial the Correct Number: For individual , please call 1-800-829-1040. If your questions are business-related, use 1-800-829-4933.

- Follow the Prompts: When the automated system prompts you, select the option for '' or '.' This will direct you to the appropriate department that can assist you.

- Be Patient: It’s common to experience varying wait times. During the filing season, the average wait is around three minutes, but it can extend up to 12 minutes in the off-season. Being prepared for a potential wait can ease some of the stress.

- Have Your Paperwork Ready: To facilitate a smoother interaction, ensure you have , such as your or ITIN, date of birth, and any IRS correspondence.

By following these steps, you can feel more confident in discussing your options, including how to call the IRS . Remember, we're here to help, and you are not alone in this journey.

Understand the Call Process and Requirements

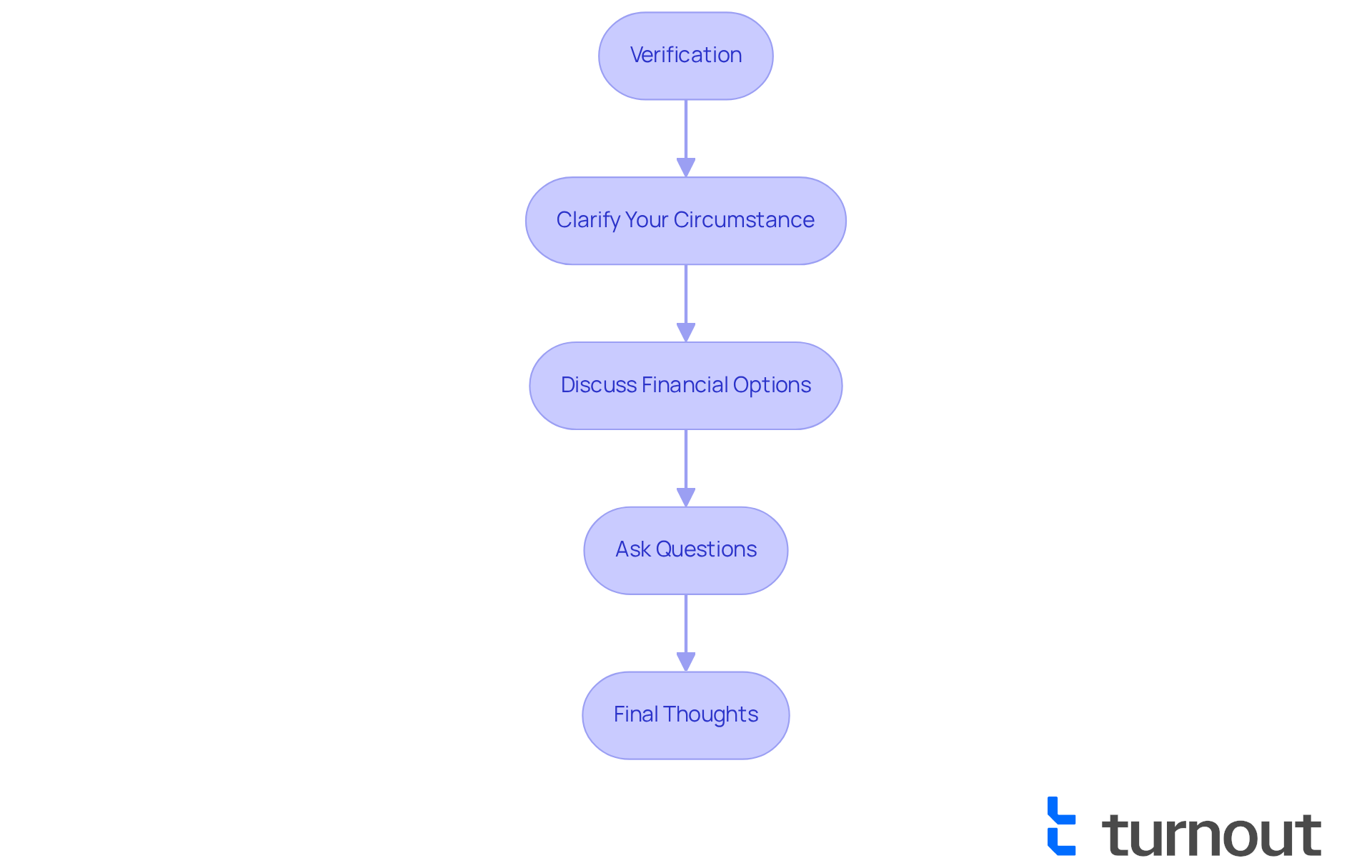

When preparing to call the , it's important to approach the process with confidence and clarity. Here are some steps to help you smoothly:

- Verification: We understand that verifying your identity can feel daunting. Be ready to provide your Social Security Number, date of birth, and other identifying information. Remember, the IRS will never reach out through phone, text, or social media for urgent requests for funds, so always verify any correspondence you receive.

- Clarify Your Circumstance: Clearly express your intention to establish a . Share the total amount owed and any relevant details from IRS notices you have received. This clarity helps the representative understand your situation better and can lead to more effective solutions.

- Discuss Financial Options: The representative will explain your choices for financing arrangements. It's common to feel uncertain about what you can afford, so be prepared to . Most individual taxpayers can access an online repayment arrangement through IRS.gov. For instance, if you owe less than $50,000, you may qualify for a long-term arrangement allowing monthly installments for up to 10 years. If your balance is below $100,000, a short-term arrangement may permit up to 180 days to pay in full. Just be mindful that setup charges may apply for creating a billing arrangement.

- Ask Questions: Don’t hesitate to seek clarification on any terms or conditions that are unclear. Understanding your responsibilities under the financial arrangement is essential, as penalties and interest can accumulate during any delays in payment. Engaging in this conversation can lead to better outcomes. Many taxpayers have successfully arranged feasible repayment options by clearly expressing their situations. As Jim Buttonow wisely notes, "Each year, millions of taxpayers establish an IRS installment arrangement when they submit their returns and can’t pay what they owe."

By following these steps, you can effectively and work towards resolving your tax obligations with confidence. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Follow Up and Manage Your Payment Plan

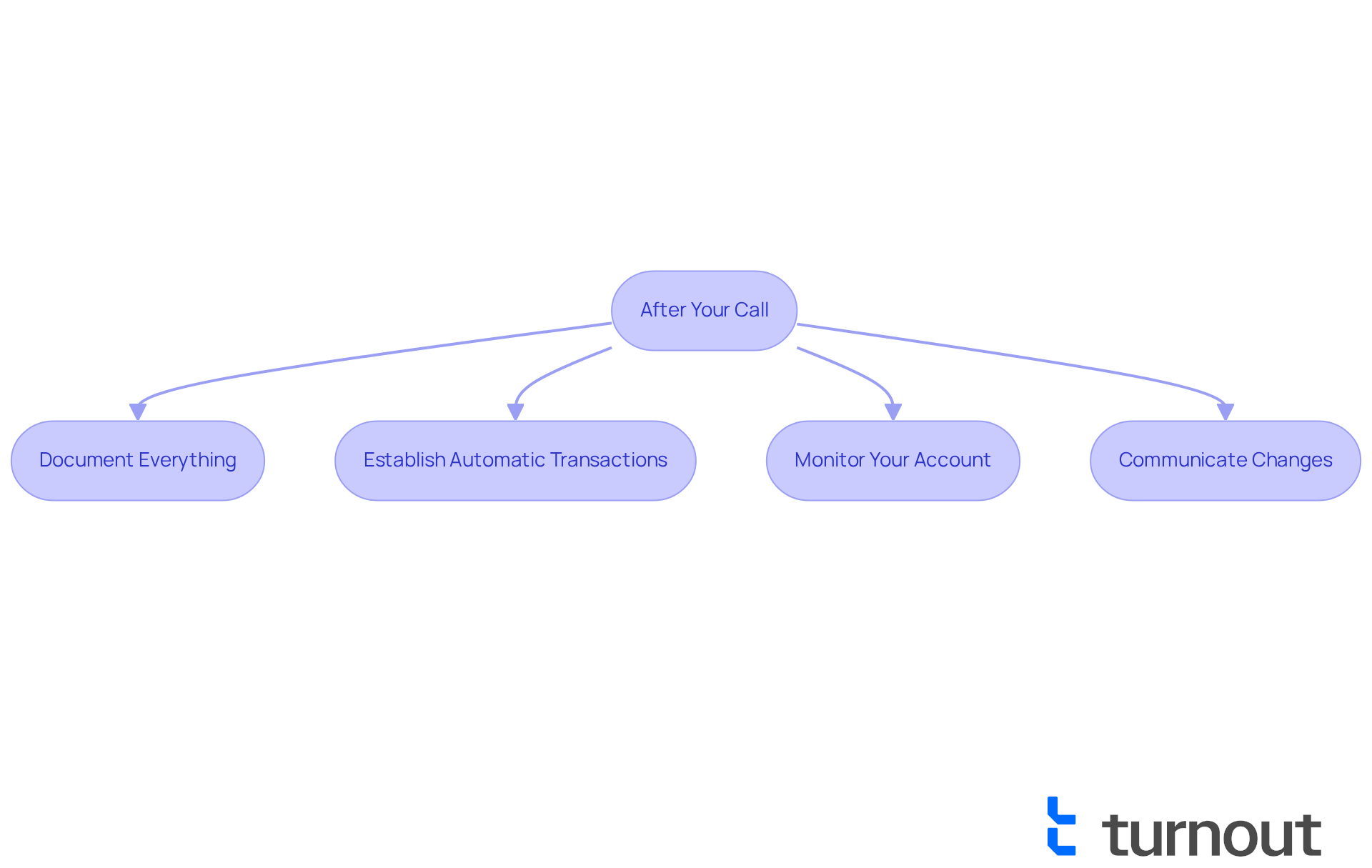

After your call, it's important to take a few thoughtful steps to ensure your peace of mind:

- Document Everything: It's crucial to maintain a detailed record of your conversation. Make sure to note the representative's name, the date and time of the call, and any reference numbers provided. This documentation can be a helpful resource for you in the future.

- Establish : Whenever possible, consider setting up automatic transactions, ideally through direct debit. This way, you can ensure that you never miss a due date. You can often accomplish this through the (OPA), which simplifies the process and reduces the risk of default.

- : Regularly checking your IRS account online can help you confirm that your contributions are being applied accurately. Staying informed about your balance allows you to catch any discrepancies early, providing you with peace of mind.

- : If your financial situation changes and you find it difficult to manage the agreed amount, please reach out to the IRS as soon as possible. They may be able to adjust your financial arrangement to better fit your current circumstances.

By following these steps, you can effectively and ensure that you remain on track with your tax responsibilities. Remember, most taxpayers qualify to call the , making it a viable option for many. You're not alone in this journey, and we're here to help you navigate these challenges.

Conclusion

Preparing to call the IRS for a payment plan can significantly ease the stress associated with tax obligations. We understand that navigating this process can feel overwhelming, but by gathering essential information and following a structured approach, you can manage it more effectively. Knowing what to expect during the call empowers you to engage confidently with IRS representatives.

This article outlines crucial steps to ensure a successful interaction. Start by preparing your personal and tax information. Initiate the call at optimal times and familiarize yourself with the verification process. Clear communication about your financial circumstances and the options available for repayment is essential. Additionally, consider post-call management strategies, such as documenting conversations and monitoring your accounts, to maintain compliance and peace of mind.

Ultimately, establishing an IRS payment plan is a viable solution for many taxpayers facing financial challenges. Taking proactive steps not only helps in managing your tax responsibilities but also fosters a sense of control over your financial situation. Remember, you are not alone in this journey. By being prepared and informed, you can transform a potentially daunting task into a manageable process, paving the way for a smoother resolution of your tax obligations.

Frequently Asked Questions

What essential information should I prepare before calling the IRS payment plan?

You should gather your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN), the specific tax year for which you owe taxes and the total amount due, any notices or letters from the IRS, details about your monthly contribution ability and preferred due date, and a reliable phone number where the IRS can reach you.

Why is it important to have IRS correspondence handy?

IRS correspondence contains vital details about your account and any previous communications, which can help ensure a smooth conversation when discussing your payment plan.

What financial information should I be ready to discuss during the call?

Be prepared to discuss how much you can contribute monthly and your preferred due date for payments, which can be set between the 1st and 28th of the month.

Are there any fees associated with setting up a long-term financing arrangement?

Yes, there may be a setup fee of $31 for automatic withdrawals when submitted online.

How can I prepare to minimize wait time when calling the IRS?

To make the most of your time on the line, review your tax documents, check your IRS account online, and ensure all relevant paperwork is accessible before making the call.

What should I do if I fail to comply with an IRS installment agreement?

If you fail to comply, it's advisable to call the IRS payment plan to avoid further penalties and potential federal tax liens on your property.

Why is it important to understand the criteria and consequences of financial arrangements with the IRS?

Understanding these criteria and consequences is essential for effectively managing your tax responsibilities and avoiding complications.