Introduction

Navigating the complex world of home buying can feel overwhelming, especially for those grappling with IRS tax debt. We understand that the implications of tax liens can weigh heavily on your mind, impacting your chances of mortgage approval. It’s crucial for potential homeowners to grasp how these financial obligations can affect their dreams of owning a home.

This article offers a step-by-step checklist designed to empower you to explore viable paths toward homeownership, even in the face of tax challenges. You are not alone in this journey. What strategies can help bridge the gap between tax debt and the dream of owning a home? Let's find out together.

Understand Your Tax Debt and Liens

-

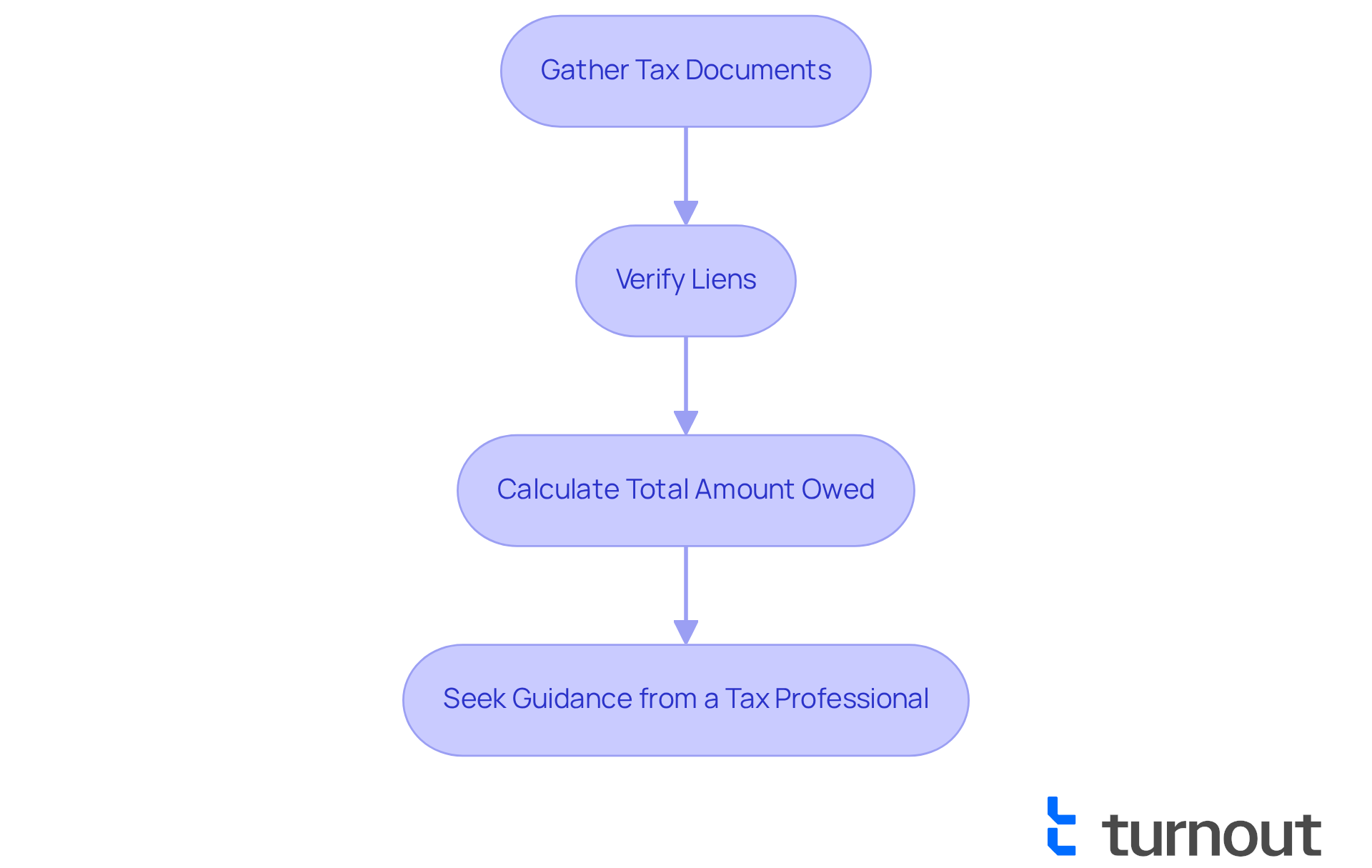

We understand that dealing with tax documents can be overwhelming. Start by gathering all relevant tax documents, including notices from the IRS and state tax authorities. This will give you a comprehensive view of your tax situation.

-

It's common to feel uncertain about federal tax liens. Take a moment to verify if there are any liens against your property by reviewing public records. It's important to understand how these liens can affect your ability to secure a mortgage and to consider if you owe IRS can you buy a house.

-

Next, calculate the total amount owed, including any penalties and interest. Understanding your financial obligations is crucial, especially to determine if you owe IRS can you buy house and how this may affect your home purchase.

-

Finally, consider seeking guidance from a tax professional. They can help clarify the implications of your tax debt and explore potential solutions. Remember, you are not alone in this journey, and being well-informed before proceeding with a mortgage application is essential.

Evaluate How Tax Debt Affects Mortgage Approval

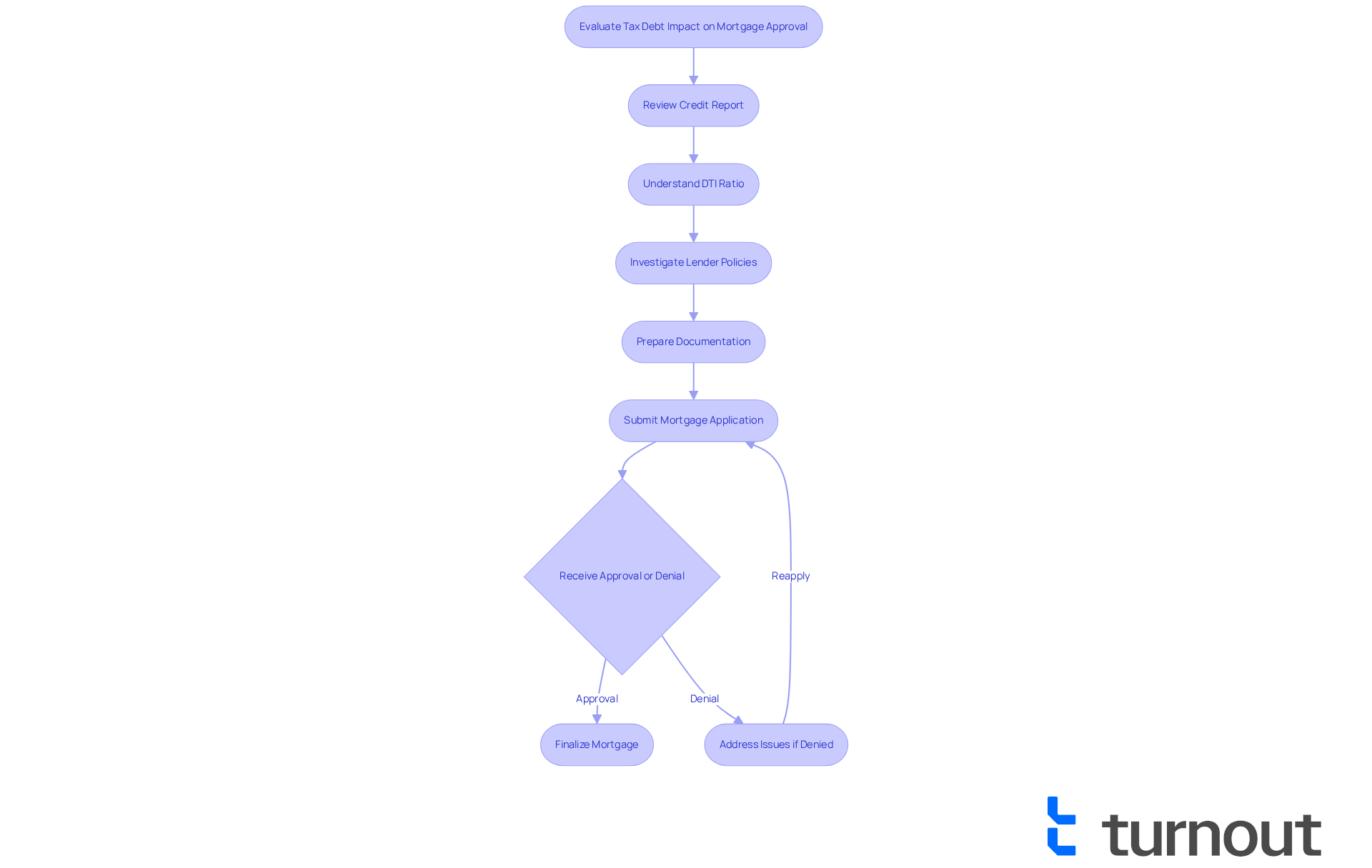

Begin by reviewing your credit report. It’s important to understand how tax debt impacts your financial situation, especially if you owe IRS can you buy house. A Notice of Federal Tax Lien can significantly lower your credit score, leading to concerns such as if you owe IRS can you buy house. This information is public, and lenders will scrutinize it during the mortgage application process to determine if you owe IRS can you buy house.

We understand that tax obligations can feel overwhelming. They can increase your debt-to-income (DTI) ratio, which is a key measure lenders use to assess your ability to manage monthly expenses. Typically, mortgage lenders look for DTI ratios between 33% and 36%. However, if you owe IRS can you buy house, the Federal Housing Authority permits qualifying borrowers to have a DTI of 43% or less for FHA loans.

It’s worth investigating specific lender policies regarding tax debt. Some lenders may show more flexibility than others. For example, while traditional loans can be challenging to secure with a tax lien, it raises the question of if you owe IRS can you buy house, but FHA loans might still be an option if you have an approved repayment arrangement.

Be prepared to provide comprehensive documentation of your tax situation to potential lenders. This includes proof of any arrangements with the IRS. Showing your commitment to handling your tax responsibilities can enhance your chances of mortgage approval. Remember, you are not alone in this journey, and we’re here to help.

Establish an IRS Payment Plan

-

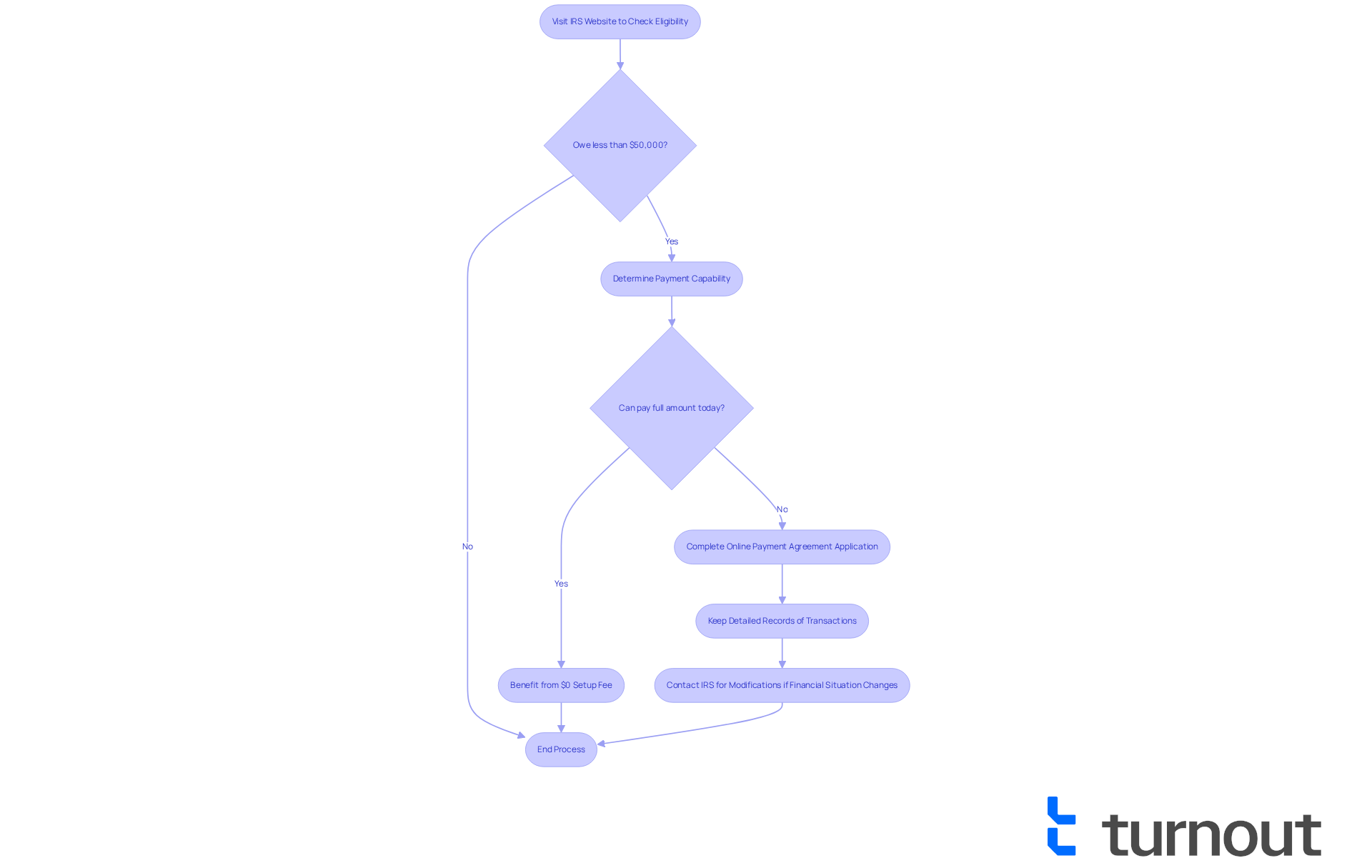

We understand that navigating financial arrangements can be overwhelming. Start by visiting the IRS website to see if you qualify for assistance. Most individual taxpayers find they’re eligible, especially if they owe less than $50,000 in total tax, penalties, and interest. Just remember, all tax returns need to be submitted before you can set up a financial arrangement.

-

If you’re in a position to pay the full amount today, you can benefit from a $0 setup fee. For those who owe less than $10,000, there’s a guaranteed installment agreement that offers a straightforward path forward.

-

Take a moment to complete the Online Payment Agreement application. This tool helps you create a plan tailored to your budget. The process is designed to be simple and can often be done without needing to make phone calls or send mail. If your balance exceeds $10,000, a Direct Debit Installment Agreement (DDIA) will be necessary.

-

It’s important to keep detailed records of all transactions made under this arrangement. This documentation will be vital when you apply for a mortgage, particularly if you owe IRS can you buy house, as it serves as proof to lenders. Please keep in mind that penalties and interest will continue to accrue on any unpaid portion of your debt during the installment agreement.

-

If your financial situation changes, don’t hesitate to reach out to the IRS to adjust your financial arrangement. The IRS is open to modifications that reflect your current circumstances, and you can also request a temporary delay in collection if that would help.

Explore Alternative Financing Options

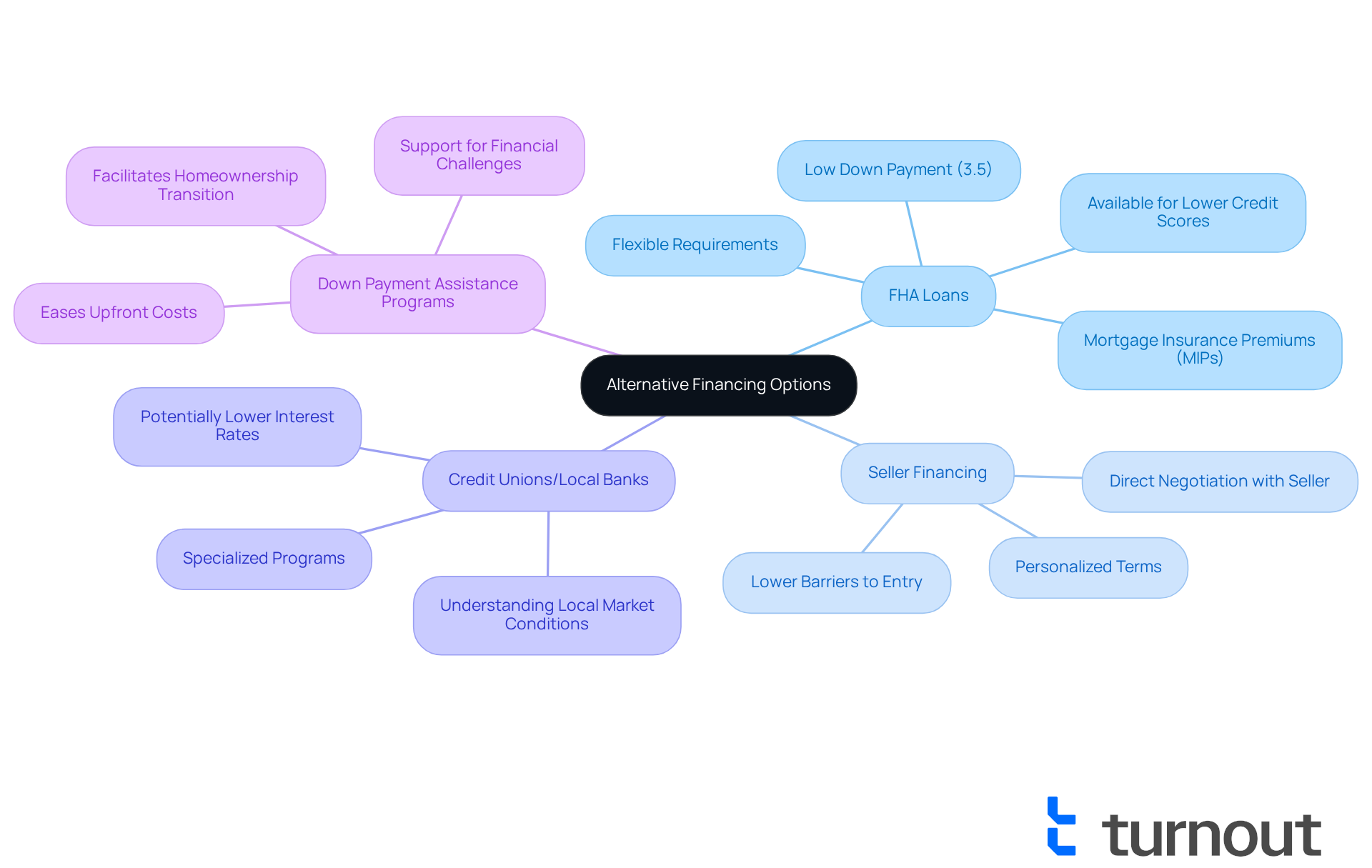

If you're grappling with tax debt and wondering if you owe IRS, can you buy a house? Researching FHA loans might be a great first step. These loans often come with flexible requirements, making homeownership more attainable, even during tough financial times. They can help reduce initial costs and offer more lenient credit score criteria. In fact, by 2025, around 30% of sellers are expected to provide financing options, creating additional pathways for buyers like you to consider if you owe IRS can you buy house and are facing tax issues.

Have you considered seller financing? In this arrangement, the seller acts as the lender, which can lead to more personalized terms and potentially lower barriers to entry. This option can be particularly helpful for those who find it challenging to secure traditional financing, especially if you owe IRS can you buy house due to outstanding tax obligations.

Don’t overlook credit unions or local banks, either. These institutions often have specialized programs designed for individuals who are concerned about if you owe IRS can you buy house. They typically understand local market conditions better and may offer more favorable terms, such as lower interest rates or flexible repayment plans.

Lastly, exploring down payment assistance programs can significantly ease the burden of upfront costs. These programs can help you transition into homeownership, even if you're dealing with financial challenges. Remember, these resources are here to support you, allowing you to focus on securing your new home.

Conclusion

Buying a house while managing IRS tax debt can feel overwhelming, but it’s absolutely achievable with the right approach. We understand that navigating your tax situation is crucial, especially when it comes to mortgage approval. By establishing a payment plan with the IRS and exploring alternative financing options, you can take significant steps toward your goal of homeownership.

Gathering your tax documents is essential. It’s important to understand how tax liens can affect your credit score and to consider flexible loan options like FHA loans or seller financing. Establishing a solid payment plan with the IRS not only shows your commitment but also demonstrates financial responsibility to potential lenders. This can greatly enhance your chances of securing a mortgage.

Remember, financial challenges shouldn’t stand in the way of your dream home. By taking informed steps and leveraging available resources, you can set yourself up for success. Whether it’s understanding the implications of your tax debt or exploring creative financing solutions, the journey to homeownership is within reach. Embrace the process, seek professional guidance, and know that you are not alone in this journey. Support is available to help turn your aspirations into reality.

Frequently Asked Questions

What should I do first when dealing with tax debt and liens?

Start by gathering all relevant tax documents, including notices from the IRS and state tax authorities, to get a comprehensive view of your tax situation.

How can I check if there are any liens against my property?

You can verify if there are any liens against your property by reviewing public records.

How do tax liens affect my ability to secure a mortgage?

Tax liens can impact your ability to secure a mortgage, so it's important to understand their implications before applying for a loan.

What steps should I take to understand my total tax obligations?

Calculate the total amount owed, including any penalties and interest, to understand your financial obligations.

Should I seek professional help regarding my tax debt?

Yes, consider seeking guidance from a tax professional who can clarify the implications of your tax debt and explore potential solutions.

Why is it important to be well-informed before applying for a mortgage?

Being well-informed about your tax situation is essential to understand how it may affect your mortgage application and home purchase.