Overview

Navigating the process of suing an insurance company can feel overwhelming, and we understand that. This article outlines a structured approach designed to support you through this journey. It emphasizes the importance of fully understanding your policy and identifying valid grounds for a lawsuit. By following a step-by-step legal process and seeking professional guidance, you can empower yourself.

Essential steps include:

- Gathering evidence

- Drafting a complaint

- Preparing for court

Did you know that statistics show a higher likelihood of settlements and favorable outcomes when you are adequately prepared? This knowledge can instill hope and motivate you to take action.

Remember, you are not alone in this journey. We're here to help you every step of the way. By acknowledging your struggles and providing the right tools, we aim to guide you toward a successful resolution.

Introduction

Understanding the intricacies of insurance policies is crucial, especially as denial rates for claims continue to rise—projected to reach 17% by 2025. We understand that this statistic can be alarming, highlighting the importance of being informed about your rights and the process involved in contesting a denied claim.

In this article, you will explore a comprehensive guide on how to successfully sue an insurance company. From identifying valid grounds for legal action to navigating the complexities of the court system, we’re here to help you every step of the way.

But what happens when the very entity meant to protect policyholders becomes a source of frustration and denial? It's common to feel overwhelmed. This article delves into the steps necessary to reclaim your rights and secure the coverage you deserve.

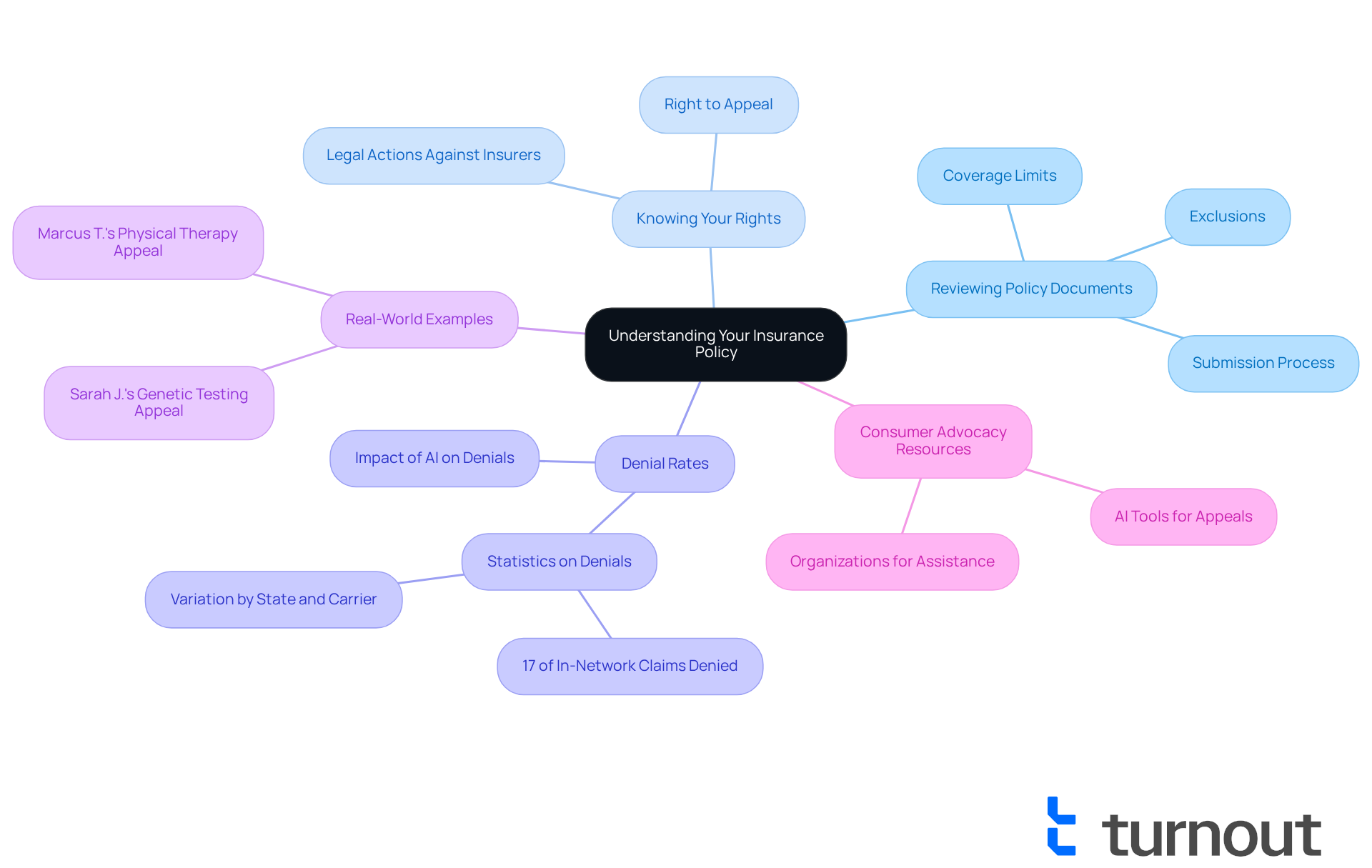

Understand Your Insurance Policy and Rights

Begin by thoroughly reviewing your insurance policy documents. We understand that this can feel overwhelming, so pay close attention to coverage limits, exclusions, and the process for submitting requests outlined in the policy. Make a list of any unclear terms or conditions. It's important to know your rights as a policyholder, which may include understanding how to sue an insurance company if you need to contest a rejected request and ensuring prompt replies from your insurer.

Did you know that in 2025, approximately 17% of in-network claims are denied? Denial rates can vary significantly by state, carrier size, and product line. This highlights the importance of understanding your policy to navigate potential pitfalls effectively. If you find yourself needing assistance, consider referring to consumer advocacy resources or organizations that can provide guidance on how to sue an insurance company. They can provide you with a clearer understanding of your rights and your provider's responsibilities.

Real-world examples, such as Sarah J.'s successful appeal for a genetic test and Marcus T.'s appeal for additional physical therapy sessions, show how informed policyholders can challenge denials and secure necessary coverage. Interacting with these resources can empower you to take charge of your coverage experience. Additionally, consider utilizing AI tools that can assist in generating appeal letters, making the process more efficient.

Take the next step by reaching out to consumer advocacy groups. They can further enhance your understanding and provide assistance in navigating coverage challenges. Remember, you are not alone in this journey, and we're here to help.

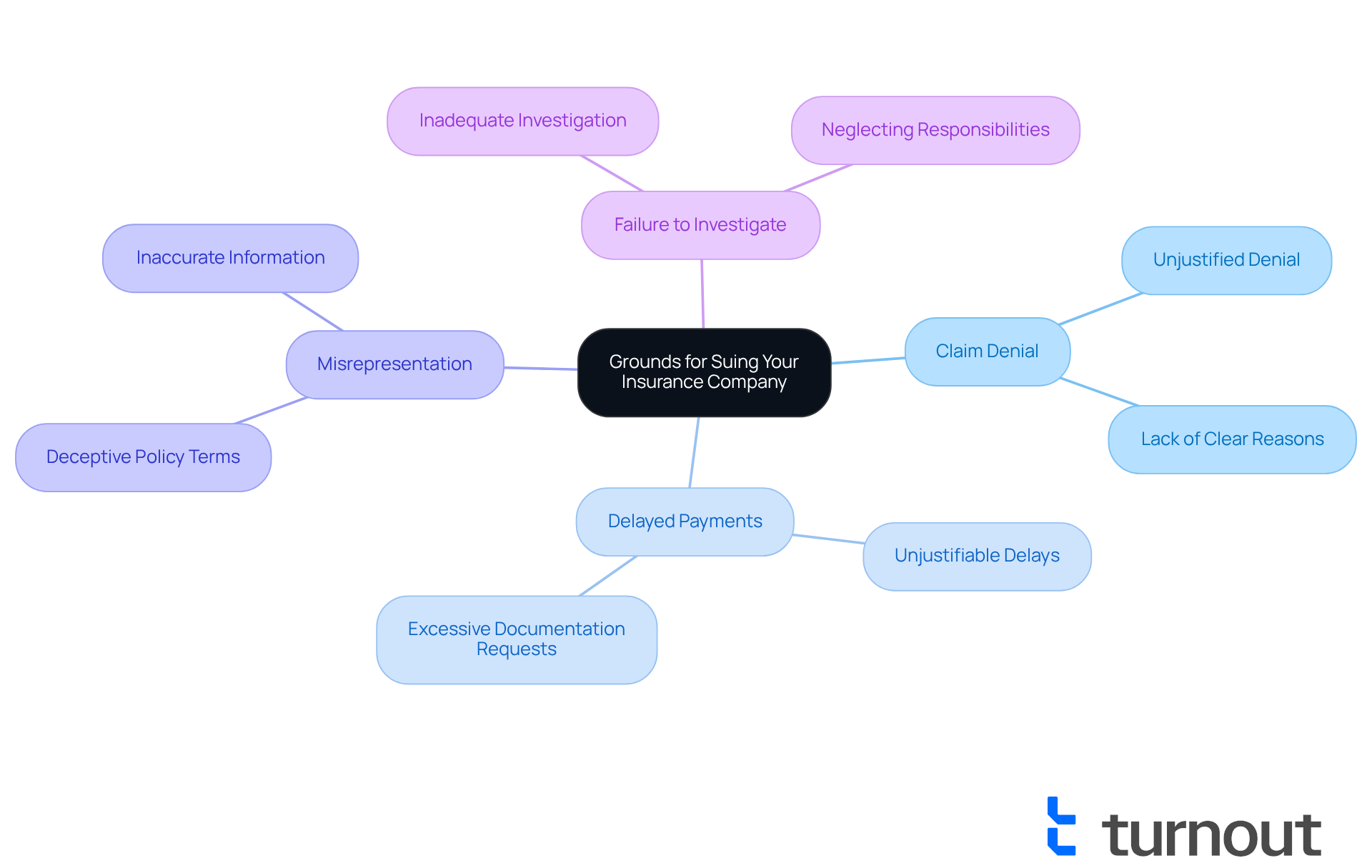

Identify Grounds for Suing Your Insurance Company

If you're feeling dissatisfied with your insurance company, it's important to evaluate the reasons behind those feelings. We understand that navigating these issues can be overwhelming, and you deserve clarity and support. Here are some common grounds for a lawsuit that may resonate with your experience:

- Claim Denial: Have you faced a claim denial without a valid reason? This could be a basis for legal action. Insurance companies must provide clear and justifiable reasons for any denial, and failing to do so might indicate bad faith.

- Delayed Payments: It's frustrating when there are unjustifiable delays in payments on a legitimate request. This can signify bad faith, especially since many coverage requests face delays due to excessive documentation requests or slow investigations.

- Misrepresentation: If the insurance company misrepresented the terms of your policy or the coverage provided, you may need to learn how to sue an insurance company. Deceptive information can significantly impact your ability to receive the benefits you deserve, as companies often misrepresent policy wording to deny requests.

- Failure to Investigate: Did the insurer fail to conduct a thorough investigation into your request? This could also be a legitimate basis for understanding how to sue an insurance company. Insurers are legally required to investigate requests swiftly and thoroughly; neglecting this responsibility can indicate bad faith.

It's crucial to document all interactions with the insurance company, including dates, times, and the content of conversations. Collecting comprehensive records of your assertion is vital for supporting your case, especially if you suspect dishonest behaviors from the insurance company. Recognizing these signs early can empower you to take action and protect your rights.

If you believe your insurance provider is behaving dishonestly or unreasonably, seeking advice from a professional can be an essential step towards holding them accountable. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

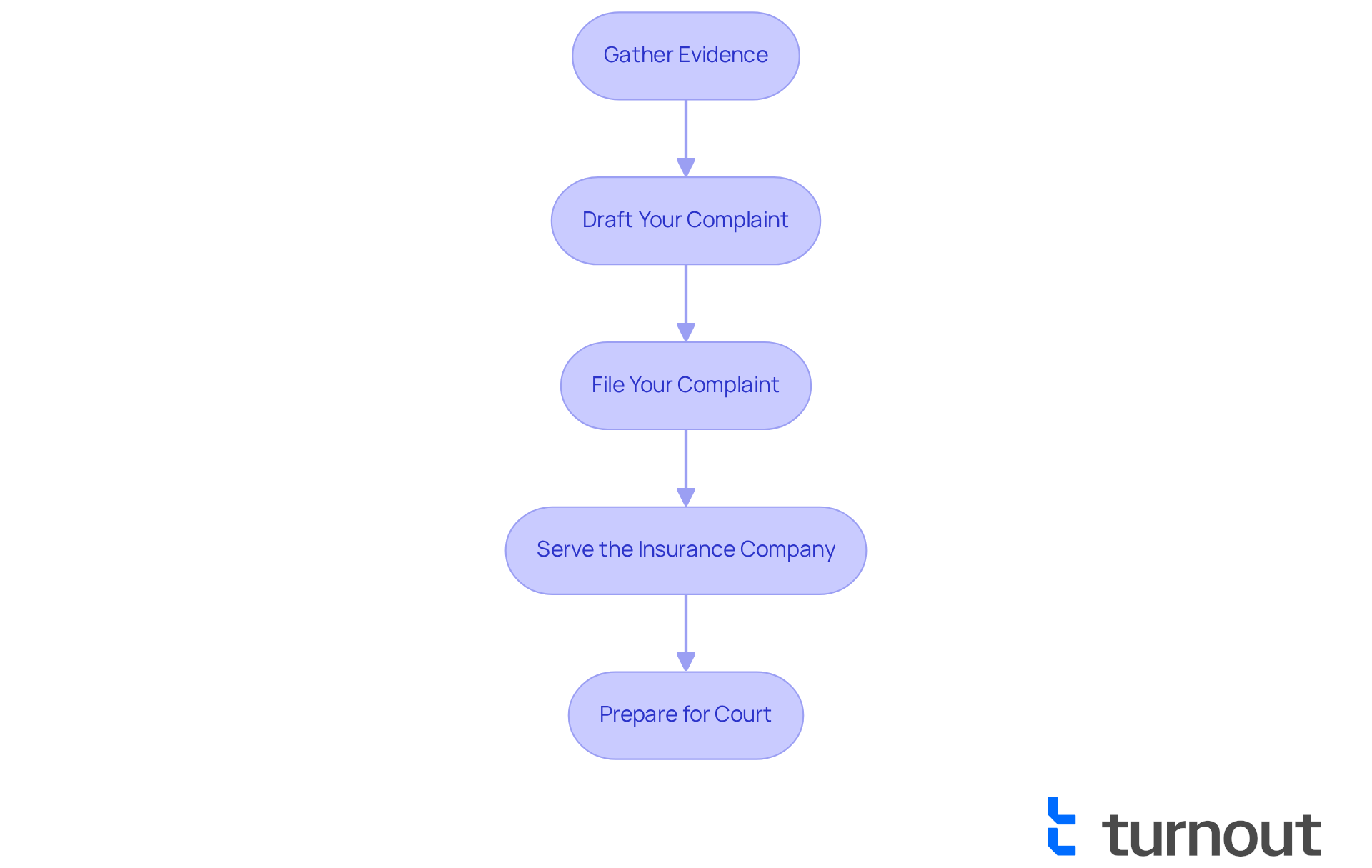

Follow a Step-by-Step Process to File Your Lawsuit

Filing a lawsuit can feel overwhelming, especially when you need to know how to sue an insurance company, but we're here to help you navigate the process with care. Follow these steps to ensure you're prepared:

-

Gather Evidence: Start by collecting all relevant documents, such as your insurance policy, correspondence with the insurer, and any proof that supports your request. Effective evidence collection is vital. Research shows that cases with thorough documentation have significantly higher success rates in court. Remember, nearly 20 percent of requests are rejected, highlighting the importance of understanding how to sue an insurance company to avoid such outcomes.

-

Draft Your Complaint: Take the time to write a complaint that clearly outlines your situation. Include the facts, the legal basis for your claim, and the relief you are seeking. Expressing your complaints clearly is essential for a strong argument. Experts emphasize that knowing how to sue an insurance company involves establishing an actionable reason for your lawsuit; simply feeling dissatisfied with the service won't suffice.

-

File Your Complaint: Once your complaint is ready, submit it to the appropriate court. Don’t forget to pay any required filing fees and keep copies of all documents. Timeliness is key; delays can jeopardize your case. Keep in mind that the coverage provider usually requires a response to a lawsuit within 20 to 30 days.

-

Serve the Insurance Company: After filing, you must formally notify the insurance company of the lawsuit by serving them with a copy of your complaint. This step is critical to ensure the insurer understands how to sue an insurance company.

-

Prepare for Court: As you prepare to present your argument in court, gather additional evidence, prepare witnesses, and familiarize yourself with court procedures. Engaging in thorough preparation can significantly enhance your chances of a favorable outcome. It's a good idea to keep detailed notes when preparing to make an insurance claim, as this can help streamline the flow of information.

Remember, you are not alone in this journey. Taking these steps can empower you to advocate for your rights effectively.

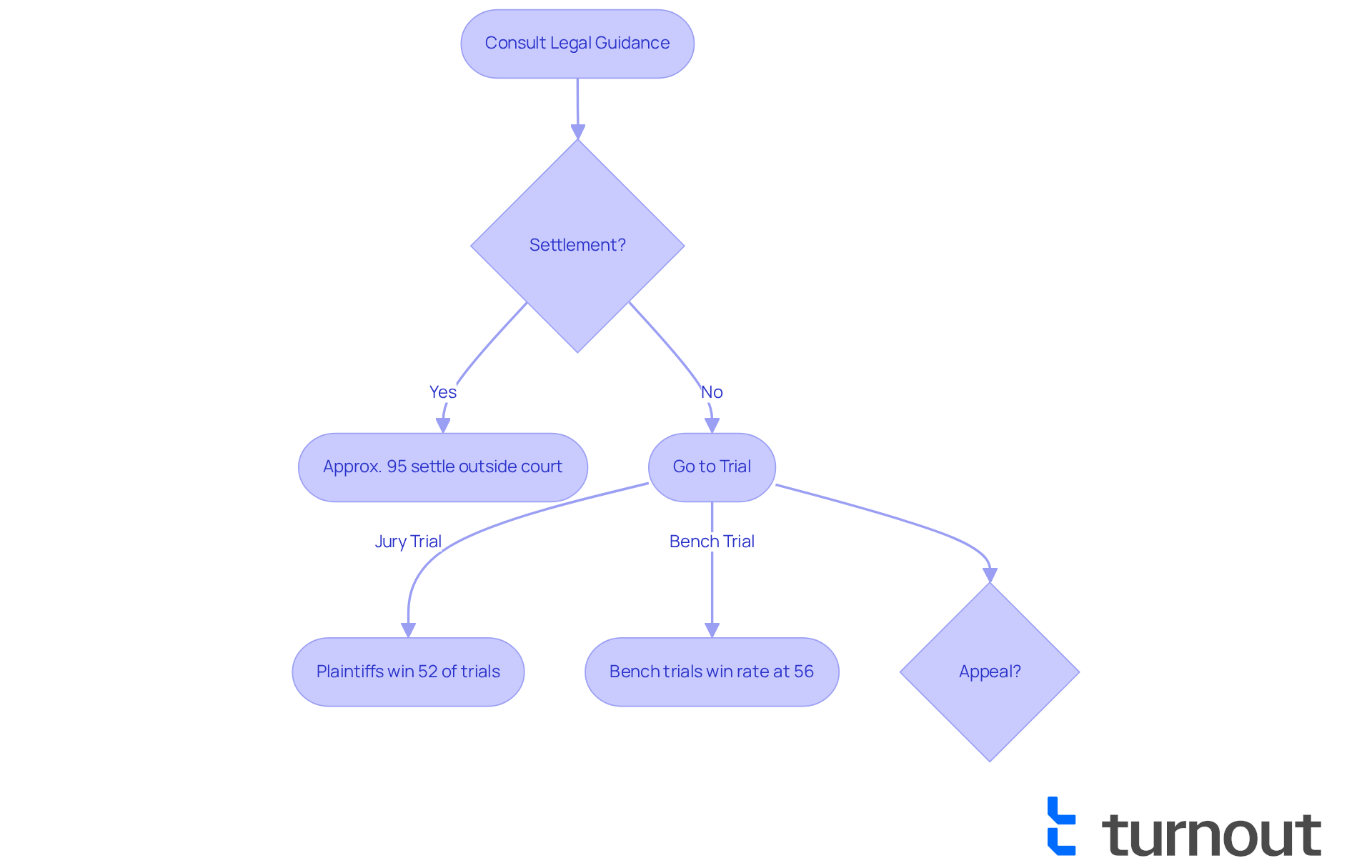

Seek Legal Guidance and Understand Possible Outcomes

If you find yourself navigating a challenging situation, consider consulting with a knowledgeable professional who can offer insights tailored to your specific needs. They can help you grasp the subtleties of your case and the likelihood of a positive outcome. It's also essential to be aware of possible outcomes, which may include:

- Settlement: Did you know that around 95% of personal injury cases are settled outside of court before trial? This often leads to quicker resolutions, allowing injured parties to receive compensation sooner. As noted, "The reality is that the vast majority of civil lawsuits are resolved out of court, long before a jury is ever involved."

- Trial: If a settlement cannot be reached, your matter may go to trial, where a judge or jury will determine the outcome. Statistics show that plaintiffs won in about 52% of personal injury trials, with bench trials having a slightly higher win rate of around 56% compared to jury trials.

- Appeal: If you lose your case, you may have the option to appeal the decision, depending on the circumstances. Understanding these possibilities will help you prepare mentally and strategically for the journey ahead.

Recent outcomes in insurance lawsuits suggest that many plaintiffs achieve favorable settlements, especially when they know how to sue an insurance company and are well-prepared with strong evidence. Engaging with experienced professionals can significantly enhance your chances of successfully navigating this complex landscape. Remember, it's important to acknowledge the emotional burden that trials can impose, making settlements a more appealing option for many. You're not alone in this journey, and support is available to guide you through.

Conclusion

Understanding how to effectively sue an insurance company is crucial for policyholders facing unjust claim denials or other issues with their insurers. We recognize how overwhelming this process can be, but knowing your rights and the intricacies of your insurance policy can empower you to take appropriate action. This guide outlines the necessary steps to navigate the often complex process of filing a lawsuit against an insurance company, ensuring you are well-prepared to advocate for your rights.

We’ll delve into essential steps, such as thoroughly reviewing your insurance policy and identifying valid grounds for a lawsuit. Following a structured process to file your complaint is vital. Remember, documentation and legal guidance play a crucial role in this journey. Many cases are settled outside of court, leading to quicker resolutions, which can alleviate some of the stress you may be feeling. Real-life examples illustrate how informed policyholders have successfully challenged claim denials, reinforcing the notion that knowledge and preparation are key to overcoming obstacles in the insurance landscape.

Ultimately, taking action against an insurance company is not just about seeking compensation; it's about holding insurers accountable and ensuring they fulfill their obligations. By understanding your rights, documenting your interactions, and seeking professional advice, you can navigate this challenging process with confidence. Empowerment comes from knowledge, so take the first step today to protect your rights and secure the coverage you deserve. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What should I do to understand my insurance policy better?

Begin by thoroughly reviewing your insurance policy documents, paying close attention to coverage limits, exclusions, and the process for submitting requests. Make a list of any unclear terms or conditions.

What are my rights as a policyholder?

As a policyholder, it's important to know your rights, which may include understanding how to contest a rejected request and ensuring prompt replies from your insurer.

What is the denial rate for in-network claims?

In 2025, approximately 17% of in-network claims are denied, with denial rates varying by state, carrier size, and product line.

What can I do if my insurance claim is denied?

If your claim is denied, consider referring to consumer advocacy resources or organizations that can provide guidance on how to sue an insurance company and help you understand your rights and your provider's responsibilities.

Can you provide examples of successful appeals?

Yes, real-world examples include Sarah J.'s successful appeal for a genetic test and Marcus T.'s appeal for additional physical therapy sessions, demonstrating how informed policyholders can challenge denials and secure necessary coverage.

How can I get assistance with my insurance coverage challenges?

You can reach out to consumer advocacy groups for assistance in navigating coverage challenges and enhancing your understanding of your insurance policy.

Are there tools available to help with the appeal process?

Yes, consider utilizing AI tools that can assist in generating appeal letters, making the process more efficient.