Introduction

Navigating the maze of tax forgiveness can feel like an uphill battle. We understand that facing stringent IRS criteria and complex processes can be overwhelming. However, grasping the foundational requirements and strategies can provide significant relief for those burdened by tax debt.

What if there were proven methods to not only qualify for forgiveness but also to streamline the entire process? Imagine feeling the weight of tax debt lift off your shoulders. This article delves into four essential strategies for tax forgiveness in 2024, equipping you with the knowledge needed to tackle your tax challenges head-on. Remember, you are not alone in this journey; we're here to help.

Understand Tax Forgiveness Criteria and Processes

Navigating tax relief can feel overwhelming, but understanding the criteria set by the IRS and other relevant authorities is a crucial first step. Programs like the Offer in Compromise (OIC) allow taxpayers to settle their debts for less than what they owe, providing a glimmer of hope in tough financial times.

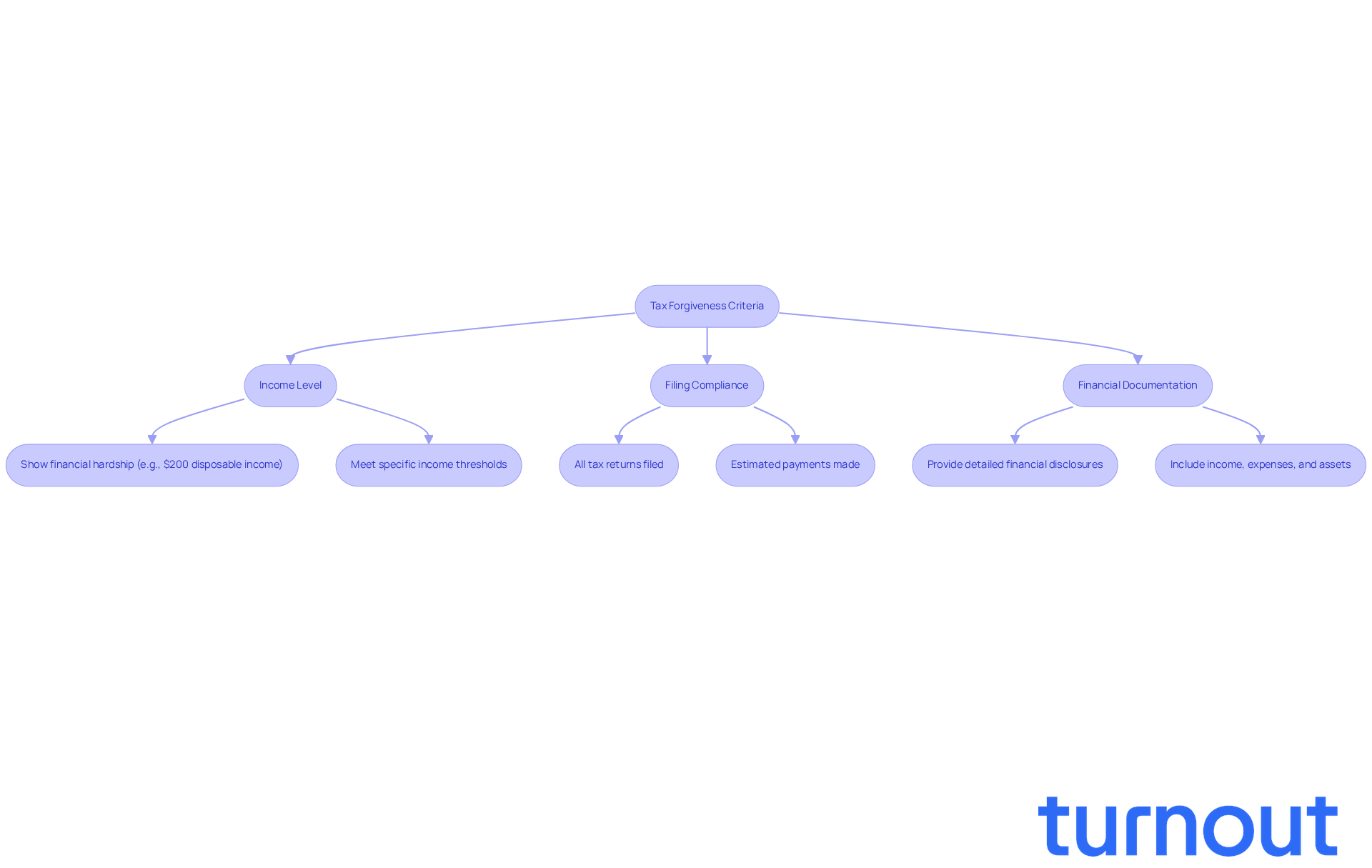

Key eligibility requirements include:

- Income Level: It’s important to show financial hardship, often defined by specific income thresholds. For example, if you have a monthly disposable income of $200, you might qualify for an OIC. The minimum offer amount is calculated based on your unique financial situation.

- Filing Compliance: Make sure all required tax returns are filed and estimated payments are made. If these requirements aren’t met, your request could be automatically dismissed.

- Financial Documentation: You’ll need to provide detailed financial disclosures, including your income, expenses, and assets. The IRS will evaluate these factors to determine your ability to pay, which is critical for OIC acceptance.

In 2023, the IRS accepted only 12,711 out of 30,163 OIC requests. This statistic highlights the stringent requirements and the importance of thorough preparation. Real-world examples show that applicants who carefully document their financial situations and follow compliance guidelines significantly improve their chances of success. For instance, those who qualify under low-income certification criteria are exempt from the fee and initial payment, making the process more attainable.

Understanding these criteria not only helps you evaluate your eligibility but also prepares you for the complex submission process. We know it can be daunting, but with patience and attention to detail, you can navigate this journey. Remember, you’re not alone in this process; we’re here to help.

Implement Effective Strategies for Tax Forgiveness

To enhance your chances of obtaining tax forgiveness, consider these proven strategies:

-

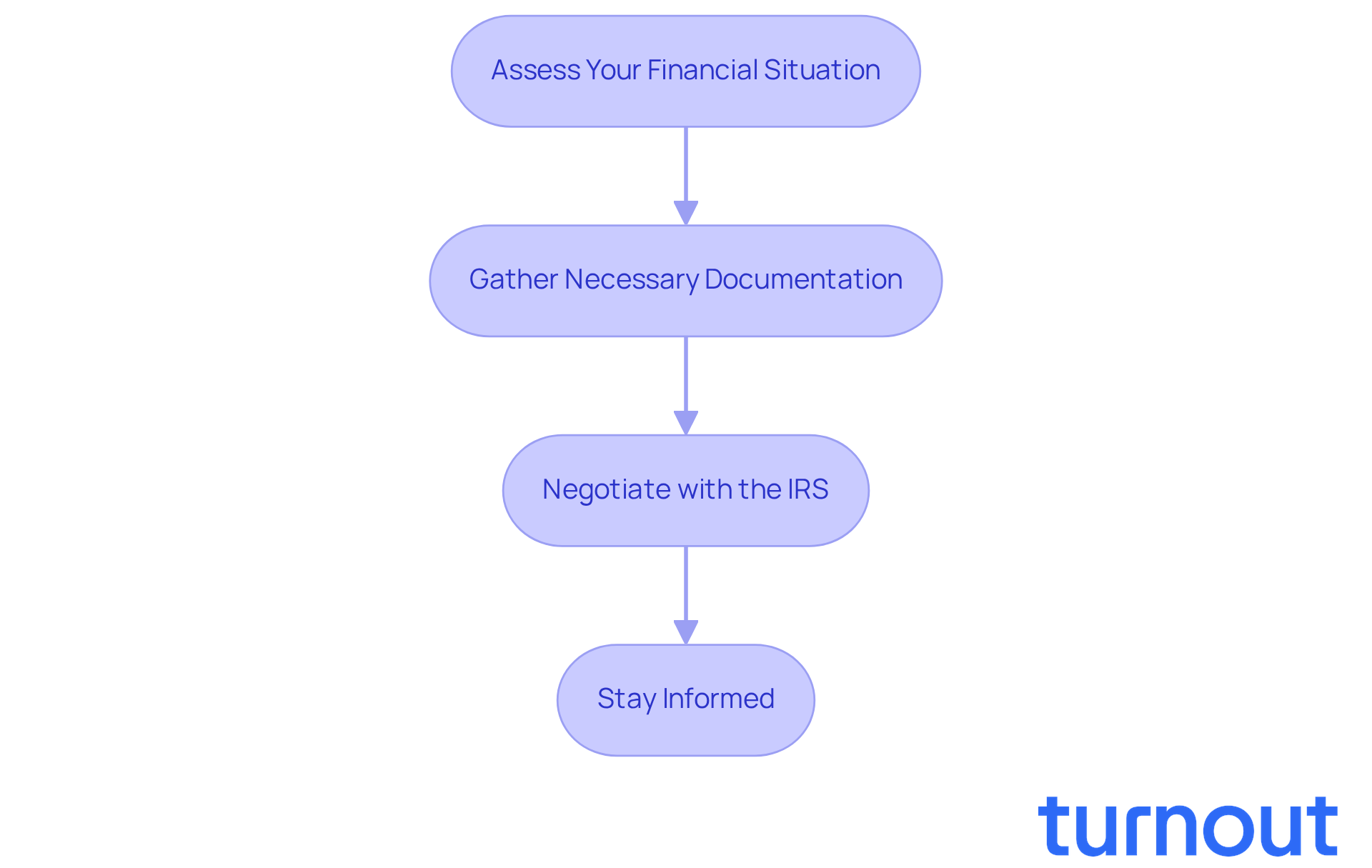

Assess Your Financial Situation: We understand that navigating your financial status can be overwhelming. Start by conducting a comprehensive review to determine your eligibility for various tax relief programs. The IRS Offer in Compromise Pre-Qualifier tool can help you evaluate your chances of qualifying for an offer in compromise.

-

Gather Necessary Documentation: It’s essential to compile all necessary documents, such as tax returns, income statements, and proof of expenses. Precise and thorough documentation is crucial for a successful submission, as the IRS requires detailed financial information to assess your situation.

-

Negotiate with the IRS: If applicable, don’t hesitate to engage in negotiations with the IRS regarding your tax debt. Present a compelling case that highlights your financial hardships and justifies your request for relief. Remember, the IRS is often willing to work with taxpayers to find a manageable solution. Turnout's trained nonlawyer advocates can assist you in this process, ensuring you have the support needed to navigate these discussions effectively.

-

Stay Informed: Keeping updated on changes in tax laws and relief programs is vital. For instance, the IRS Fresh Start Program offers various options for taxpayers facing financial difficulties. Understanding these options can open additional avenues for relief, making it easier to manage your tax obligations. It’s important to note that Turnout is not a law firm and does not provide legal advice, but we’re here to help you understand these programs and how to access them without the need for legal representation.

Maintain Accurate Documentation and Compliance

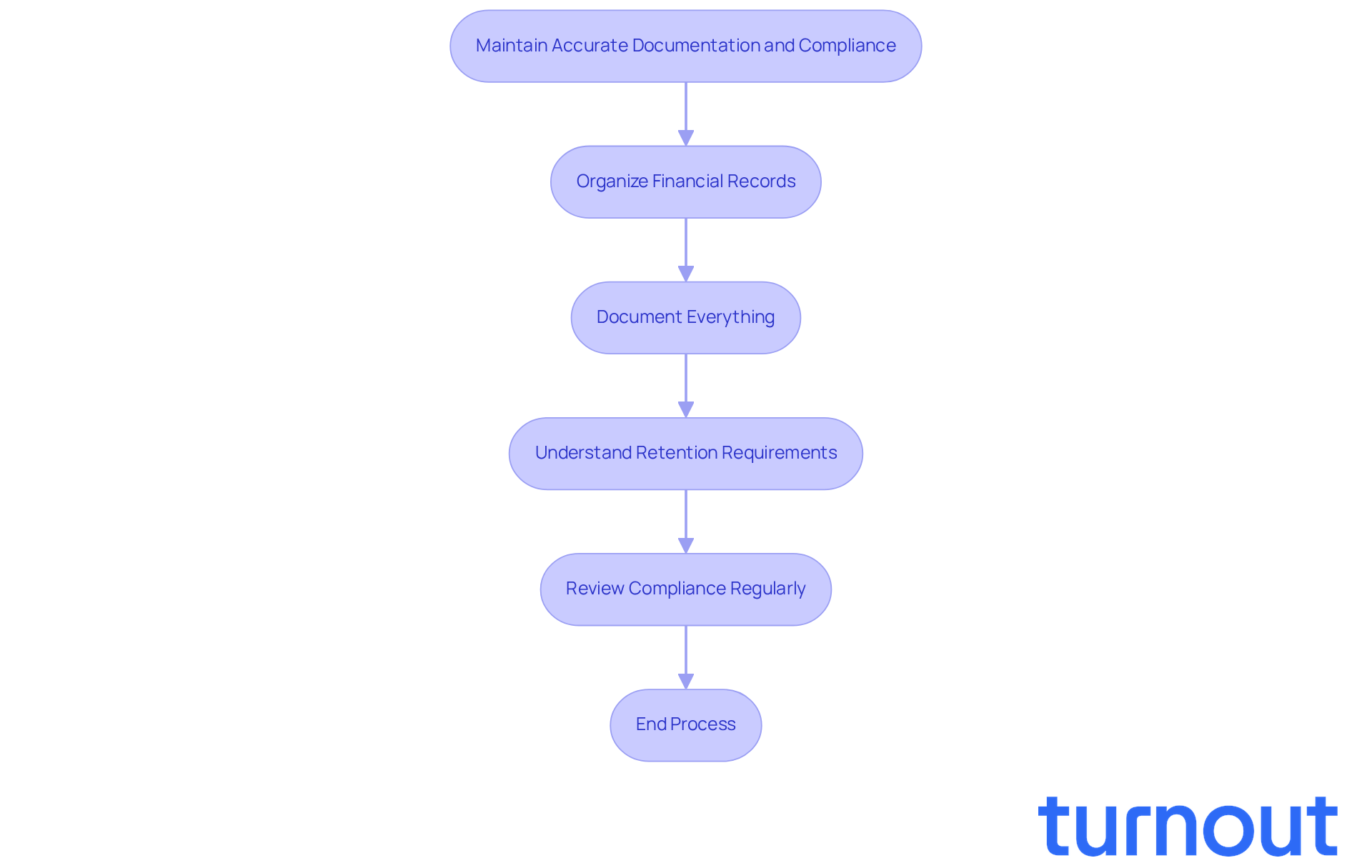

Accurate documentation is truly the backbone of any successful tax forgiveness 2024 request. We understand that navigating this process can be overwhelming, but with the right practices, you can ensure compliance and ease your journey.

- Organize Financial Records: Establishing a systematic filing system for all your financial documents-like income statements, tax returns, and receipts-can make a world of difference. A well-structured method not only helps you access everything easily during submission but also strengthens your case.

- Document Everything: Keeping meticulous records of all communications with the IRS is crucial. Note down dates, names of representatives, and summaries of discussions. This comprehensive documentation can be invaluable if disputes arise or clarifications are needed during the submission process.

- Understand Retention Requirements: Familiarizing yourself with IRS guidelines on record retention is essential. Generally, you should keep records for at least three years from the date of filing your return or two years from when you paid the tax, whichever is later. If you have unreported income exceeding 25% of your gross income, records should be kept for six years. And remember, if a fraudulent return is filed, records must be kept indefinitely.

- Review Compliance Regularly: Conducting regular reviews of your compliance with tax laws is a proactive step. It ensures that all required filings are current, as non-compliance can jeopardize your eligibility for relief programs. Also, keep in mind that applying for an Offer in Compromise incurs a $205 application fee, which is an important consideration in your planning.

You're not alone in this journey. By following these practices, you can navigate the complexities of tax forgiveness 2024 with confidence.

Seek Professional Assistance and Advocacy

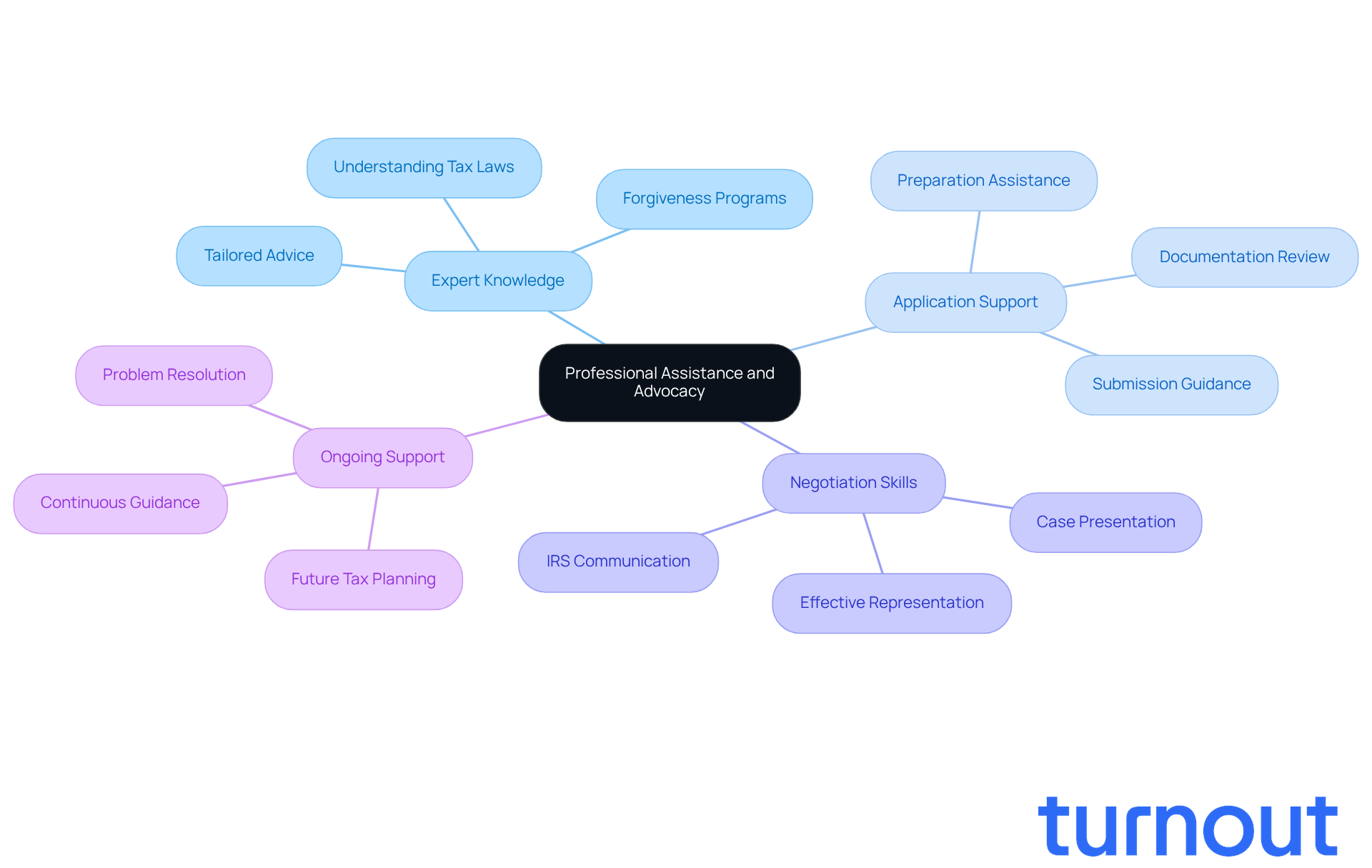

Navigating the tax relief landscape can feel overwhelming, and we understand that seeking help is a big step. At Turnout, we’re here to support you with trained nonlawyer advocates and IRS-licensed enrolled agents who specialize in tax debt relief. While we’re not a law firm and don’t provide legal advice, we offer valuable assistance that can make a real difference in your journey.

-

Expert Knowledge: Our professionals have a deep understanding of tax laws and forgiveness programs. This means you’ll receive accurate advice tailored to your unique situation.

-

Application Support: We know that the application process can be tricky. That’s why our advocates are ready to help you prepare and submit your application, ensuring all necessary documentation is included and everything is completed correctly.

-

Negotiation Skills: Negotiating with the IRS can be daunting. Our experienced advocates can represent you effectively, presenting your case in a way that might be challenging to do on your own.

-

Ongoing Support: You’re not alone in this. A Turnout professional will provide ongoing support and guidance, helping you navigate any challenges that arise during the forgiveness process. Plus, we can assist with future tax planning to help you avoid similar issues down the road.

We’re here to help you take the next step toward relief. You deserve support, and we’re committed to walking this path with you.

Conclusion

Navigating the complexities of tax forgiveness in 2024 can feel overwhelming. We understand that many taxpayers are seeking relief from tax debt, and it’s essential to grasp the criteria, processes, and effective strategies available to you. By familiarizing yourself with eligibility requirements and programs like the Offer in Compromise, you can significantly enhance your chances of finding the relief you deserve.

Key strategies to consider include:

- Assessing your financial situation

- Gathering comprehensive documentation

- Negotiating with the IRS

- Staying informed about evolving tax laws

Each of these steps is crucial in ensuring compliance and improving the likelihood of a successful application. Remember, maintaining accurate records and seeking professional assistance can further streamline the process and provide invaluable support.

Ultimately, the journey toward tax forgiveness may seem daunting, but it is achievable with the right knowledge and resources. Taking proactive steps, such as engaging with tax professionals and utilizing available tools, empowers you to tackle your tax burdens effectively. Embracing this approach not only paves the way for immediate relief but also fosters long-term financial stability. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is tax forgiveness and how can it help taxpayers?

Tax forgiveness allows taxpayers to settle their debts for less than what they owe, providing relief during tough financial times, often through programs like the Offer in Compromise (OIC).

What are the key eligibility requirements for the Offer in Compromise (OIC)?

The key eligibility requirements for OIC include demonstrating financial hardship through specific income levels, ensuring all required tax returns are filed, making estimated payments, and providing detailed financial documentation.

How is financial hardship defined for the OIC?

Financial hardship is often defined by specific income thresholds. For example, having a monthly disposable income of $200 may qualify you for an OIC.

What happens if I do not meet filing compliance requirements for the OIC?

If you do not meet the filing compliance requirements, such as not filing all required tax returns or making estimated payments, your OIC request could be automatically dismissed.

What kind of financial documentation is needed for the OIC application?

You will need to provide detailed financial disclosures, including your income, expenses, and assets, as the IRS evaluates these factors to determine your ability to pay.

What is the acceptance rate for OIC requests in 2023?

In 2023, the IRS accepted only 12,711 out of 30,163 OIC requests, indicating stringent requirements and the importance of thorough preparation.

How can I improve my chances of being accepted for an OIC?

Carefully documenting your financial situation and following compliance guidelines can significantly improve your chances of success with an OIC application.

Are there any benefits for low-income applicants applying for the OIC?

Yes, applicants who qualify under low-income certification criteria are exempt from the fee and initial payment, making the OIC process more attainable for them.