Introduction

Navigating the complexities of Supplemental Security Income (SSI) can feel overwhelming, especially when it comes to important decisions like buying a car. We understand that understanding the reporting requirements for vehicle purchases is crucial for SSI recipients. Failing to report can lead to serious consequences, including the loss of benefits, which can be a source of anxiety.

This article aims to shed light on the essential guidelines surrounding vehicle purchases and SSI. We want to help you understand what you need to know to protect your eligibility. After all, owning a car can bring a sense of freedom and independence. How can you ensure compliance with these regulations while still enjoying the benefits of car ownership? You're not alone in this journey, and we're here to help.

Understand SSI Reporting Requirements for Vehicle Purchases

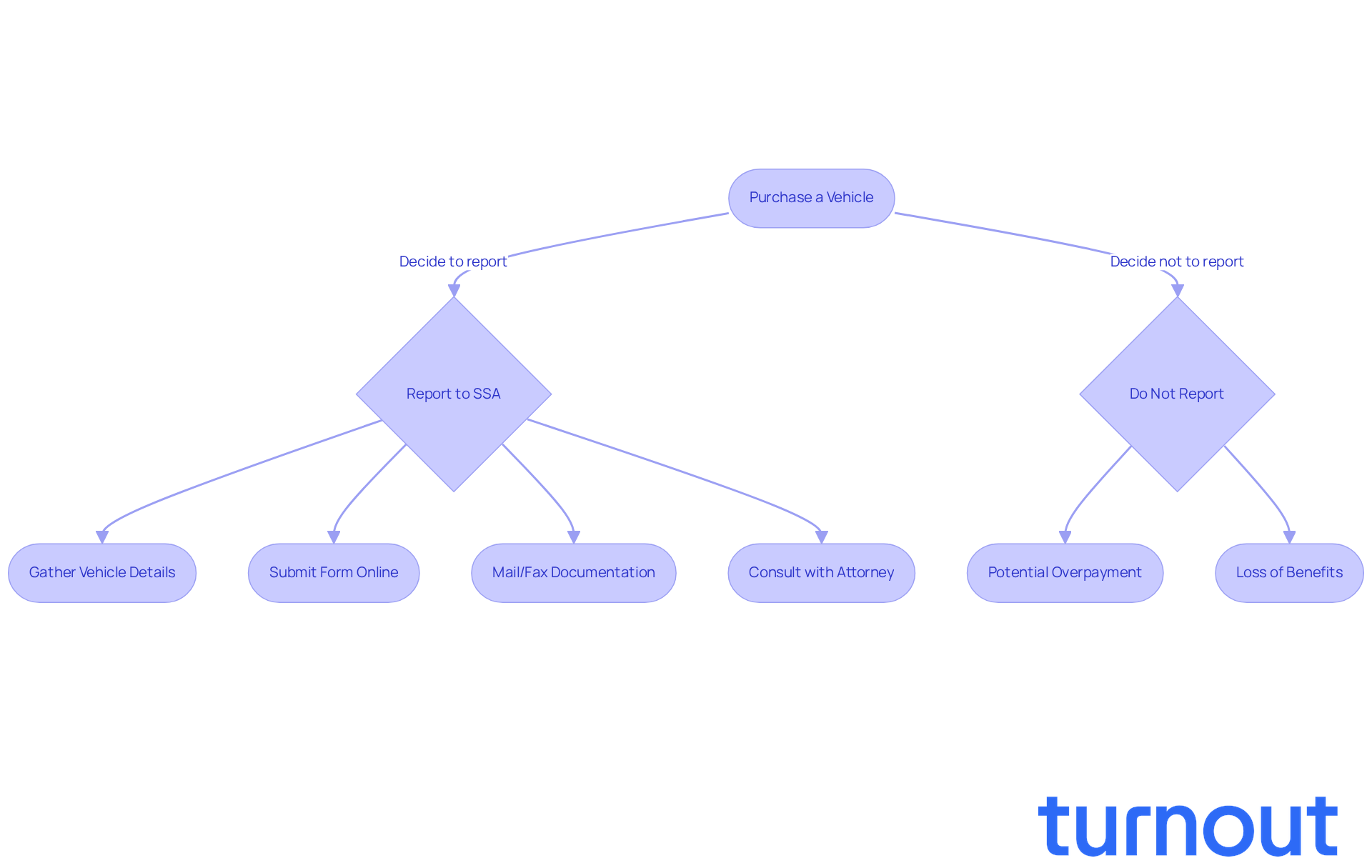

When it comes to securing a mode of transportation while receiving Supplemental Security Income (SSI), one important question is, do I have to report buying a car to SSI? We know that navigating these rules can be overwhelming, but it’s crucial to stay informed. The Social Security Administration (SSA) requires recipients to report any changes that might affect their eligibility, such as asking, do I have to report buying a car to SSI? This means providing specific details like the automobile's make, model, year, and financing information.

For example, if you buy a car using SSI back pay and it becomes your primary mode of transportation, it’s generally exempt from being counted as a resource. This is good news! There’s no price cap on exempt modes of transport, giving you some flexibility in your choices. However, owning multiple automobiles can complicate things, as the SSA counts extra cars against SSI eligibility. In California, the CAPI program doesn’t impose additional restrictions on automobiles beyond federal rules, which is a relief for recipients in that state.

It’s important to remember that neglecting to disclose a car purchase may raise the question, do I have to report buying a car to SSI, and can lead to serious consequences, such as overpayments or even losing your benefits. Many recipients have faced interruptions due to misunderstandings about ownership and reporting requirements. To avoid these pitfalls, we recommend considering whether do I have to report buying a car to SSI within 10 days following the month of purchase. You can do this by reaching out to the SSA directly, submitting a form online, or mailing or faxing the necessary documentation.

As Jan Dils wisely points out, "Your car ownership can impact your ability to get SSI benefits from the Social Security Administration, so it is wise to consult an attorney to determine your options."

Understanding these reporting obligations is vital for maintaining your SSI benefits and ensuring compliance with SSA guidelines. Consulting with a disability lawyer can provide valuable insights into navigating these complexities and avoiding costly mistakes. Remember, you are not alone in this journey, and we’re here to help.

Identify When Reporting a Vehicle Purchase is Mandatory

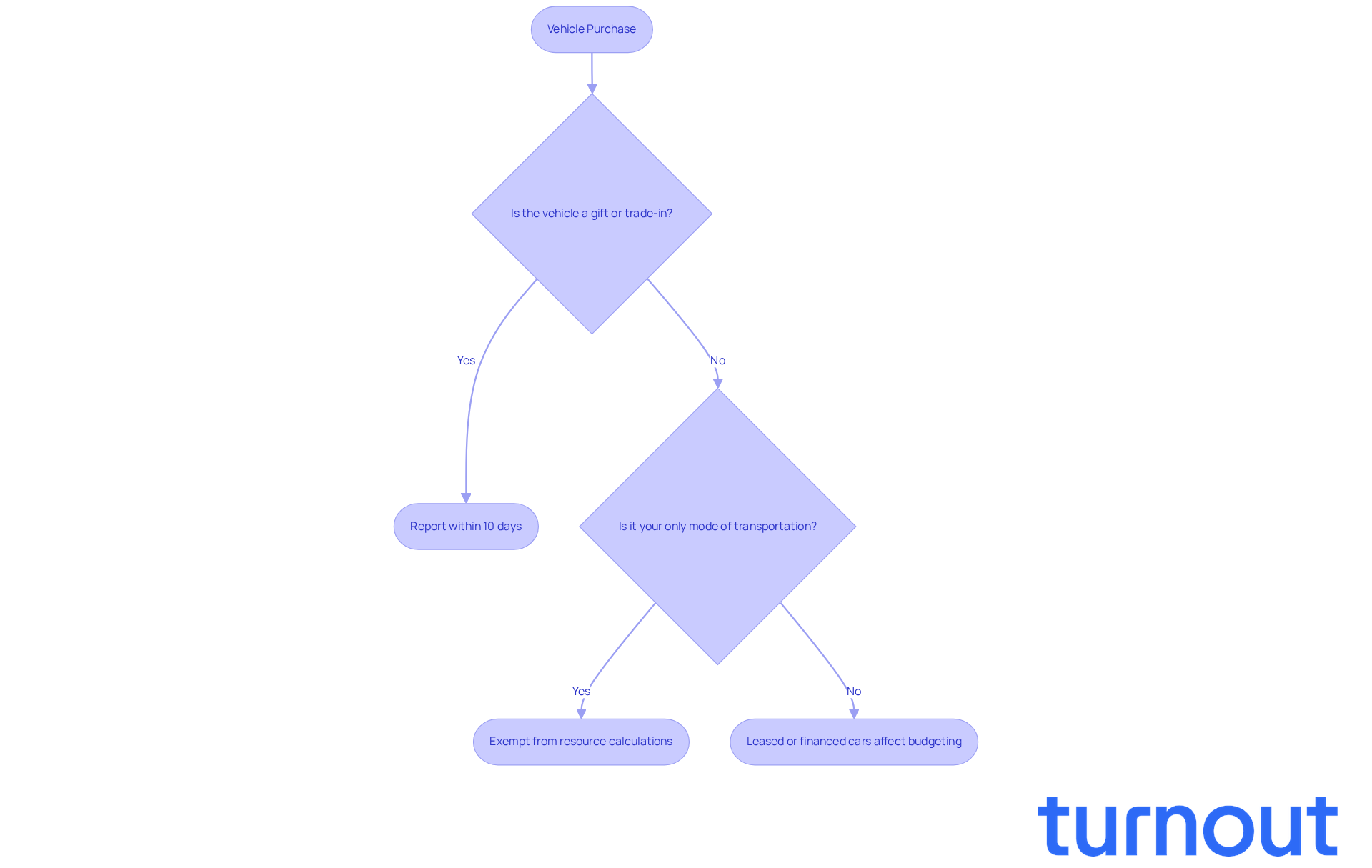

If you’re receiving SSI, you might ask, do I have to report buying a car to SSI, as reporting an automobile purchase is mandatory under certain circumstances. We understand that navigating these requirements can feel overwhelming, but notifying the Social Security Administration (SSA) is essential, even if the car is your only means of transportation. The good news is that the SSA allows one mode of transportation to be exempt from resource calculations, meaning owning just one vehicle won’t affect your SSI eligibility.

However, if you receive a car as a gift or trade in an old one, you need to report these transactions too. It’s common to feel unsure about these rules, and many wonder, do I have to report buying a car to SSI within 10 days of my purchase to avoid penalties, such as overpayments or reductions in benefits? For example, if you get a car on March 15, make sure to report it by April 10, which is within 10 days after the month of acquisition.

Leased or financed cars are generally not counted as resources for SSI purposes, but remember that the monthly payments are considered expenses and can affect your budgeting. Understanding these reporting requirements is crucial for ensuring compliance and protecting your benefits. We’re here to help you navigate this process and ensure you’re supported every step of the way.

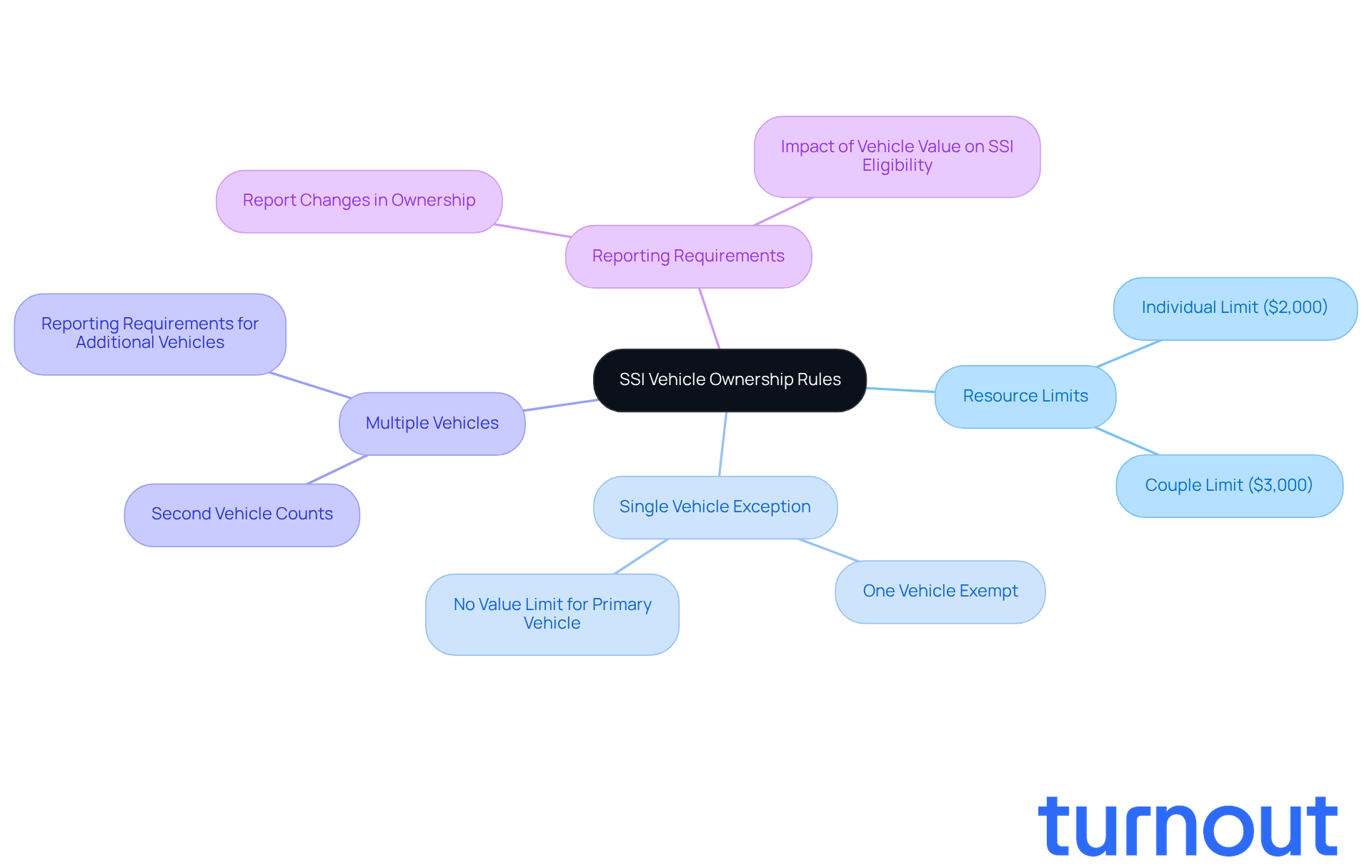

Learn How SSI Counts Vehicles Toward Resource Limits

Navigating the world of Social Security can be challenging, especially when it comes to understanding how your assets affect your benefits. We understand that many individuals rely on Supplemental Security Income (SSI) for support, and it's important to know that the Social Security Administration (SSA) allows SSI recipients to own one automobile without it affecting the resource limit. As of 2026, this limit is set at $2,000 for individuals and $3,000 for couples. Remarkably, these resource limits have remained unchanged since 1989, providing a sense of stability for over 35 years.

This means that if you have one car that you use for personal travel and it's operable, the SSA generally won't count it against your resources, no matter its value. However, if you own multiple vehicles, the value of any additional cars will count towards your resource limit. It's crucial to report these automobiles to the SSA, as their values can significantly impact your eligibility for benefits, prompting the question, do I have to report buying a car to SSI? For instance, if the total worth of your cars exceeds the resource threshold, you could risk losing your SSI benefits.

Keeping accurate records of your automobile values and ownership is essential for managing your assets effectively while receiving support. Remember, you are not alone in this journey. If you experience any changes in car ownership, you might be wondering, do I have to report buying a car to SSI to avoid any future complications? We're here to help you navigate these requirements and ensure you receive the support you need.

Follow Steps to Report a Vehicle Purchase Correctly

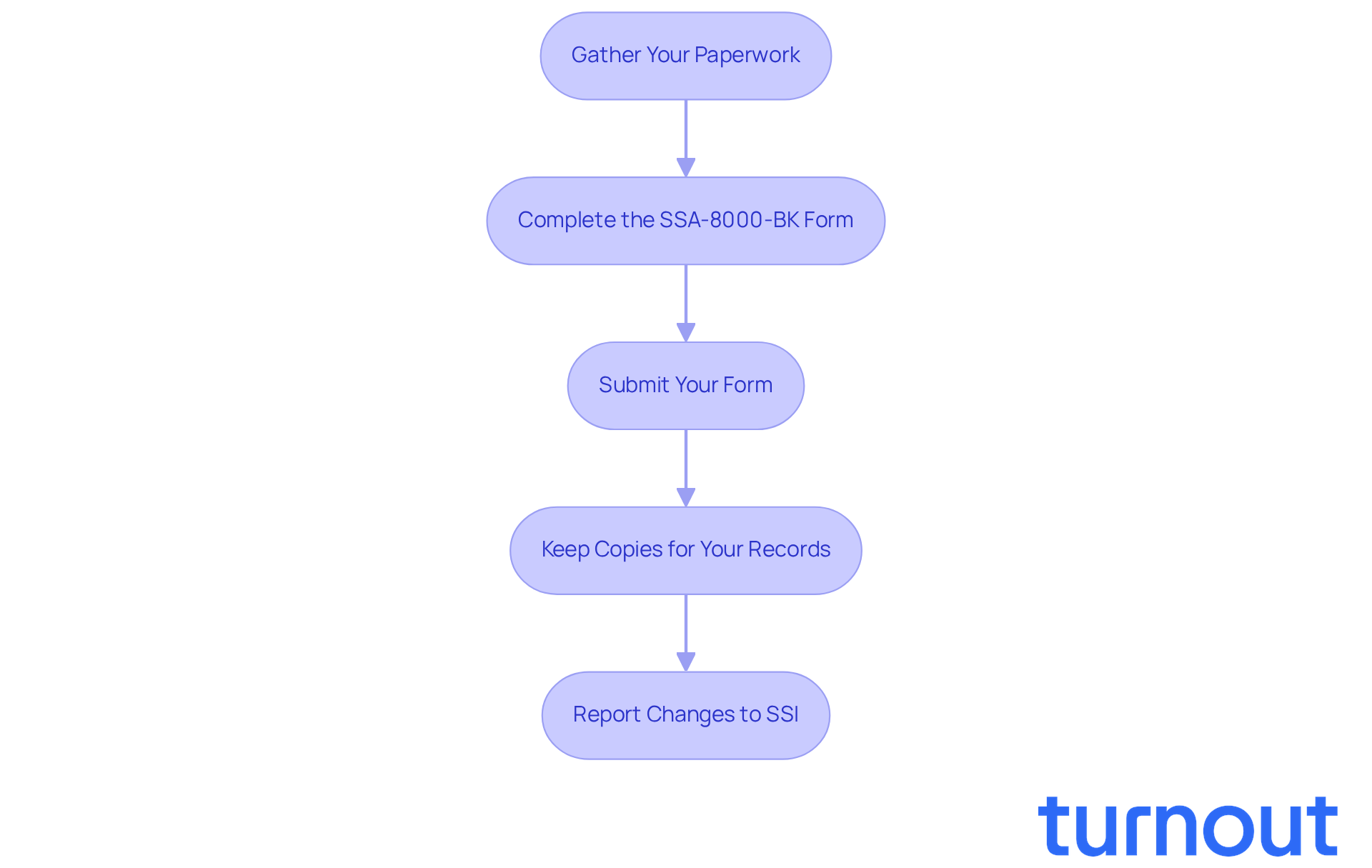

When it comes to documenting a motor purchase, we understand that it can feel overwhelming. But don’t worry; we’re here to help you through it. Follow these important steps to ensure everything is in order:

-

Gather Your Paperwork: Start by collecting all the necessary documents, like the bill of sale and auto title. This validates your acquisition and sets a solid foundation for the process.

-

Complete the SSA-8000-BK Form: Take your time filling out the SSA-8000-BK form. Make sure to include the owner's name, vehicle year, make, and model in the right sections. Accuracy here is key!

-

Submit Your Form: Once you’ve completed the form, submit it to the SSA, either online or by mail. Remember to do this within the required timeframe to avoid any penalties. If you’re receiving SSI, you may wonder, do I have to report buying a car to SSI, even if it’s excluded as a resource.

-

Keep Copies for Your Records: Retain copies of all documents you submit. This can be vital for future reference. To avoid issues with your SSI benefits, it's important to know if do I have to report buying a car to SSI. Not communicating changes can lead to overpayment alerts, temporary halting of benefits, or penalties.

Also, remember that you need to report any changes affecting SSI eligibility within 10 days after the month the change occurs. Using retroactive SSI payments to buy a car is a common and accepted way to stay under the resource limit.

You’re not alone in this journey, and taking these steps can help ensure a smoother process. We’re here to support you every step of the way!

Conclusion

Understanding the nuances of reporting vehicle purchases to the Social Security Administration (SSA) is crucial for anyone receiving Supplemental Security Income (SSI). We know that navigating these requirements can feel overwhelming, but doing so properly can help ensure that your benefits are maintained and your eligibility is not at risk. It’s important to be proactive in this process, as clarity around what needs to be reported can make a significant difference.

Key points to keep in mind include the need to report vehicle purchases within a specific timeframe. Remember, a single vehicle can be exempt from resource calculations, but owning multiple cars may count against resource limits, which could affect your SSI eligibility. We understand that this can be confusing, but knowing the steps to report these purchases accurately - like gathering documentation and submitting the SSA-8000-BK form - is essential for compliance.

Staying informed about SSI reporting requirements for vehicle purchases isn’t just about following rules; it directly impacts your financial stability and access to essential benefits. By understanding the reporting process and adhering to guidelines, you can safeguard your SSI benefits and avoid unnecessary complications. We encourage you to consult with a knowledgeable professional who can help you navigate these complexities effectively. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

Do I have to report buying a car to SSI?

Yes, you must report any changes that might affect your eligibility for Supplemental Security Income (SSI), including the purchase of a car.

What details do I need to provide when reporting a car purchase to SSI?

You need to provide specific details such as the automobile's make, model, year, and financing information.

Is a car purchased with SSI back pay considered a resource?

If you buy a car using SSI back pay and it becomes your primary mode of transportation, it is generally exempt from being counted as a resource.

Are there any price caps on exempt modes of transportation for SSI?

No, there is no price cap on exempt modes of transportation, which gives you flexibility in your choices.

What happens if I own multiple automobiles while receiving SSI?

The SSA counts extra cars against SSI eligibility, which can complicate your situation.

Are there any additional restrictions on automobiles for SSI recipients in California?

No, the CAPI program in California does not impose additional restrictions on automobiles beyond federal rules.

What are the consequences of not reporting a car purchase to SSI?

Failing to disclose a car purchase can lead to serious consequences, such as overpayments or losing your benefits.

How soon should I report a car purchase to SSI?

It is recommended to report the purchase within 10 days following the month of purchase.

How can I report a car purchase to SSI?

You can report a car purchase by reaching out to the SSA directly, submitting a form online, or mailing or faxing the necessary documentation.

Should I consult an attorney regarding my car ownership and SSI benefits?

Yes, consulting with a disability lawyer can provide valuable insights into navigating the complexities of SSI reporting requirements and help avoid costly mistakes.