Introduction

Navigating the complexities of tax regulations can often feel like an uphill battle. We understand that facing the implications of Tax Topic 151 can be overwhelming. This critical area of tax law not only influences potential refunds but also highlights the rights you have to contest IRS decisions. Understanding these nuances is essential for safeguarding your financial interests and avoiding costly missteps.

How can you effectively leverage your appeal rights? It’s common to feel uncertain about navigating the appeal process, especially when timely action is paramount. Remember, you are not alone in this journey. We're here to help you through it.

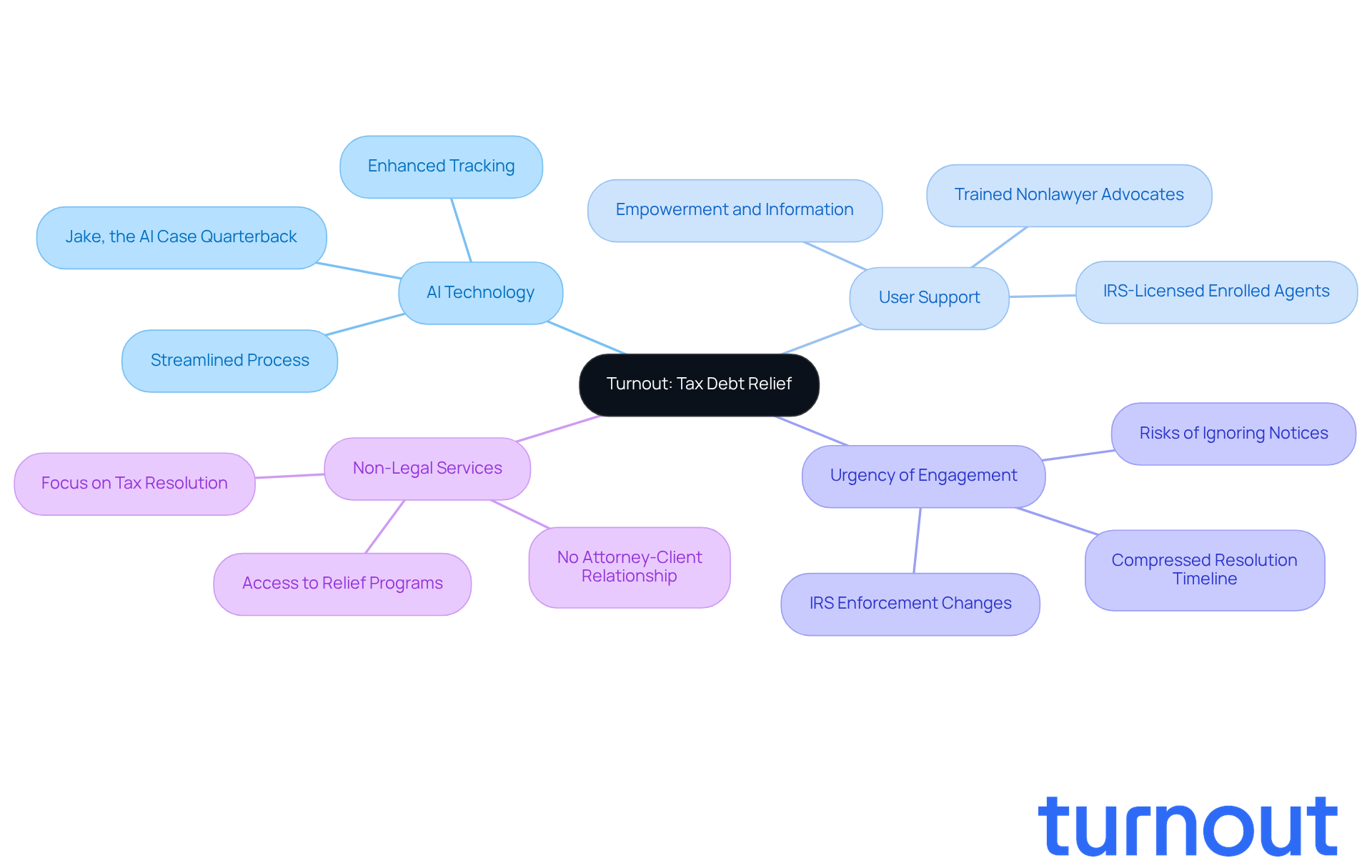

Turnout: Revolutionizing Tax Debt Relief for Americans

Turnout is changing the game for tax debt relief in America by using AI technology to make the process easier for you. We understand that dealing with tax issues can be overwhelming and frustrating. Unlike traditional agencies that often leave you feeling lost, Turnout offers a streamlined approach, especially for those facing challenges related to the tax topic 151 meaning, which encompasses IRS guidelines on refunds and adjustments.

It's important to remember that Turnout is not a law firm and does not provide legal advice; our services do not create an attorney-client relationship. At the heart of our innovation is Jake, our AI case quarterback. He keeps you updated and supported, ensuring you feel informed and empowered throughout your tax resolution journey.

This modern approach not only boosts efficiency but also instills confidence in you, making tax relief more accessible than ever. Our trained nonlawyer advocates and IRS-licensed enrolled agents work together to help you navigate complex financial systems without needing legal representation.

With the IRS's recent enhancements in enforcement, which have shortened the timeline for actions, and the increasing complexity of tax regulations, Turnout's proactive and user-friendly system stands out as a vital resource for anyone looking to resolve their tax challenges effectively. As experts at Coast One Tax Group note, "The IRS in 2026 is not the overwhelmed, understaffed agency of previous years." This highlights the urgency for you to engage with relief options promptly. Remember, you are not alone in this journey; we're here to help.

Understanding Your Appeal Rights Under Tax Topic 151

The tax topic 151 meaning indicates that the IRS has taken a closer look at your tax return, which may lead to an offset of your refund. It is essential for citizens to comprehend their rights to contest in this context. Under IRS guidelines, individuals have the right to contest decisions made regarding their tax returns. This includes the ability to appeal any adjustments or offsets that may affect their refunds. Knowing these rights empowers taxpayers to take proactive steps in addressing any discrepancies and ensures they are not left at the mercy of the IRS's decisions.

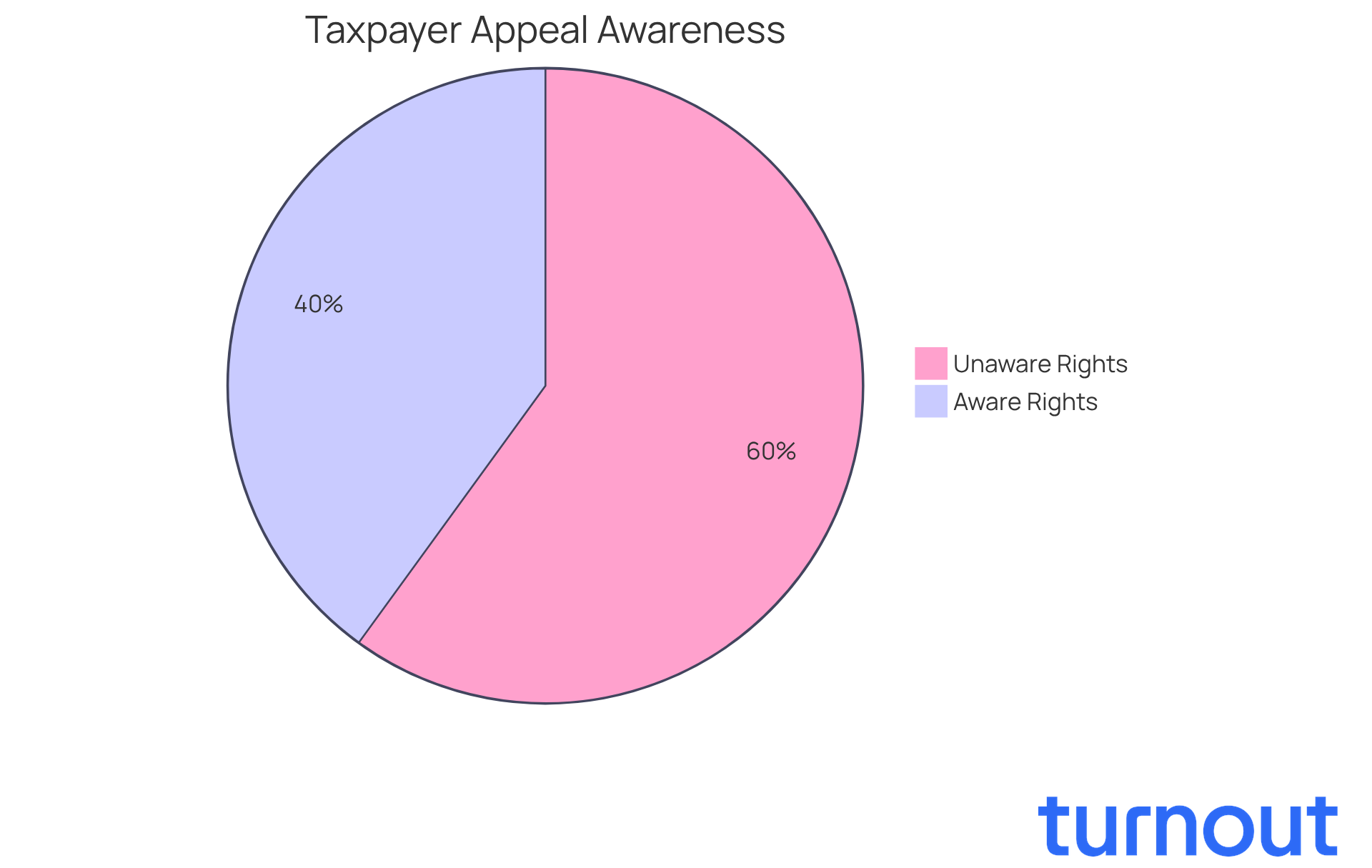

In 2026, approximately 60% of taxpayers are unaware of their appeal rights, underscoring the need for education on this critical aspect of tax management. Attorney Chad Silver emphasizes, 'The first letter regarding tax topic 151 meaning you will receive is simply a courtesy notification,' highlighting the importance of understanding the implications of such notices.

Taxpayers should respond to the IRS Notice of Deficiency within 90 days if they wish to contest any findings. By being informed and prepared, individuals can effectively navigate the complexities of Tax Topic 151 meaning and advocate for their financial interests.

Navigating the Appeal Process for Tax Topic 151

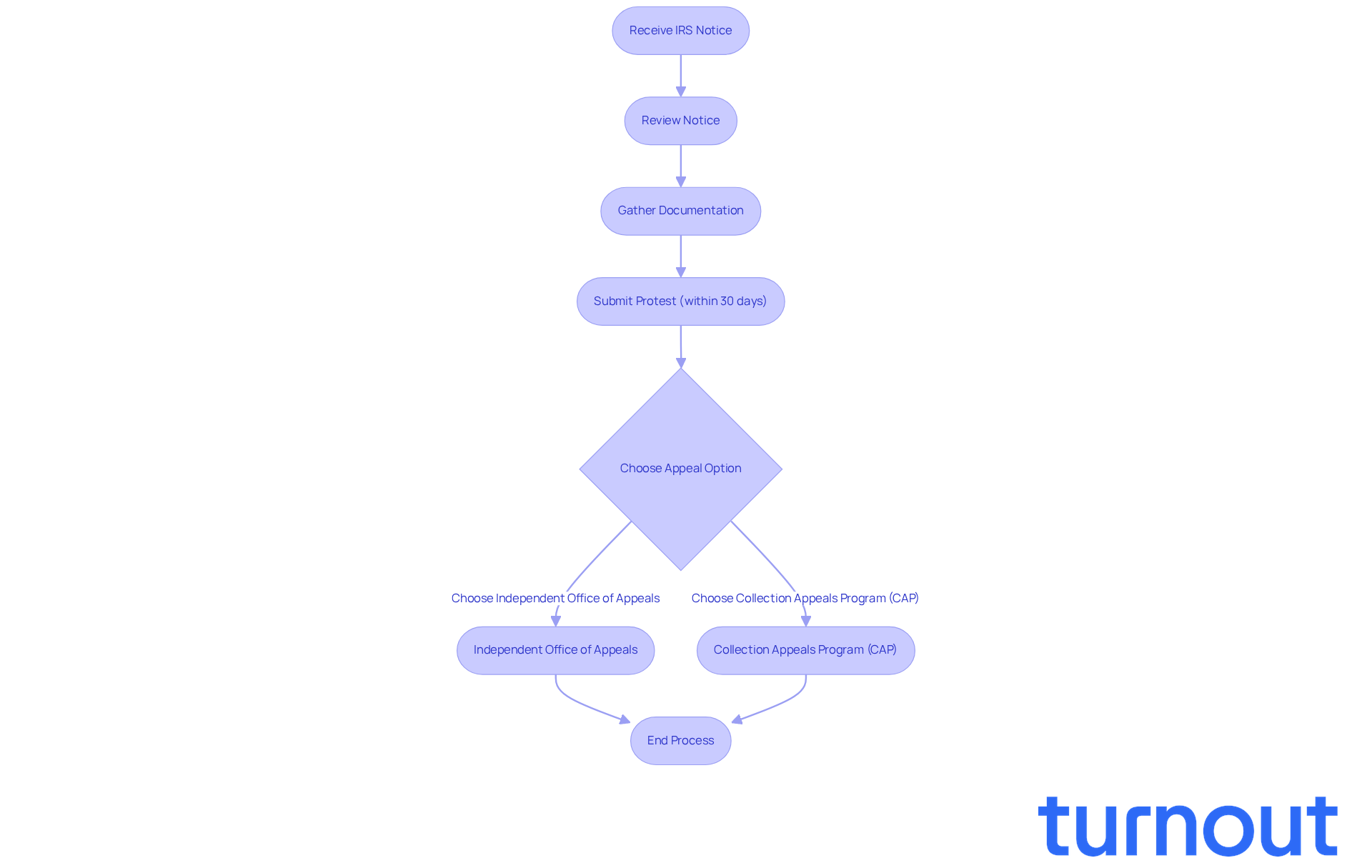

Navigating the dispute process for tax topic 151 meaning can feel overwhelming, but you’re not alone in this journey. Start by carefully reviewing the notice you received from the IRS. This notice outlines the reasons for the offset and includes essential information for submitting your challenge. Remember, you typically have 30 days to submit a protest, so it’s important to act quickly.

You can contest directly with the IRS through the Independent Office of Appeals. This option offers a less formal process, allowing you to settle disputes without needing to go to court. Gather all relevant documentation and clearly express your reasons for the appeal. Make sure your arguments are concise and well-supported.

As J. David Tax Law wisely notes, "Yes, you can submit a tax challenge without a lawyer, but it’s often advisable to seek professional assistance." Taking this proactive approach can streamline the process and significantly improve your chances of a favorable outcome.

Statistics show that most tax disputes can be resolved without court involvement, making this route particularly beneficial for you. Successful case studies reveal that timely and well-prepared requests can lead to significant tax offsets, highlighting the importance of diligence in this process.

Additionally, consider the Collection Appeals Program (CAP) as another option for disputing IRS collection actions. This program provides yet another avenue for resolution, ensuring you have multiple paths to address your concerns. Remember, we’re here to help you through this process.

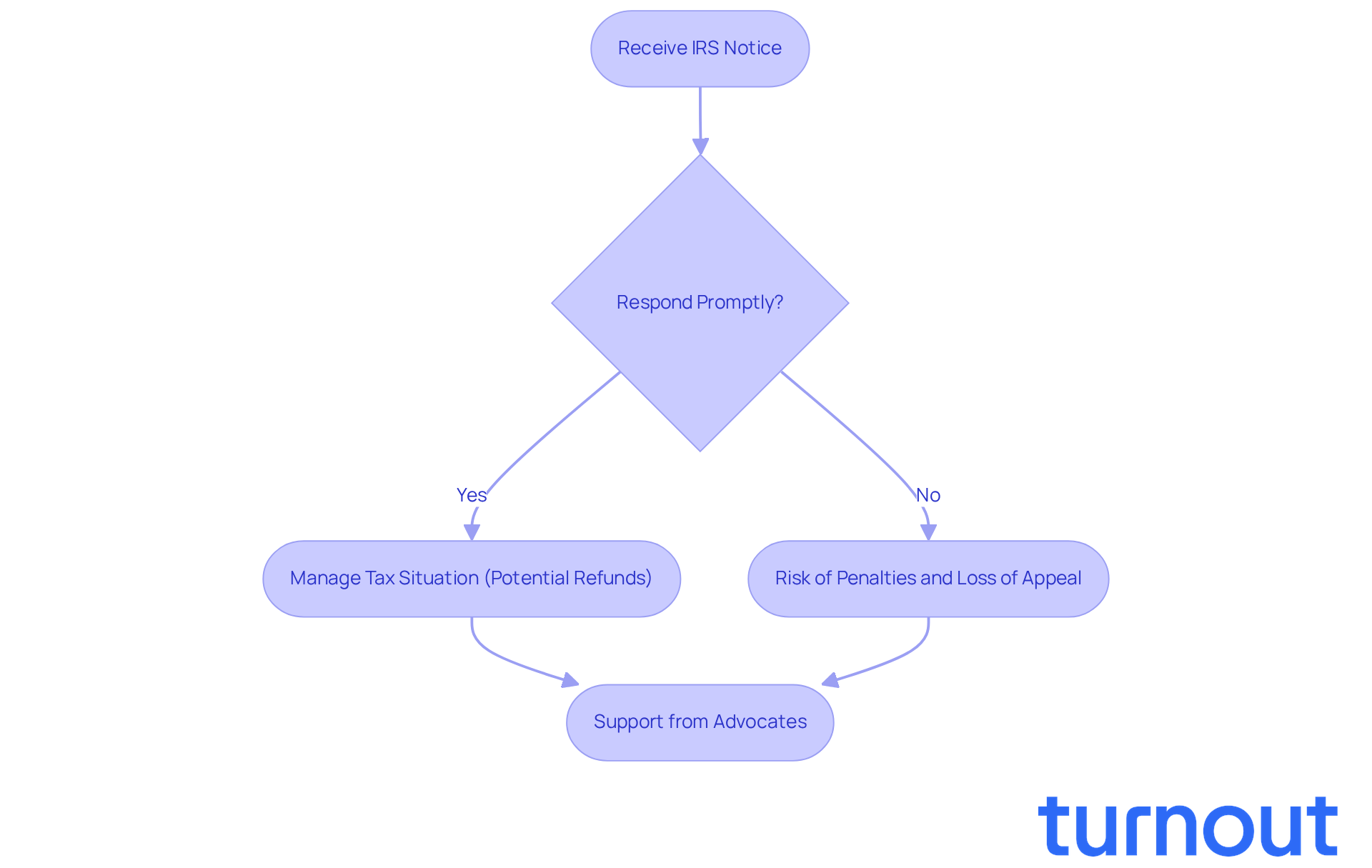

Recognizing the Importance of Timely Action in Tax Matters

Timely action is crucial when it comes to Tax Topic 151. We understand that receiving IRS notices can be overwhelming, and it’s important to respond promptly to avoid complications like additional offsets or penalties. The IRS typically allows only a limited timeframe for appeals, and missing this window can mean losing the right to contest a decision.

By prioritizing timely responses, you can effectively manage your tax situation. This way, you won’t miss out on potential refunds or relief options that could ease your burden. Remember, you’re not alone in this journey. Turnout's trained nonlawyer advocates and IRS-licensed enrolled agents are here to help you navigate these processes, providing support without the need for legal representation.

This proactive approach not only reduces stress but also increases the chances of a favorable resolution. We’re here to help you every step of the way.

Conclusion

Understanding Tax Topic 151 is crucial for taxpayers navigating the complexities of IRS regulations and potential refund offsets. We know that dealing with tax issues can be overwhelming, but Turnout is here to help. By leveraging AI technology, Turnout is revolutionizing tax debt relief, making it more accessible and supportive for individuals facing these challenges. It’s important to empower yourself by understanding your appeal rights and taking timely action to contest IRS decisions effectively.

Key insights include:

- The necessity of being informed about your appeal rights under Tax Topic 151

- The streamlined process for contesting IRS decisions

- The urgency of responding promptly to notices

Engaging with resources like Turnout can help you navigate your financial situation with confidence and clarity, ensuring you’re not left vulnerable to the complexities of tax regulations.

Ultimately, the message is clear: proactive engagement and timely action are vital in managing tax matters effectively. We encourage you to leverage available resources, such as Turnout's innovative services, to advocate for your rights and secure the benefits you deserve. By understanding the implications of Tax Topic 151 and acting decisively, you can take control of your financial future and avoid unnecessary complications. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Frequently Asked Questions

What is Turnout and how does it help with tax debt relief?

Turnout is a service that utilizes AI technology to simplify the tax debt relief process for Americans, making it easier for individuals to navigate their tax issues.

How does Turnout differ from traditional tax relief agencies?

Unlike traditional agencies that may leave clients feeling lost, Turnout offers a streamlined approach and keeps clients informed and supported throughout their tax resolution journey.

Does Turnout provide legal advice?

No, Turnout is not a law firm and does not provide legal advice, nor does it create an attorney-client relationship.

Who is Jake and what role does he play in Turnout's services?

Jake is Turnout's AI case quarterback, designed to keep clients updated and supported, ensuring they feel informed and empowered during their tax resolution process.

What kind of professionals does Turnout employ to assist clients?

Turnout employs trained nonlawyer advocates and IRS-licensed enrolled agents to help clients navigate complex financial systems without the need for legal representation.

Why is it important to engage with tax relief options promptly?

Due to recent enhancements in IRS enforcement and the increasing complexity of tax regulations, it is crucial to engage with relief options promptly to effectively resolve tax challenges.

What should clients expect from Turnout's approach to tax resolution?

Clients can expect a modern, efficient, and user-friendly system that instills confidence and makes tax relief more accessible than ever.