Introduction

Understanding the tax implications of GoFundMe donations is essential in today’s changing financial landscape. We know that with crowdfunding becoming a popular way to raise funds for personal and charitable causes, it can feel overwhelming to navigate the complexities of tax deductions and liabilities. Have you ever wondered what happens when a generous contribution turns into a tax headache?

This article explores the key tax considerations every donor should be aware of. We’re here to help you ensure that your contributions are not only impactful but also compliant with IRS regulations. You are not alone in this journey; let’s take this step together.

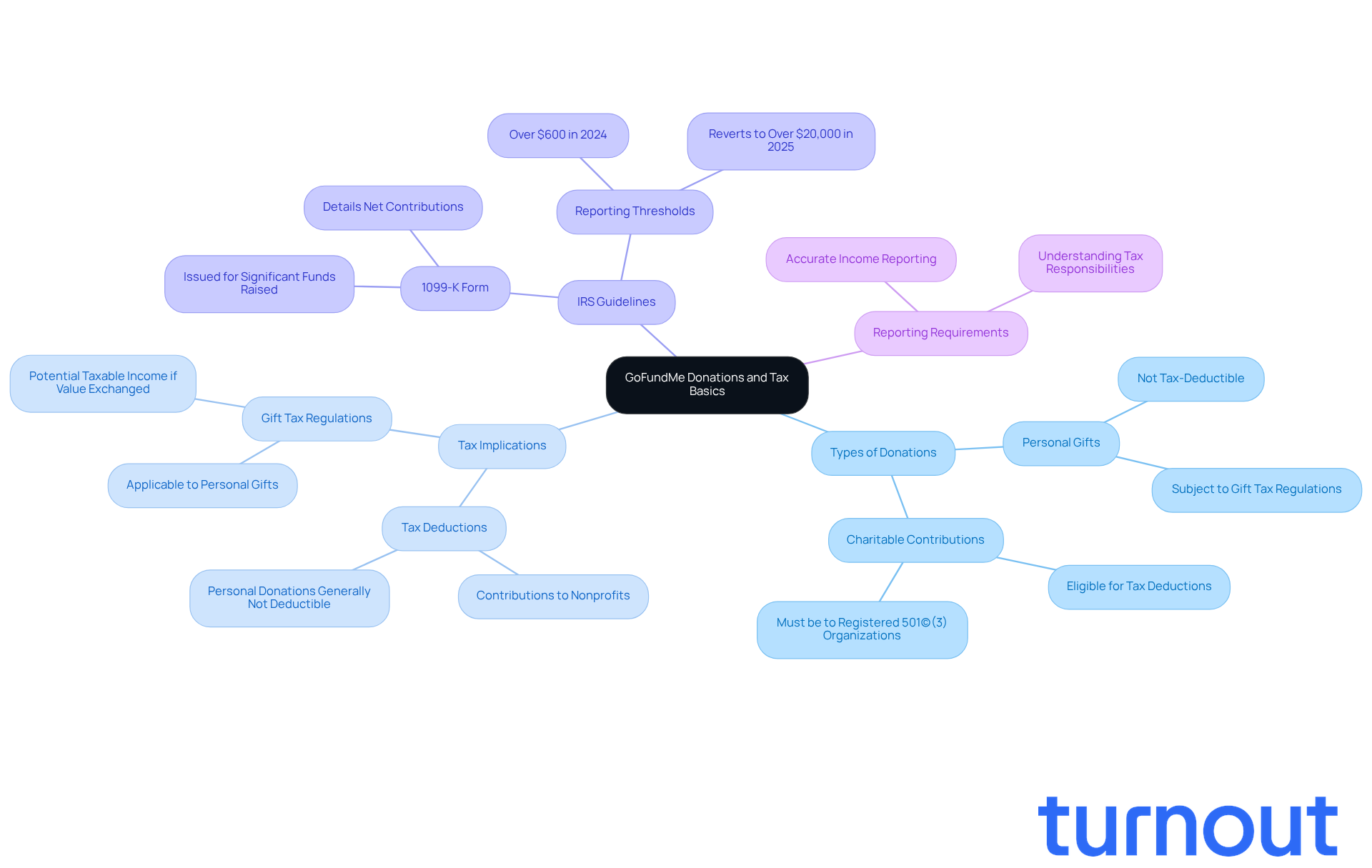

Clarify GoFundMe Donations and Tax Basics

Crowdfunding platforms are invaluable resources, helping individuals raise funds for a variety of causes, from personal emergencies to charitable initiatives. We understand that navigating the gofundme tax implications of these contributions can be overwhelming. Typically, donations made to individual fundraising efforts are seen as personal gifts and aren’t eligible for tax deductions. However, contributions to initiatives run by registered 501(c)(3) nonprofit organizations may qualify for tax deductions. It’s essential for contributors to verify the initiative's status to fully grasp their potential tax benefits.

According to IRS guidelines, gifts are defined as amounts given without any expectation of return. This definition plays a significant role in determining tax liability. For instance, if a crowdfunding initiative collects substantial funds, recipients might receive a 1099-K tax document. This document outlines net contributions and helps ensure accurate income reporting to the IRS.

Starting in 2024, the IRS has changed the reporting threshold for 1099-K forms to over $600 in payments, which will revert to more than $20,000 in 2025. Understanding the distinction between personal gifts and charitable contributions is vital for both donors and recipients as they navigate the gofundme tax implications in relation to their tax responsibilities.

Furthermore, if something of value is offered in exchange for contributions, those funds may be taxable as income. Recipients should also be aware that personal gifts might be subject to gift tax regulations. Remember, you’re not alone in this journey; we’re here to help you understand these complexities.

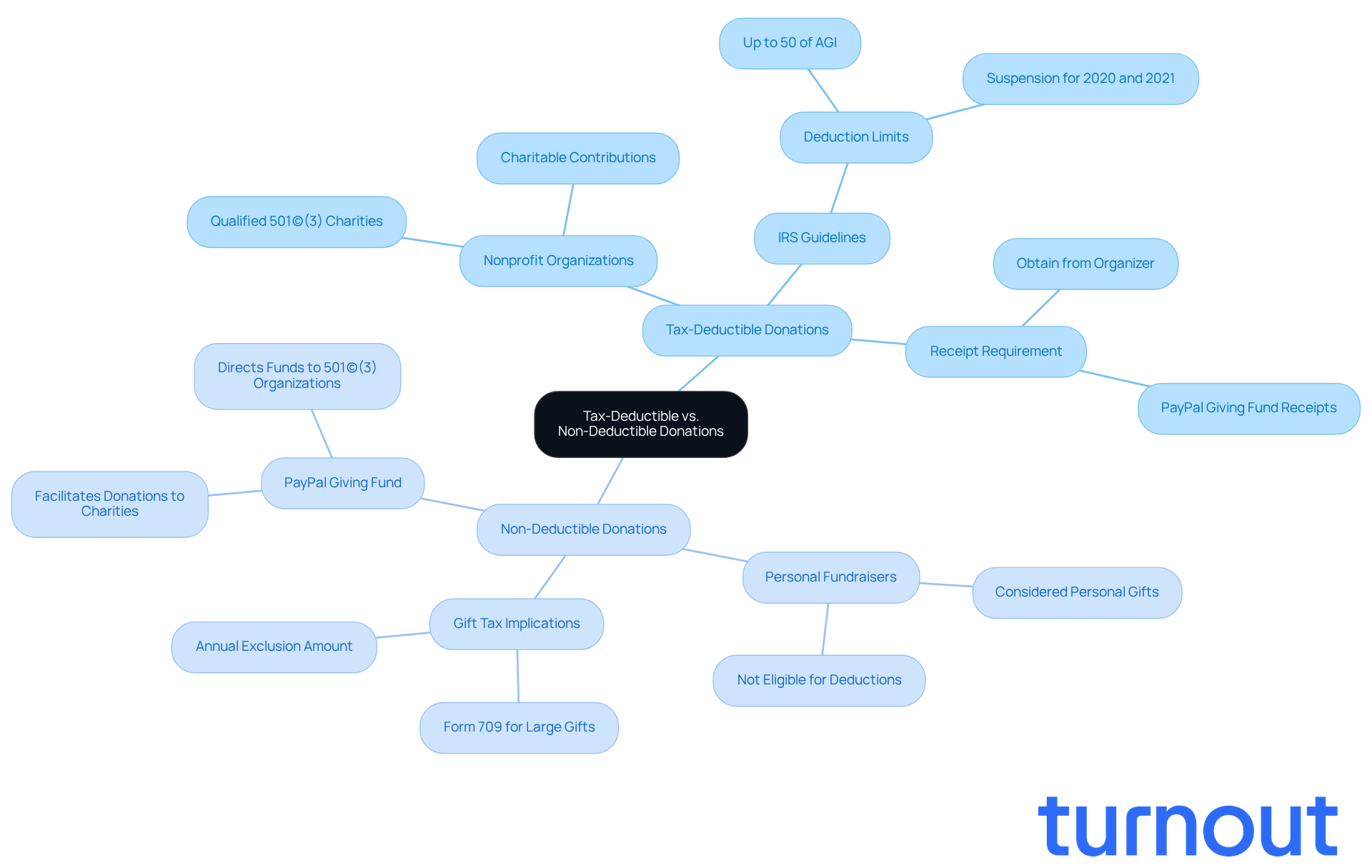

Identify Tax-Deductible vs. Non-Deductible Donations

When it comes to crowdfunding contributions, understanding the gofundme tax implications can often feel overwhelming. We know that navigating these rules can be tricky, but it’s important to assess the nature of the initiative you’re considering.

Donations made to personal fundraisers are typically seen as personal gifts, which means they usually aren’t eligible for tax deductions. However, if you’re contributing to a nonprofit organization recognized by the IRS, you may be in luck! For instance, if you support a fundraising initiative that benefits a registered charity, you can claim that donation as a tax deduction on your tax return.

The IRS allows taxpayers to deduct charitable contributions of up to 50% of their adjusted gross income (AGI). To ensure you can validate your claims during tax filing, it’s essential to obtain a receipt from the organizer. Remember, many GoFundMe efforts are personal in nature, so it is crucial to confirm the status of the initiative and understand the GoFundMe tax implications before contributing.

It’s also worth noting that if your personal gifts exceed the annual exclusion gift amount, you may need to file Form 709. To make sure your contribution is tax-deductible, check if the campaign is linked to the PayPal Giving Fund, which supports donations to registered charities.

We’re here to help you navigate this process, ensuring your generosity can truly make a difference!

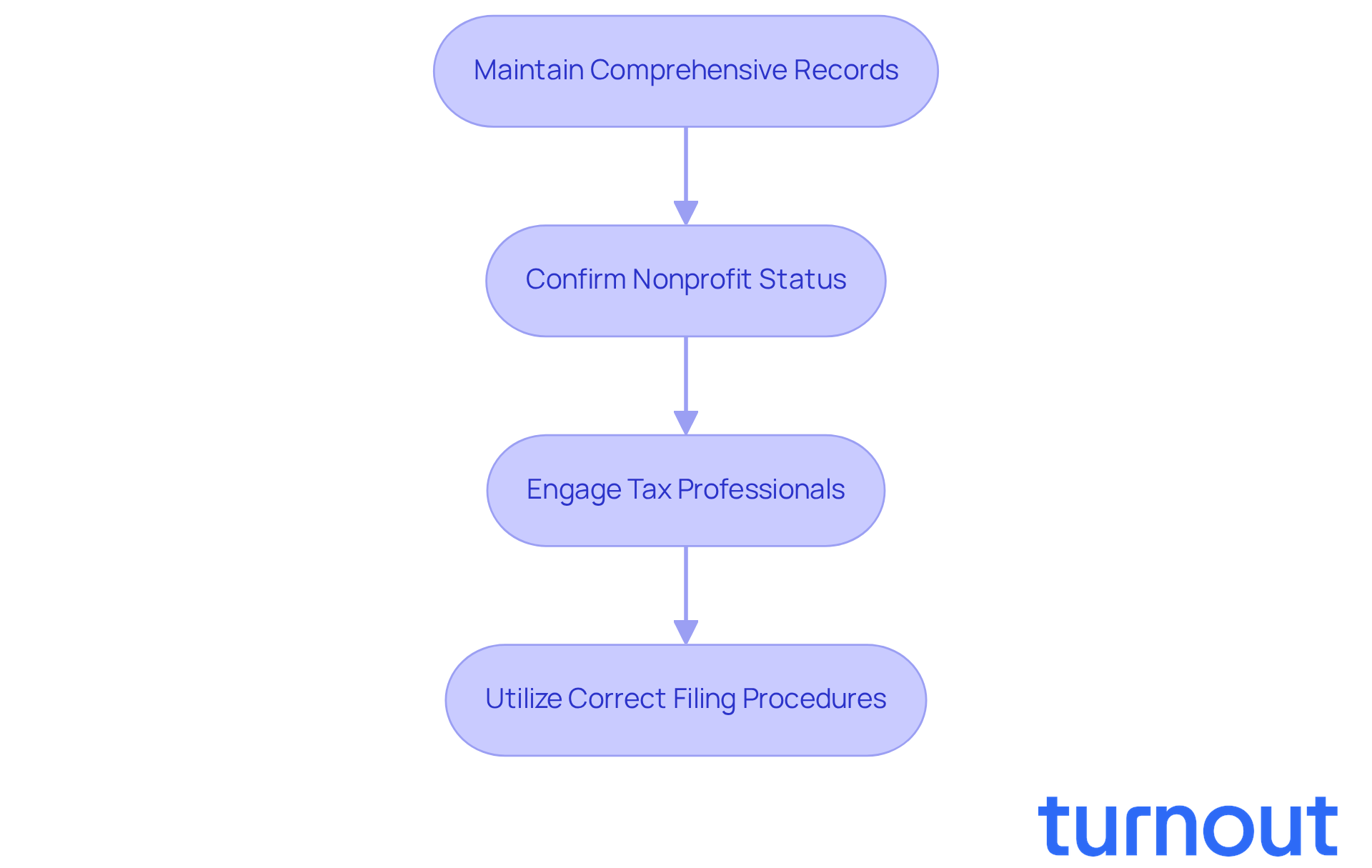

Implement Best Practices for Claiming Tax Deductions

Navigating the gofundme tax implications for donations can be overwhelming, but we're here to help you through it. By following these essential practices, you can ensure that your contributions are maximized and compliant with tax regulations.

-

Maintain Comprehensive Records: Keeping thorough documentation of all your gifts is crucial. Make sure to save receipts that detail the date, amount, and purpose of each contribution. This will help substantiate your claims when tax season rolls around. If you’ve donated $250 or more, don’t forget to get a written acknowledgment from the charity. This should confirm the donation amount and state that no goods or services were received in exchange.

-

Confirm Nonprofit Status: It’s important to verify that the initiative is organized by a registered 501(c)(3) organization. You can usually find this information on the GoFundMe page or by reaching out directly to the campaign organizer.

-

Engage Tax Professionals: Consulting with a tax advisor can provide valuable insights into the gofundme tax implications of your contributions. They can help ensure you’re adhering to IRS regulations, which is vital for maximizing your potential deductions and avoiding any pitfalls. Remember, cash contributions are deductible up to 60% of your Adjusted Gross Income (AGI) until January 1, 2026. Understanding your AGI can help you optimize your tax advantages.

-

Utilize Correct Filing Procedures: When it’s time to prepare your tax return, make sure you’re using the right forms, like Schedule A for itemized deductions. For single filers in 2025, remember that your itemized deductions must exceed $14,600 to provide a tax advantage over the standard deduction.

By following these best practices, you can confidently navigate the complexities of tax deductions associated with your donations. You’re not alone in this journey, and with the right approach, you can maximize your charitable impact.

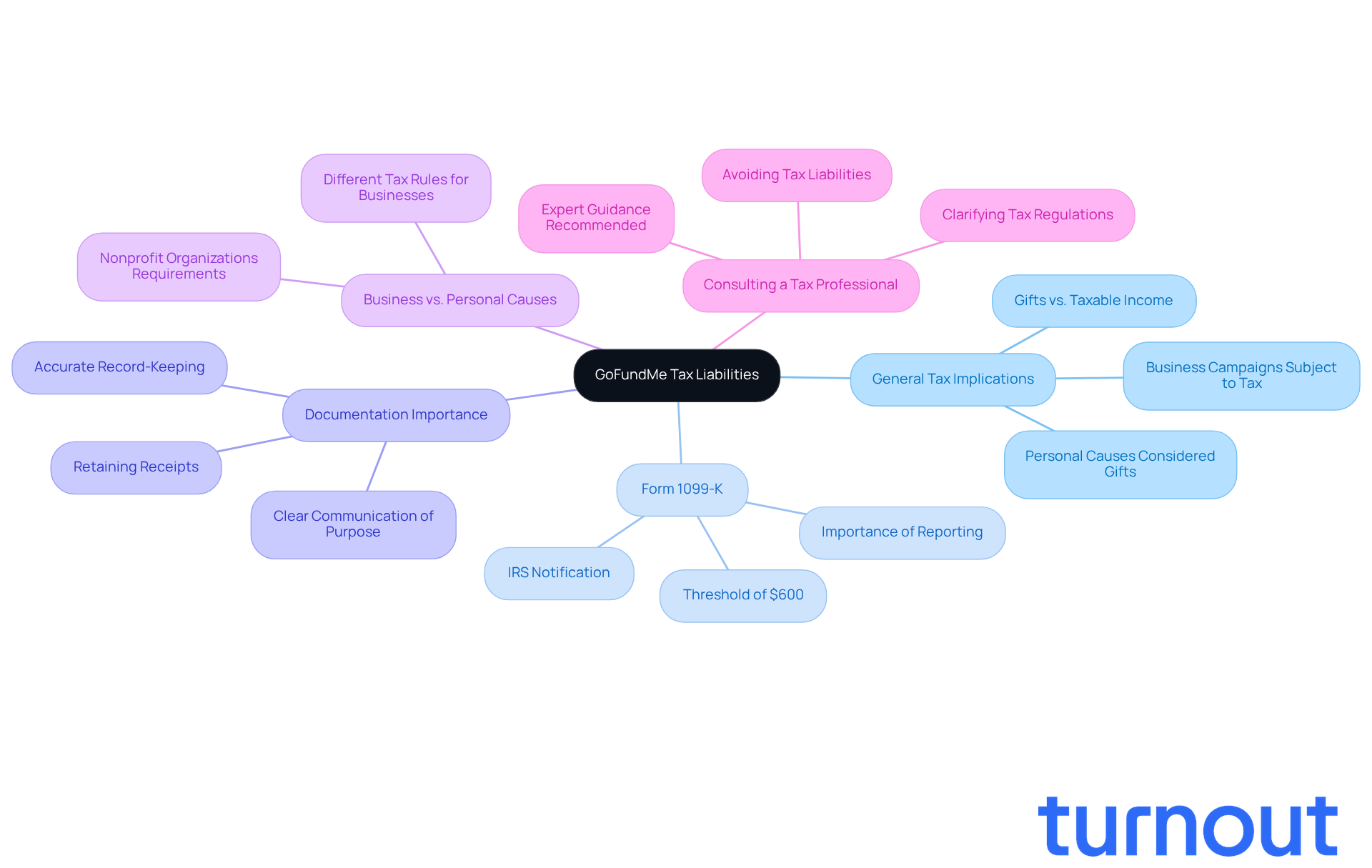

Examine Tax Liabilities for GoFundMe Organizers

Navigating gofundme tax implications can feel overwhelming for organizers of fundraising efforts. We understand that you want to ensure everything is handled correctly. Generally, funds raised through individual initiatives are classified as gifts and are not subject to income tax. For personal causes like medical bills or educational goals, these funds are typically considered gifts as well. However, if you raise more than $600 in a calendar year, you’ll receive a Form 1099-K from GoFundMe, which reports the gofundme tax implications of this income to the IRS. This form is crucial because it details the total funds raised, and the IRS gets a copy too. Keeping accurate records is essential.

It’s important to meticulously document all funds received and any expenses related to your initiative. The gofundme tax implications vary depending on whether the funds are used for business purposes or if you operate as a nonprofit organization. For instance, campaigns aimed at generating funds for business projects may encounter gofundme tax implications, while contributions to help individuals in need are generally regarded as gifts and exempt from taxable income. A relevant case study shows that donations made through detached and disinterested generosity are considered gifts by the IRS, meaning they are excluded from the recipient's gross income.

We highly recommend consulting with a qualified tax professional to understand the gofundme tax implications and ensure compliance with all applicable tax laws. This can help clarify any uncertainties about when funds are considered taxable income. As Tanya Akimenko wisely states, "It’s always wise to consult a tax professional to clarify when funds are considered taxable income and how to navigate the relevant tax regulations." This proactive approach can help you avoid potential tax liabilities and navigate the complexities of IRS regulations effectively. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding the tax implications of GoFundMe donations is crucial for both donors and organizers. We know that navigating these waters can be challenging. Crowdfunding platforms enable generous contributions for various causes, but the tax treatment of these donations can vary significantly.

Donations to personal fundraisers are generally considered personal gifts and do not qualify for tax deductions. On the other hand, contributions to registered 501(c)(3) nonprofit organizations may be eligible for deductions. Recognizing this distinction is essential for anyone looking to maximize their charitable impact while staying compliant with tax regulations.

This article outlines several key points regarding the tax implications of GoFundMe contributions. It highlights the importance of verifying an initiative's nonprofit status to determine tax deductibility. Maintaining thorough records for tax purposes is also necessary. If contributions exceed certain thresholds, you may receive a 1099-K form. We encourage both donors and organizers to consult tax professionals to navigate the complexities of tax regulations effectively.

Ultimately, being informed about GoFundMe tax implications empowers individuals to make educated decisions about their contributions. By understanding the differences between tax-deductible and non-deductible donations, following best practices for claiming deductions, and recognizing tax liabilities for organizers, everyone can contribute meaningfully while optimizing their financial responsibilities.

Engaging with these insights not only enhances personal giving experiences but also fosters a culture of responsible and impactful charity. Remember, you are not alone in this journey; we're here to help you make the most of your contributions.

Frequently Asked Questions

What are the general tax implications of donations made through GoFundMe?

Donations made to individual fundraising efforts on GoFundMe are generally considered personal gifts and are not eligible for tax deductions. However, contributions to registered 501(c)(3) nonprofit organizations may qualify for tax deductions.

How can contributors verify if their donations are tax-deductible?

Contributors should verify the status of the initiative to determine if it is run by a registered 501(c)(3) nonprofit organization, which would allow for potential tax deductions.

What is the IRS definition of a gift in the context of crowdfunding?

According to IRS guidelines, gifts are defined as amounts given without any expectation of return, which is important for determining tax liability.

What tax document might recipients of crowdfunding initiatives receive, and what does it indicate?

Recipients of crowdfunding initiatives may receive a 1099-K tax document, which outlines net contributions and assists in accurate income reporting to the IRS.

What are the upcoming changes to the reporting threshold for 1099-K forms?

Starting in 2024, the IRS will change the reporting threshold for 1099-K forms to over $600 in payments, which will revert to more than $20,000 in 2025.

What should recipients consider if they offer something of value in exchange for contributions?

If recipients offer something of value in exchange for contributions, those funds may be taxable as income.

Are personal gifts subject to any tax regulations?

Yes, personal gifts may be subject to gift tax regulations, so recipients should be aware of these potential tax implications.