Introduction

Navigating the complexities of tax debt relief can feel overwhelming, especially for disabled individuals. We understand that facing financial challenges can be daunting. The IRS Offer in Compromise (OIC) program offers a unique opportunity to settle debts for less than the full amount owed. This could be a potential lifeline during tough times.

However, the path to securing an OIC isn’t always straightforward. It’s common to feel confused and uncertain about the steps involved. What are the key actions you can take to ensure a successful application? We're here to help you through this journey.

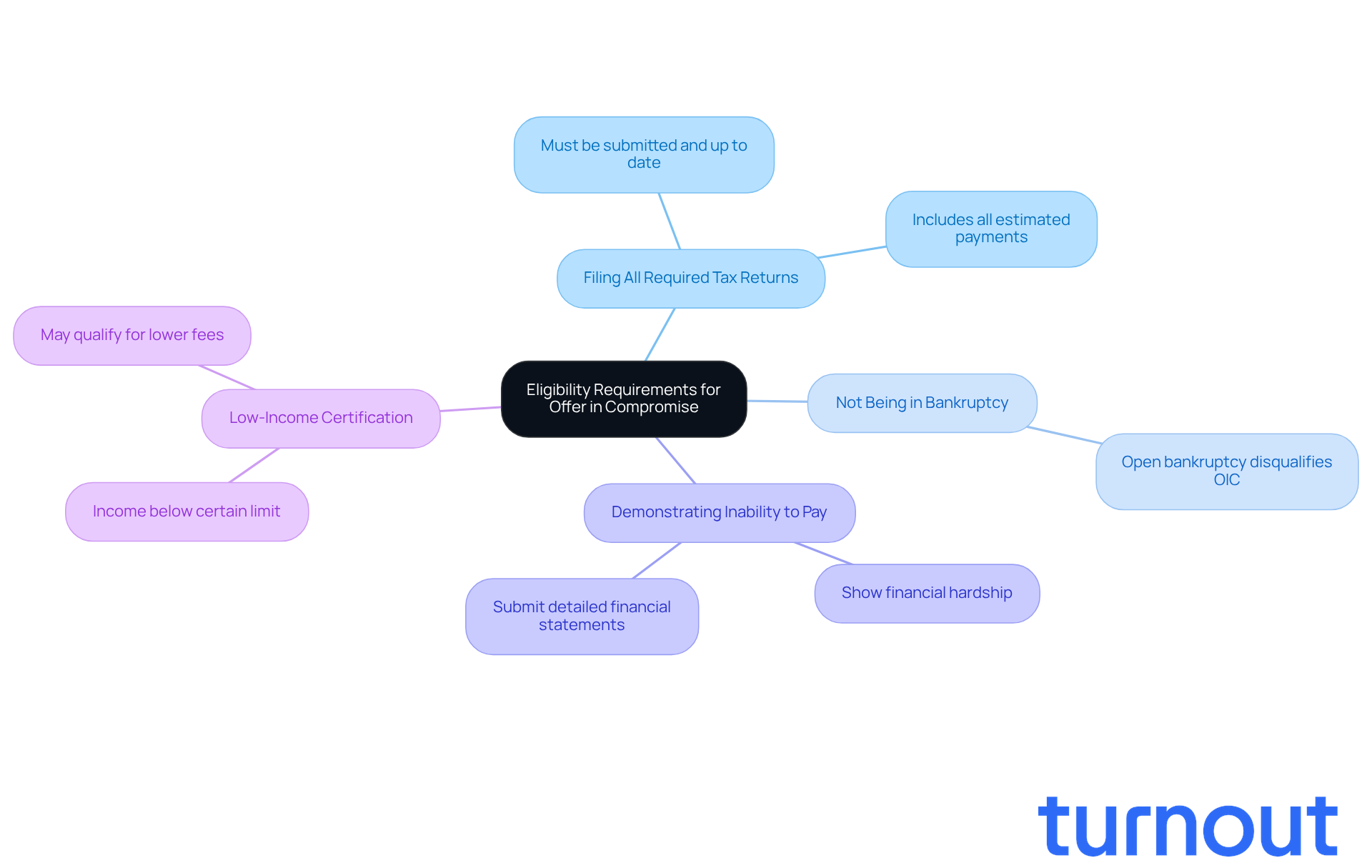

Understand Eligibility Requirements for Offer in Compromise

Navigating the process can feel overwhelming, especially for disabled individuals, so it's important to consider IRS offer in compromise tips. We understand that you may have concerns about your eligibility. To qualify for an OIC, there are specific criteria set by the IRS that you need to meet:

- Filing all required tax returns: It’s crucial to ensure that all your tax returns are submitted and up to date. This is a fundamental requirement for consideration.

- Not being in bankruptcy: If you’re currently involved in an open bankruptcy proceeding, it disqualifies you from the OIC process.

- Demonstrating inability to pay: You’ll need to show that paying your tax debt in full isn’t feasible, whether through a lump sum or an installment agreement. This typically involves submitting detailed financial statements and proof of income.

- Low-income certification: If your income falls below a certain limit, you might qualify for a lower processing fee or even no fee at all. Understanding these requirements is essential in determining if pursuing an OIC, along with IRS offer in compromise tips, is a viable option for you.

Statistics show that the IRS accepts about 30-40% of OIC requests each year. Many disabled individuals have successfully navigated this process by following IRS offer in compromise tips. Real-world examples reveal that those who provide thorough financial documentation and clearly demonstrate their inability to pay are more likely to qualify.

Consulting with tax experts can significantly improve your chances of approval. They can offer personalized guidance and support throughout the submission process. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

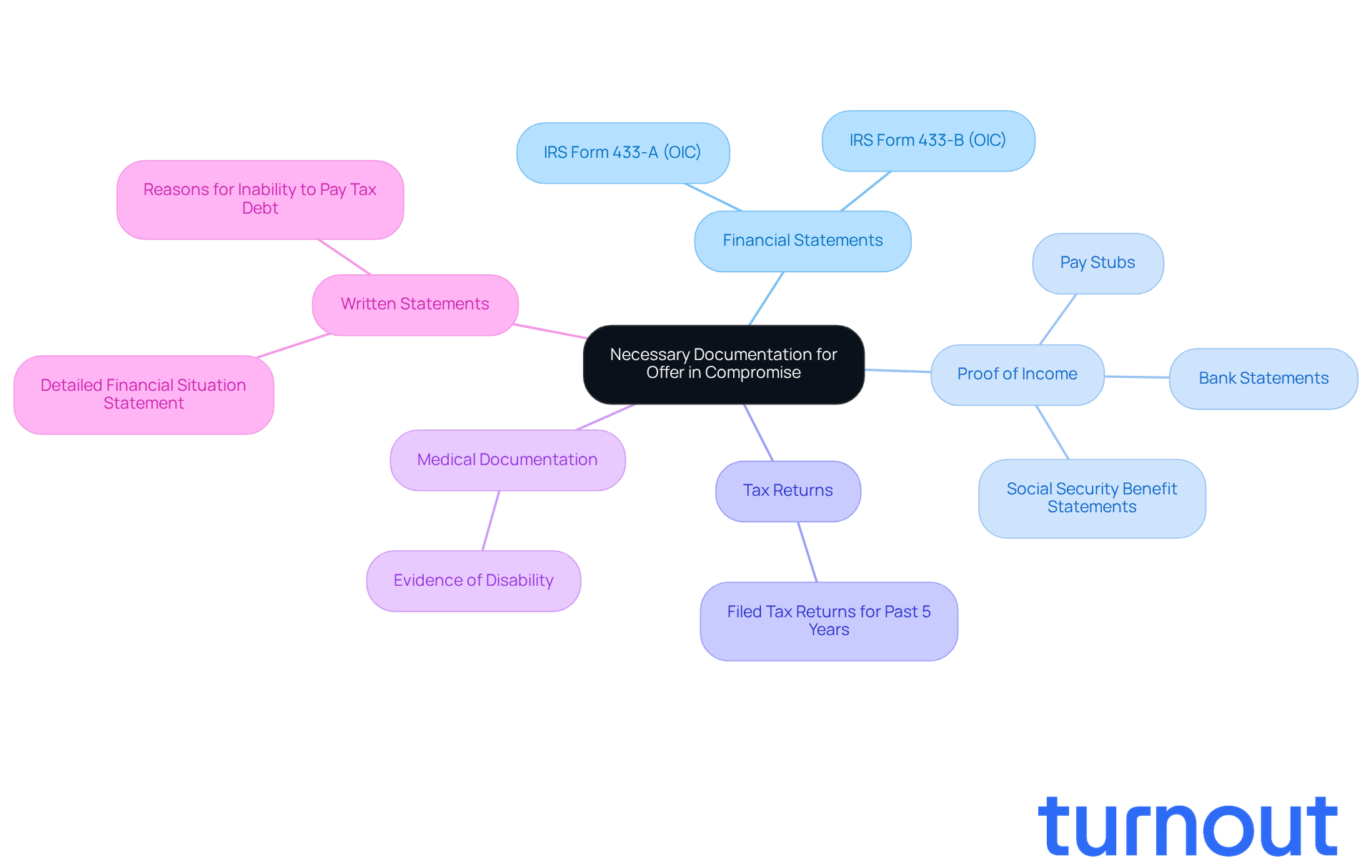

Gather Necessary Documentation for Your Application

When applying for an Offer in Compromise, utilizing IRS offer in compromise tips for gathering the right documentation is crucial for a successful submission. We understand that this process can feel overwhelming, but you’re not alone. Here are the essential financial statements you need:

- Financial Statements: Complete IRS Form 433-A (OIC) or Form 433-B (OIC) to provide a comprehensive overview of your financial situation, detailing your income, expenses, and assets.

- Proof of Income: Include documentation such as pay stubs, bank statements, or Social Security benefit statements to verify your income.

- Tax Returns: Ensure you have copies of your filed tax returns for the past five years, as this is a requirement for eligibility.

- Medical Documentation: If applicable, provide evidence of your disability, which can help illustrate your financial hardship and support your case.

- Written Statements: Prepare a detailed statement explaining your financial situation and the reasons you cannot pay your tax debt in full. This narrative is vital for the IRS to understand your unique circumstances.

Statistics indicate that about 40% of Offer in Compromise requests are accepted. This highlights the importance of thorough and accurate submissions. Tax advisors emphasize that adhering to the IRS offer in compromise tips, complete and truthful documentation is essential to avoid complications and enhance the likelihood of acceptance. Remember, failing to supply thorough documentation can result in rejection or delays in processing your request.

We’re here to help you navigate this journey.

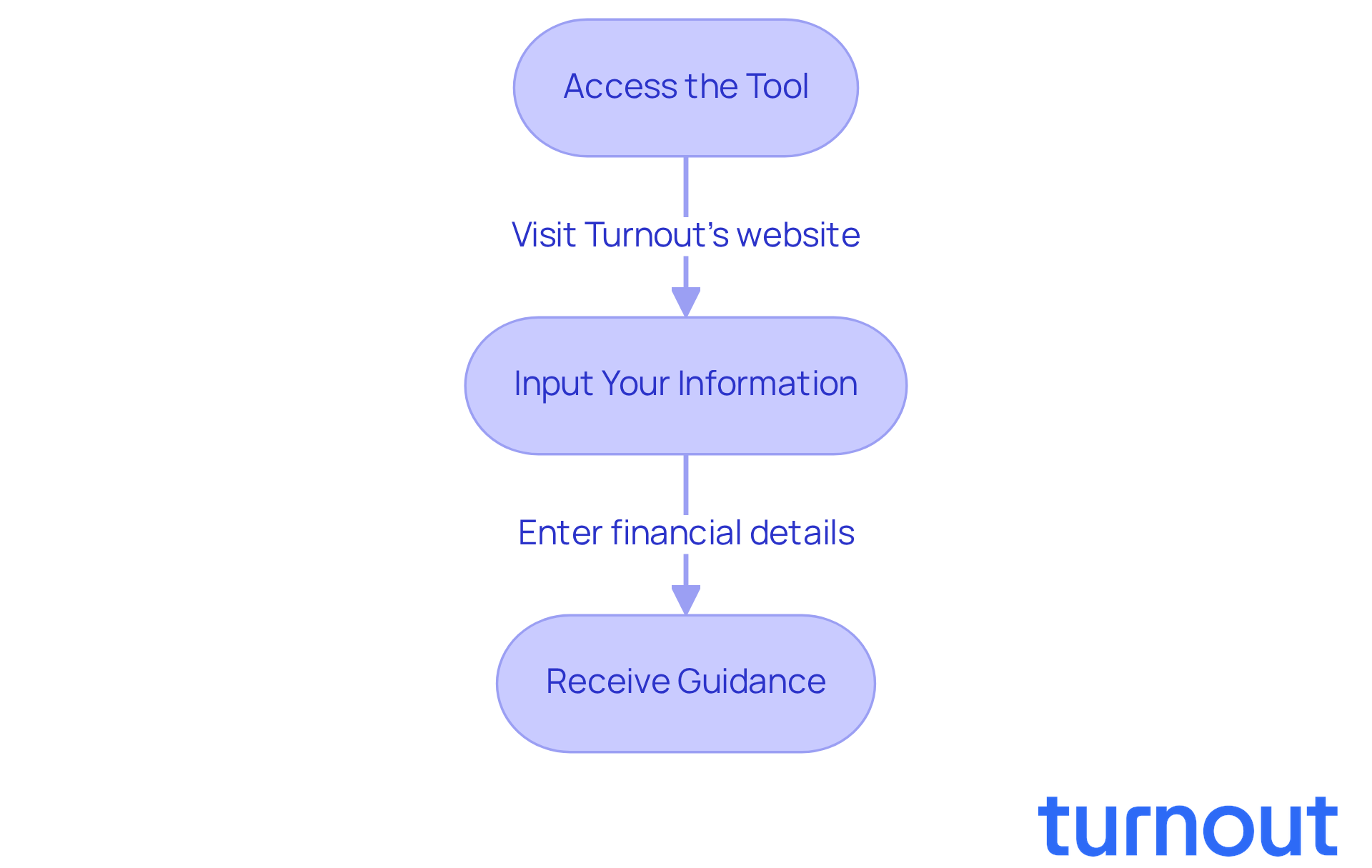

Utilize Tools Like Turnout's Pre-Qualifier for Eligibility Assessment

Turnout offers a valuable Pre-Qualifier tool that can help you assess your eligibility for an Offer in Compromise (OIC). We understand that navigating tax issues can be overwhelming, and this tool is designed to make the process easier for you. Here’s how to make the most of it:

- Access the tool: Start by visiting Turnout's website and finding the Pre-Qualifier section. It’s simple and user-friendly.

- Input your information: Enter your financial details, including income, expenses, and tax liabilities. The tool will analyze this data to give you a preliminary assessment of your eligibility.

- Receive guidance: Based on your input, the tool will provide insights into your potential qualification for an OIC and recommend next steps. This guidance can simplify your preparation for the submission process, saving you time and effort.

Using tools like Turnout's Pre-Qualifier can significantly enhance your chances of success with the IRS Offer in Compromise tips. By accurately assessing your eligibility, you can better navigate the complexities of tax debt relief, ensuring you are well-prepared to pursue the benefits you deserve. Remember, you are not alone in this journey. While Turnout is not a law firm and does not provide legal advice, we utilize trained nonlawyer advocates and IRS-licensed enrolled agents to assist you every step of the way.

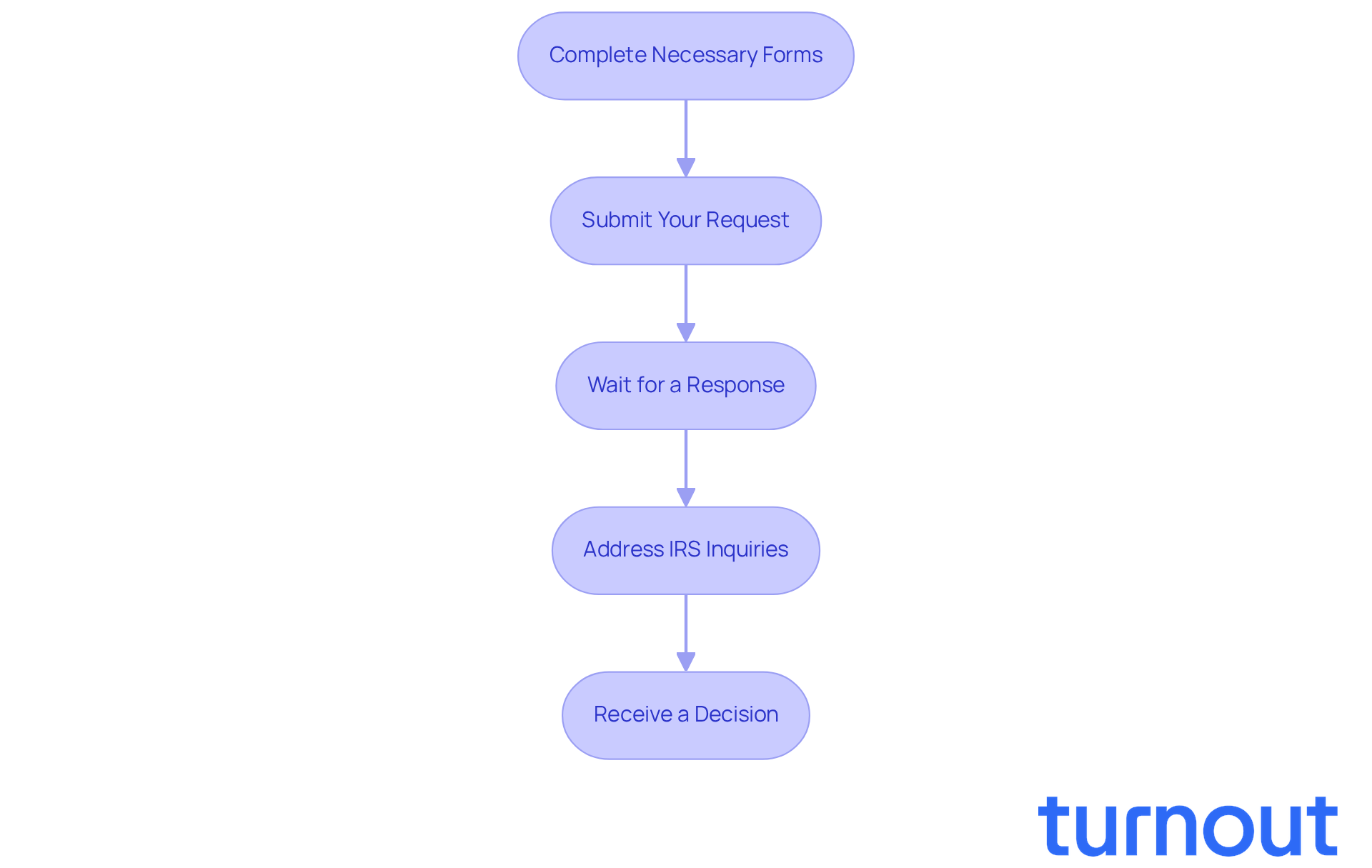

Comprehend the Application Process for Offer in Compromise

Navigating the application process for an IRS offer in compromise tips can feel overwhelming, but we're here to help. Let’s break it down into manageable steps:

- Complete the necessary forms: Start by filling out IRS Form 656 and either Form 433-A (OIC) or Form 433-B (OIC) accurately. We understand that paperwork can be daunting, but taking this first step is crucial.

- Submit your request: Once your forms are complete, send them along with any required documentation and processing fee (if applicable) to the IRS. Remember, this is your chance to seek relief by following IRS offer in compromise tips.

- Wait for a response: After submission, the IRS will assess your request. This process can take several months, and it’s common to feel anxious during this waiting period. Be prepared for potential follow-up requests for additional information.

- Address IRS inquiries: If the IRS reaches out for more details, respond quickly. We know that delays can be frustrating, but timely replies can help keep your application moving forward.

- Receive a decision: Finally, once the IRS has reviewed your application, they will notify you of their decision. If approved, you’ll receive clear instructions on how to proceed with your payment plan. Remember, you are not alone in this journey; support is available every step of the way.

Conclusion

Navigating the IRS Offer in Compromise (OIC) process can be particularly challenging for disabled individuals. We understand that this journey can feel overwhelming, but knowing some essential tips and requirements can significantly ease the process.

First and foremost, it’s crucial to understand the eligibility criteria. Make sure to:

- File all tax returns

- Demonstrate your inability to pay

- Provide thorough financial documentation to support your case

Resources like Turnout's Pre-Qualifier tool can streamline your eligibility assessment and offer personalized guidance. Consulting with tax experts can further bolster your chances of approval.

Ultimately, pursuing an Offer in Compromise is not just about resolving tax debt; it’s about reclaiming your financial stability and peace of mind. You are not alone in this journey. Disabled individuals facing tax challenges should feel empowered to take these steps, knowing that support is available.

By leveraging the right information and resources, navigating the complexities of tax relief becomes a more manageable and achievable goal. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is an agreement with the IRS that allows a taxpayer to settle their tax debt for less than the full amount owed.

What are the eligibility requirements for an OIC?

To qualify for an OIC, you must meet several criteria: 1. All required tax returns must be filed and up to date. 2. You must not be in an open bankruptcy proceeding. 3. You must demonstrate an inability to pay your tax debt in full. 4. If your income is below a certain limit, you may qualify for a lower processing fee or no fee at all.

How can I demonstrate my inability to pay?

You can demonstrate your inability to pay by submitting detailed financial statements and proof of income to show that paying your tax debt in full is not feasible.

What is the acceptance rate for OIC requests?

Statistics show that the IRS accepts about 30-40% of OIC requests each year.

Can disabled individuals qualify for an OIC?

Yes, many disabled individuals have successfully navigated the OIC process by following IRS offer in compromise tips and providing thorough financial documentation.

How can consulting with tax experts help in the OIC process?

Consulting with tax experts can significantly improve your chances of approval, as they can provide personalized guidance and support throughout the submission process.

What should I do if I am considering an OIC?

Ensure that all your tax returns are filed, assess your financial situation to demonstrate your inability to pay, and consider consulting with a tax expert for assistance.