Introduction

Understanding the complexities of disability deductions can truly ease the financial burden many individuals with impairments face. We recognize that navigating this landscape can feel overwhelming. By exploring the various tax benefits available, you can uncover opportunities to optimize your tax returns and secure the support you deserve.

It's common to feel uncertain about how to maximize these deductions. How can you navigate the intricate world of tax regulations and documentation requirements? You’re not alone in this journey. This article will delve into effective strategies and supportive practices that empower you to claim your rightful deductions with confidence.

Understand Available Disability Deductions

If you have impairments, you might be surprised to learn that there are several tax benefits, such as disability deductions, available to help ease your financial burden. Understanding disability deductions can be the first step toward optimizing your tax advantages and ensuring you receive the support you deserve.

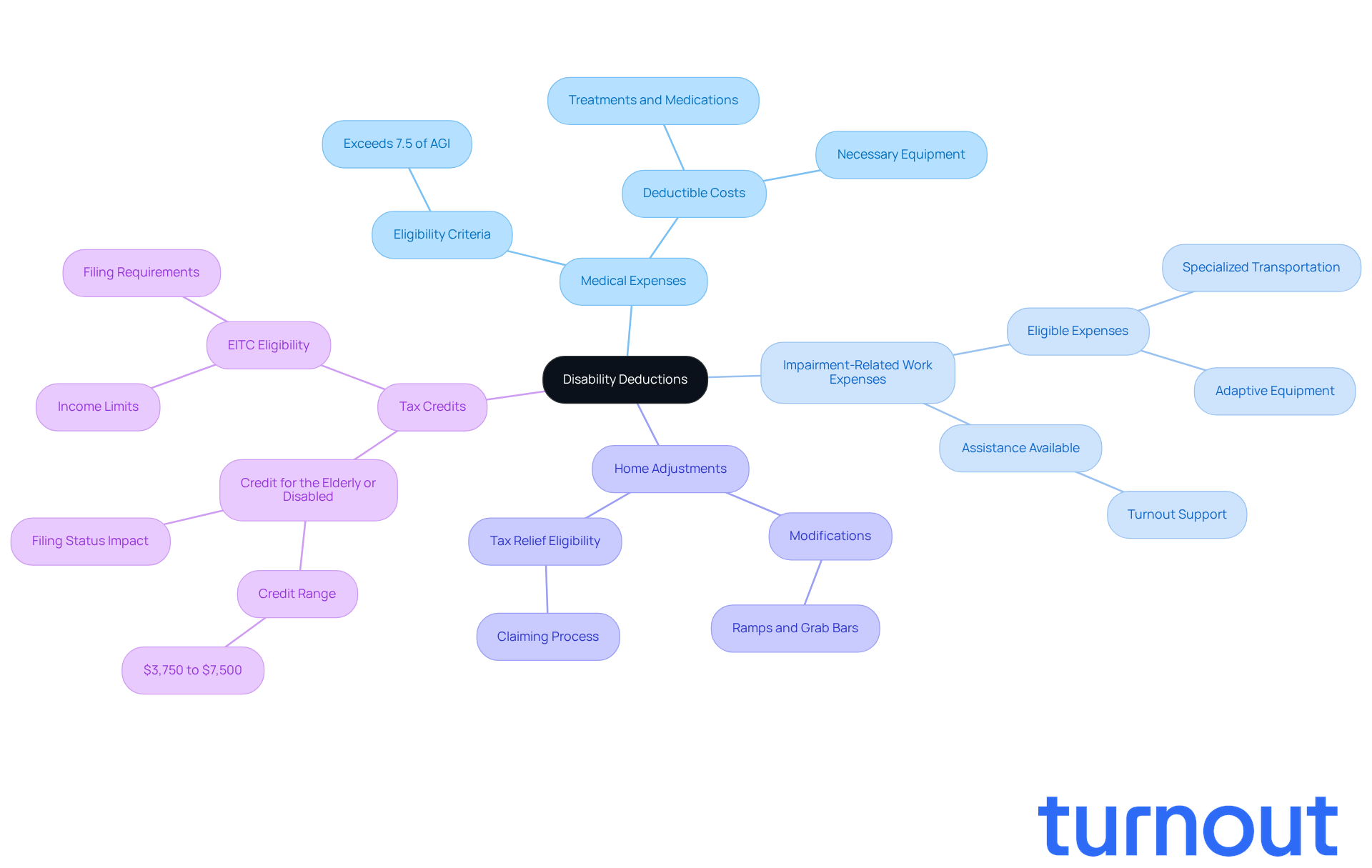

-

Medical Expenses: Did you know that costs related to medical care-like treatments, medications, and necessary equipment-can be deducted? If these expenses exceed 7.5% of your adjusted gross income (AGI), you can claim them. Our trained nonlawyer advocates at Turnout are here to help you navigate the documentation and claiming process effectively.

-

Impairment-Related Work Expenses are expenses directly tied to your condition that help you work, such as specialized transportation or adaptive equipment, which can be eligible for disability deductions. Turnout can assist you in recognizing and organizing these expenses to maximize your tax benefits.

-

Home Adjustments: Making your home more accessible can come with costs, such as adding ramps or grab bars. Good news! These modifications may qualify for tax relief. Turnout's resources are available to guide you through claiming these necessary changes.

-

Tax Credits: There are various credits available, like the Credit for the Elderly or the Disabled, which can provide additional financial relief. For 2025, this credit ranges from $3,750 to $7,500 based on your filing status. Turnout can help you determine your eligibility and assist with the application process.

We understand that navigating these options can feel overwhelming. But remember, you are not alone in this journey. Turnout is here to support you with trained nonlawyer advocates for SSD requests and IRS-licensed enrolled agents for tax debt relief. Together, we can ensure you access the benefits you need without the complexities of legal representation.

Implement Effective Claiming Strategies

To effectively claim disability deductions, it’s important to consider a few supportive strategies:

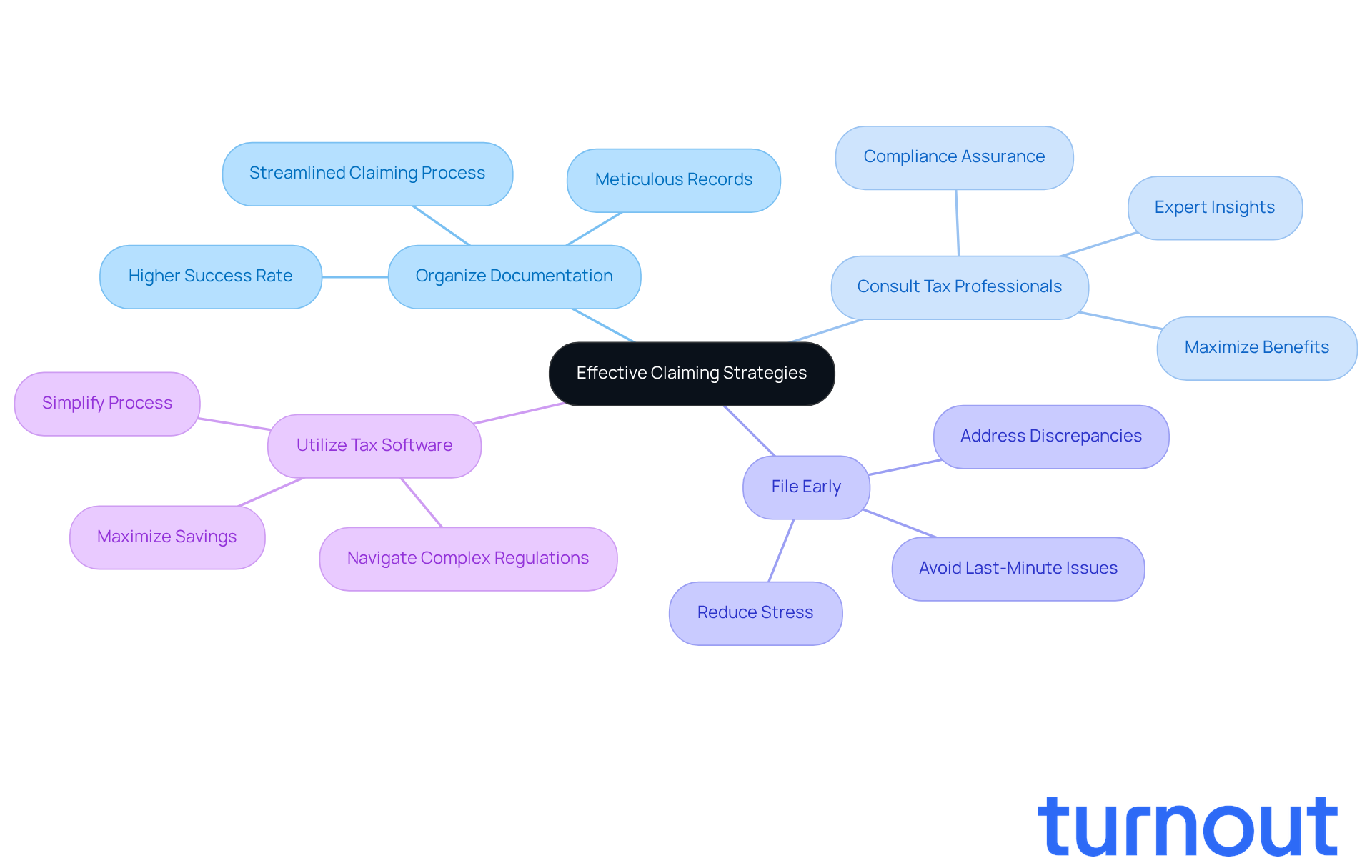

- Organize Documentation: Keeping meticulous records of all medical expenses, receipts, and relevant documentation can make a world of difference. This not only streamlines the claiming process but also provides necessary evidence if the IRS has questions. Many individuals who documented their medical expenses accurately found a higher success rate in their claims, showing just how crucial organization can be.

- Consult Tax Professionals: We understand that navigating tax matters can be overwhelming. Engaging with a tax expert who specializes in disability deductions can provide valuable insights into maximizing your benefits while ensuring compliance with tax regulations. Their expertise can help you discover lesser-known allowances that might significantly impact your tax return. Turnout can connect you with IRS-licensed enrolled agents who are ready to support you through this process.

- File Early: It’s common to feel anxious about tax season. Submitting your tax return early can help you avoid last-minute issues and give you time to address any discrepancies that may arise. Early filing has been shown to reduce stress and increase the likelihood of receiving refunds promptly. As the IRS states, "Direct Deposit is the safest and fastest way to receive a tax refund."

Utilize tax software to assist you in claiming disability deductions, ensuring you don’t miss out on potential savings. These tools simplify the process and help you navigate complex tax regulations effectively.

By applying these strategies, you can greatly improve your ability to secure the benefits you deserve, ultimately enhancing your financial well-being. For instance, the Earned Income Tax Credit (EITC) can be worth up to $8,046 for eligible individuals in 2025, underscoring the importance of thorough documentation and timely filing. Remember, Turnout is here to help you navigate these complexities without the need for legal representation. You are not alone in this journey.

Maintain Comprehensive Documentation

Accurate documentation is the cornerstone of any successful tax claim, particularly for individuals who can benefit from disability deductions. We understand that navigating this process can be challenging, but keeping thorough records can make a significant difference. Here are some key elements to maintain:

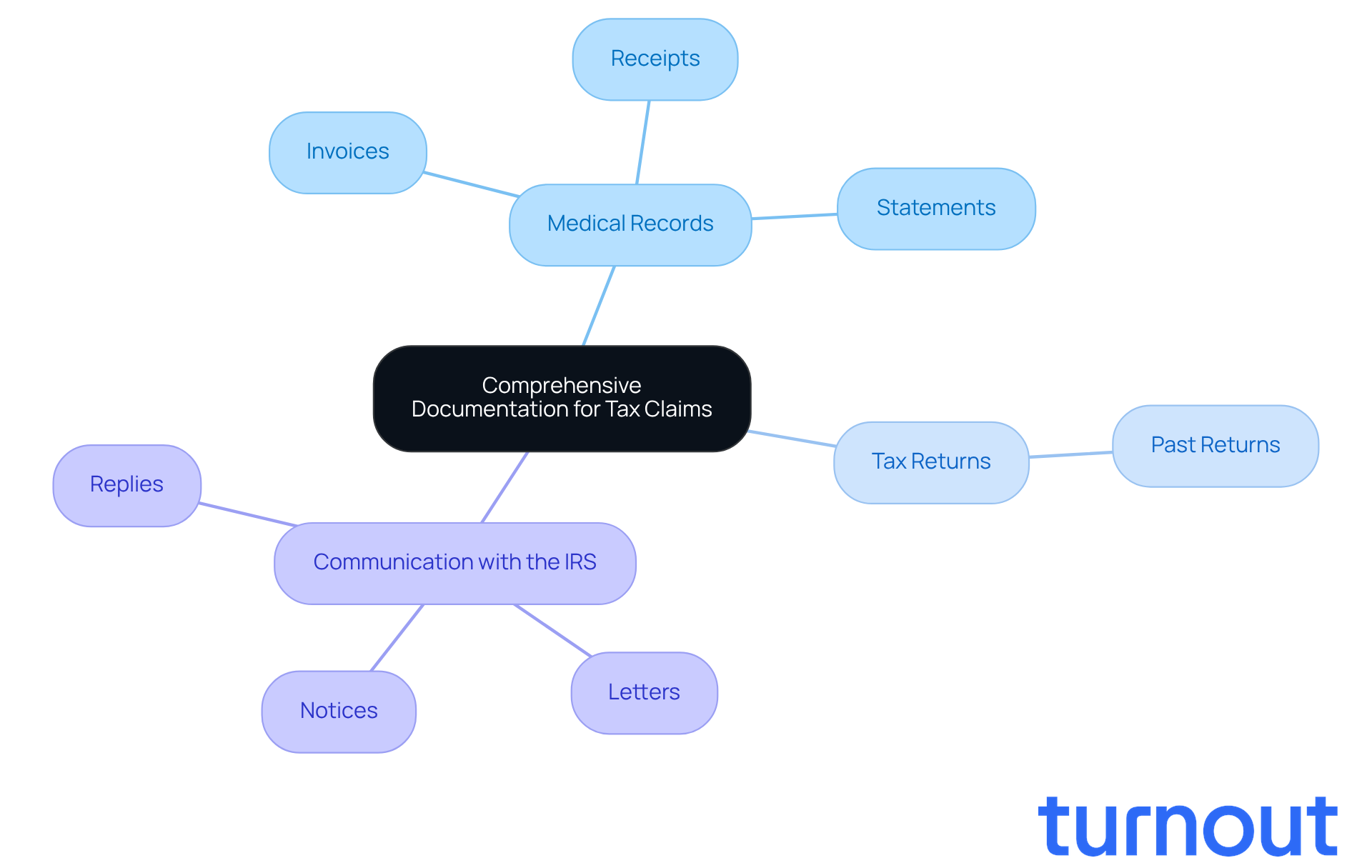

-

Medical Records: It's essential to keep detailed records of all medical treatments, prescriptions, and related expenses. This includes invoices, receipts, and statements from healthcare providers. Did you know that 1 in 4 adults in the U.S. experience a limitation? This statistic underscores the importance of careful documentation to optimize potential tax benefits such as disability deductions. Maintaining a log of all expenses related to your disability deductions is crucial. This includes transportation costs, home modifications, and any other relevant expenditures. By doing this, you can identify expenses eligible for disability deductions that might otherwise be overlooked.

-

Tax Returns: Keeping copies of past tax returns can provide valuable context for your current submissions. They help in recognizing trends in your deductions, which is invaluable when preparing for audits or inquiries.

-

Communication with the IRS: Record any interaction with the IRS regarding your requests, including letters, notices, and replies. This practice is vital for addressing any questions or disputes that may arise.

In the words of Mark Friedlich, "Accounting is the language of business," and in the realm of tax requests, clear documentation speaks volumes. By keeping thorough records, you can ensure that you're ready for any inquiries and can effectively support your assertions. Remember, it's common to feel overwhelmed by the documentation process. Be mindful of typical mistakes, like not retaining receipts or overlooking to record all pertinent expenses, as these can hinder your ability to obtain deductions. Successful tax claims for disability deductions often hinge on the quality of documentation, so let's prioritize thoroughness in your record-keeping. You're not alone in this journey; we're here to help.

Leverage Professional Guidance and Technology

Navigating tax filing can be challenging, especially for individuals with disabilities who can benefit from disability deductions. But don’t worry; there are resources available to make this process smoother and more manageable.

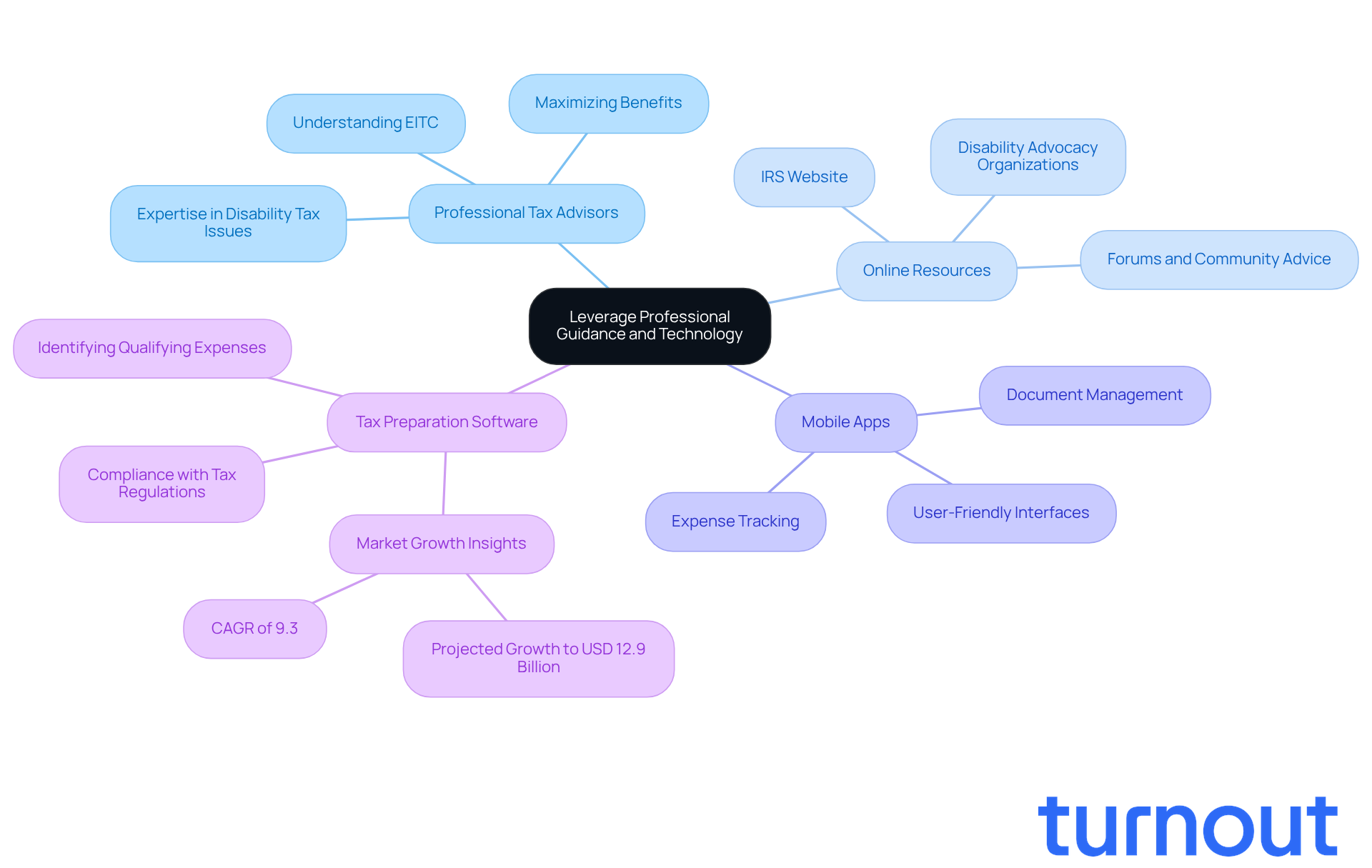

Consider investing in reliable tax preparation software that accommodates individuals with disability deductions. These tools can help identify qualifying expenses and simplify the filing process, ensuring you stay compliant with the latest tax regulations. Did you know that the U.S. tax preparation software market is expected to grow from USD 6.4 billion in 2024 to USD 12.9 billion by 2032? This growth highlights the increasing need for effective tax management solutions.

-

Professional Tax Advisors: Hiring a tax advisor who specializes in disability-related tax issues can be a game-changer. Their expertise allows them to navigate complex regulations and maximize your potential benefits. For instance, many tax consultants emphasize understanding credits like the Earned Income Tax Credit (EITC), which can lead to significant savings without affecting certain public benefits. As the National Disability Institute points out, one approach to assist in establishing a more secure financial future is to understand and take advantage of specific tax reductions, income exclusions, credits, and disability deductions that individuals facing challenges may be eligible for.

-

Online Resources: Don’t forget to tap into online materials and forums where others share their experiences and advice about disability deductions for those with disabilities. Websites from the IRS and disability advocacy organizations often provide valuable insights and updates on available benefits.

-

Mobile Apps: Explore mobile applications designed to help you track expenses and manage documentation throughout the year. These tools can make tax preparation less stressful and more organized.

By leveraging these resources, you can simplify your tax preparation process and effectively maximize your deductions. Remember, you’re not alone in this journey, and with the right support, you can pave the way to a more stable financial future.

Conclusion

Maximizing disability deductions is essential for easing the financial burden that individuals with impairments often face. We understand that navigating these complexities can be overwhelming. By grasping the available deductions, employing effective claiming strategies, keeping thorough documentation, and seeking professional guidance, you can significantly boost your chances of receiving the tax benefits you deserve.

Let’s explore some key points. There are various types of disability deductions, including:

- Medical expenses

- Impairment-related work expenses

- Home adjustments

- Tax credits

Organizing your documentation, consulting with tax professionals, and filing early are crucial steps that can lead to greater financial relief. Plus, utilizing technology and online resources can simplify the tax preparation process, making it more manageable for you.

These practices go beyond just saving on taxes; they pave the way to financial stability and empowerment for individuals with disabilities. By actively engaging with these resources and strategies, you can take control of your financial future and ensure you’re not leaving any benefits on the table. Remember, you are not alone in this journey. Embrace the support available and take the necessary steps to maximize your disability deductions in 2025.

Frequently Asked Questions

What are disability deductions?

Disability deductions are tax benefits available to individuals with impairments that can help ease their financial burden by allowing them to deduct certain expenses from their taxable income.

What medical expenses can be deducted?

You can deduct medical expenses related to treatments, medications, and necessary equipment if they exceed 7.5% of your adjusted gross income (AGI).

What are impairment-related work expenses?

Impairment-related work expenses are costs directly tied to your condition that help you work, such as specialized transportation or adaptive equipment, which may be eligible for disability deductions.

Can home modifications be deducted for tax purposes?

Yes, costs associated with making your home more accessible, such as adding ramps or grab bars, may qualify for tax relief.

What tax credits are available for individuals with disabilities?

Various tax credits are available, including the Credit for the Elderly or the Disabled, which ranges from $3,750 to $7,500 for 2025, depending on your filing status.

How can Turnout assist with disability deductions and credits?

Turnout provides trained nonlawyer advocates to help you navigate the documentation and claiming process for disability deductions and credits, ensuring you access the benefits you need.

What support does Turnout offer for tax-related issues?

Turnout offers support through IRS-licensed enrolled agents for tax debt relief, helping you manage and optimize your tax situation without the complexities of legal representation.