Introduction

Navigating the complexities of the 38 revenue collection unit can often feel like traversing a maze. With numerous departments and personnel involved in the process of debt recovery, it’s easy to feel overwhelmed. We understand that many individuals face the challenge of not knowing where to start or how to communicate effectively within this intricate system.

Understanding the structure and function of this unit is essential. It empowers you to manage your interactions and streamline your efforts in resolving outstanding debts. You are not alone in this journey; many share your concerns. What best practices can be employed to ensure successful engagement and favorable outcomes?

Let’s explore some supportive strategies together. By acknowledging your struggles and providing clear steps, we can help you navigate this process with confidence.

Understand the Structure and Function of the 38 Revenue Collection Unit

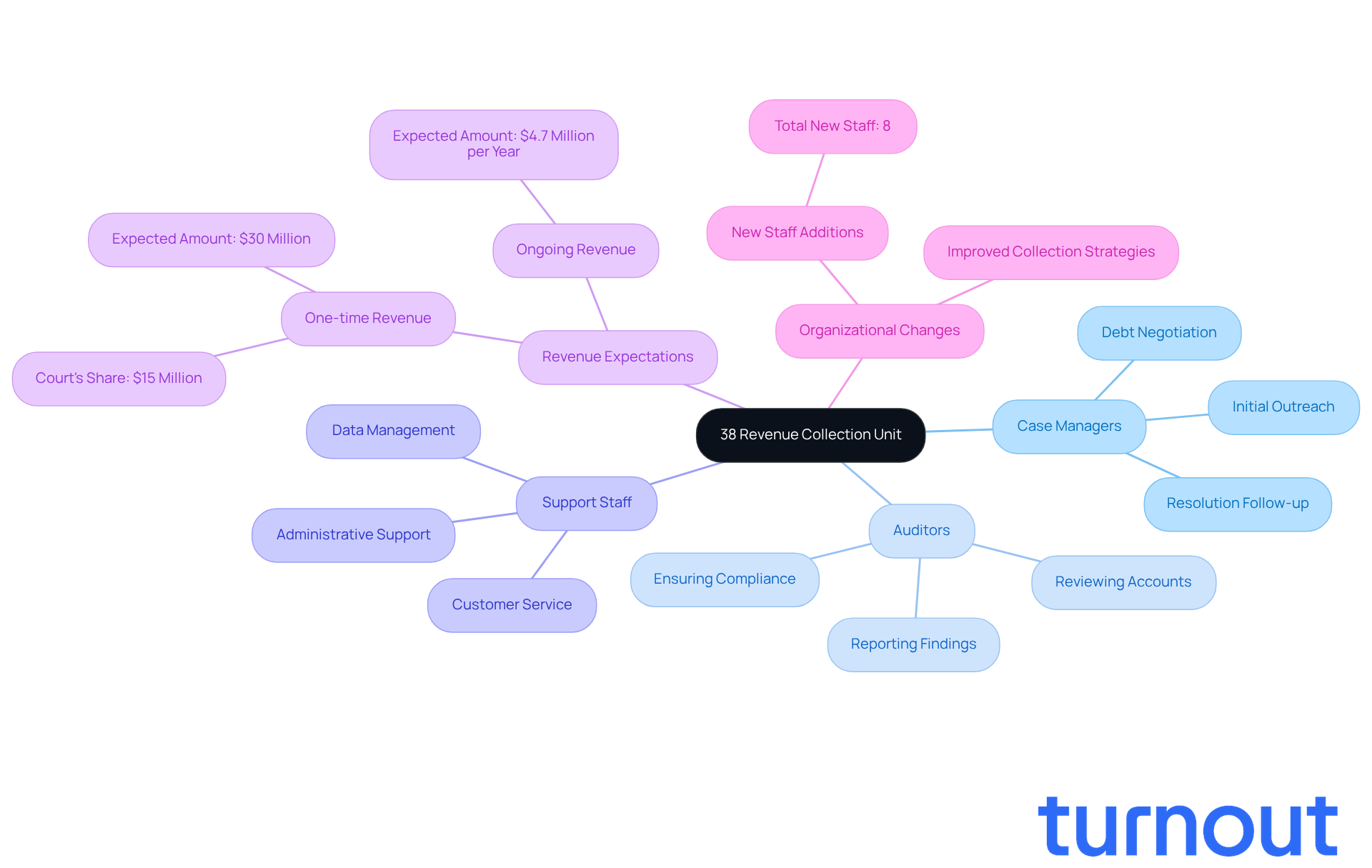

The 38 revenue collection unit plays a vital role in government revenue management by focusing on collecting outstanding debts such as taxes and fees. We understand that navigating this system can be challenging, and recognizing the various departments and personnel involved - such as case managers, auditors, and support staff - can make a difference. Each individual has a unique role in the process, from initial outreach to final resolution. Familiarizing yourself with these roles can empower you to know whom to contact for specific issues and how to escalate matters if needed.

As consultant Kate Harrison points out, "The court anticipates one-time revenue receipts of nearly $30 million, half to benefit the court." This significant expectation highlights the importance of understanding how the 38 revenue collection unit operates and the roles within the unit. Additionally, the court expects ongoing revenue of $4.7 million per year, reflecting the impact of recent organizational changes aimed at improving revenue collection efforts. These enhancements are crucial for effective navigation and can lead to more favorable outcomes in resolving outstanding debts.

We’re here to help you through this journey. Understanding the operational procedures of the 38 revenue collection unit, such as response timelines and gathering methods, can prepare you for what to expect during your interactions. Remember, you are not alone in this process. If you have questions or need assistance, don’t hesitate to reach out. Together, we can work towards resolving your concerns.

Prepare Essential Documentation for Effective Engagement

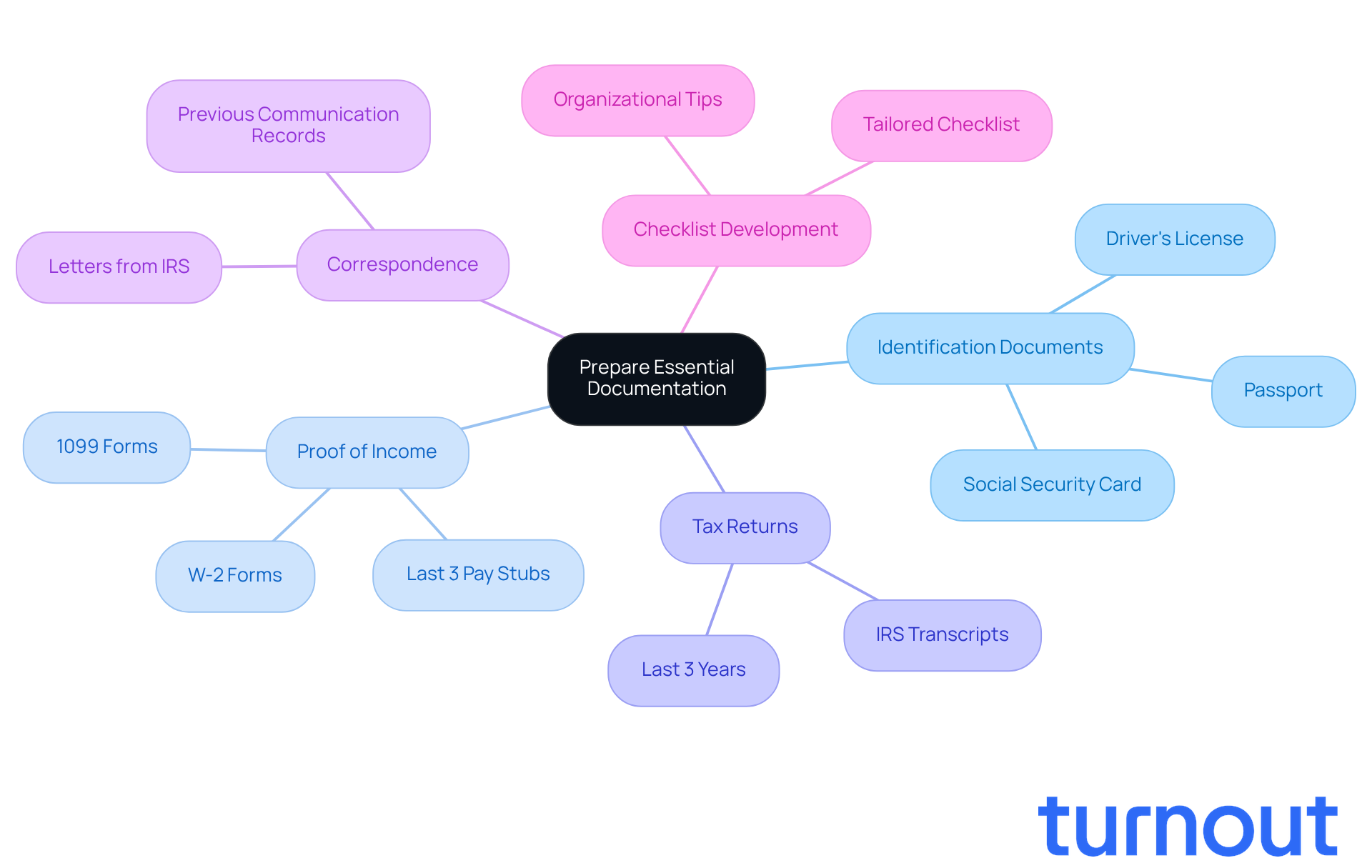

When engaging with the 38 revenue collection unit, we recognize that compiling all necessary documentation can feel overwhelming. It’s important to gather identification documents, proof of income, tax returns, and any correspondence related to your situation ahead of time. By organizing these documents clearly, you can make your interactions with the 38 revenue collection unit much smoother.

Consider maintaining a comprehensive file that consolidates all relevant interactions. This way, you can easily reference past discussions and clarify any misunderstandings that may arise. It’s common to feel uncertain about what to include, so think about developing a checklist tailored to your specific needs. This will help ensure that no essential information is overlooked, which could impact the outcome of your situation.

Remember, while Turnout offers support through trained nonlawyer advocates and IRS-licensed enrolled agents, they do not provide legal representation. Being well-prepared is essential for effective engagement. You are not alone in this journey; we’re here to help you navigate through it.

Utilize Clear Communication Strategies for Successful Interactions

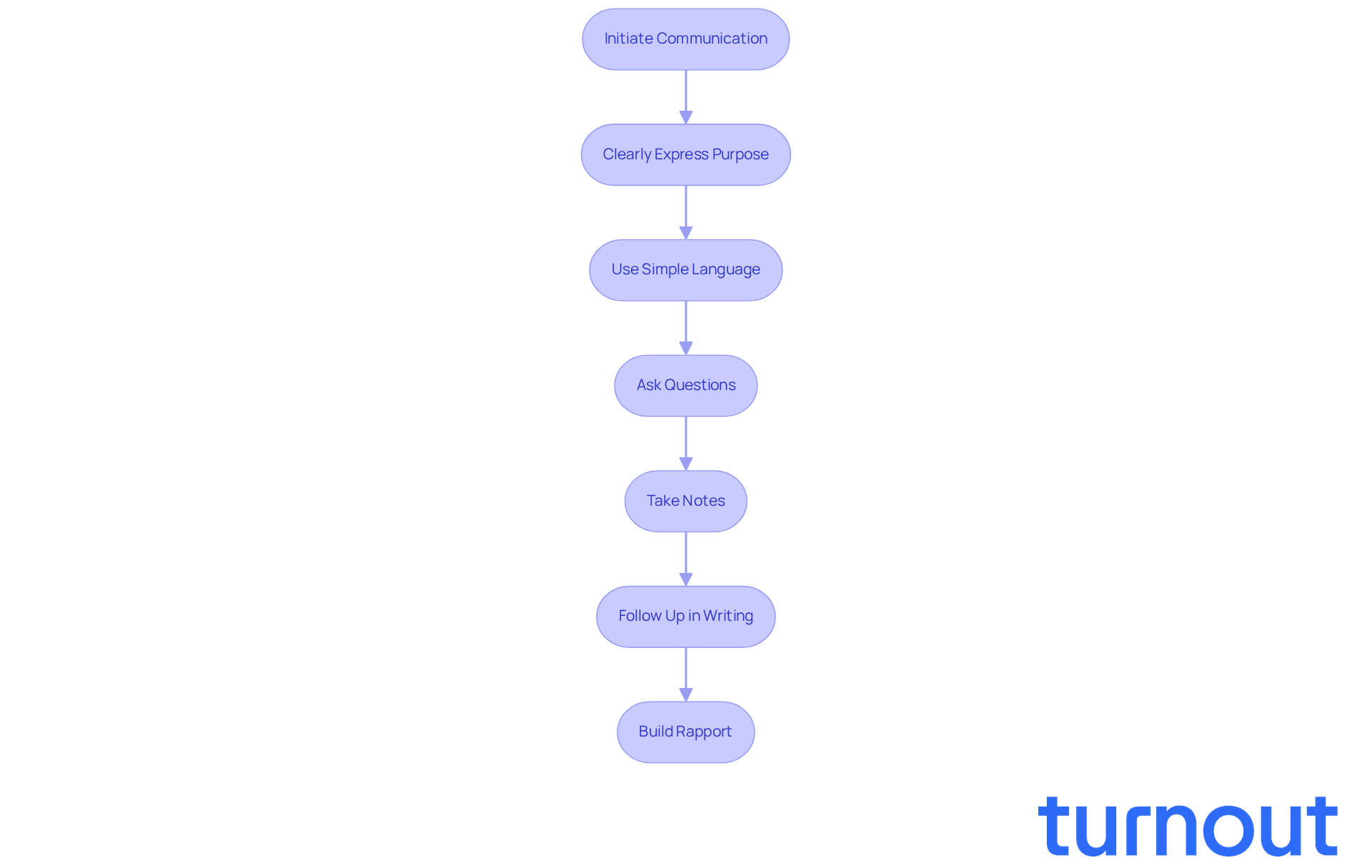

Effective communication is essential when engaging with the 38 revenue collection unit. We understand that navigating this process can be challenging. Start by clearly expressing your purpose for contacting them, including any relevant reference numbers or identifiers. Using simple, straightforward language can help avoid confusion, so steer clear of jargon that might hinder understanding.

It's common to feel uncertain, so be prepared to ask questions if anything is unclear. Taking notes during your conversations can help you capture essential information. Following up in writing is also a great idea; summarize your understanding of the discussion and any agreed-upon next steps. This practice not only reinforces your comprehension but also creates a documented record of your interactions, which can be invaluable in case of future disputes.

As communication expert Stephen R. Covey noted, high trust levels facilitate easier and more effective dialogue. Building rapport with the personnel you interact with is crucial. By employing these strategies, you can significantly improve your resolution rates and navigate the complexities of the revenue collection process with greater confidence. Remember, you are not alone in this journey; we're here to help.

Implement Follow-Up Practices to Ensure Progress

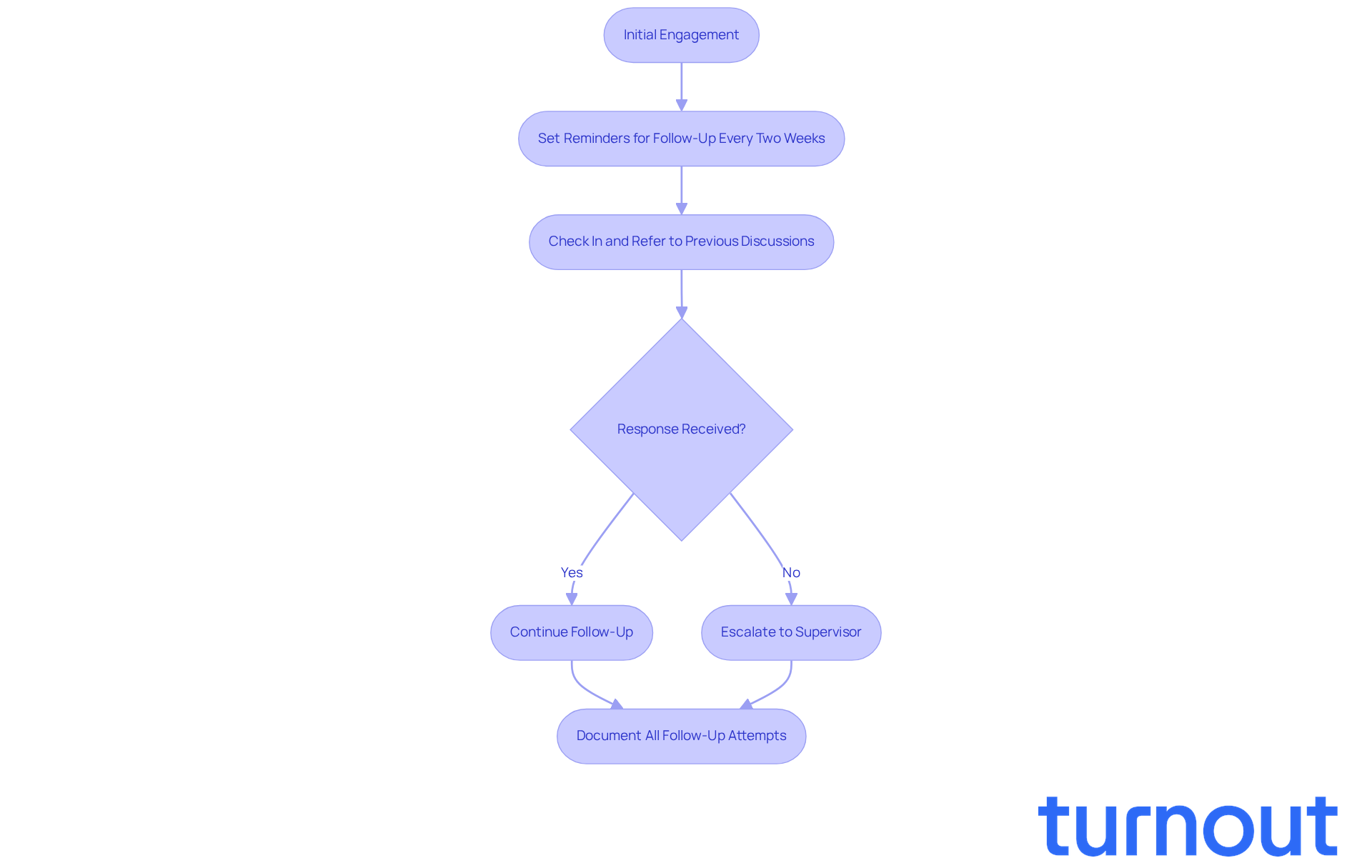

After your initial engagement with the 38 revenue collection unit, establishing a strong follow-up strategy is important. We understand that navigating this process can be challenging, so setting reminders to check in on your situation every two weeks can make a difference. During these follow-ups, refer back to your earlier discussions and ask if there are any updates or additional information needed.

If you don’t receive a timely response, it’s perfectly okay to escalate the issue. Request to speak with a supervisor or a higher authority within the unit. Remember, documenting all your follow-up attempts is crucial. Keep track of dates, times, and the names of individuals you spoke with. This record can be invaluable when advocating for your case or addressing ongoing delays.

By maintaining consistent communication and thorough documentation, you significantly enhance your chances of a favorable resolution. It’s common to feel overwhelmed, but you’re not alone in this journey. While Turnout offers support through trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, effective follow-up is key to successfully navigating these complex processes. We’re here to help you every step of the way.

Conclusion

Navigating the complexities of the 38 revenue collection unit can feel overwhelming. We understand that dealing with debt resolution and government revenue management is no small task. By familiarizing yourself with the structure and functions of this unit, you can interact more confidently with its various departments and personnel. This knowledge empowers you to streamline your approach and increases your chances of achieving favorable outcomes in resolving outstanding debts.

Key practices to consider include:

- Preparing essential documentation

- Employing clear communication strategies

- Implementing follow-up practices

Compiling necessary documents ensures that your interactions are efficient. Effective communication fosters understanding and builds rapport with unit personnel. Additionally, consistent follow-up keeps the process on track and reinforces the importance of accountability within the unit.

Ultimately, mastering these best practices is crucial for anyone dealing with the 38 revenue collection unit. By taking proactive steps-such as organizing your documentation, communicating clearly, and following up diligently-you can navigate this often daunting process with greater ease and confidence. Remember, you are not alone in this journey. Embracing these strategies not only aids in your personal situation but also contributes to the overall effectiveness of government revenue management. Together, we can foster a more efficient system.

Frequently Asked Questions

What is the primary role of the 38 revenue collection unit?

The primary role of the 38 revenue collection unit is to manage government revenue by focusing on collecting outstanding debts, such as taxes and fees.

Who are the key personnel involved in the 38 revenue collection unit?

Key personnel in the 38 revenue collection unit include case managers, auditors, and support staff, each with unique roles in the debt collection process.

Why is it important to understand the roles within the 38 revenue collection unit?

Understanding the roles within the unit can help individuals know whom to contact for specific issues and how to escalate matters if needed, making the navigation of the system easier.

What are the expected revenue receipts for the court from the 38 revenue collection unit?

The court anticipates one-time revenue receipts of nearly $30 million, with half of that amount benefiting the court, and ongoing revenue of $4.7 million per year.

How have recent organizational changes impacted the 38 revenue collection unit?

Recent organizational changes have been aimed at improving revenue collection efforts, which is reflected in the expected ongoing revenue of $4.7 million per year.

What operational procedures should individuals be aware of when interacting with the 38 revenue collection unit?

Individuals should understand the operational procedures, including response timelines and gathering methods, to better prepare for their interactions with the unit.

What should I do if I have questions or need assistance regarding the 38 revenue collection unit?

If you have questions or need assistance, you are encouraged to reach out for help, as support is available to work towards resolving your concerns.