Introduction

Understanding the complexities of withholding allowances can feel overwhelming. Many individuals find themselves confused by the details, and that’s completely normal. This guide aims to simplify the process, providing clear steps to help you determine the right number of allowances that align with your financial goals and life changes.

But how do you find the right balance between maximizing your take-home pay and avoiding unexpected tax bills? It’s a common concern, and exploring this question can empower you to take control of your tax situation. By making informed decisions, you can pave the way toward financial stability.

We’re here to help you navigate this journey. You are not alone in this process, and together, we can work towards a clearer understanding of your financial landscape.

Understand Withholding Allowances and Their Purpose

Withholding exemptions can feel a bit overwhelming, but they’re simply deductions that help reduce the amount of income tax taken from your paycheck. Each deduction you claim on your W-4 form, which is determined by the number of withholding allowances, lowers your taxable income and directly affects how much tax is withheld. Understanding this can really empower you in managing your finances effectively.

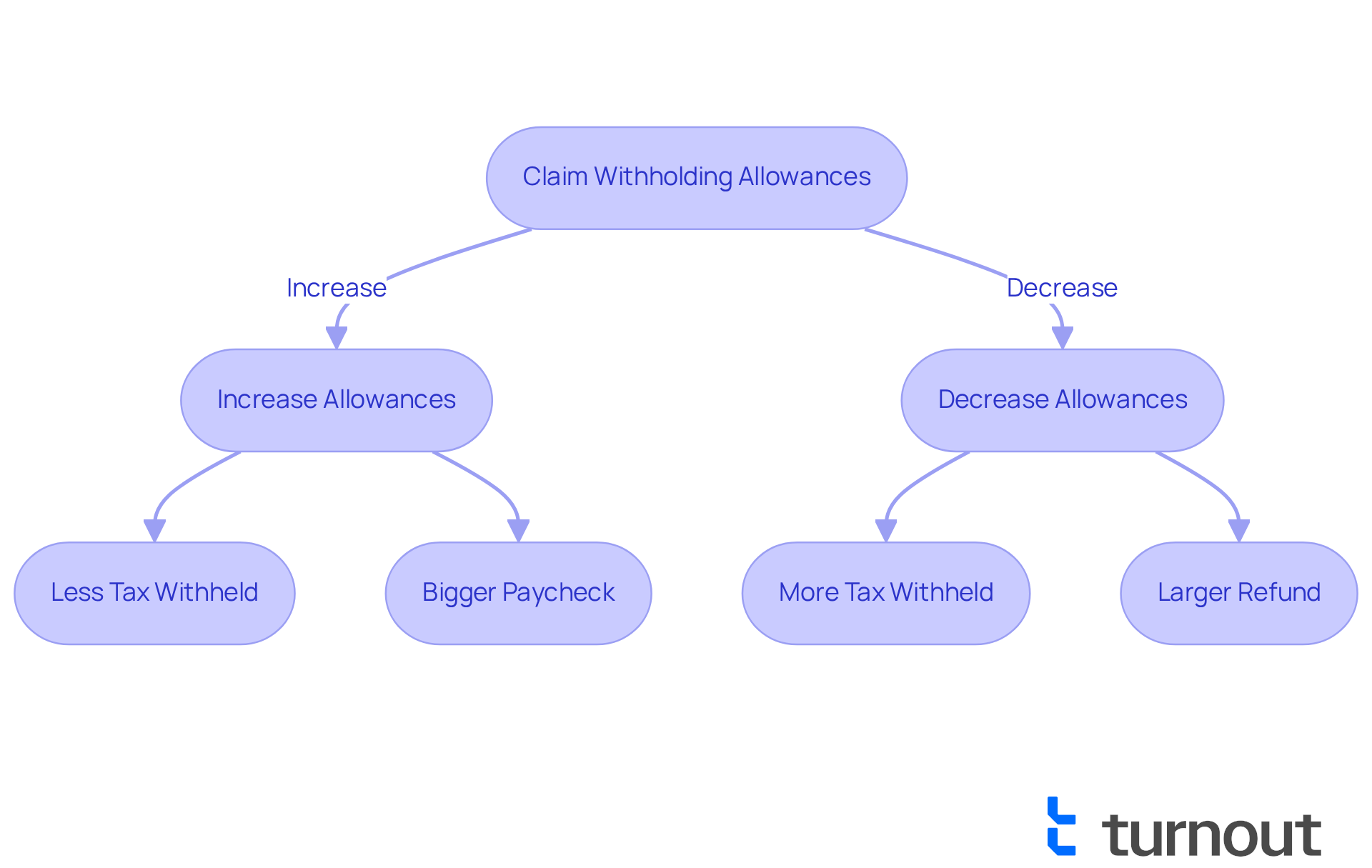

When you request an increase in the number of withholding allowances, you’ll see less tax withheld, which means a bigger paycheck. However, this could lead to a smaller tax refund or even a tax bill when the year ends, depending on the number of withholding allowances. On the flip side, claiming fewer deductions can lead to an increased number of withholding allowances, meaning more tax is withheld, which potentially results in a larger refund but less take-home pay throughout the year.

In 2025, many Americans claimed significantly fewer exemptions than in previous years, reflecting a shift in how people approach tax planning. Financial advisors often emphasize the importance of managing the number of withholding allowances carefully to align with your personal financial goals. For example, Amanda Dixon, a personal finance writer, reminds us that "finding a financial advisor doesn’t have to be hard" and can offer personalized guidance on managing your withholding.

Getting familiar with these provisions is a great first step toward improving your tax situation. It allows you to balance your immediate cash flow needs with your overall tax obligations. Just remember, claiming too many deductions while not properly accounting for the number of withholding allowances might lead to owing money to the IRS, so it’s crucial to find that sweet spot.

The updated Form W-4 is a helpful tool in this process, making it easier to determine the number of withholding allowances for claiming exemptions. Real-life stories show that individuals who claimed excessive exemptions often faced unexpected tax bills. This highlights the importance of being thoughtful when filling out your W-4.

You’re not alone in navigating this journey, and we’re here to help you make informed decisions that suit your financial needs.

Calculate Your Ideal Number of Withholding Allowances

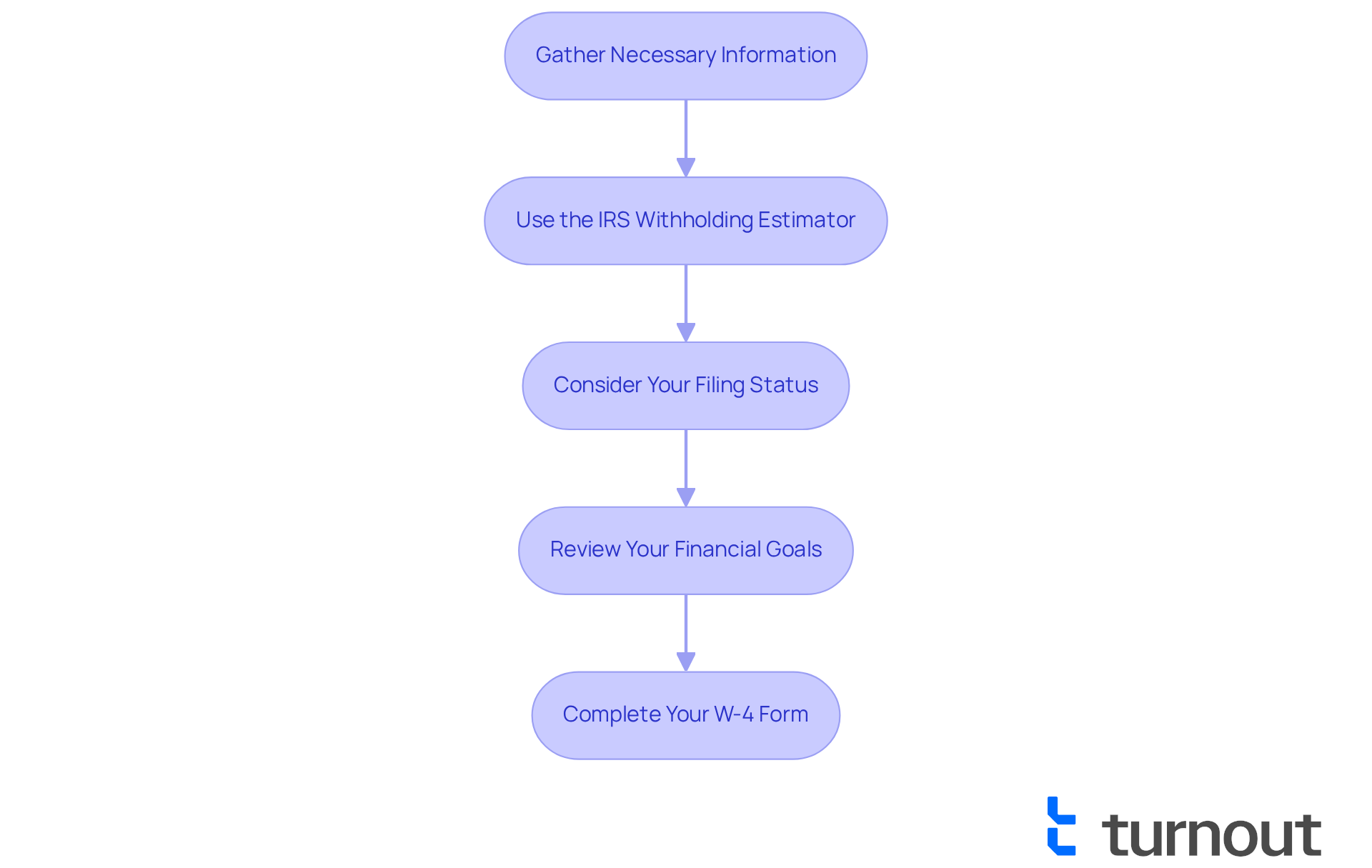

Although calculating the ideal number of withholding allowances can feel overwhelming, we're here to help you through it. Follow these steps to make the process smoother:

-

Gather Necessary Information: Start by collecting your most recent pay stub, last year’s tax return, and details about any dependents or deductions. Don’t forget to include all income statements from other sources. Having these documents ready is crucial for an accurate assessment.

-

Use the IRS Withholding Estimator: Visit the IRS website and take advantage of the Tax Withholding Estimator. This free tool guides you through a series of questions tailored to your financial situation, helping you determine the right number of withholding allowances.

-

Consider your filing status: Your marital status, along with the number of withholding allowances you have due to dependents, can significantly impact your tax situation. For instance, married individuals often claim more exemptions than singles, which can lead to a more favorable tax outcome. Understanding the typical deductions for different filing statuses can provide valuable context.

-

Review Your Financial Goals: Think about your financial objectives for the year. If you anticipate major changes in income or expenses—like buying a home or welcoming a child—consider adjusting the number of withholding allowances to increase your take-home pay. Many find that aligning their deductions with their financial goals helps manage tax liabilities more effectively. Remember, it’s wise to reassess your tax deductions after significant life changes to avoid unexpected tax bills or penalties.

-

Complete Your W-4 Form: Once you’ve calculated the number of withholding allowances, fill out the W-4 form with the correct details and submit it to your employer as soon as possible. This ensures your deductions are adjusted throughout the year, helping you avoid surprises when it’s time to file your return. As the IRS suggests, making changes to your tax deductions now can help you secure the refund you desire next year.

We understand that navigating taxes can be daunting, but taking these steps can empower you to make informed decisions. You're not alone in this journey!

Adjust Withholding Based on Life Changes and Financial Goals

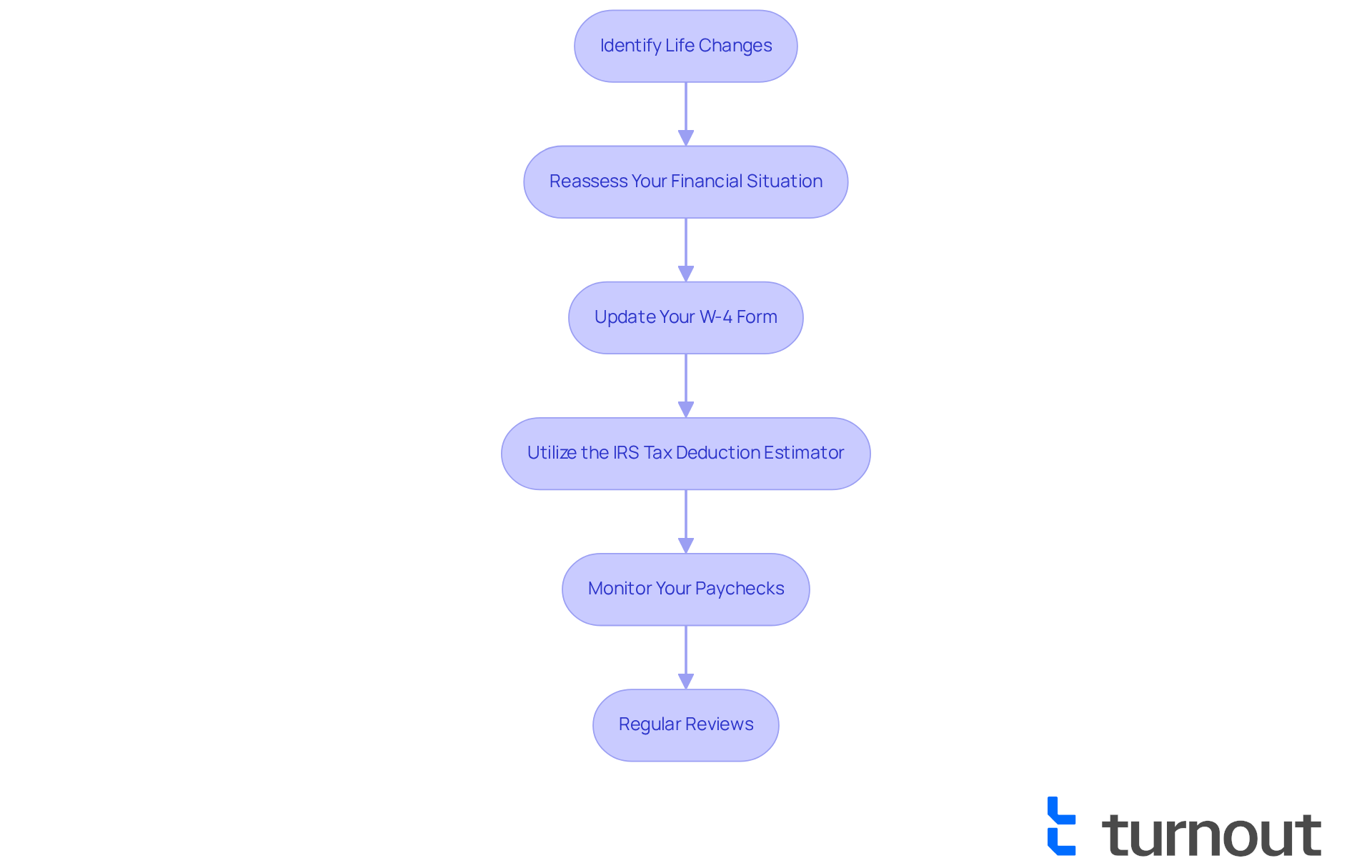

Modifying your tax exemptions is essential, especially when you face significant life changes. We understand that navigating these transitions can be overwhelming, so here’s a gentle guide to help you through:

-

Identify Life Changes: Major events like marriage, divorce, welcoming a child, starting a new job, or shifts in your spouse’s employment often signal the need to reassess your tax deductions. Recognizing these moments is the first step.

-

Reassess Your Financial Situation: After any major life event, take a moment to reflect on how these changes might affect your income and tax obligations. For example, the arrival of a child can open doors to various tax credits, significantly reshaping your financial landscape.

-

Update Your W-4 Form: If your circumstances have shifted, it’s important to fill out a new W-4 form to reflect the updated number of withholding allowances. Submitting this promptly to your employer ensures your deductions align with your current situation. Did you know that only about 30% of taxpayers update their W-4 after significant life changes? This can lead to unexpected tax bills, so don’t let it catch you off guard.

-

Utilize the IRS Tax Deduction Estimator: This free tool is here to help you assess whether your deductions are appropriate based on your current financial situation. It can guide you in making necessary adjustments to your W-4, giving you peace of mind.

-

Monitor Your Paychecks: After making adjustments, keep an eye on your paychecks to ensure the correct amount is withheld. If you notice any discrepancies, don’t hesitate to reach out to your HR department or a tax professional for assistance.

-

Regular Reviews: Make it a habit to review your withholding at least once a year or whenever you experience a significant life change. This proactive approach helps you avoid under-withholding or over-withholding by effectively managing the number of withholding allowances, leading to better financial management. Remember, timely tax planning can help you avoid surprises and stay compliant with IRS rules.

You’re not alone in this journey. We’re here to help you navigate these changes with confidence.

Conclusion

Understanding and managing withholding allowances is essential for your financial well-being. We know that figuring out the right number of allowances can feel overwhelming. But by getting it right, you can balance your immediate cash flow needs with your overall tax obligations. This way, you won’t owe money at tax time, and you won’t miss out on potential refunds.

To help you navigate this complex topic, we’ve outlined a simple three-step process:

- Gather your necessary financial documents.

- Utilize tools like the IRS Withholding Estimator to guide your decisions.

- Remember to regularly reassess your withholding status, especially when significant life changes occur.

By following these steps, you can make informed choices that align with your financial goals, leading to a more secure future.

In conclusion, staying proactive about your withholding allowances is key. It not only helps you manage your taxes effectively but also empowers you to take control of your financial situation. Regularly reviewing and adjusting these allowances as your life circumstances change can prevent unexpected tax bills and keep your financial plans on track. Embracing this approach can boost your confidence in financial decision-making and lead to a more favorable tax outcome. Remember, you’re not alone in this journey; we’re here to help!

Frequently Asked Questions

What are withholding allowances and their purpose?

Withholding allowances are deductions that help reduce the amount of income tax taken from your paycheck. Each deduction claimed on your W-4 form lowers your taxable income and affects the amount of tax withheld.

How do withholding allowances affect my paycheck?

Increasing the number of withholding allowances results in less tax being withheld, leading to a larger paycheck. Conversely, claiming fewer allowances means more tax is withheld, which reduces your take-home pay.

What are the potential consequences of claiming too many withholding allowances?

Claiming too many allowances can lead to a smaller tax refund or even a tax bill at the end of the year, as you may not have withheld enough tax throughout the year.

How can claiming fewer withholding allowances benefit me?

Claiming fewer allowances results in more tax being withheld, which may lead to a larger tax refund when you file your taxes, although it means less take-home pay during the year.

What is the significance of the updated Form W-4?

The updated Form W-4 helps individuals determine the appropriate number of withholding allowances to claim, making it easier to manage their tax situation effectively.

Why is it important to manage withholding allowances carefully?

Managing withholding allowances carefully is crucial to align with personal financial goals and avoid owing money to the IRS due to improper deductions.

What should I consider when filling out my W-4?

Consider your overall tax obligations and immediate cash flow needs. It’s important to balance the number of allowances claimed to avoid unexpected tax bills.

How can I get help with managing my withholding allowances?

Seeking guidance from a financial advisor can provide personalized assistance in managing your withholding allowances and overall tax planning.