Introduction

Navigating the complex world of tax obligations can feel overwhelming for many individuals and businesses. We understand that as financial pressures mount, the search for effective debt relief solutions becomes even more urgent. In this article, we’ll explore some of the top tax law firms in Chicago that specialize in providing personalized assistance for those facing tax-related challenges.

How can you ensure you choose the right firm? It’s essential to find one that not only helps alleviate your current financial burdens but also empowers you with the knowledge to avoid future pitfalls. Remember, you are not alone in this journey, and there are professionals ready to support you.

Turnout: AI-Powered Tax Advocacy for Debt Relief

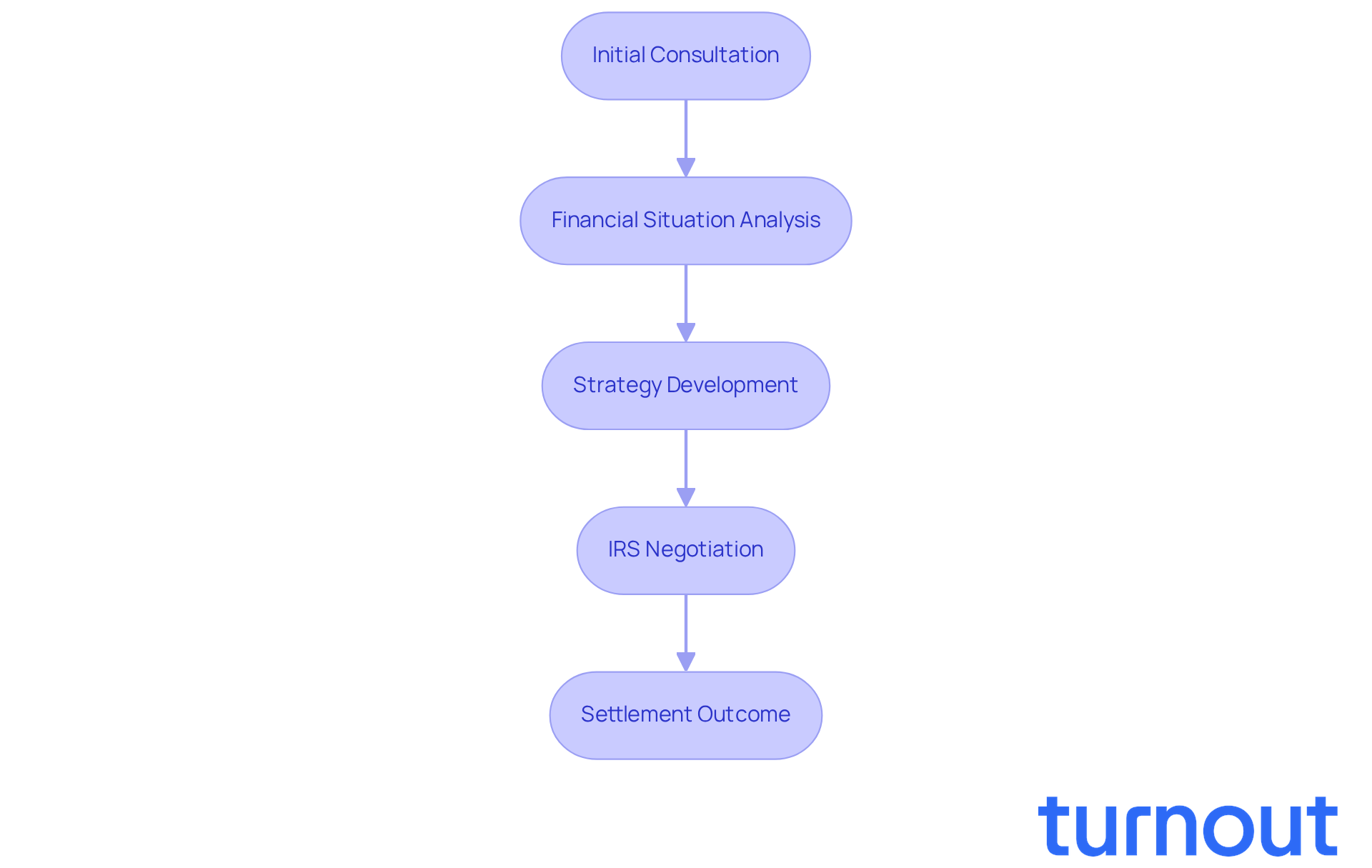

Navigating tax obligations can feel overwhelming. We understand that many people struggle with this complex terrain. That’s where Turnout comes in, utilizing advanced AI technology to transform tax advocacy services.

At the heart of this initiative is Jake, our AI case quarterback. Jake is here to streamline your management of tax-related challenges. With timely updates and comprehensive support, he makes the process smoother and less stressful.

This innovative approach not only enhances your experience but also significantly increases the chances of a successful tax resolution. By prioritizing user-friendly solutions, Turnout empowers you to regain control over your financial circumstances with confidence.

You’re not alone in this journey. We’re here to help you transform what once felt daunting into a manageable and actionable path. Let’s take this step together.

Smith & Associates: Expert Tax Law Services in Chicago

At Smith & Associates, we understand that navigating the complexities of tax law firms in Chicago can be overwhelming. Many individuals and companies face significant challenges in managing their tax obligations, which is where tax law firms Chicago can provide assistance. That’s why we’re here to help, offering extensive services from tax law firms Chicago focused on providing financial relief solutions tailored to your unique situation.

Our team of experienced tax attorneys is dedicated to offering personalized consultations. We take the time to assess your specific needs, ensuring that you feel supported every step of the way. With a strong emphasis on negotiation and settlement strategies, we aim to lighten your tax burden while ensuring compliance with IRS regulations.

It’s common to feel uncertain about options like the Offer in Compromise, especially since it has a high rejection rate in Cook County and surrounding areas. Pursuing this option too early can cost you valuable time and leverage. That’s why we encourage you to explore various resolution options available outside of this approach. We believe in empowering you with knowledge and choices.

With a proven track record of successful resolutions, we’re proud to be a top choice for those seeking expert guidance from tax law firms Chicago. Remember, you are not alone in this journey. Let us help you find the best path forward.

Johnson Tax Group: Comprehensive Tax Debt Solutions

At Johnson Tax Group, we understand that dealing with tax debt can feel overwhelming. You're not alone in this journey. Our dedicated team excels in providing comprehensive solutions tailored to your unique financial situation. We specialize in IRS negotiations, installment agreements, and offers in compromise, working closely with you to develop strategies that truly address your needs.

Imagine the relief of reducing your tax debt significantly. In recent years, we've successfully negotiated settlements that have led to savings of up to 90% for some individuals. For example, one client who faced daunting tax liabilities was able to settle for a fraction of what they owed, showcasing the potential for substantial financial relief. This is why professional representation is so crucial; it ensures you don’t leave money on the table.

We emphasize the importance of having a tax professional by your side during negotiations with the IRS. Trained revenue officers are more likely to offer favorable terms to those who are represented by experts. This strategic advantage has led to numerous success stories, where individuals not only resolved their tax issues but also avoided severe enforcement actions like levies and garnishments. With increased IRS enforcement, seeking professional help has never been more critical.

By thoroughly analyzing your financial situation, we identify opportunities for relief that may not be immediately obvious. Our commitment to helping you navigate the complexities of tax obligations has established us as one of the leading tax law firms in Chicago, making us a trusted partner in your quest for economic tranquility. Remember, we're here to help you regain control over your tax responsibilities.

Chicago Tax Relief: Personalized Legal Support for Tax Debts

At Chicago Tax Relief, we understand that dealing with tax obligations can be overwhelming. Many individuals find themselves struggling, and that’s where we come in. Our customized legal assistance is designed specifically for those facing these challenges.

We take the time to thoroughly assess your unique economic situation. This allows us to create focused strategies that aim for successful debt resolution. By prioritizing your education, we empower you to fully grasp your options and the potential consequences of your choices. This commitment to fostering understanding creates a collaborative atmosphere, enhancing the likelihood of achieving the tax relief you deserve.

It’s common to feel lost in the complexities of tax issues. That’s why we align our approach with Turnout, which helps consumers navigate these intricate economic systems, even without legal representation. We also recognize the invaluable role of IRS-licensed enrolled agents. These experts work alongside us to provide informed advice on tax relief alternatives, ensuring you’re well-prepared to make choices that fit your financial circumstances.

Remember, you are not alone in this journey. We’re here to help you every step of the way.

Tax Strategies Group: Integrating Tax Law and Financial Planning

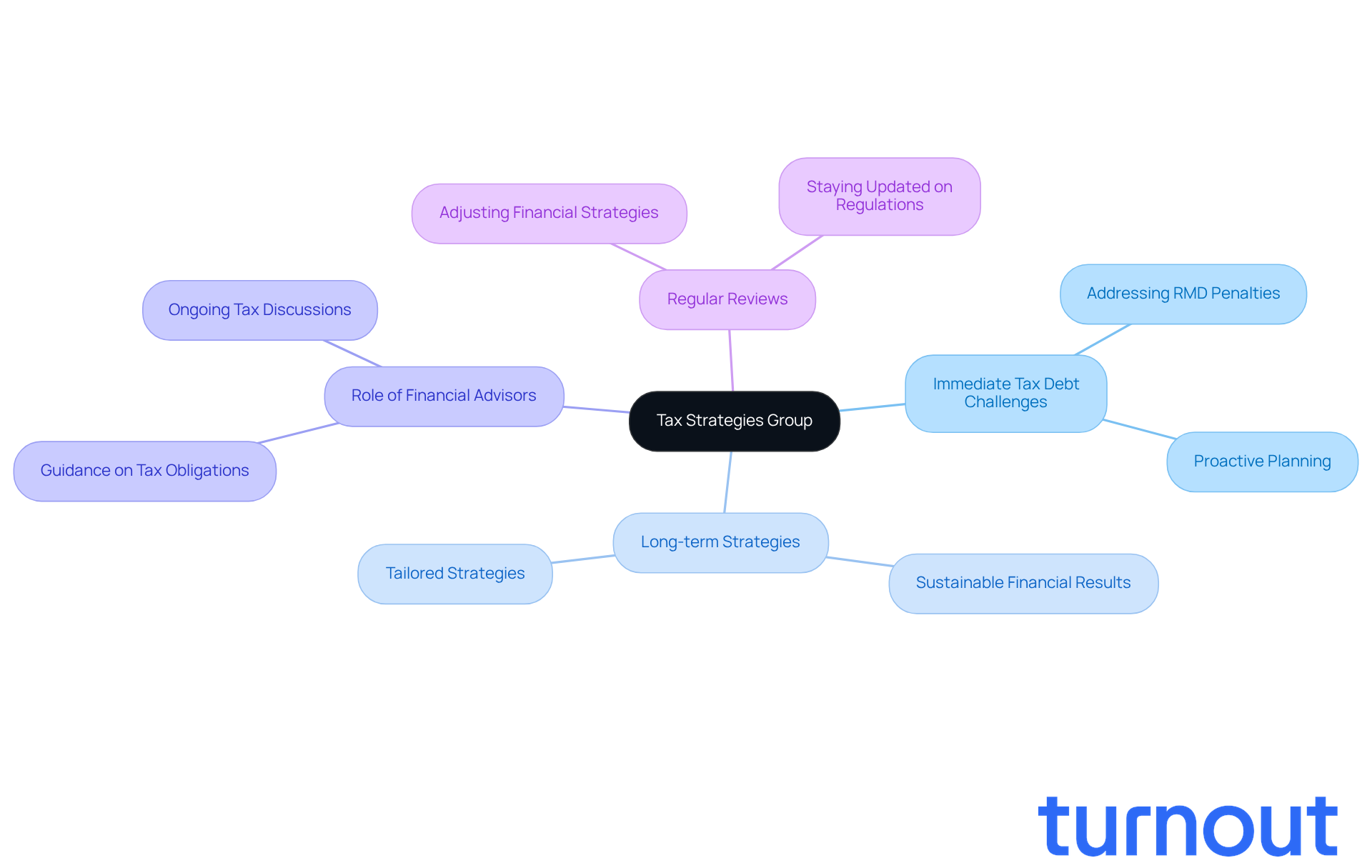

At Tax Strategies Group, we understand that navigating the services of tax law firms in Chicago can be overwhelming. Our expertise in tax law firms Chicago, combined with comprehensive planning services, enables us to support you in addressing immediate tax debt challenges while also crafting long-term strategies to ease future tax issues.

We’re here to help you create tailored strategies that not only tackle your tax responsibilities but also promote your overall economic health. Staying informed about tax regulations is crucial, and our dedicated team at tax law firms Chicago ensures you receive the most accurate and timely advice.

It’s common to feel uncertain about tax obligations, especially when research shows that one in three retirees faces penalties for missed Required Minimum Distributions (RMDs). This highlights the importance of proactive planning. Financial advisors play a pivotal role in guiding you through these complexities, ensuring that tax planning becomes an ongoing conversation rather than a seasonal task.

As planner Elijah Nicholson-Messmer wisely states, "1 in 3 retirees faces an RMD tax penalty. Here's how advisors help fix it." Our commitment to your long-term economic well-being means we address your current tax obligations while fostering sustainable financial results.

To further support you, we recommend regularly reviewing and adjusting your financial strategies. This ensures they remain effective as regulations and personal circumstances change. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Tax Defense Network: Aggressive Representation for Tax Debtors

At Tax Defense Network, we understand that dealing with tax debts can be overwhelming. You’re not alone in this journey. Our dedicated team of experienced lawyers is here to provide aggressive representation for individuals facing challenges with the IRS, including audits, liens, and levies.

We know how crucial it is to protect your rights. That’s why we adopt a proactive strategy, working diligently to negotiate favorable outcomes for you. In states like Illinois and New York, where steep tax obligations and aggressive collection tactics are common, having a strong advocate from tax law firms Chicago by your side makes all the difference.

For instance, many Illinois residents often find themselves juggling conflicting financial obligations from both state and federal authorities, prompting them to consult tax law firms Chicago. The strict enforcement by the Illinois Department of Revenue can add to your stress, making it essential to consult tax law firms Chicago. But with Tax Defense Network, you have a partner who understands these challenges and is committed to helping you navigate them.

Our success stories speak volumes about our capability to manage these situations. We focus on achieving positive results, ensuring that you have experienced advocates in this challenging tax environment. Remember, you are not alone in this fight against tax obligations. Let us help you find the relief you deserve.

Federal & State Tax Solutions: Navigating Complex Tax Challenges

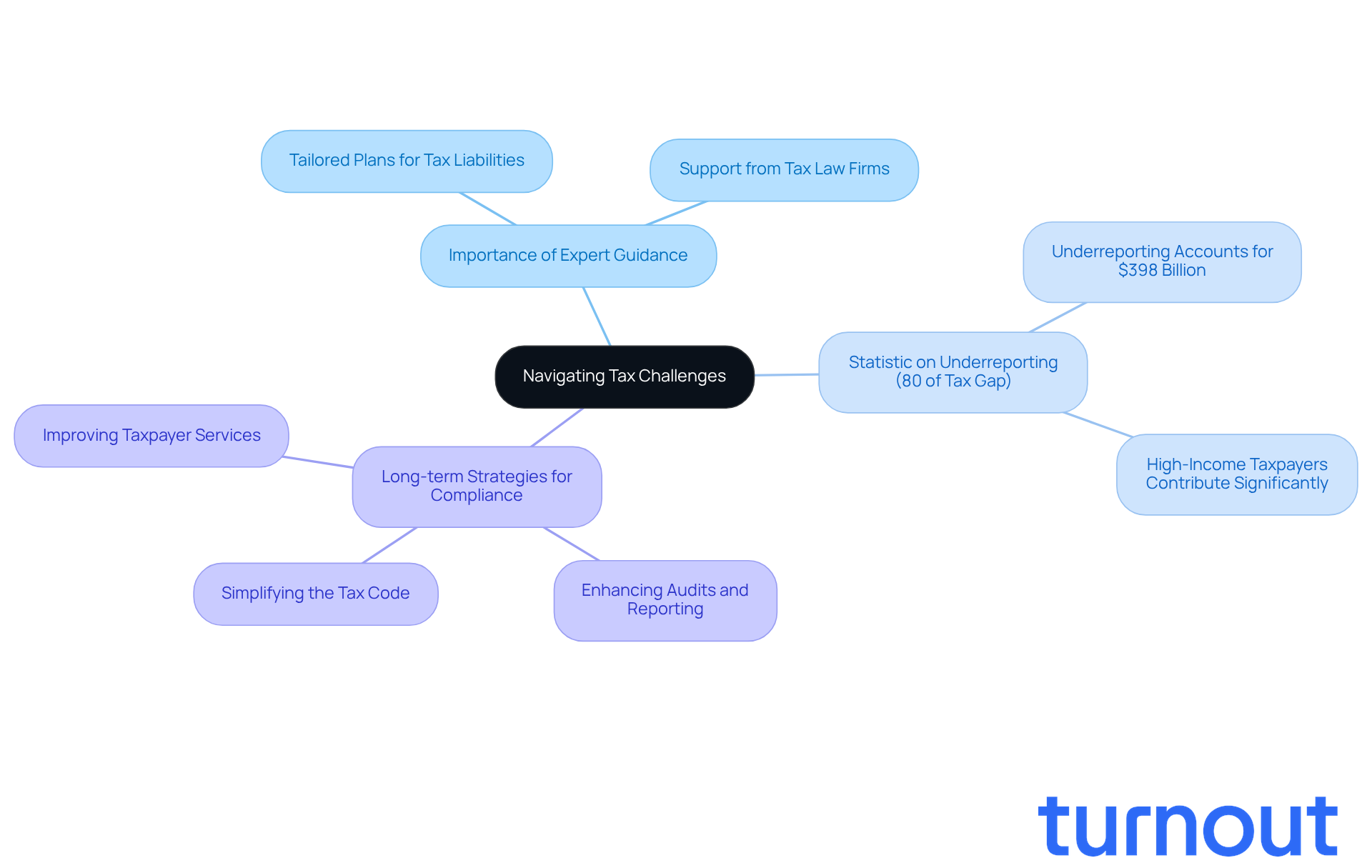

Navigating the complex world of federal and state tax laws can feel overwhelming, which is why many turn to tax law firms Chicago for assistance. At Federal & State Tax Solutions, we understand that many individuals face challenges in this area. Our team of experienced tax experts is here to help you every step of the way.

With a deep understanding of various tax regulations, we create tailored plans to address your specific tax liabilities. Did you know that underreporting accounts for a staggering 80% of the gross tax gap? This often stems from income not reported by third parties, highlighting the importance of seeking guidance from tax law firms Chicago in your journey.

By leveraging our extensive knowledge of tax law firms Chicago, we empower you to make informed decisions. This significantly increases your chances of achieving successful outcomes for your tax issues. Our approach goes beyond just addressing immediate concerns; we also focus on long-term strategies to enhance compliance and minimize future liabilities.

You are not alone in this journey. We’re here to help you navigate these challenges with care and compassion. Let us support you in finding the best solutions for your tax needs.

Innovative Tax Solutions: Technology-Driven Tax Debt Relief

We understand that dealing with tax obligations can be overwhelming. Innovative Tax Solutions is here to help you navigate these challenges with care and expertise. By leveraging advanced technology, we provide effective tax relief services tailored to your unique needs.

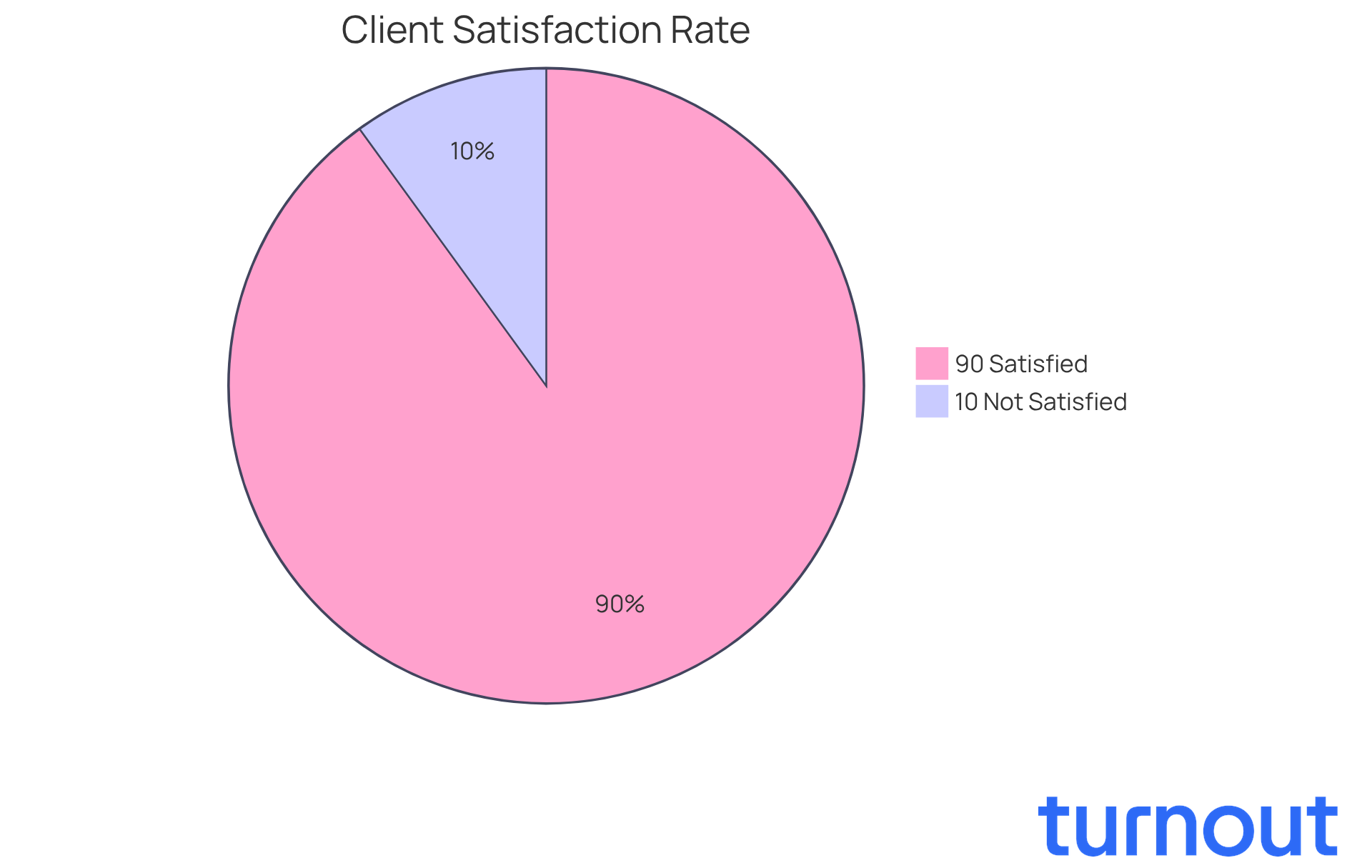

Our approach utilizes cutting-edge software and data analytics to optimize tax case management. This means you’ll receive timely updates and strategies designed just for you. It’s common to feel anxious about tax issues, but our technology-focused services not only enhance your experience but also significantly improve the success rate in resolving your tax obligations.

In fact, over 90% of our consumers report satisfaction with our services. This underscores our commitment to being a leading choice for individuals seeking compassionate assistance. Remember, you are not alone in this journey. Let us support you in finding the relief you deserve.

Resolution Tax Services: Proven Success in Tax Debt Relief

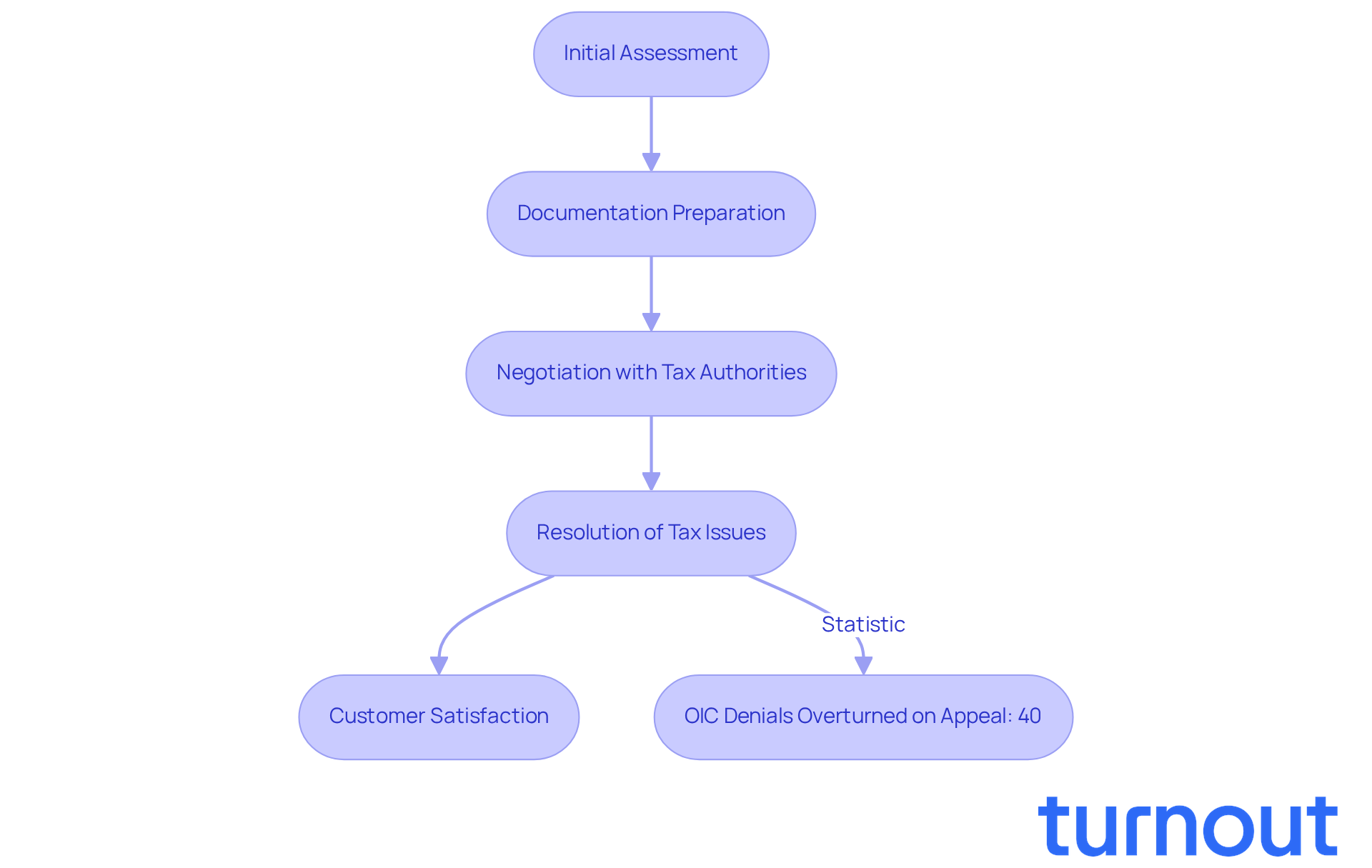

At Resolution Tax Services, we understand that dealing with tax issues can be overwhelming. That’s why we’ve built a solid reputation for achieving successful results in tax relief. Our team of seasoned professionals is dedicated to negotiating settlements and efficiently resolving tax problems, often leading to significant reductions in liabilities. For example, we helped a casual dining chain reduce a staggering $847,000 DOR assessment to just $127,000. This showcases our ability to navigate complex negotiations effectively.

Customer satisfaction is at the heart of what we do. We employ a strategic approach that includes thorough documentation and proactive communication with tax authorities. This method not only speeds up the resolution process-often reducing the average time taken to resolve tax issues to just a few months-but also enhances the likelihood of favorable outcomes.

We know that persistence and well-prepared cases are crucial. In fact, IRS appeals data from 2025 showed that over 40% of Offer in Compromise (OIC) denials are later overturned on appeal when backed by strong documentation. This insight underscores our commitment to thorough preparation and strategic negotiation. You are not alone in this journey; we are here to help you navigate your tax challenges with confidence.

Affordable Tax Relief: Flexible Payment Options for Clients

Affordable Tax Relief understands that dealing with tax obligations can be overwhelming. Many individuals hesitate to seek help due to financial constraints. That’s why we offer a range of flexible payment options designed to fit your budget. Our customized plans not only ease the anxiety associated with tax issues but also connect you with the support you need. By prioritizing affordability and understanding your unique situation, we stand out as a compassionate provider in tax assistance.

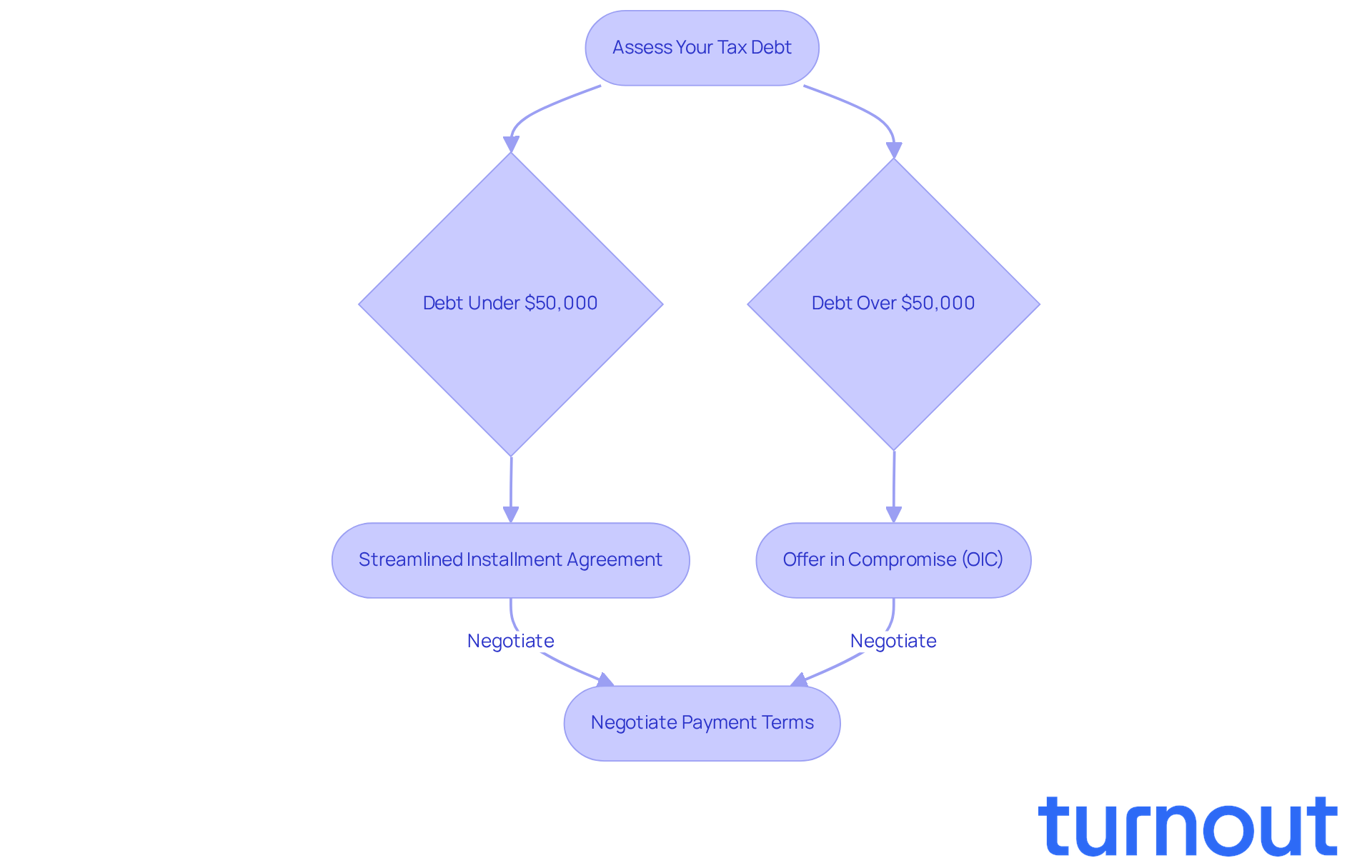

We offer streamlined installment agreements for debts under $50,000, which can be set up quickly online or over the phone. For larger debts, we provide more complex arrangements like Offers in Compromise (OIC). This allows you to settle your tax liabilities for less than what you owe. Our tax relief professionals emphasize the importance of negotiating payment terms that reflect your actual financial situation. Remember, the IRS's initial offers are rarely the best. Engaging proactively can significantly improve your chances of a favorable outcome. It’s essential to explore all available relief options before considering drastic measures, like liquidating retirement funds.

As tax professionals remind us, "You have the right to understand what you’re paying for and how your case will be managed." This transparency is crucial for building trust and ensuring you feel supported throughout the resolution process. By providing flexible payment solutions, Affordable Tax Relief not only addresses your immediate financial concerns but also helps lay the groundwork for long-term stability.

We’re here to help you navigate this journey. You are not alone in this process. Let’s work together to find the best solution for your tax relief needs.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming, but there’s hope. The insights from top tax law firms in Chicago show that relief is within reach. These dedicated professionals are here to empower you - whether you're an individual or a business - helping you regain control over your financial situation.

By combining traditional legal expertise with innovative technology, these firms offer solutions that turn daunting tax challenges into manageable tasks. Key players like Turnout, Smith & Associates, and Johnson Tax Group highlight the importance of personalized support and strategic negotiation. They utilize AI-driven advocacy to enhance case management and provide expert representation that aims for favorable outcomes. Their shared mission? To ease the stress that comes with tax debt.

As tax laws evolve and enforcement tightens, seeking help from reputable tax law firms in Chicago is crucial. Remember, you don’t have to navigate this journey alone. With the right support, you can explore your options confidently and work towards a brighter financial future.

So, why wait? Take that first step today. Reach out to a trusted tax professional and discover how they can help you achieve the relief you deserve. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Turnout and how does it assist with tax obligations?

Turnout is an AI-powered tax advocacy service that helps individuals manage their tax-related challenges by utilizing advanced AI technology. It provides timely updates and comprehensive support, making the process smoother and less stressful.

Who is Jake in the context of Turnout?

Jake is the AI case quarterback at Turnout, designed to streamline the management of tax-related issues and enhance the user experience, ultimately increasing the chances of successful tax resolution.

What services does Smith & Associates provide?

Smith & Associates offers expert tax law services in Chicago, including personalized consultations, negotiation and settlement strategies, and financial relief solutions tailored to individual and company needs.

What is the Offer in Compromise and why is it important to consider other options?

The Offer in Compromise is a tax resolution option that can be challenging to pursue due to its high rejection rate in Cook County and surrounding areas. It is important to explore various resolution options to avoid wasting time and leverage.

What kind of solutions does Johnson Tax Group specialize in?

Johnson Tax Group specializes in comprehensive tax debt solutions, including IRS negotiations, installment agreements, and offers in compromise, tailored to the unique financial situations of clients.

How successful has Johnson Tax Group been in negotiating tax settlements?

Johnson Tax Group has successfully negotiated settlements that have led to savings of up to 90% for some individuals, demonstrating the potential for substantial financial relief through professional representation.

Why is it important to have a tax professional during negotiations with the IRS?

Having a tax professional during IRS negotiations is crucial because trained revenue officers are more likely to offer favorable terms to those represented by experts, which can lead to successful resolutions and avoidance of severe enforcement actions.

What sets Johnson Tax Group apart as a leading tax law firm in Chicago?

Johnson Tax Group is recognized for its commitment to helping clients navigate tax obligations and for identifying relief opportunities that may not be immediately obvious, making it a trusted partner in achieving economic tranquility.