Introduction

Navigating the complexities of securing a substantial settlement check after a car accident in Alberta can feel overwhelming. We understand that the process involves various compensation types, intricate claims procedures, and numerous factors that influence payouts. For claimants seeking justice, it’s essential to grasp these nuances.

But amidst these challenges, a crucial question arises: what strategies can you employ to maximize your compensation while steering clear of common pitfalls? This article offers ten actionable tips designed to empower you as a victim, helping you advocate for your rights effectively.

You are not alone in this journey. With the right guidance and support, you can enhance your chances of receiving the compensation you truly deserve.

Turnout: Leverage AI for Streamlined Claims Management

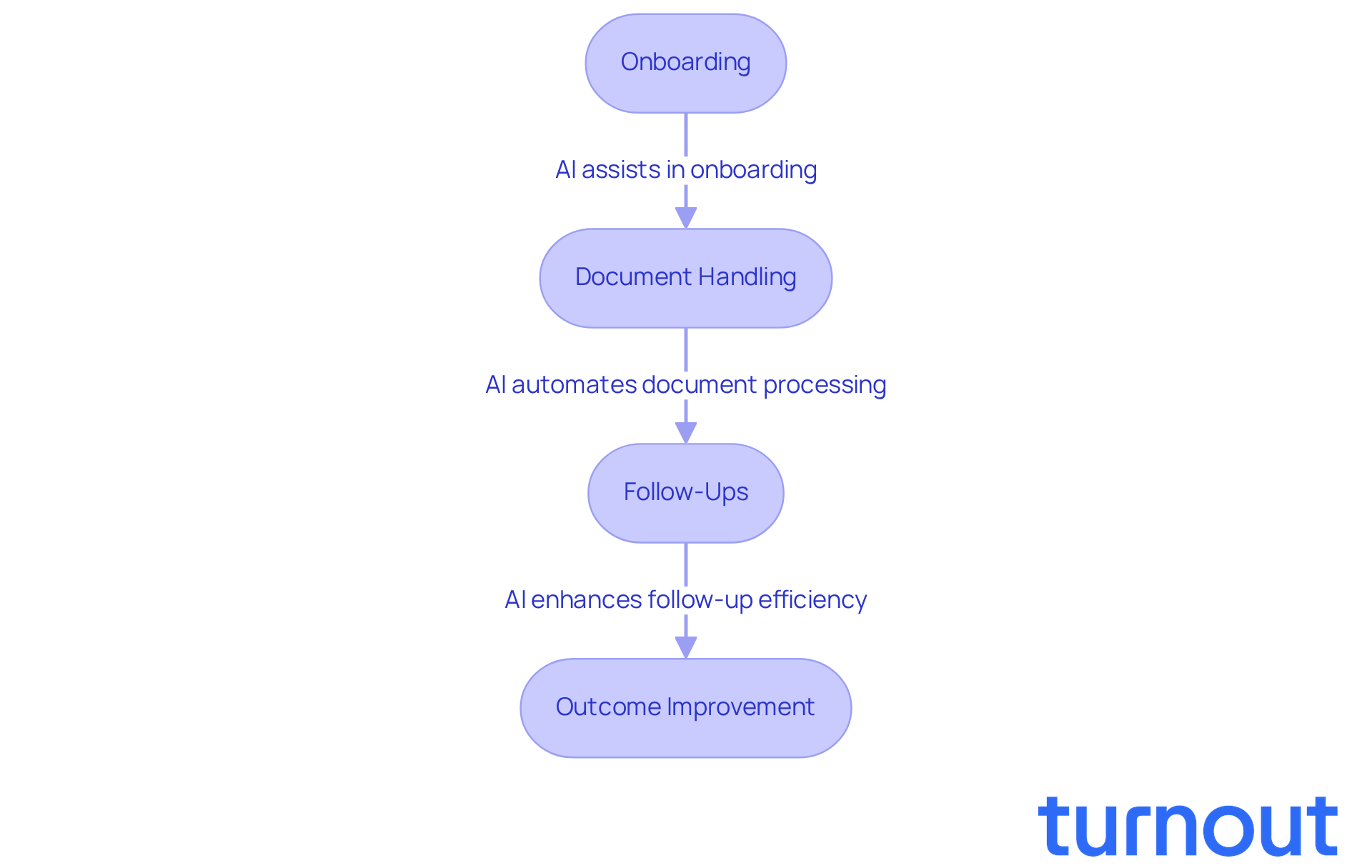

Turnout harnesses the power of Jake, an AI-driven case quarterback, to transform how we manage requests and access government benefits. We understand that navigating these processes can be overwhelming. That’s why this advanced technology automates critical tasks like onboarding, document handling, and follow-ups. It ensures that you stay informed and engaged throughout your journey.

Importantly, Turnout is not a law office and does not offer legal representation. Instead, we employ trained nonlawyer advocates for SSD matters and collaborate with IRS-licensed enrolled agents for tax debt relief. By streamlining these processes, Turnout significantly reduces the administrative burden on advocates. This allows them to focus on strategic communication and high-impact actions that lead to better outcomes for you.

This innovative approach not only speeds up the process but also enhances your overall experience. We know that what can often feel like a daunting ordeal can be transformed into a more manageable and supportive endeavor. Industry leaders have noted that AI can decrease processing time by 55-75%, showcasing its potential to improve efficiency and advocacy results.

As Turnout continues to leverage AI technology, we are setting a new standard for how consumer advocacy can be delivered in this complex landscape. Remember, you are not alone in this journey; we’re here to help.

Types of Car Accident Settlement Payouts in Alberta: Know Your Options

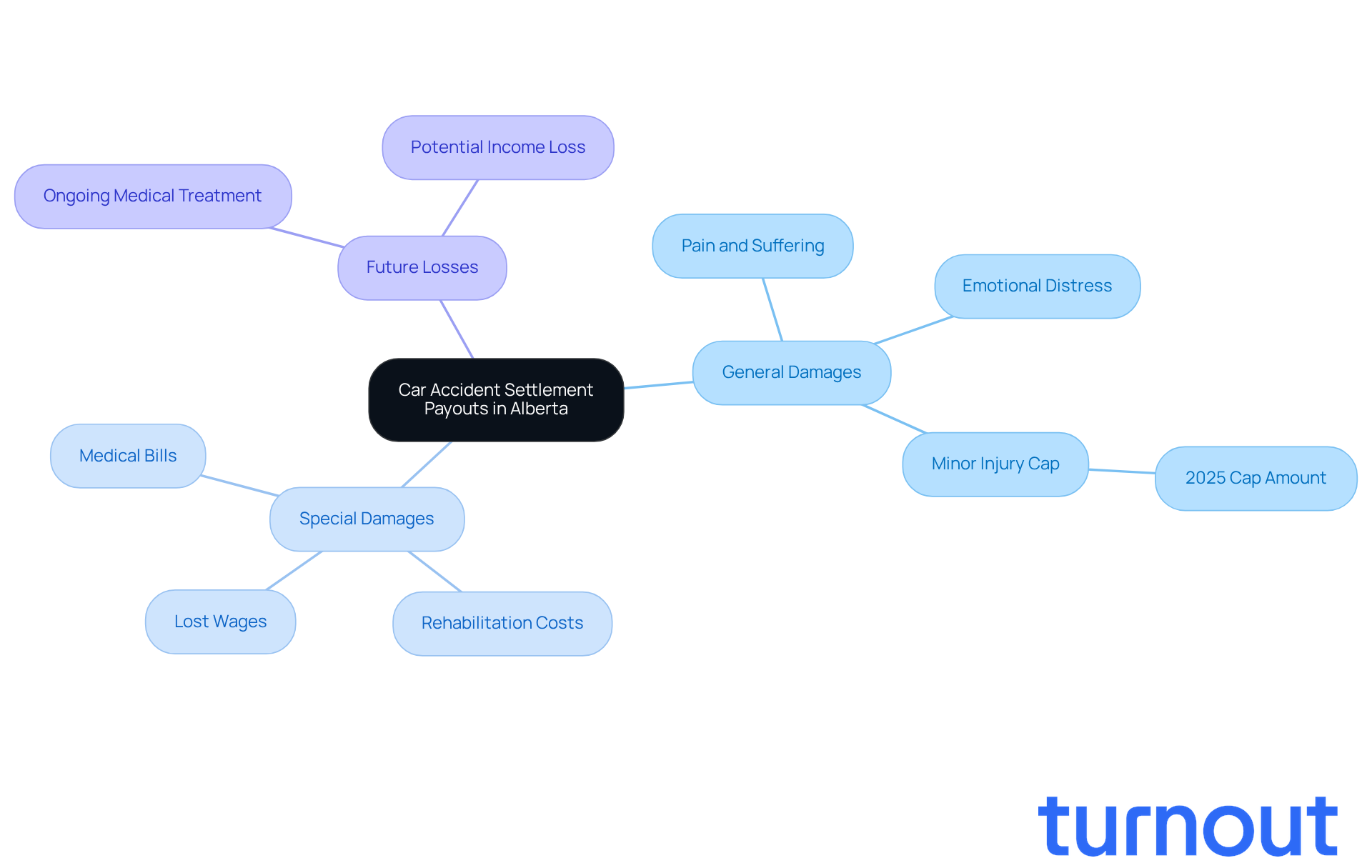

In Alberta, we understand that navigating automobile accident compensations can be overwhelming. The types of harm and damages suffered can lead to very different payouts, and knowing what to expect is crucial for claimants. Let’s explore the primary categories of compensation that can help you on this journey:

-

General Damages: These are awarded for non-economic losses, such as pain and suffering, emotional distress, and loss of enjoyment of life. In Alberta, assessing general damages can be complex, often requiring expert testimony to support your claims. For example, big settlement checks for general damages can vary widely. Minor ailments might average around $10,000, while serious conditions could result in a big settlement check reaching the high six to seven figures. It's important to note that the 2025 minor injury cap is set at $6,182 for pain and suffering damages, which may limit compensation for less severe cases.

-

Special Damages: This category includes out-of-pocket expenses directly related to the accident, like medical bills, rehabilitation costs, and lost wages. To ensure you receive full reimbursement, it’s essential to meticulously document all expenses. Legal specialists emphasize that keeping comprehensive records from the start is vital for backing your assertions.

-

Future Losses: Considering ongoing medical treatment and potential future income loss due to long-term disabilities is crucial. This aspect of compensation can significantly influence the overall amount, especially for serious harm that affects your ability to work.

Experts like Sivan Tumarkin and David Sowemimo stress the importance of understanding these categories. This knowledge can empower you to articulate your needs effectively during negotiations. Recent changes in Alberta's compensation structure, including the upcoming Care-First model set to begin in January 2027, aim to simplify the claims process and improve outcomes for victims. By staying informed about these options, you can better advocate for your rights and secure the compensation you deserve. Remember, you are not alone in this journey; we’re here to help.

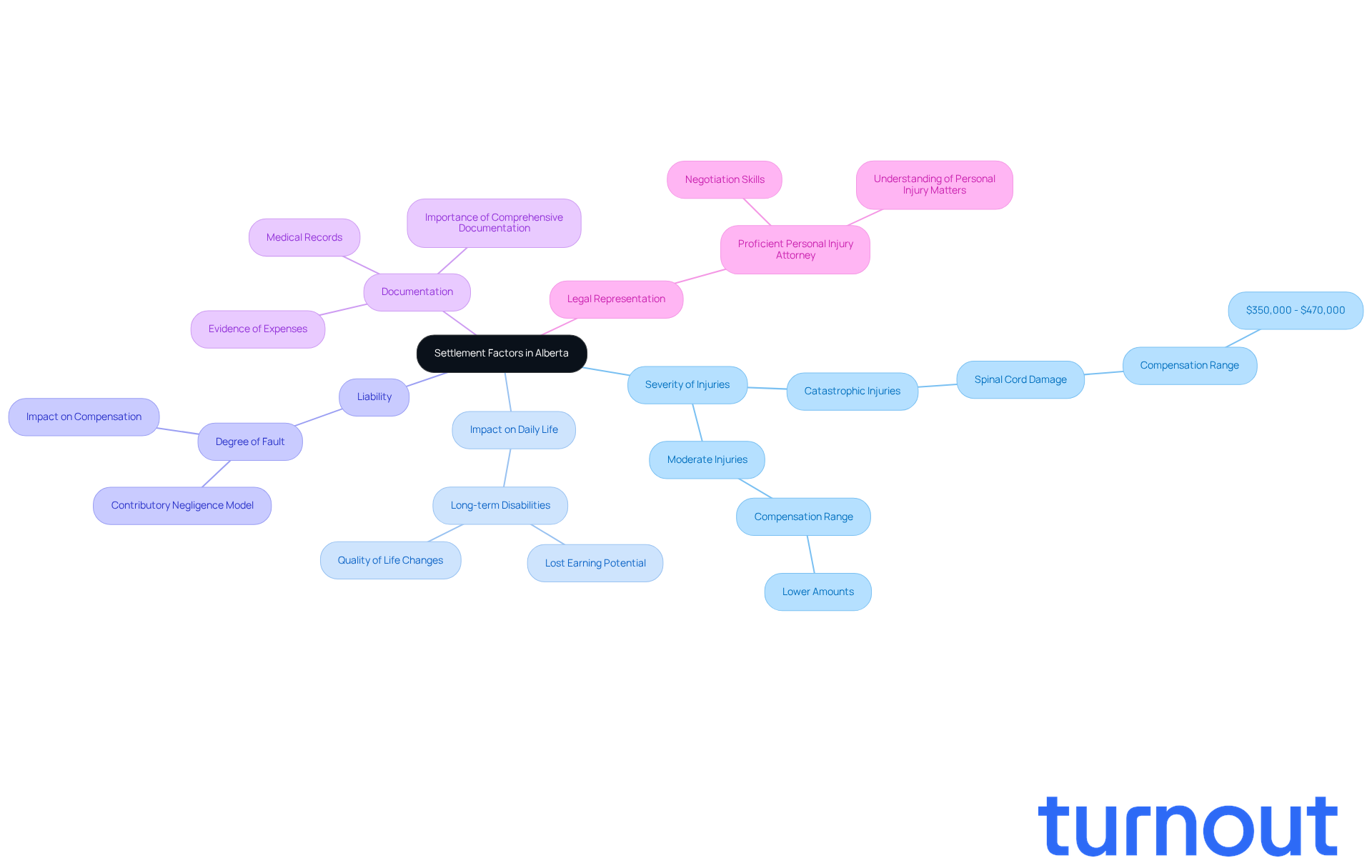

Common Settlement Factors in Alberta: What Affects Your Payout

Several critical factors can significantly influence the amount of a car accident settlement in Alberta, and we understand how overwhelming this process can be:

- Severity of Injuries: Generally, more severe injuries lead to higher compensation. For instance, catastrophic injuries like spinal cord damage can lead to compensations ranging from $350,000 to $470,000, while moderate injuries may produce lower amounts. It's important to recognize how these injuries can impact your life, especially when pursuing a big settlement check.

- Impact on Daily Life: If the incident has substantially affected your lifestyle or ability to work, this can result in a big settlement check. Individuals who experience long-term disabilities may receive a big settlement check that reflects their lost earning potential and quality of life. We know how crucial it is to consider these changes.

- Liability: The degree of fault assigned to each party involved in the accident plays a crucial role in determining the compensation amount. Alberta operates under a contributory negligence model, meaning that if you are found partially at fault, your compensation may be reduced accordingly. It's common to feel uncertain about this aspect.

- Documentation: Comprehensive medical records and evidence of expenses are vital for strengthening your claim. Adequate documentation can lead to more advantageous resolutions, as it offers clear proof of the harms experienced and the financial consequences for you. We encourage you to gather this information carefully.

- Legal Representation: Hiring a proficient personal harm attorney can greatly improve your chances of obtaining a just resolution. Seasoned lawyers understand the subtleties of personal injury matters and can negotiate effectively with insurance firms on your behalf. Remember, you are not alone in this journey.

Comprehending these factors is crucial for claimants navigating the intricacies of personal harm settlements in Alberta to secure a big settlement check. We're here to help you advocate for your rights and ensure you receive the support you deserve.

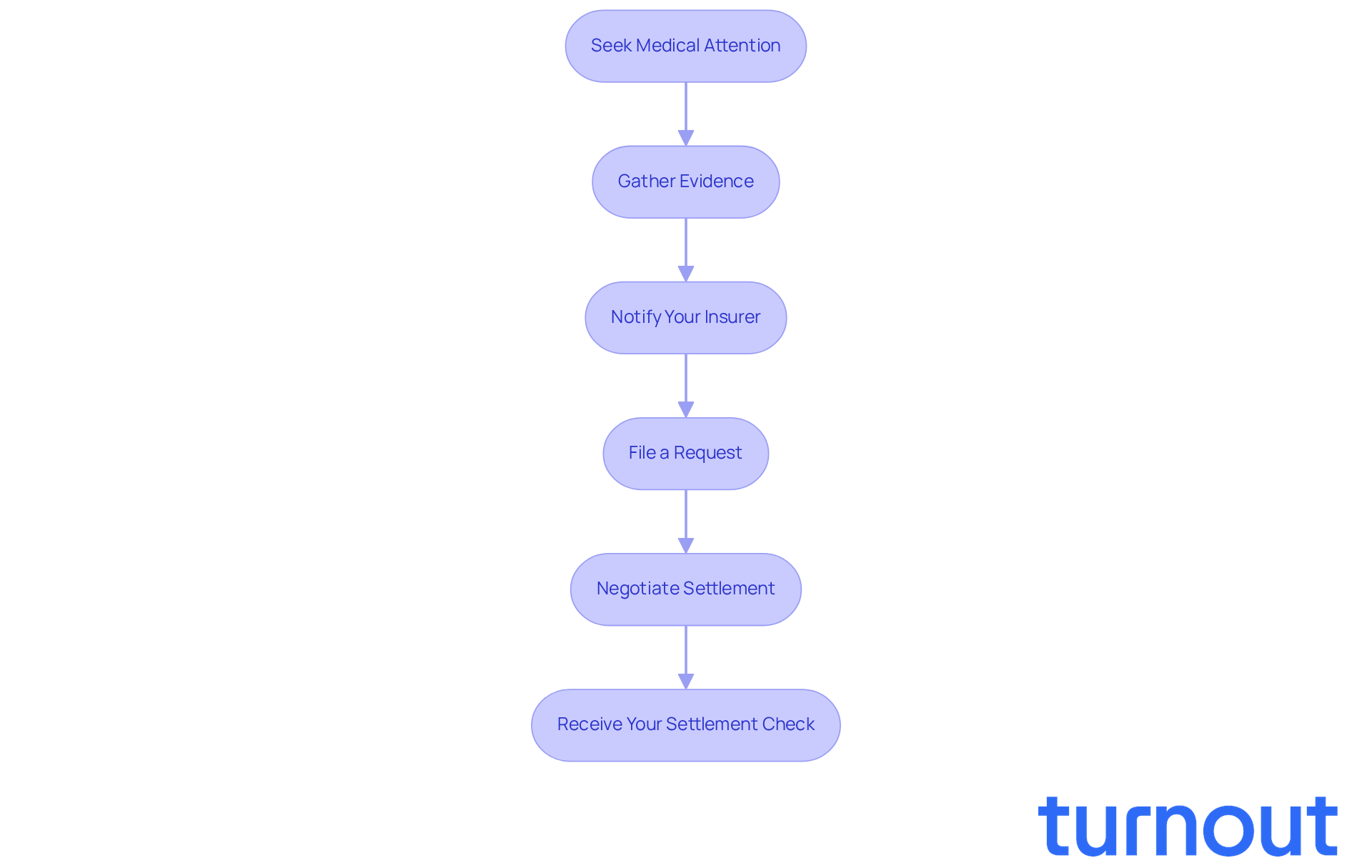

How the Claims Process Works: A Step-by-Step Guide

Navigating the claims process in Alberta can feel overwhelming, but you’re not alone. Here’s a step-by-step guide to help you through it:

-

Seek Medical Attention: Your health is the top priority. Make sure to get medical attention right away and keep a detailed record of any injuries you sustained during the incident.

-

Gather Evidence: Collect important evidence, like photographs of the scene, witness statements, and police reports. This documentation is vital for supporting your claim. Remember, having a legal expert on your side can ease your stress and allow you to focus on healing.

-

Notify Your Insurer: It’s crucial to report the accident to your insurance company as soon as possible. Quick communication helps kickstart the process and avoid complications down the line.

-

File a Request: Submit your request along with all necessary documents. Make sure everything is filled out accurately to ensure a smoother review process. Well-organized documentation can boost your approval chances by over 50 percent!

-

Negotiate Settlement: Engage in discussions with the insurance adjuster. Be ready to negotiate for a fair settlement that will lead to a big settlement check truly reflecting your damages. Consulting a legal professional can provide you with valuable insights during this stage.

-

Receive your big settlement check: Once you reach an agreement, you’ll get your payout. Understanding each step empowers you to stay organized and proactive throughout the process. Keeping a communication log with dates, names of representatives, and summaries of conversations can safeguard your claim from potential issues.

We understand that this journey can be challenging, but remember, you’re taking important steps towards recovery. If you need support, don’t hesitate to reach out. We’re here to help!

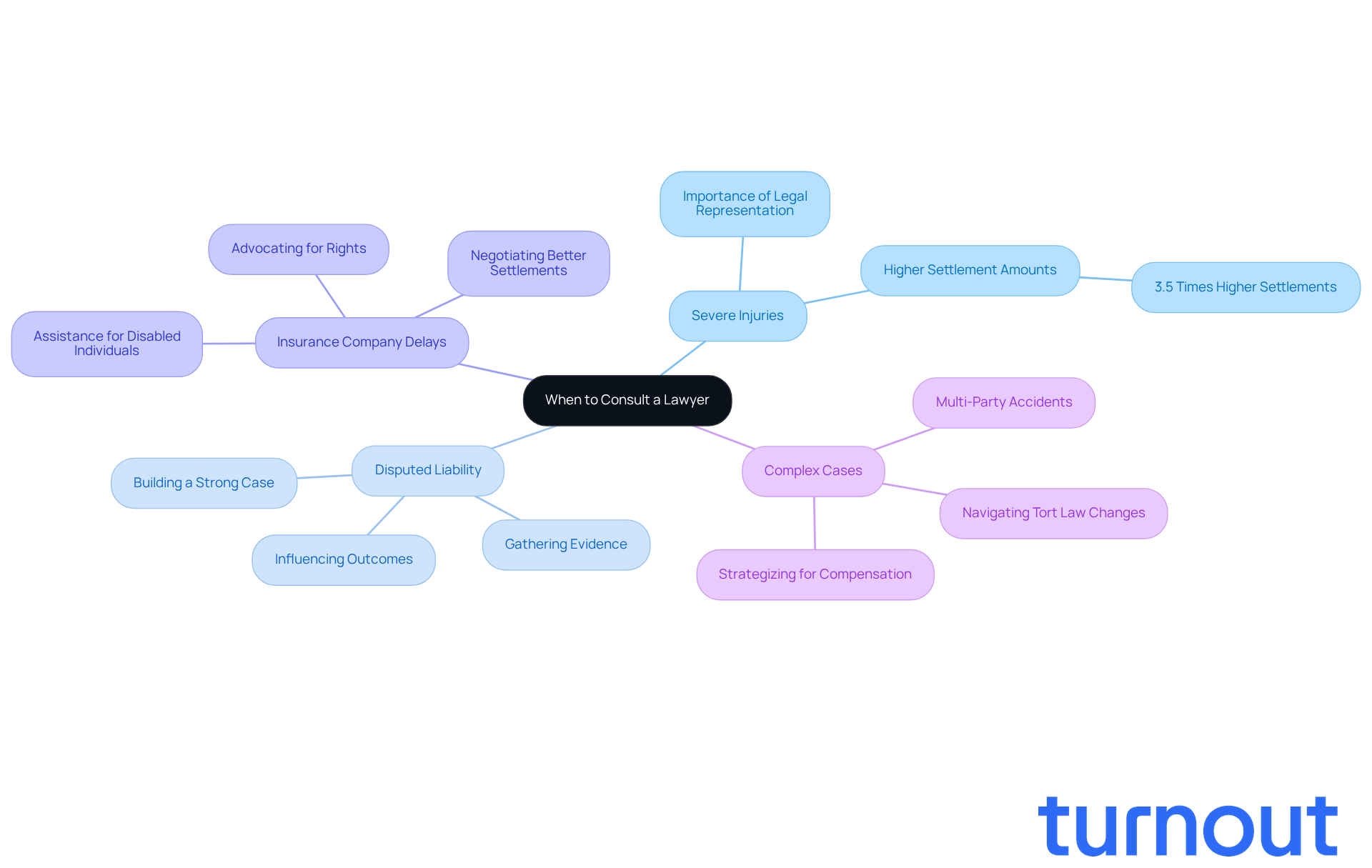

When to Consult a Lawyer: Key Indicators for Legal Support

Consulting a lawyer can be a crucial step in navigating difficult situations. We understand that facing legal challenges can feel overwhelming, especially when it comes to your well-being and future. Here are some scenarios where having legal support can make a significant difference:

-

Severe Injuries: If you've suffered serious injuries or face long-term implications, it's vital to seek legal expertise. Research shows that individuals with legal counsel in personal harm cases often receive a big settlement check that is nearly 3.5 times greater than what those without legal representation receive. As personal injury attorney Wayne Hardee puts it, "Having a lawyer can significantly impact the outcome of your case, especially when dealing with severe injuries."

-

Disputed Liability: It's common to feel lost when fault is contested. An experienced attorney can help gather evidence, interview witnesses, and build a strong case to establish liability. This support can greatly improve your chances of a favorable outcome. Tom Chute, a prominent trial attorney, notes, "In contested liability cases, the appropriate legal representation can significantly influence achieving a just resolution."

-

Insurance Company Delays: If you find yourself facing unresponsive insurers or low compensation offers, having legal representation can advocate for your rights. Attorneys are skilled negotiators who can often secure a big settlement check through better settlement offers. This is especially important for disabled individuals seeking benefits, as they may encounter additional hurdles in the claims process.

-

Complex Cases: When dealing with multiple parties or significant damages, legal expertise becomes essential. In multi-party accidents, determining fault can be complicated. Having a lawyer by your side can help strategize on obtaining compensation from various insurance providers. With changes in tort laws expected by 2025, having legal support is more crucial than ever to navigate these evolving challenges.

Remember, you are not alone in this journey. We're here to help you find the support you need.

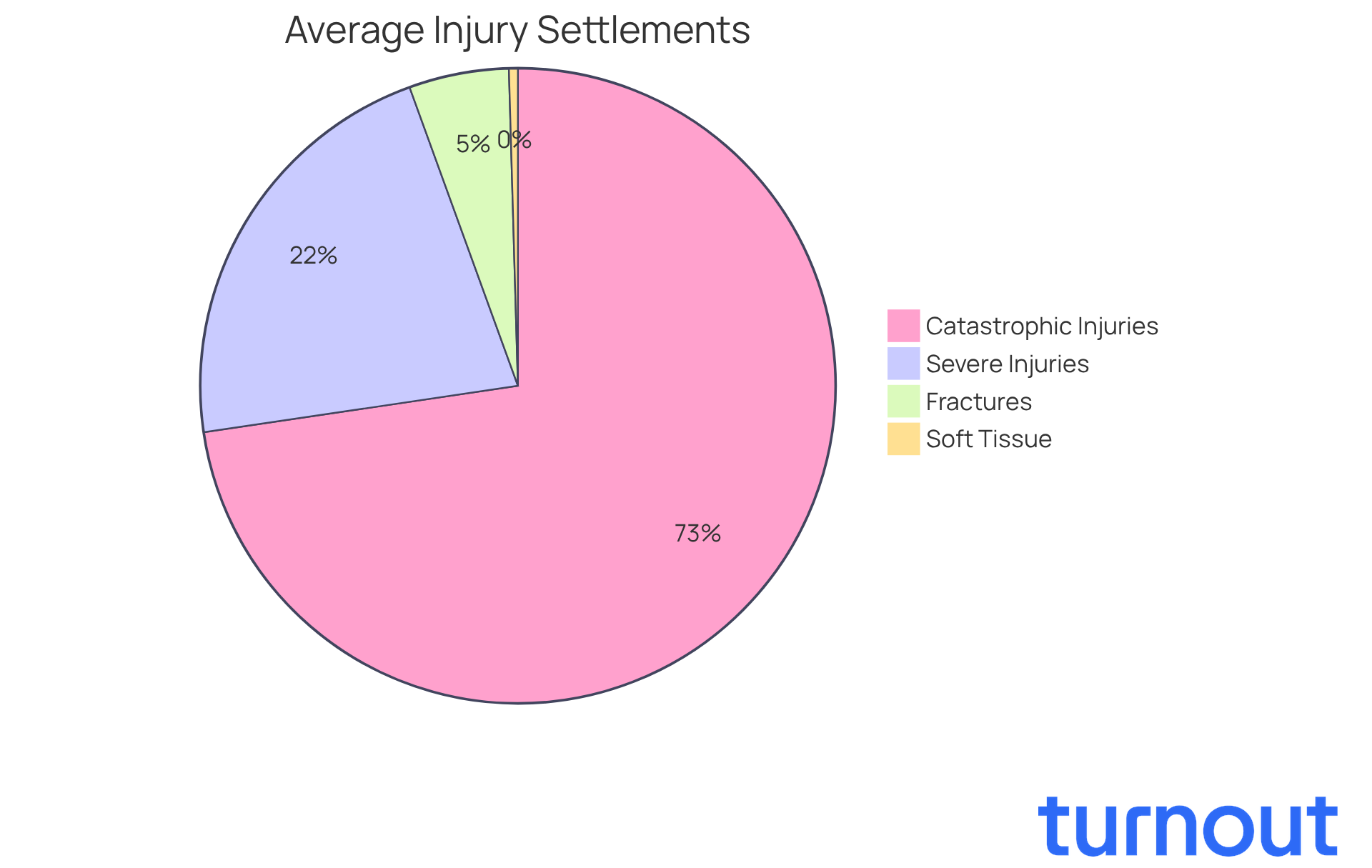

Typical Settlement Amounts by Injury Type: What to Expect

Settlement amounts in Alberta can vary significantly based on the kind of harm incurred. We understand that navigating this process can be overwhelming. Here’s a look at typical compensation ranges:

- Soft Tissue Injuries: $2,500 - $15,000 (with average insurance settlements ranging from $2,500 to $10,000)

- Fractures: $15,000 - $125,000

- Severe Injuries (e.g., spinal injuries): $100,000 - $500,000+

- Catastrophic Injuries: $1 million or more.

These figures serve as essential benchmarks for claimants, helping you assess the potential value of your own case. As pointed out by Viral Mehta, managing attorney at Mehta & McConnell, "If you’ve suffered soft tissue damage in a car accident, we can assist you in obtaining compensation."

Grasping these ranges can empower you to negotiate successfully and ensure you receive just recompense for your damages. Simple soft tissue cases can often settle within a few months after treatment stabilizes. If you think you have a case, remember, you are not alone in this journey. Consider reaching out to a personal injury attorney for guidance on the next steps. We're here to help.

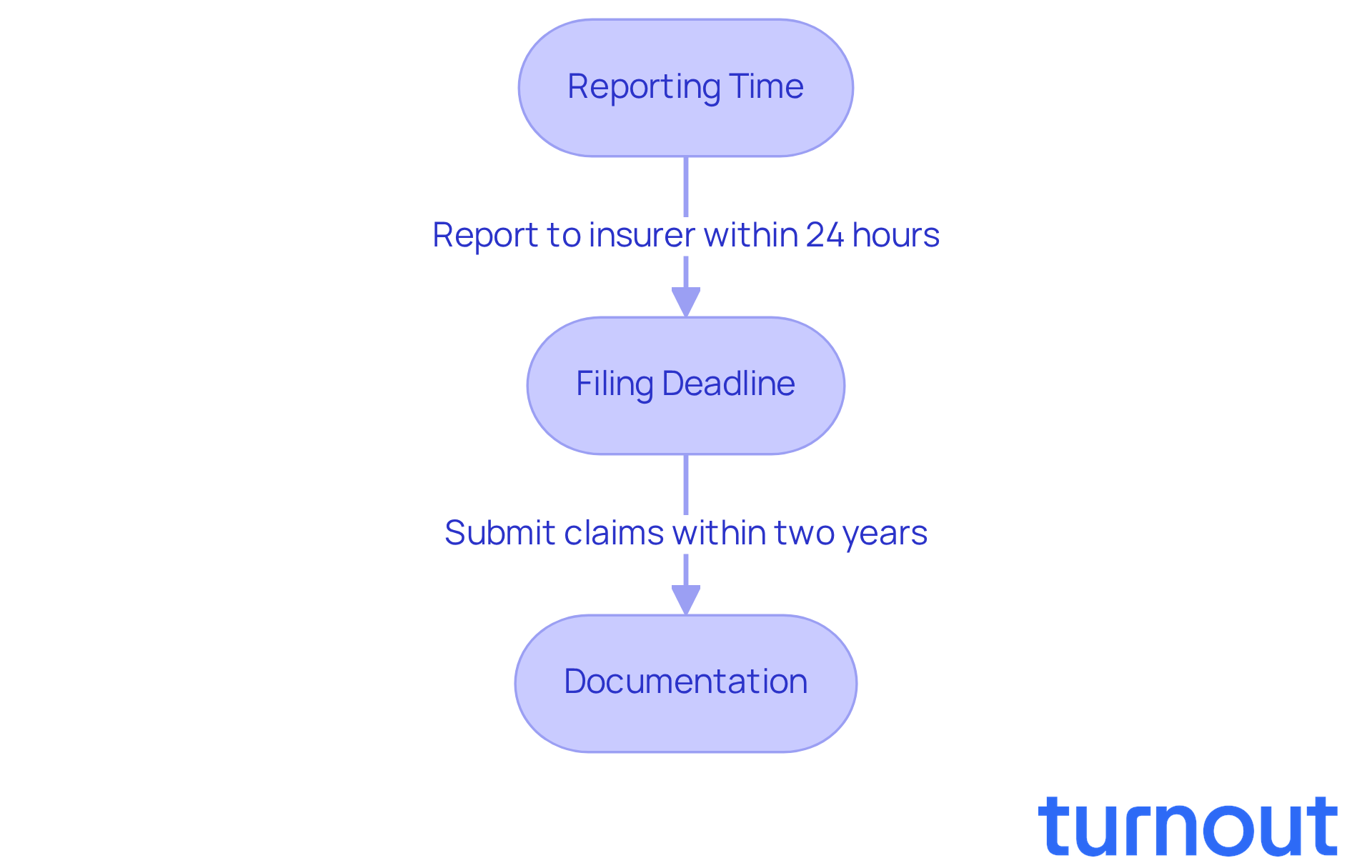

Insurance Rules and Time Limits: Essential Guidelines for Claimants

In Alberta, navigating the claims process can feel overwhelming, but understanding specific insurance regulations and deadlines can make it smoother for you:

-

Reporting Time: We understand that accidents can be stressful. That’s why it’s crucial to report them to your insurer as soon as possible-ideally within 24 hours. Timely reporting not only helps speed up the processing of your requests but also ensures you receive the medical care you need before conditions worsen. As FFVA Mutual states, "Notifying your workers’ comp insurance provider as soon as possible leads to timely, suitable medical care for the affected employee - before conditions deteriorate and healthcare expenses related to that situation rise."

-

Filing Deadline: It’s common to feel uncertain about deadlines. Most personal injury cases must be submitted within two years from the date of the accident. Sticking to this timeline is essential to protect your right to compensation. Statistics show that reports submitted after 14 days tend to be more complex and take longer to resolve, which can delay your case significantly.

-

Documentation: We know that submitting all necessary documents accurately and promptly can be daunting. However, familiarizing yourself with these requirements can simplify the process and lead to a more efficient resolution. Case studies indicate that prompt reporting can reduce medical expenses and speed up resolution, benefiting both you and your insurer.

Understanding these guidelines is key to maximizing your chances of securing a big settlement check in 2025. Remember, you are not alone in this journey; we’re here to help.

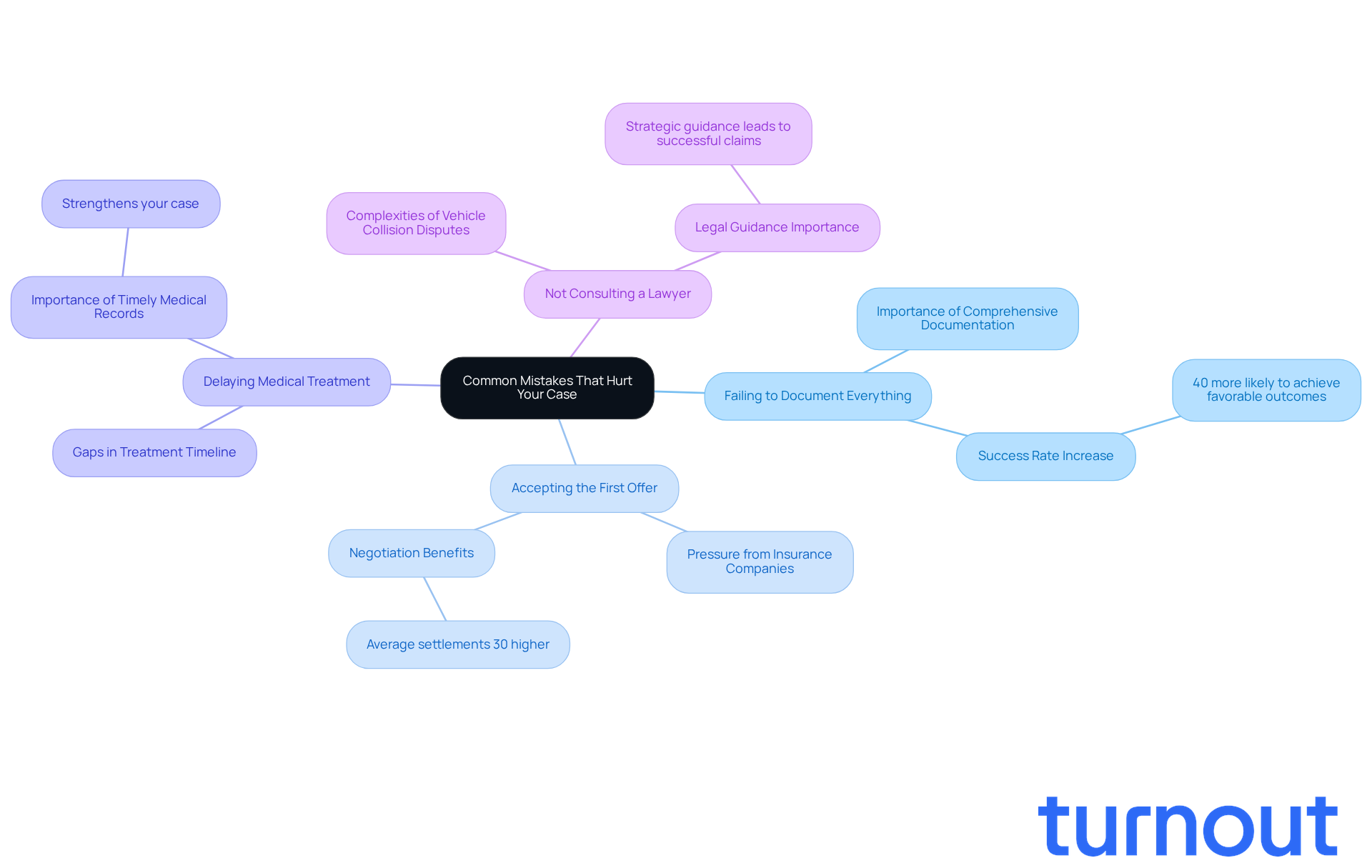

Common Mistakes That Hurt Your Case: What to Avoid

To maximize your chances of a successful claim, it’s important to steer clear of these common pitfalls:

-

Failing to Document Everything: We understand that keeping track of everything can feel overwhelming. However, comprehensive documentation is vital. By maintaining meticulous records of medical treatments, expenses, and all details related to the accident, you create a strong foundation for your claim. Studies show that thorough documentation significantly increases success rates, providing clear evidence of injuries and associated costs. For instance, a recent study revealed that claimants with detailed records were 40% more likely to achieve favorable outcomes compared to those who didn’t.

-

Accepting the First Offer: It’s common to feel pressured when insurance companies present low initial offers. Remember, they often aim to minimize payouts. It’s essential to negotiate for a fair agreement that truly reflects the extent of your damages. Many claimants who hold out for better proposals report receiving compensations that are significantly higher than the initial offer. Legal experts suggest that negotiating can lead to settlements that are, on average, 30% higher than those first offers.

-

Delaying Medical Treatment: We know that seeking medical attention right away can be tough, but prompt care is critical. Delays can create gaps in the timeline between the accident and treatment, making it harder to establish a direct link between the incident and your injuries. Legal experts emphasize that timely medical records strengthen your case. As attorney Benson Varghese wisely states, "Timely medical documentation is essential; it not only backs your case but also illustrates the seriousness of your injuries."

-

Not Consulting a Lawyer: Navigating the complexities of vehicle collision disputes can feel daunting. We’re here to help. Legal advice is invaluable, especially in intricate cases where liability is disputed. Lawyers can guide you in understanding your rights, gathering necessary evidence, and negotiating effectively with insurance companies. Many successful claims have benefited from the strategic guidance of legal experts. For example, in the case of F, thorough legal representation led to the removal of a permanent bar against him, highlighting the importance of having a knowledgeable advocate by your side.

Remember, you are not alone in this journey. Taking these steps can significantly improve your chances of a successful claim.

Advanced Settlement Strategies: Maximizing Your Compensation

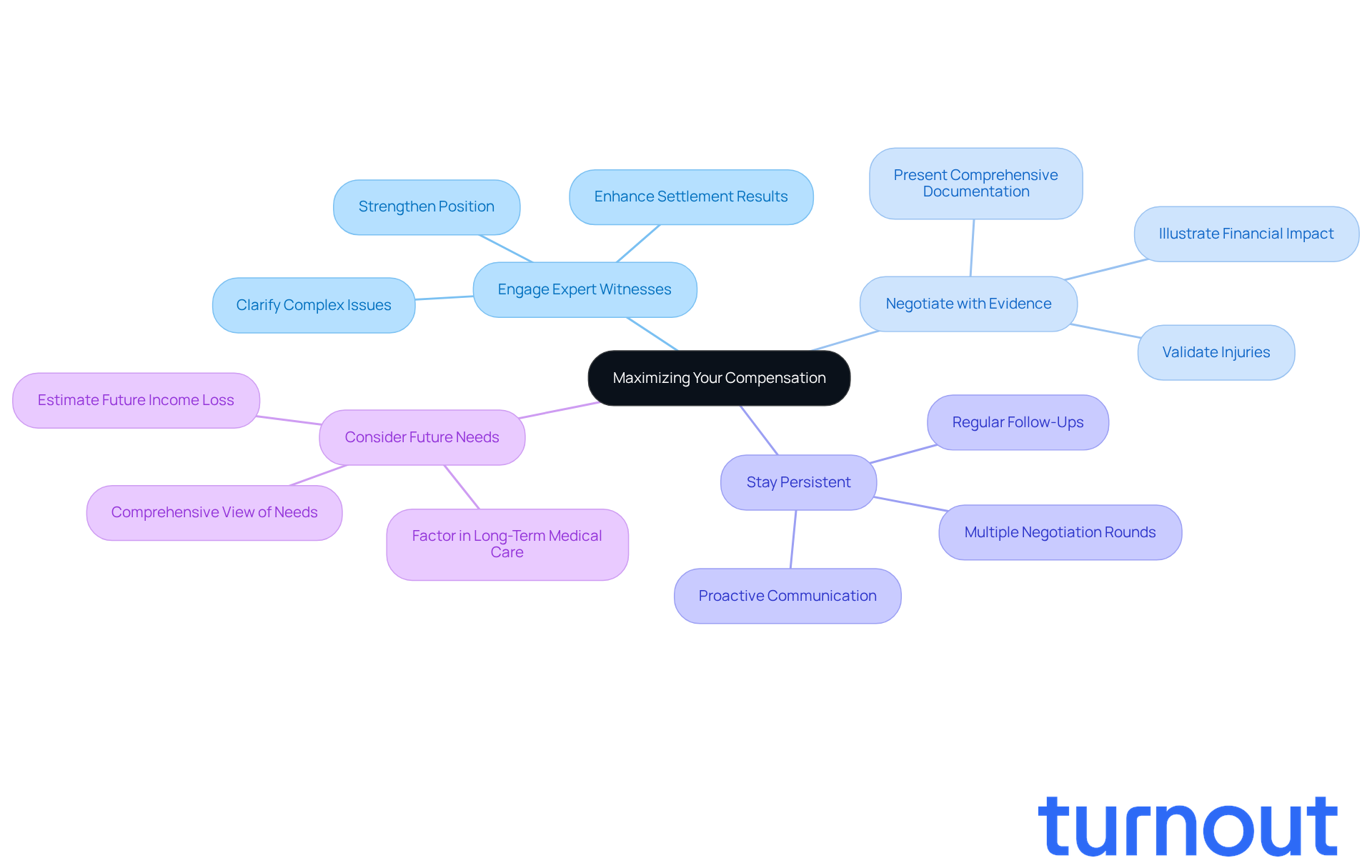

To maximize your compensation, consider these thoughtful strategies:

-

Engage Expert Witnesses: We understand that navigating the complexities of your case can be overwhelming. By utilizing medical professionals or accident reconstruction experts, you can significantly strengthen your position. Their specialized knowledge offers critical insights that clarify complex issues, making it easier for juries and insurers to grasp the extent of your injuries and the circumstances surrounding the accident. In Alberta, expert witnesses have been shown to enhance settlement results by providing objective evidence that supports your claims.

-

Negotiate with Evidence: It’s common to feel uncertain about how to present your case. Presenting comprehensive documentation, including detailed medical records and expense receipts, is essential to support your assertion. This evidence not only validates your injuries but also illustrates the financial impact of the accident on your life. Legal professionals emphasize that thorough documentation can lead to larger compensation amounts, as it minimizes the opportunity for insurers to contest your claims.

-

Stay Persistent: We know that dealing with insurers can be frustrating. Regular follow-ups are crucial. Your determination can yield benefits, as multiple requests often require several rounds of negotiation before reaching a satisfactory resolution. Legal experts advise that being proactive in communication signals to insurers that you are serious about your claim, which can lead to better offers.

-

Consider Future Needs: When assessing your compensation requests, it’s vital to factor in long-term medical care and potential income loss. Specialist witnesses can assist in estimating future medical costs and the impact of your ailments on your earning potential, providing a more comprehensive view of your needs. This foresight can significantly influence the final settlement amount, potentially resulting in a big settlement check that ensures you are adequately compensated for both current and future challenges.

Alberta's No-Fault Insurance Benefits: What You Need to Know

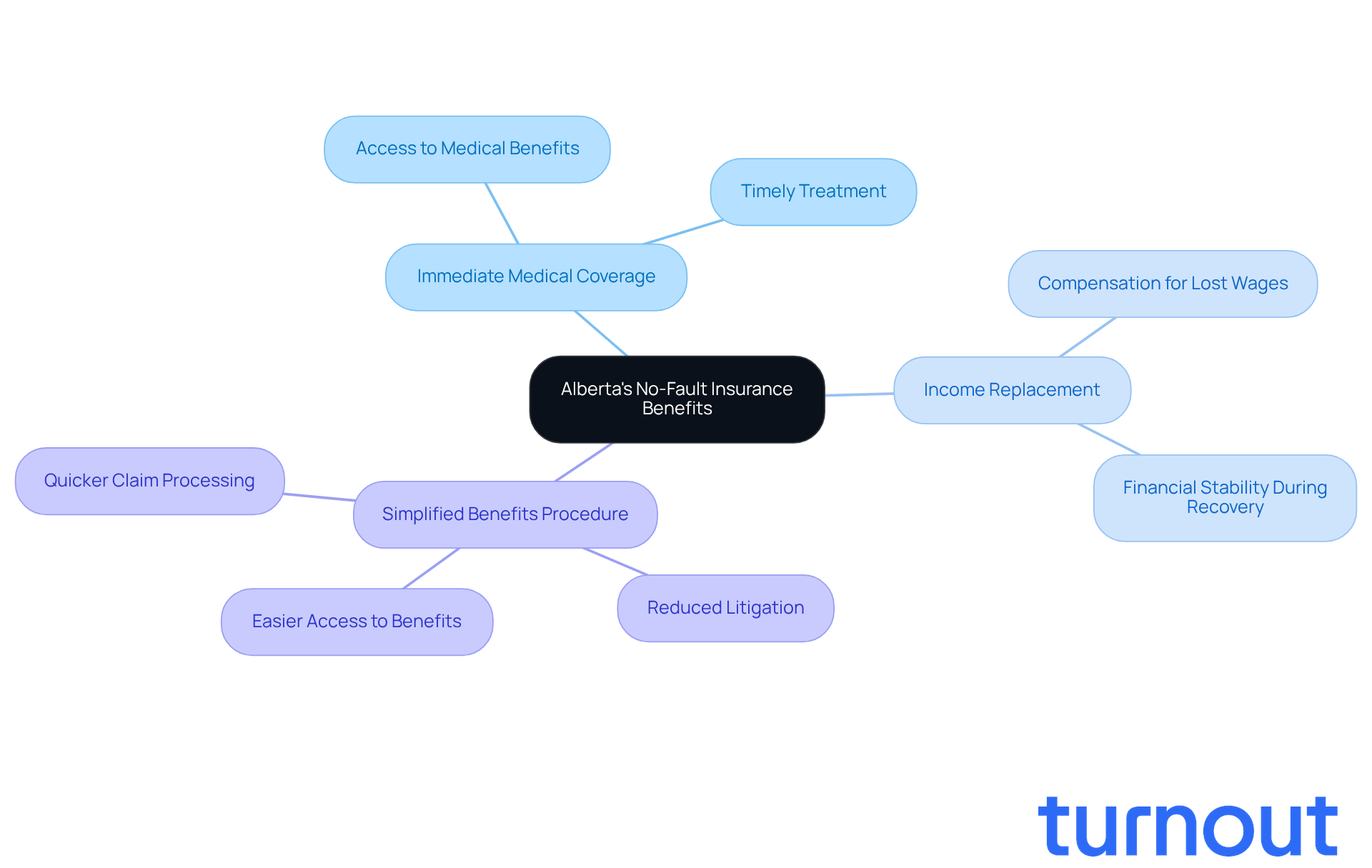

Alberta's no-fault insurance system, set to be implemented in 2027, brings several significant benefits for those who have been injured:

- Immediate Medical Coverage: You’ll have access to medical benefits without needing to establish fault. This means you can receive timely treatment and support when you need it most.

- Income Replacement: If you're unable to work due to your injuries, you will receive compensation for lost wages. This provides financial stability during your recovery.

- Simplified Benefits Procedure: The no-fault system aims to reduce litigation and enhance the benefits process, making it easier for you to access what you need. This shift is crucial for managing future requests effectively.

We understand that navigating insurance can be overwhelming. Insurance professionals have noted that under this new framework, the reliance on government-determined compensation models may present challenges for some claimants. For instance, Joseph A. Nagy, a personal injury lawyer, emphasizes that the no-fault system will shift financial responsibility from negligent drivers to taxpayers. This could potentially impact the adequacy of compensation for injuries.

However, the streamlined process is designed to reduce claim processing times, allowing for quicker access to benefits. This is essential for those facing immediate medical needs and financial pressures. Remember, you are not alone in this journey; we’re here to help you through it.

Conclusion

Securing a substantial settlement check in Alberta can feel overwhelming. We understand that navigating the complexities of the claims process and the various factors influencing compensation is no small feat. By utilizing advanced tools like AI for claims management, knowing the types of damages available, and recognizing the importance of legal representation, you can approach this challenging landscape with greater confidence.

Key insights from this guide highlight the significance of thorough documentation and understanding the different categories of compensation. It's common to feel uncertain about common pitfalls that can hinder a claim. From general and special damages to the impact of liability and injury severity, each element plays a crucial role in determining your final settlement amount. Plus, the upcoming no-fault insurance system aims to simplify access to benefits, providing immediate support for those injured in accidents.

Taking proactive steps can significantly enhance your chances of receiving a fair settlement. Consulting with legal experts, documenting every detail, and negotiating effectively are all vital actions. Remember, you are not alone in this journey. We encourage you to stay informed and seek assistance, ensuring you have the support you need to advocate for your rights and secure the compensation you deserve.

Frequently Asked Questions

What is Turnout and how does it assist with claims management?

Turnout is an organization that leverages AI technology, specifically through an AI-driven case quarterback named Jake, to streamline the management of requests and access to government benefits. It automates tasks like onboarding, document handling, and follow-ups, making the process more manageable for users.

Does Turnout provide legal representation?

No, Turnout is not a law office and does not offer legal representation. Instead, it employs trained nonlawyer advocates for Social Security Disability (SSD) matters and collaborates with IRS-licensed enrolled agents for tax debt relief.

How does Turnout reduce the administrative burden on advocates?

By automating critical tasks, Turnout significantly reduces the administrative workload on advocates, allowing them to focus on strategic communication and actions that lead to better outcomes for clients.

What impact does AI have on processing times in claims management?

Industry leaders have noted that AI can decrease processing time by 55-75%, which highlights its potential to improve efficiency and advocacy results in claims management.

What types of compensation are available for car accident claims in Alberta?

In Alberta, the primary categories of compensation for car accident claims include: General Damages: For non-economic losses like pain and suffering. Special Damages: For out-of-pocket expenses related to the accident, such as medical bills and lost wages. Future Losses: For ongoing medical treatment and potential future income loss due to long-term disabilities.

How are general damages assessed in Alberta?

General damages are complex to assess and often require expert testimony. The amount can vary widely based on the severity of the injuries, with minor ailments averaging around $10,000 and serious conditions potentially reaching high six to seven figures. There is also a minor injury cap set at $6,182 for pain and suffering damages in 2025.

What factors can affect the amount of a car accident settlement in Alberta?

Several factors can influence the settlement amount, including: Severity of Injuries: More severe injuries generally lead to higher compensation. Impact on Daily Life: Long-term disabilities can result in higher settlement amounts reflecting lost earning potential. Liability: The degree of fault assigned can affect compensation under Alberta's contributory negligence model. Documentation: Comprehensive medical records and evidence of expenses strengthen claims. Legal Representation: Hiring an experienced personal injury attorney can improve the chances of obtaining a fair settlement.

What upcoming changes in Alberta's compensation structure should claimants be aware of?

Claimants should be aware of the upcoming Care-First model, set to begin in January 2027, which aims to simplify the claims process and improve outcomes for victims.