Introduction

Navigating the complexities of tax obligations can feel overwhelming, can't it? Especially when it comes to setting up payment plans with the IRS. We understand that many taxpayers are seeking relief from financial burdens, and knowing your options is crucial. However, it’s common to feel uncertain about managing tax debts and whether payment plans are a viable solution.

What if there were strategies to simplify this process? What if you could ensure compliance while alleviating stress? This article explores essential tips and resources designed to empower you to take control of your tax situation. Together, we can explore viable payment plan options that may help you find the relief you need.

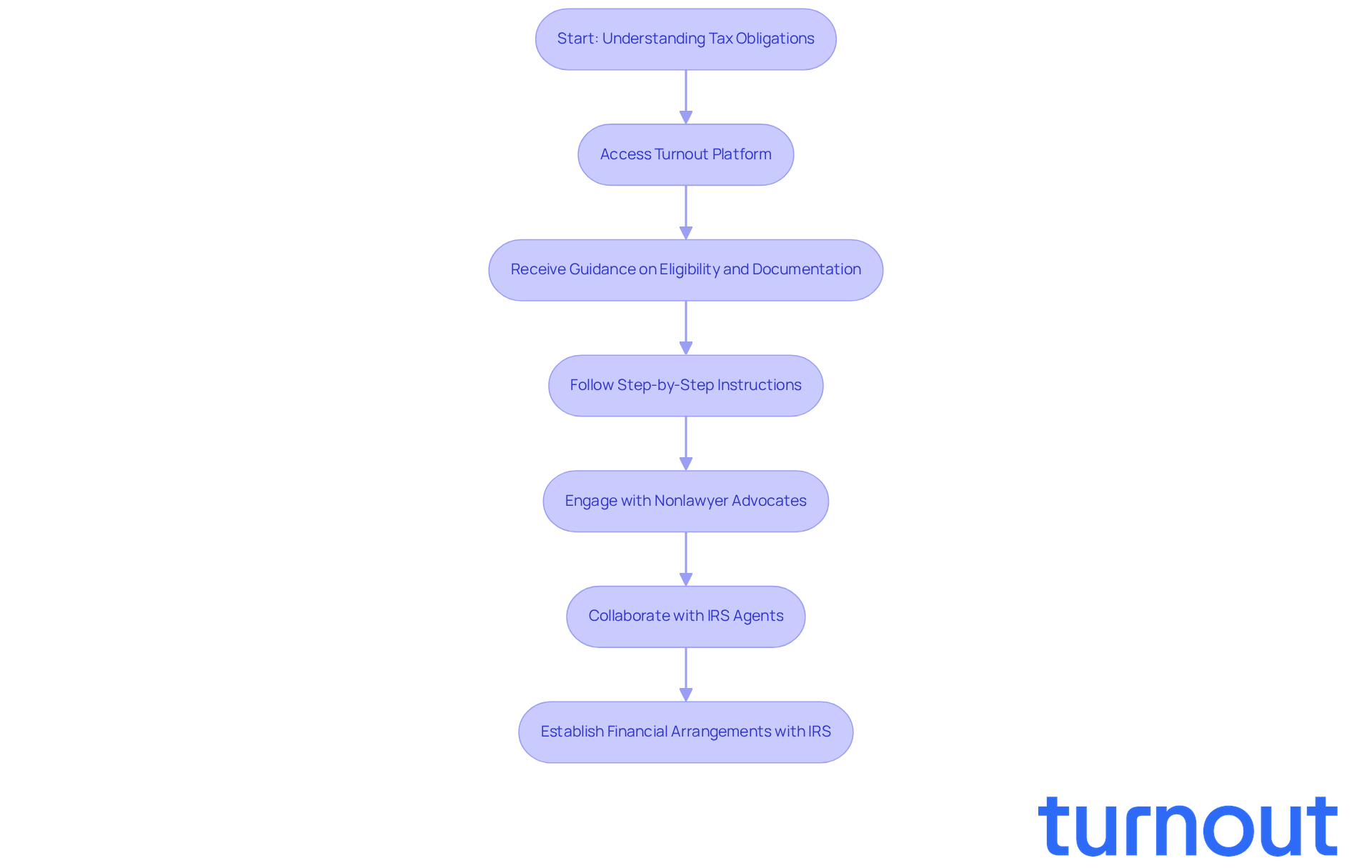

Utilize Turnout for Tax Payment Plan Guidance

We understand that dealing with tax obligations can be overwhelming. Turnout transforms how you approach tax settlement options by offering a user-friendly platform that simplifies the entire process. With advanced AI technology, Turnout provides clear guidance on eligibility criteria, necessary documentation, and step-by-step instructions to help you avoid common pitfalls.

This innovative approach not only enhances accessibility but also empowers you to manage your tax obligations with confidence. Turnout employs trained nonlawyer advocates and collaborates with IRS-licensed enrolled agents, ensuring you have the support needed to navigate tax debt relief.

With Turnout, you can efficiently establish financial arrangements with the IRS, and you might ask, can you do payment plans for taxes, making the complex tax system feel less daunting. The integration of AI allows for quicker responses and tailored advice, helping you feel more in control of your tax compliance journey.

Remember, you are not alone in this process. We're here to help you every step of the way.

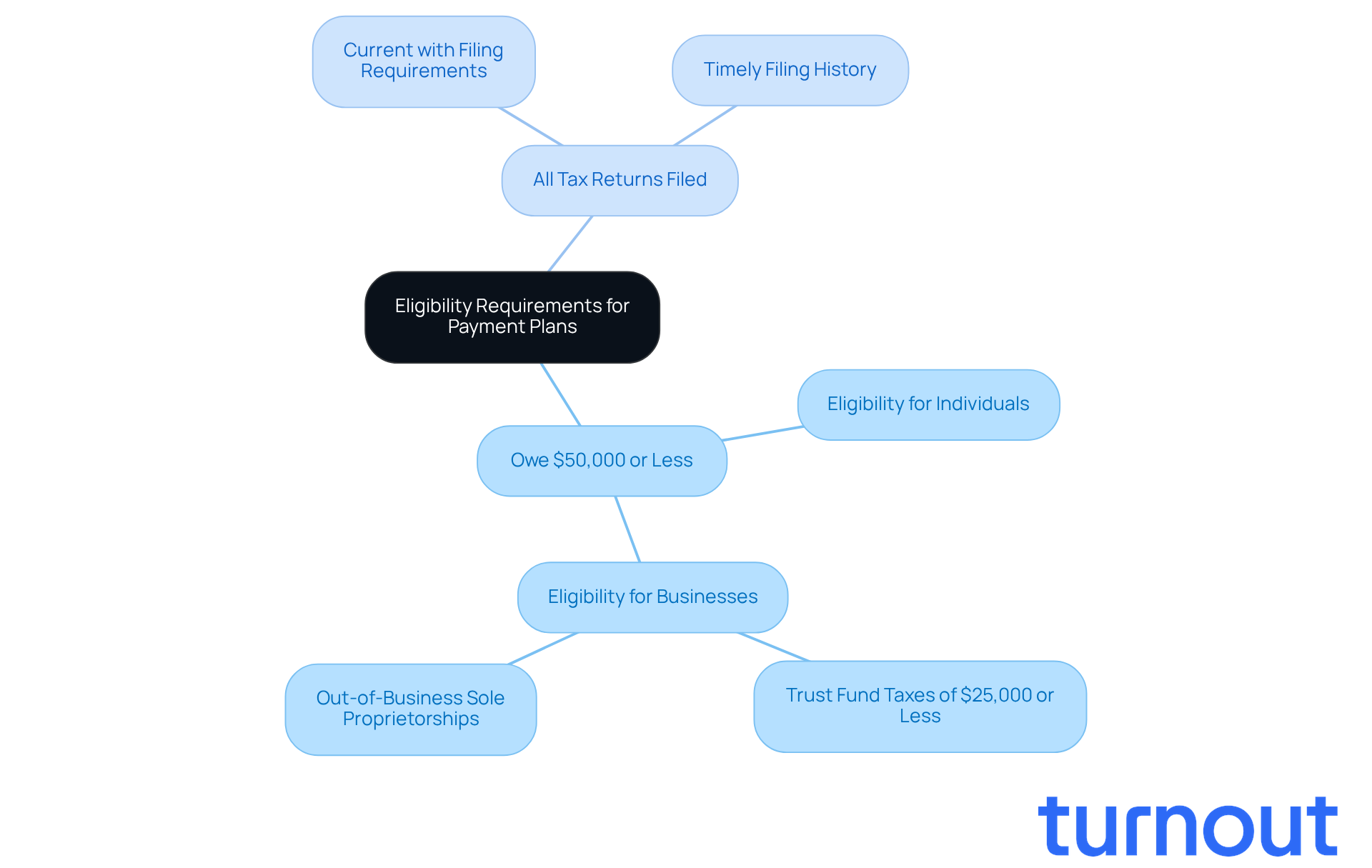

Understand Eligibility Requirements for Payment Plans

We understand that dealing with tax issues can be overwhelming. To qualify for an IRS installment arrangement, it’s important to know the eligibility criteria. Typically, if you owe $50,000 or less in total tax, penalties, and interest, you can apply for a long-term arrangement.

Additionally, all required tax returns must be filed. Knowing these requirements can help you identify your options and avoid delays in setting up your financial arrangements, such as asking if you can do payment plans for taxes. Remember, you’re not alone in this journey. We’re here to help you navigate through these challenges.

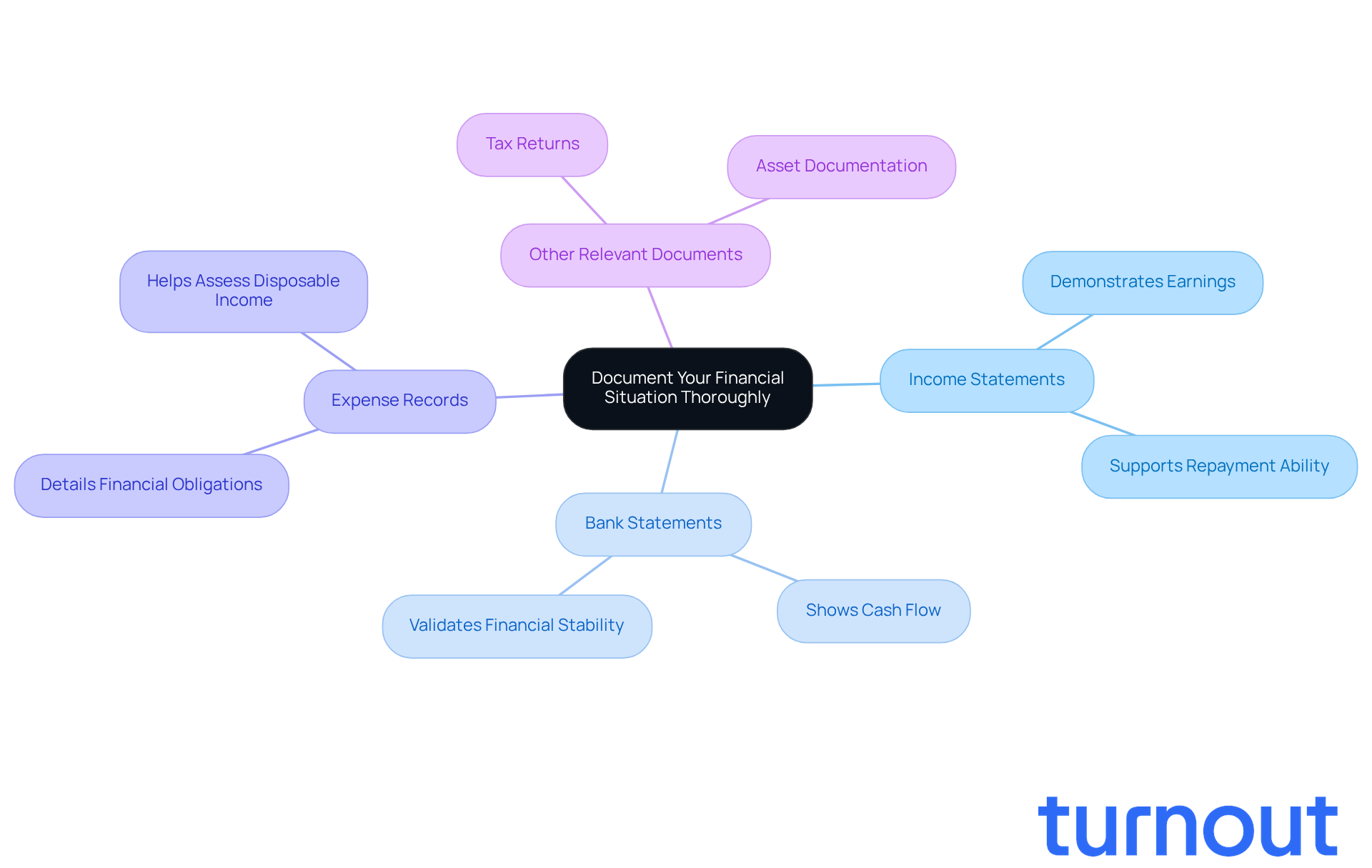

Document Your Financial Situation Thoroughly

When you're looking to arrange financing, it’s crucial to share a complete picture of your financial situation. This means including:

- Income statements

- Bank statements

- Expense records

- Any other relevant documents

By providing thorough documentation, you not only strengthen your position in negotiations but also increase your chances of getting your financial arrangement approved.

We understand that dealing with the IRS can be daunting. In fact, successful negotiations often depend on the quality of the financial information you provide. Taxpayers who submit complete documentation are more likely to secure favorable repayment terms. This shows your willingness to cooperate and gives the IRS a clear view of your financial capabilities. As one tax specialist points out, "Your financial records are the basis of any negotiation with the IRS; they reveal your situation and help them understand the practicality of your proposed repayment plan."

In FY 2024, the IRS collected over $5.1 trillion in gross taxes, highlighting the scale of their operations and the importance of effective negotiation strategies for taxpayers like you. If you can settle your entire tax obligation within 180 days, you might qualify for a short-term arrangement, which can lead to quicker resolutions.

By ensuring that your financial circumstances are accurately represented, you can negotiate more effectively and create a plan that aligns with your ability to pay. Remember, you’re not alone in this journey; we’re here to help you navigate these challenges.

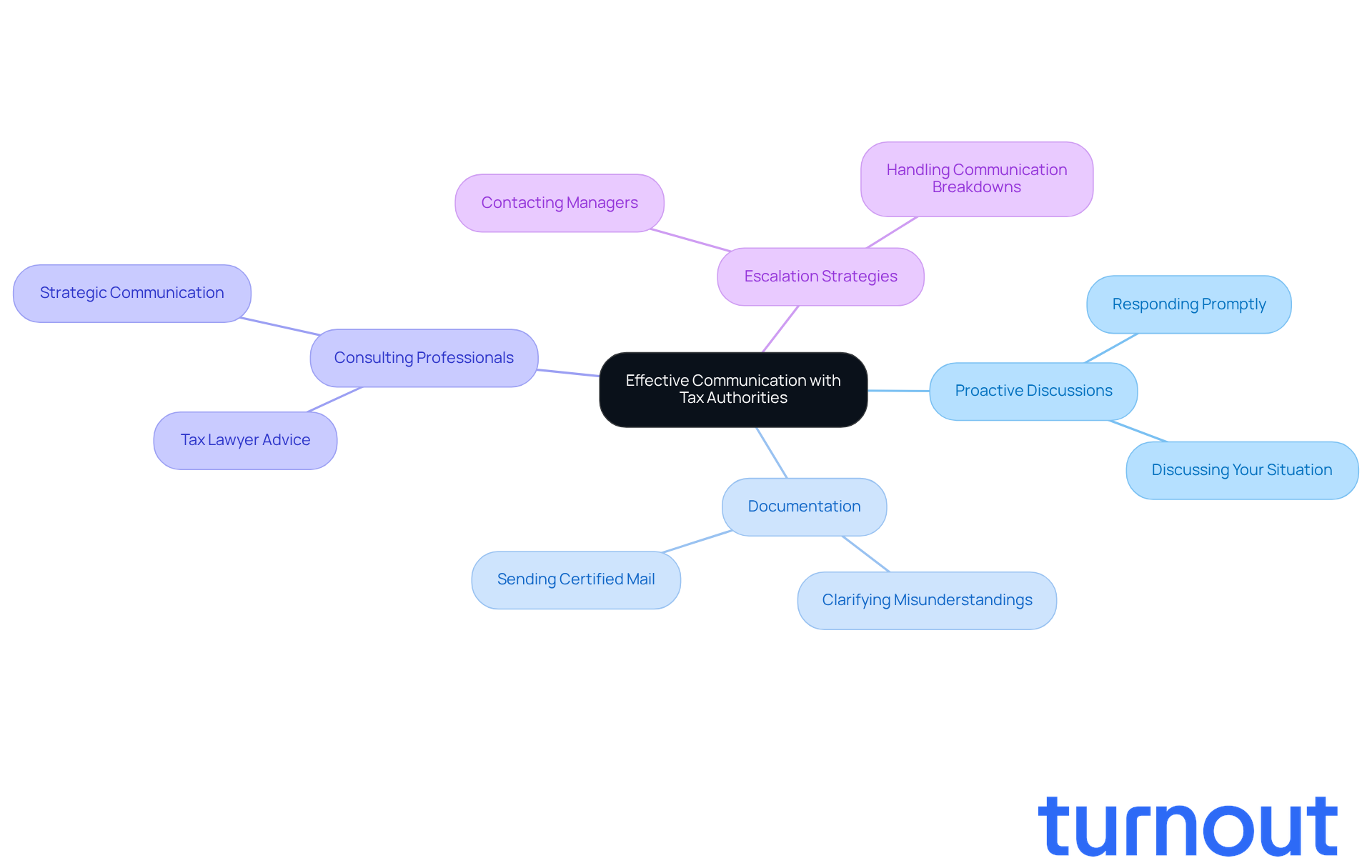

Communicate Effectively with Tax Authorities

Effective communication with the IRS is crucial for navigating your tax settlement successfully. We understand that reaching out can feel daunting, but proactively discussing your situation and responding promptly to any correspondence can make a significant difference. Documenting all communications is vital; it not only helps clarify misunderstandings but also serves as a valuable reference for future discussions.

During the 2024 filing season, the IRS achieved an impressive 87 percent level of service, with calls answered in an average of three minutes. This highlights the importance of utilizing available resources and keeping those lines of communication open. Taxpayers who effectively manage their interactions with the IRS often inquire, can you do payment plans for taxes, and report higher success rates in negotiating financial plans and resolving issues.

Additionally, consulting with tax professionals can provide tailored advice on how to communicate strategically with tax authorities. As Lawrence Brown emphasizes, discussing your situation with a tax lawyer ensures you will receive due process under the law. Remember, clear and timely communication can significantly impact the outcome of your tax situation.

If you encounter communication breakdowns, don’t hesitate to escalate issues with IRS agents to their managers or regional managers for better resolution. You are not alone in this journey; we’re here to help you navigate these challenges.

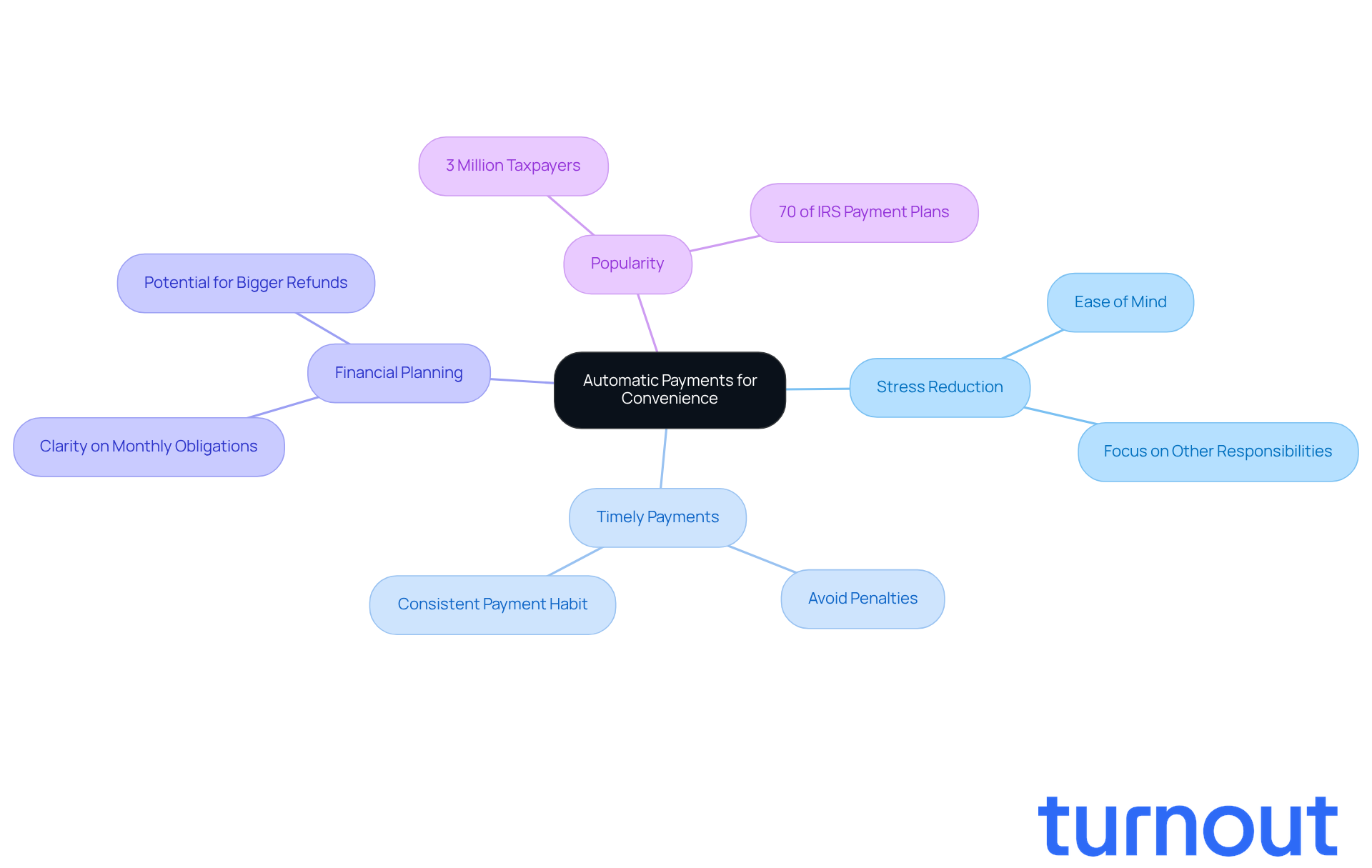

Consider Automatic Payments for Convenience

Are you feeling overwhelmed by the tax settlement process? We understand that managing deadlines and payments can be stressful. Utilizing a Direct Debit Installment Agreement (DDIA) can significantly ease this burden. This automated transaction method ensures timely payments, helping you avoid penalties for late submissions. By automating your transactions, you can take a breath and focus on other important financial responsibilities.

Many taxpayers who have adopted DDIAs report feeling more at ease with their tax obligations. The convenience of automatic deductions encourages a consistent contribution habit, making it easier to stay on track. In fact, almost 3 million taxpayers set up IRS installment agreements in the past two years, which speaks volumes about their popularity.

Tax experts emphasize that DDIAs not only simplify the transaction process but also enhance your financial planning. They provide clarity on your monthly obligations, allowing you to manage your finances more effectively. As Mark Steber notes, "This means you could get a bigger tax refund or owe the IRS less." This illustrates the potential financial benefits of using DDIAs.

Taking this proactive approach can lead to better financial management and peace of mind. Remember, you are not alone in this journey. We're here to help you navigate your tax responsibilities with confidence.

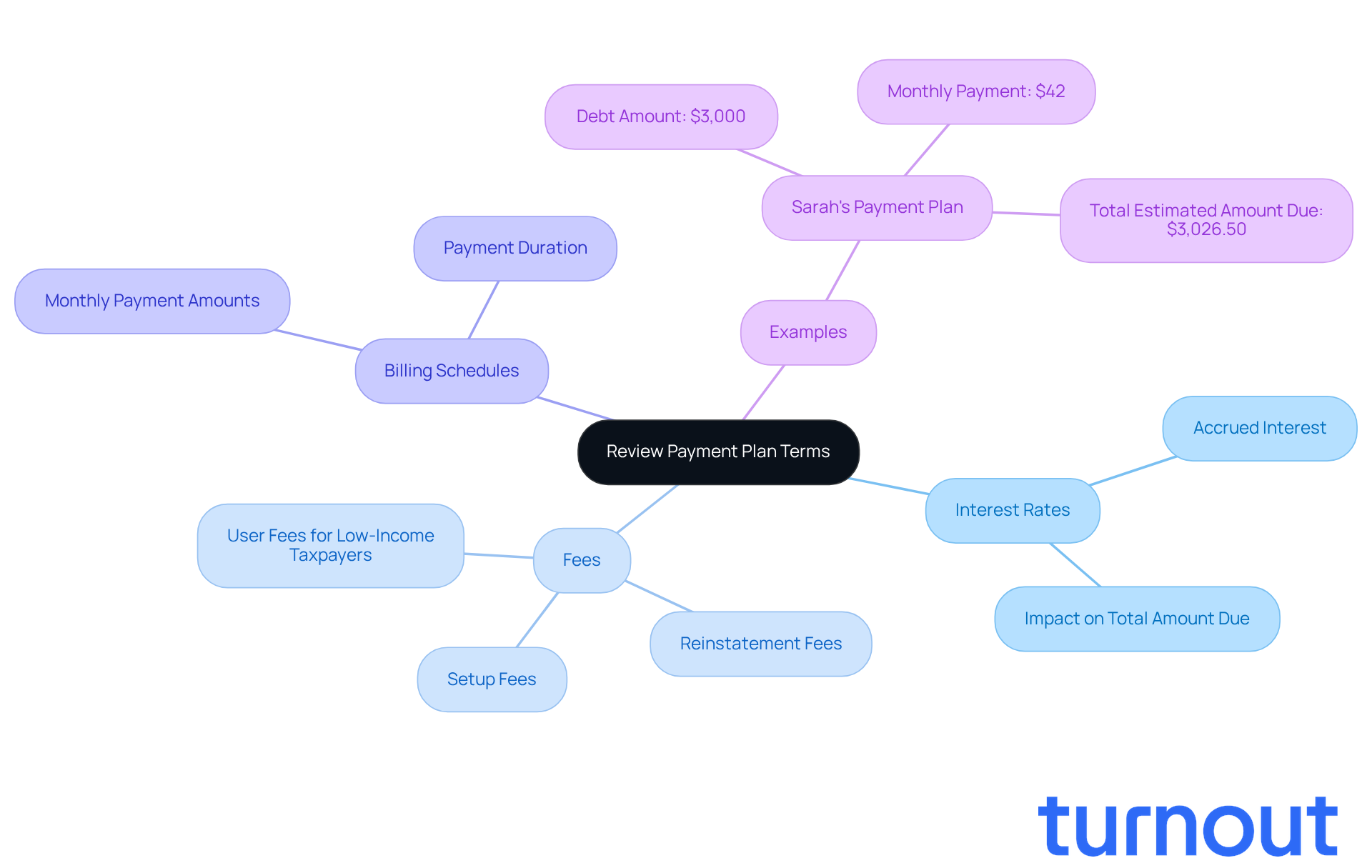

Review Payment Plan Terms Carefully

Before you agree to a financial arrangement, it’s crucial to take a close look at the terms and conditions. We understand that this can feel overwhelming, but focusing on key aspects like interest rates, fees, and billing schedules can make a big difference. Did you know that about 40% of taxpayers feel uncertain about their financial arrangements? This uncertainty can lead to unexpected financial stress. By understanding these details, you can avoid surprises and ensure that the arrangement fits your situation.

For instance, consider Sarah. She owed $3,000 and found that her Long-Term Installment Agreement required a monthly payment of about $42 over 72 months. This allowed her to budget effectively. After accounting for penalties and interest, her total estimated amount due is around $3,026.50.

If you’re looking to set up a financial arrangement, can you do payment plans for taxes by calling or by mailing Form 9465? Consulting with tax experts can provide valuable insights into the specifics of these plans, helping you navigate potential pitfalls. Remember, clarity in these agreements is vital to avoid future complications and ensure you meet IRS requirements.

It’s also important to keep in mind that penalties and interest will continue to accumulate until your tax balance is fully paid. If you’re a low-income taxpayer, you might even qualify for a waiver or reimbursement of user fees under certain conditions. You are not alone in this journey, and we’re here to help you find the best path forward.

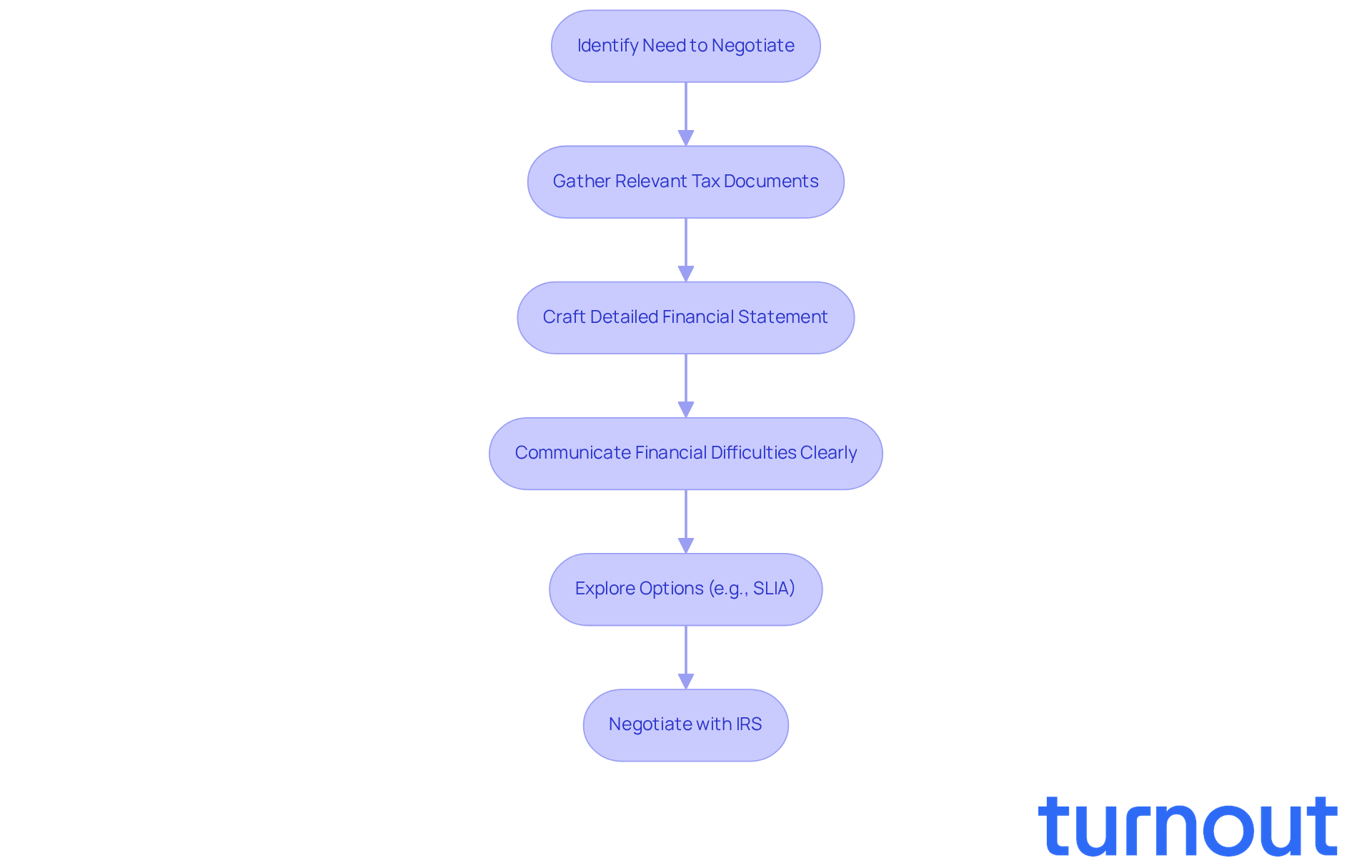

Negotiate Payment Terms When Possible

When standard financial terms don’t quite match your reality, negotiating with the IRS can be a helpful path forward. We understand that dealing with taxes can be overwhelming, but the IRS often shows flexibility. They may allow changes to what you owe or extend deadlines based on your unique situation. To strengthen your negotiating position, it’s essential to present a well-documented case that clearly outlines your financial circumstances, including your income, expenses, and any hardships you might be facing.

Many taxpayers who successfully negotiated repayment plans shared that their ability to communicate their financial difficulties clearly made a significant difference. They provided supporting documentation that helped tell their story. In fact, the IRS has expanded its criteria for streamlined processing of installment agreements, with 80-90% of applicants qualifying for online settlement agreements. This shows a real willingness from the IRS to collaborate with taxpayers who actively seek solutions.

Before you start negotiations, it’s crucial to be prepared. Gathering relevant tax documents and crafting a detailed financial statement can greatly improve your chances of reaching a favorable agreement. Understanding the various options available, like the Streamlined Installment Agreement (SLIA) for debts under $50,000, can help answer the question, can you do payment plans for taxes? Working with a tax professional can enhance your negotiating power, as they know IRS procedures and can effectively present your case.

Remember, acting quickly and keeping clear communication with the IRS are vital steps to prevent collections and safeguard your financial well-being. By taking these proactive measures, you can navigate the complexities of tax negotiations more effectively and find a manageable solution tailored to your needs. You are not alone in this journey; we’re here to help.

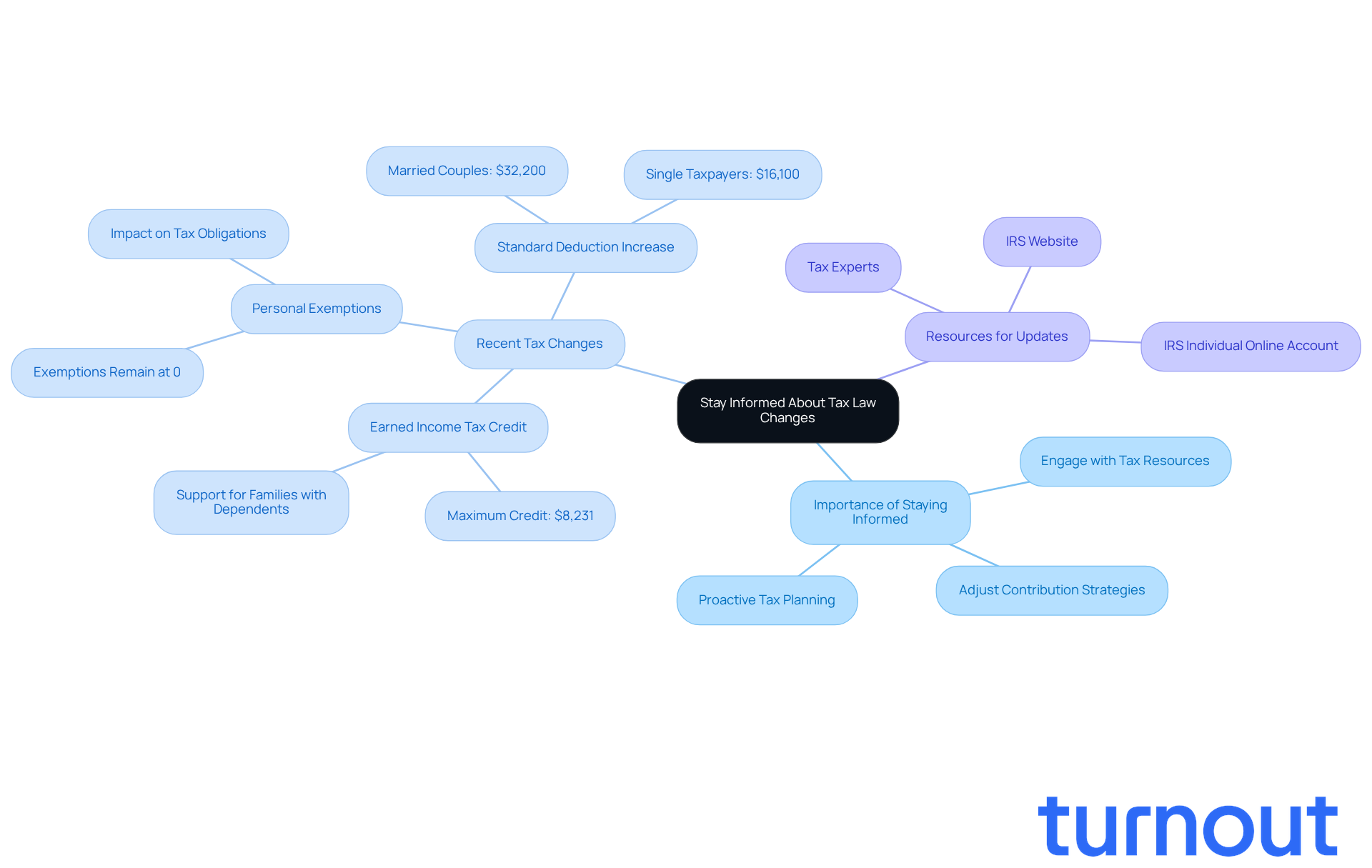

Stay Informed About Tax Law Changes

Tax regulations are always changing, and we understand how overwhelming that can feel. Staying informed is crucial for adjusting your contribution strategies effectively. By frequently checking the IRS website or seeking advice from a tax expert, you can gain insights into new regulations that might impact your financial situation or overall tax responsibilities.

For example, the IRS recently announced significant updates for the 2026 tax year. The maximum Earned Income Tax Credit will rise to $8,231 for qualifying families, showing a commitment to support those with multiple dependents. However, personal exemptions will remain at 0 for tax year 2026, which is a notable change that could affect your overall tax obligations.

Mark your calendars! The 2026 tax filing season opens on January 26, 2026, giving you the opportunity to start filing your returns. It's common to feel uncertain about these changes, and statistics reveal that many taxpayers are unaware of them. This highlights the importance of engaging with tax resources proactively.

As the IRS emphasizes, understanding these updates can lead to more effective tax planning and potentially lower tax burdens. Remember, you are not alone in this journey. We're here to help you navigate these changes and ensure you’re prepared as laws evolve.

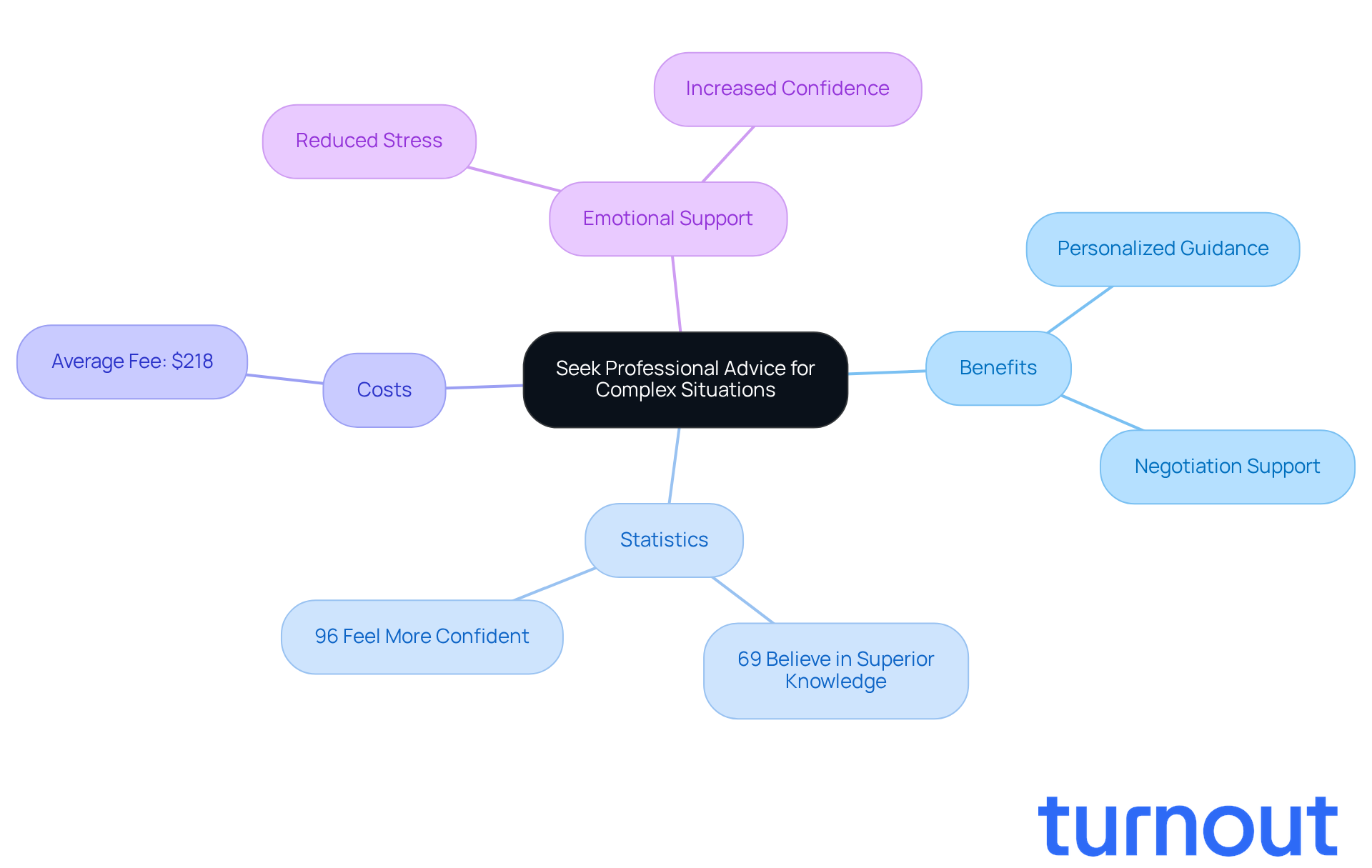

Seek Professional Advice for Complex Situations

Navigating a complex tax situation can feel overwhelming, and it’s completely normal to seek help. That’s where tax professionals come in. They provide personalized guidance tailored to your unique circumstances, helping you understand the intricacies of tax laws.

Imagine having someone by your side who can advocate for you, especially when negotiating financial arrangements. These experts can secure terms that align with your financial capabilities, easing your worries. In fact, statistics show that 69% of Americans believe tax preparers possess superior knowledge, which can lead to maximizing refunds and minimizing liabilities.

Hiring a tax professional can save you significant time and stress, allowing you to focus on what truly matters in your life. In 2023, the average fee for new clients was $218, reflecting the rising costs associated with these valuable services. But remember, many tax experts can help you do payment plans for taxes, successfully helping clients negotiate feasible arrangements that alleviate the burden of tax debt and provide peace of mind.

In a landscape where tax laws are constantly evolving, having a knowledgeable professional can truly make all the difference. Notably, 96% of those who use a pro reported feeling more confident about filing. This underscores the immense value of professional assistance.

As demand for accountants continues to grow, it’s important to understand the challenges firms face in recruiting talent. Seeking expert help is not just a smart choice; it’s a step towards a more secure financial future. Remember, you are not alone in this journey, and we’re here to help.

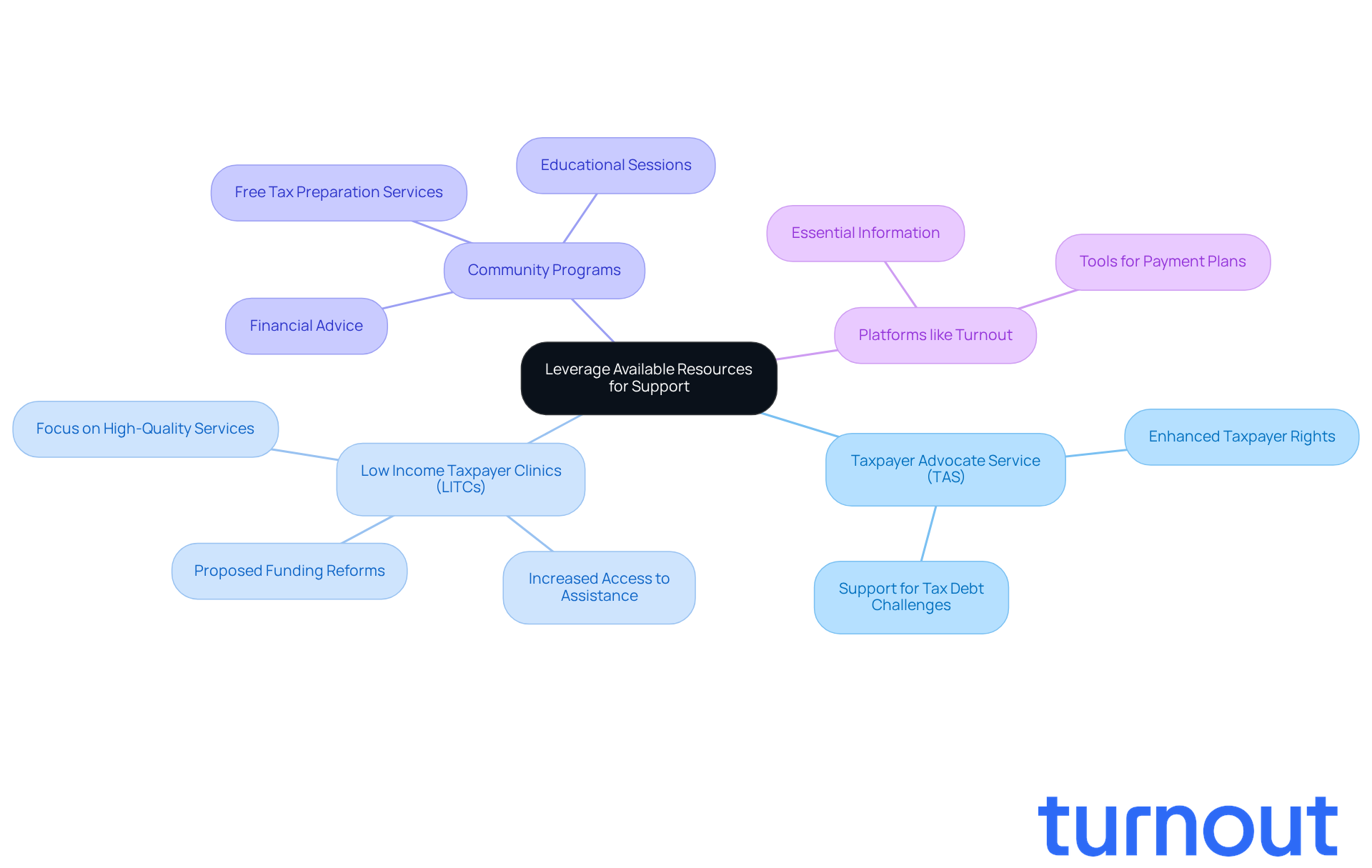

Leverage Available Resources for Support

Managing tax obligations can feel overwhelming, but there are resources available to help you navigate this journey. The Taxpayer Advocate Service (TAS) is here to support individuals facing tax debt challenges. Recent updates from TAS show a strong commitment to enhancing taxpayer rights and expanding access to assistance. Proposed reforms aim to reduce funding restrictions for Low Income Taxpayer Clinics (LITCs), which could significantly increase the number of taxpayers served. This means clinics can focus on delivering high-quality services in areas that need it most.

Community programs also provide valuable support for those struggling with tax debt. Many local groups offer free or affordable tax preparation services, financial advice, and educational sessions. These resources can help you understand your tax responsibilities and explore options for settling amounts owed, such as asking, can you do payment plans for taxes? In fact, statistics reveal that taxpayers who utilize community programs for tax assistance often report improved financial outcomes. For instance, 72% of small business owners have seen better results after adopting digital tools and best practices in financial management.

Additionally, platforms like Turnout empower you by providing essential information and tools to navigate the payment plan process. By leveraging these resources, you can gain the knowledge and support needed to manage your tax responsibilities confidently and effectively. Remember, you are not alone in this journey; help is available, and we're here to assist you.

Conclusion

Navigating tax obligations can often feel overwhelming. We understand that the thought of managing these responsibilities can weigh heavily on your mind. However, knowing the options available for payment plans can significantly lighten that load. This article has explored various strategies to help you effectively manage your tax liabilities. From utilizing innovative platforms like Turnout to understanding eligibility requirements and thoroughly documenting your financial situation, there are paths forward.

Key insights include:

- The importance of effective communication with tax authorities.

- Automatic payment options can offer convenience.

- Carefully reviewing payment plan terms is essential.

- Negotiating terms with the IRS can lead to more manageable arrangements.

- Staying informed about changes in tax law ensures you’re prepared for any shifts that may impact your financial responsibilities.

- Seeking professional advice can further enhance your ability to navigate these complex situations.

Ultimately, it’s crucial to remember that support is available. Whether through community resources, tax professionals, or platforms like Turnout, you are not alone in this journey. Taking proactive steps to understand and manage tax payment plans not only alleviates stress but also empowers you to take control of your financial future. By leveraging these resources and insights, you can confidently tackle your tax obligations and find solutions that work for your unique situation.

Frequently Asked Questions

What is Turnout and how does it help with tax payment plans?

Turnout is a user-friendly platform that simplifies the process of dealing with tax obligations by providing clear guidance on eligibility criteria, necessary documentation, and step-by-step instructions for tax settlement options.

What technology does Turnout use to assist users?

Turnout employs advanced AI technology to offer quicker responses and tailored advice, enhancing accessibility and empowering users to manage their tax obligations confidently.

Who provides support through Turnout?

Turnout utilizes trained nonlawyer advocates and collaborates with IRS-licensed enrolled agents to ensure users have the necessary support to navigate tax debt relief.

What are the eligibility requirements for IRS installment arrangements?

To qualify for an IRS installment arrangement, you typically must owe $50,000 or less in total tax, penalties, and interest, and all required tax returns must be filed.

What documents should I provide when arranging financing for tax payments?

You should provide a complete picture of your financial situation, including income statements, bank statements, expense records, and any other relevant documents.

Why is thorough documentation important in negotiations with the IRS?

Providing thorough documentation strengthens your position in negotiations and increases your chances of getting your financial arrangement approved, as it shows your willingness to cooperate and gives the IRS a clear view of your financial capabilities.

What is a short-term arrangement with the IRS?

A short-term arrangement can be established if you can settle your entire tax obligation within 180 days, potentially leading to quicker resolutions.

How can I ensure effective negotiation with the IRS?

To negotiate effectively, ensure that your financial circumstances are accurately represented by providing complete documentation, which will help create a repayment plan that aligns with your ability to pay.