Introduction

Navigating the world of tax preparation can feel overwhelming, especially with the rapid changes driven by technology and the complexities of tax laws. We understand that many individuals are seeking professional help to manage these challenges, and this presents a unique opportunity for compassionate entrepreneurs to step in and make a meaningful impact.

In this article, we’ll explore ten compelling reasons to consider starting a tax preparation franchise today. You’ll discover the potential for high profit margins, the flexibility that comes with ownership, and the vital role of ongoing support and training. It’s common to feel uncertain about taking this step, but rest assured, you’re not alone in this journey.

However, it’s important to acknowledge that aspiring franchisees may face challenges in this promising landscape. Together, we can navigate these hurdles effectively, ensuring your path to success is as smooth as possible.

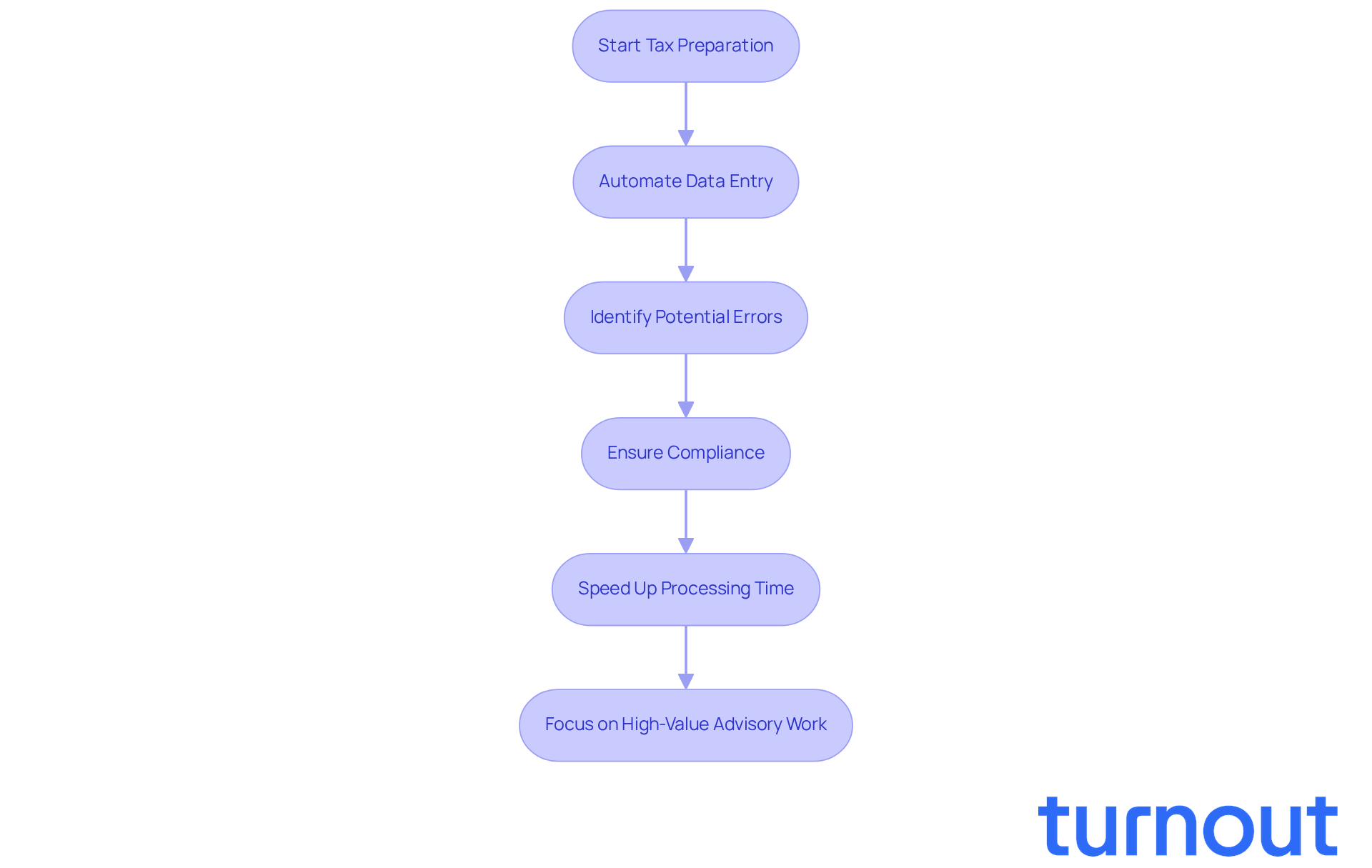

Leverage Turnout's AI for Enhanced Efficiency in Tax Preparation

Navigating tax preparation can be overwhelming, and we understand that many individuals face challenges in this area. That’s where Turnout’s AI technology comes in. By automating data entry and identifying potential errors, we help ensure compliance with the latest tax regulations. This integration not only speeds up the processing time for each return but also significantly reduces the risk of costly mistakes.

It’s important to note that Turnout is not a law firm and does not offer legal representation. Instead, we have trained nonlawyer advocates and IRS-licensed enrolled agents ready to assist you in navigating complex financial and governmental systems, including tax debt relief. This support allows franchise owners to focus on what truly matters: enhancing client interactions and strategic planning, which leads to improved service delivery and higher client retention rates.

Imagine saving over 20 hours each month! With AI streamlining workflows, tax professionals can dedicate more time to high-value advisory work. As AI continues to evolve, its role in tax services will only grow, making it an essential resource for any modern tax preparation franchise. Remember, you are not alone in this journey; we’re here to help you every step of the way.

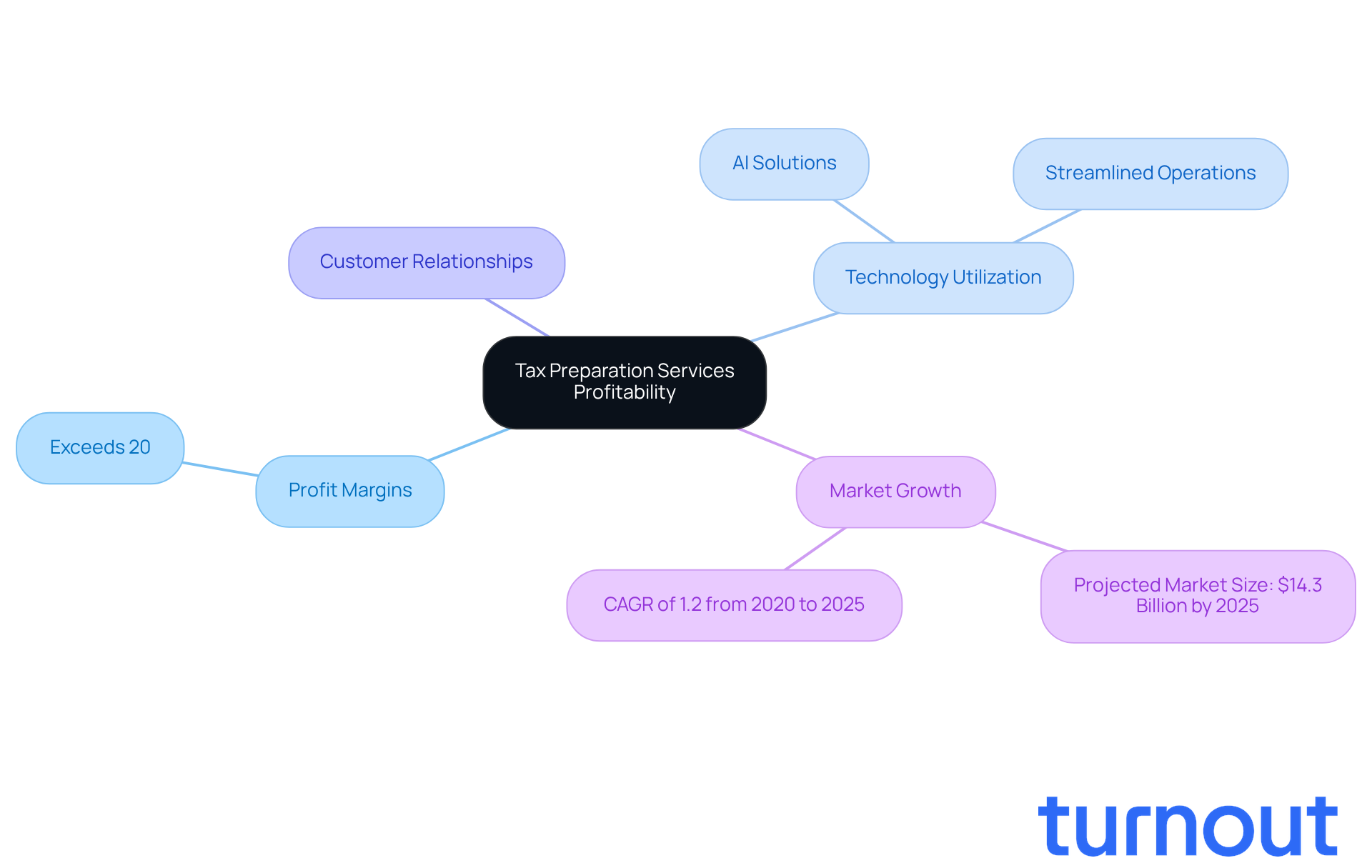

Achieve High Profit Margins with Tax Preparation Services

Tax preparation franchise services are not just about numbers; they represent a significant opportunity for those looking to make a meaningful impact. With profit margins often exceeding 20%, this sector stands out as a beacon of potential. We understand that starting a business can feel daunting, but the low overhead costs associated with running a tax business can ease some of those worries, especially when technology is effectively harnessed.

Imagine utilizing AI solutions to streamline your operations. This not only reduces manual workloads but also enhances customer interactions, making your services more accessible and user-friendly. By focusing on improving these processes and nurturing customer relationships, you can significantly boost your profitability while providing essential services that truly meet consumer needs.

It's common to feel uncertain about entering a new market, but consider this: the tax preparation franchise industry is on a growth trajectory, with a market size projected to reach $14.3 billion by 2025. This underscores the financial viability of stepping into this rewarding sector. Remember, you are not alone in this journey; we’re here to help you navigate the path to success.

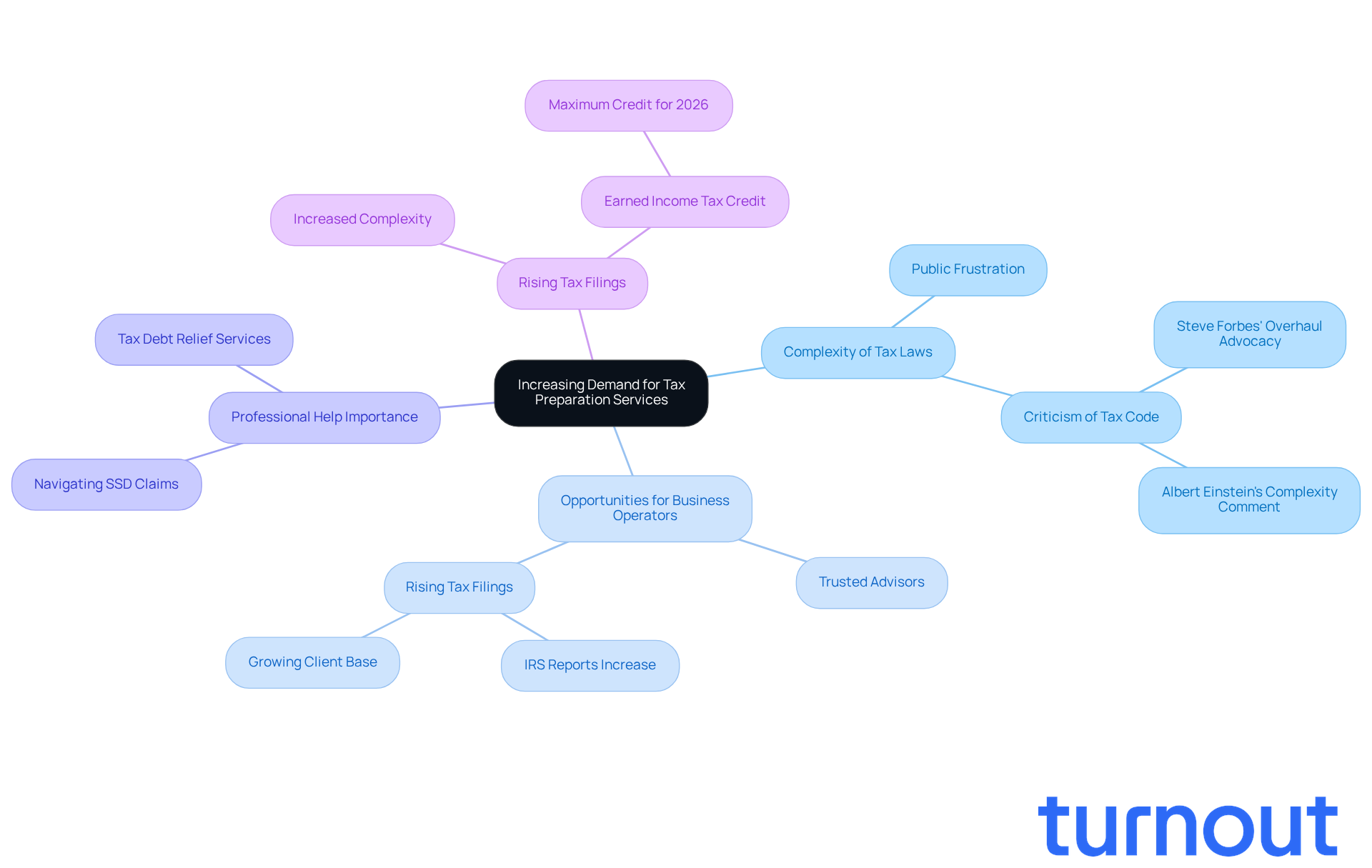

Capitalize on the Increasing Demand for Tax Preparation Services

The demand for a tax preparation franchise is on the rise, and it’s easy to see why. Many individuals are feeling overwhelmed by the increasing complexity of tax laws and are seeking professional help. As the IRS reports a steady increase in tax filings, this presents a unique opportunity for business operators to step in and support those in need.

By positioning themselves as trusted advisors, they can attract a loyal client base and secure consistent revenue streams. We understand that navigating processes like Social Security Disability (SSD) claims and tax debt relief can be daunting. That’s where services like Turnout come in, simplifying access to government benefits and financial support.

It’s common to feel lost in the intricate tax landscape. Albert Einstein once noted that income tax is one of the hardest concepts to grasp, and many share this sentiment. With the maximum Earned Income Tax Credit for 2026 set at $8,231 for qualifying taxpayers with three or more children, the stakes are high. This makes professional tax preparation franchise services more valuable than ever.

As tax submissions continue to rise, the opportunity for business operators within a tax preparation franchise to thrive in this environment is considerable. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and find the support you need.

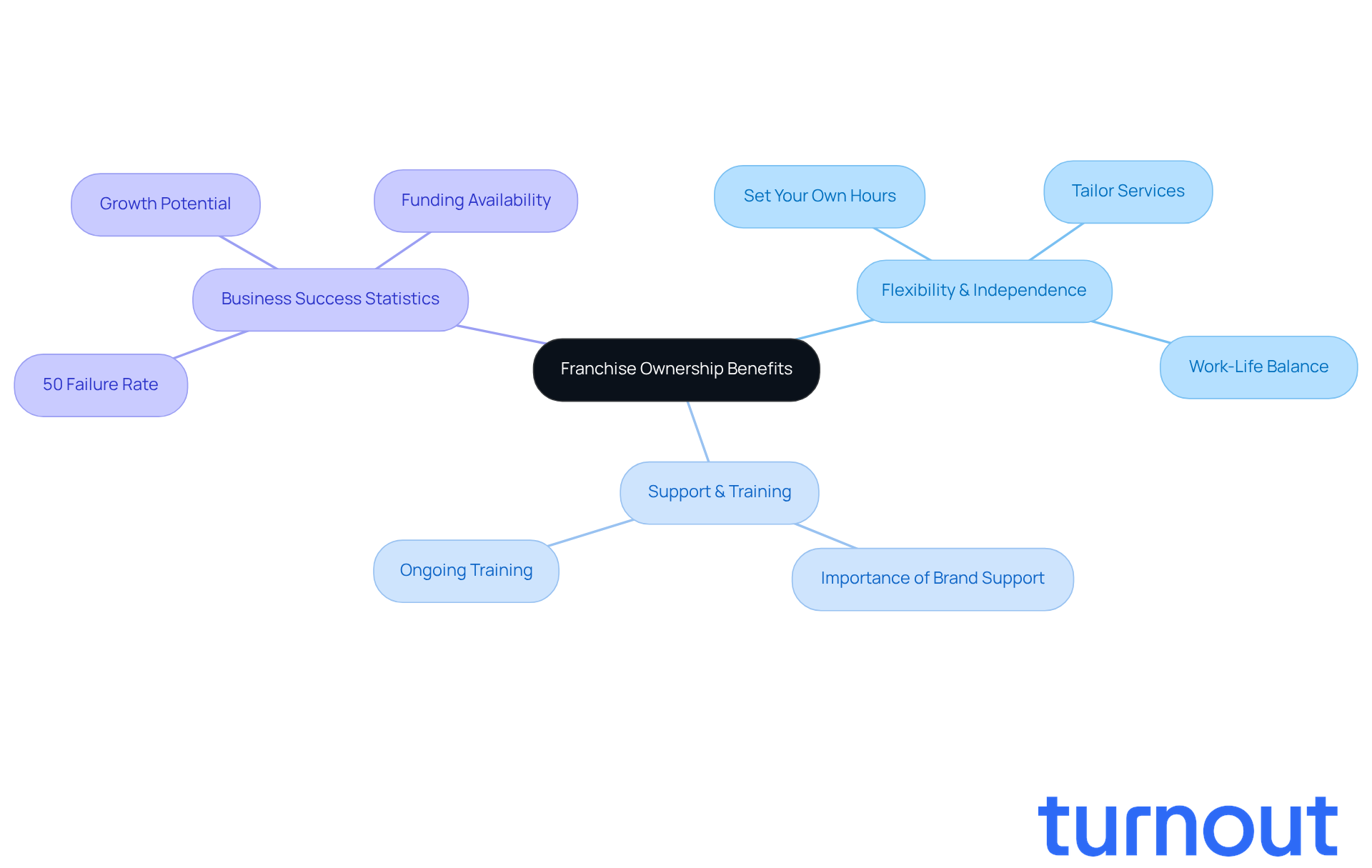

Enjoy Flexibility and Independence as a Franchise Owner

Owning a tax preparation franchise can provide you with the flexibility and independence you might be seeking. Imagine being able to set your own hours, choose your work environment, and tailor your services to meet your clients' needs. This kind of autonomy not only helps you achieve a better work-life balance but also makes it an attractive option for anyone looking to break free from the traditional 9-to-5 routine.

We understand that flexibility is essential for personal well-being and professional success. Many franchise operators find that they can adjust their schedules to accommodate family commitments or personal interests, leading to a more fulfilling lifestyle. For instance, numerous tax business operators share how they can spend more quality time with their families during peak seasons, thanks to the ability to modify their working hours.

The tax preparation franchise sector is uniquely positioned to provide this flexibility. Demand for tax preparation franchise services often peaks at certain times of the year, allowing franchise operators to strategically plan their workload. This ensures they meet client needs while still maintaining their desired work-life balance. Such adaptability is a significant advantage of owning a tax preparation franchise, making it a compelling choice for aspiring entrepreneurs.

However, it’s common to feel apprehensive about the challenges that come with this path. Statistics reveal that over 50% of business ventures fail within the first five years due to inadequate financial management. This highlights the importance of selecting a brand that offers solid training and ongoing support. Additionally, the U.S. business sector is projected to reach a value of $893.9 billion by the end of 2025, showcasing the growth potential of various business models. Approximately 60% of potential business owners can secure funding from conventional lenders, making it easier to enter the market. Furthermore, 87% of franchisees report receiving ongoing support from their franchisors, which can significantly enhance their chances of success. It’s also worth noting that only about 50% of small businesses survive beyond the five-year mark, adding a layer of risk to ownership.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges and find the right path for your future.

Receive Comprehensive Training and Ongoing Support from Franchise Networks

Franchise networks understand that navigating the world of a tax preparation franchise and business management can be overwhelming. That’s why they offer extensive training programs covering everything from tax techniques to effective management strategies. Continuous support is there to keep business owners informed about regulatory changes and best practices, which is especially invaluable for new franchisees. This support helps build confidence and competence in their operations.

As Turnout simplifies access to government benefits and financial support, franchisees can assist customers with SSD claims and tax relief - all without needing legal representation. It’s common to feel uncertain about these processes, but remember, you’re not alone in this journey. With the right resources, you can make a significant impact.

As the landscape of accounting evolves with advancements in AI, it’s crucial for franchisees to adapt and leverage these technologies. We understand that change can be daunting, but embracing these tools can lead to greater efficiency and success.

A gentle reminder: "Your limitation - it’s only your imagination." Overcoming challenges is part of the journey to success in the tax preparation franchise. So, let’s take this journey together, and remember, we’re here to help you every step of the way.

Build a Trusted Brand in Your Community

Creating a reliable brand is crucial for any tax preparation franchise. We understand that establishing trust can be challenging, but by offering outstanding service and nurturing strong connections with customers, owners of a tax preparation franchise can build a positive reputation in their community.

Participating in local events and providing educational workshops can significantly enhance your brand's visibility and trust. These efforts not only attract new clients but also foster loyalty among existing ones. Listening to your customers is essential; understanding their needs can lead to long-term satisfaction and loyalty.

As Tony Hsieh wisely pointed out, customer service should be a company-wide commitment. Every team member plays a role in creating a favorable customer experience. Did you know that satisfied customers are more likely to refer others? A 4.9 Google review rating is a testament to how exceptional service can establish a trusted brand.

Moreover, engaging in community activities benefits not just your clients but also boosts employee motivation and loyalty. This creates a supportive network that encourages referrals and strengthens your market position. Remember, you are not alone in this journey; we’re here to help you thrive.

Scale Your Business with Diverse Service Offerings

We understand that managing your finances can be overwhelming. Franchise operators have a wonderful opportunity to enhance their revenue potential by offering a variety of services beyond just their tax preparation franchise. Imagine a tax preparation franchise that provides bookkeeping, financial planning, and tax advisory services all under one roof.

This diversification not only attracts a broader customer base but also allows you to offer comprehensive solutions to meet individuals' financial needs. By doing so, you foster long-term relationships and encourage repeat business.

You’re not alone in this journey. We’re here to help you navigate these options and create a nurturing environment for your clients. Together, we can build a supportive community that addresses their concerns and helps them thrive.

Network with Industry Professionals for Enhanced Opportunities

Building a strong network with fellow tax professionals is crucial for discovering new opportunities and forming valuable partnerships. We understand that navigating the tax industry can be challenging, but engaging in conferences, joining professional associations, and participating in local business groups can significantly enhance your professional network.

This expanded network not only opens doors for potential collaborations but also boosts referrals, which are vital for your business growth. It's common to feel overwhelmed, but statistics show that successful partnerships in the tax sector can lead to improved service offerings and greater customer satisfaction. For example, partnerships filed over 4.5 million returns in Tax Year 2022, underscoring the power of collaboration in achieving success.

By actively engaging in the tax community, you can position yourself as a reliable resource. Remember, you are not alone in this journey. As Porter Gale wisely states, "Your network is your net worth." This highlights the critical role that professional relationships play in your growth. So, let's take that step together and build a network that supports your success in this competitive market.

Make a Positive Impact on Clients' Financial Well-Being

Tax preparation is more than just crunching numbers; it’s about transforming lives. We understand that navigating tax regulations can be overwhelming, but with the right guidance, you can maximize your refunds and improve your financial situation. This service not only brings satisfaction but also builds lasting loyalty among customers.

Turnout makes it easier for you to access government benefits and financial support, especially if you’re dealing with complex processes like Social Security Disability (SSD) claims or tax debt relief. It’s common to feel lost in these situations, but remember, you’re not alone in this journey.

For franchisees, the tax preparation franchise business model is rewarding. They witness firsthand the positive changes they help create in their customers' financial well-being. Imagine the satisfaction of knowing you’ve made a real difference in someone’s life. We’re here to help you take that step toward a brighter financial future.

Adapt to Changing Tax Laws for Continued Success

The tax landscape is always changing, and we understand how overwhelming that can feel. New laws and regulations pop up regularly, making it crucial for business operators like you to stay informed. This isn’t just beneficial; it’s essential for compliance and delivering accurate services to your customers.

Continuous education can be your ally in navigating these complexities. By participating in ongoing training and tapping into resources from business networks, you can manage these changes effectively. Did you know that franchisees in a tax preparation franchise who prioritize education are significantly more adaptable to tax law changes? This adaptability leads to better compliance and happier customers.

For example, Kentucky's individual income tax rate is set to decrease from 4 percent to 3.5 percent starting January 1, 2026. Staying informed about such changes is vital. Investing in your knowledge and skills not only secures your long-term success but also helps you maintain a competitive edge in the industry.

As tax expert Rocky Mengle wisely states, 'Continuous education is vital for navigating the ever-changing tax environment, ensuring that those in the tax preparation franchise can provide the best service to their clients.' Remember, you’re not alone in this journey. We’re here to help you thrive.

Conclusion

Starting a tax preparation franchise offers a unique chance to achieve not just financial success but also to make a real difference in the lives of your clients. We understand that navigating the complexities of tax preparation can be daunting. That’s where advanced technologies like Turnout's AI come in. They enhance efficiency, reduce errors, and allow you to focus on delivering exceptional service. This blend of innovation and personal touch is what truly sets successful franchises apart in today’s competitive market.

Throughout this article, we’ve highlighted several compelling reasons to invest in a tax preparation franchise. Think about the potential for high profit margins and the increasing demand for professional tax services. Plus, the flexibility that comes with franchise ownership can be incredibly rewarding. And let’s not forget the importance of comprehensive training and ongoing support. These elements are crucial for navigating the complexities of tax laws and building a trusted brand within your community.

Ultimately, owning a tax preparation franchise is about more than just numbers; it’s about fostering relationships and enhancing your clients' financial well-being. It’s common to feel overwhelmed by the ever-evolving tax landscape, but embracing change and leveraging technology will be key to sustaining your success. For those considering this path, the time to act is now. Capitalize on the growing demand and position yourself as a trusted advisor in your community. Together, let’s embark on this rewarding journey toward financial empowerment and professional fulfillment.

Frequently Asked Questions

What is Turnout's AI technology used for in tax preparation?

Turnout's AI technology automates data entry and identifies potential errors, ensuring compliance with tax regulations, speeding up processing times, and reducing the risk of costly mistakes.

Does Turnout provide legal representation for tax issues?

No, Turnout is not a law firm and does not offer legal representation. Instead, it employs trained nonlawyer advocates and IRS-licensed enrolled agents to assist with tax-related matters.

How can Turnout's services benefit tax professionals?

Turnout's services allow tax professionals to save over 20 hours each month by streamlining workflows, enabling them to focus on high-value advisory work and enhancing client interactions.

What are the profit margins for tax preparation services?

Profit margins for tax preparation franchise services often exceed 20%, making this sector a significant opportunity for business operators.

What advantages do tax preparation franchises have in terms of business costs?

Tax preparation franchises typically have low overhead costs, which can ease the challenges of starting a business, especially when leveraging technology.

What is the projected market size for the tax preparation franchise industry by 2025?

The projected market size for the tax preparation franchise industry is expected to reach $14.3 billion by 2025.

Why is there an increasing demand for tax preparation services?

The increasing complexity of tax laws and a steady rise in tax filings have led many individuals to seek professional help, creating a growing demand for tax preparation franchises.

How can tax preparation franchises attract and retain clients?

By positioning themselves as trusted advisors and simplifying processes like SSD claims and tax debt relief, tax preparation franchises can attract a loyal client base and secure consistent revenue streams.

What is the maximum Earned Income Tax Credit for 2026?

The maximum Earned Income Tax Credit for 2026 is set at $8,231 for qualifying taxpayers with three or more children.

How does Turnout support individuals navigating tax complexities?

Turnout simplifies access to government benefits and financial support, helping individuals navigate the intricate tax landscape and providing necessary assistance.