Overview

The primary focus of this article is to illuminate the benefits of hiring a Houston tax attorney during IRS audits. We understand that facing an audit can be daunting, and having the right support can make a significant difference. Tax attorneys bring essential expertise to the table, ensuring that your rights as a taxpayer are protected.

Their deep understanding of IRS regulations, combined with successful negotiation strategies, can greatly enhance your chances of achieving a favorable outcome. It’s common to feel overwhelmed during such processes, but knowing that there are professionals ready to assist can provide a sense of relief.

We’re here to help you navigate these challenges with confidence. Engaging a tax attorney not only offers you expert guidance but also reassures you that you are not alone in this journey. Take the first step towards peace of mind by considering the support of a dedicated professional.

Introduction

Navigating the complexities of an IRS audit can feel overwhelming and anxiety-inducing. We understand that this experience can leave individuals feeling lost and stressed. Hiring a Houston tax attorney offers not just expert guidance but also emotional support, ensuring that taxpayers are well-equipped to navigate the intricacies of tax regulations and safeguard their rights.

With audits becoming more frequent and the potential for costly mistakes looming, you might wonder: how can the right legal representation transform this stressful ordeal into a manageable process? This article explores ten compelling reasons to engage a tax attorney, highlighting the invaluable benefits they provide during IRS examinations. You're not alone in this journey, and we're here to help.

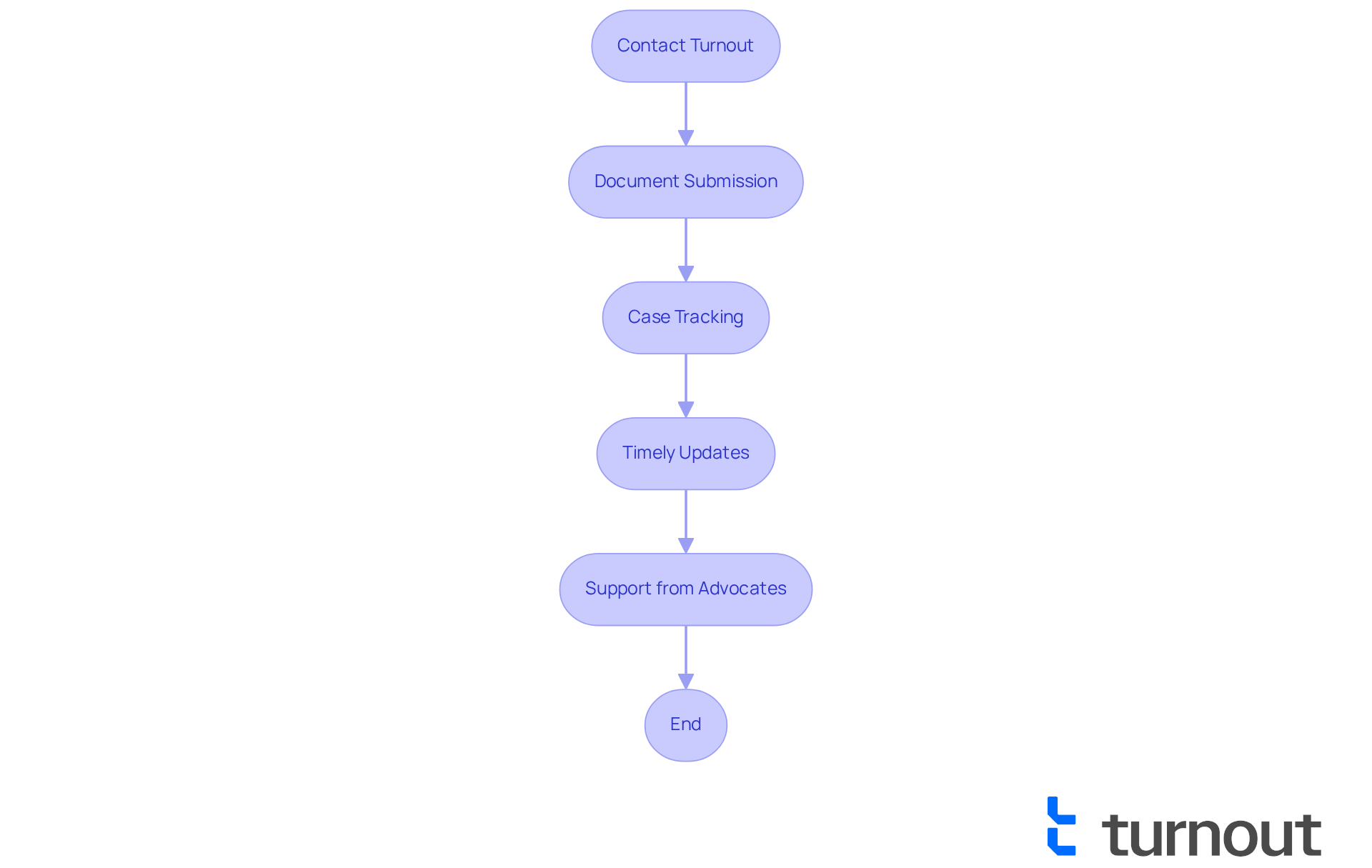

Turnout: AI-Powered Advocacy for Tax Debt Relief

We understand that dealing with tax debt can be overwhelming. Turnout harnesses AI technology to provide efficient and compassionate support for individuals grappling with these challenges. By automating critical processes such as document management and case tracking, Turnout ensures that you receive timely updates and assistance throughout your interactions with the IRS.

This progressive approach is designed to reduce the stress often linked with tax examinations. It enables you to confidently navigate the intricacies of tax regulations, knowing that support is readily available. With trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout simplifies access to government benefits and financial support, making it more accessible and effective for everyday Americans.

Importantly, it's essential to note that Turnout is not a law firm and does not provide legal advice or representation. As AI continues to evolve, its role in streamlining tax processes and improving resolution success rates becomes increasingly vital. This reflects a broader trend towards technology-driven solutions in consumer advocacy. Remember, you are not alone in this journey; we are here to help.

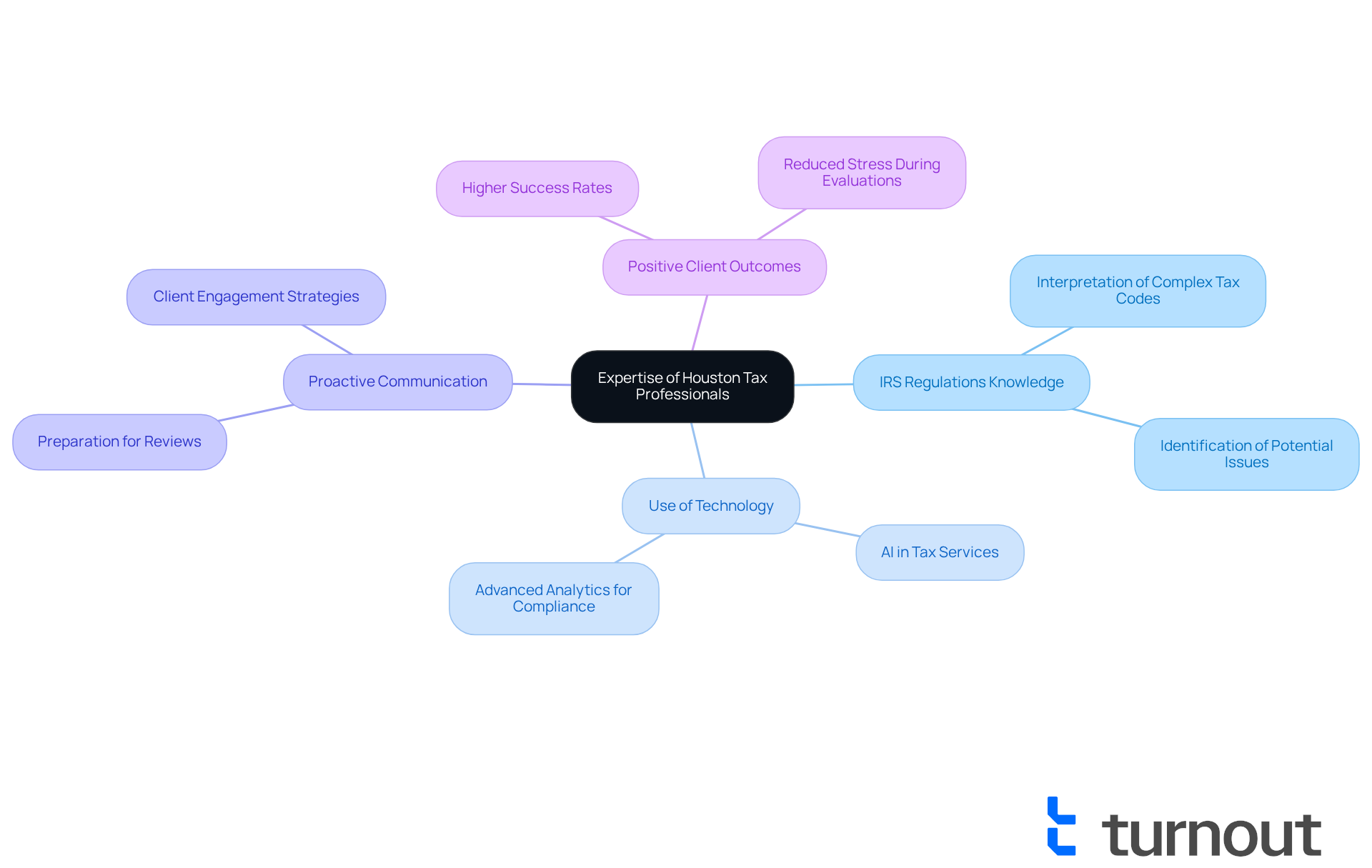

Expertise of Houston Tax Professionals in IRS Audit Navigation

Navigating tax evaluations can be overwhelming, and we understand that many individuals feel uncertain during this process. Houston tax attorneys possess a deep comprehension of IRS regulations and examination processes, making them invaluable partners. Their expertise allows them to interpret complex tax codes, identify potential issues, and devise effective strategies to address IRS inquiries. By utilizing this specialized knowledge, you can navigate the examination process more smoothly, ensuring your rights are protected and that you receive fair treatment from the IRS.

This expertise is essential for reducing stress and enhancing positive results during evaluations. Current trends show that tax specialists are increasingly employing advanced technologies, such as AI, to improve their services. This can lead to greater efficiency and precision in managing evaluations. Furthermore, data indicate that clients who seek assistance from tax experts during evaluations encounter notably greater success rates, highlighting the importance of expert advice.

In Houston, specialists emphasize the significance of proactive communication with a Houston tax attorney to prepare for reviews. This proactive approach can lead to improved outcomes and lower stress for taxpayers. Remember, you are not alone in this journey. We're here to help you every step of the way.

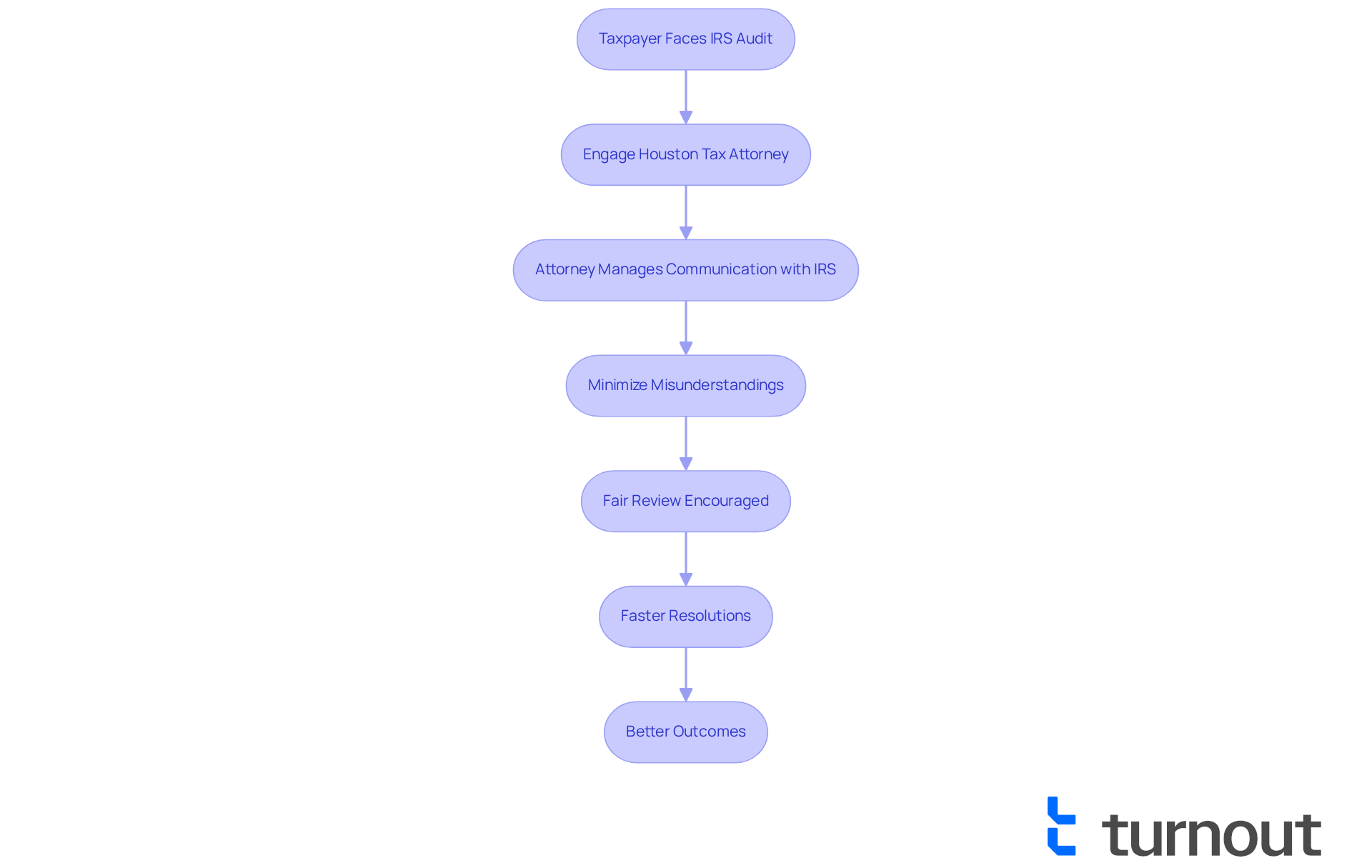

Legal Representation: Protecting Your Rights During IRS Audits

Having expert assistance from a Houston tax attorney during an IRS examination is crucial for protecting your rights as a taxpayer. We understand that navigating these situations can be daunting. With the right support from a Houston tax attorney, you can ensure that all communications with the IRS are handled correctly, which minimizes misunderstandings and potential violations of your rights. These experts not only manage the process but also encourage a fair review, shielding you from undue pressure or examination.

This protective layer is essential for preserving your peace of mind. You deserve to know that your interests are prioritized during the evaluation. Research shows that taxpayers represented by a Houston tax attorney are less likely to face negative outcomes. They can navigate the complexities of the examination process more efficiently, leading to quicker resolutions and better overall results.

You are not alone in this journey. The right advocates by your side can make all the difference. Remember, we’re here to help you through these challenging times.

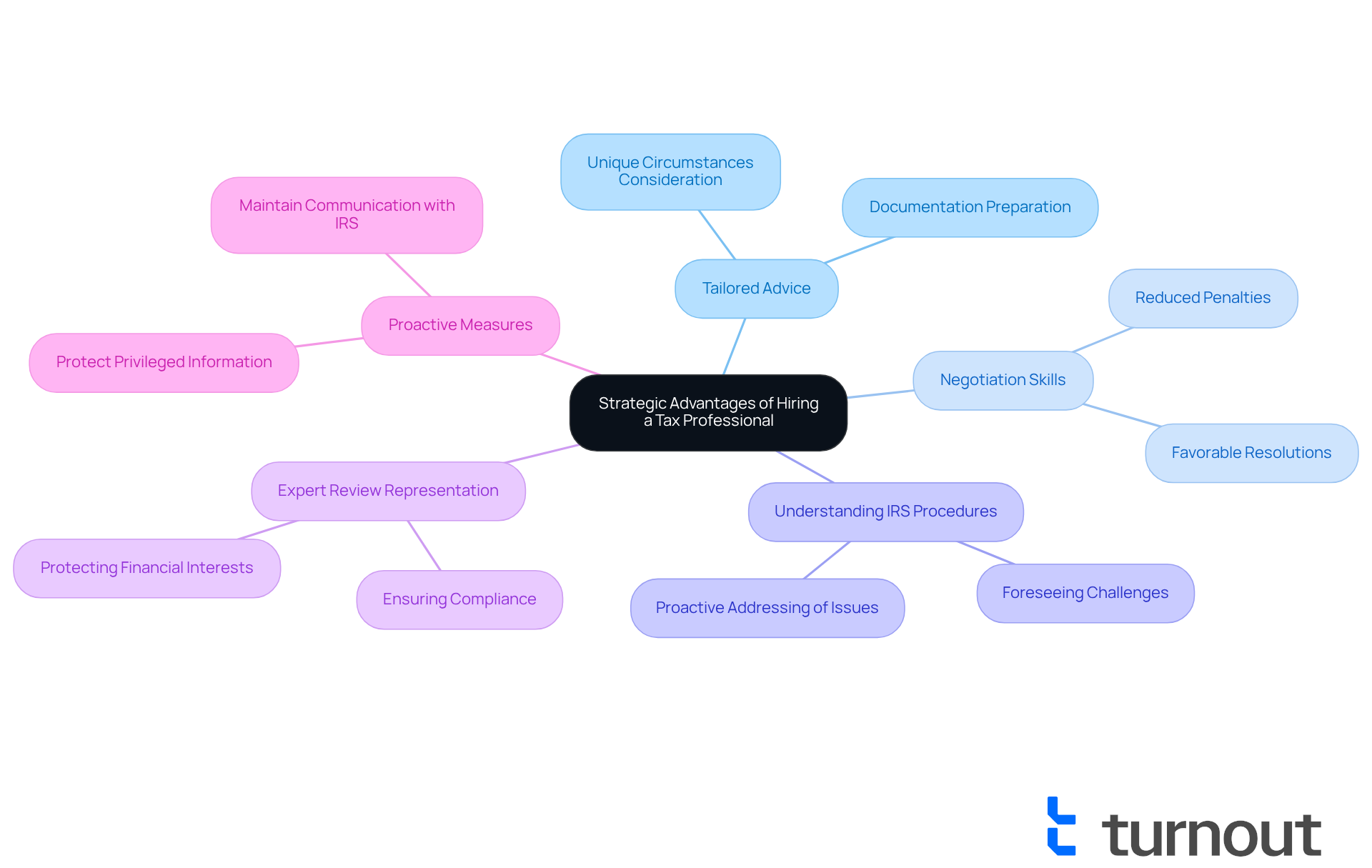

Strategic Advantages of Hiring a Tax Professional for IRS Audits

Navigating an IRS examination can be daunting, but involving a tax expert can provide you with significant strategic benefits. These professionals offer tailored advice that considers your unique circumstances, helping you prepare documentation and responses that align with IRS expectations.

Their negotiation skills are invaluable; they can often lead to reduced penalties or more favorable resolutions of disputes. With their deep understanding of IRS procedures, they can foresee potential challenges and proactively address them, significantly improving your chances of achieving a favorable review result.

It's important to note that in 2020, only 0.5% of personal tax returns were examined. This infrequency can help ease taxpayer concerns. However, the IRS plans to enhance examinations, particularly targeting high-income individuals, making expert advice even more essential.

As highlighted by Walters & Associates, their expert review representation services are designed to protect your financial interests. They ensure that you adhere to regulations and safeguard your rights throughout the review process.

Proactive measures, such as maintaining open communication with the IRS and protecting privileged information, are essential strategies that can help you avoid costly mistakes. Remember, you are not alone in this journey. We're here to help you navigate these challenges with confidence.

Financial Benefits: How a Tax Professional Can Save You Money

Hiring a Houston tax attorney during an IRS audit can truly make a difference in your financial well-being. We understand that navigating through tax issues can be overwhelming, and having a Houston tax attorney by your side can provide substantial relief. These experts are skilled at identifying deductions and credits that individuals often overlook, which can significantly reduce your overall tax liability.

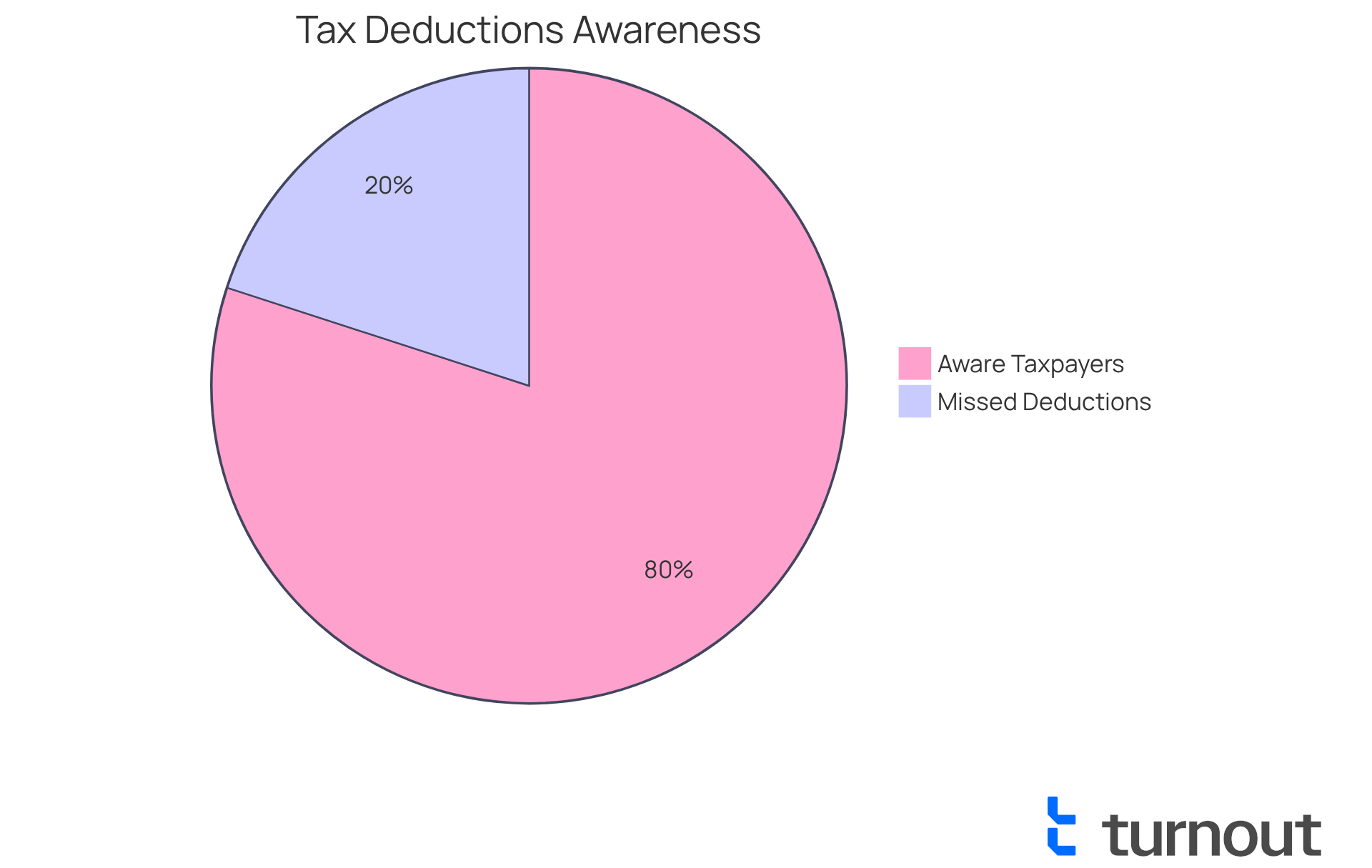

Did you know that approximately 20% of taxpayers miss out on valuable deductions? This often results in higher tax payments than necessary. It’s common to feel lost in the complexities of tax regulations, but a Houston tax attorney can provide assistance. They can work with a Houston tax attorney to negotiate payment arrangements or settlements that lower the amount owed to the IRS, ensuring you’re not overpaying or facing unnecessary penalties.

As Katelynn Minott, CPA & CEO, wisely observes, 'Frequently, the savings that tax experts assist you in discovering surpass the expense of employing them.' This proactive approach not only conserves funds but also leads to a more favorable financial outcome. You are not alone in this journey; seeking expert support can be a valuable investment in your financial future.

Emotional Relief: The Peace of Mind from Professional Support

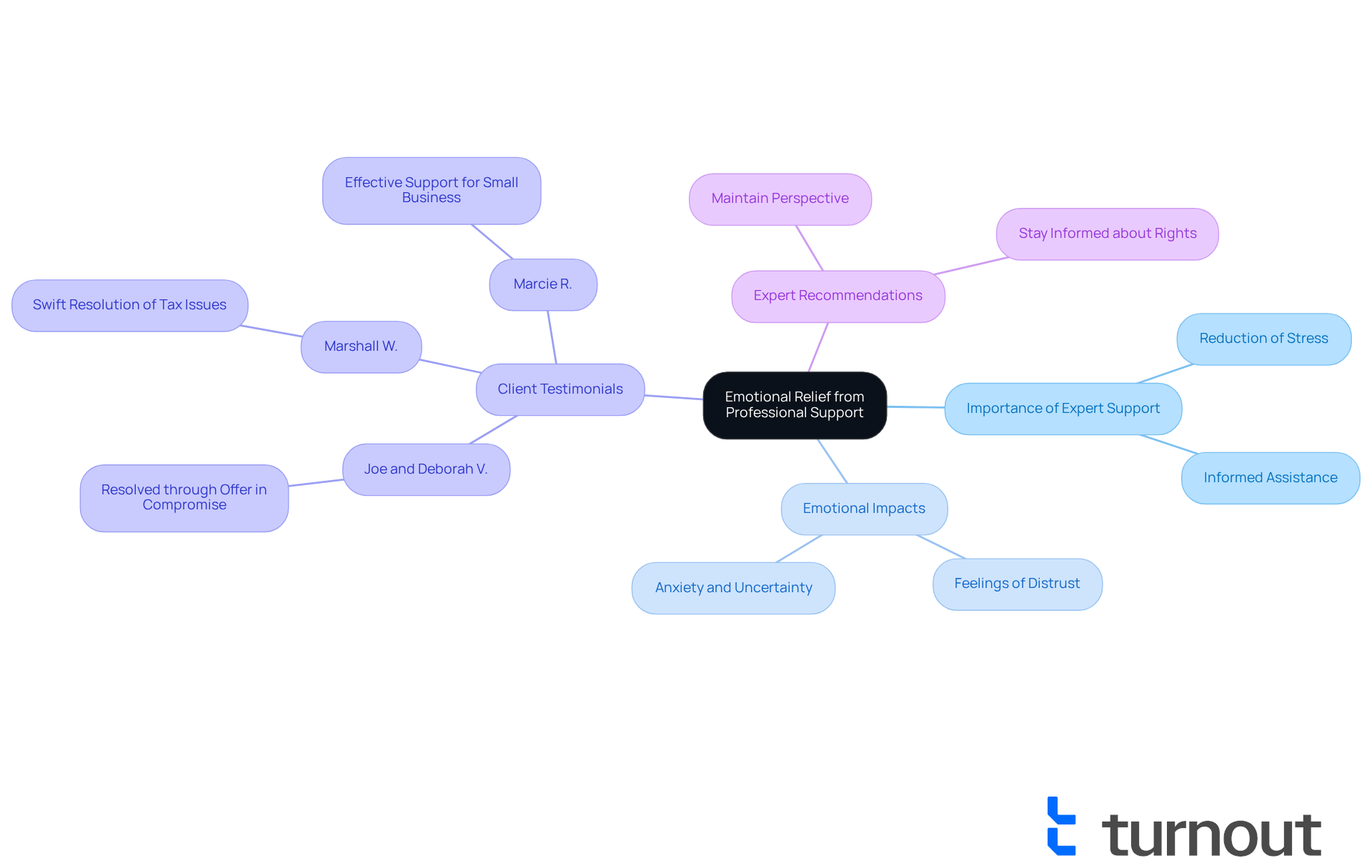

Facing an IRS examination can be an emotionally taxing experience, often filled with anxiety and uncertainty. Engaging a Houston tax attorney not only offers practical assistance but also provides emotional support. Knowing you have an experienced advocate by your side can significantly reduce stress, allowing you to focus on other aspects of your life. This peace of mind is invaluable, empowering you to approach the review process with confidence, secure in the knowledge that your interests are being effectively represented.

We understand that the emotional impact of IRS examinations can lead to feelings of distrust and coercion among taxpayers. For instance, a national survey conducted by the Taxpayer Advocate revealed that evaluations can provoke significant emotional reactions, underscoring the need for informed assistance. Clients like Joe and Deborah V. have expressed their relief after consulting a Houston tax attorney for their IRS matters, which highlights the effectiveness of expert support in navigating the complexities of the review process.

Experts recommend maintaining perspective during an examination. Viewing the review as a procedural matter rather than a personal accusation can greatly alleviate anxiety. As the specialists at Goldburd McCone emphasize, being aware of your rights and understanding the scope of the audit can further ease stress, showcasing the importance of hiring a Houston tax attorney for specialized assistance.

Case studies illustrate the positive impact of expert support. For example, Marshall W. chose a tax specialist for their responsiveness and expertise, leading to a swift resolution of his tax issues. Similarly, another client, overwhelmed by a large tax balance, found relief through the guidance of a tax expert, who helped negotiate a lower balance and establish an affordable payment plan, restoring their peace of mind.

In summary, the emotional comfort provided by expert assistance during IRS evaluations is profound. By alleviating anxiety and offering expert guidance, tax specialists empower individuals to navigate the review process with confidence and transparency.

Comprehensive Services: What a Tax Professional Offers Beyond Audits

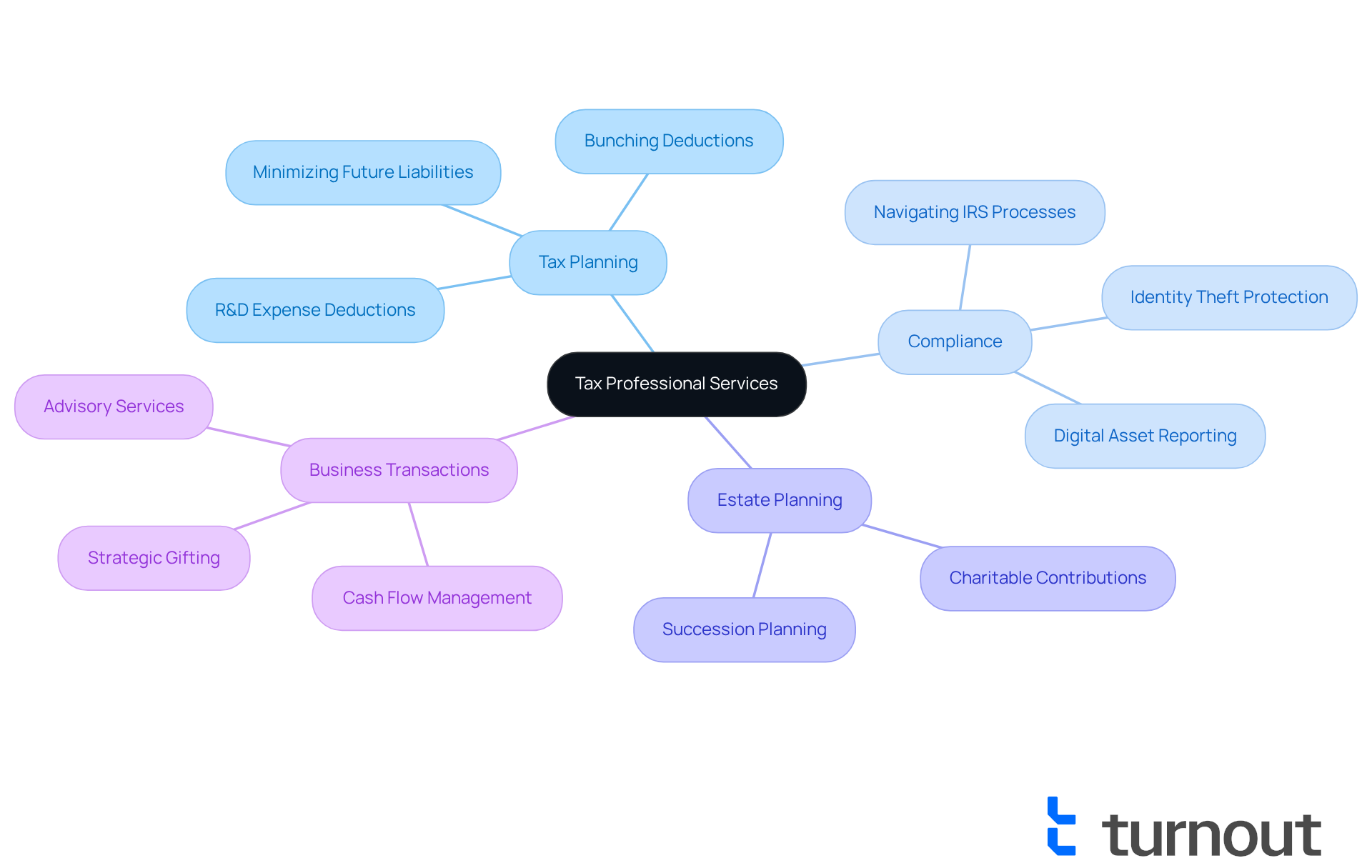

Navigating tax matters can be overwhelming, and we understand that you may have concerns about compliance and future liabilities. Tax experts offer a wide range of services that extend beyond mere representation in examinations. They can assist you with tax planning, ensuring you adhere to current regulations while minimizing future liabilities.

Moreover, these professionals can provide valuable guidance on estate planning, business transactions, and other financial matters that may influence your tax situation. This extensive support not only helps you manage evaluations but also paves the way for lasting financial success.

You're not alone in this journey. With the right assistance, you can take proactive steps towards a more secure financial future. Remember, we're here to help you every step of the way.

Timely Action: Responding Effectively to IRS Inquiries

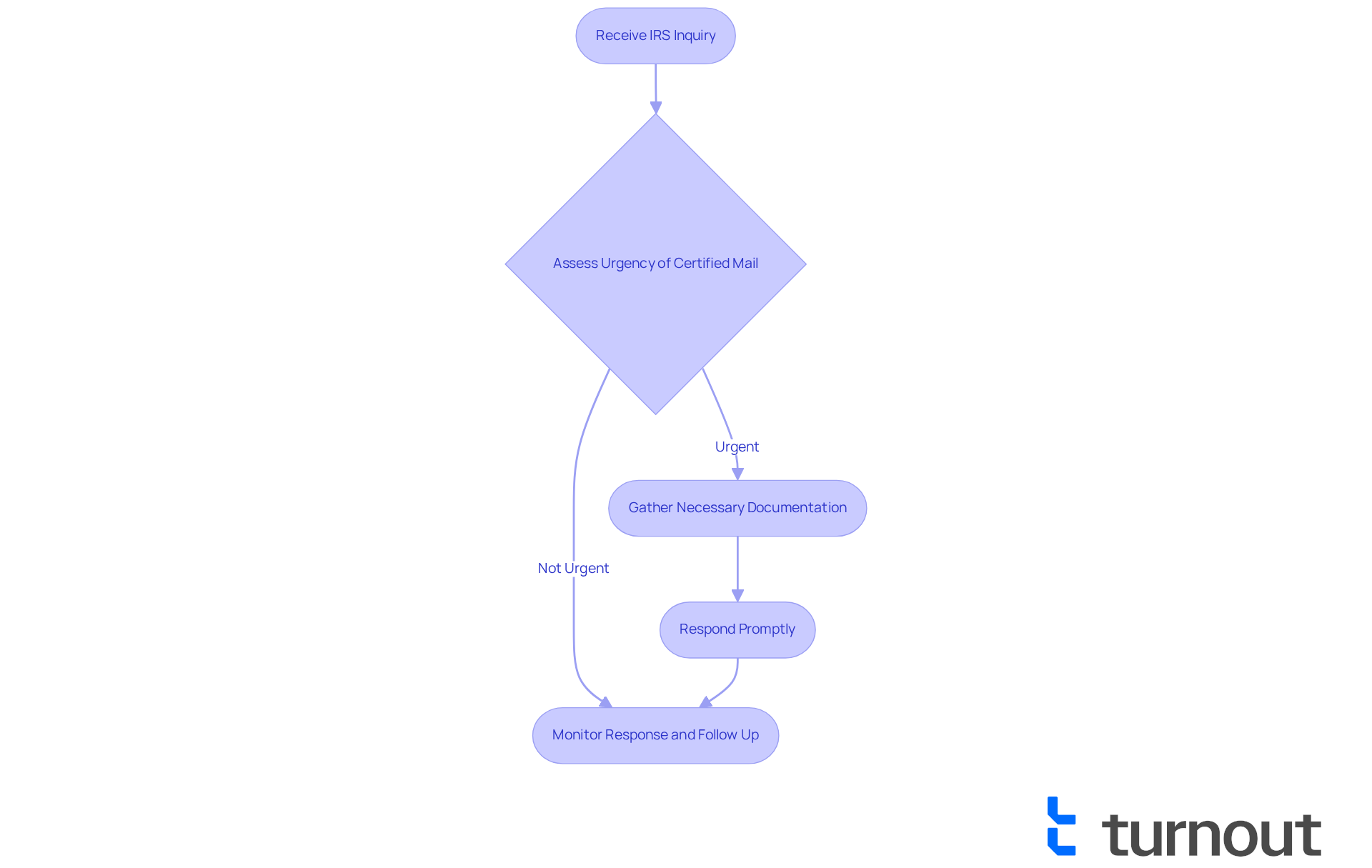

Responding promptly to IRS inquiries is crucial during a review. We understand that delays can lead to misunderstandings, increased scrutiny, and potentially unfavorable outcomes. Tax experts excel at managing timelines, ensuring that all necessary documentation is submitted punctually. Their proactive strategy not only reduces risks but also shows the IRS that you are cooperative and organized, which can positively affect the examination process.

It's common to feel overwhelmed by the demands of tax season. For instance, taxpayers should respond timely to avoid delays in processing their tax return. Timely responses to IRS certified letters, such as CP2000, are essential; IRS certified mail ensures important tax notices are officially delivered. Delays could postpone tax refunds and escalate issues, adding to your stress.

Understanding the types of certified mail helps you recognize urgent matters requiring immediate attention. By maintaining proper documentation and adhering to deadlines, a Houston tax attorney can effectively navigate the complexities of IRS audits, ultimately leading to more favorable outcomes for their clients. Remember, ignoring IRS certified mail can lead to serious consequences, including additional penalties and potential collection actions. This underscores the importance of timely responses.

You're not alone in this journey. We're here to help you manage these challenges with the expertise of a Houston tax attorney.

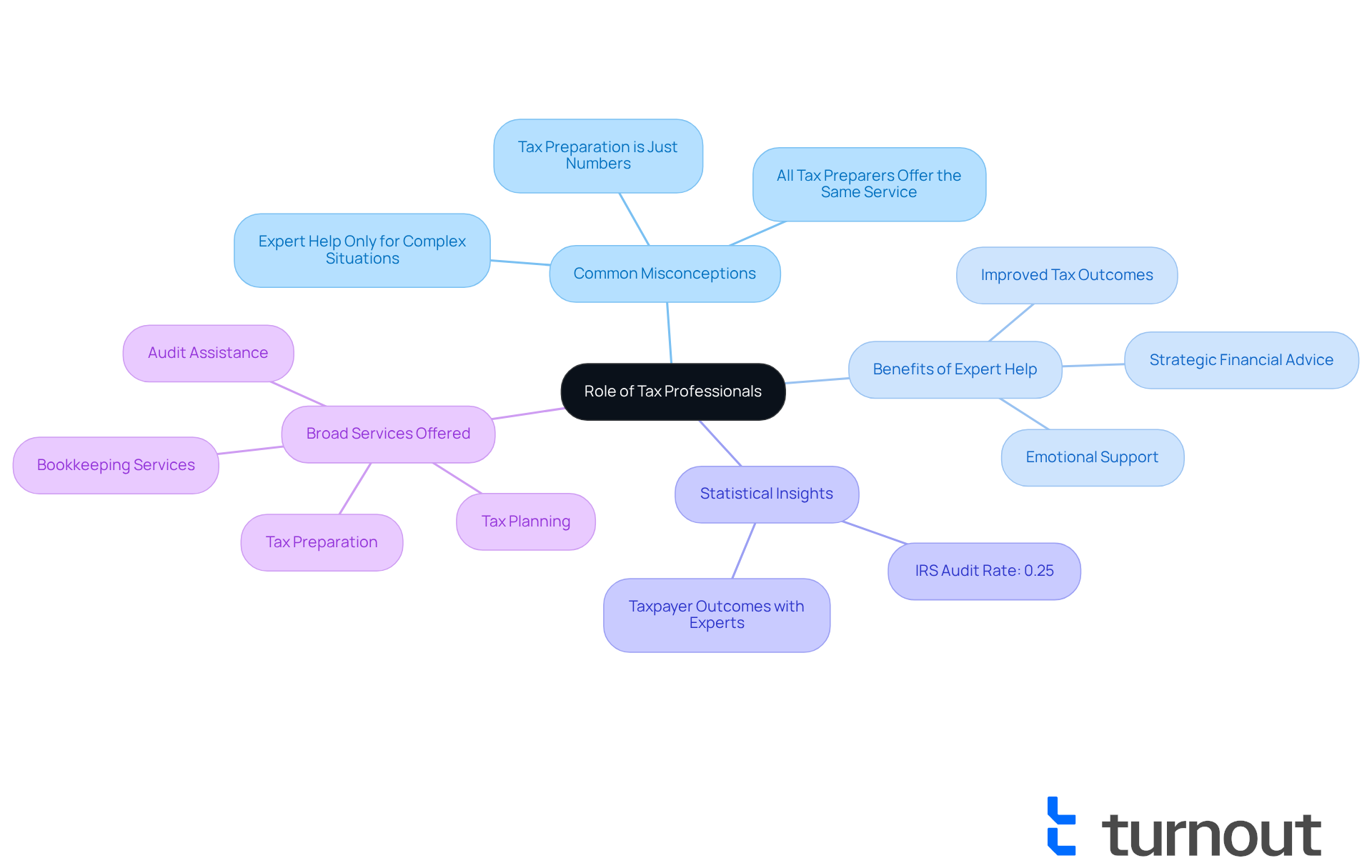

Debunking Myths: Understanding the Role of Tax Professionals

Many individuals struggle with misconceptions about tax experts, often leading them to undervalue the services these professionals provide. It's common to believe that expert help is only needed for complicated tax situations. However, even straightforward evaluations can greatly benefit from their guidance.

Statistics reveal that taxpayers who enlist specialists during evaluations tend to achieve more favorable outcomes. These experts are adept at navigating the complexities of tax regulations. For instance, consider that the IRS audits only 0.25 percent of all personal income tax filings. This statistic underscores the low likelihood of inspections and reinforces the importance of seeking expert assistance, even for simpler cases.

Moreover, many assume that tax experts focus solely on legal matters. In reality, they also offer strategic financial advice and emotional support, helping clients feel more secure throughout the review process. The IRS Annual Filing Season Program emphasizes the importance of continuous education for tax experts, highlighting their commitment to staying current in their field.

It's crucial to recognize that not all tax preparers offer the same quality of service. This is illustrated in the case study titled 'All Tax Preparers Are the Same.' Understanding the broad role of these professionals can empower individuals to make informed decisions about seeking help during evaluations. Remember, you are not alone in this journey; expert assistance is available to guide you.

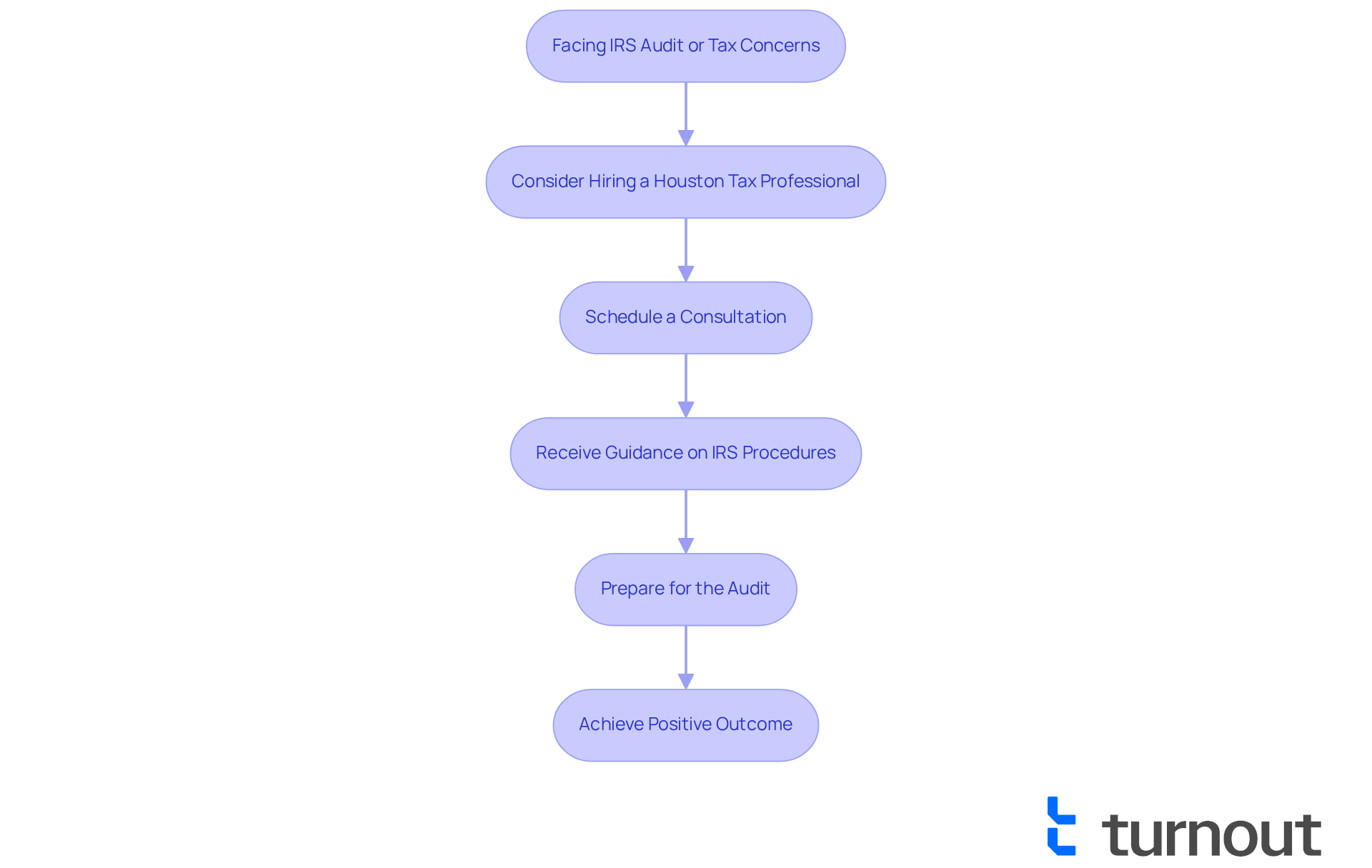

Take Action: Why You Should Hire a Houston Tax Professional Today

If you are facing an IRS audit or have concerns about your tax situation, we understand that this can be a daunting experience. Now is the time to take action. Collaborating with a Houston tax attorney can provide you with the knowledge, assistance, and assurance needed to navigate this challenging process. With their extensive understanding of IRS procedures and a commitment to safeguarding your rights, these experts can significantly enhance your chances of achieving a positive outcome.

In FY 2024, the IRS concluded 505,514 tax return examinations, resulting in over $29.0 billion in suggested additional tax. This statistic underscores the importance of having expert support during evaluations. Imagine having a dedicated Houston tax attorney by your side, helping you maximize deductions and ensuring compliance—both of which are crucial during audits. As Chad Evans, Managing Partner at Evans Sternau CPA, shares, "Evans Sternau CPA is for those that want year-round support, not just during tax season."

Don't wait until it's too late. Reach out to a tax professional today to ensure you are well-prepared and supported throughout your audit journey. Taking proactive steps now can truly make all the difference in managing your tax obligations effectively. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Navigating the complexities of an IRS audit can feel overwhelming. We understand that this daunting process can leave you feeling uncertain and anxious. However, hiring a Houston tax attorney can transform your experience into a manageable journey. Their specialized knowledge and expertise not only protect your rights but also enhance your chances of achieving favorable outcomes. By enlisting the support of a tax professional, you gain access to invaluable resources, strategic insights, and emotional relief. You are not alone in this challenging situation.

Throughout this article, we have explored the key benefits of hiring a tax attorney. They can:

- Interpret intricate tax codes

- Provide legal representation

- Offer financial advantages

Their skills in negotiation and proactive communication can lead to reduced penalties and improved resolutions. Additionally, their emotional support helps alleviate the stress often associated with audits. Furthermore, the role of AI in tax advocacy has emerged as a progressive solution, providing efficient assistance and timely updates, which complements the expertise of tax professionals.

Ultimately, seeking the assistance of a Houston tax attorney is not merely an option; it is a crucial step towards securing peace of mind and financial stability. With the IRS increasing scrutiny, now is the time to take proactive action. Engaging with a tax professional can lead to better outcomes, allowing you to navigate your tax obligations with confidence. Don't hesitate to reach out for expert support—your financial future depends on it.

Frequently Asked Questions

What is Turnout and how does it assist with tax debt relief?

Turnout is an AI-powered platform that provides efficient and compassionate support for individuals dealing with tax debt. It automates processes such as document management and case tracking, ensuring timely updates and assistance throughout interactions with the IRS.

Is Turnout a law firm and does it provide legal advice?

No, Turnout is not a law firm and does not provide legal advice or representation. It offers support through trained nonlawyer advocates and IRS-licensed enrolled agents.

How does Turnout help reduce stress during tax examinations?

Turnout simplifies access to government benefits and financial support, allowing individuals to navigate tax regulations confidently, knowing that support is readily available.

What expertise do Houston tax professionals offer during IRS audits?

Houston tax professionals possess a deep understanding of IRS regulations and examination processes. They can interpret complex tax codes, identify potential issues, and develop effective strategies to address IRS inquiries.

Why is it important to seek assistance from tax experts during evaluations?

Clients who seek assistance from tax experts during evaluations experience significantly greater success rates, which highlights the importance of expert advice in navigating the examination process.

How can a Houston tax attorney protect my rights during an IRS audit?

A Houston tax attorney ensures that all communications with the IRS are handled correctly, minimizing misunderstandings and protecting your rights as a taxpayer during the examination process.

What are the benefits of having legal representation during an IRS examination?

Having legal representation can lead to quicker resolutions, better overall results, and less likelihood of negative outcomes, as the attorney manages the process and advocates for your interests.

What should I do if I feel overwhelmed by the tax evaluation process?

Remember that you are not alone; seeking support from professionals, such as Houston tax attorneys or platforms like Turnout, can provide the assistance you need to navigate the challenges of tax evaluations.