Introduction

Navigating the complexities of tax levies can feel overwhelming. We understand that the thought of wage garnishments, bank seizures, and even passport restrictions can weigh heavily on your mind. It's crucial to grasp the implications of these levies if you're looking to protect your financial well-being.

In this article, we’ll explore ten compelling examples of tax levies, shedding light on their impact on personal finances. We’ll also discuss available avenues for relief. What strategies can you employ to ease these burdens and regain control over your financial future? Remember, you’re not alone in this journey, and there are steps you can take to find relief.

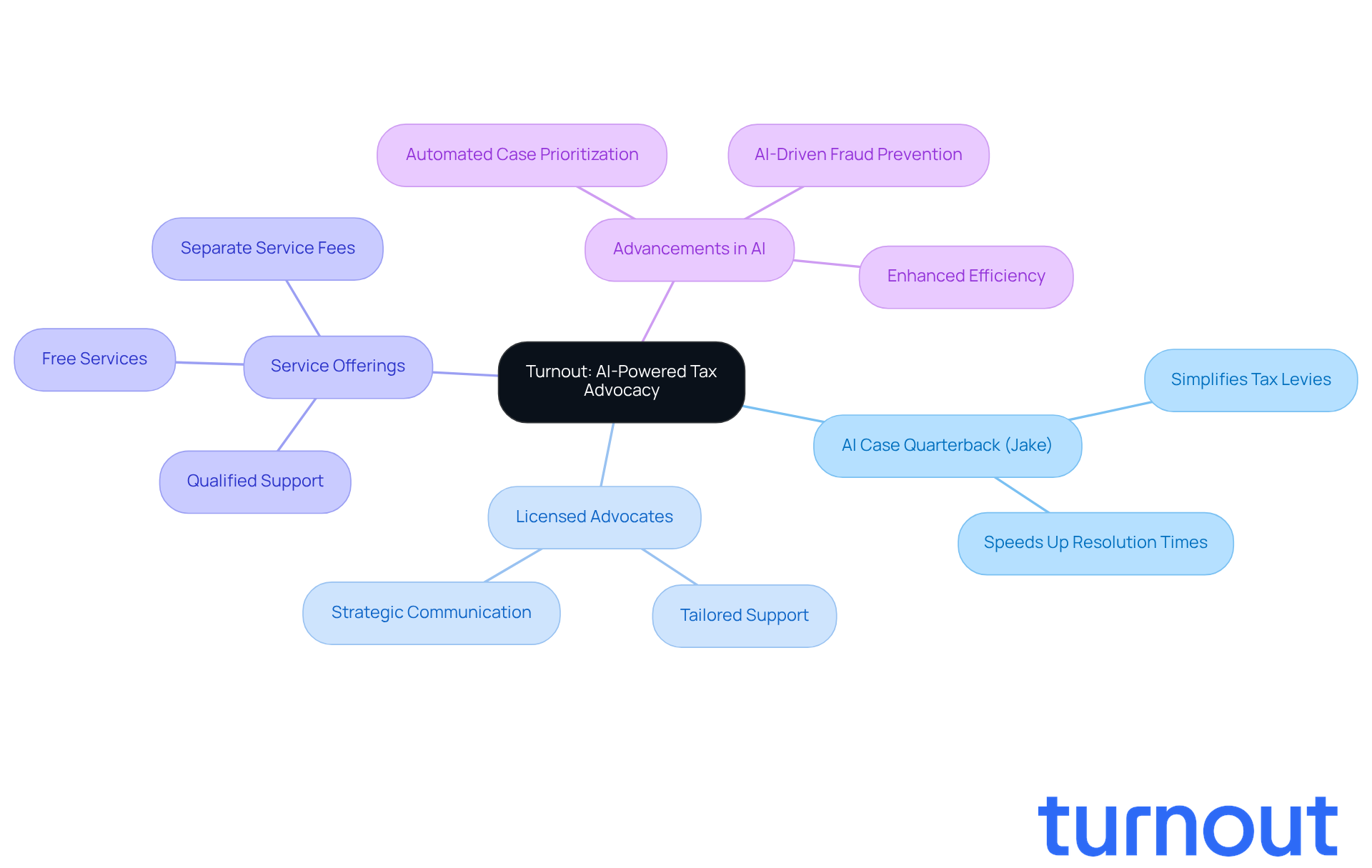

Turnout: Navigating Tax Levies with AI-Powered Advocacy

Navigating tax obligations can feel overwhelming, and we understand that. Turnout is here to help you through this intricate landscape with the power of AI technology. Meet Jake, our AI case quarterback, who makes understanding and responding to tax levies simpler and more accessible.

Imagine having a system that not only speeds up resolution times but also empowers you with tailored support. That’s exactly what Turnout offers. Our licensed advocates work hand-in-hand with Jake, focusing on strategic communication and personalized guidance. You’ll feel well-informed and equipped to tackle your tax challenges effectively.

We believe in providing qualified support without the need for legal representation. That’s why we utilize trained nonlawyer advocates for tax debt relief. Some of our services are even offered for free, while others may have separate service fees, distinct from any government fees that need to be settled before submitting paperwork.

Recent advancements in AI-driven tax advocacy highlight the potential for better outcomes. Automated systems are increasingly being used to prioritize cases and enhance efficiency in tax resolution services. Remember, you are not alone in this journey. We’re here to support you every step of the way.

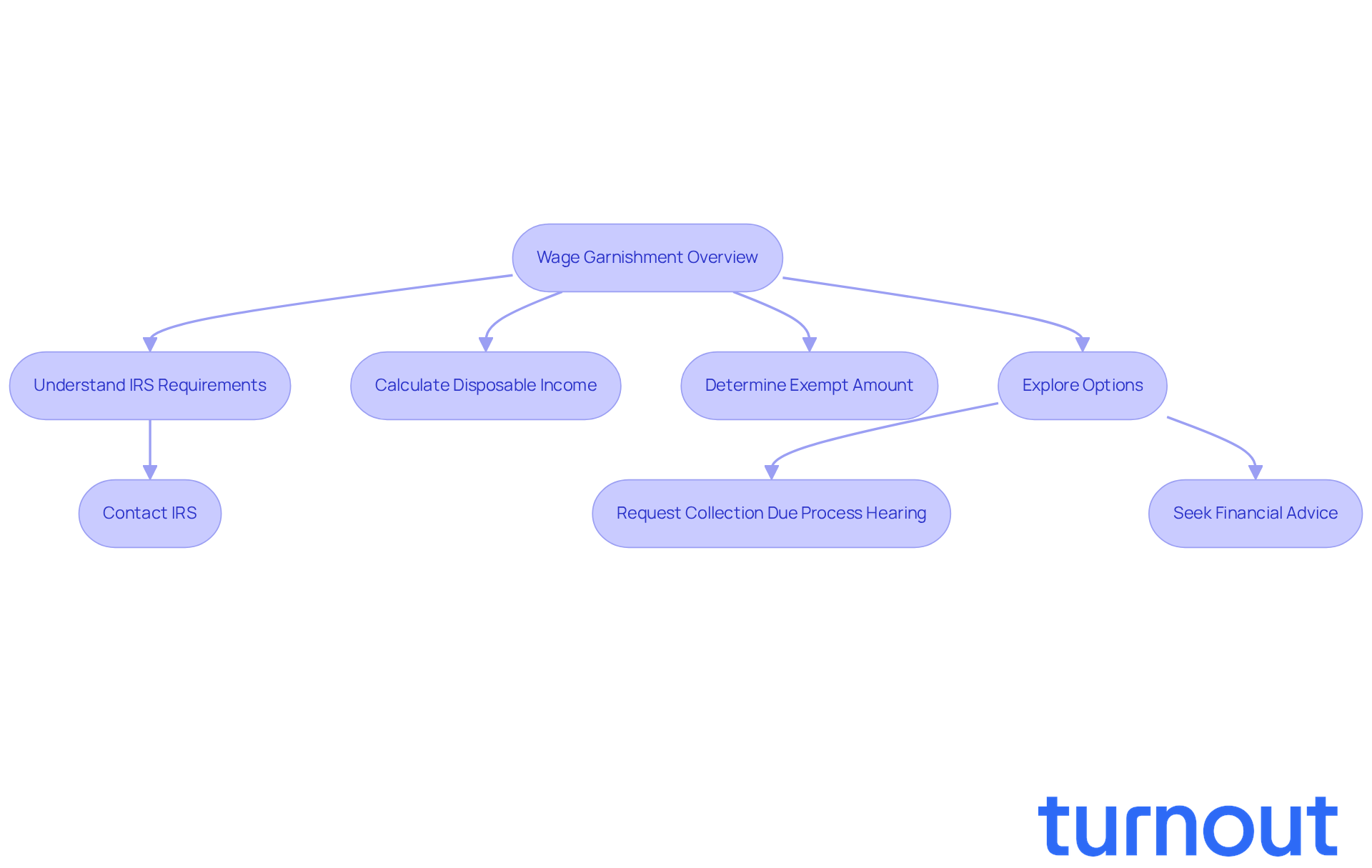

Wage Garnishment: Understanding Its Role as a Tax Levy

Wage garnishment can feel overwhelming, especially when the IRS requires your employer to withhold part of your earnings to settle tax debts. This process can significantly affect your financial stability, particularly if you're already facing economic challenges. Understanding the exemptions and limits on garnishment amounts is essential for protecting your income effectively. Did you know that the IRS can garnish up to 25% of your paycheck after issuing a notice? This is based on your disposable income, which is calculated after mandatory deductions. Knowing how this amount is determined is crucial for managing your finances.

Recent statistics reveal that low and moderate-wage workers, especially those earning between $25,000 and $39,999 annually, experience the highest garnishment rates, reaching up to 4.6%. In 2019, over 4.5 million workers in the U.S. had their wages garnished for consumer debts. This highlights not only the scale of the issue but also the vulnerability of this demographic, as garnishment can worsen existing financial difficulties.

Consumer advocacy is vital in these situations. Organizations can help you navigate the complexities of wage garnishment, ensuring you understand your rights and options. Financial advisors emphasize the importance of being proactive. If you find yourself facing garnishment, reach out to the IRS as soon as possible. Delays can prolong the garnishment process. Remember, you can request a Collection Due Process hearing within 30 days of receiving a final notice. This can temporarily halt all seizure activity while your appeal is reviewed.

To illustrate how the exempt amount is calculated, let’s consider a scenario. Imagine you have a gross monthly pay of $4,500 and mandatory deductions of $1,100. This leaves you with a disposable income of $3,400. If the exempt amount is calculated at $2,362, the IRS can garnish $1,038 from your paycheck. Additionally, it’s crucial to submit any outstanding tax returns, as this is necessary for the IRS to negotiate or remove a lien.

In summary, being informed about wage garnishment exemptions and limits is vital for your financial well-being. By understanding your rights and seeking assistance, you can better manage your financial situation and lessen the impact of tax impositions on your earnings. Remember, you are not alone in this journey, and there are resources available to help you.

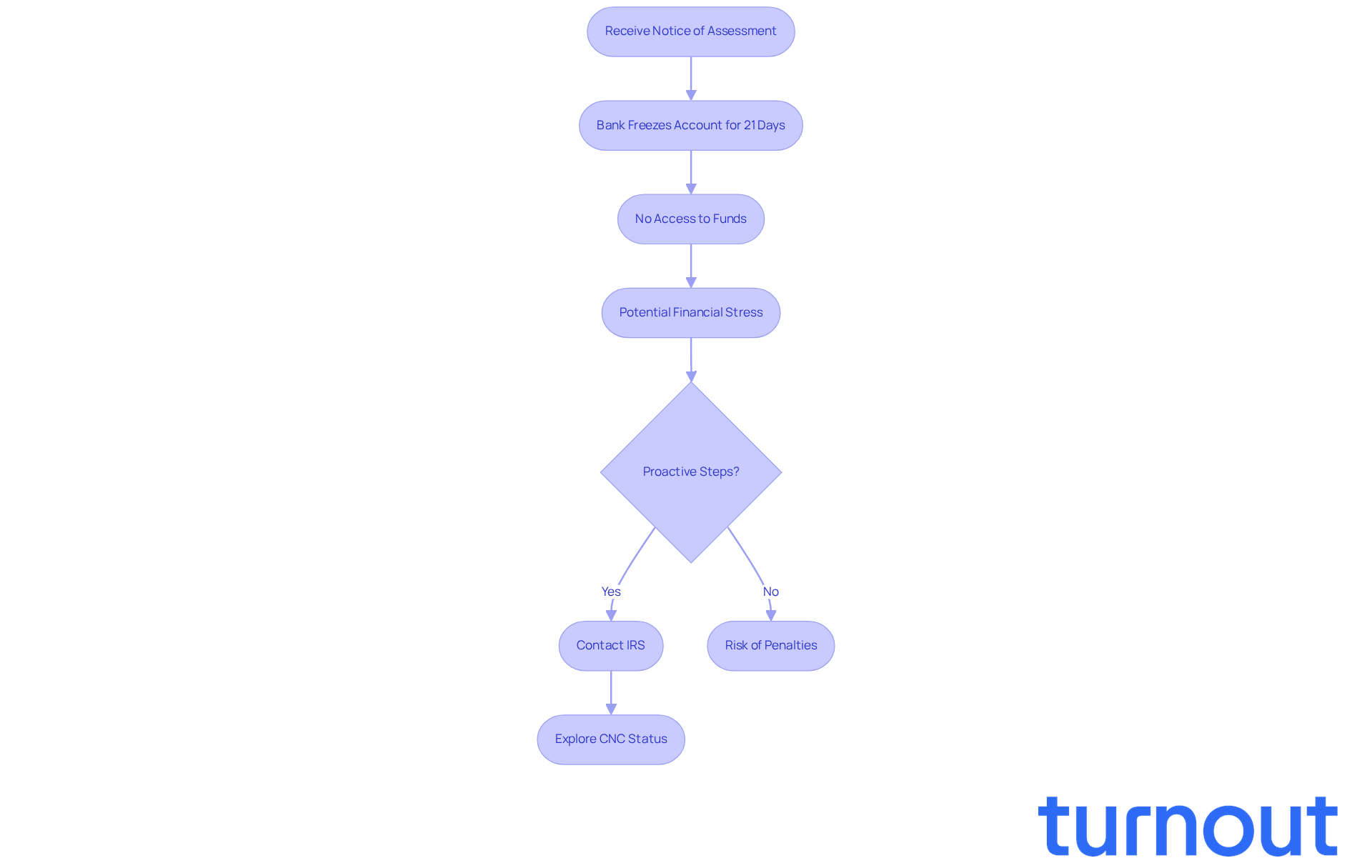

Bank Levy: A Direct Impact on Your Financial Accounts

A bank garnishment can feel overwhelming, as it allows the IRS to take funds directly from your bank account to cover unpaid taxes. When you receive a notice of assessment, your bank must freeze your account for 21 days. During this time, you won’t have access to your money, which can create significant stress, especially if you rely on those funds for daily expenses.

In 2026, the impact of bank charges on consumers has become more pronounced. Many taxpayers find themselves in tough situations, as the IRS can seize 100% of the balance from personal, joint, and business accounts all at once. Imagine facing a sudden stop in payroll or vendor payments - this can threaten your financial stability and lead to defaults on loans or leases.

But there is hope. Effective management of bank charges is possible. Take Vincent R., for example. He navigated a complicated tax situation involving a large amount owed and achieved a positive outcome through careful negotiation and help from tax experts. Financial advisors stress the importance of taking proactive steps, like reaching out to the IRS and considering options such as Currently Not Collectible (CNC) status, which can pause collection actions if paying would cause you financial hardship.

On average, bank garnishments can freeze significant amounts - often thousands of dollars. This underscores the need to act quickly when you receive a notice. Waiting just one year can add around $2,500 in penalties and interest for a $25,000 tax obligation. By engaging with the IRS before enforcement begins, you can maintain control over your finances and explore ways to lessen the impact of a seizure. Remember, you typically have 30 days to respond to a notice suggesting a charge before it moves forward, so prompt action is crucial.

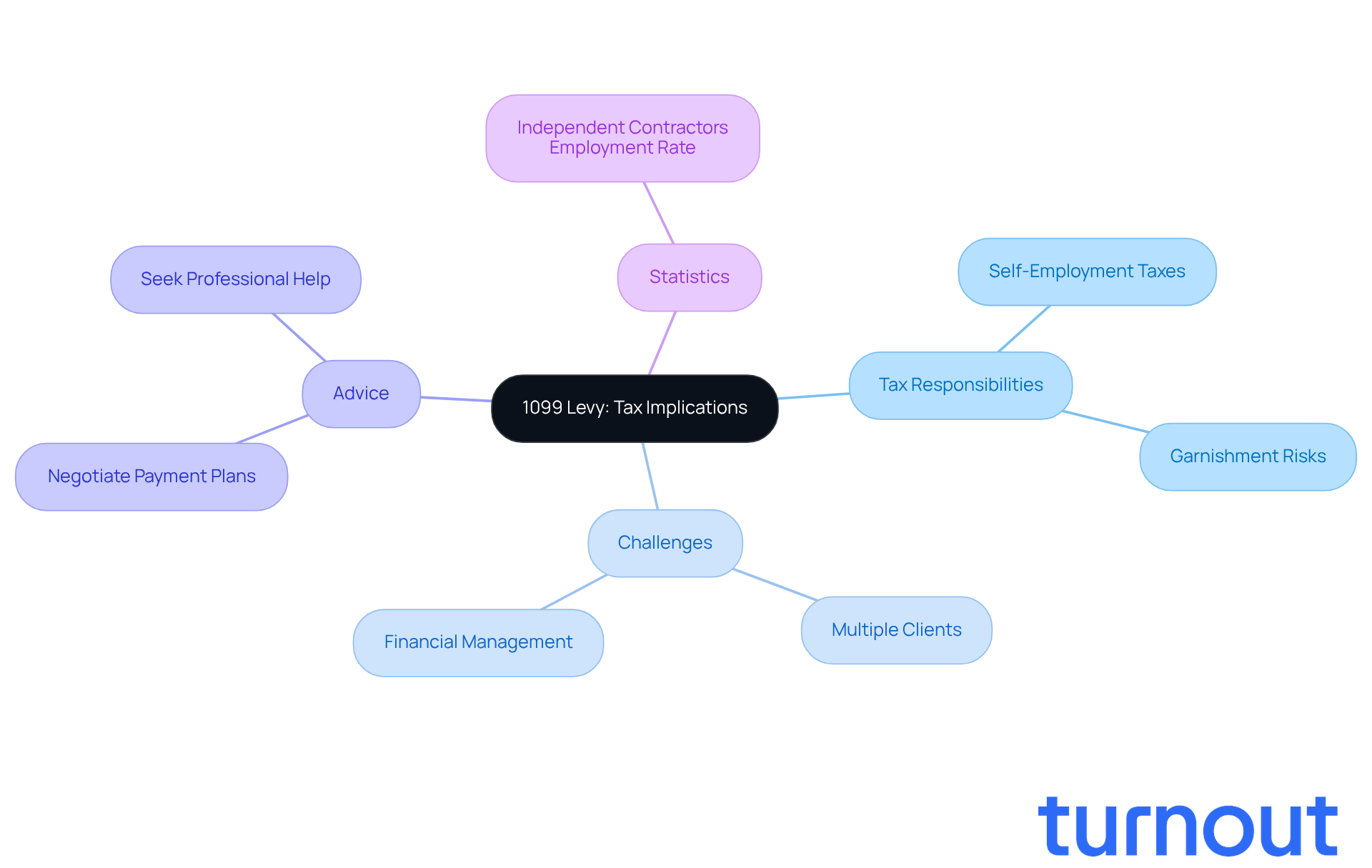

1099 Levy: Tax Implications for Independent Contractors

A 1099 seizure can be a daunting experience for independent contractors, as it involves the IRS claiming payments made to them. Unlike traditional employees, independent contractors bear the responsibility for their own taxes, which can make them particularly vulnerable to such claims. Understanding the levy taxes example from the IRS in terms of payments from clients or accounts receivable is crucial for managing tax obligations effectively.

We understand that navigating these waters can feel overwhelming. Tax professionals stress the importance of proactive management in these situations. One expert wisely notes, "Responding early can mean the difference between a manageable resolution and a financial emergency." This underscores the urgency for independent contractors to act swiftly upon receiving IRS notices.

Independent contractors often face unique challenges when it comes to handling deductions. If a contractor has multiple clients, the IRS can garnish all 1099 payments, complicating their financial landscape. As one tax professional pointed out, "The IRS can garnish your earnings just as easily as it can with any employee." This highlights the need for contractors to stay informed about their tax liabilities.

Average tax obligations for independent contractors can vary widely, and many find themselves in tough situations when faced with a levy taxes example. To mitigate these risks, we encourage contractors to consider negotiating payment plans with the IRS or seeking assistance from the Taxpayer Advocate Service. By understanding how the IRS imposes payments, independent contractors can better navigate their tax obligations and protect their income.

It's also worth noting that independent contractors made up 6.9 percent of total employment in May 2017. This statistic emphasizes the importance of grasping the tax responsibilities associated with 1099 taxes. Remember, you are not alone in this journey; we're here to help.

Asset Seizure: Consequences of Tax Levies on Personal Property

Asset seizure happens when the IRS takes possession of your property to settle unpaid tax debts. This can include various assets like real estate, vehicles, and even bank accounts. It’s important to know that the IRS can also tap into social security payments and future tax refunds, which can really shake up your financial stability.

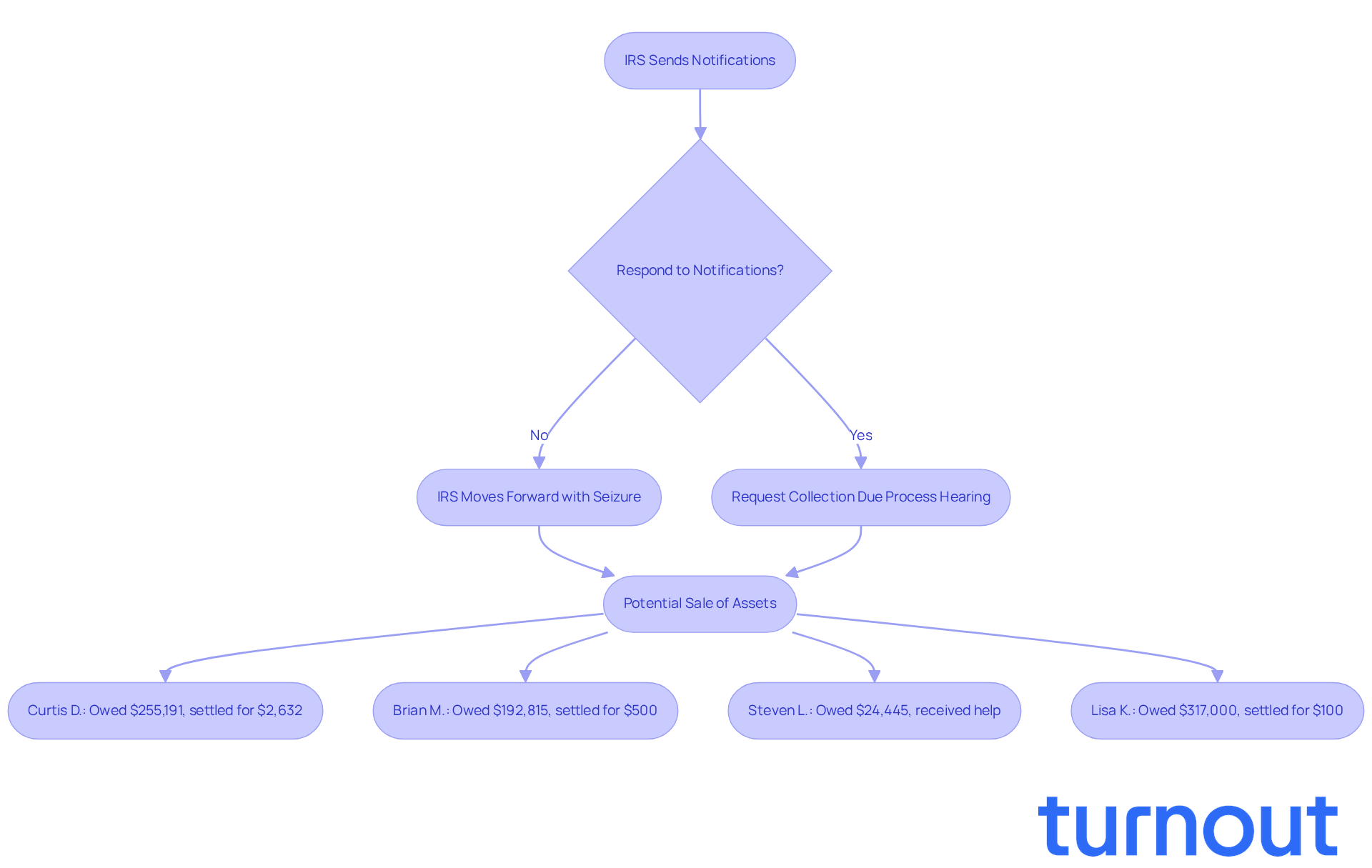

We understand that navigating the IRS asset seizure process can be daunting. Initially, the IRS sends out multiple notifications, culminating in a Final Notice of Intent to Seize. This notice must be sent certified, giving you 30 days' notice before any enforcement actions begin. You have the right to request a Collection Due Process hearing to challenge the levy or suggest alternatives. If you don’t respond, the IRS can move forward with the seizure, potentially leading to the sale of your assets to cover the owed tax.

Taking preventive measures is key to avoiding asset seizure. Make sure to file your tax returns on time and communicate promptly with the IRS. If you can’t pay your tax debts in full, consider options like installment agreements or Offers in Compromise (OIC). Seeking professional help, such as from Precision Tax Relief, can provide clarity and support as you navigate these complex situations.

Stories of consumers recovering from asset seizure highlight the importance of acting quickly. For example:

- Curtis D. faced a tax debt of $255,191 but managed to settle for just $2,632 with professional help.

- Brian M. owed $192,815 and resolved his debt for only $500 after seeking assistance.

- Steven L. owed $24,445 and received help from Precision Tax Relief over a year and a half.

- Lisa K. had a debt of $317,000 and settled for $100, expressing gratitude to Precision Tax Relief for changing her life.

These cases show that with the right support, you can achieve favorable outcomes even in tough situations.

In summary, understanding the IRS asset seizure process and taking proactive steps can help you protect your assets and navigate your tax obligations effectively. Remember, you’re not alone in this journey, and we’re here to help.

The Tax Levy Process: Steps from Notification to Enforcement

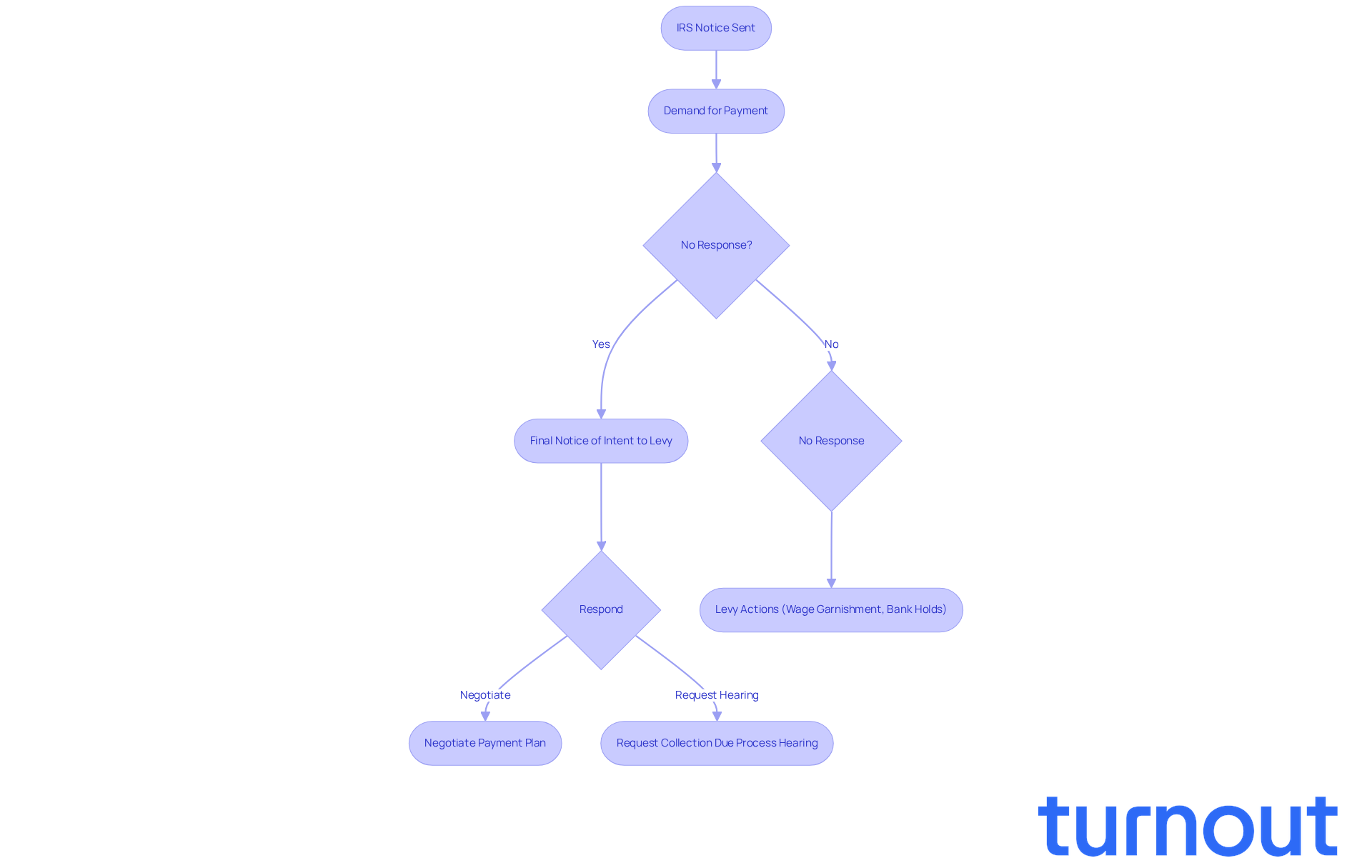

The tax levy process can feel overwhelming, but understanding the levy taxes example is essential for finding a resolution. It all begins when the IRS sends a notice about the tax amount due, followed by a demand for payment. If you don’t respond, the IRS may escalate things by issuing a Final Notice of Intent to levy taxes example. This notice is crucial, as it gives you a 30-day window to address the issue before the IRS takes further action, which could include a levy taxes example.

Did you know that about 70% of individuals facing taxation don’t reply to these notifications? This can lead to serious financial consequences, like wage garnishments and bank holds. It’s common to feel anxious in these situations, but tax professionals, like Steven N. Klitzner, stress the importance of acting quickly. He says, "Timely intervention can lead to successful resolutions, such as negotiating payment plans or filing for a Collection Due Process hearing."

Many taxpayers who reach out to experts find effective ways to manage their debts, avoiding severe repercussions. Grasping these steps, including your right to request a Collection Due Process hearing, is vital for navigating the complexities of tax actions and protecting your financial health.

If you receive a Final Notice of Intent to Levy, remember: you’re not alone in this journey. Consider contacting a tax professional right away to explore your options. We're here to help you find the best path forward.

Reversing a Tax Levy: Options for Consumers

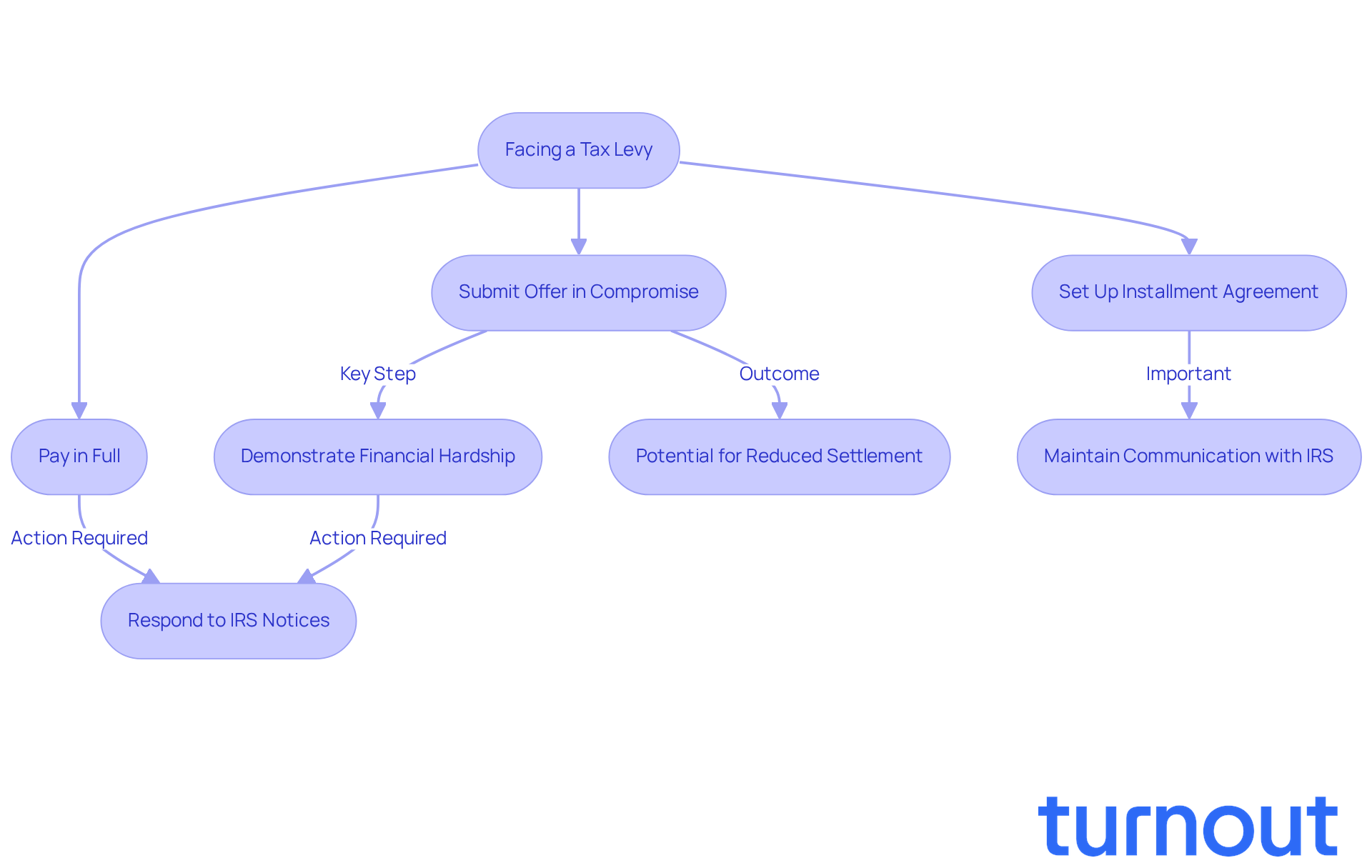

If you're facing a tax charge, know that you have options available to help you find relief. You can:

- Pay the amount owed in full

- Set up an installment agreement

- Submit an Offer in Compromise to negotiate a lower settlement

It's important to understand that demonstrating financial difficulty can be a key factor in having a charge removed. Tax consultants often emphasize that providing proof of your financial hardships can significantly increase your chances of getting that restriction lifted. In fact, many consumers who successfully claimed financial difficulty have had their charges removed, allowing them to regain access to their funds.

In 2026, the IRS has made significant strides in offering more flexible installment agreements. This means you can manage your tax debts incrementally without sacrificing your essential living expenses. This flexibility is especially important for those who may find it challenging to pay their tax debts all at once.

Real-life stories illustrate just how effective negotiation with the IRS can be. Take John T., for example. He owed $172,441 but managed to settle for just $100 after showing his financial situation. Similarly, Vincent R. negotiated a remarkable reduction from $523,927 to $27,343, highlighting the potential for substantial savings when you engage proactively with the IRS.

Understanding these options empowers you to take control of your financial situation and alleviate the stress associated with tax seizures. It's crucial to respond promptly to any correspondence from the IRS to keep your options open and avoid enforcement actions. If you need assistance, Turnout is here for you. While not a law firm and not providing legal advice, they connect you with trained nonlawyer advocates and IRS-licensed enrolled agents who can guide you through these processes. You're not alone in this journey. Resources like the video tutorial 'Understanding Your IRS Tax Levy Notice' can also offer valuable insights.

Reduced Tax Refunds: Financial Consequences of Tax Levies

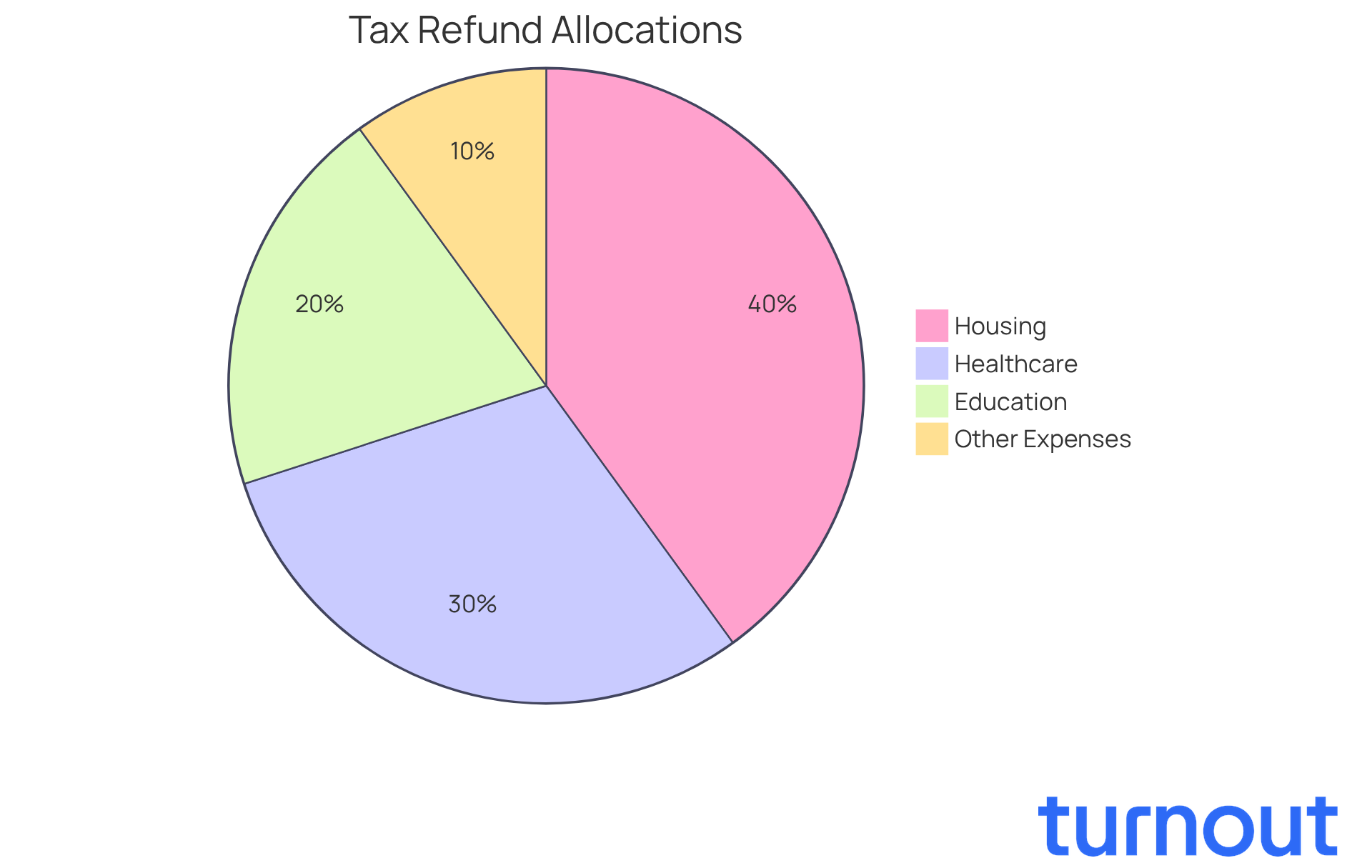

Tax assessments can really take a toll on your tax refunds. The IRS might intercept these refunds to settle any outstanding tax debts. In fiscal year 2024, they collected around $120.2 billion in unpaid assessments, which shows just how big this issue is. For many of us, tax refunds are a vital source of income, often relied upon for essential expenses like housing, healthcare, and education. With the typical tax refund being about $3,050, even a small decrease can create significant financial pressure.

We understand that facing reduced refunds can be stressful, and it's crucial for effective financial planning. If you encounter tax charges, consider strategies to lessen the impact. Budgeting for essential expenses and exploring options for tax relief can make a difference. Financial planners often emphasize the importance of being proactive. As one expert noted, "When a taxpayer fails to pay a debt owed to the state or federal government, it becomes delinquent, and the Treasury Offset Program may collect the overdue amount by withholding funds from federal payments like tax refunds or Social Security benefits."

After facing tax impacts, many find it helpful to:

- Set aside emergency funds

- Seek professional advice on tax obligations

- Explore offers in compromise to settle debts for less than the total amount owed

By taking these steps, you can better navigate the complexities of tax levies, using a levy taxes example to safeguard your financial well-being. Remember, you are not alone in this journey, and we're here to help.

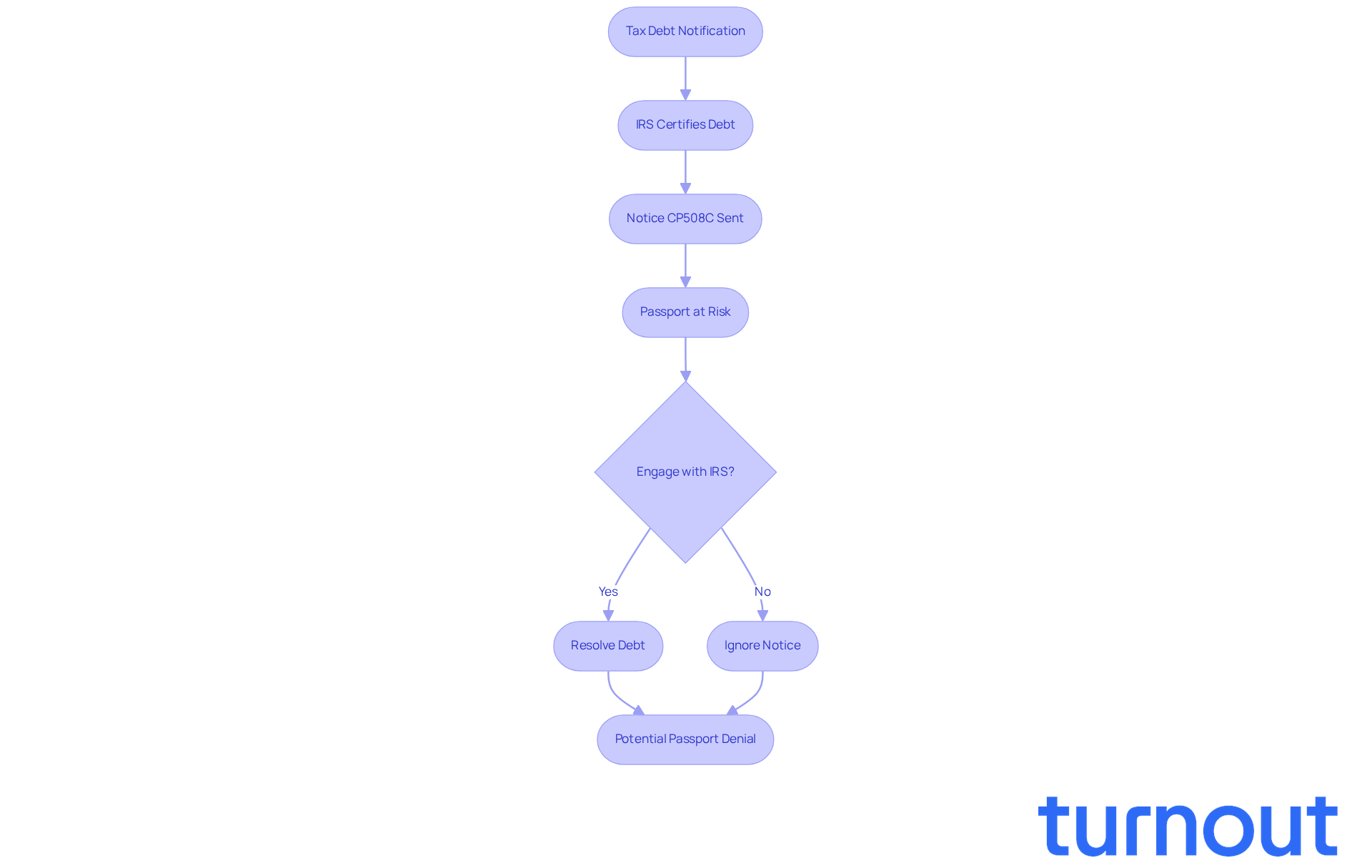

Passport Seizure: A Serious Consequence of Tax Levies

The IRS has the authority to certify individuals with seriously delinquent tax debts to the State Department. This can lead to the denial or revocation of passports, which can be quite distressing. If you owe more than $51,000-adjusted for inflation since December 2015-you might face heightened risks of passport restrictions. For example, Drew J. Pfirrman saw his tax liability grow to $182,687 by March 2023. This led to the IRS certifying his debt and notifying the State Department, putting his passport at risk.

Many individuals experience travel disruptions due to passport seizures linked to tax issues. The IRS sends out Notice CP508C to inform taxpayers about their seriously delinquent tax debt certification, which can lead to immediate travel complications. We understand that while owing back taxes doesn’t automatically prevent travel, ignoring IRS notices can lead to severe consequences, including passport denial.

It’s crucial to understand how tax debts can affect your ability to travel internationally. Engaging with the IRS promptly upon receiving any notices regarding tax debts can help mitigate the risk of passport issues. Remember, establishing a payment plan or resolving your debts can restore your passport eligibility, allowing you to travel without restrictions. You are not alone in this journey; we’re here to help.

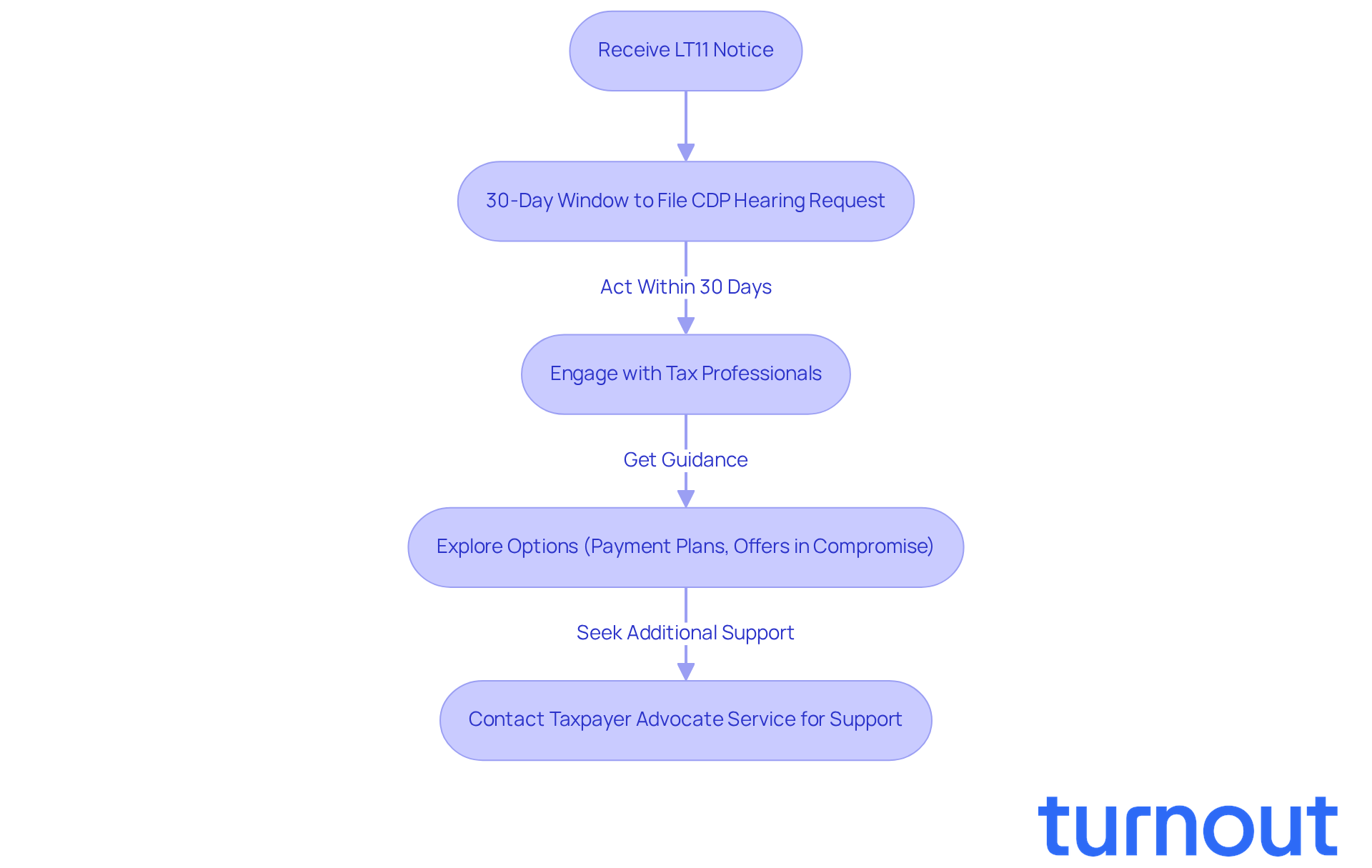

Who to Contact About Tax Levies: Seeking Help and Guidance

If you're facing a levy taxes example, it’s crucial to understand that you’re not alone. We understand that dealing with the IRS can be overwhelming, but reaching out to them to discuss your specific situation is a crucial first step. The IRS typically initiates contact through the mail, so understanding the order of notifications can help you respond promptly.

After receiving an LT11 notice, remember that you have a critical 30-day window to file a Collection Due Process (CDP) hearing request. This is vital to avoid severe enforcement actions. Engaging with tax professionals, like enrolled agents or tax attorneys, can provide you with invaluable guidance. These experts can help you navigate complex tax issues and negotiate with the IRS, ensuring you’re aware of your rights and options, such as payment plans or offers in compromise.

It’s essential to act quickly, as the IRS has the authority to seize wages, bank funds, Social Security benefits, retirement income, and personal property. But there’s hope! Organizations like the Taxpayer Advocate Service are here to support you. They act as a resource for individuals needing assistance with tax levies, offering a levy taxes example while advocating for your rights and ensuring your voice is heard within the IRS system.

Even if you’re 5+ years behind on bookkeeping, you can still receive help from this service, highlighting its accessibility. Additionally, educational resources are available that outline the IRS's collection processes and your rights under the Taxpayer Bill of Rights. By leveraging these resources, you can better manage your tax situation and work towards a favorable outcome. Remember, we’re here to help you through this journey.

Conclusion

Navigating the complexities of tax levies can feel overwhelming, especially when faced with the potential consequences of unpaid tax debts. We understand that this situation can weigh heavily on your mind. This article has explored various types of tax levies - like wage garnishments, bank levies, and asset seizures - highlighting their significant impact on your financial stability and personal well-being.

It's crucial to grasp the implications of these levies. By understanding your options and seeking support, you can take charge of your tax obligations. Remember, timely responses to IRS notifications are essential. Knowing your rights regarding garnishments and levies can empower you to act decisively. Technology can also play a vital role in facilitating tax advocacy, making it easier for you to find the help you need.

Consider the real-life examples shared here, where individuals have successfully navigated their tax challenges through informed decision-making and professional guidance. Engaging with resources like Turnout and the Taxpayer Advocate Service can provide critical support in overcoming tax-related hurdles.

Ultimately, you don’t have to face the journey through tax levies alone. By taking advantage of available resources and understanding the steps necessary to mitigate the impact of tax actions, you can regain control over your financial future. It’s important to act swiftly and seek assistance when needed. This way, you can avoid severe consequences like asset seizures or reduced refunds.

Remember, knowledge is power. With the right support, overcoming tax levies is not just a possibility; it’s within your reach. We're here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it assist with tax levies?

Turnout is an organization that helps individuals navigate tax obligations using AI technology. It features Jake, an AI case quarterback, who simplifies understanding and responding to tax levies. Turnout provides tailored support through licensed advocates who work with Jake to offer strategic communication and personalized guidance.

What kind of support does Turnout provide for tax debt relief?

Turnout utilizes trained nonlawyer advocates to provide qualified support for tax debt relief. Some services are offered for free, while others may have separate service fees, distinct from any government fees that must be settled before submitting paperwork.

How does AI improve tax advocacy according to the article?

Recent advancements in AI-driven tax advocacy have led to better outcomes by automating systems that prioritize cases and enhance efficiency in tax resolution services.

What is wage garnishment and how does it relate to tax levies?

Wage garnishment is a process where the IRS requires an employer to withhold part of an employee's earnings to settle tax debts. It can significantly affect financial stability, especially for those already facing economic challenges.

How much can the IRS garnish from a paycheck?

The IRS can garnish up to 25% of your paycheck after issuing a notice, based on your disposable income, which is calculated after mandatory deductions.

Who is most affected by wage garnishment?

Low and moderate-wage workers, particularly those earning between $25,000 and $39,999 annually, experience the highest rates of garnishment, with statistics indicating that up to 4.6% of this demographic is affected.

What should you do if you face wage garnishment?

It is important to reach out to the IRS as soon as possible if facing garnishment. You can also request a Collection Due Process hearing within 30 days of receiving a final notice to temporarily halt all seizure activity while your appeal is reviewed.

What is a bank levy and how does it affect financial accounts?

A bank levy allows the IRS to take funds directly from your bank account to cover unpaid taxes. Upon receiving a notice of assessment, your bank must freeze your account for 21 days, preventing access to your money.

What are the consequences of a bank levy?

A bank levy can seize 100% of the balance from personal, joint, and business accounts, which can threaten financial stability and lead to defaults on loans or leases.

What steps can you take to manage a bank levy effectively?

It is crucial to act quickly upon receiving a notice. Engaging with the IRS before enforcement begins can help maintain control over your finances and explore options like Currently Not Collectible (CNC) status, which can pause collection actions if paying would cause financial hardship.