Introduction

Navigating the complexities of disability benefits can feel overwhelming, especially if you're considering part-time work. We understand that the Social Security Administration's guidelines on Substantial Gainful Activity (SGA) are always changing, leaving many to wonder: will I lose my disability if I work part-time?

This article aims to shed light on the important aspects of part-time employment and how it affects your disability benefits. We’re here to offer you valuable strategies to help you through these challenges. As new work opportunities come your way, the stakes can feel high. How do you balance the desire to earn with the fear of losing essential support?

You are not alone in this journey. Many individuals face similar concerns, and together, we can explore the options available to you.

Understand Substantial Gainful Activity (SGA)

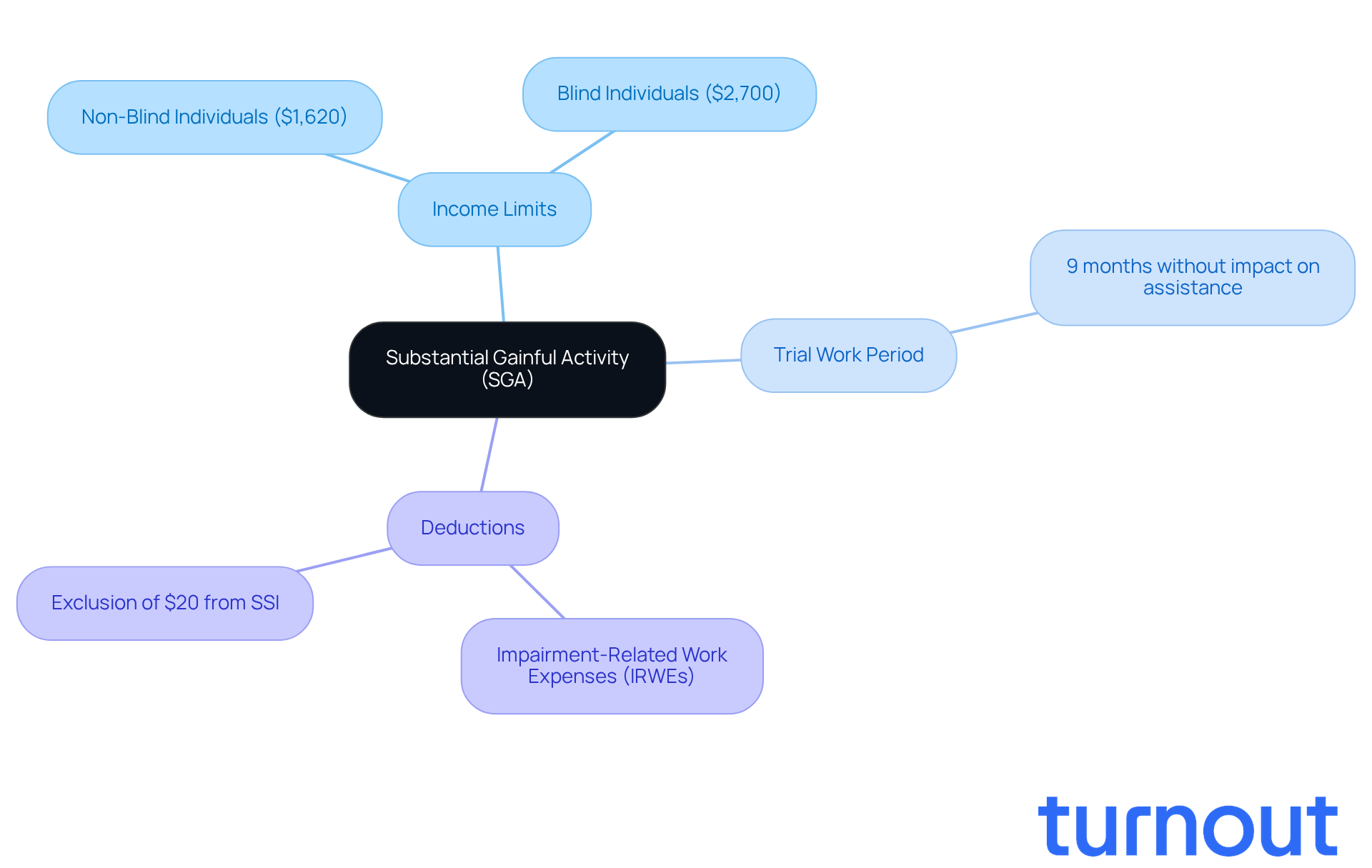

Understanding Substantial Gainful Activity (SGA) is essential for anyone asking, 'will I lose my disability if I work part time' while receiving assistance. SGA refers to the level of employment and income that the Social Security Administration (SSA) considers significant enough to potentially affect your eligibility for support. For 2025, the SGA cap is set at $1,620 per month for non-blind individuals and $2,700 for those who are blind.

We understand that navigating these limits can be daunting. Surpassing them might lead to a review of your assistance status, making you wonder, will I lose my disability if I work part time, which can feel overwhelming. However, it’s important to know that the SSA allows for a trial work period (TWP) of at least nine months, which is relevant to the question, will I lose my disability if I work part time. During this time, you can earn above the SGA limits without it impacting your assistance. This can be a great opportunity to explore your options while considering if I will lose my disability if I work part time.

Additionally, if you’re receiving Supplemental Security Income (SSI), there’s some good news! The SSA excludes $20 of general income from your total monthly income calculations. This little bit of flexibility can make a difference when you’re trying to earn extra income.

Moreover, you may wonder, will I lose my disability if I work part time, considering that impairment-related work expenses (IRWEs) can be deducted from your SGA? This means you can evaluate your options more effectively while still receiving disability assistance. Remember, you’re not alone in this journey, and we’re here to help you navigate these important decisions.

Explore the Trial Work Period (TWP)

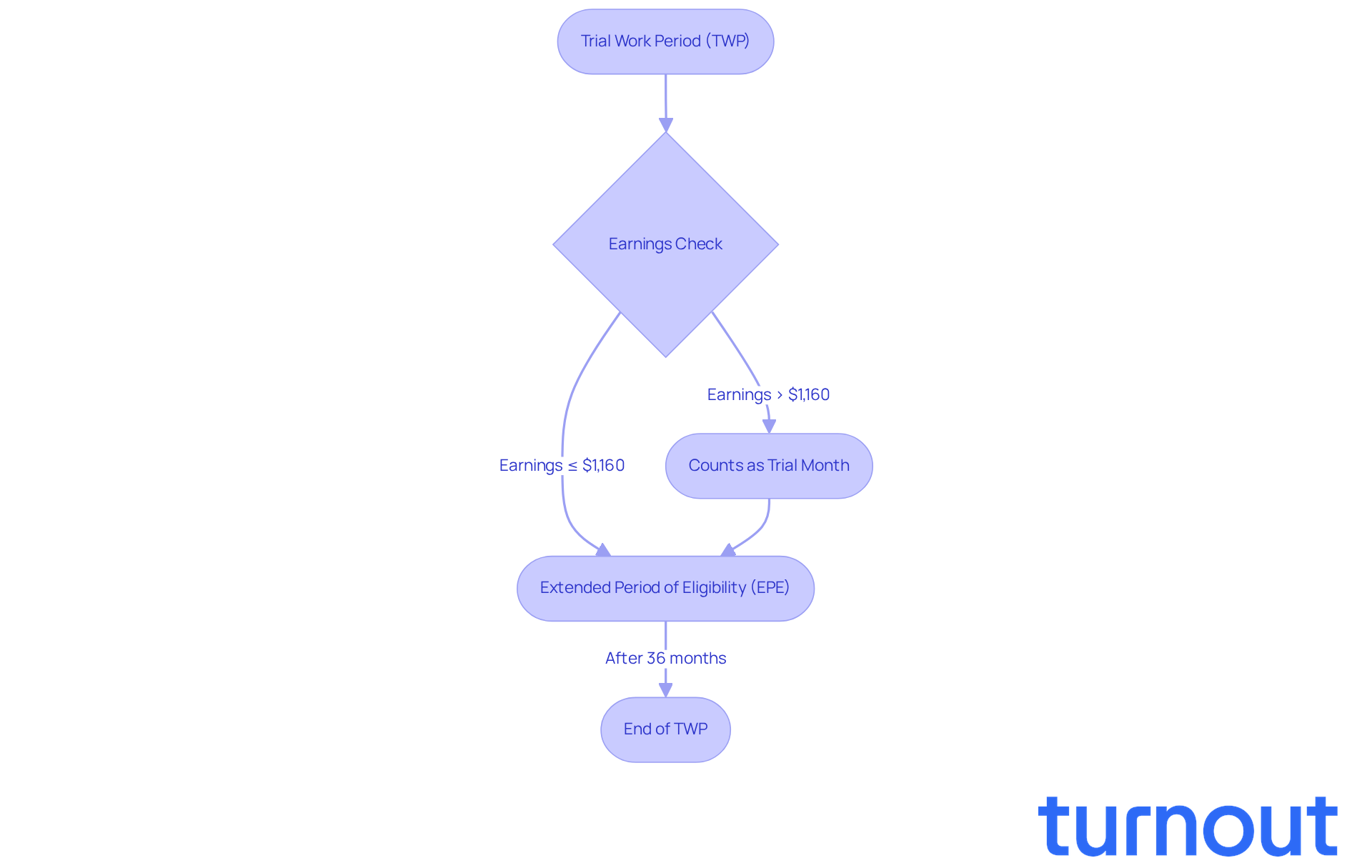

The Trial Work Period (TWP) is a vital opportunity for individuals receiving Social Security Disability Insurance (SSDI). It allows you to explore your ability to work for up to nine months without the worry of losing your benefits. During this time, you can earn any amount, and your SSDI payments will remain unaffected. For 2025, if your earnings exceed $1,160 in a month, that month will count as a trial work month. This initiative encourages you to rejoin the workforce while providing a safety net to protect your financial support.

After the TWP, you enter the Extended Period of Eligibility (EPE), which lasts for 36 months. This period allows you to continue receiving benefits based on your monthly earnings, ensuring you have the financial support you need as you transition back to work.

In recent years, more beneficiaries have taken advantage of the TWP, with many successfully returning to work. Those who have participated often share stories of newfound confidence and skills that enhance their employability. The flexibility of the TWP allows you to explore job opportunities while considering the question, will I lose my disability if I work part time, without the immediate fear of losing your financial stability.

Turnout plays a crucial role in this journey by providing access to trained nonlawyer advocates. These advocates help clients navigate SSD claims and understand their rights during the TWP. It’s important to remember that Turnout is not a law firm and does not provide legal representation. Supporters emphasize the significance of the TWP, stating, 'The Trial Work Period offers a crucial chance for SSDI recipients to reestablish themselves in the workforce, addressing concerns such as, will I lose my disability if I work part time?' This highlights how the TWP facilitates a smoother transition back to employment. Another supporter adds, "With numerous possible changes approaching for SSDI in 2025, it’s crucial to remain aware of how these updates may affect your advantages."

Overall, the TWP serves as a powerful tool for SSDI beneficiaries. It enables you to assess your work capabilities while ensuring your financial stability remains intact during this critical period. With Turnout's support, you're not alone in navigating the complexities of this process. We're here to help you every step of the way.

Learn About the Extended Period of Eligibility (EPE)

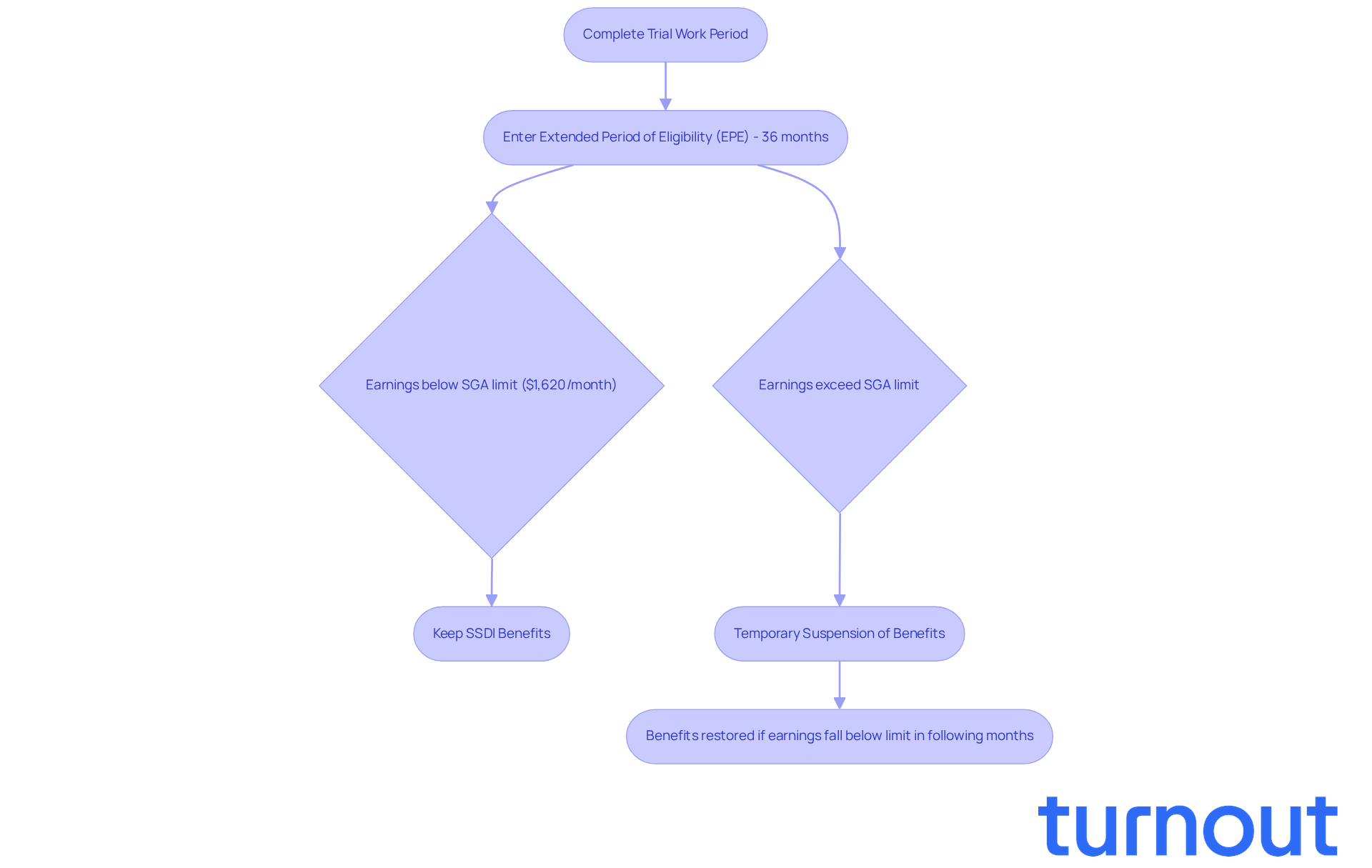

After completing the Trial Work Period, you may find yourself transitioning into the Extended Period of Eligibility (EPE), which lasts for 36 months. During this time, you can keep your SSDI benefits as long as your earnings stay below the Substantial Gainful Activity (SGA) limit, which is set at $1,620 per month for 2025.

We understand that navigating this process can be challenging. If your earnings exceed this threshold in any month, your support will be temporarily suspended. However, there's good news: it can be restored if your earnings fall below the limit in the following months. This framework serves as a vital safety net for those re-entering the job market, addressing the concern of 'will I lose my disability if I work part time' while allowing you to explore your ability to work without the immediate worry of losing your financial support.

For many, the EPE acts as an important cushion, making the transition back to work smoother while preserving essential support. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Identify Risks of Working Part-Time on Disability

Participating in part-time employment can offer financial benefits, but it also brings significant risks for those receiving assistance. We understand that if your earnings exceed the Substantial Gainful Activity (SGA) threshold, the Social Security Administration (SSA) may review your disability status, which could jeopardize your support. For instance, surpassing the SGA limit can lead to immediate consequences, as assistance might be cut off for the month when the limit is exceeded. In 2024, the SGA limit is set at $1,550 per month for non-blind individuals and $2,590 for those who are blind.

It's common to feel anxious about whether will I lose my disability if I work part time might affect your assistance. If a recipient demonstrates an increased capacity to perform significant tasks, their support may be reduced or entirely withdrawn. This emphasizes the importance of closely monitoring your earnings and understanding the implications of any work activities, particularly the question of will I lose my disability if I work part time. Legal experts stress that failing to report income accurately can lead to compliance issues, including overpayments and potential penalties. Therefore, staying informed about your earnings and the SSA's regulations is crucial to avoid jeopardizing your assistance.

Turnout simplifies access to government benefits and financial support by providing tools and services that help you navigate these complexities. They offer assistance with SSD claims and tax debt relief. It's important to note that Turnout is not a law firm and does not provide legal representation. For SSD claims, Turnout employs trained nonlawyer advocates, and for tax debt relief, they work with IRS-licensed enrolled agents, ensuring you receive qualified support throughout the process. As Pinyerd Law states, "If you are wondering, can you engage in part-time activities on Social Security Disability?" First, it’s essential to understand the two assistance programs managed by the SSA. This emphasizes the complexity of managing employment while questioning, will I lose my disability if I work part time?. Additionally, Kathleen Romig notes, "That’s a lengthy process, especially for a rule that gets a lot of comments," indicating the challenges beneficiaries face in understanding their rights and responsibilities.

To reduce risks, consider utilizing work incentives like the Trial Work Period. This allows you to assess your ability to work without losing assistance. By understanding these programs and keeping accurate records of your income, you can navigate the complexities of working part-time, especially regarding the question of will I lose my disability if I work part time. Remember, you’re not alone in this journey; Turnout's trained nonlawyer advocates are here to help.

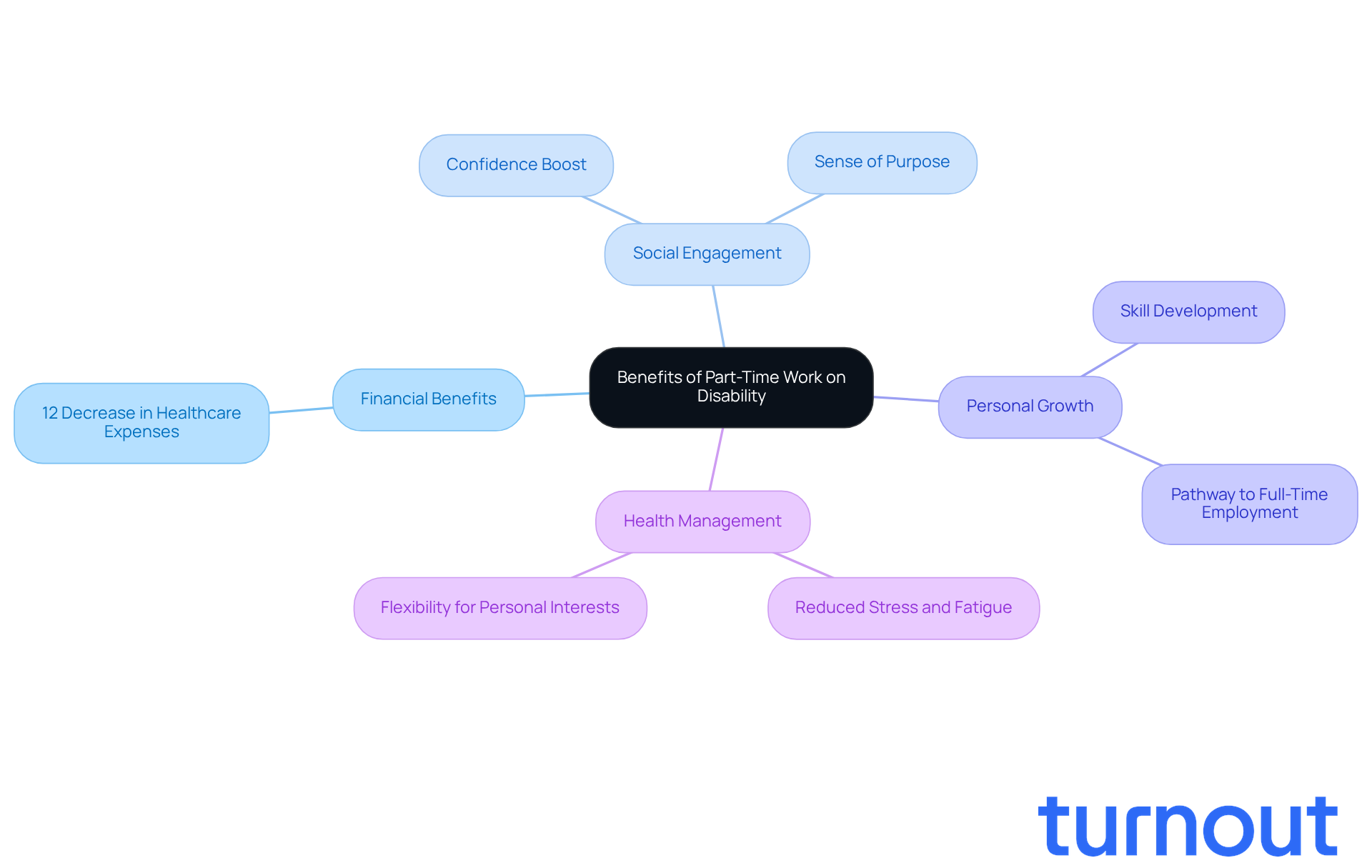

Recognize Benefits of Part-Time Work on Disability

Working part-time while receiving assistance can truly enhance your overall well-being. We understand that navigating life with challenges can be tough, but studies show that individuals with disabilities who engage in part-time employment see a 12% decrease in healthcare expenses compared to those who aren’t employed. This highlights the financial benefits of having a job.

But it’s not just about the money. Part-time work fosters social engagement, allowing you to connect with others and regain a sense of purpose and independence. Many people share that part-time employment not only boosts their quality of life but also enhances their confidence and social connections.

Consider this: one participant recovering from cancer shared how part-time work helped restore their sense of self-sufficiency after a challenging illness. Similarly, individuals with disabilities often find that part-time positions serve as stepping stones to full-time employment, providing essential skills and experiences that can lead to better job prospects down the line.

Moreover, part-time employment allows you to manage your health conditions more effectively. It reduces stress and fatigue while offering the flexibility to pursue personal interests or education. This balance is crucial, especially when juggling family and medical appointments.

Ultimately, part-time employment can be a life-changing experience. It empowers individuals facing challenges to thrive both personally and professionally. Remember, you are not alone in this journey, and we’re here to help you explore these opportunities.

Implement Strategies for Successful Part-Time Work

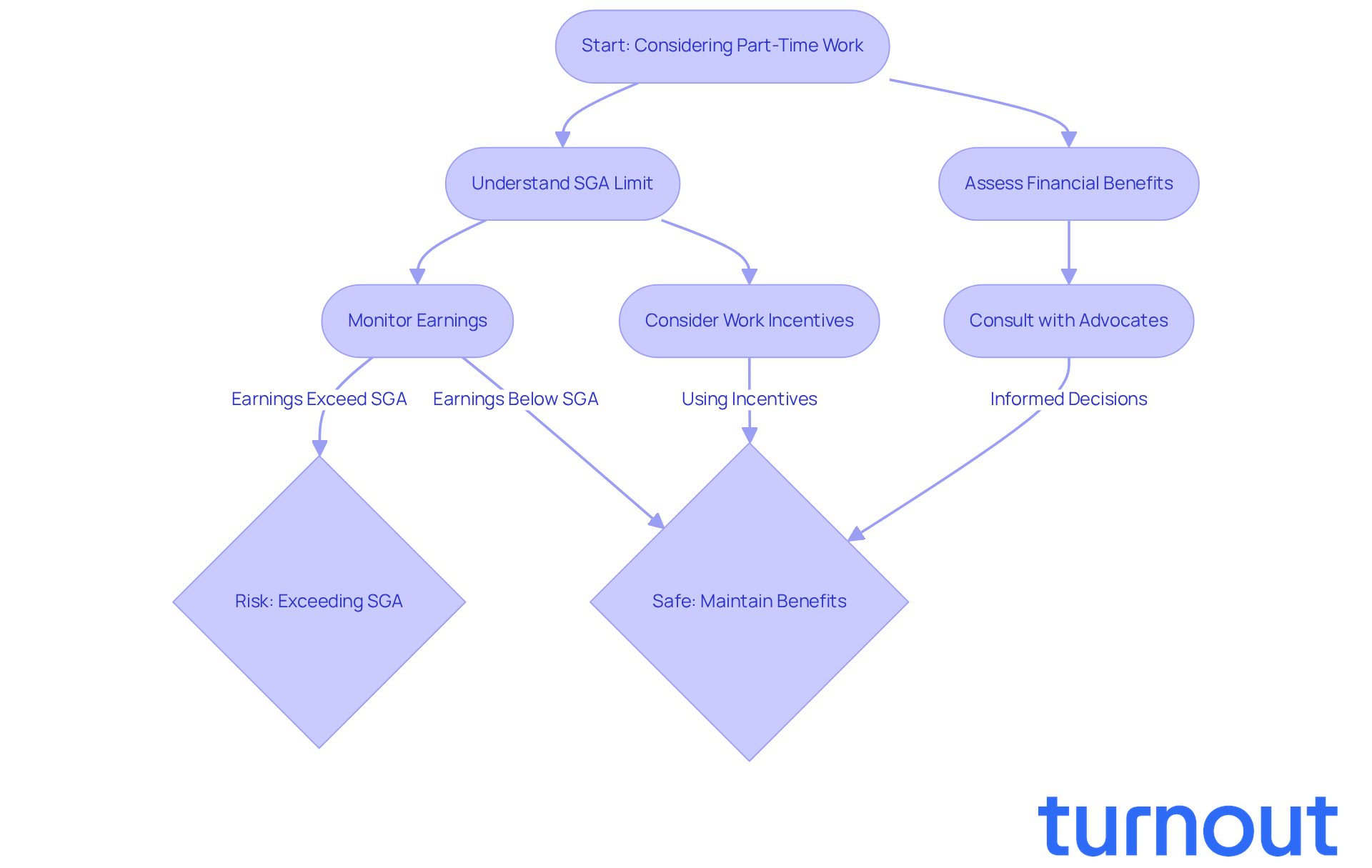

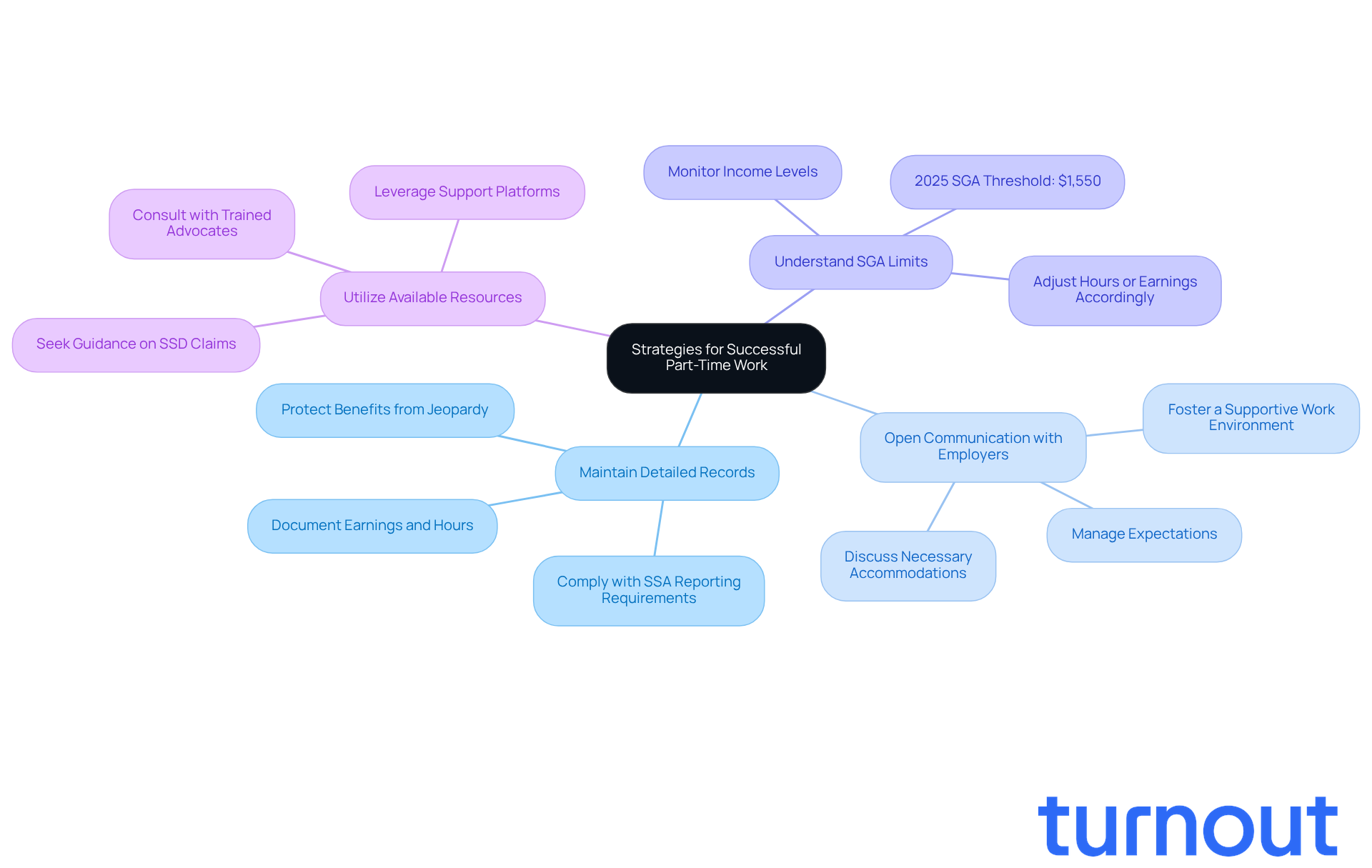

Navigating part-time work while receiving disability benefits can make one wonder, will I lose my disability if I work part time? But with the right strategies, you can manage this journey successfully. Here are some supportive steps to consider:

-

Maintain Detailed Records: Keeping meticulous records of your earnings and hours worked is crucial. This not only helps you comply with Social Security Administration (SSA) reporting requirements but also protects your benefits from being jeopardized. You deserve peace of mind knowing your hard work is documented.

-

Open Communication with Employers: It’s essential to communicate openly with your employers about any necessary accommodations related to your disabilities. This transparency fosters a supportive work environment and helps manage expectations. Remember, you’re not alone in this; many employers are willing to help.

-

Understanding the Substantial Gainful Activity (SGA) limits is vital for maintaining your benefits, especially if you are concerned about whether you will lose my disability if I work part time. For 2025, the SGA threshold is set at $1,550 per month for non-blind individuals. To ensure you maintain your eligibility, you might wonder, will I lose my disability if I work part time, by adjusting your hours or earnings to stay within this limit.

-

Utilize Available Resources: Don’t hesitate to leverage resources like Turnout for guidance and support throughout your employment journey. While Turnout isn’t a law firm, it connects you with trained nonlawyer advocates who can assist with SSD claims and IRS-licensed enrolled agents for tax debt relief. Consulting with these experts can provide valuable insights tailored to your health needs and financial goals.

By implementing these strategies, you can effectively manage part-time employment while ensuring adherence to SSA regulations. Remember, you’re taking important steps toward enhancing your financial stability and personal fulfillment. We’re here to help you every step of the way.

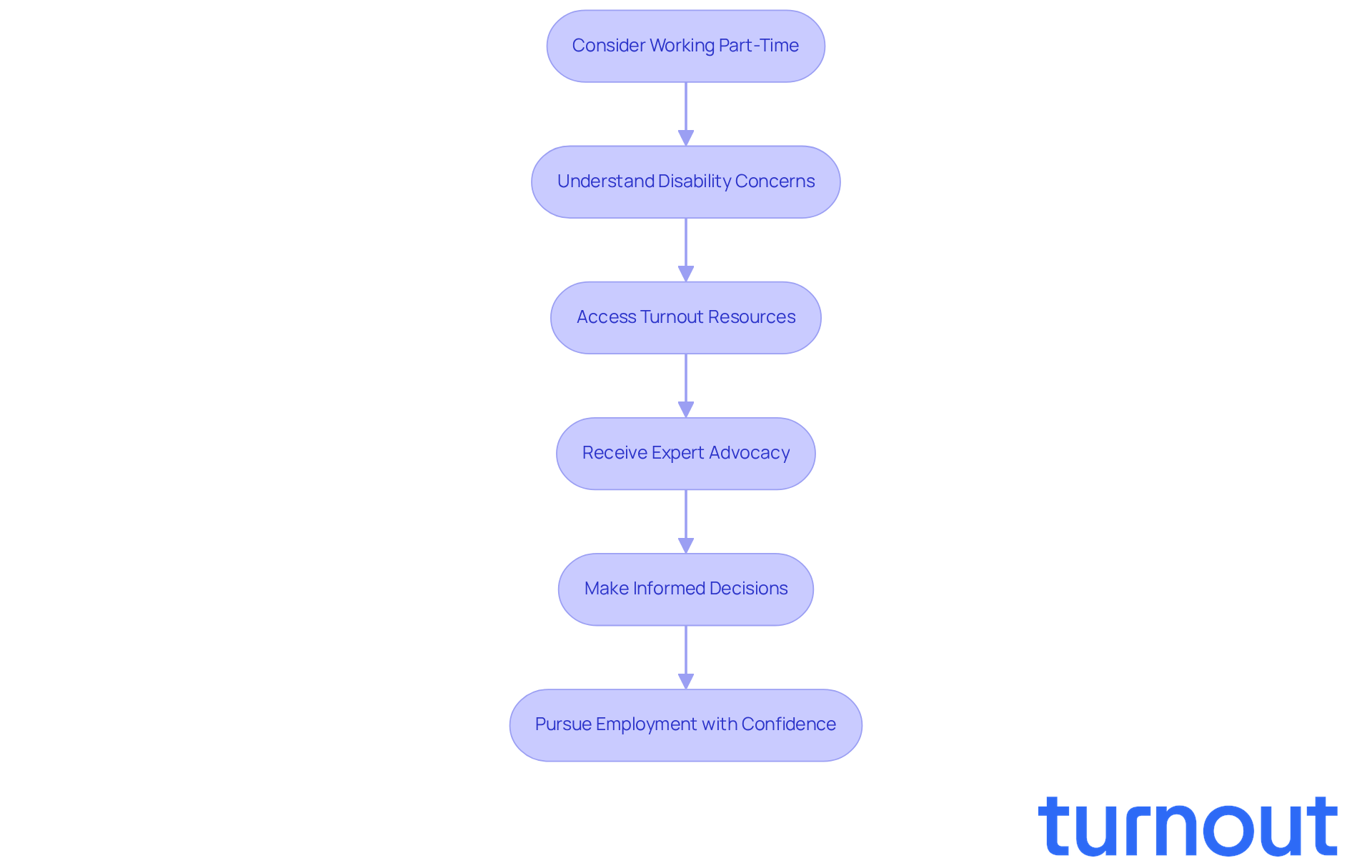

Utilize Turnout for Guidance on Disability and Work

Navigating the complex landscape of support while considering, will I lose my disability if I work part time, can be overwhelming. We understand that many people face challenges in finding the right resources. That’s where Turnout comes in.

Turnout provides essential resources and assistance to help you through this journey. By harnessing AI technology alongside expert advocacy, we empower you to understand your rights and manage your cases effectively. Imagine feeling confident in making informed employment decisions.

This innovative approach allows you to pursue part-time employment with assurance, while also addressing the concern of whether I will lose my disability if I work part time, all in compliance with Social Security Administration (SSA) regulations. You’re not alone in this process; we’re here to help transform what seems daunting into a manageable experience.

Take the first step today. Let us support you in navigating your path to part-time employment.

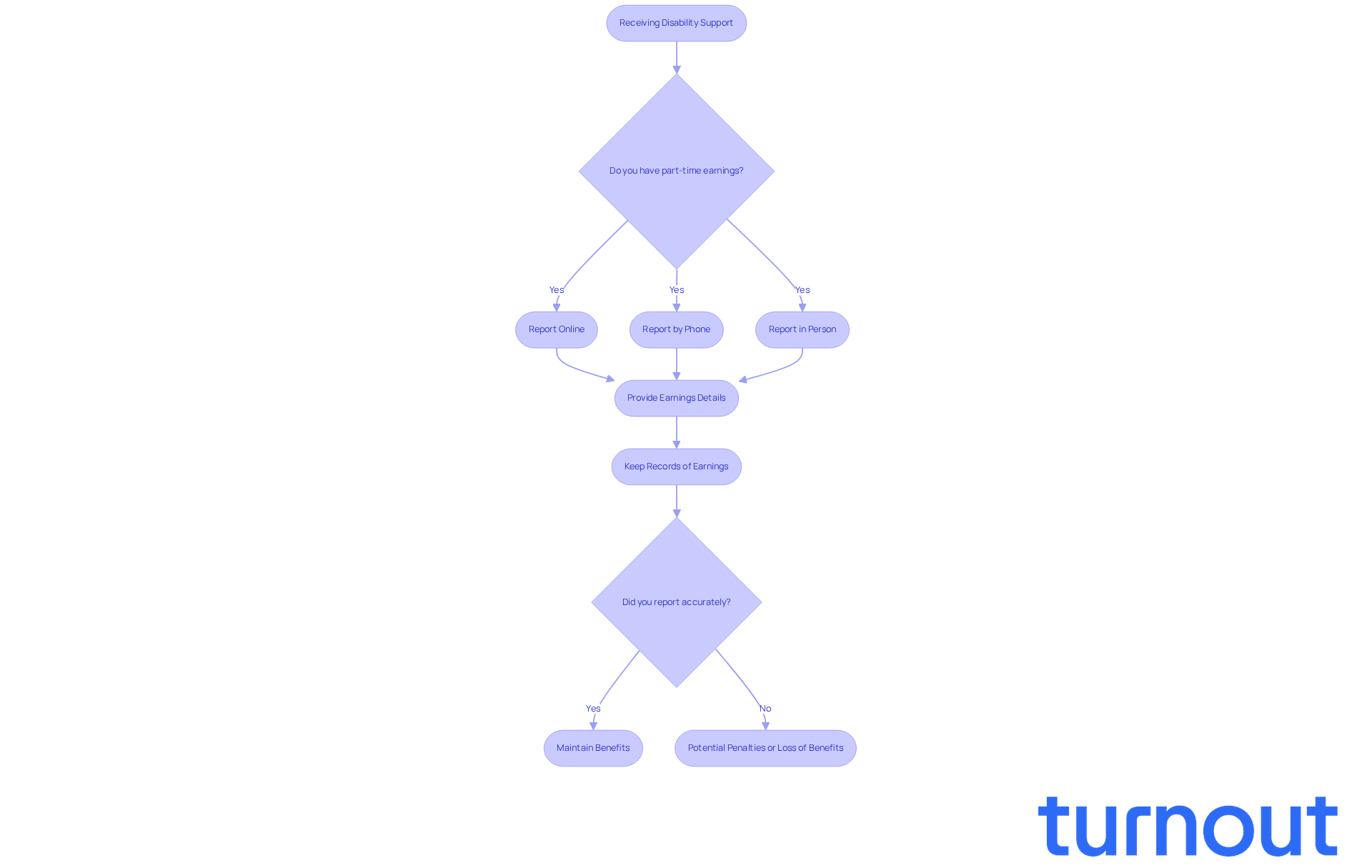

Understand Reporting Requirements for Part-Time Work

If you're receiving disability support, it's important to report any earnings from part-time work to the Social Security Administration (SSA) to determine if you will lose your disability if you work part time. This means sharing details like how much you earn, the hours you work, and any work-related expenses that might affect your eligibility. You can submit your reports in several ways:

- online

- by phone

- in person at your local SSA office

We understand that keeping track of these details can feel overwhelming. However, precise reporting is crucial. If you neglect this, it could lead to overpayments, which might result in penalties or even the loss of your benefits. For instance, if you earn more than the Substantial Gainful Activity (SGA) limit, you may wonder, will I lose my disability if I work part time this month? In 2025, the SGA limit is set at $1,550 per month for non-blind individuals.

To avoid complications, it's wise to keep meticulous records of your earnings and promptly notify the SSA of any changes. As one legal expert wisely noted, "Documenting your work activity avoids issues such as having to reimburse assistance later or encountering penalties for failing to report."

Real-life examples show that those who diligently report their earnings can successfully navigate the complexities of maintaining their benefits while considering, 'will I lose my disability if I work part time?'. By understanding and following these reporting obligations, you can ensure compliance and protect your financial stability. Remember, you're not alone in this journey; we're here to help you every step of the way.

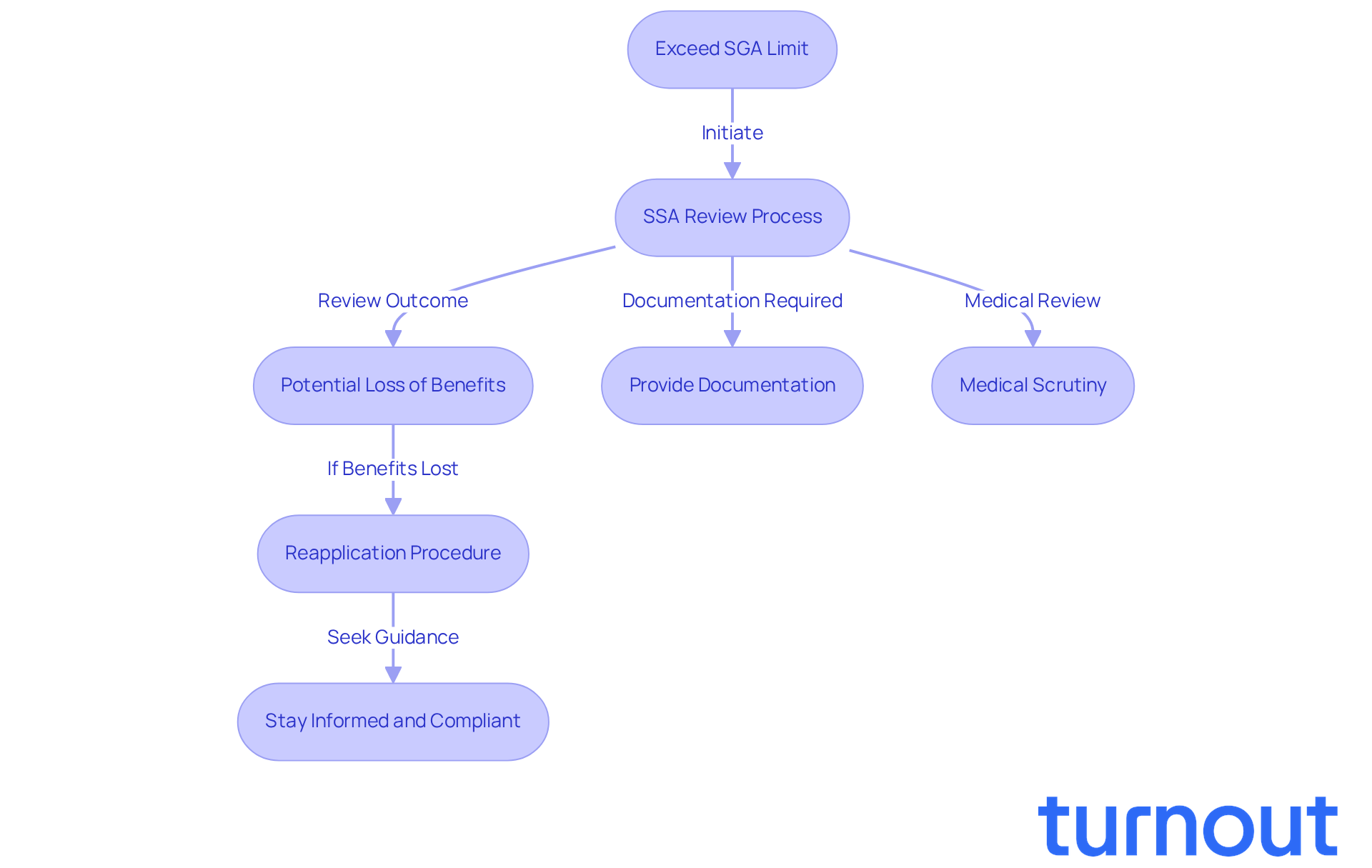

Clarify Consequences of Exceeding SGA Limits

Surpassing the Substantial Gainful Activity (SGA) threshold can be a daunting experience for those receiving assistance. When a beneficiary earns more than the SGA threshold-set at $1,300 per month for most and $2,830 for blind individuals-the Social Security Administration (SSA) may review their disability status. This process can lead to a suspension or even cancellation of support, leaving individuals to navigate a complex reapplication procedure that can feel overwhelming.

Many recipients have shared their stories of losing assistance after exceeding the SGA limit. Often, this happens due to misunderstandings about the thresholds and the importance of reporting income changes promptly. It's crucial to stay vigilant, as a significant number of beneficiaries face termination of benefits because of SGA violations.

The SSA's review process for exceeding the SGA limit is thorough. Beneficiaries should be prepared to provide documentation and may face additional scrutiny regarding their medical condition and ability to work. Understanding these risks is vital for anyone considering part-time employment while questioning, "Will I lose my disability if I work part time?" The consequences can be serious and far-reaching.

To help clients navigate these challenges, Turnout offers valuable tools and services. Our trained nonlawyer advocates are here to guide beneficiaries in understanding their rights and responsibilities. Additionally, the Trial Work Period (TWP) allows beneficiaries to explore their ability to work while addressing the concern of "Will I lose my disability if I work part time?" providing a safety net for those interested in part-time jobs.

We encourage beneficiaries to maintain regular communication with the SSA and seek support to stay informed and compliant. Remember, you are not alone in this journey-we're here to help.

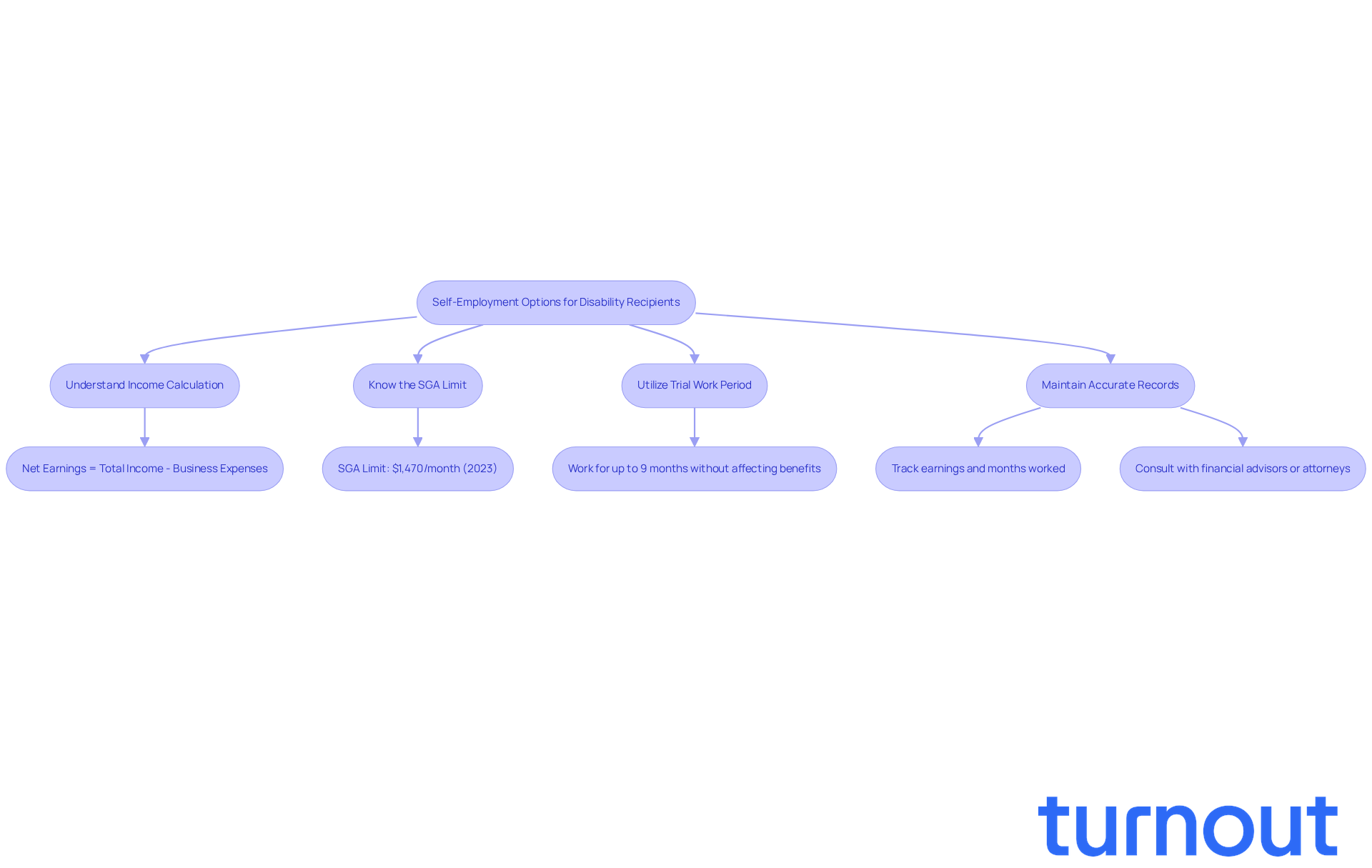

Examine Self-Employment Options While on Disability

Self-employment can be a wonderful option for those receiving disability support, offering the flexibility and control over working hours that many desire. However, it’s essential to understand how self-employment income is calculated and reported to the Social Security Administration (SSA). We understand that navigating these rules can be daunting, but it’s crucial for beneficiaries to ensure their earnings stay below the Substantial Gainful Activity (SGA) limit, which is set at $1,470 per month for non-blind individuals in 2023. Keeping detailed records of your business activities is vital for compliance and helps prevent any issues with your benefits.

During the SSA's trial work phase, SSDI recipients can work for up to nine months without affecting their assistance. This period allows individuals to assess their ability to maintain a business while still receiving financial support. It’s a great opportunity to explore self-employment while wondering, will I lose my disability if I work part time, without the immediate pressure of losing benefits. If your net earnings exceed $400 in a year, accurate reporting is required, calculated as total income minus business expenses. This ensures you adhere to SSA regulations and helps protect your benefits.

Real-life stories show that many beneficiaries have successfully managed self-employment while receiving assistance. For instance, numerous individuals have turned to resources like Turnout to help navigate the complexities of self-employment, ensuring they remain compliant while pursuing their entrepreneurial dreams. Consulting with financial advisors or disability benefits attorneys can provide tailored guidance, helping you understand how your business activities impact your SSDI assistance and whether you will lose your disability if you work part time.

By focusing on accurate reporting, taking advantage of the trial work period, and balancing business growth with benefit requirements, you can successfully manage your SSDI while nurturing your business. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Navigating the complexities of part-time work while receiving disability benefits can be daunting. We understand that the fear of losing assistance is a common concern. However, grasping the relationship between employment and disability support is essential for maintaining financial stability and exploring new opportunities. While part-time work may seem risky, it can also bring significant benefits, enhancing your quality of life and helping you regain a sense of purpose.

Key insights to consider include understanding the Substantial Gainful Activity (SGA) limits. Familiarizing yourself with the advantages of the Trial Work Period (TWP) and the Extended Period of Eligibility (EPE) can provide a safety net as you transition back to work. It’s crucial to report your earnings accurately, as exceeding SGA limits can impact your eligibility for benefits. Remember, resources like Turnout are available to assist you in navigating these complexities, ensuring you have the support needed to make informed decisions.

Ultimately, embracing part-time work can be a transformative experience for those receiving disability benefits. By leveraging available resources and understanding the rules surrounding employment, you can confidently explore job opportunities while safeguarding your financial security. Taking proactive steps today can lead to a brighter future, where work and disability support coexist harmoniously. You are not alone in this journey; we’re here to help you thrive both personally and professionally.

Frequently Asked Questions

What is Substantial Gainful Activity (SGA)?

Substantial Gainful Activity (SGA) refers to the level of employment and income that the Social Security Administration (SSA) considers significant enough to potentially affect your eligibility for disability support. For 2025, the SGA cap is $1,620 per month for non-blind individuals and $2,700 for those who are blind.

How does earning above the SGA limit affect my disability benefits?

Earning above the SGA limit may lead to a review of your assistance status. However, the SSA allows for a trial work period (TWP) of at least nine months, during which you can earn above the SGA limits without impacting your assistance.

What is the Trial Work Period (TWP)?

The Trial Work Period (TWP) is a nine-month opportunity for individuals receiving Social Security Disability Insurance (SSDI) to explore their ability to work without losing their benefits. During this time, SSDI payments remain unaffected regardless of how much you earn.

How does the Extended Period of Eligibility (EPE) work?

The Extended Period of Eligibility (EPE) lasts for 36 months following the TWP. During this time, you can continue receiving SSDI benefits as long as your earnings stay below the SGA limit. If your earnings exceed the limit in any month, your support will be temporarily suspended but can be restored if your earnings fall below the limit in subsequent months.

What happens if I earn more than the SGA limit during the EPE?

If your earnings exceed the SGA limit during the EPE, your SSDI support will be temporarily suspended. However, it can be restored if your earnings fall below the limit in the following months.

Are there any deductions that can affect my SGA calculations?

Yes, impairment-related work expenses (IRWEs) can be deducted from your SGA, allowing you to evaluate your options more effectively while still receiving disability assistance.

How can I get support while navigating the TWP and EPE?

Organizations like Turnout provide access to trained nonlawyer advocates who can help you navigate SSD claims and understand your rights during the TWP and EPE. They offer support but do not provide legal representation.