Introduction

Understanding Supplemental Security Income (SSI) is vital for many individuals grappling with financial challenges due to age, blindness, or disability. We recognize that navigating this system can feel overwhelming. As the federal assistance rate adjusts for 2025, the differences in state-specific SSI supplements become even more pronounced. These variations can significantly impact the support recipients receive, affecting their financial stability.

How do these disparities influence the lives of disabled individuals across various states? It's common to feel uncertain about what to expect. By exploring these differences, we can uncover essential insights that will help you navigate this complex landscape with confidence. Remember, you are not alone in this journey, and we're here to help.

Understand SSI Supplemental Payments

Supplemental Security Income (SSI) is more than just a federal program; it’s a lifeline for individuals who are aged, blind, or disabled and face financial hardships. As of January 1, 2025, the federal assistance rate stands at $967 per month for individuals and $1,450 for couples. This support is crucial for helping recipients meet their essential needs - like food, clothing, and shelter - especially for those with disabilities who often encounter significant financial challenges.

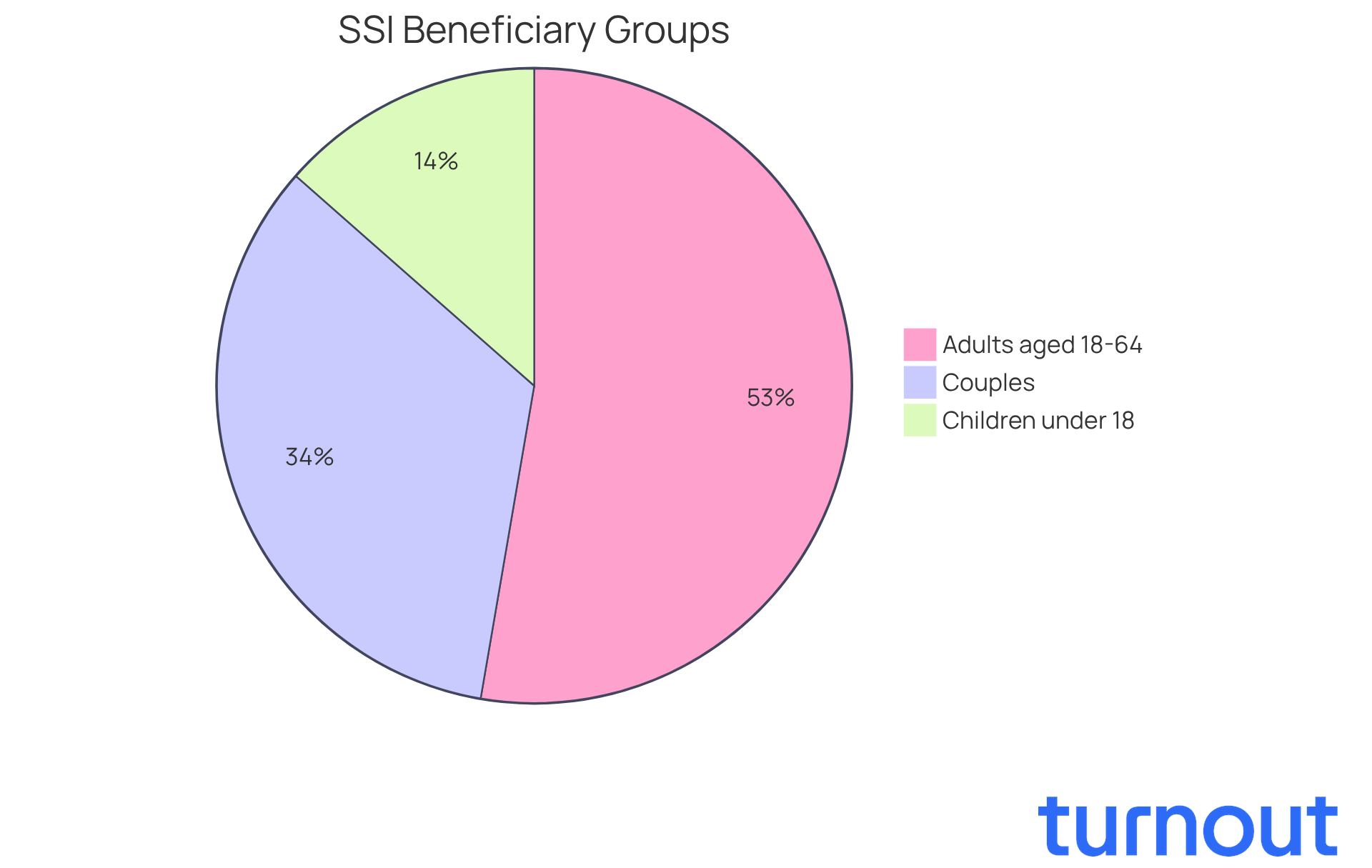

In 2025, around 7.4 million people benefit from SSI, including 1 million children under 18 and 3.9 million adults aged 18-64. The program plays a vital role in reducing poverty among disabled individuals. In fact, the average monthly assistance for disabled workers in current-payment status reached $1,581 in December 2024. These payments are not just numbers; they represent a safety net that allows individuals to maintain a basic standard of living.

Financial experts highlight how impactful SSI payments can be. For many, these benefits are not merely supplemental; they are essential for managing daily expenses and avoiding deeper financial distress. We understand that navigating these challenges can be overwhelming, and it’s important to stay informed about support rates and eligibility criteria. Remember, you are not alone in this journey. We’re here to help you understand your options and ensure you receive the assistance you need.

Explore State-Specific SSI Payment Variations

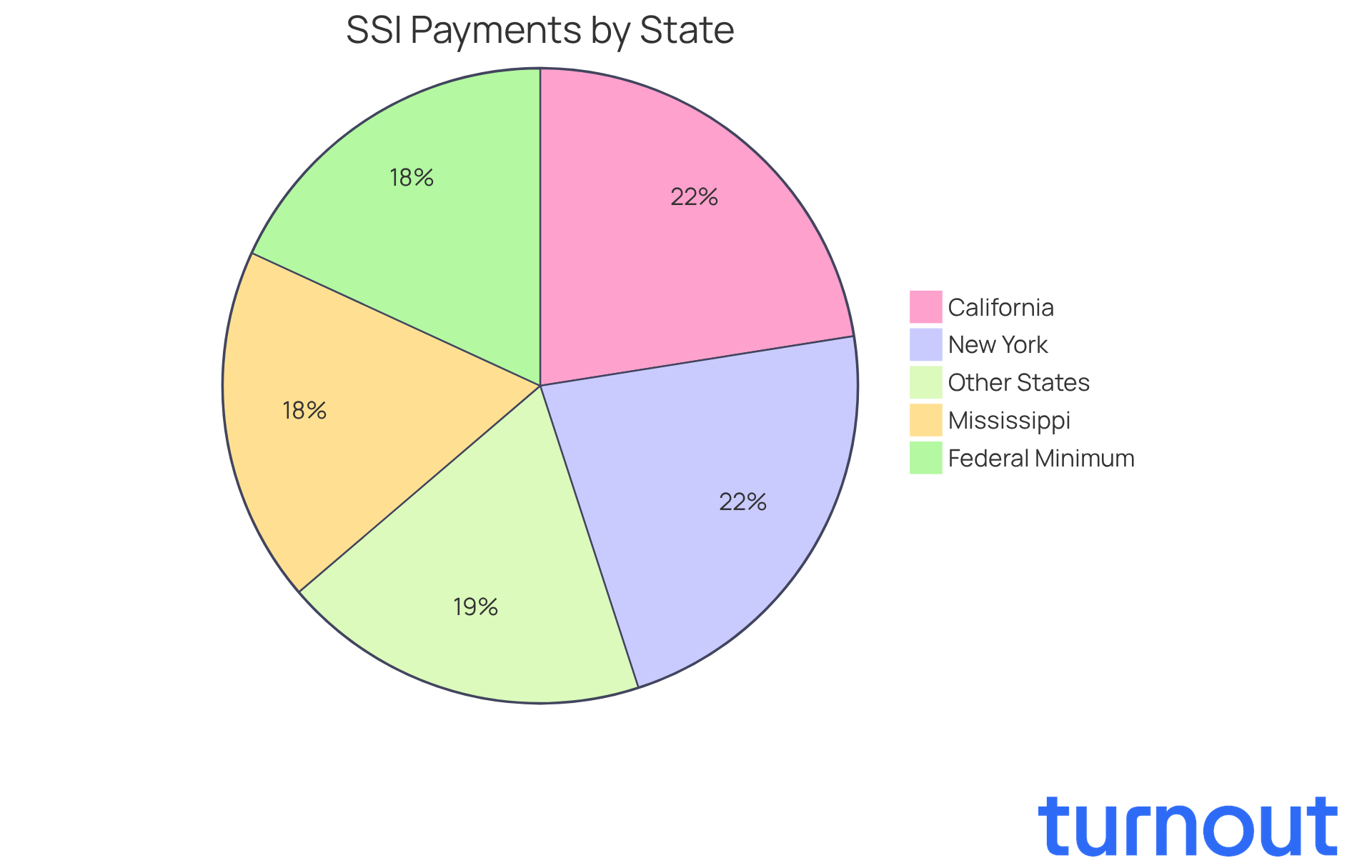

Understanding SSI payments can feel overwhelming, especially when you realize how much they vary from state to state. This variation is often influenced by the SSI supplement by state, which can significantly affect the support you receive. For example, in states like California and New York, the management of their own SSI supplement by state can lead to total monthly assistance exceeding $1,200. This kind of support is crucial for disabled residents who rely on these funds to make ends meet.

On the other hand, states like Mississippi typically offer only the federal minimum for the SSI supplement by state, which results in much lower overall assistance. As of January 1, 2025, the Federal SSI assistance rate stands at $967 for individuals and $1,450 for couples. We understand that navigating these distinctions is essential for maximizing your benefits and managing your financial planning effectively.

At Turnout, we’re dedicated to simplifying access to government benefits and financial support. Our trained nonlawyer advocates are here to guide you through SSD claims, while our IRS-licensed enrolled agents can assist with tax debt relief. If you have questions about supplemental payments, we encourage you to reach out to your respective state for detailed information.

For further insights, consider checking out the publication titled 'SSI Recipient by State and County, 2022' available on the SSA website. Remember, you are not alone in this journey; we’re here to help.

Identify Eligibility Criteria for SSI Supplements

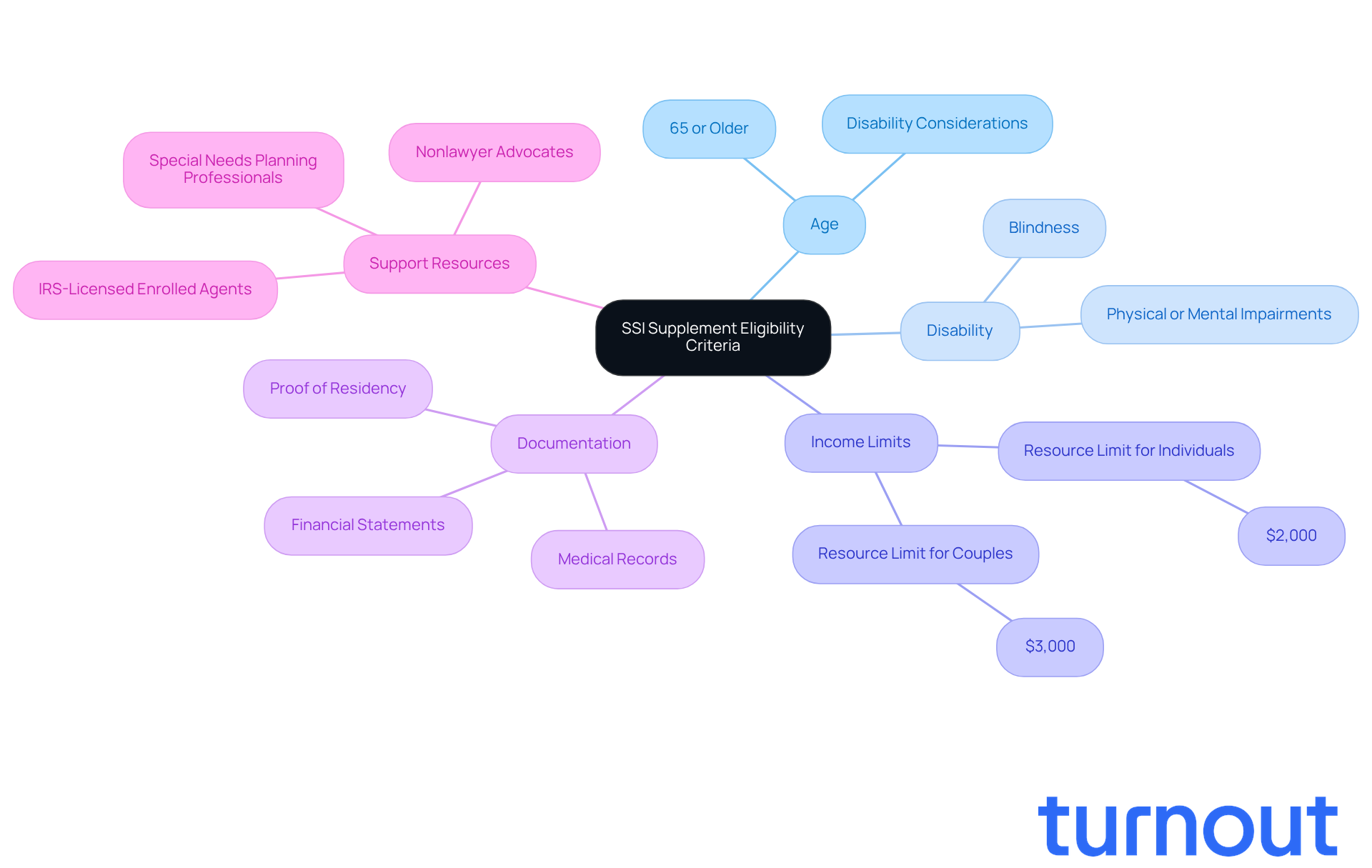

Navigating the world of SSI supplement by state can feel overwhelming, especially when you’re facing challenges like age, disability, or limited resources. To qualify for the SSI supplement by state, individuals must meet specific criteria: you should be aged 65 or older, blind, or disabled, and have limited income and resources. As of 2025, the resource limit is set at $2,000 for individuals and $3,000 for couples. It’s also important to note that candidates must be U.S. citizens or meet certain immigration criteria.

We understand that the application process can be daunting. The Social Security Administration (SSA) evaluates these factors rigorously, and unfortunately, about 65% of disability assistance applicants are denied on average. This highlights how crucial it is to gather comprehensive documentation to support your claims. This includes:

- Medical records

- Financial statements

- Proof of residency

For instance, Christopher Tincher faced significant health challenges but successfully qualified for Social Security Disability Insurance benefits at age 55 after initially being denied. He emphasized that having all documentation in order can significantly influence the outcome of your submission.

Such stories remind us of the importance of understanding eligibility criteria to navigate the SSI enrollment process effectively. If you’re feeling uncertain, know that you’re not alone in this journey. Turnout offers valuable assistance, utilizing trained nonlawyer advocates and IRS-licensed enrolled agents to help clients prepare their claims without the need for legal representation.

Given potential changes to the SSI supplement by state eligibility rules, it’s crucial to stay informed. Consider consulting with a special needs planning professional to prepare for any adjustments that may impact your benefits. Remember, we’re here to help you every step of the way.

Navigate the Application Process for SSI Payments

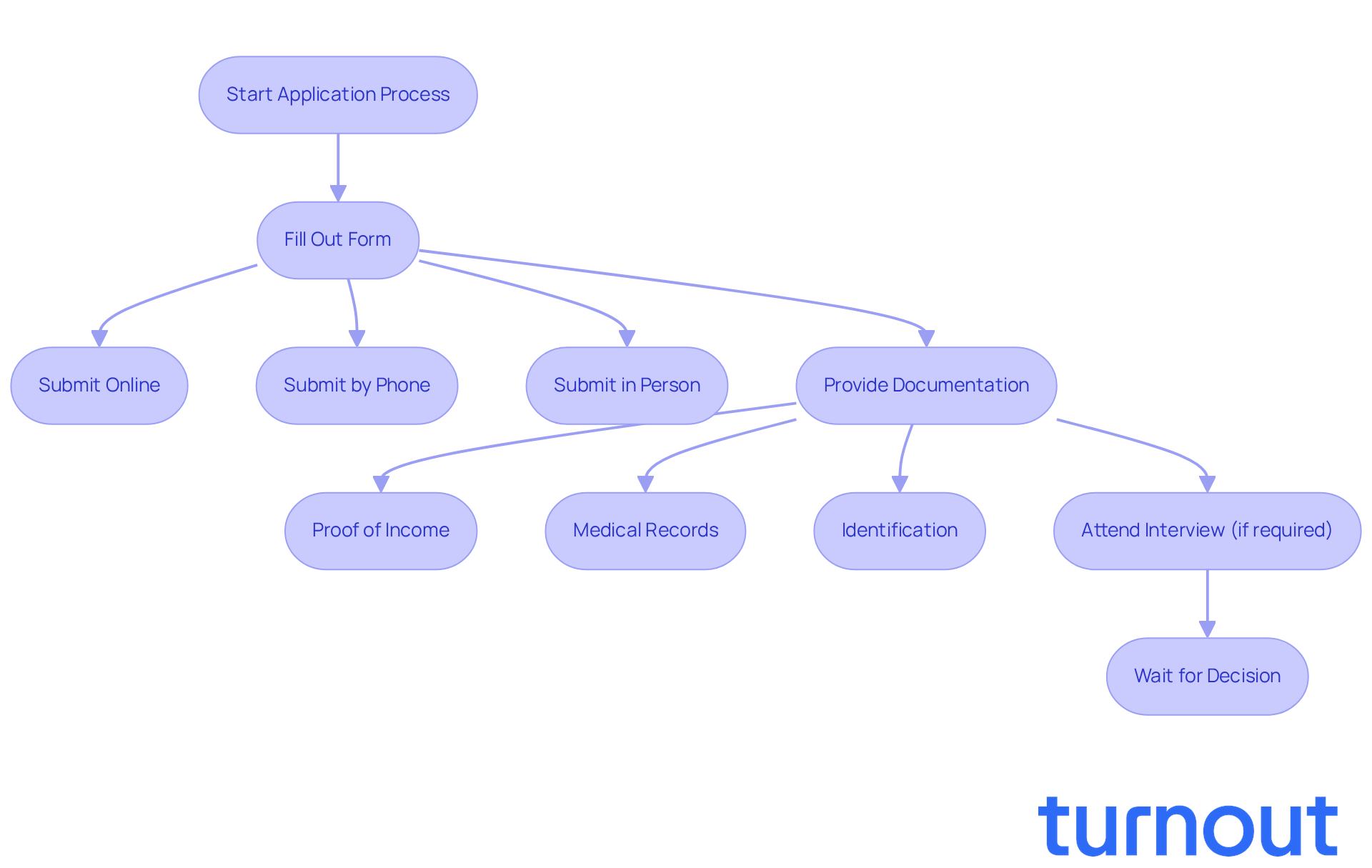

Applying for Supplemental Security Income (SSI) can feel overwhelming, but we're here to help you through it. The first step is filling out a form, which you can submit online, by phone, or in person at your local Social Security Administration (SSA) office. It's crucial to provide accurate information and the necessary documentation - like proof of income, medical records, and identification - to ensure a smooth submission process.

After submitting your form, you might need to attend an interview or provide additional information. This step can significantly speed up the review process. In 2025, the SSA plans to make things even easier by introducing a simplified online application that uses plain language questions and prepopulated answers. This change aims to make the process more accessible for individuals aged 18 to 64.

We understand that waiting for a decision can be stressful. As of November 2023, new candidates faced an average wait time of 225 days, which is an 86% increase since 2019. This extended wait can lead to financial difficulties, with three out of five individuals being denied assistance after such delays. That's why thorough preparation and timely submission of all required documents are so important. Advocates emphasize that these steps can significantly improve your chances of approval.

Real-life examples show that successful SSI submissions often involve careful attention to detail and proactive communication with SSA representatives. By understanding the steps involved and following these best practices, you can navigate the process of obtaining the SSI supplement by state more effectively. Remember, you are not alone in this journey, and with the right preparation, you can enhance your chances of obtaining the benefits you deserve.

Leverage Turnout for SSI Application Support

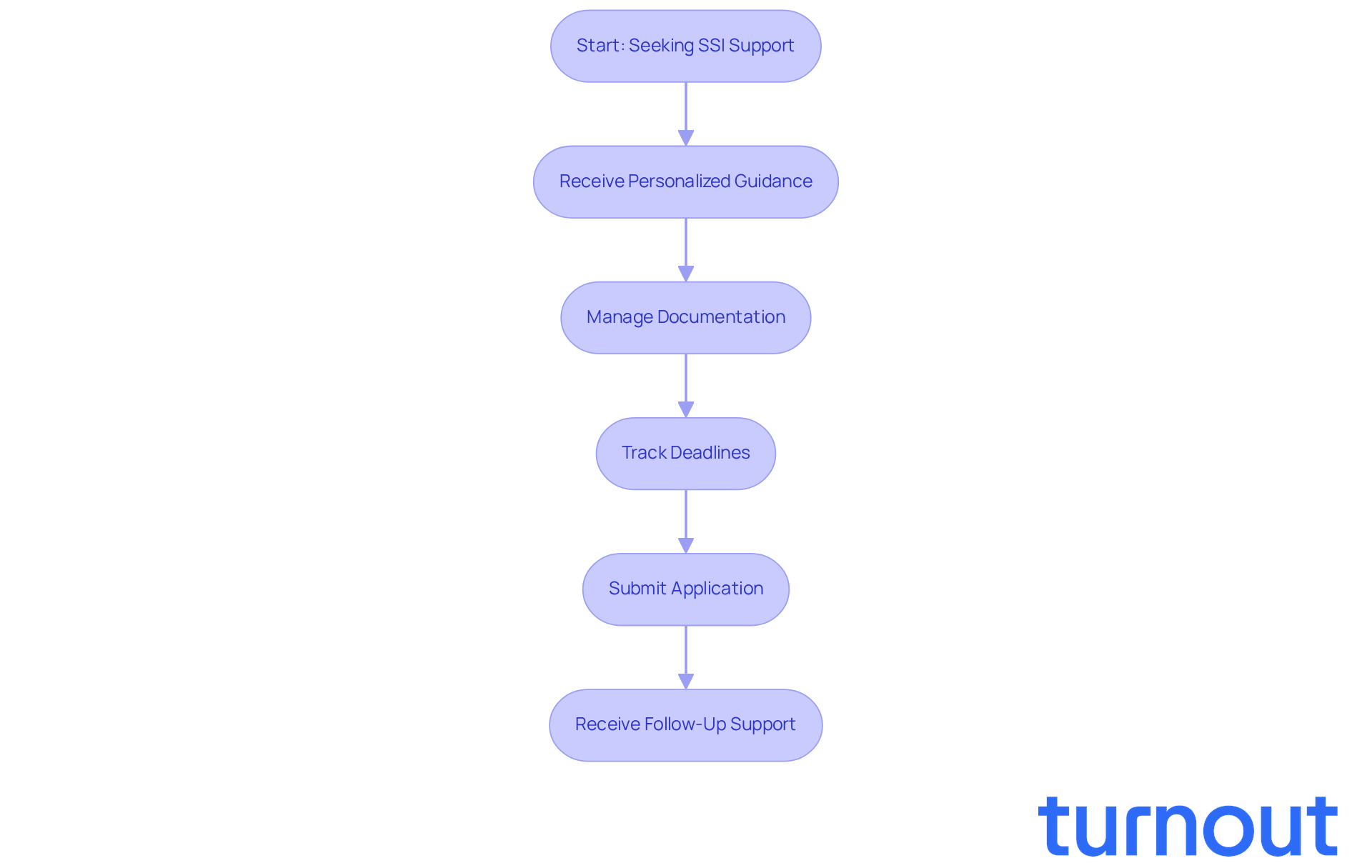

Navigating the SSI enrollment process can feel overwhelming, but you’re not alone. Turnout offers a unique platform that combines AI technology with compassionate human advocacy, designed to support you every step of the way. With Turnout, you’ll receive personalized guidance, helping you complete your submissions accurately and efficiently.

Imagine having assistance managing your documentation, deadlines, and follow-ups. This support significantly reduces the stress often associated with the process. While some of Turnout's services are free, it's important to remember that others may incur service fees, and any government fees must be paid separately before your paperwork can be submitted on your behalf.

Turnout also prioritizes your experience by ensuring that all communications regarding your request are sent electronically. This streamlining keeps you informed and engaged throughout the process. By simplifying access to government benefits and financial support, Turnout makes it easier for individuals with disabilities to navigate the complexities of claims for SSI supplement by state.

We understand that seeking assistance can be daunting, but with Turnout, you have a partner in this journey. Let us help you take the next step toward securing the support you deserve.

Recognize Common Challenges in SSI Applications

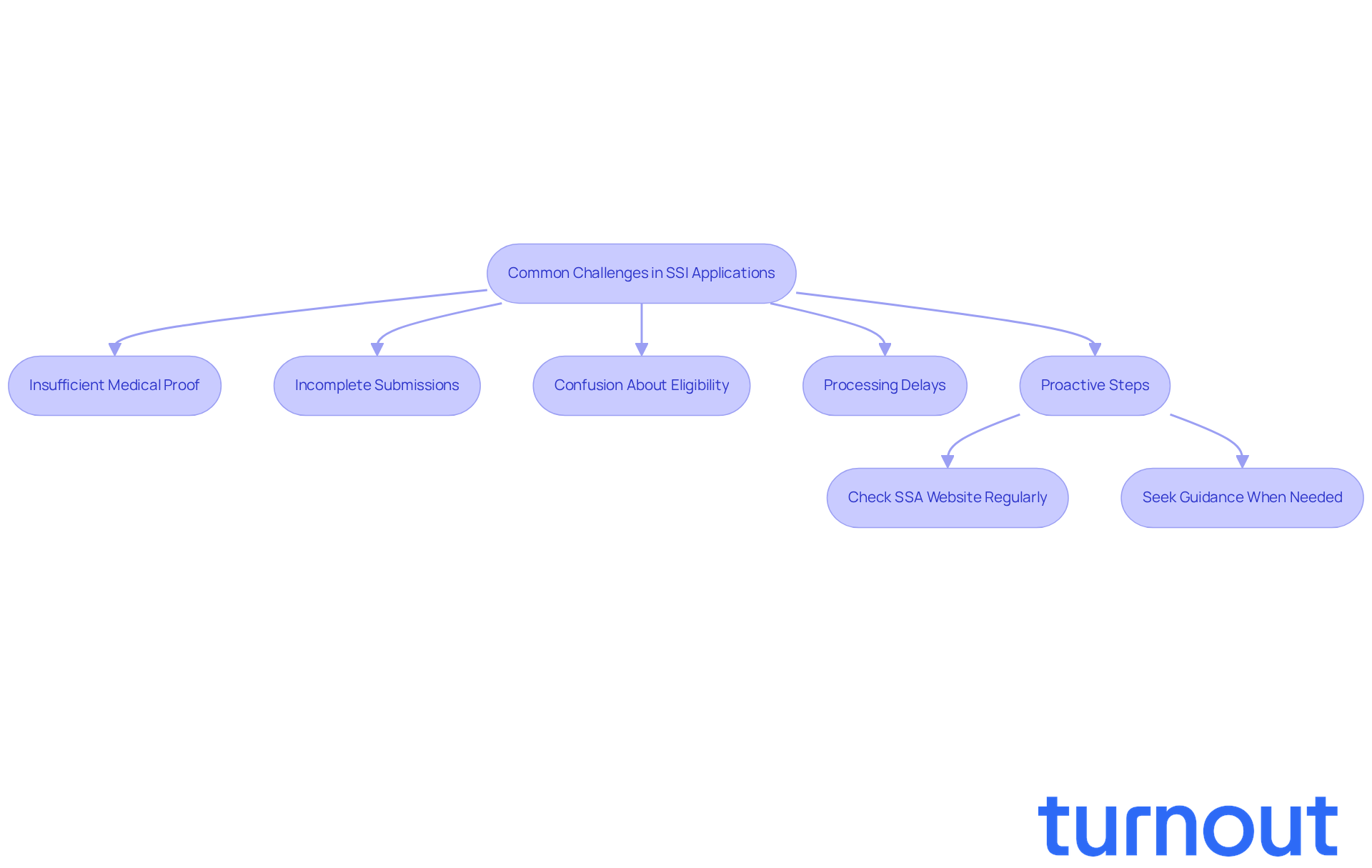

Many candidates face challenges like insufficient medical proof, incomplete submissions, or confusion about eligibility criteria. We understand that these hurdles can be overwhelming. Additionally, processing delays often arise from high application volumes and staffing shortages at the Social Security Administration (SSA), which have worsened in recent years. For example, the number of fully trained disability examiners dropped from 6,627 in 2018 to 5,252 in 2023, leading to increased backlogs.

Being aware of these challenges can empower candidates to take proactive steps. Ensuring you have comprehensive medical documentation and understanding the SSA's criteria for disability are crucial. While Turnout is not a law firm and does not provide legal counsel, we offer valuable assistance in this process. Our trained nonlawyer advocates for SSD claims help individuals navigate these complexities without needing legal representation.

Disability advocate Kerry Magro, who has been engaged for eight years, emphasizes that understanding the submission procedure can help individuals overcome these challenges. To improve your chances of a successful submission, consider the following steps:

- Regularly check the SSA website for updates on your claims.

- Seek guidance when needed.

Remember, you are not alone in this journey; we're here to help.

Gather Necessary Documentation for SSI Benefits

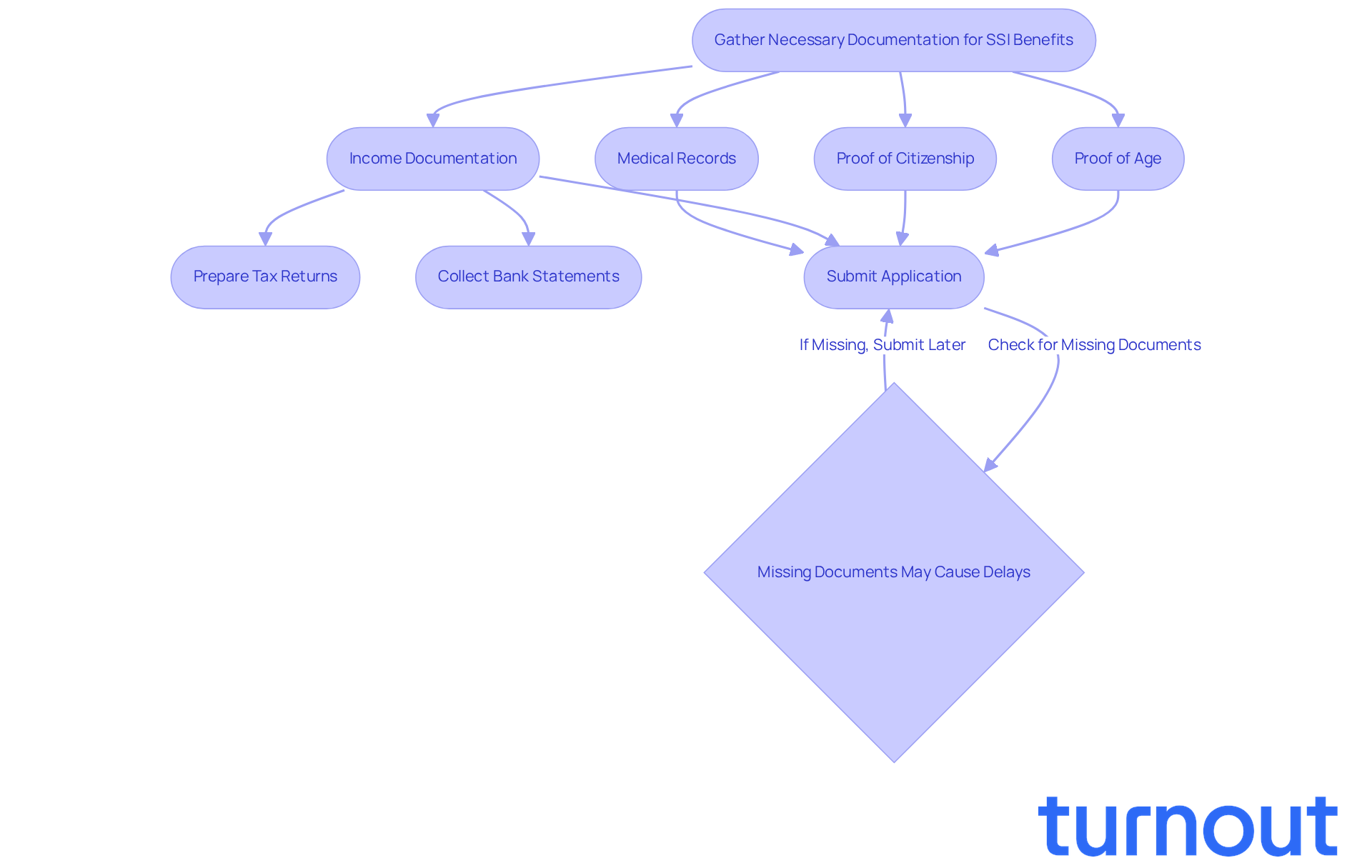

Applying for Supplemental Security Income (SSI) can feel overwhelming, but gathering the right documents can make a world of difference. It’s essential to have proof of age, citizenship, income, and medical records ready. Think about preparing your tax returns, bank statements, and detailed letters from healthcare providers that explain your medical conditions.

Proper documentation not only makes the process smoother but also helps avoid delays or denials. Did you know that just one missing document can extend the decision-making process by months? This really highlights how important it is to be thorough in your preparation. As one expert wisely said, "If you didn’t document it, it didn’t happen." This underscores the need for meticulous record-keeping to ensure that all relevant information is presented to the Social Security Administration (SSA).

We understand that it can be daunting, but remember, you can still submit your application even if some documents are missing. One expert recommends, "Do not postpone submission if you are lacking a few items. You can submit the application and provide the remaining documents later." By proactively gathering and organizing these documents, you can significantly enhance your chances of a successful claim for SSI supplement by state.

Turnout's trained non-lawyer advocates are here to help you through this process, ensuring you feel prepared and informed every step of the way. It’s also important to keep in mind that the initial decision on submissions can take anywhere from three to six months or even longer. This makes timely and complete documentation even more critical.

Additionally, Turnout offers tax debt relief services, providing comprehensive support for clients navigating financial challenges. Remember, you are not alone in this journey; we’re here to help.

Understand the Timeline for SSI Payment Processing

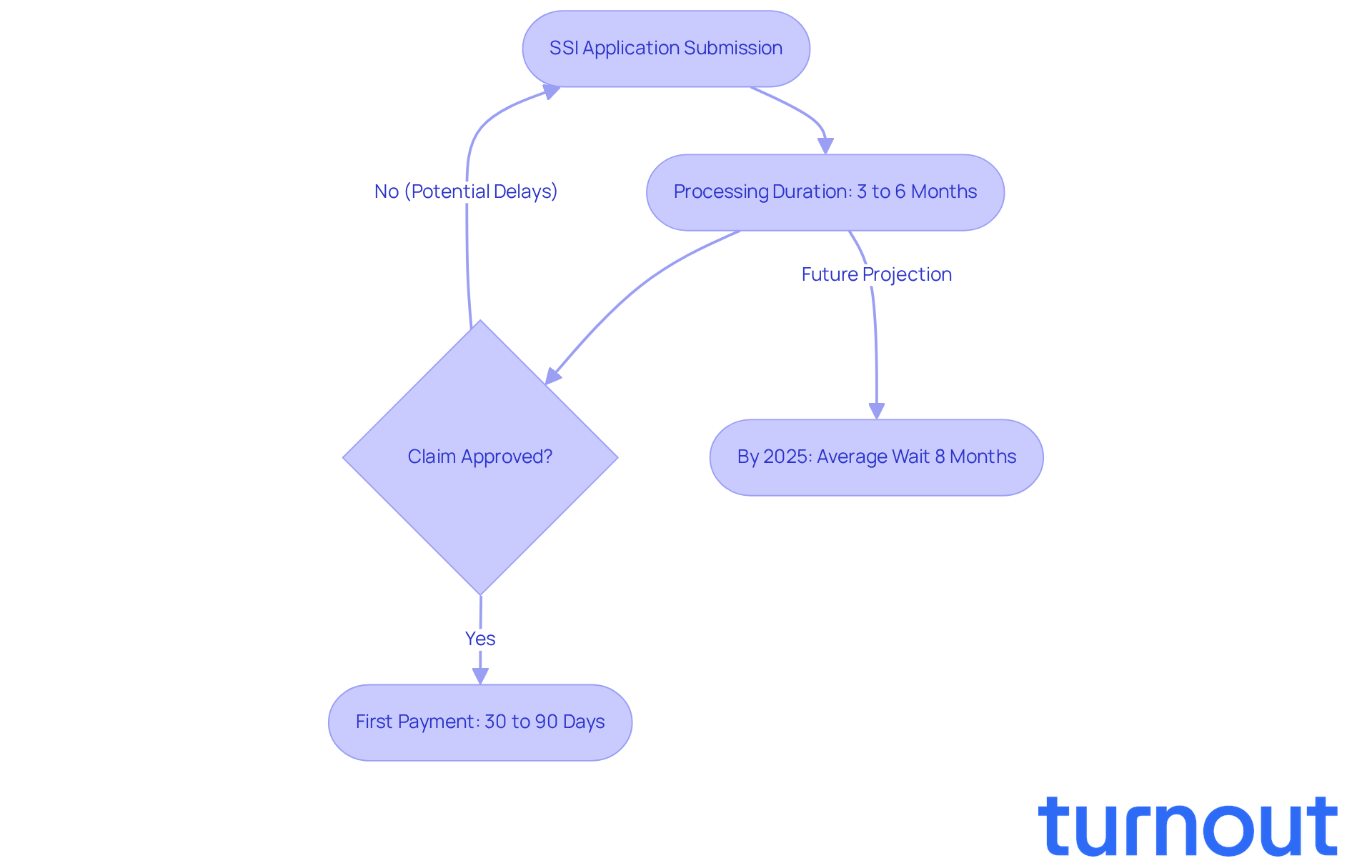

Navigating the Supplemental Security Income (SSI) process can be challenging, and we understand that waiting for approval can feel overwhelming. Typically, the processing duration for SSI requests ranges from 3 to 6 months. Once a claim is approved, recipients can expect their first payment within 30 to 90 days. However, these timelines can fluctuate based on the complexity of individual cases and the current volume of applications at the Social Security Administration (SSA).

Looking ahead, the SSA anticipates that by 2025, the average wait for an initial decision could extend to 8 months due to ongoing backlogs. This delay can significantly impact recipients, many of whom rely on these supports for essential living expenses. It's common to feel anxious about financial strain, especially when meeting basic needs becomes a struggle.

At Turnout, we're committed to simplifying access to these government advantages. We offer expert guidance to assist individuals in navigating the complexities of the SSI application process. According to SSA Commissioner Frank J. Bisignano, addressing these delays is crucial to ensuring that assistance reflects current economic realities and provides necessary support to those in need. Remember, you are not alone in this journey; we're here to help.

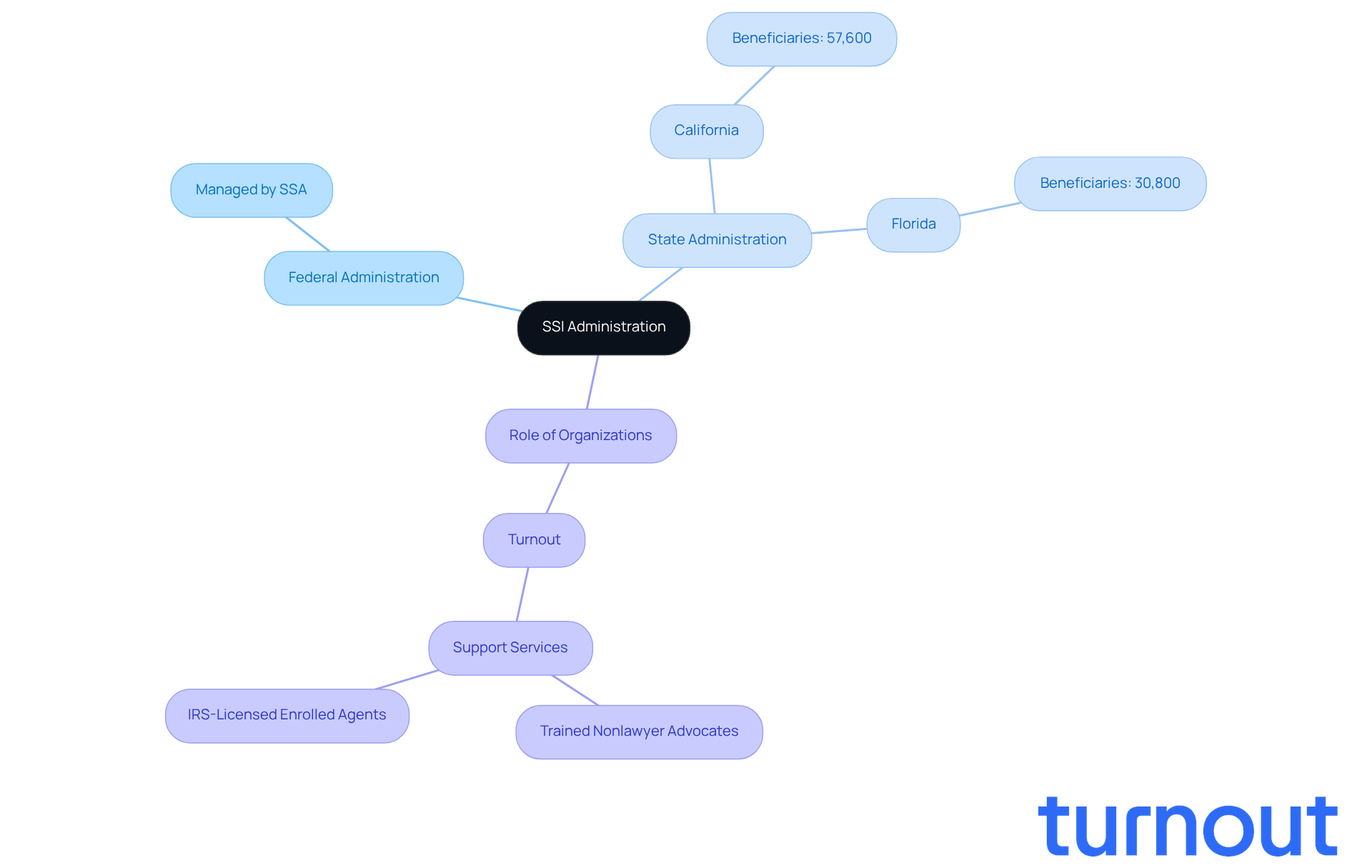

Differentiate Between State and Federal SSI Administration

Navigating the Supplemental Security Income (SSI) program can feel overwhelming, particularly in understanding how the SSI supplement by state affects your support. While the Social Security Administration (SSA) manages the program at the federal level, states have the ability to offer additional payments to beneficiaries through the SSI supplement by state. This means that although the federal government sets the base assistance rates, each state can establish its own policies concerning the SSI supplement by state for additional support.

For example, as of January 2025, states like California and Florida have significant numbers of SSI beneficiaries - 57,600 and 30,800 individuals, respectively - who could be affected by potential policy changes. We understand that grasping how these state policies affect your SSI aid is crucial. These differences can significantly alter the total assistance you receive from the SSI supplement by state.

States may choose to provide an SSI supplement by state to add to federal SSI payments, which can lead to higher overall assistance for recipients. This distinction is vital for applicants to navigate effectively. It’s important to direct your inquiries and applications to the right state agencies to access additional support.

Turnout plays a crucial role in simplifying access to these benefits. They provide tools and services, including trained nonlawyer advocates and IRS-licensed enrolled agents, to help you navigate the complexities of government processes. With Turnout's guidance, you can better understand your options and access the financial assistance you need. Remember, you are not alone in this journey; we’re here to help.

Summarize Key Facts About SSI Supplemental Payments

In summary, the SSI supplement by state plays a crucial role in providing financial support to individuals with disabilities, seniors, and those facing limited income. For 2025, the federal assistance rate is set at $967 for individuals and $1,450 for couples, with some states potentially providing higher amounts through the SSI supplement by state. Take California, for instance, where over 1.1 million people rely on the SSI supplement by state, leading to nearly $11 billion in payments. This illustrates just how vital the program is for supporting vulnerable communities across the nation.

We understand that navigating these essential resources can feel overwhelming. That’s where Turnout comes in. We offer tools and services designed to help you through the complexities of government processes, including SSI claims. Knowing the eligibility criteria, the application steps, and the required documentation is key to successfully obtaining the assistance you need. Our trained nonlawyer advocates are here to guide you every step of the way, ensuring you have the support necessary to navigate the system effectively.

As families prepare for potential changes in SSI eligibility rules, it’s common to feel uncertain. Staying informed and keeping thorough documentation of all household benefits, including the SSI supplement by state, SNAP, and Medicaid, is essential for maintaining access to these vital resources. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Navigating the complexities of Supplemental Security Income (SSI) and its state-specific supplements can feel overwhelming, especially for individuals with disabilities and financial hardships. We understand that this journey is not easy. The insights shared here highlight the critical role of SSI in providing financial support, as well as the significant variations that exist from state to state. By understanding these differences, you can empower yourself to maximize your benefits and ensure you receive the assistance you need to maintain a basic standard of living.

Key points to consider include:

- The federal assistance rates for 2025

- The importance of thorough documentation during the application process

- The challenges many face in securing these benefits

With over 7.4 million individuals relying on SSI, this program serves as a vital safety net, particularly in states like California and New York, where additional state supplements can significantly enhance monthly assistance. It's common to feel frustrated with the ongoing backlogs and processing delays at the Social Security Administration, which is why being well-prepared and informed is essential.

As changes in SSI eligibility rules loom on the horizon, staying updated and organized becomes increasingly important for you and your family. Engaging with resources like Turnout can provide valuable support in navigating the application process and understanding the nuances of state-specific benefits. Remember, by taking proactive steps and seeking assistance, you can better position yourself to secure the financial support you deserve. You are not alone in this journey, and together, we can ensure your needs are met amidst the complexities of the SSI system.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal program that provides financial assistance to individuals who are aged, blind, or disabled and face financial hardships. It helps recipients meet essential needs such as food, clothing, and shelter.

What are the federal assistance rates for SSI as of January 1, 2025?

As of January 1, 2025, the federal assistance rate for SSI is $967 per month for individuals and $1,450 for couples.

How many people benefit from SSI?

In 2025, around 7.4 million people benefit from SSI, including 1 million children under 18 and 3.9 million adults aged 18-64.

How do SSI payments impact individuals with disabilities?

SSI payments play a vital role in reducing poverty among disabled individuals, providing essential support for managing daily expenses and maintaining a basic standard of living.

Why do SSI payments vary from state to state?

SSI payments vary by state due to the SSI supplement provided by each state, which can significantly affect the total monthly assistance received by individuals.

Which states offer higher SSI assistance?

States like California and New York manage their own SSI supplement, resulting in total monthly assistance exceeding $1,200.

What is the resource limit for qualifying for SSI supplements?

As of 2025, the resource limit to qualify for SSI supplements is $2,000 for individuals and $3,000 for couples.

What are the eligibility criteria for SSI supplements?

To qualify for SSI supplements, individuals must be aged 65 or older, blind, or disabled, have limited income and resources, and be U.S. citizens or meet certain immigration criteria.

What documentation is needed to apply for SSI?

Applicants should provide comprehensive documentation, including medical records, financial statements, and proof of residency.

What should applicants do if their SSI claims are denied?

It is crucial to gather comprehensive documentation to support claims, as many applicants are denied. Seeking assistance from trained advocates can help improve the chances of success.

How can Turnout assist individuals with SSI claims?

Turnout offers support through trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, helping clients navigate the SSI claims process without legal representation.

Where can individuals find more information about SSI payments by state?

For detailed information on SSI payments by state, individuals can refer to the publication titled 'SSI Recipient by State and County, 2022' available on the SSA website.